UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8‑K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) July 29, 2015

BUTLER NATIONAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Kansas

(State or Other Jurisdiction of Incorporation)

|

|

0-1678

(Commission File Number)

|

41-0834293

(IRS Employer Identification No.)

|

|

|

|

19920 W. 161st Street, Olathe, Kansas

(Address of Principal Executive Offices)

|

66062

(Zip Code)

|

|

913-780-9595

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition

|

|

Item 2.02

|

On July 29, 2015 Butler National Corporation issued a press release announcing its financial results for the fourth quarter and fiscal year end 2015 financial results for the period ending April 30, 2015. Butler National Corporation will have a conference call on July 30, 2015 to discuss the results. A copy of the press release is attached as Exhibit 99 to this Current Report on Form 8-K.

The information furnished under this Item 2.02, including Exhibit 99, shall not be deemed "filed" for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act of 1933, as amended, of the Exchange Act, except as otherwise expressly stated in any such filing.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit 99

|

Press release announcing Butler National Corporation fourth quarter and fiscal year end 2015 financial results and conference call.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

BUTLER NATIONAL CORPORATION

(Registrant)

|

|

July 29, 2015

Date

|

/S/ Clark D. Stewart

Clark D. Stewart

(President and Chief Executive Officer)

|

|

July 29, 2015

Date

|

/S/ Craig D. Stewart

Craig D. Stewart

(Chief Financial Officer)

|

|

Exhibit 99

|

| |

|

PRESS RELEASE

FOR IMMEDIATE RELEASE

|

July 29, 2015

|

|

BUTLER NATIONAL CORPORATION REPORTS FOURTH QUARTER AND FISCAL YEAR END FINANCIAL RESULTS AND CONFERENCE CALL

|

[OLATHE, KANSAS] July 29, 2015 - Butler National Corporation (OTC Pink: BUKS), a leader in the growing global market for aircraft structural modification, maintenance, repair and overhaul (MRO) and a recognized provider of management services in diverse business groups, announces its financial results for the fourth quarter fiscal 2015 and year ended April 30, 2015. In conjunction with the release, the Company has scheduled a conference call Thursday, July 30, 2015 at 9:00 AM Central Daylight Time.

What: Butler National Corporation Fourth Quarter and Fiscal Year-End Results Conference Call

When: Thursday, July 30, 2015 - 9:00AM Central Daylight Time

How: Live via phone by dialing 877-358-7305. Code: Butler National Corporation. Participants to the conference call should call in at least 5 minutes prior to the start time.

Clark Stewart, President & CEO, Butler National Corporation, will be leading the call and discussing results of the fourth quarter and fiscal year-end financial results, the status of existing and new business, and an outlook for fiscal 2016.

|

Historical selected financial data related to all operations:

|

| |

Year Ended April 30

|

Quarter Ended April 30

|

| |

(In thousands except per share data)

|

(In thousands except per share data)

|

| |

2015

|

2014

|

2013

|

2015

|

2014

|

2013

|

|

Net Revenue

|

$ 47,062

|

$ 47,271

|

$ 49,152

|

$ 11,836

|

$ 14,632

|

$ 12,326

|

|

Operating Income

|

1,319

|

1,921

|

1,503

|

(389)

|

1,958

|

38

|

|

Net Income (Loss)

|

27

|

112

|

(148)

|

(322)

|

965

|

225

|

|

Total Assets

|

41,598

|

41,678

|

43,860

|

41,598

|

41,678

|

43,860

|

|

Long-term Obligations

|

6,870

|

6,820

|

10,155

|

6,870

|

6,820

|

10,155

|

|

Stockholders' Equity

|

25,402

|

24,354

|

23,574

|

25,402

|

24,354

|

23,574

|

|

Weighted Average Shares – Diluted

|

62,260

|

60,893

|

59,015

|

62,260

|

60,893

|

59,015

|

|

Diluted Earnings per Share

|

0.00

|

0.00

|

0.00

|

(0.01)

|

0.02

|

0.00

|

|

New Product Research and Development Cost

|

2,048

|

1,765

|

1,755

|

828

|

196

|

487

|

| |

|

|

|

|

|

|

Management Comments:

"Fiscal 2015 was a challenging period for Butler National Corporation. Revenue remained constant at $47.1 million in fiscal 2015, as compared to $47.3 million in fiscal 2014. Revenue from both Professional Services and Aerospace Products remained relatively constant. Butler National Corporation continues to drive growth in international markets and through the development of new supplemental type certificates. This includes significant efforts in South America, Europe, Africa, and Asia.

Fiscal 2015 net income was $27,000 compared to a net income of $112,000 in fiscal 2014. The decrease in net income was primarily due to lower margin product mix and weaker demand in Aerospace Products. Fiscal 2015 operating margin was 3% compared to a 4% operating margin in fiscal 2014. We continue to work to improve efficiencies in our implementation and operational processes and controlling general and administrative expenses.

The fourth quarter of fiscal 2015 was a difficult quarter for Butler National Corporation. Revenue decreased 19% to $11.8 million in fourth quarter fiscal 2015, as compared to $14.6 million in fourth quarter fiscal 2014. The fourth quarter of fiscal 2015 resulted in a net loss of $322,000 compared to a net income of $965,000 in fourth quarter fiscal 2014. This was primarily due to a decrease in demand in Aerospace Products compared to extremely high demand in fourth quarter fiscal 2014.

During fiscal 2015, we invested approximately $2.0 million in projects focused on product development of new products to address various federal agency requirements in multiple countries and address continued support of legacy aircraft. We feel these expenditures for the design and development engineering, testing, and certification of new products may help stabilize our long-term revenue and enhance our profits.

