Filed Pursuant to Rule

424(b)(4)

Registration No. 333-204599

VAPOR

CORP.

Up

to 3,800,000 Units Consisting of

Shares

of Series A Convertible Preferred Stock and

Series

A Warrants

We are offering by this prospectus up to 3,800,000

units, with each unit consisting of one-fourth of a share of our Series A Convertible Preferred Stock convertible into 10 shares

of common stock and 20 Series A Warrants each exercisable into one share of common stock (the “Units”). The Units

are being offered at a price of $11.00 per Unit. The Units, the Series A Convertible Preferred Stock and the Series A Warrants

will not be certificated.

The

shares of Series A Convertible Preferred Stock and the Series A Warrants will automatically separate six months after the date

of this prospectus. However, the shares of Series A Convertible Preferred Stock and the Series A Warrants will separate prior

to the expiration of the six-month period if at any time after 30 days from the date of this prospectus either (i) the closing

price of our common stock is greater than $2.48 per share for 10 consecutive trading days (a “Trading Separation Trigger”),

(ii) the Series A Warrants are exercised for cash (solely with respect to the Units that included the exercised Series A Warrants)

(a “Cash Warrant Exercise Trigger”) or (iii) the Units are delisted (a “Delisting Trigger”) from the Nasdaq

Capital Market for any reason (such earlier date, the “Separation Trigger Date”). We refer to this separation prior

to the six-month period as an Early Separation. The Units will become separable: (i) 15 days after the Trading Separation Trigger

date or (ii) immediately after the Series A Warrants are exercised for cash (solely with respect to the Units that included the

exercised Series A Warrants) or a Delisting Trigger. In the event of an Early Separation, the Preferred Stock will become convertible

into common stock: (i) immediately upon the separation of the Unit if a Trading Separation Trigger or a Delisting Trigger occurs,

or (ii) on the six month anniversary of the date of this prospectus (unless an earlier Trading Separation Trigger or Delisting

Trigger occurs) on the occurrence of a Cash Warrant Exercise Trigger.

Each one-fourth of a share of Series A Convertible

Preferred Stock will be convertible at the option of the holder into 10 shares of common stock upon the separation of the Units,

provided that upon a Cash Warrant Exercise Trigger the Series A Convertible Preferred Stock will not be convertible until six-months

after the date of this prospectus (unless an Early Separation occurs due to a Trading Separation Trigger or Delisting Trigger).

The Series A Warrants have an exercise price of $1.24. The Series A Warrants will expire on the fifth anniversary of the date

of this prospectus. This prospectus also covers the shares of common stock issuable from time to time upon the exercise of the

Series A Warrants or the conversion of the Series A Convertible Preferred Stock. This prospectus also covers the Units and underlying

securities issuable upon exercise of the unit purchase option to be issued to the underwriters.

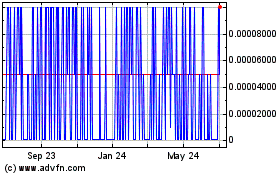

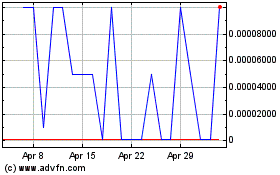

Our

common stock is listed on the Nasdaq Capital Market under the symbol “VPCO.” On July 23, 2015, the last reported sales

price of our common stock on the Nasdaq Capital Market was $1.23 per share. On July 8, 2015, the Company effectuated a one-for-five

reverse stock split of its common stock. There is no market for our Units. We have applied for the listing of the Units on the

Nasdaq Capital Market under the trading symbol “VPCOU”. If this offering is completed, trading of the Units will not

commence until the day after the closing of the offering, which trading we expect to commence on July 30, 2015. We do not intend

to list the Series A Convertible Preferred Stock or the Series A Warrants on the Nasdaq Capital Market, any other national securities

exchange or any other nationally recognized trading system.

