UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-35299

ALKERMES PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Ireland

|

|

98-1007018

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

Connaught House

1 Burlington Road

Dublin 4, Ireland

(Address of principal executive offices)

+ 353-1-772-8000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

Large accelerated filer ☒

|

|

Accelerated filer ☐

|

|

|

|

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☐

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The number of the registrant’s ordinary shares, $0.01 par value, outstanding as of July 27, 2015 was 149,398,549 shares.

ALKERMES PLC AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2015

Cautionary Note Concerning Forward-Looking Statements

This document contains and incorporates by reference “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, these statements can be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “should,” “would,” “expect,” “anticipate,” “continue,” “believe,” “plan,” “estimate,” “intend” or other similar words. These statements discuss future expectations, and contain projections of results of operations or of financial condition, or state trends and known uncertainties or other forward-looking information. Forward-looking statements in this Quarterly Report on Form 10-Q (“Form 10-Q”) include, without limitation, statements regarding:

|

·

| |

our expectations regarding our financial performance, including revenues, expenses, gross margins, liquidity, capital expenditures and income taxes; |

|

·

| |

our expectations regarding our products, including the development, regulatory review (including expectations about regulatory approval and regulatory timelines) and therapeutic and commercial scope and potential of such products and the costs and expenses related thereto; |

|

·

| |

our expectations regarding the initiation, timing and results of clinical trials of our products; |

|

·

| |

our expectations regarding the competitive landscape, and changes therein, related to our products, including our development programs; |

|

·

| |

our expectations regarding the financial impact of currency exchange rate fluctuations and valuations; |

|

·

| |

our expectations regarding future amortization of intangible assets; |

|

·

| |

our expectations regarding our collaborations and other significant agreements relating to our products, including our development programs; |

|

·

| |

our expectations regarding the financial impact related to the sale of our Gainesville, GA facility and the related manufacturing and royalty revenue associated with products manufactured at the facility, and the rights to IV/IM and parenteral forms of Meloxicam and the related contingent consideration (herein referred to as the “Gainesville Transaction”); |

|

·

| |

our expectations regarding the impact of adoption of new accounting pronouncements; |

|

·

| |

our expectations regarding near-term changes in the nature of our market risk exposures or in management’s objectives and strategies with respect to managing such exposures; |

|

·

| |

our ability to comply with restrictive covenants of our indebtedness and our ability to fund our debt service obligations; and |

|

·

| |

our expectations regarding future capital requirements and capital expenditures and our ability to finance our operations and capital requirements. |

Actual results might differ materially from those expressed or implied by the forward-looking statements contained in this Form 10-Q because these forward-looking statements are subject to risks, assumptions and uncertainties. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this Form 10-Q. Except as required by applicable law or regulation, we do not undertake any obligation to update publicly or revise any forward-looking statements in this Form 10-Q, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Form 10-Q might not occur. For more information regarding the risks and uncertainties of our business, see ‘‘Item 1A—Risk Factors’’ in Part II of this Form 10-Q, “Part I, Item 1A—Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2014 (the “Annual Report”) and any subsequent reports filed with the U.S. Securities and Exchange Commission (“SEC”).

Unless otherwise indicated, information contained in this Form 10-Q concerning the disorders targeted by our products and the markets in which we operate is based on information from various third-party sources (including, without limitation, industry publications, medical and clinical journals and studies, surveys and forecasts) as well as our internal research. Our internal research involves assumptions that we have made, which we believe are reasonable, based on data from those and other similar sources and on our knowledge of the markets for our marketed and development products. Our internal research has not been verified by any independent source, and we have not independently verified any third-party information. These projections, assumptions and estimates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in ‘‘Item 1A—Risk Factors’’ in Part II of this

Form 10-Q and ‘‘Part I, Item 1A—Risk Factors’’ of our Annual Report. These and other factors could cause our results to differ materially from those expressed in the estimates included in this Form 10-Q.

Note Regarding Company

Alkermes plc (as used in this report, together with our subsidiaries, “Alkermes,” “the Company,” ‘‘us,’’ ‘‘we’’ and ‘‘our’’) is a fully integrated, global biopharmaceutical company that applies its scientific expertise and proprietary technologies to research, develop and commercialize, both with partners and on our own, pharmaceutical products that are designed to address unmet medical needs of patients in major therapeutic areas. We have a diversified portfolio of commercial drug products and a clinical pipeline of product candidates that address central nervous system (“CNS”) disorders such as schizophrenia, depression, addiction and multiple sclerosis.

Note Regarding Trademarks

We are the owner of various U.S. federal trademark registrations (“®”) and registration applications (“TM”), including ARISTADATM, LinkeRx®, NanoCrystal®, SECATM and VIVITROL®. The following are trademarks of the respective companies listed: ABILIFY®— Otsuka Pharmaceutical Co., Ltd.; AMPYRA® and FAMPYRA®—Acorda Therapeutics, Inc.; BIDILTM—Arbor Pharmaceuticals, LLC; BYDUREON® and BYETTA®—Amylin Pharmaceuticals, LLC; INVEGA® SUSTENNA®, INVEGA TRINZATM, XEPLION®, and RISPERDAL® CONSTA®—Johnson & Johnson Corp. (or its affiliate); MEGACE®—E.R. Squibb & Sons, LLC; RITALIN LA® and FOCALIN XR®—Novartis AG; TECFIDERA®—Biogen MA Inc.; TRICOR®—Abbvie Inc.; VERELAN®—Recro Technology, LLC; ZOHYDRO® ER— Ferrimill Limited; and ZYPREXA®—Eli Lilly and Company. Other trademarks, trade names and service marks appearing in this Form 10-Q are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Form 10-Q are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements:

