Clichy, July 30, 2015 at 6:00 pm

First-half 2015 results

STRONG SALES INCREASE: +14.7%

12.82 billion

euros, i.e. +3.8% like-for-like and +5% at

constant exchange rates

STRONG OPERATING PROFIT GROWTH: +14.5%

2.32 billion

euros, at 18.1% of sales

STRONG RISE IN NET EPS*: +18.9% at 3.47 euros

-

Very positive currency

effect

-

Gradual improvement in sales in

Western Europe and North America

-

Solid sales in New Markets

excluding Brazil

Commenting on the figures, Mr

Jean-Paul Agon, Chairman and Chief Executive Officer of L'Oréal,

said:

"At the end of

June, our reported growth is the strongest recorded for the last

twenty years, with a very positive currency effect.

All Divisions are

growing. L'Oréal Luxe is significantly outperforming a dynamic

worldwide market with a double-digit growth of its brands Giorgio

Armani, Yves Saint Laurent and Kiehl's. Professional Products are

showing a clear rebound thanks to the performance at L'Oréal

Professionnel and the success of Redken. The Active Cosmetics

Division is also greatly strengthening its worldwide position,

driven in particular by its La Roche-Posay brand, whose success is

continuing in all regions. Finally, growth in the Consumer Products

Division is improving slightly, due especially to the renewed

dynamism of its make-up brand Maybelline.

Among the

geographic zones, sales are improving in Western Europe and North

America. The New Markets are experiencing solid momentum, excluding

Brazil where the economic context is very unfavourable.

The strong

increase in sales has been achieved alongside good quality

first-half results. As announced, operating profit growth is very

strong and our operating profitability is practically stable at a

high level. We are continuing to make significant investments in

accelerating the digital transformation and in the development of

our brands. In all, the EPS increased +18.9%.

Thanks in

particular to a rich innovation portfolio, prospects of rapid

e-commerce growth and the continuing roll-out of recently acquired

brands, we are projecting an acceleration in growth in the second

half. We are confident in our ability to outperform the beauty

market and achieve a year of significant growth in both sales and

profits."

* Diluted earnings per share of

continuing operations, after non-controlling interests, excluding

non-recurring items.

A - First-half 2015 sales

Like-for-like, i.e. based on a comparable structure and

identical exchange rates, sales growth

was +3.8%.

The net impact of changes in the scope of

consolidation was +1.2%.

Growth at constant exchange rates was

+5.0%.

Currency fluctuations had a positive impact of

+9.7%. If the exchange rates at June 30, 2015, i.e.

€1 = $1.119, are extrapolated up to December 31, the impact of

currency fluctuations on sales would be approximately +7.8% for the

whole of 2015.

Based on reported figures, the Group's sales

at June 30, 2015 amounted to 12.82 billion euros, up by +14.7%.

Sales by operational Division and geographic

Zone

| |

2nd quarter

2015 |

1st half

2015 |

| |

|

Growth |

|

Growth |

| |

€m |

Like-for-like |

Reported |

€m |

Like-for-like |

Reported |

| By operational Division |

|

|

|

|

|

|

|

Professional Products |

887.7 |

3.5% |

15.3% |

1,740.3 |

3.5% |

15.6% |

| Consumer

Products |

3,083.0 |

2.0% |

13.2% |

6,161.4 |

1.9% |

12.4% |

| L'Oréal

Luxe |

1,732.9 |

5.8% |

20.1% |

3,486.7 |

6.7% |

20.1% |

| Active

Cosmetics |

459.4 |

6.5% |

11.1% |

1,018.6 |

7.1% |

10.6% |

| Cosmetics Divisions total |

6,163.1 |

3.6% |

15.2% |

12,407.0 |

3.8% |

14.8% |

| By

geographic Zone |

|

|

|

|

|

|

| Western

Europe |

2,060.4 |

2.6% |

5.1% |

4,160.9 |

1.9% |

4.5% |

| North

America |

1,704.3 |

2.9% |

28.4% |

3,326.3 |

2.7% |

26.8% |

| New

Markets, of which: |

2,398.4 |

5.1% |

16.4% |

4,919.9 |

6.3% |

16.9% |

| - Asia, Pacific |

1,311.8 |

4.1% |

24.3% |

2,787.9 |

5.0% |

25.5% |

| - Latin America |

489.9 |

1.5% |

5.1% |

950.1 |

5.3% |

8.3% |

| - Eastern Europe |

406.6 |

10.0% |

2.3% |

803.2 |

9.7% |

-2.6% |

| - Africa, Middle East |

190.1 |

13.2% |

34.5% |

378.8 |

12.3% |

33.1% |

| Cosmetics Divisions total |

6,163.1 |

3.6% |

15.2% |

12,407.0 |

3.8% |

14.8% |

| The Body

Shop |

219.5 |

1.5% |

17.1% |

411.9 |

2.8% |

13.2% |

| Group total |

6,382.6 |

3.6% |

15.3% |

12,818.9 |

3.8% |

14.7% |

PROFESSIONAL PRODUCTS

At the end of

June, the Professional Products Division posted growth of +3.5%

like-for-like and +15.6% based on reported figures, with

improvements particularly in the United States.

-

Haircare, the number one contributor to growth,

is being driven by the success of Thérapiste

at Kérastase, Frizz

Dismiss at Redken, Biolage Cleansing Conditioner at Matrix and the very good start made by Pro Fiber at L'Oréal

Professionnel. Hair colour is benefiting from the strong

momentum of Redken and Matrix and the solid sales of Majirel and Inoa at L'Oréal Professionnel. Essie is

growing strongly in Europe. Growth in professional skincare with

Carita and Decléor is

promising in Western Europe.