Before

investing in our Units, preferred stock and warrants exercisable for common stock, you should carefully read the discussion of

“Risk Factors” beginning on page 5. Any investment in our company is highly speculative and could result in the loss

of your entire investment. Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is

a criminal offense.

| |

Per

Unit |

|

Total |

| Public

offering price |

$ |

11.00 |

|

$ |

41,800,000 |

| Underwriting

commissions (1) |

$ |

0.7238 |

|

$ |

2,750,440 |

| Offering

proceeds to us, before expenses |

$ |

10.2762 |

|

$ |

39,049,560 |

| (1) |

Does

not include other compensation payable to Dawson James Securities, Inc., the representative

of the underwriters. See “Underwriting.”

|

The

underwriters are selling the Units in this offering on a “best efforts” basis. The underwriters are not required to

sell any specific number or dollar amount of Units, but will use their best efforts to sell the securities offered. Because this

is a best efforts offering, the underwriters do not have an obligation to purchase any securities, and, as a result, there is

a possibility that we may not receive any proceeds from the offering.

The

underwriters expect to deliver the securities to investors upon payment approximately three business days following acceptance

of an order.

This

offering shall terminate upon the earlier of August 3, 2015 or the receipt of a notice of termination from the underwriters.

Dawson

James Securities, Inc.

The

date of this prospectus is July 23, 2015.

TABLE

OF CONTENTS

We

have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus

or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for,

and can provide no assurance as to the reliability of, any other information that others may give to you. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or

any sale of our common stock.

Unless

the context requires otherwise references to “Vapor”, the “Company,” “we,” “us”

or “our” refer to Vapor Corp., a Delaware corporation. When we refer to “Smoke Anywhere” we are referring

to Smoke Anywhere USA, Inc., our wholly-owned subsidiary. When we refer to Vaporin, we are referring to Vaporin, Inc., a company

we merged with in March 2015. All warrant, option, common stock and per share of common stock information in this prospectus gives

effect to the 1-for-5 reverse split of our common stock effectuated on July 8, 2015.

PROSPECTUS

SUMMARY

The

following information is a summary of the prospectus and it does not contain all of the information you should consider before

investing in our securities. You should read the entire prospectus carefully, including the “Risk Factors” section

and our financial statements and the notes relating to the financial statements, before making an investment decision.

Our

Company

We

operate nine Florida-based vape stores (and expects to open two more in the next three weeks) and are focusing on expanding the

number of Company operated stores as well as launching a franchise program. We also design, market, and distribute vaporizers,

e-liquids, electronic cigarettes and accessories under the emagine vaporTM, Krave®, Fifty-One® (also known as Smoke 51),

Vapor X®, Hookah Stix® and Alternacig® brands. We also design and develop private label brands for our distribution

customers. Third party manufacturers manufacture our products to meet our design specifications. We market our products as alternatives

to traditional tobacco cigarettes and cigars. In 2014, as a response to market product demand changes, Vapor began to shift its

primary focus from electronic cigarettes to vaporizers. “Vaporizers” and “electronic cigarettes,” or “e-cigarettes,”

are battery-powered products that enable users to inhale nicotine vapor without smoke, tar, ash, or carbon monoxide.

We

offer our vaporizers and e-cigarettes and related products through our vape stores, online, to retail channels through our direct

sales force, and through third party wholesalers, retailers and value-added resellers. Retailers of our products include small-box

discount retailers, big-box retailers, gas stations, drug stores, convenience stores, and tobacco shops and kiosk locations in

shopping malls throughout the United States. Vapor leverages its ability to design, market and develop multiple vaporizer and

e-cigarette brands and to bring those brands to market through its multiple distribution channels including the vape stores, online

and through retail operations operated by third parties. The Company’s business strategy is currently focused on a multi-pronged

approach to diversify our revenue streams to include the Vape Store brick-and-mortar retail locations which Vaporin had successfully

deployed.

