UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 OR 15(d) Of The Securities Exchange Act of 1934

|

Date of report (Date of earliest event reported) |

July 30, 2015 |

| |

|

| |

|

|

PATRICK INDUSTRIES, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Indiana |

000-03922 |

35-1057796 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification Number) |

|

107 West Franklin, P.O. Box 638, Elkhart, Indiana |

46515 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

|

Registrant’s Telephone Number, including area code |

(574) 294-7511 |

| |

|

(Former name or former address if changed since last report) |

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02 |

Results of Operations and Financial Condition. |

On July 30, 2015, the Company issued a press release announcing operating results for the second quarter ended June 28, 2015. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01 |

Financial Statements and Exhibits. |

|

|

(d) |

Exhibits |

| |

|

|

| |

|

Exhibit 99.1 - Press Release issued July 30, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PATRICK INDUSTRIES, INC. |

| |

(Registrant) |

| |

|

|

| |

|

|

|

Date: July 30, 2015 |

By: |

/s/ Andy L. Nemeth |

| |

|

Andy L. Nemeth |

| |

|

Executive Vice President – Finance and |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

For Immediate Release

Patrick Industries, Inc. Reports Second Quarter and

Six Months 2015 Financial Results

ELKHART, IN – July 30, 2015 – Patrick Industries, Inc. (NASDAQ: PATK), a major manufacturer and distributor of building and component products for the recreational vehicle (“RV”), manufactured housing (“MH”) and industrial markets, today reported its financial results for the second quarter and six months ended June 28, 2015.

Second Quarter 2015 Financial Results

Net sales for the second quarter of 2015 increased $45.6 million or 24.3%, to $233.5 million from $187.9 million in the same quarter of 2014. The increase was primarily attributable to a 26% increase in the Company’s revenue from the RV industry, which reflected the contributions from six acquisitions completed in 2014 and the first six months of 2015, as well as industry unit growth and market share gains. Sales to the RV industry represented 75% of the Company’s second quarter 2015 sales. Additionally, sales to the MH industry increased 18% and sales to the industrial markets increased 20%, quarter over quarter. According to industry sources, wholesale unit shipments in the RV industry increased approximately 3% in the second quarter of 2015 from the second quarter of 2014. Additionally, the Company estimates that wholesale unit shipments in the MH industry, which represented 14% of the Company’s second quarter 2015 sales, rose approximately 4% from the second quarter of 2014. The industrial market sector, which is primarily tied to a combination of the residential housing and commercial and retail fixtures markets, accounted for 11% of the Company’s second quarter 2015 sales. According to industry sources, new housing starts in the second quarter of 2015 compared to the prior year increased approximately 16%.

For the second quarter of 2015, Patrick reported operating income of $20.4 million, an increase of $4.9 million or 31.3%, from the $15.5 million reported in the second quarter of 2014. Net income in the second quarter of 2015 increased 30.8% to $12.1 million from $9.2 million in the second quarter of 2014, while net income per diluted share increased 36.8% to $0.78 from $0.57.

Todd Cleveland, President and Chief Executive Officer, said, “We are pleased with our operating and financial performance in the second quarter, reflecting continued positive momentum in the industries we serve, the impact of the acquisitions we have made over the past several years, and the team’s commitment to driving the execution of our strategic plan. We continue to increase overall content per unit in both the RV and MH industries through acquisitions and market share gains. In addition, our industrial team continues to increase its presence and territorial coverage, demonstrating its ability to grow revenue and capture market share as well. While we have seen a shift in the RV industry towards entry level and lower priced units, which has nominally impacted content per unit growth, this mix shift primarily affects certain of our more commodity-based product lines, which generally carry lower gross margins. However, we are encouraged to see younger and first-time consumers entering the market, as indicated by this mix shift and supported by recent dealer surveys, thus broadening the market’s foundation and extending the opportunity for longer-term industry growth potential. We believe our commitment to quality customer service and our large complement of innovative product lines at various price points position us to address our customers’ changing needs and buying patterns.”