ALKERMES PLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2015

|

|

December 31, 2014

|

|

|

|

|

(In thousands, except share and per

share amounts)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

196,893

|

|

$

|

224,064

|

|

|

Investments — short-term

|

|

|

579,877

|

|

|

407,102

|

|

|

Receivables, net

|

|

|

135,782

|

|

|

151,551

|

|

|

Inventory

|

|

|

38,801

|

|

|

51,357

|

|

|

Prepaid expenses and other current assets

|

|

|

50,424

|

|

|

29,289

|

|

|

Deferred tax assets — current

|

|

|

15,185

|

|

|

13,430

|

|

|

Total current assets

|

|

|

1,016,962

|

|

|

876,793

|

|

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

|

|

239,258

|

|

|

265,740

|

|

|

INTANGIBLE ASSETS—NET

|

|

|

407,599

|

|

|

479,412

|

|

|

GOODWILL

|

|

|

92,873

|

|

|

94,212

|

|

|

CONTINGENT CONSIDERATION

|

|

|

59,100

|

|

|

-

|

|

|

INVESTMENTS—LONG-TERM

|

|

|

55,589

|

|

|

170,480

|

|

|

OTHER ASSETS

|

|

|

43,295

|

|

|

34,635

|

|

|

TOTAL ASSETS

|

|

$

|

1,914,676

|

|

$

|

1,921,272

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

125,722

|

|

$

|

121,258

|

|

|

Long-term debt—short-term

|

|

|

6,750

|

|

|

6,750

|

|

|

Deferred revenue—short-term

|

|

|

1,746

|

|

|

2,574

|

|

|

Total current liabilities

|

|

|

134,218

|

|

|

130,582

|

|

|

LONG-TERM DEBT

|

|

|

348,056

|

|

|

351,220

|

|

|

OTHER LONG-TERM LIABILITIES

|

|

|

12,859

|

|

|

11,914

|

|

|

DEFERRED TAX LIABILITIES, NET—LONG-TERM

|

|

|

12,747

|

|

|

18,918

|

|

|

DEFERRED REVENUE—LONG-TERM

|

|

|

7,805

|

|

|

11,801

|

|

|

Total liabilities

|

|

|

515,685

|

|

|

524,435

|

|

|

COMMITMENTS AND CONTINGENCIES (Note 15)

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY:

|

|

|

|

|

|

|

|

|

Preferred shares, par value, $0.01 per share; 50,000,000 shares authorized; zero issued and outstanding at June 30, 2015 and December 31, 2014, respectively

|

|

|

—

|

|

|

—

|

|

|

Ordinary shares, par value, $0.01 per share; 450,000,000 shares authorized; 150,581,367 and 148,545,150 shares issued; 149,304,016 and 147,538,519 shares outstanding at June 30, 2015, and December 31, 2014, respectively

|

|

|

1,503

|

|

|

1,482

|

|

|

Treasury shares, at cost (1,277,351 and 1,006,631 shares at June 30, 2015 and December 31, 2014, respectively)

|

|

|

(49,384)

|

|

|

(32,052)

|

|

|

Additional paid-in capital

|

|

|

2,038,700

|

|

|

1,942,878

|

|

|

Accumulated other comprehensive loss

|

|

|

(2,725)

|

|

|

(3,136)

|

|

|

Accumulated deficit

|

|

|

(589,103)

|

|

|

(512,335)

|

|

|

Total shareholders’ equity

|

|

|

1,398,991

|

|

|

1,396,837

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$

|

1,914,676

|

|

$

|

1,921,272

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALKERMES PLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

|

|

June 30,

|

|

June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

|

(In thousands, except per share amounts)

|

|

REVENUES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing and royalty revenues

|

|

$

|

113,162

|

|

$

|

130,366

|

|

$

|

241,906

|

|

$

|

241,646

|

|

Product sales, net

|

|

|

37,172

|

|

|

21,595

|

|

|

68,309

|

|

|

38,674

|

|

Research and development revenue

|

|

|

1,036

|

|

|

1,463

|

|

|

2,369

|

|

|

3,316

|

|

Total revenues

|

|

|

151,370

|

|

|

153,424

|

|

|

312,584

|

|

|

283,636

|

|

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods manufactured and sold (exclusive of amortization of acquired intangible assets shown below)

|

|

|

30,418

|

|

|

43,290

|

|

|

70,392

|

|

|

82,129

|

|

Research and development

|

|

|

87,882

|

|

|

67,207

|

|

|

158,160

|

|

|

119,347

|

|

Selling, general and administrative

|

|

|

71,539

|

|

|

50,663

|

|

|

134,589

|

|

|

93,213

|

|

Amortization of acquired intangible assets

|

|

|

14,052

|

|

|

15,089

|

|

|

29,272

|

|

|

27,665

|

|

Total expenses

|

|

|

203,891

|

|

|

176,249

|

|

|

392,413

|

|

|

322,354

|

|

OPERATING LOSS

|

|

|

(52,521)

|

|

|

(22,825)

|

|

|

(79,829)

|

|

|

(38,718)

|

|

OTHER INCOME, NET:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

795

|

|

|

323

|

|

|

1,455

|

|

|

834

|

|

Interest expense

|

|

|

(3,315)

|

|

|

(3,385)

|

|

|

(6,603)

|

|

|

(6,741)

|

|

Gain on Gainesville Transaction

|

|

|

9,911

|

|

|

—

|

|

|

9,911

|

|

|

—

|

|

Increase in the fair value of contingent consideration

|

|

|

1,500

|

|

|

—

|

|

|

1,500

|

|

|

—

|

|

Other income (expense), net

|

|

|

585

|

|

|

518

|

|

|

374

|

|

|

(1,332)

|

|

Gain on sale of property, plant and equipment

|

|

|

—

|

|

|

12,285

|

|

|

—

|

|

|

12,285

|

|

Gain on sale of investment in Acceleron Pharma Inc.

