UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

July 29, 2015

|

SKECHERS U.S.A., INC.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-14429

|

95-4376145

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

228 Manhattan Beach Boulevard, Manhattan Beach, California

|

|

90266

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(310) 318-3100

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 29, 2015, the Company issued a press release announcing its results of operations and financial condition for the three months and six months ended June 30, 2015. A copy of the press release is attached hereto as exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished as part of this report:

99.1 Press Release dated July 29, 2015.

The information in this current report and the exhibit attached hereto is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The Information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended. The furnishing of the Information in this Current Report is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the Information this Current Report contains is material investor information that is not otherwise publicly available.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

SKECHERS U.S.A., INC.

|

|

|

|

|

|

|

|

July 29, 2015

|

|

By:

|

|

/s/ David Weinberg

|

|

|

|

|

|

|

|

|

|

|

|

Name: David Weinberg

|

|

|

|

|

|

Title: Chief Operating Officer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated July 29, 2015.

|

For Immediate Release

| |

|

|

|

|

|

|

|

Company Contact:

|

|

David Weinberg

Chief Operating Officer,

Chief Financial Officer

SKECHERS USA, Inc.

(310) 318-3100 |

|

|

|

Investor Relations:

|

|

Andrew Greenebaum

(310) 829-5400 |

SKECHERS ANNOUNCES RECORD SECOND QUARTER 2015

FINANCIAL RESULTS

Record Net Sales of $800.5 Million, an Increase of 36.4 Percent

Record Earnings from Operations of $112.3 Million

Record Net Earnings of $79.8 Million

Record Diluted Earnings per Share of $1.55

MANHATTAN BEACH, CA. – July 29, 2015 – SKECHERS USA, Inc. (NYSE:SKX), a global leader in footwear,

today announced financial results for the second quarter ended June 30, 2015.

Second quarter 2015 net sales were $800.5 million compared to $587.1 million for the second quarter

of 2014. Gross profit for the second quarter of 2015 was $374.6 million, or 46.8 percent of net

sales, compared to $269.4 million, or 45.9 percent of net sales, for the second quarter of last

year. Earnings from operations for the second quarter of 2015 were $112.3 million, or 14.0 percent

of net sales, compared to net earnings from operations of $53.8 million, or 9.2 percent of net

sales for the second quarter of 2014.

Net earnings in the second quarter of 2015 were $79.8 million compared to net earnings of $34.8

million for the second quarter of 2014. Diluted net earnings per share in the second quarter of

2015 were $1.55 based on 51.3 million weighted average shares outstanding compared to diluted net

earnings per share of $0.68 based on 50.9 million weighted average shares outstanding for the same

period last year.

“The continued strong demand for our product worldwide led to record quarterly financial results

for the second quarter—including net sales, earnings from operations and earnings per share. Our

second quarter net sales of more than $800 million combined with record sales in the first quarter

resulted in the Company achieving $1.57 billion in sales for the first half of 2015,” began David

Weinberg, chief operating officer and chief financial officer. “Driving this growth were

double-digit increases in our three main business channels: domestic wholesale with an average

price per pair increase of 9.0 percent; international wholesale, which includes 665

third-party-owned Skechers retail stores; and Company-owned Skechers domestic and international

retail stores with a total comp store sales increase of 12.9 percent for the quarter. Furthermore,

the second quarter benefitted from both pent up demand resulting from U.S. port issues in the first

quarter as well a shift in back-to-school shipments due to increased demand in both domestic and

international markets. Our international subsidiary business also remained strong with double-digit

increases despite currency headwinds in several key markets.”

For the six months ended June 30, 2015, net sales were $1.57 billion compared to net sales of $1.13

billion in the first six months of 2014. Gross profit for the first six months of 2015 was $707.1

million, or 45.1 percent of net sales, compared to $509.8 million, or 45.0 percent of net sales,

for the first six months of 2014. Earnings from operations for the first six months of 2015 were

$200.5 million, or 12.8 percent of net sales, compared to earnings from operations of $101.9

million, or 9.0 percent of net sales, for the first six months of 2014.

Net earnings in the first six months of 2015 were $135.9 million compared to net earnings of $65.8

million in the same period last year. For the first six months of 2015, diluted net earnings per

share were $2.65 based on 51.3 million weighted average common shares outstanding compared to

diluted net earnings per share of $1.29 based on 50.9 million weighted average common shares

outstanding for the first six months of 2014.

Robert Greenberg, SKECHERS chief executive officer, commented: “Skechers is clearly in the midst of

the most exciting time in the Company’s 23-year history. The present has never looked as colorful,

comfortable and successful thanks to our product and marketing, and resulting record sales,

shipments and earnings. We just announced the signing of global pop singer Meghan Trainor, and

together with Demi Lovato we are capturing the attention of 12 to 24 year olds worldwide. During

the second quarter, we announced that boxing great Sugar Ray Leonard joined our team of

accomplished athletes and brand ambassadors, including Pete Rose and his #PeteintheHall campaign.

