UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report

(Date of earliest event reported): July 30, 2015

THRESHOLD PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-32979 |

94-3409596 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

170 Harbor Way, Suite 300

South San Francisco, California 94080

(Address of principal executive offices, including zip code)

(650) 474-8200

(Registrant’s telephone number, including area code)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| o | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On July 30, 2015,

Threshold Pharmaceuticals, Inc. issued a press release regarding its financial results for the second quarter ended June 30, 2015.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference. The press

release contains statements intended as “forward-looking statements” which are subject to the cautionary statements

about forward-looking statements set forth therein.

The information furnished

pursuant to this Item 2.02 (including Exhibit 99.1 hereto) shall not be deemed “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that Section

or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, or the Securities Act. The information contained herein

and in the accompanying exhibit shall not be deemed to be incorporated by reference into any filing under the Securities Act or

the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

Exhibits

| Exhibit Number |

Description |

| 99.1 |

Press Release of Threshold Pharmaceuticals, Inc. dated July 30, 2015 regarding its financial results for the second quarter ended June 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Threshold Pharmaceuticals, Inc. |

| |

|

|

| |

By: |

/s/ Joel A. Fernandes |

| |

|

Name: Joel A. Fernandes |

| |

|

Title: Vice President, Finance and Controller |

Date: July 30, 2015

EXHIBIT INDEX

| Exhibit Number |

Description |

| 99.1 |

Press Release of Threshold Pharmaceuticals, Inc. dated July 30, 2015 regarding its financial results for the second quarter ended June 30, 2015. |

Exhibit 99.1

|

NEWS

RELEASE |

Threshold Pharmaceuticals Reports Second

Quarter 2015 Financial and Operational Results

SOUTH SAN FRANCISCO, CA – July

30, 2015 – Threshold Pharmaceuticals, Inc. (NASDAQ: THLD) today reported financial results for the second quarter 2015.

Revenue for the second quarter ended June 30, 2015 was $3.7 million. The operating loss for the second quarter ended June 30, 2015

was $8.9 million. The net loss for the second quarter ended June 30, 2015 was $8.3 million, which included the operating loss of

$8.9 million and non-cash income of $0.6 million related to the changes in fair value of the Company's outstanding warrants and

was classified as other income (expense). As of June 30, 2015, Threshold had $67.0 million in cash, cash equivalents and marketable

securities, with no debt outstanding.

“We are pleased with progress being

made in the development programs for both of our product candidates, evofosfamide and tarloxotinib,” said Barry Selick, Ph.D.,

Chief Executive Officer of Threshold. “We expect to announce top-line results from the two pivotal Phase 3 clinical trials

of evofosfamide in patients with advanced soft tissue sarcoma and in patients with advanced pancreatic cancer (MAESTRO) around

the end of this year. We are initiating two proof-of-concept Phase 2 clinical trials of tarloxotinib this year in patients whom

we believe may benefit from treatment with our proprietary and novel hypoxia-activated EGFR tyrosine kinase inhibitor."

Second Quarter 2015 Financial and Operational

Results

Revenue of $3.7 million was recognized

for both the second quarter of 2015 and 2014. Revenue is related to the amortization of the aggregate of $110 million in upfront

and milestone payments earned in 2013 and 2012 from Threshold’s collaboration with Merck KGaA, Darmstadt, Germany.

The revenue from the upfront and milestone payments earned under the agreement is being amortized over the relevant performance

period, rather than being immediately recognized when the upfront and milestone payments are earned or received.

The net loss for the second quarter of

2015 was $8.3 million compared to a net loss of $0.8 million for the second quarter of 2014. Included in the net loss for the second

quarter of 2015 was an operating loss of $8.9 million and non-cash income of $0.6 million compared to an operating loss of $7.5

million and non-cash income of $6.7 million included in the net loss for the second quarter of 2014. The non-cash income is related

to the change in fair value of the Company's outstanding warrants and was classified as other income (expense).

Research and development expenses were

$10.1 million for the second quarter of 2015 compared to $8.7 million for the second quarter of 2014. The increase in research

and development expenses was due primarily to a $1.2 million increase in clinical development expenses, net of reimbursement from

Merck KGaA, Darmstadt, Germany related to their 70% share of total development expenses for evofosfamide (previously known as TH-302).