-

All the geographic Zones are growing. The main

contributors to growth are the United States, India and the United

Kingdom.

CONSUMER PRODUCTS

In the first

half, the Consumer Products Division recorded growth of +1.9%

like-for-like and +12.4% based on reported figures. Excluding

Brazil, the Division is accelerating, from +1.7% in the first

quarter to +2.9% in the second quarter.

-

The Division is boosting its growth in make-up

with the launches of Infallible Gloss and

False Lash Superstar by L'Oréal Paris, with eyebrow make-up and palettes by

Maybelline. In addition, NYX is expanding very quickly.

In haircare, the globalisation of L'Oréal

Paris is continuing thanks to the successful launches of

Hyaluron Moisture in China and Nutri-Gloss in Western Europe and North America.

Ultra Doux by Garnier is

maintaining its winning momentum.

The men's skincare ranges L'Oréal Men Expert

and Garnier Men are growing in Asia.

In hair colour, the successful launch of Excellence Age Perfect by L'Oréal

Paris shows it is well suited to the senior target group.

L'ORÉAL LUXE

L'Oréal Luxe

posted solid growth at +6.7% like-for-like and +20.1% based on

reported figures. The Division is continuing to win market

share.

- Lancôme is expanding thanks

to the successes of its fragrances "La vie est

belle" and La Nuit Trésor, its innovative

Miracle Cushion foundation launched all over

the world, Grandiôse mascara and the relaunch

of the star skincare Génifique. Giorgio Armani is posting double-digit growth thanks to

the upsurge in its fragrances Sì Eau de Toilette and Acqua di Giò Profumo. Yves Saint

Laurent is growing very quickly thanks to Black Opium and the quality of its make-up initiatives.

Urban Decay is now being rolled out

internationally. The American skincare brand Kiehl's is maintaining a very high growth level,

confirming the relevance of its business model. Shu Uemura is successfully developing its Asian make-up

artistry concept.

- L'Oréal Luxe is outperforming the world market,

particularly in Western Europe, in Asia thanks to the strategically

important Chinese market, in the Middle East and in Latin America.

Travel Retail also remains very robust.

ACTIVE COSMETICS

At +7.1%

like-for-like and +10.6% based on reported figures, the Active

Cosmetics Division is continuing to grow very strongly and

reinforcing its worldwide position.

-

Vichy is boosting its

Idealia franchise with the successful launch

of Idealia Skin Sleep and is strengthening its

position in the body care segment with the success of Ideal Body.

La Roche-Posay is demonstrating its great

vitality with double-digit growth in all Zones, building on the

success of its franchises Lipikar in body care

and Anthelios in sun protection.

SkinCeuticals is gaining share in all

geographic Zones.

Roger & Gallet has successfully launched

its perfume Fleur de Figuier.

Multi-division summary by geographic Zone

WESTERN EUROPE

Growth amounted to +1.9%

like-for-like and +4.5% based on reported figures. L'Oréal Luxe

made a major contribution to this performance by outstripping the

growth of the dynamic selective channel. In a mass-market channel

which remains lacklustre, the Consumer Products Division is making

progress in the haircare, and skincare and facial cleansing

categories. Both Divisions are making large market share gains in

Germany and the United Kingdom.

NORTH

AMERICA

L'Oréal recorded +2.7% like-for-like and +26.8% based on reported

figures. L'Oréal Luxe and the Active Cosmetics and Professional

Products Divisions are driving growth, with several brands -

including Kiehl's, Giorgio

Armani and La Roche-Posay - posting an

increase of more than 10%. The Consumer Products Division is

continuing to strengthen its positions in make-up. Meanwhile, its

two recent acquisitions NYX and Carol's Daughter are maintaining momentum with market

share gains.

NEW

MARKETS

-

Asia, Pacific:

L'Oréal recorded growth of +5.0% like-for-like and +25.5% based on

reported figures. Despite a slowdown in Hong Kong, L'Oréal Luxe

posted good growth, still driven by Kiehl's,

Yves Saint Laurent and Giorgio Armani, and by the dynamism of the Japanese

market. The Consumer Products Division remains dynamic in the

countries of South-East Asia. In China, L'Oréal

Paris is growing thanks to the success of its launches. Another

highlight of the first half was the very good performance of Active

Cosmetics Division, thanks to La

Roche-Posay.

-

Latin America:

Sales grew by +5.3% like-for-like and +8.3% based on reported

figures. Excluding Brazil, sales achieved double-digit growth,

thanks to L'Oréal Paris, Maybelline and

Lancôme. In a difficult economic environment,

the Brazilian market is also being held back by the recent reform

of the IPI (Tax on Industrialised Products).

-

Eastern Europe:

The Zone posted +9.7% like-for-like and -2.6% based on reported

figures, with an acceleration in the second quarter, reflecting

good performances from the Consumer Products and Professional

Products Divisions. The four Divisions are gaining market share.

Russia and Turkey, whose sales rose by more than 10% over the

period, are the largest contributors to growth.

-

Africa, Middle

East: Growth amounted to +12.3%

like-for-like and +33.1% based on reported figures. The Group is

outperforming the market in the Zone, and posting strong market

share gains in Saudi Arabia, South Africa and Pakistan.

This performance is being driven by Elvive by

L'Oréal Paris, Color

Naturals by Garnier and Maybelline in Consumer Products Division. In other

Divisions, the fragrances of Giorgio Armani,

the brands Yves Saint Laurent, Kérastase, Vichy and La Roche-Posay are achieving double-digit

growth.