Mr. Cleveland further stated, “We believe the opportunities that currently exist to grow our revenue base and increase our market share, through both the introduction of new and innovative product lines and strategic acquisitions, will provide us with the opportunity to bring additional value to our customer base and drive shareholder value. In addition, the newest members of the Patrick family, Better Way Products and Structural Composites of Indiana, are an excellent fit with our existing RV businesses, and we continue to focus on our goal of bringing the highest quality product offerings and service to our customers.”

Six Months 2015 Financial Results

Net sales for the first six months of 2015 increased $98.9 million or 27.6%, to $456.9 million from $358.0 million in the same period in 2014, including the impact of the acquisitions completed in 2014 and 2015. For the first six months of 2015, the Company’s revenue from the RV industry, which represented 77% of its six months 2015 sales, increased by 30%. According to industry sources, RV industry wholesale unit shipments increased approximately 6% in the first six months of 2015 compared to the prior year. Additionally, revenues from the MH industry, which represented 13% of the Company’s six months 2015 sales, rose 18% compared to the prior year as wholesale unit shipments in this industry, as estimated by the Company, increased by approximately 8%. Revenues from the industrial market increased 21% and benefited primarily from continued market share gains in the retail fixtures market, as well as improved residential cabinet and office and institutional furniture sales. The industrial market, which accounted for 10% of the Company’s six months 2015 sales, saw new housing starts increase by approximately 11% for the first six months of 2015 compared to the prior year. The Company estimates that approximately 50% of its industrial market sales are linked to the residential housing sector and its sales to the industrial markets generally lag new housing starts by approximately six to nine months.

The Company’s RV content per unit (on a trailing twelve-month basis) for the second quarter of 2015 increased approximately 21% to $1,707 from $1,410 for the second quarter of 2014. The MH content per unit (on a trailing twelve-month basis) for the second quarter of 2015 increased approximately 13% to an estimated $1,797 from $1,592 for the second quarter of 2014.

For the first six months of 2015, Patrick reported operating income of $35.9 million, an increase of $8.6 million or 31.7%, from the $27.3 million reported in the first six months of 2014. Net income in the first six months of 2015 increased 31.6% to $21.2 million from $16.1 million in the first six months of 2014, while net income per diluted share increased 37.0% to $1.37 from $1.00.

Patrick’s total assets increased $75.2 million to $330.8 million at June 28, 2015 from $255.6 million at December 31, 2014, primarily reflecting seasonality, overall growth, and the addition of acquisition-related assets. Total debt outstanding at June 28, 2015 increased $48.9 million to $150.0 million compared to $101.1 million at December 31, 2014, reflecting the funding of the Better Way Products and Structural Composites of Indiana acquisitions, stock repurchases, working capital needs, and capital expenditures, net of debt reduction.

In the first six months of 2015, the Company repurchased 195,750 shares at an average price of $28.86 per share for a total cost of approximately $5.7 million. There were no stock repurchases in the second quarter of 2015. Since the inception of the stock repurchase program in February 2013 through June 28, 2015, the Company has repurchased in the aggregate 1,323,870 shares at an average price of $19.38 per share for a total cost of approximately $25.7 million. As of June 28, 2015, there is $20.0 million available for stock repurchases under the existing stock buyback program as authorized by the Company’s Board of Directors in February 2015.

“Our first half revenue, operating income and net income performance and our strong cash flows have allowed us to continue to strengthen our balance sheet and utilize our leverage position in accordance with our capital allocation strategy to reinvest in our business through both acquisitions and capital expenditures,” stated Mr. Cleveland. “The recent expansion of our credit facility has provided increased capacity, as well as a strong financing platform to support the Company’s organizational strategic agenda, which includes strategic acquisitions in our existing businesses and similar markets, maximizing efficiencies to support our long-term strategic growth initiatives, and our ongoing working capital requirements. In anticipation of the continued growth in all three of our end markets and with the dedication and support of our more than 3,400 team members, we intend to continue to pursue acquisitions and other opportunities to increase our revenues and grow our operating income, net income, cash flows, and earnings per share through the remainder of 2015 and into 2016.”