General and administrative expenses were

$2.5 million for both the second quarter of 2015 and 2014.

Non-cash stock-based compensation expense

included in total operating expenses was $1.9 million for the second quarter of 2015 versus $1.5 million for the second quarter

of 2014. The increase in stock-based compensation expense was due to the amortization of a greater number of options with higher

fair values.

As of June 30, 2015 and March 31, 2015,

Threshold had $67.0 million and $83.1 million in cash, cash equivalents and marketable securities, respectively. The net decrease

of $16.1 million in cash, cash equivalents and marketable securities during the second quarter of 2015 was primarily due to the

Company’s operating cash requirements for the second quarter of 2015.

Second Quarter and Recent Key Achievements

Evofosfamide

In May, Threshold announced that the

U.S. Food and Drug Administration (FDA) granted Fast Track designation to the Company's partner Merck KGaA, Darmstadt,

Germany, for the development of evofosfamide (TH-302), administered in combination with gemcitabine, for the treatment of

previously untreated patients with locally advanced unresectable or metastatic pancreatic cancer. This is the second Fast

Track designation for evofosfamide, the first having been granted to Threshold in November 2014 for the development of

evofosfamide in combination with doxorubicin for the treatment of patients with locally advanced or metastatic soft tissue

sarcoma.

|

NEWS

RELEASE |

Also in May, Threshold presented data from

the Phase 2 component of an ongoing Phase 1/2 trial of evofosfamide in combination with the proteasome inhibitor Velcade® (bortezomib)

and low-dose dexamethasone ("EBorD") in patients with relapsed or refractory multiple myeloma at the annual meeting of

the American Society of Clinical Oncology (Abstract 8579). A clinical benefit rate of 29% (one complete response, two partial responses,

and one minimal response) was observed in 4 of 14 patients treated at the recommended Phase 2 dose of evofosfamide (340 mg/m2)

in EBorD. These patients had already received multiple types of treatment prior to enrollment including a median of 3 prior bortezomib-containing

regimens. The most common adverse events were thrombocytopenia and anemia and no patients discontinued treatment due to an adverse

event.

In April, preclinical data evaluating the

potential use of evofosfamide in a variety of tumor types were presented by Threshold and Merck KGaA, Darmstadt, Germany, at the

annual meeting of the American Association for Cancer Research (AACR) (Abstract Nos. 2424, 2603, 3867, 5271, and 5333).

Tarloxotinib bromide* (“tarloxotinib”)

In April, data on tarloxotinib (TH-4000;

previously referred to as PR610 or Hypoxin™), Threshold’s proprietary, hypoxia-activated irreversible epidermal growth

factor receptor (EGFR) tyrosine kinase inhibitor, were presented in collaboration with the molecule’s co-inventors from The

University of Auckland at the American Association for Cancer Research (AACR) annual meeting (Abstract 5358). The Company believes

the data presented support its planned Phase 2 proof-of-concept clinical trials of tarloxotinib in patients with EGFR-positive,

T790M-negative NSCLC after conventional EGFR-TKI therapy has failed as well as in patients with recurrent or metastatic squamous

cell carcinoma of the head and neck or skin.

Clinical Development Outlook for

Threshold- and Merck KGaA, Darmstadt, Germany-Sponsored Trials of Evofosfamide

The development

plan for evofosfamide is designed to investigate its safety and efficacy across a broad range of solid tumors and hematologic malignancies.

Evofosfamide is being developed in therapeutic areas supported by preclinical and clinical data and where there is high unmet need

for new anti-cancer agents. To date, evofosfamide has been evaluated in more than 1,500 patients with cancer. Threshold anticipates

the following development activities related to Threshold- and Merck KGaA, Darmstadt, Germany-sponsored clinical trials for evofosfamide

in 2015:

| · | Continue to efficiently execute the two

Phase 3 clinical trials of evofosfamide to allow for timely data analyses and to prepare for the potential submission of marketing

applications, assuming the data from the trials are supportive; |

| · | Continue enrollment in the Phase 2 clinical

trial of evofosfamide designed to support registration for the treatment of patients with non-squamous non-small cell lung cancer; |

| · | Complete enrollment in the Phase 2 clinical

trial of evofosfamide in combination with bortezomib (Velcade®) and low-dose dexamethasone in patients with relapsed or refractory

multiple myeloma; and |

| · | Threshold is in the process of closing

the Phase 2 clinical trial of evofosfamide in patients with melanoma due to a slower than anticipated enrollment rate in light

of the evolving treatment landscape and new therapeutic options for patients with melanoma since the trial began. |