Our

Corporate Information

The

Company was originally incorporated under the name Consolidated Mining International, Inc. in 1985. On November 5, 2009, the Company

acquired Smoke Anywhere a distributor of electronic cigarettes, in a reverse triangular merger. On January 7, 2010, the Company

changed its name to Vapor Corp. The Company reincorporated in the State of Delaware from the State of Nevada effective on December

31, 2013. On March 3, 2015, the Company merged with Vaporin and was the surviving and controlling entity.

Our

executive offices are located at 3001 Griffin Road, Dania Beach, Florida 33312, and our telephone number is (888) 766-5351. Our

website is located at www.vapor-corp.com. The information contained on, or that can be accessed through, our website is not incorporated

by reference in this prospectus and should not be considered a part of this prospectus.

THE

OFFERING

| Price per Unit. |

|

$11.00

per Unit. |

| |

|

|

Securities

we are offering; Separation of the Units

|

|

Up

to 3,800,000 Units. Each Unit consists of one-fourth of a share of Series A Convertible

Preferred Stock, convertible into 10 shares of common stock and 20 Series A Warrants

each exercisable for one share of common stock.

The shares

of Series A Convertible Preferred Stock and the Series A Warrants will automatically separate six months after the date of this

prospectus. However, the shares of Series A Convertible Preferred Stock and the Series A Warrants will separate prior to the expiration

of the six-month period if at any time after 30 days from the date of this prospectus there is an Early Separation. The Units

will become separable: (i) 15 days after the Trading Separation Trigger date or (ii) immediately after a Cash Warrant Exercise

Trigger (solely with respect to the Units that included the exercised Series A Warrants) or a Delisting Trigger. In the event

of an Early Separation, the Preferred Stock will become convertible into common stock: (i) immediately upon a Trading Separation

Trigger or a Delisting Trigger, or (ii) on the six month anniversary of the date of this prospectus if the separation occurs due

to a Cash Warrant Exercise Trigger (unless an earlier Trading Separation Trigger or Delisting Trigger occurs). We are also registering

the shares of common stock issuable upon conversion of the Series A Convertible Preferred Stock and the exercise or exchange of

the Series A Warrants.

|

| |

|

|

| Series A Convertible

Preferred Stock we are offering |

|

Each

one-fourth of a share of Series A Convertible Preferred Stock will be convertible into

10 shares of common stock upon the separation of the Units, provided that upon a Cash

Warrant Exercise Trigger the Series A Convertible Preferred Stock will not be convertible

until six-months after the date of this prospectus (unless an Early Separation occurs

due to a Trading Separation Trigger or Delisting Trigger). For additional information,

see “Description of Capital Stock—Preferred Stock Included in the Units Offered

Hereby” on page 56 of this prospectus.

|

| |

|

|

| Series A Warrants

we are offering |

|

Each

Series A Warrant is exercisable for one share of common stock. The Series A Warrants have an exercise price of $1.24 and are

exercisable upon the separation of the Units; provided they may be exercised for cash 30 days from the date of this prospectus,

which will cause a Cash Warrant Exercise Trigger. The Series A Warrants will expire on the fifth anniversary of the date of

this prospectus. For additional information, see “Description of Capital Stock—Warrants Included in the Units

Offered Hereby” on page 56 of this prospectus. |

| |

|

|

| Best Efforts |

|

The

underwriters are selling the Units offered in this prospectus on a “best efforts” basis and are not required to

sell any specific number or dollar amount of the Units offered by this prospectus, but will use their best efforts to sell

the Units. |

| |

|

|

| Common stock

outstanding before this offering |

|

7,600,657

shares

|

| |

|

|

| Common stock

to be outstanding immediately after this offering |

|

7,600,657,

which assumes no conversion of the Series A Convertible Preferred Stock or exercise of the Series A Warrants. |

| |

|

|

| Use of proceeds |

|

Assuming

we complete the maximum offering, we estimate that the net proceeds from this offering

will be approximately $38.7 million, at a public offering price of $11.00 per Unit, after

deducting the underwriting commissions and estimated offering expenses payable by us.