Conference Call Webcast

As previously announced, Patrick Industries will host an online webcast of its second quarter 2015 earnings conference call that can be accessed on the Company’s website, www.patrickind.com, under “Investor Relations,” on Thursday, July 30, 2015 at 10:00 a.m. Eastern time.

About Patrick Industries

Patrick Industries, Inc. (www.patrickind.com) is a major manufacturer of component products and distributor of building products serving the recreational vehicle, manufactured housing, kitchen cabinet, office and household furniture, fixtures and commercial furnishings, marine, and other industrial markets and operates coast-to-coast through locations in 10 states. Patrick’s major manufactured products include decorative vinyl and paper laminated panels, countertops, fabricated aluminum products, wrapped profile mouldings, slide-out trim and fascia, cabinet doors and components, hardwood furniture, fiberglass bath fixtures, fiberglass and plastic component products, interior passage doors, exterior graphics and RV painting, simulated wood and stone products, and slotwall panels and components. The Company also distributes drywall and drywall finishing products, electronics, wiring, electrical and plumbing products, cement siding, FRP products, interior passage doors, roofing products, laminate and ceramic flooring, shower doors, furniture, fireplaces and surrounds, interior and exterior lighting products, and other miscellaneous products.

Forward-Looking Statements

This press release contains certain statements related to future results, or states our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: the impact of any economic downturns especially in the residential housing market, a decline in consumer confidence levels, pricing pressures due to competition, costs and availability of raw materials, availability of commercial credit, availability of retail and wholesale financing for residential and manufactured homes, availability and costs of labor, inventory levels of retailers and manufacturers, levels of repossessed residential and manufactured homes, the financial condition of our customers, retention and concentration of significant customers, the ability to generate cash flow or obtain financing to fund growth, future growth rates in the Company's core businesses, the seasonality and cyclicality in the industries to which our products are sold, the ability to effectively manage the costs and the implementation of the new enterprise resource management system, the successful integration of acquisitions and other growth initiatives, interest rates, oil and gasoline prices, adverse weather conditions impacting retail sales, and our ability to remain in compliance with our credit agreement covenants. In addition, national and regional economic conditions and consumer confidence may affect the retail sale of recreational vehicles and residential and manufactured homes. The Company does not undertake to update forward-looking statements, except as required by law. Further information regarding these and other risks, uncertainties and factors is contained in the section entitled "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2014, and in the Company's Form 10-Qs for subsequent quarterly periods, which are filed with the Securities and Exchange Commission ("SEC") and are available on the SEC's website at www.sec.gov.

Contact:

Julie Ann Kotowski

Patrick Industries, Inc.

574-294-7511 / kotowskj@patrickind.com

|

(thousands except per share data) |

|

SECOND QUARTER |

|

|

SIX MONTHS |

|

| |

|

ENDED |

|

|

ENDED |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

June 28, |

|

|

June 29, |

|

|

June 28, |

|

|

June 29, |

|

|

(Unaudited) |

|

2015 (1) |

|

|

2014 (1) |

|

|

2015 (1) |

|

|

2014 (1) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

233,481 |

|

|

$ |

187,855 |

|

|

$ |

456,869 |

|

|

$ |

358,005 |

|

|

Cost of goods sold |

|

|

193,088 |

|

|

|

156,036 |

|

|

|

381,082 |

|

|

|

299,039 |

|

|

Gross profit |

|

|

40,393 |

|

|

|

31,819 |

|

|

|

75,787 |

|

|

|

58,966 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warehouse and delivery |