THE BODY SHOP

The Body Shop recorded growth of

+2.8% like-for-like and +13.2% based on reported figures. The

strategy based on innovation, service, digital communication and

point-of-sale optimisation is reaping rewards. Europe, the Americas

and the Middle East are continuing to expand, while growth in some

key Asian countries remains difficult. The integration of the

Australian franchisee and the reorganisation in the United States

are on track.

B - Important events during the period

04/01/15 to 06/30/15

-

On April 16, L'Oréal unveiled the first results

of its Sharing Beauty With All programme for sustainable

development, including a 50% reduction of CO2

emissions from the Group's production in absolute terms, from a

2005 baseline.

-

At the Annual General Meeting on April 22 at the

Palais des Congrès in Paris, L'Oréal shareholders adopted all the

resolutions by a very large majority, including the appointment

of

Mrs Sophie Bellon as a Director, the renewal of the tenure of Mr

Charles-Henri Filippi as a Director and the decision to maintain

simple voting rights. At its meeting at the end of the Annual

General Meeting, the Board of Directors decided to cancel 2,905,000

shares acquired under the buyback programme approved by the Board

on November 29, 2013.

-

On June 3, L'Oréal announced the signing of a

license agreement with Proenza Schouler for

the creation and development of fine fragrances. A New York-based

women's wear brand, Proenza Schouler was

founded by designers Jack McCollough and Lazaro Hernandez in 2002,

and is considered to be one of today's most exciting American

fashion brands.

C - First-half 2015 results

The half-year consolidated accounts have undergone

a limited examination by the Statutory Auditors.

- Operating profitability at 18.1%

of sales

Consolidated profit and loss account: from sales

to operating profit.

| In € million |

06/30/14 |

As % of sales |

12/31/14 |

As % of sales |

06/30/15 |

As % of sales |

Change

H1-2015 vs. H1-2014 |

| Sales |

11,174.6 |

100.0% |

22,532.0 |

100.0% |

12,818.9 |

100.0% |

+14.7% |

| Cost of sales |

-3,151.2 |

28.2% |

-6,500.7 |

28.9% |

-3,630.3 |

28.3% |

|

| Gross profit |

8,023.4 |

71.8% |

16,031.3 |

71.1% |

9,188.6 |

71.7% |

+14.5% |

| R&D expenses |

-367.2 |

3.3% |

-760.6 |

3.4% |

-379.7 |

3.0% |

|

| Advertising and promotion expenses |

- 3,270.9 |

29.3% |

-6,558.9 |

29.1% |

-3,753.3 |

29.3% |

|

| Selling, general and administrative expenses |

-2,356.2 |

21.1% |

-4,821.1 |

21.4% |

-2,732.6 |

21.3% |

|

| Operating profit |

2,029.0 |

18.2% |

3,890.7 |

17.3% |

2,323.0 |

18.1% |

+14.5% |

Gross profit,

at 9,189 million euros, has come out at 71.7% of sales, compared

with 71.8% in the first half of 2014, representing a decrease of 10

basis points. At constant exchange rates, gross profit would have

posted a noticeable increase as a percentage of sales.

Research and

Development expenses, at 380 million euros, i.e. 3.0% of sales,

decreased in relative value due to the impact of currency

conversion, as the largest part of Research is carried out in the

Euro zone.

Advertising and

promotion expenses, at 3,753 million euros, are flat as a

percentage of sales, which corresponds to a stronger investment in

volume.

Selling, general

and administrative expenses have increased in percentage of

sales, due in particular to the acceleration of our digital

transformation.

Overall, the operating profit, at 2,323 million euros, amounted to

18.1% of sales, representing a very strong increase of +14.5%.

- Operating profit by operational

Division

|

|

06/30/14 |

12/31/14 |

06/30/15 |

|

|

€m |

% of sales |

€m |

% of sales |

€m |

% of sales |

| By operational Division |

|

|

|

|

|

|

|

Professional Products |

294.7 |

19.6% |

608.8 |

20.1% |

332.0 |

19.1% |

| Consumer

Products |

1,157.2 |

21.1% |

2,186.2 |

20.3% |

1,313.1 |

21.3% |

| L'Oréal

Luxe |

590.6 |

20.3% |

1,269.2 |

20.5% |

716.0 |

20.5% |

| Active

Cosmetics |

259.5 |

28.2% |

376.4 |

22.7% |

280.2 |

27.5% |

Total Divisions

before non-allocated |

2,302.0 |

21.3% |

4,440.6 |

20.5% |

2,641.3 |

21.3% |

| Non-allocated(1) |

-275.7 |

-2.6% |

-615.2 |

-2.8% |

-311.1 |

-2.5% |

Total Divisions

after non-allocated |

2,026.3 |

18.7% |

3,825.4 |

17.7% |

2,330.2 |

18.8% |

| The Body

Shop |

2.7 |

0.8% |

65.3 |

7.5% |

-7.2 |

-1.8% |

| Group |

2,029.0 |

18.2% |

3,890.7 |

17.3% |

2,323.0 |

18.1% |

(1) Non-allocated

expenses = Central Group expenses, fundamental research expenses,

stock option and free grant of shares expenses and miscellaneous

items. As a % of total Divisions sales.

The Professional

Products Division's profitability has declined from 19.6% to

19.1% following the consolidation of Decléor

and Carita brands.

At 21.3% of sales, the

profitability of the Consumer Products

Division has further improved by 20 basis points.