About Evofosfamide

Evofosfamide is an investigational hypoxia-activated

prodrug that is designed to be preferentially activated under severe tumor hypoxic conditions, a feature of many solid tumors.

Areas of low oxygen levels (hypoxia) in solid tumors are due to insufficient blood vessel supply. Similarly, the bone marrow of

patients with hematological malignancies has also been shown, in some cases, to be severely hypoxic.

|

NEWS

RELEASE |

Evofosfamide is currently in two Phase

3 trials, both of which are fully recruited: one in combination with doxorubicin versus doxorubicin alone in patients with locally

advanced unresectable or metastatic soft tissue sarcoma (STS) (the TH-CR-406 trial), and the other in combination with gemcitabine

versus gemcitabine and placebo in patients with locally advanced unresectable or metastatic pancreatic cancer (the MAESTRO trial).

Both Phase 3 trials are being conducted under Special Protocol Assessment (SPA) agreements with the FDA. The FDA and the European

Commission have granted evofosfamide Orphan Drug designation for the treatment of STS and pancreatic cancer. The FDA has also granted

Fast Track designation for evofosfamide for both STS and pancreatic cancer. Evofosfamide is also being investigated in a Phase

2 trial designed to support registration for the treatment of non-squamous non-small cell lung cancer, and in earlier-stage clinical

trials of other solid tumors and hematological malignancies.

Threshold has a global license and co-development

agreement for evofosfamide with Merck KGaA, Darmstadt, Germany, which includes an option for Threshold to co-commercialize in the

U.S.

About Tarloxotinib Bromide

Tarloxotinib bromide, or “tarloxotinib”,

(TH-4000) is a hypoxia-activated, covalent (irreversible) epidermal growth factor receptor tyrosine kinase inhibitor (EGFR-TKI)

that targets the activating mutations of EGFR (L858R and Del19) and wild-type, or “normal”, EGFR. Tarloxotinib is designed

as a prodrug to selectively release its EGFR-TKI upon encountering severe tumor hypoxic conditions, a feature of many solid tumors.

Accordingly, it has the potential to effectively shut down aberrant wild-type and mutant EGFR signaling in a tumor-selective manner,

thus potentially avoiding or reducing the toxic side effects associated with currently available EGFR-TKIs and systemic wild-type

EGFR inhibition. Threshold expects to initiate two Phase 2 proof-of-concept trials with tarloxotinib in 2015: one in patients with

mutant EGFR-positive, T790M-negative advanced non-small cell lung cancer progressing on an EGFR-TKI, and the other in patients

with recurrent or metastatic squamous cell carcinoma of the head and neck or skin. Threshold licensed exclusive worldwide rights

to tarloxotinib from the University of Auckland in September 2014.

About Threshold Pharmaceuticals

Threshold Pharmaceuticals, Inc. is a biotechnology

company focused on the discovery and development of drugs targeting tumor hypoxia, the low oxygen condition found in microenvironments

of most solid tumors as well as the bone marrows of some hematologic malignancies. This approach offers broad potential to treat

a variety of cancers. By selectively targeting tumor cells, we are building a pipeline of drugs that hold promise to be more effective

and less toxic to healthy tissues than conventional anticancer drugs. For additional information, please visit our website (www.thresholdpharm.com).