|

|

6,826 |

|

|

|

6,659 |

|

|

|

13,485 |

|

|

|

12,771 |

|

|

Selling, general and administrative |

|

|

11,219 |

|

|

|

8,765 |

|

|

|

22,738 |

|

|

|

17,265 |

|

|

Amortization of intangible assets |

|

|

1,982 |

|

|

|

841 |

|

|

|

3,641 |

|

|

|

1,628 |

|

|

(Gain) loss on sale of fixed assets |

|

|

(5 |

) |

|

|

37 |

|

|

|

(11 |

) |

|

|

24 |

|

|

Total operating expenses |

|

|

20,022 |

|

|

|

16,302 |

|

|

|

39,853 |

|

|

|

31,688 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME |

|

|

20,371 |

|

|

|

15,517 |

|

|

|

35,934 |

|

|

|

27,278 |

|

|

Interest expense, net |

|

|

898 |

|

|

|

507 |

|

|

|

1,702 |

|

|

|

1,056 |

|

|

Income before income taxes |

|

|

19,473 |

|

|

|

15,010 |

|

|

|

34,232 |

|

|

|

26,222 |

|

|

Income taxes |

|

|

7,400 |

|

|

|

5,779 |

|

|

|

13,009 |

|

|

|

10,095 |

|

|

NET INCOME |

|

$ |

12,073 |

|

|

$ |

9,231 |

|

|

$ |

21,223 |

|

|

$ |

16,127 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC NET INCOME PER COMMON SHARE |

|

$ |

0.79 |

|

|

$ |

0.57 |

|

|

$ |

1.39 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DILUTED NET INCOME PER COMMON SHARE |

|

$ |

0.78 |

|

|

$ |

0.57 |

|

|

$ |

1.37 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - Basic |

|

|

15,312 |

|

|

|

16,061 |

|

|

|

15,319 |

|

|

|

16,057 |

|

|

- Diluted |

|

|

15,513 |

|

|

|

16,142 |

|

|

|

15,498 |

|

|

|

16,132 |

|

| |

| |

|

(1) Net income per common share and weighted average shares outstanding, on both a basic and diluted basis, reflect the impact of the three-for-two common stock split paid on May 29, 2015. |

|

(thousands) |

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|

June 28, |

|

|

Dec. 31, |

|

|

(Unaudited) |

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,606 |

|

|

$ |

123 |

|

|

Trade receivables, net |

|

|

51,345 |

|

|

|

32,637 |

|

|

Inventories |

|

|

73,428 |

|

|

|

71,020 |

|

|

Deferred tax assets |

|

|

4,427 |

|

|

|

4,563 |

|

|

Prepaid expenses and other |

|

|

3,097 |

|

|

|

6,453 |

|

|

Total current assets |

|

|

138,903 |

|

|

|

114,796 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

61,466 |

|

|

|

57,353 |

|

|

Goodwill and other intangible assets, net |

|

|

126,796 |

|

|

|

81,174 |

|

|

Deferred financing costs, net |

|

|

2,420 |

|

|

|

1,024 |

|

|

Other non-current assets |

|

|

1,232 |

|

|

|

1,214 |

|

|

TOTAL ASSETS |

|

$ |

330,817 |

|

|

$ |

255,561 |

|

| |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Current maturities of long-term debt |

|

$ |

10,714 |

|

|

$ |

- |

|

|

Accounts payable |

|

|

36,429 |

|

|

|

29,754 |

|

|

Accrued liabilities |

|

|

17,131 |

|

|

|

15,388 |

|

|

Total current liabilities |

|

|

64,274 |

|

|

|

45,142 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities |

|

|

139,286 |

|

|

|

101,054 |

|

|

Deferred compensation and other |

|

|

2,177 |

|

|

|

2,239 |

|

|

Deferred tax liabilities |

|

|

3,688 |

|

|

|

4,358 |

|

|

TOTAL LIABILITIES |

|

|

209,425 |

|

|

|

152,793 |

|

| |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

121,392 |

|

|

|

102,768 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

330,817 |

|

|

$ |

255,561 |

|

| |

|

|

|

|

|

|

|

|

6

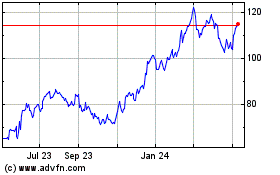

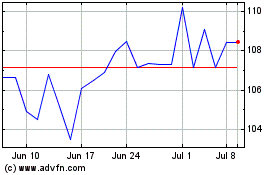

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Apr 2023 to Apr 2024