L'Oréal Luxe

also improved its profitability by 20 basis points.

The Active

Cosmetics Division, with a profitability of 27.5%, has

re-balanced its profitability which reached a record level of 28.2%

in the first half of 2014.

The Body Shop

is affected by the technical impact of the first time consolidation

of its Australian franchisee.

- Net profit from continuing

operations

Consolidated profit and loss account: from

operating profit to net profit excluding non-recurring items.

| In € million |

06/30/14 |

12/31/14 |

06/30/15 |

Change

H1-2015 vs. H1-2014 |

| Operating profit |

2,029.0 |

3,890.7 |

2,323.0 |

+14.5% |

Financial revenues and expenses

excluding dividends received |

-8.1 |

-24.1 |

-9.8 |

|

| Sanofi

dividends |

331.0 |

331.0 |

336.9 |

|

Profit

before tax and associates

excluding non-recurring items |

2,352.0 |

4,197.6 |

2,650.1 |

+12.7% |

| Income tax excluding non-recurring items |

-575.4 |

-1,069.5 |

-692.1 |

|

Net profit excluding non-recurring items

of equity consolidated companies |

-1.5 |

-3.0 |

- |

|

| Non-controlling interests |

-1.6 |

+0.1 |

-0.6 |

|

| Net profit from continuing operations, excluding

non-recurring items, after non-controlling interests(1) |

1,773.5 |

3,125.3 |

1,957.3 |

+10.4% |

| Net EPS(2)

(€) |

2.92 |

5.34 |

3.47 |

+18.9% |

| Net profit

after non-controlling interests |

1,734.8 |

4,910.2 |

1,882.6 |

|

| Diluted

earnings per share after non-controlling interests (€) |

2.85 |

8.39 |

3.34 |

|

| Diluted average number of shares |

607,667,507 |

585,238,674 |

564,094,688 |

|

(1) Net profit

from continuing operations, excluding non-recurring items after

non-controlling interests does not include capital gains and losses

on disposals of long-term assets, impairment of assets,

restructuring costs, as well as competition litigation, tax effects

and non-controlling interests. (2) Diluted earnings per share of

continuing operations, after non-controlling interests, excluding

non-recurring items.

Overall finance

costs amounted to 9.8 million euros, compared with 8.1 million

euros in the first half of 2014.

Sanofi

dividends amounted to 337 million euros.

Income tax

excluding non-recurring items amounted to 692 million euros,

i.e. a tax rate of 26.1%, slightly above that of the first half of

2014.

Net profit from

continuing operations, excluding non-recurring items, after

non-controlling interests, amounted to 1,957 million euros, up

by 10.4% compared with the first half of 2014.

Net EPS rose

18.9% to 3.47 euros.

Net profit after non-controlling

interests rose 8.5% to 1,883 million euros.

- Operating cash flow and balance

sheet

Gross cash

flow amounted to 2,370 million euros, up by +12.4% compared

with the first half of 2014.

The change in

working capital amounted to 816 million euros. As it is the

case every year, it includes the impact of the seasonality of part

of the business on the trade receivables. In the first half of

2015, it takes also into account the payment of the fine linked

with the decision of the French Competition Authority.

Investments,

at 512 million euros, represented 4% of sales.

Operating cash

flow has come out at 1,042 million euros.

After payment of the dividend and

acquisitions, the residual cash flow amounted

to -701 million euros.

At June 30, 2015, net debt amounted to 1,394 million euros, higher than

the level of December 31, 2014, mainly due, as is the case every

year, to the payment of the annual dividend in the first half.

The balance sheet structure is

particularly solid: shareholders' equity of

22.9 billion euros is stronger than the level at December 31,

2014.

"This news

release does not constitute an offer to sell, or a solicitation of

an offer to buy L'Oréal shares. If you wish to obtain more

comprehensive information about L'Oréal, please refer to the public

documents registered in France with the Autorité des Marchés

Financiers, also available in English on our Internet site

www.loreal-finance.com.

This news release may contain some forward-looking

statements. Although the Company considers that these statements

are based on reasonable hypotheses at the date of publication of

this release, they are by their nature subject to risks and

uncertainties which could cause actual results to differ materially

from those indicated or projected in these statements."

This a free

translation into English of the First-half 2015 results news

release issued in the French language and is provided solely for

the convenience of English speaking readers. In case of discrepancy, the French version

prevails.

Contacts at L'Oréal

(switchboard: +33 1 47 56 70 00)

Individual shareholders and

market authorities

Mr Jean Régis CAROF

Tel: +33 1 47 56 83 02

jean-regis.carof@loreal.com

Financial analysts and

Institutional investors

Mrs Françoise LAUVIN

Tel: +33 1 47 56 86 82

francoise.lauvin@loreal.com

Journalists

Mrs Stephanie CARSON-PARKER

Tel: +33 1 47 56 76 71

stephanie.carsonparker@loreal.com

For more information, please

contact your bank, broker or financial institution (I.S.I.N. code:

FR0000120321), and consult your usual newspapers, and the Internet

site for shareholders and investors, http://www.loreal-finance.com,

alternatively,call +33 1 40 14 80 50.