|

|

|

—

|

|

|

15,296

|

|

|

—

|

|

|

15,296

|

|

Total other income, net

|

|

|

9,476

|

|

|

25,037

|

|

|

6,637

|

|

|

20,342

|

|

(LOSS) INCOME BEFORE INCOME TAXES

|

|

|

(43,045)

|

|

|

2,212

|

|

|

(73,192)

|

|

|

(18,376)

|

|

PROVISION (BENEFIT) FOR INCOME TAXES

|

|

|

3,064

|

|

|

(1,523)

|

|

|

3,574

|

|

|

2,243

|

|

NET (LOSS) INCOME

|

|

$

|

(46,109)

|

|

$

|

3,735

|

|

$

|

(76,766)

|

|

$

|

(20,619)

|

|

(LOSS) EARNINGS PER COMMON SHARE:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.31)

|

|

$

|

0.03

|

|

$

|

(0.52)

|

|

$

|

(0.14)

|

|

Diluted

|

|

$

|

(0.31)

|

|

$

|

0.02

|

|

$

|

(0.52)

|

|

$

|

(0.14)

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

148,867

|

|

|

144,913

|

|

|

148,480

|

|

|

144,140

|

|

Diluted

|

|

|

148,867

|

|

|

154,300

|

|

|

148,480

|

|

|

144,140

|

|

COMPREHENSIVE LOSS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$

|

(46,109)

|

|

$

|

3,735

|

|

$

|

(76,766)

|

|

$

|

(20,619)

|

|

Holding (losses) gains, net of tax of $(39), $6,174, $170 and $7,627, respectively

|

|

|

(80)

|

|

|

4,540

|

|

|

409

|

|

|

2,009

|

|

Reclassification of unrealized gains to realized gains

|

|

|

—

|

|

|

(15,296)

|

|

|

—

|

|

|

(15,296)

|

|

COMPREHENSIVE LOSS

|

|

$

|

(46,189)

|

|

$

|

(7,021)

|

|

$

|

(76,357)

|

|

$

|

(33,906)

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ALKERMES PLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2015

|

|

2014

|

|

|

|

|

(In thousands)

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(76,766)

|

|

$

|

(20,619)

|

|

|

Adjustments to reconcile net loss to cash flows from operating activities:

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

43,108

|

|

|

47,486

|

|

|

Share-based compensation expense

|

|

|

39,206

|

|

|

32,758

|

|

|

Deferred income taxes

|

|

|

(21,624)

|

|

|

(10,664)

|

|

|

Excess tax benefit from share-based compensation

|

|

|

(16,506)

|

|

|

(6,984)

|

|

|

Gain on Gainesville Transaction

|

|

|

(9,911)

|

|

|

—

|

|

|

Increase in fair value of contingent consideration

|

|

|

(1,500)

|

|

|

—

|

|

|

Gain on sale of property, plant and equipment

|

|

|

(104)

|

|

|

(12,160)

|

|

|

Gain on sale of investment of Acceleron Pharma Inc.

|

|

|

—

|

|

|

(15,296)

|

|

|

Other non-cash charges

|

|

|

(435)

|

|

|

9,965

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

3,249

|

|

|

(5,162)

|

|

|

Inventory, prepaid expenses and other assets

|

|

|

7,012

|

|

|

(19,714)

|

|

|

Accounts payable and accrued expenses

|

|

|

21,138

|

|

|

3,693

|

|

|

Deferred revenue

|

|

|

(788)

|

|

|

(1,304)

|

|

|

Other long-term liabilities

|

|

|

592

|

|

|

3,306

|

|

|

Cash flows (used in) provided by operating activities

|

|

|

(13,329)

|

|

|

5,305

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Additions of property, plant and equipment

|

|

|

(24,755)

|

|

|

(11,438)

|

|

|

Proceeds from the sale of equipment

|

|

|

40

|

|

|

14,361

|

|

|

Net proceeds from the Gainesville Transaction

|

|

|

50,241

|

|

|

—

|

|

|

Purchases of investments

|

|

|

(269,447)

|

|

|

(433,203)

|

|

|

Sales and maturities of investments

|

|

|

212,143

|

|

|

184,446

|

|

|

Cash flows used in investing activities

|

|

|

(31,778)

|

|

|

(245,834)

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Proceeds from the issuance of ordinary shares, net

|

|

|

—

|

|

|

248,406

|

|

|

Proceeds from the issuance of ordinary shares under share-based compensation arrangements

|

|

|

21,837

|

|

|

21,821

|

|

|

Excess tax benefit from share-based compensation

|

|

|

16,506

|

|

|

6,984

|

|

|

Employee taxes paid related to net share settlement of equity awards

|

|

|

(17,032)

|

|

|

(12,546)

|

|

|

Principal payments of long-term debt

|

|

|

(3,375)

|

|

|

(3,376)

|

|

|

Cash flows provided by financing activities

|

|

|

17,936

|

|

|

261,289

|

|

|

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

|

|

|

(27,171)

|

|

|

20,760

|

|

|

CASH AND CASH EQUIVALENTS—Beginning of period

|

|

|

224,064

|

|

|

167,562

|

|

|

CASH AND CASH EQUIVALENTS—End of period

|

|

$

|

196,893

|

|

$

|

188,322

|

|

|

SUPPLEMENTAL CASH FLOW DISCLOSURE:

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

Purchased capital expenditures included in accounts payable and accrued expenses

|

|

$

|

4,480

|

|

$

|

1,491

|

|

|

Fair value of warrants received as part of Gainesville Transaction

|

|

$

|

2,123

|

|

$

|

—

|

|

|

Fair value of contingent consideration received as part of Gainesville Transaction

|

|

$

|

57,600

|

|

$

|

—

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited)

1. THE COMPANY

Alkermes is a fully integrated, global biopharmaceutical company that applies its scientific expertise and proprietary technologies to research, develop and commercialize, both with partners and on our own, pharmaceutical products that are designed to address unmet medical needs of patients in major therapeutic areas. We have a diversified portfolio of commercial drug products and a clinical pipeline of product candidates that address central nervous system (“CNS”) disorders such as schizophrenia, depression, addiction and multiple sclerosis. Headquartered in Dublin, Ireland, Alkermes has a research and development (“R&D”) center in Waltham, Massachusetts; a research and manufacturing facility in Athlone, Ireland; and a manufacturing facility in Wilmington, Ohio.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements of the Company for the three and six months ended June 30, 2015 and 2014 are unaudited and have been prepared on a basis substantially consistent with the audited financial statements for the year ended December 31, 2014. The year-end condensed consolidated balance sheet data, which is presented for comparative purposes, was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America (“U.S.”) (commonly referred to as “GAAP”). In the opinion of management, the condensed consolidated financial statements include all adjustments, which are of a normal recurring nature, that are necessary to state fairly the results of operations for the reported periods.

These financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto of Alkermes, which are contained in the Company’s Annual Report, which has been filed with the SEC. The results of the Company’s operations for any interim period are not necessarily indicative of the results of the Company’s operations for any other interim period or for a full fiscal year.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of Alkermes plc and its wholly owned subsidiaries as disclosed in Note 2, Summary of Significant Accounting Policies, within the “Notes to Consolidated Financial Statements” accompanying its Annual Report. Intercompany accounts and transactions have been eliminated.

Use of Estimates

The preparation of the Company’s condensed consolidated financial statements in accordance with GAAP requires management to make estimates, judgments and assumptions that may affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, the Company evaluates its estimates and judgments and methodologies, including those related to revenue recognition and related allowances, its collaborative relationships, clinical trial expenses, the valuation of inventory, impairment and amortization of intangibles and long-lived assets, share-based compensation, income taxes including the valuation allowance for deferred tax assets, valuation of contingent consideration, valuation of investments, litigation and restructuring charges. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions.

Segment Information

The Company operates as one business segment, which is the business of developing, manufacturing and commercializing medicines designed to yield better therapeutic outcomes and improve the lives of patients with serious diseases. The Company’s chief decision maker, the Chairman and Chief Executive Officer, reviews the Company’s operating results on an aggregate basis and manages the Company’s operations as a single operating unit.

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard-setting bodies that are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption.

In April 2014, the FASB adopted guidance that amends the requirements for reporting discontinued operations. Under the amendment, only those disposals of components of an entity that represent a strategic shift that has (or will have) a major effect on an entity's operations and financial results will be reported as discontinued operations in the financial statements. Currently, many disposals, some of which may be routine in nature and not a change in an entity's strategy, are reported in discontinued operations. The Company adopted this guidance on January 1, 2015.

In June 2014, the FASB issued guidance that clarifies the accounting for share-based payments when the terms of an award provide that a performance target could be achieved after the requisite service period. Existing GAAP does not contain explicit guidance on how to account for these share-based payments. The new guidance requires that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. Entities have the option of prospectively applying the guidance to awards granted or modified after the effective date or retrospectively applying the guidance to all awards with performance targets that are outstanding as of the beginning of the earliest annual period presented in the financial statements. The guidance becomes effective for the Company in its year ending December 31, 2016, and early adoption is permitted. The Company is currently assessing the impact that this standard will have on its consolidated financial statements.

In January 2015, the FASB issued guidance that simplifies income statement presentation by eliminating the concept of extraordinary items. The guidance becomes effective for the Company in its year ending December 31, 2016 and is not expected to have an impact on the Company’s consolidated financial statements.

In April 2015, the FASB issued guidance simplifying the presentation of debt issuance costs. To simplify presentation of debt issuance costs, the amendments require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The guidance becomes effective for the Company in its year ending December 31, 2016, and early adoption is permitted. The Company is currently assessing the impact that this standard will have on its consolidated financial statements.

In May 2014, the FASB issued guidance that outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The guidance is based on the principle that an entity should recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to fulfill a contract. Entities have the option of using either a full retrospective or a modified retrospective approach for the adoption of the new standard. The guidance becomes effective for the Company in its year ending December 31, 2018, and the Company could early adopt the standard for its year ending December 31, 2017. The Company is currently assessing the impact that this standard will have on its consolidated financial statements.

3. DIVESTITURE

On March 7, 2015, the Company entered into a definitive agreement to sell the Gainesville, GA facility, the related manufacturing and royalty revenue associated with products manufactured at the facility, and the rights to IV/IM and parenteral forms of Meloxicam to Recro Pharma, Inc. (“Recro”) and Recro Pharma LLC (together with Recro, the “Purchasers”). The sale was completed on April 10, 2015 and, under the terms of the agreement, Recro paid the Company $54.0 million in cash and issued warrants to purchase an aggregate of 350,000 shares of Recro common stock at a per share exercise price of $19.46, which was two times the closing price of Recro’s common stock on the day prior

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

to closing. The Company is also eligible to receive low double-digit royalties on net sales of IV/IM and parenteral forms of Meloxicam and up to $120.0 million in milestone payments upon the achievement of certain regulatory and sales milestones related to IV/IM and parenteral forms of Meloxicam.