* Tarloxotinib bromide is the proposed

International Nonproprietary Name (pINN)

Forward-Looking Statements

Except for statements of historical fact,

the statements in this press release are forward-looking statements, including all statements regarding anticipated development

activities and clinical development outlook related to company- and Merck KGaA, Darmstadt, Germany-sponsored clinical trials for

evofosfamide, including anticipated enrollment events related to, and the planned conduct of data analyses of, ongoing evofosfamide

clinical trials, and the timing thereof; the expected efficient execution of and the expected timing of and availability of the

top-line results from the ongoing evofosfamide Phase 3 clinical trials; the potential submission of marketing applications for

evofosfamide assuming the data from the Phase 3 clinical trials are supportive; the potential for Threshold's ongoing evofosfamide

Phase 2 clinical trial to support registration for the treatment of patients with non-squamous non-small cell lung cancer; the

potential therapeutic uses and benefits of evofosfamide to treat patients with STS, advanced pancreatic cancer, non-squamous non-small

cell lung cancer and other cancers; the planned initiation of two Phase 2 proof-of-concept clinical trials of tarloxotinib and

the timing thereof; Threshold's belief that the data presented at AACR support Threshold's planned development of tarloxotinib;

and the therapeutic potential of tarloxotinib. These statements involve risks and uncertainties that can cause actual results to

differ materially from those in such forward-looking statements. Potential risks and uncertainties include, but are not limited

to: the ability of Threshold and Merck KGaA, Darmstadt, Germany, to enroll or complete evofosfamide clinical trials, including

the ability of Threshold and Merck KGaA, Darmstadt, Germany, to complete the ongoing Phase 3 clinical trials of evofosfamide in

the expected timeframe or at all; the risk that Threshold cannot predict with certainty when the top-line data from either of the

evofosfamide Phase 3 clinical trials will be available; Threshold's dependence on its collaborative relationship with Merck KGaA,

Darmstadt, Germany, including its dependence on decisions by Merck KGaA, Darmstadt, Germany, regarding the amount and timing of

resource expenditures for the development of evofosfamide and the risk of potential disagreements with Merck KGaA, Darmstadt, Germany,

regarding the commencement of additional clinical trials or milestone payments; the difficulty and uncertainty of pharmaceutical

product development, including the time and expense required to conduct clinical trials and analyze data, and the uncertainty of

clinical success and regulatory approval; the risk that later trials may not confirm the results of earlier trials; the risks that

the design of, or data collected from, the ongoing Phase 3 clinical trials of evofosfamide may be inadequate to demonstrate safety

and efficacy, or otherwise may be insufficient to support any marketing authorization submissions and/or regulatory approvals,

and that despite the potential benefits of the SPA agreements with the FDA and evofosfamide’s Fast Track designations, significant

uncertainty remains regarding the regulatory approval process for evofosfamide and that evofosfamide may not receive any marketing

approvals in a timely manner or at all; issues arising in the regulatory process and the results of such clinical trials (including

product safety issues and efficacy results); dependence of Threshold and Merck KGaA, Darmstadt,

Germany, on single source suppliers for evofosfamide, including the risk that these single

source suppliers may be unable to meet clinical supply demands for evofosfamide which could significantly delay the development

of evofosfamide; the risks that Threshold's evaluation of tarloxotinib is at an early stage and it is possible that tarloxotinib

may not be found to be safe or effective in the planned Phase 2 proof-of-concept trials of tarloxotinib or in any other studies

of tarloxotinib that Threshold may conduct, and that Threshold may otherwise fail to realize the anticipated benefits of its licensing

of this product candidate; the risk that preclinical studies and Phase 1 or 2 clinical trials of our product candidates may not

predict the results of subsequent human clinical trials, including the risks that tarloxotinib preclinical and Phase 1 clinical

data may not accurately predict whether a safe and effective dose can be attained in the patient populations for tarloxotinib that

Threshold is targeting; the ability of Threshold to enroll or complete planned tarloxotinib clinical trials, including as a result

of Threshold's potential inability to develop a formulation of tarloxotinib with adequate quality that meets the specifications

previously filed with the regulatory agency and that meets the need for testing in its clinical trials; Threshold's

dependence on single source suppliers for tarloxotinib, including the risk that these single source suppliers may be unable to

meet clinical supply demands for tarloxotinib which could significantly delay the development of tarloxotinib; and Threshold's

need for and the availability of resources to develop evofosfamide and tarloxotinib and to support Threshold's operations. Further

information regarding these and other risks is included under the heading "Risk

Factors" in Threshold's Annual Report on Form 10-K, which has been filed with

the Securities and Exchange Commission on March 3, 2015 and

is available from the SEC's website (www.sec.gov) and on our website (www.thresholdpharm.com) under the heading "Investors".