D - Appendices

Appendix 1: L'Oréal

Group sales 2014/2015 (€

millions)

| |

2014 |

2015 |

| First

quarter: |

|

|

| Cosmetics

Divisions |

5,462.2 |

6,243.9 |

| The Body

Shop |

176.4 |

192.4 |

| First quarter total |

5,638.6 |

6,436.3 |

| Second

quarter: |

|

|

| Cosmetics

Divisions |

5,348.5 |

6,163.1 |

| The Body

Shop |

187.4 |

219.5 |

| Second quarter total |

5,536.0 |

6,382.6 |

| First

half: |

|

|

| Cosmetics

Divisions |

10,810.8 |

12,407.0 |

| The Body

Shop |

363.8 |

411.9 |

| First half total |

11,174.6 |

12,818.9 |

| Third

quarter: |

|

|

| Cosmetics

Divisions |

5,200.7 |

|

| The Body

Shop |

190.4 |

|

| Third quarter total |

5,391.1 |

|

| Nine

months: |

|

|

| Cosmetics

Divisions |

16,011.4 |

|

| The Body

Shop |

554.2 |

|

| Nine months total |

16,565.7 |

|

| Fourth

quarter: |

|

|

| Cosmetics

Divisions |

5,646.7 |

|

| The Body

Shop |

319.6 |

|

| Fourth quarter total |

5,966.4 |

|

| Full

year |

|

|

| Cosmetics

Divisions |

21,658.2 |

|

| The Body

Shop |

873.8 |

|

| Full year total |

22,532.0 |

|

Appendix 2: Compared consolidated

income statements

| € millions |

1st half

2015 |

1st half

2014 |

2014 |

| Net sales |

12,818.9 |

11,174.6 |

22,532.0 |

| Cost of

sales |

-3,630.3 |

-3,151.2 |

-6,500.7 |

| Gross profit |

9,188.6 |

8,023.4 |

16,031.3 |

| Research

and development |

-379.7 |

-367.2 |

-760.6 |

| Advertising

and promotion |

-3,753.3 |

-3,270.9 |

-6,558.9 |

| Selling,

general and administrative expenses |

-2,732.6 |

-2,356.2 |

-4,821.1 |

| Operating profit |

2,323.0 |

2,029.0 |

3,890.7 |

| Other

income and expenses |

-47.9 |

-48.0 |

-307.2 |

| Operational profit |

2,275.1 |

1,981.1 |

3,583.5 |

| Finance

costs on gross debt |

-13.6 |

-13.0 |

-31.4 |

| Finance

income on cash and cash equivalents |

27.6 |

23.1 |

42.3 |

| Finance costs, net |

14.0 |

10.1 |

11.0 |

| Other

financial income (expenses) |

-23.8 |

-18.2 |

-35.1 |

| Sanofi

dividends |

336.9 |

331.0 |

331.0 |

| Profit before tax and associates |

2,602.2 |

2,304.0 |

3,890.4 |

| Income

tax |

-721.7 |

-607.1 |

-1,111.0 |

| Share of

profit in associates |

2.7 |

-1.5 |

-13.5 |

| Net profit from continuing operations |

1,883.2 |

1,695.4 |

2,765.9 |

| Net profit from discontinued operations |

- |

41.0 |

2,142.7 |

| Net profit |

1,883.2 |

1,736.4 |

4,908.6 |

|

Attributable to: |

|

|

|

| · owners of

the company |

1,882.6 |

1,734.8 |

4,910.2 |

| ·

non-controlling interests |

0.6 |

1.6 |

-1.6 |

| Earnings

per share attributable to owners of the company (euros) |

3.39 |

2.89 |

8.51 |

| Diluted

earnings per share attributable to owners of the company (euros) |

3.34 |

2.85 |

8.39 |

| Earnings

per share of continuing operations attributable to owners of the

company (euros) |

3.39 |

2.82 |

4.79 |

| Diluted

earnings per share of continuing operations attributable to owners

of the company (euros) |

3.34 |

2.79 |

4.73 |

| Earnings

per share of continuing operations attributable to owners of the

company, excluding non-recurring items (euros) |

3.52 |

2.96 |

5.41 |

| Diluted

earnings per share of continuing operations attributable to owners

of the company, excluding non-recurring items (euros) |

3.47 |

2.92 |

5.34 |

Appendix 3: Consolidated

statement of comprehensive income

| € millions |

1st half

2015 |

1st half

2014 |

2014 |

| Consolidated net profit for the period |

1,883.2 |

1,736.4 |

4,908.6 |

| Financial assets available-for-sale |

1,487.3 |

54.4 |

-172.7 |

| Cash flow hedges |

-80.0 |

-73.8 |

-17.2 |

| Cumulative translation adjustments |

507.8 |

69.3 |

584.0 |

| Income tax on items that may be reclassified to profit or

loss (1) |

-35.7 |

18.3 |

7.3 |

| Items that

may be reclassified to profit or loss |

1,879.4 |

68.2 |

401.4 |

| Actuarial gains and losses |

345.7 |

-139.8 |

-672.7 |

| Income tax on items that may not be reclassified to profit

or loss (1) |

-119.4 |

49.3 |

225.1 |

| Items that

may not be reclassified to profit or loss |

226.3 |

-90.5 |

-447.6 |

| Other comprehensive income |

2,105.7 |

-22.3 |

-46.2 |

| Consolidated comprehensive income |

3,988.9 |

1,714.1 |

4,862.4 |

|

Attributable to: |

|

|

|

| · owners of the company |

3,988.7 |

1,712.2 |

4,864.3 |

| ·

non-controlling interests |

0.2 |

1.9 |

-1.9 |

(1)