The gain on the Gainesville Transaction was determined as follows:

|

|

|

|

|

|

|

|

|

April 10, 2015

|

|

|

|

|

(In thousands)

|

|

|

Sales Proceeds:

|

|

|

|

|

|

Cash

|

|

$

|

54,010

|

|

|

Fair value of warrants

|

|

|

2,123

|

|

|

Fair value of contingent consideration

|

|

|

57,600

|

|

|

Total consideration received

|

|

$

|

113,733

|

|

|

Less net assets sold

|

|

|

(101,373)

|

|

|

Less transaction costs

|

|

|

(2,449)

|

|

|

Gain on Gainesville Transaction

|

|

$

|

9,911

|

|

The Company recorded the gain on the Gainesville Transaction within the accompanying condensed consolidated statement of operations and comprehensive loss. The Company determined that the sale of assets in connection with the Gainesville Transaction did not constitute a strategic shift and that it did not and will not have a major effect on its operations and financial results. Accordingly, the operations from the Gainesville Transaction are not reported in discontinued operations.

During the three and six months ended June 30, 2015, the Gainesville, GA facility and associated intellectual property (“IP”) generated income before income taxes of $2.4 million and $7.6 million, respectively, and generated income before income taxes of $7.8 million and $16.4 million during the three and six months ended June 30, 2014, respectively.

The Company determined the value of the Gainesville Transaction’s contingent consideration using the following valuation approaches:

|

·

| |

The fair value of the two regulatory milestones were estimated based on applying the likelihood of achieving the regulatory milestone and applying a discount rate from the expected time the milestone occurs to the balance sheet date. The Company expects the regulatory milestone events to occur within the next two and three years, respectively, and used a discount rate of 4.2% and 4.9%, respectively, for each of these events. |

|

·

| |

To estimate the fair value of future royalties on net sales of the product, the Company assessed the likelihood of the product being approved for sale and expected future sales given approval and IP protection. The Company then discounted these expected payments using a discount rate of 15.9%, which the Company believes captures a market participant’s view of the risk associated with the expected payments. |

|

·

| |

The sales milestones were determined through the use of a real options approach, where net sales are simulated in a risk-neutral world. To employ this methodology, the Company used a risk-adjusted expected growth rate based on its assessments of expected growth in net sales of the approved product, adjusted by an appropriate factor capturing their respective correlation with the market. A resulting expected (probability-weighted) milestone payment was then discounted at a cost of debt plus an alpha, which ranged from 11.3% to 12.2%. |

At June 30, 2015, the Company determined that the value of the Gainesville Transaction’s contingent consideration increased to $59.1 million due primarily to a shorter time to payment on the milestones and royalties included in the contingent consideration. The $1.5 million increase was recorded as “Change in the fair value of contingent consideration” in the three months ended June 30, 2015 in the accompanying condensed consolidated statements of operations and comprehensive loss.

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

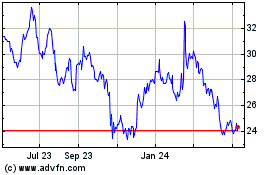

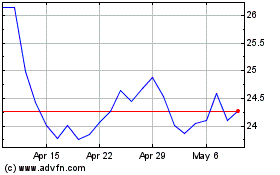

The warrants the Company received to purchase 350,000 shares of Recro common stock were determined to have a fair value of $2.1 million on the closing date of the transaction. At June 30, 2015, the Company determined that the value of these warrants had increased to $3.0 million and are being recorded within other long-term assets in the accompanying condensed consolidated balance sheets. The company used a Black-Scholes model with the following assumptions to determine the fair value of these warrants at June 30, 2015:

|

|

|

|

|

|

|

Closing stock price at June 30, 2015

|

|

$

|

12.92

|

|

|

Warrant strike price

|

|

$

|

19.46

|

|

|

Expected term (years)

|

|

|

6.78

|

|

|

Risk-free rate

|

|

|

2.07

|

%

|

|

Volatility

|

|

|

80.0

|

%

|

The increase in the fair value of the warrants of $0.9 million during the three months ended June 30, 2015 was recorded within other income (expense), net in the accompanying condensed consolidated statements of operations and comprehensive loss.

4. INVESTMENTS

Investments consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Unrealized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses

|

|

|

|

|

|

|

|

Amortized

|

|

|

|

|

Less than

|

|

Greater than

|

|

Estimated

|

|

|

|

|

Cost

|

|

Gains

|

|

One Year

|

|

One Year

|

|

Fair Value

|

|

|

|

|

(In thousands)

|

|

|

June 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

$

|

342,084

|

|

$

|

394

|

|

$

|

(12)

|

|

$

|

—

|

|

$

|

342,466

|

|

|

Corporate debt securities

|

|

|

220,406

|

|

|

75

|

|

|

(80)

|

|

|

—

|

|

|

220,401

|

|

|

International government agency debt securities

|

|

|

17,000

|

|

|

11

|

|

|

(1)

|

|

|

—

|

|

|

17,010

|

|

|

Total short-term investments

|

|

|

579,490

|

|

|

480

|

|

|

(93)