We undertake no duty to update any forward-looking statement made in this news release.

Contact

Laura Hansen, Ph.D.

Senior Director, Corporate Communications

Phone: 650-474-8206

E-mail: lhansen@thresholdpharm.com

|

NEWS

RELEASE |

THRESHOLD PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 3,680 | | |

$ | 3,680 | | |

$ | 7,361 | | |

$ | 7,361 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 10,141 | | |

| 8,664 | | |

| 20,821 | | |

| 18,317 | |

| General and administrative | |

| 2,480 | | |

| 2,477 | | |

| 5,096 | | |

| 5,111 | |

| Total Operating Expenses | |

| 12,621 | | |

| 11,141 | # | |

| 25,917 | # | |

| 23,428 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (8,941 | ) | |

| (7,461 | ) | |

| (18,556 | ) | |

| (16,067 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| 39 | | |

| 30 | | |

| 72 | | |

| 70 | |

| Other income (expense) (1) | |

| 596 | | |

| 6,665 | | |

| (976 | ) | |

| 8,122 | |

| Net loss | |

$ | (8,306 | ) | |

$ | (766 | ) | |

$ | (19,460 | ) | |

$ | (7,875 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.12 | ) | |

$ | (0.01 | ) | |

$ | (0.28 | ) | |

$ | (0.13 | ) |

| Diluted | |

$ | (0.12 | ) | |

$ | (0.12 | ) | |

$ | (0.28 | ) | |

$ | (0.25 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used in per common | |

| | | |

| | | |

| | | |

| | |

| share calculation: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 71,334 | | |

| 59,347 | | |

| 69,046 | | |

| 59,325 | |

| Diluted | |

| 72,815 | | |

| 62,998 | | |

| 69,046 | | |

| 63,433 | |

| (1) | Noncash income (expense) related to change in the fair

value of the Company's outstanding and exercised warrants, classified as other income (expense). |

|

NEWS

RELEASE |

THRESHOLD PHARMACEUTICALS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

(unaudited) | | |

(1) | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Cash, cash equivalents and | |

| | | |

| | |

| marketable securities | |

$ | 67,019 | | |

$ | 58,600 | |

| Collaboration Receivable | |

| 3,647 | | |

| 7,248 | |

| Prepaid expenses and other current assets | |

| 1,500 | | |

| 832 | |

| Property and equipment, net | |

| 424 | | |

| 557 | |

| Other assets | |

| 1,264 | | |

| 1,159 | |

| Total assets | |

$ | 73,854 | | |

$ | 68,396 | |

| | |

| | | |

| | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| | |

| | | |

| | |

| Total current liabilities (2) | |

$ | 25,528 | | |

$ | 25,974 | |

| Deferred Revenue | |

| 54,833 | | |

| 62,194 | |

| Long-term liabilities (3) | |

| 19,796 | | |

| 4,204 | |

| Stockholders' equity (deficit) | |

| (26,303 | ) | |

| (23,976 | ) |

| Total liabilities and stockholders' equity (deficit) | |

$ | 73,854 | | |

$ | 68,396 | |

| (1) | Derived from audited financial statements |

| (2) | Amount includes current portion of deferred revenue of

$14.7 million for both June 30, 2015 and December 31, 2014, respectively. |

| (3) | Includes as of June 30, 2015 and December 31, 2014, $19.6

million and $4.0 million of warrant liability, respectively. |

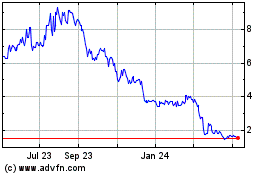

Molecular Templates (NASDAQ:MTEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

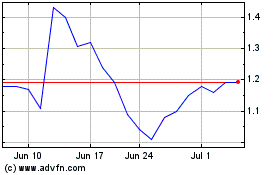

Molecular Templates (NASDAQ:MTEM)

Historical Stock Chart

From Apr 2023 to Apr 2024