The tax effect is as follows:

| € millions |

1st half

2015 |

1st half

2014 |

2014 |

| Financial assets available-for-sale |

-61.5 |

-2.3 |

7.2 |

| Cash flow hedges |

25.8 |

20.6 |

0.1 |

| Items that

may be reclassified to profit or loss |

-35.7 |

18.3 |

7.3 |

| Actuarial gains and losses |

-119.4 |

49.3 |

225.1 |

| Items that

may not be reclassified to profit or loss |

-119.4 |

49.3 |

225.1 |

| Total |

-155.1 |

67.6 |

232.4 |

Appendix 4: Compared consolidated

balance sheets

Assets

| € millions |

06.30.2015 |

06.30.2014

(1) |

12.31.2014

(1) |

| Non-current assets |

25,642.9 |

22,047.0 |

23,284.2 |

|

Goodwill |

8,180.6 |

6,941.6 |

7,525.5 |

| Other

intangible assets |

2,901.9 |

2,157.5 |

2,714.6 |

| Property,

plant and equipment |

3,283.8 |

2,982.6 |

3,141.1 |

| Non-current

financial assets |

10,535.1 |

9,262.1 |

9,069.0 |

| Investments

in associates |

- |

0.8 |

- |

| Deferred

tax assets |

741.5 |

702.4 |

834.0 |

| Current assets |

9,725.5 |

12,026.7 |

8,774.6 |

| Current assets excluding assets held for

sale |

9,725.5 |

11,593.7 |

8,774.6 |

|

Inventories |

2,446.9 |

2,217.4 |

2,262.9 |

| Trade

accounts receivable |

3,980.4 |

3,576.7 |

3,297.8 |

| Other

current assets |

1,410.8 |

1,615.1 |

1,199.3 |

| Current tax

assets |

122.3 |

41.7 |

97.6 |

| Cash and

cash equivalents |

1,765.1 |

4,142.8 |

1,917.0 |

| Assets held for sale |

- |

433.0 |

- |

| Total |

35,368.4 |

34,073.7 |

32,058.8 |

(1)

The balance sheets at June 30th, 2014 and

December 31st, 2014 have

been restated to reflect the change in accounting policies

on recognition of levies resulting from the

application of IFRIC 21.

Equity & liabilities

| € millions |

06.30.2015 |

06.30.2014

(1) |

12.31.2014

(1) |

| Equity |

22,916.1 |

22,921.4 |

20,196.9 |

| Share

capital |

112.2 |

121.7 |

112.3 |

| Additional

paid-in capital |

2,496.5 |

2,222.3 |

2,316.8 |

| Other

reserves |

12,789.9 |

15,739.2 |

9,773.3 |

| Other

comprehensive income |

5,343.9 |

4,278.5 |

3,745.9 |

| Cumulative

translation adjustments |

525.9 |

-497.4 |

17.8 |

| Treasury

stock |

-237.1 |

-685.3 |

-683.0 |

| Net profit

attributable to owners of the company |

1,882.6 |

1,734.8 |

4,910.2 |

| Equity attributable to owners of the company |

22,913.9 |

22,913.8 |

20,193.3 |

|

Non-controlling interests |

2.2 |

7.6 |

3.6 |

| Non-current liabilities |

2,366.0 |

2,014.4 |

2,595.6 |

| Provisions

for employee retirement obligations and related benefits |

1,106.8 |

1,019.4 |

1,479.7 |

| Provisions

for liabilities and charges |

233.5 |

175.8 |

193.6 |

| Deferred

tax liabilities |

954.5 |

733.9 |

855.2 |

| Non-current

borrowings and debt |

71.2 |

85.3 |

67.1 |

| Current liabilities |

10,086.3 |

9,137.9 |

9,266.3 |

| Trade

accounts payable |

3,688.1 |

3,253.1 |

3,452.8 |

| Provisions

for liabilities and charges |

737.1 |

514.7 |

722.0 |

| Other

current liabilities |

2,413.1 |

2,049.0 |

2,403.2 |

| Income

tax |

159.8 |

185.4 |

167.1 |

| Current

borrowings and debt |

3,088.2 |

3,135.7 |

2,521.2 |

| Total |

35,368.4 |

34,073.7 |

32,058.8 |

(1)

The balance sheets at June 30th, 2014 and

December 31st, 2014 have

been restated to reflect the change in accounting policies

on recognition of levies resulting from the

application of IFRIC 21.