This is an exciting time for Butler National Corporation. Management and all employees are focused on the execution of our numerous business development opportunities as well as increasing revenue while managing costs. We believe we are positioned for the future as we focus on serving the needs of our customers and enhancing shareholder value," commented Clark D. Stewart, President of the Company.

Business Segment Highlights

Professional Services:

Revenue from Professional Services decreased less than 1% to $30.8 million in fiscal 2015 from $31.0 million in fiscal 2014. Costs remained constant in fiscal 2015 at $18.8 million compared to $18.8 million in fiscal 2014. Expenses decreased 2% in fiscal 2015 to $10.2 million compared to $10.4 million fiscal 2014. Operating income from Professional Services, before minority interest, remained constant in fiscal 2015 at $1.8 million compared to $1.8 million in fiscal 2014.

Aerospace Products:

Revenue was $16.3 million in fiscal 2015 compared to $16.2 million in fiscal 2014. In an effort to offset decreased domestic military spending, the Company has invested in the development of several supplemental type certificates (STCs). These STCs involve state-of-the-art avionics and solutions to solve obsolescence issues. We plan to aggressively market these STCs both domestically and internationally.

We received FAA approvals of a number of products: These include the newly redesigned rate gyroscope for Learjets, the replacement vertical accelerometer safety device that resolves obsolescence as a key component of the legacy Learjet stall warning systems, the addition of the GARMIN GTN 650/750 Global Position System Navigator with Communication transceiver in the Learjet Model 30 series and 20 series, the new cargo/sensor carrying pod that mounts to the bottom of a King Air Model 90 aircraft, the provisions for external stores on a Learjet Model 60 to enable the 60 for consideration as the next Learjet candidate for special mission operations; and the noise suppression for Learjet 20 series aircraft.

Costs increased 4% to $12.7 million in fiscal 2015 compared to $12.1 million in fiscal 2014. Costs were 78% of segment total revenue in fiscal 2015, as compared to 74% of segment total revenue in fiscal 2014. Expenses increased 1% in fiscal 2015 to $4.1 million compared to $4.0 million in fiscal 2014. Expenses were 25% of segment total revenue in fiscal 2015 and fiscal 2014. Aerospace Products had an operating loss of $475,000 in fiscal 2015 compared to an operating income of $103,000 in fiscal 2014.

Costs related to Professional Services and Aerospace Products include the cost of engineering, labor, materials, equipment utilization, control systems, security and occupancy. Expenses related to Professional Services and Aerospace Products include marketing and advertising, employee benefits, depreciation and amortization, general and administrative and other expenses.

Backlog:

As of April 30, 2015, our backlog totaled approximately $9.1 million. The backlog includes firm, pending, and contract orders, which may not be completed within the next fiscal year. As of July 3, 2015, our backlog totaled approximately $9.4 million. This is consistent with the industry in which modification services and related contracts may take several months, and sometimes years, to complete. There can be no assurance that all orders will be completed or that some may ever commence.

Our Business:

Butler National Corporation operates in the Aerospace and Services business segments. The Aerospace segment focuses on the manufacturing of support systems for "Classic" commercial and military aircraft including the Butler National TSD for the Boeing 737 and 747 Classic aircraft, switching equipment for Boeing McDonnell Douglas Aircraft, weapon control systems for Boeing Helicopter and performance enhancement structural modifications for Learjet, Cessna, Dassault and Beechcraft business aircraft. Services include temporary employee services, gaming services and administrative management services.

Forward-Looking Information:

Statements made in this report, filed with the Securities and Exchange Commission, communications to stockholders, press releases, and oral statements made by representatives of the Company that are not historical in nature, or that state the Company or management intentions, hopes, beliefs, expectations or predictions of the future, may constitute "forward-looking statements" within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements can often be identified by the use of forward-looking terminology, such as "could," "should," "will," "intended," "continue," "believe," "may," "expect," "hope," "anticipate," "goal," "forecast," "plan," "guidance" or "estimate" or the negative of these words, variations thereof or similar expressions. Forward-looking statements are not guarantees of future performance or results. They involve risks, uncertainties, and assumptions. It is important to note that any such performance and actual results, financial condition or business, could differ materially from those expressed in such forward-looking statements. The forward looking statements in this report are only predictions and actual events or results may differ materially. These factors and risks include, but are not limited to the Cautionary Statements and Risk Factors, filed as Exhibit 99 and Section 1A to the Company's Annual Report on Form 10-K, incorporated herein by reference. Investors are specifically referred to such Cautionary Statements and Risk Factors for discussion of factors, which could affect the Company's operations, and forward-looking statements contained herein. Other unforeseen factors not identified herein could also have such an effect. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial condition or business over time.

|

FOR MORE INFORMATION, CONTACT:

|

|

David Drewitz, Public Relations

david@creativeoptionscommunications.com

www.creativeoptionscommunications.com

Butler National Corporation Investor Relations

|

Ph (972) 814-5723

Ph (913) 780-9595

|

THE WORLDWIDE WEB:

Please review www.butlernational.com for pictures of our products and details about Butler National Corporation and its subsidiaries.

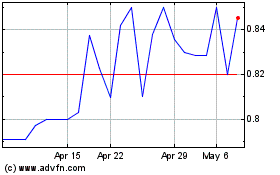

Butler National (QB) (USOTC:BUKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

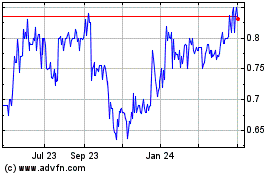

Butler National (QB) (USOTC:BUKS)

Historical Stock Chart

From Apr 2023 to Apr 2024