|

|

|

—

|

|

|

579,877

|

|

|

Long-term investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

|

24,996

|

|

|

—

|

|

|

(32)

|

|

|

—

|

|

|

24,964

|

|

|

Corporate debt securities

|

|

|

19,068

|

|

|

—

|

|

|

(48)

|

|

|

—

|

|

|

19,020

|

|

|

International government agency debt securities

|

|

|

9,995

|

|

|

—

|

|

|

(9)

|

|

|

—

|

|

|

9,986

|

|

|

|

|

|

54,059

|

|

|

—

|

|

|

(89)

|

|

|

—

|

|

|

53,970

|

|

|

Held-to-maturity securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit

|

|

|

1,619

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,619

|

|

|

Total long-term investments

|

|

|

55,678

|

|

|

—

|

|

|

(89)

|

|

|

—

|

|

|

55,589

|

|

|

Total investments

|

|

$

|

635,168

|

|

$

|

480

|

|

$

|

(182)

|

|

$

|

—

|

|

$

|

635,466

|

|

|

December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

$

|

226,387

|

|

$

|

88

|

|

$

|

(15)

|

|

$

|

—

|

|

$

|

226,460

|

|

|

Corporate debt securities

|

|

|

140,900

|

|

|

26

|

|

|

(66)

|

|

|

—

|

|

|

140,860

|

|

|

International government agency debt securities

|

|

|

39,774

|

|

|

13

|

|

|

(5)

|

|

|

—

|

|

|

39,782

|

|

|

Total short-term investments

|

|

|

407,061

|

|

|

127

|

|

|

(86)

|

|

|

—

|

|

|

407,102

|

|

|

Long-term investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

|

100,429

|

|

|

—

|

|

|

(196)

|

|

|

(40)

|

|

|

100,193

|

|

|

Corporate debt securities

|

|

|

61,187

|

|

|

—

|

|

|

(84)

|

|

|

—

|

|

|

61,103

|

|

|

International government agency debt securities

|

|

|

7,568

|

|

|

—

|

|

|

(2)

|

|

|

(1)

|

|

|

7,565

|

|

|

|

|

|

169,184

|

|

|

—

|

|

|

(282)

|

|

|

(41)

|

|

|

168,861

|

|

|

Held-to-maturity securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit

|

|

|

1,619

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,619

|

|

|

Total long-term investments

|

|

|

170,803

|

|

|

—

|

|

|

(282)

|

|

|

(41)

|

|

|

170,480

|

|

|

Total investments

|

|

$

|

577,864

|

|

$

|

127

|

|

$

|

(368)

|

|

$

|

(41)

|

|

$

|

577,582

|

|

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

The proceeds from the sales and maturities of marketable securities, which were primarily reinvested and resulted in realized gains and losses, were as follows:

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

|

|

|

|

June 30,

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

Proceeds from the sales and maturities of marketable securities

|

|

$

|

212,143

|

|

$

|

184,446

|

|

Realized gains

|

|

$

|

16

|

|

$

|

15,304

|

|

Realized losses

|

|

$

|

1

|

|

$

|

10

|

The Company’s available-for-sale and held-to-maturity securities at June 30, 2015 had contractual maturities in the following periods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available-for-sale

|

|

Held-to-maturity

|

|

|

|

|

Amortized

|

|

Estimated

|

|

Amortized

|

|

Estimated

|

|

|

(In thousands)

|

|

Cost

|

|

Fair Value

|

|

Cost

|

|

Fair Value

|

|

|

Within 1 year

|

|

$

|

342,340

|

|

$

|

342,368

|

|

$

|

1,619

|

|

$

|

1,619

|

|

|

After 1 year through 5 years

|

|

|

291,209

|

|

|

291,479

|

|

|

—

|

|

|

—

|

|

|

Total

|

|

$

|

633,549

|

|

$

|

633,847

|

|

$

|

1,619

|

|

$

|

1,619

|

|

At June 30, 2015, the Company believed that the unrealized losses on its available-for-sale investments were temporary. The investments with unrealized losses consisted primarily of U.S. government and agency debt securities and corporate debt securities. In making the determination that the decline in fair value of these securities was temporary, the Company considered various factors, including but not limited to: the length of time each security was in an unrealized loss position; the extent to which fair value was less than cost; financial condition and near-term prospects of the issuers; and the Company’s intent not to sell these securities and the assessment that it is more likely than not that the Company would not be required to sell these securities before the recovery of their amortized cost basis.

In May 2014, the Company entered into an agreement whereby it is committed to provide up to €7.4 million to a partnership, Fountain Healthcare Partners II, L.P. of Ireland (“Fountain”), which was created to carry on the business of investing exclusively in companies and businesses engaged in healthcare, pharmaceutical and life sciences sectors. The Company’s commitment represents approximately 7% of the partnership’s total funding, and the Company is accounting for its investment in Fountain under the equity method. At June 30, 2015, the Company had made payments of, and its investment is equal to, $1.5 million (€1.2 million), which is included within “Other assets” in the accompanying condensed consolidated balance sheets. During the three and six months ended June 30, 2015, the Company recorded a reduction in its investment in Fountain of less than $0.1 million and $0.1 million, respectively, which represented the Company’s proportional share of Fountain’s net losses for these periods.