Appendix 5: Consolidated statements of changes in

equity

| € millions |

Com-

mon

shares

out-

standing |

Share

capital |

Addi-

tional

paid-

in

capi-

tal |

Re-

tained

earn-

ings

and

net

profit |

Other

compre-

hensive

income |

Treas-

ury

stock |

Cumu-

lative

trans-

lation

adjust-ments |

Equity

attribute-

able

to

owners

of

the

com-

pany |

Non-

control-

ling

interests |

Total

equity |

| At 12.31.2013 |

599,794,030 |

121.2 |

2,101.2 |

17,179.0 |

4,370.1 |

-568.1 |

-566.4 |

22,637.0 |

5.8 |

22,642.8 |

Changes in

accounting policies

at 01.01.2014 (1) |

|

|

|

8.2 |

|

|

|

8.2 |

|

8.2 |

| At 01.01.2014 |

599,794,030 |

121.2 |

2,101.2 |

17,187.2 |

4,370.1 |

-568.1 |

-566.4 |

22,645.2 |

5.8 |

22,651.0 |

|

Consolidated net profit for the period |

|

|

|

4,910.2 |

|

|

|

4,910.2 |

-1.6 |

4,908.6 |

| Financial assets available-for-sale |

|

|

|

|

-165.5 |

|

|

-165.5 |

|

-165.5 |

| Cash flow hedges |

|

|

|

|

-17.0 |

|

|

-17.0 |

-0.1 |

-17.1 |

| Cumulative translation adjustments |

|

|

|

|

|

|

584.2 |

584.2 |

-0.2 |

584.0 |

| Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

-182.5 |

|

584.2 |

401.7 |

-0.3 |

401.4 |

| Actuarial gains and losses |

|

|

|

|

-447.6 |

|

|

-447.6 |

|

-447.6 |

| Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

-447.6 |

|

|

-447.6 |

- |

-447.6 |

| Consolidated comprehensive income |

|

|

|

4,910.2 |

-630.1 |

|

584.2 |

4,864.3 |

-1.9 |

4,862.4 |

| Capital

increase |

3,828,502 |

0.8 |

215.6 |

-0.1 |

|

|

|

216.3 |

2.3 |

218.6 |

|

Cancellation of Treasury stock |

|

-9.7 |

|

-6,035.9 |

|

6,045.6 |

|

- |

- |

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,507.3 |

|

|

|

-1,507.3 |

-2.8 |

-1,510.1 |

| Share-based

payment |

|

|

|

113.5 |

|

|

|

113.5 |

|

113.5 |

| Net changes

in Treasury stock |

-49,380,654 |

|

|

0.2 |

|

-6,160.5 |

|

-6,160.3 |

|

-6,160.3 |

| Purchase

commitments for minority interests |

|

|

|

21.0 |

|

|

|

21.0 |

-2.3 |

18.7 |

| Changes in

scope of consolidation |

|

|

|

|

|

|

|

- |

2.5 |

2.5 |

| Other

movements |

|

|

|

-5.3 |

5.9 |

|

|

0.6 |

|

0.6 |

| At 12.31.2014 |

554,241,878 |

112.3 |

2,316.8 |

14,683.5 |

3,745.9 |

-683.0 |

17.8 |

20,193.3 |

3.6 |

20,196.9 |

|

Consolidated net profit for the period |

|

|

|

1,882.6 |

|

|

|

1,882.6 |

0.6 |

1,883.2 |

| Financial assets available-for-sale |

|

|

|

|

1,425.8 |

|

|

1,425.8 |

|

1,425.8 |

| Cash flow hedges |

|

|

|

|

-54.1 |

|

|

-54.1 |

-0.1 |

-54.2 |

| Cumulative translation adjustments |

|

|

|

|

|

|

508.1 |

508.1 |

-0.3 |

507.8 |

| Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

1,371.7 |

|

508.1 |

1,879.8 |

-0.4 |

1,879.4 |

| Actuarial gains and losses |

|

|

|

|

226.3 |

|

|

226.3 |

|

226.3 |

| Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

226.3 |

|

|

226.3 |

- |

226.3 |

| Consolidated comprehensive income |

|

|

|

1,882.6 |

1,598.0 |

|

508.1 |

3,988.8 |

0.2 |

3,988.9 |

| Capital

increase |

2,533,663 |

0.5 |

179.7 |

|

|

|

|

180.2 |

|

180.2 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-362.8 |

|

363.4 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,511.4 |

|

|

|

-1,511.4 |

-2.7 |

-1,514.1 |

| Share-based

payment |

|

|

|

58.5 |

|

|

|

58.5 |

|

58.5 |

| Net changes

in Treasury stock |

1,021,865 |

|

|

-77.3 |

|

82.5 |

|

5.2 |

|

5.2 |

| Purchase

commitments for minority interests |

|

|

|

-0.9 |

|

|

|

-0.9 |

1.1 |

0.2 |

| Changes in

scope of consolidation |

|

|

|

|

|

|

|

- |

|

- |

| Other

movements |

|

|

|

0.3 |

|

|

|

0.3 |

|

0.3 |

| At 06.30.2015 |

557,797,406 |

112.2 |

2,496.5 |

14,672.5 |

5,343.9 |

-237.1 |

525.9 |

22,913.9 |

2.2 |

22,916.1 |

(1)

Taking into account the change in accounting policies on recognition of levies resulting from the application of

IFRIC 21.