Together, they and legendary musician Ringo Starr are speaking to Generation X and Baby Boomers

with their humorous television commercials for Skechers Relaxed Fit footwear. Our numerous other

impactful lifestyle campaigns along with our targeted marketing for Skechers Performance and

Skechers Kids lines are resonating with our diverse consumer base. Our efforts in product and

marketing also resulted in Skechers becoming the No. 2 athletic footwear brand and the No. 1

walking brand in the United States. While domestic wholesale remains the largest piece of our

business at 42 percent, the highest channel increase in the second quarter came from our

international segment, which improved by 60 percent and now represents 30 percent of our total

sales. With 1,126 Skechers retail stores worldwide, including the new markets of Czech Republic,

Nigeria and Alaska, our global footprint is expanding steadily with additional Skechers stores

already opened in the third quarter by our international distribution partners in Russia,

Australia, Taiwan and Ireland, a joint venture store in India, and another six domestic and

international Company-owned stores. The demand for Skechers footwear in markets worldwide

continues, and we are excited for several new product introductions coming later this

year—including Star Wars® from Skechers shoes for boys and men, along with some developments in our

Skechers Performance and athletic lifestyle divisions. We believe that our accelerated growth trend

will remain through 2015 and into 2016.”

Mr. Weinberg added: “Our record first half of 2015 follows a record 2014, and is a result of the

universal demand for our wide assortment of diverse footwear collections for men, women and kids.

At no other time in the history of our company have so many product lines resonated with consumers,

giving us a broad base to continue to build upon and grow. With increased year-over-year backlogs

at the end of June, strong incoming order rates and July sales, as well as the positive

sell-through reports from wholesale and an additional 125 to 135 Company-owned and

third-party-owned Skechers retail stores planned to open later this year, we believe that we will

continue to achieve new sales and profit records through 2015. With $513.9 million in cash,

inventories in line with sales, and improved efficiencies and capacity in both our North American

and European distribution centers, we believe we are well prepared for our planned growth. We

remain comfortable with the analysts’ current consensus estimates for the back half of 2015.”

About SKECHERS USA, Inc.

SKECHERS USA, Inc., based in Manhattan Beach, California, designs, develops and markets a diverse

range of lifestyle footwear for men, women and children, as well as performance footwear for men

and women. SKECHERS footwear is available in the United States and over 120 countries and

territories worldwide via department and specialty stores, more than 1,100 SKECHERS retail stores,

and the Company’s e-commerce website. The Company manages its international business through a

network of global distributors, joint venture partners in Asia, and 12 wholly-owned subsidiaries in

Brazil, Canada, Chile, Japan and throughout Europe. For more information, please visit

skechers.com and follow us on Facebook (facebook.com/SKECHERS) and Twitter

(twitter.com/SKECHERSUSA).

This announcement contains forward-looking statements that are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, without limitation, the Company’s future growth, financial results and

operations, its development of new products, future demand for its products and growth

opportunities, its planned opening of new stores, advertising and marketing initiatives, and the

expansion plans for the Company’s European Distribution Center. Forward-looking statements can be

identified by the use of forward looking language such as “believe,” “anticipate,” “expect,”

“estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “could,” “may,”

“might,” or any variations of such words with similar meanings. Any such statements are subject to

risks and uncertainties that could cause actual results to differ materially from those projected

in forward-looking statements. Factors that might cause or contribute to such differences include

international economic, political and market conditions including the uncertainty of sustained

recovery in Europe; entry into the highly competitive performance footwear market; sustaining,

managing and forecasting costs and proper inventory levels; losing any significant customers;

decreased demand by industry retailers and cancellation of order commitments due to the lack of

popularity of particular designs and/or categories of products; maintaining brand image and intense

competition among sellers of footwear for consumers; anticipating, identifying, interpreting or

forecasting changes in fashion trends, consumer demand for the products and the various market

factors described above; sales levels during the spring, back-to-school and holiday selling

seasons; and other factors referenced or incorporated by reference in the Company’s annual report

on Form 10-K for the year ended December 31, 2014 and its quarterly report on Form 10-Q for the

three months ended March 31, 2015. The risks included here are not exhaustive. The Company operates

in a very competitive and rapidly changing environment. New risks emerge from time to time and the

companies cannot predict all such risk factors, nor can the companies assess the impact of all such

risk factors on their respective businesses or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking

statements. Given these risks and uncertainties, you should not place undue reliance on

forward-looking statements as a prediction of actual results. Moreover, reported results should not

be considered an indication of future performance.