5. FAIR VALUE MEASUREMENTS

The following table presents information about the Company’s assets and liabilities that are measured at fair value on a recurring basis and indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

|

|

|

|

|

|

|

|

|

(In thousands)

|

|

2015

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

$

|

367,430

|

|

$

|

220,286

|

|

$

|

147,144

|

|

$

|

—

|

|

Corporate debt securities

|

|

|

239,421

|

|

|

—

|

|

|

239,421

|

|

|

—

|

|

International government agency debt securities

|

|

|

26,995

|

|

|

—

|

|

|

26,995

|

|

|

—

|

|

Contingent consideration

|

|

|

59,100

|

|

|

—

|

|

|

—

|

|

|

59,100

|

|

Common stock warrants

|

|

|

2,999

|

|

|

—

|

|

|

—

|

|

|

2,999

|

|

Total

|

|

$

|

695,945

|

|

$

|

220,286

|

|

$

|

413,560

|

|

$

|

62,099

|

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

2014

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency debt securities

|

|

$

|

326,653

|

|

$

|

189,030

|

|

$

|

137,623

|

|

$

|

—

|

|

Corporate debt securities

|

|

|

201,963

|

|

|

—

|

|

|

201,963

|

|

|

—

|

|

International government agency debt securities

|

|

|

47,347

|

|

|

—

|

|

|

47,347

|

|

|

—

|

|

Total

|

|

$

|

575,963

|

|

$

|

189,030

|

|

$

|

386,933

|

|

$

|

—

|

The Company transfers its financial assets and liabilities, measured at fair value on a recurring basis, between the fair value hierarchies at the end of each reporting period. There were no transfers of any securities between the fair value hierarchies during the six months ended June 30, 2015.

The Company’s investments in U.S. government and agency debt securities, international government agency debt securities and corporate debt securities classified as Level 2 within the fair value hierarchy were initially valued at the transaction price and subsequently valued, at the end of each reporting period, utilizing market-observable data. The market-observable data included reportable trades, benchmark yields, credit spreads, broker/dealer quotes, bids, offers, current spot rates and other industry and economic events. The Company validated the prices developed using the market-observable data by obtaining market values from other pricing sources, analyzing pricing data in certain instances and confirming that the relevant markets are active.

The following table is a rollforward of the fair value of the Company’s assets whose fair value was determined using Level 3 inputs at June 30, 2015:

|

|

|

|

|

|

(In thousands)

|

|

Fair Value

|

|

Balance, January 1, 2015

|

|

$

|

—

|

|

Acquisition of contingent consideration

|

|

|

57,600

|

|

Acquisition of common stock warrants

|

|

|

2,123

|

|

Increase in fair value of contingent consideration

|

|

|

1,500

|

|

Increase in fair value of warrants

|

|

|

876

|

|

Balance, June 30, 2015

|

|

$

|

62,099

|

The carrying amounts reflected in the condensed consolidated balance sheets for cash and cash equivalents, accounts receivable, other current assets, accounts payable and accrued expenses approximate fair value due to their short-term nature. The fair value of the remaining financial instruments not currently recognized at fair value on the Company’s condensed consolidated balance sheets consisted of the $300.0 million, seven-year term loan bearing interest at LIBOR plus 2.75% with a LIBOR floor of 0.75% (“Term Loan B-1”) and the $75.0 million, four-year term loan bearing interest at LIBOR plus 2.75%, with no LIBOR floor (“Term Loan B-2” and together with Term Loan B-1, the “Term Loan Facility”). The estimated fair value of these term loans, which was based on quoted market price indications (Level 2 in the fair value hierarchy) and may not be representative of actual values that could have been or will be realized in the future, was as follows at June 30, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

Carrying

|

|

Estimated

|

|

|

(In thousands)

|

|

Value

|

|

Fair Value

|

|

|

Term Loan B-1

|

|

$

|

290,167

|

|

$

|

291,569

|

|

|

Term Loan B-2

|

|

$

|

64,639

|

|

$

|

64,567

|

|

6. INVENTORY

Inventory is stated at the lower of cost or market value. Cost is determined using the first-in, first-out method. Inventory consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

Raw materials

|

|

$

|

16,625

|

|

$

|

21,101

|

|

Work in process

|

|

|

10,410

|

|

|

14,824

|

|

Finished goods

|

|

|

11,766

|

|

|

15,432

|

|

Total inventory

|

|

$

|

38,801

|

|

$

|

51,357

|

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

7. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

Land

|

|

$

|

5,866

|

|

$

|

8,163

|

|

Building and improvements

|

|

|

132,936

|

|

|

149,158

|

|

Furniture, fixture and equipment

|

|

|

193,212

|

|

|

225,834

|

|

Leasehold improvements

|

|

|

13,067

|

|

|

12,971

|

|

Construction in progress

|

|

|

55,402

|

|

|

39,774

|

|

Subtotal

|

|

|

400,483

|

|

|

435,900

|

|

Less: accumulated depreciation

|

|

|

(161,225)

|

|

|

(170,160)

|

|

Total property, plant and equipment, net

|

|

$

|

239,258

|

|

$

|

265,740

|

In April 2015, as part of the Gainesville Transaction, the Company sold certain of its land, buildings, equipment and construction in progress that had a carrying value of $38.3 million.

In April 2014, the Company sold certain of its land, buildings and equipment at its Athlone, Ireland facility that had a carrying value of $2.2 million in exchange for $17.5 million. $3.0 million of the sale proceeds will remain in escrow pending the completion of certain additional services the Company is obligated to perform, and will be recognized as “Gain on sale of property, plant and equipment” in the statements of operations and comprehensive loss as the services are provided.