Changes in first-half 2014

| € millions |

Com-

mon

shares

out-

standing |

Share

capital |

Addi-

tional

paid-

in

capi-

tal |

Re-

tained

earn-

ings

and

net

profit |

Other

compre-

hensive

income |

Treas-

ury

stock |

Cumu-

lative

trans-

lation

adjust-ments |

Equity

attribute-

able

to

owners

of

the

com-

pany |

Non-

control-

ling

interests |

Total

equity |

| At 12.31.2013 |

599,794,030 |

121.2 |

2,101.2 |

17,179.0 |

4,370.1 |

-568.1 |

-566.4 |

22,637.0 |

5.8 |

22,642.8 |

Changes in

accounting policies

at 01.01.2014 (1) |

|

|

|

8.2 |

|

|

|

8.2 |

|

8.2 |

| At 01.01.2014 |

599,794,030 |

121.2 |

2,101.2 |

17,187.2 |

4,370.1 |

-568.1 |

-566.4 |

22,645.2 |

5.8 |

22,651.0 |

|

Consolidated net profit for the period |

|

|

|

1,734.8 |

|

|

|

1,734.8 |

1.6 |

1,736.4 |

| Financial assets available-for-sale |

|

|

|

|

52.1 |

|

|

52.1 |

|

52.1 |

| Cash flow hedges |

|

|

|

|

-53.2 |

|

|

-53.2 |

|

-53.2 |

| Cumulative translation adjustments |

|

|

|

|

|

|

69.0 |

69.0 |

0.3 |

69.3 |

| Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

-1.1 |

|

69.0 |

67.9 |

0.3 |

68.2 |

| Actuarial gains and losses |

|

|

|

|

-90.5 |

|

|

-90.5 |

|

-90.5 |

| Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

-90.5 |

|

|

-90.5 |

|

-90.5 |

| Consolidated comprehensive income |

|

|

|

1,734.8 |

-91.6 |

|

69.0 |

1,712.2 |

1.9 |

1,714.1 |

| Capital

increase |

2,397,512 |

0.5 |

121.1 |

|

|

|

|

121.6 |

2.3 |

123.9 |

|

Cancellation of Treasury stock |

|

|

|

|

|

|

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,507.3 |

|

|

|

-1,507.3 |

-2.9 |

-1,510.2 |

| Share-based

payment |

|

|

|

54.5 |

|

|

|

54.5 |

|

54.5 |

| Net changes

in Treasury stock |

-921,177 |

|

|

|

|

-117.2 |

|

-117.2 |

|

-117.2 |

| Purchase

commitments for minority interests |

|

|

|

4.7 |

|

|

|

4.7 |

0.8 |

5.5 |

| Changes in

scope of consolidation |

|

|

|

|

|

|

|

- |

-0.3 |

-0.3 |

| Other

movements |

|

|

|

0.1 |

|

|

|

0.1 |

|

0.1 |

| At 06.30.2014 |

601,270,365 |

121.7 |

2,222.3 |

17,474.0 |

4,278.5 |

-685.3 |

-497.4 |

22,913.8 |

7.6 |

22,921.4 |

(1)

Taking into account the change in accounting policies on recognition of levies resulting from the application of

IFRIC 21.

Appendix 6: Compared consolidated

statements of cash flows

| € millions |

1st half

2015 |

1st half

2014 |

2014 |

| Cash flows from operating activities |

|

|

|

| Net profit

attributable to owners of the company |

1,882.6 |

1,734.8 |

4,910.2 |

|

Non-controlling interests |

0.6 |

1.6 |

-1.6 |

| Elimination

of expenses and income with no impact on cash flows: |

|

|

|

| ·

depreciation, amortisation and provisions |

410.2 |

334.4 |

856.2 |

| · changes

in deferred taxes |

20.6 |

22.6 |

60.0 |

| ·

share-based payment (including free shares) |

58.5 |

54.5 |

113.5 |

| · capital

gains and losses on disposals of assets |

0.2 |

-0.2 |

-0.9 |

| Net profit

from discontinued operations |

- |

-41.0 |

-2,142.7 |

| Share of

profit in associates net of dividends received |

-2.7 |

1.5 |

13.5 |

| Gross cash flow |

2,370.0 |

2,108.2 |

3,808.2 |

| Changes in

working capital |

-815.9 |

-598.0 |

55.9 |

| Net cash provided by operating activities (A) |

1,554.1 |

1,510.2 |

3,864.1 |

| Cash flows from investing activities |

|

|

|

| Purchases

of property, plant and equipment and intangible assets |

-512.0 |

-484.8 |

-1,008.2 |

| Disposals

of property, plant and equipment and intangible assets |

5.7 |

13.1 |

18.7 |

| Changes in

other financial assets (including investments in non-consolidated

companies) |

13.2 |

-143.2 |

403.4 |

| Dividends

received from discontinued operations |

- |

41.7 |

41.7 |

| Effect of

changes in the scope of consolidation |

-412.8 |

-750.4 |

1,194.0 |

| Net cash (used in) from investing activities (B) |

-905.9 |

-1,323.6 |

649.6 |

| Cash flows from financing activities |

|

|

|

| Dividends

paid |

-1,535.0 |

-1,539.8 |

-1,589.3 |

| Capital

increase of the parent company |

180.2 |

121.5 |

216.4 |

| Capital

increase of subsidiaries |

- |

2.3 |

2.3 |

| Disposal

(acquisition) of Treasury stock |

5.2 |

-117.2 |

-6,160.3 |

| Issuance

(repayment) of short-term loans |

553.7 |

2,856.0 |

2,225.0 |

| Issuance of

long-term borrowings |

- |

0.2 |

0.2 |

| Repayment

of long-term borrowings |

-5.9 |

-10.0 |

-13.0 |

| Net cash (used in) from financing activities (C) |

-801.8 |

1,313.0 |

-5,318.7 |

| Net cash (used in) from discontinued

operations (D) |

- |

- |

- |

| Net effect

of changes in exchange rates and fair value (E) |

1.7 |

-16.1 |

62.7 |

| Change in cash and cash equivalents (A+B+C+D+E) |

-151.9 |

1,483.5 |

-742.3 |

| Cash and cash equivalents at beginning of the year

(F) |

1,917.0 |

2,659.3 |

2,659.3 |

| Change in cash and cash equivalents of discontinued

operations (G) |

- |

- |

- |

| Cash and cash equivalents at the end of the period

(A+B+C+D+E+F+G) |

1,765.1 |

4,142.8 |

1,917.0 |

Read the news release of July 30,

2015

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: L'ORÉAL via Globenewswire

HUG#1925631

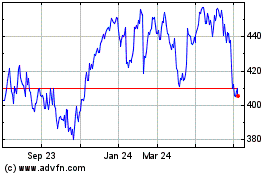

LOreal (EU:OR)

Historical Stock Chart

From Mar 2024 to Apr 2024

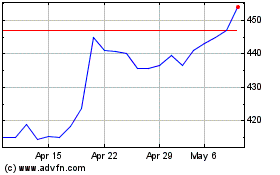

LOreal (EU:OR)

Historical Stock Chart

From Apr 2023 to Apr 2024