###

1

SKECHERS U.S.A., INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

| |

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2015 |

|

2014 |

ASSETS |

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

513,902 |

|

|

$ |

466,685 |

|

Trade accounts receivable, net |

|

|

434,191 |

|

|

|

272,103 |

|

Other receivables |

|

|

15,314 |

|

|

|

16,510 |

|

|

|

|

|

|

|

|

|

|

Total receivables |

|

|

449,505 |

|

|

|

288,613 |

|

Inventories |

|

|

470,640 |

|

|

|

453,837 |

|

Prepaid expenses and other current assets |

|

|

51,633 |

|

|

|

57,015 |

|

Deferred tax assets |

|

|

18,866 |

|

|

|

18,864 |

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

1,504,546 |

|

|

|

1,285,014 |

|

Property, plant and equipment, net |

|

|

381,853 |

|

|

|

373,183 |

|

Other assets |

|

|

26,126 |

|

|

|

16,721 |

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

|

407,979 |

|

|

|

389,904 |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

1,912,525 |

|

|

$ |

1,674,918 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

Current installments of long-term borrowings |

|

$ |

109,290 |

|

|

$ |

101,407 |

|

Accounts payable |

|

|

430,422 |

|

|

|

352,815 |

|

Short-term borrowings |

|

|

1,340 |

|

|

|

1,810 |

|

Accrued expenses |

|

|

53,626 |

|

|

|

49,705 |

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

594,678 |

|

|

|

505,737 |

|

Long-term borrowings, net of current installments |

|

|

1,592 |

|

|

|

15,081 |

|

Other long-term liabilities |

|

|

24,400 |

|

|

|

19,993 |

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities |

|

|

25,992 |

|

|

|

35,074 |

|

Total liabilities |

|

|

620,670 |

|

|

|

540,811 |

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Skechers U.S.A., Inc. equity |

|

|

1,222,210 |

|

|

|

1,075,249 |

|

Noncontrolling interests |

|

|

69,645 |

|

|

|

58,858 |

|

|

|

|

|

|

|

|

|

|

Total equity |

|

|

1,291,855 |

|

|

|

1,134,107 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

1,912,525 |

|

|

$ |

1,674,918 |

|

|

|

|

|

|

|

|

|

|

2

SKECHERS U.S.A., INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited)

(In thousands, except per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

Net sales |

|

$ |

800,464 |

|

|

$ |

587,051 |

|

|

$ |

1,568,461 |

|

|

$ |

1,133,569 |

|

Cost of sales |

|

|

425,856 |

|

|

|

317,676 |

|

|

|

861,313 |

|

|

|

623,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

374,608 |

|

|

|

269,375 |

|

|

|

707,148 |

|

|

|

509,778 |

|

Royalty income |

|

|

3,630 |

|

|

|

1,836 |

|

|

|

5,512 |

|

|

|

4,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

378,238 |

|

|

|

271,211 |

|

|

|

712,660 |

|

|

|

514,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

64,875 |

|

|

|

53,839 |

|

|

|

113,967 |

|

|

|

90,581 |

|

General and administrative |

|

|

201,021 |

|

|

|

163,616 |

|

|

|

398,162 |

|

|

|

322,139 |

|

|

|

|

265,896 |

|

|

|

217,455 |

|

|

|

512,129 |

|

|

|

412,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from operations |

|

|

112,342 |

|

|

|

53,756 |

|

|

|

200,531 |

|

|

|

101,916 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest, net |

|

|

(2,884 |

) |

|

|

(3,459 |

) |

|

|

(5,534 |

) |

|

|

(6,052 |

) |

Other, net |

|

|

2,990 |

|

|

|

148 |

|

|

|

(1,771 |

) |

|

|

(934 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

106 |

|

|

|

(3,311 |

) |

|

|

(7,305 |

) |

|

|

(6,986 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income tax expense |

|

|

112,448 |

|

|

|

50,445 |

|

|

|

193,226 |

|

|

|

94,930 |

|

Income tax expense |

|

|

25,383 |

|

|

|

12,232 |

|

|

|

44,503 |

|

|

|

23,669 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

|

87,065 |

|

|

|

38,213 |

|

|

|

148,723 |

|

|

|

71,261 |

|

Less: Net earnings attributable to noncontrolling interests |

|

|

7,283 |

|

|

|

3,411 |

|

|

|

12,861 |

|

|

|

5,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Skechers U.S.A., Inc. |

|

$ |

79,782 |

|

|

$ |

34,802 |

|

|

$ |

135,862 |

|

|

$ |

65,767 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per share attributable to Skechers U.S.A., Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.57 |

|

|

$ |

0.69 |

|

|

$ |

2.67 |

|

|

$ |

1.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

$ |

1.55 |

|

|

$ |

0.68 |

|

|

$ |

2.65 |

|

|

$ |

1.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating earnings per

share attributable to Skechers U.S.A., Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

50,904 |

|

|

|

50,565 |

|

|

|

50,855 |

|

|

|

50,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

51,342 |

|

|

|

50,914 |

|

|

|

51,259 |

|

|

|

50,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

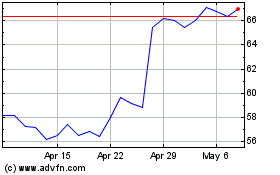

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Apr 2023 to Apr 2024