8. GOODWILL AND INTANGIBLE ASSETS

Goodwill and intangible assets consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

|

|

|

|

|

|

|

June 30, 2015

|

|

|

(In thousands)

|

|

Weighted

Amortizable

Life (Years)

|

|

Gross

Carrying

Amount

|

|

Accumulated

Amortization

|

|

Net Carrying

Amount

|

|

|

Goodwill

|

|

|

|

$

|

92,873

|

|

$

|

—

|

|

$

|

92,873

|

|

|

Finite-lived intangible assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration agreements

|

|

12

|

|

$

|

465,590

|

|

$

|

(144,721)

|

|

$

|

320,869

|

|

|

NanoCrystal technology

|

|

13

|

|

|

74,600

|

|

|

(15,758)

|

|

|

58,842

|

|

|

OCR technologies

|

|

12

|

|

|

42,560

|

|

|

(14,672)

|

|

|

27,888

|

|

|

Total

|

|

|

|

$

|

582,750

|

|

$

|

(175,151)

|

|

$

|

407,599

|

|

In April 2015, as part of the Gainesville Transaction, the Company reduced the value of its goodwill by $1.3 million and sold and/or licensed certain of its collaboration agreements with third-party pharmaceutical companies and Oral Controlled Release (“OCR”) technology which had a gross carrying amount of $34.1 million and $23.7 million, respectively.

Based on the Company’s most recent analysis, amortization of intangible assets included within its condensed consolidated balance sheet at June 30, 2015 is expected to be approximately $60.0 million, $60.0 million, $60.0 million, $60.0 million and $55.0 million in the years ending December 31, 2015 through 2019, respectively. Although the Company believes such available information and assumptions are reasonable, given the inherent risks and uncertainties underlying its expectations regarding such future revenues, there is the potential for the Company’s actual results to vary significantly from such expectations. If revenues are projected to change, the related amortization of the intangible assets will change in proportion to the change in revenues.

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

|

Accounts payable

|

|

$

|

26,945

|

|

$

|

32,335

|

|

|

Accrued compensation

|

|

|

29,113

|

|

|

36,854

|

|

|

Accrued product reserves

|

|

|

18,261

|

|

|

12,607

|

|

|

Accrued other

|

|

|

51,403

|

|

|

39,462

|

|

|

Total accounts payable and accrued expenses

|

|

$

|

125,722

|

|

$

|

121,258

|

|

10. RESTRUCTURING

On April 4, 2013, the Company approved a restructuring plan at its Athlone, Ireland manufacturing facility consistent with the evolution of the Company’s product portfolio and designed to improve operational performance for the future. The restructuring plan calls for the Company to terminate manufacturing services for certain older products that are expected to no longer be economically practicable to produce due to decreasing demand from its customers resulting from generic competition. The Company expects to continue to generate revenues from the manufacturing of these products through the year ending December 31, 2015.

As a result of the termination of these services, the Company also implemented a corresponding reduction in headcount of up to 130 employees. In connection with this restructuring plan, during the twelve months ended March 31, 2013, the Company recorded a restructuring charge of $12.3 million, which consisted of severance and outplacement services. The Company has paid in cash $11.8 million and recorded an adjustment of less than $0.1 million due to changes in foreign currency since inception of this restructuring plan.

Restructuring activity during the six months ended June 30, 2015 was as follows:

|

|

|

|

|

|

|

|

|

Severance and

|

|

|

(In thousands)

|

|

Outplacement Services

|

|

|

Balance, January 1, 2015

|

|

$

|

1,328

|

|

|

Payments

|

|

|

(743)

|

|

|

Adjustments

|

|

|

(116)

|

|

|

Balance, June 30, 2015

|

|

$

|

469

|

|

At June 30, 2015 and December 31, 2014, this restructuring accrual was included within “Accounts payable and accrued expenses,” in the accompanying condensed consolidated balance sheets.

11. LONG-TERM DEBT

Long-term debt consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

|

Term Loan B-1, due September 25, 2019

|

|

$

|

290,167

|

|

$

|

291,476

|

|

|

Term Loan B-2, due September 25, 2016

|

|

|

64,639

|

|

|

66,494

|

|

|

Total

|

|

|

354,806

|

|

|

357,970

|

|

|

Less: current portion

|

|

|

(6,750)

|

|

|

(6,750)

|

|

|

Long-term debt

|

|

$

|

348,056

|

|

$

|

351,220

|

|

Table of Contents

ALKERMES PLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED STATEMENTS — (Unaudited) (Continued)

12. SHARE-BASED COMPENSATION

Share-based compensation expense consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

June 30,

|

|

|

(In thousands)

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

Cost of goods manufactured and sold

|

|

$

|

478

|

|

$

|

1,770

|

|

$

|

2,495

|

|

$

|

4,079

|

|

|

Research and development

|

|

|

5,466

|

|

|

4,079

|

|

|

9,923

|

|

|

7,482

|

|

|

Selling, general and administrative

|

|

|

15,933

|

|

|

13,489

|

|

|

26,788

|

|

|

21,197

|

|

|

Total share-based compensation expense

|

|

$

|

21,877

|

|

$

|

19,338

|

|

$

|

39,206

|

|

$

|

32,758

|

|

At June 30, 2015 and December 31, 2014, $0.7 million and $0.8 million, respectively, of share-based compensation cost was capitalized and recorded as “Inventory” in the accompanying condensed consolidated balance sheets.

13. (LOSS) EARNINGS PER SHARE

Basic (loss) earnings per ordinary share is calculated based upon net (loss) income available to holders of ordinary shares divided by the weighted average number of shares outstanding. For the calculation of diluted (loss) earnings per ordinary share, the Company uses the weighted average number of ordinary shares outstanding, as adjusted for the effect of potential outstanding shares, including stock options and restricted stock units.

|