Since this is a “best efforts” offering, there is no assurance that any Units

will be sold, and therefore no assurance that there will be any proceeds. We intend to

use the net proceeds from this offering as follows:

|

| |

|

|

|

| |

|

(i) |

approximately

$4.97 million to repay indebtedness; |

| |

|

|

|

| |

|

(ii) |

approximately

$22.0 million to acquire and/or build vape stores; |

| |

|

|

|

| |

|

(iii) |

approximately

$4.0 million in sales and marketing expenses; and |

| |

|

|

|

| |

|

(iv) |

the

remaining proceeds, if any, will be used for general corporate purposes, including working capital. See “Use of Proceeds”

for a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Risk Factors |

|

Investing

in our securities involves substantial risks. You should read the “Risk Factors” section starting on page 5 for

a discussion of factors to consider carefully before deciding to invest in our securities. |

| |

|

|

| Nasdaq

Capital Market symbol for our common stock |

|

VPCO |

| |

|

|

| Proposed Nasdaq

Capital Market symbol for our Units |

|

We

intend to apply for listing of the Units on the Nasdaq Capital Market under the symbol “VPCOU”. No assurance can

be given that such listing will be approved or that a trading market will develop. |

The number

of shares of our common stock outstanding before and after this offering, as set forth in the table above, is based on 6,727,152

shares outstanding as of March 31, 2015 and excludes as of that date:

| |

● |

up

to 38,000,000 shares of common stock issuable upon the full conversion of the Series

A Convertible Preferred Stock offered hereby and up to 76,000,000 shares of common stock

upon the full exercise of the Series A Warrants assuming the warrants are exercised for

cash (if the warrants are exercised on a cashless basis as described in “Description

of Capital Stock – Warrant Included in the Units Offered Hereby” the number

of shares of common stock issuable is indeterminate);

|

| |

|

|

| |

● |

up

to 1,900,000 shares of common stock issuable upon the full conversion of the Series A

Convertible Preferred Stock offered hereby and up to 3,800,000 shares of common stock

upon the full exercise of the Series A Warrants assuming the warrants are exercised for

cash included in the unit purchase option to be issued to the representative of the underwriters

in connection with this offering (if the warrants are exercised on a cashless basis as

described in “Description of Capital Stock – Warrant Included in the Units

Offered Hereby” the number of shares of common stock issuable is indeterminate);

|

| |

|

|

| |

● |

248,567

shares of common stock issuable upon the exercise of outstanding stock options; |

| |

|

|

| |

● |

841,981 shares

of common stock issuable upon the full exercise of previously issued warrants to purchase shares of common stock; |

| |

|

|

| |

● |

378,047 shares of common stock issuable upon the

delivery of fully vested restricted stock units; and

|

| |

|

|

| |

● |

358,682

shares of our common stock underlying outstanding convertible notes. |

Unless otherwise

indicated, all information in this prospectus:

| |

● |

assumes 7,600,657 shares of

our common stock outstanding immediately prior to the closing of this offering;

|

| |

|

|

| |

● |

assumes

no exercise of the representative’s unit purchase option; and |

| |

|

|

| |

● |

assumes

no exercise of any outstanding options or warrants to purchase common stock. |

SUMMARY

FINANCIAL DATA

The

summary financial data set forth below should be read in conjunction with our financial statements and the related notes, “Selected

Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included elsewhere in this prospectus.

We

derived the statement of operations data for the fiscal years ended December 31, 2014 and 2013 and balance sheet data as of December

31, 2014 and 2013 from our audited consolidated financial statements appearing elsewhere in this prospectus. We derived the statement

of operations data for the three months ended March 31, 2015 and 2014 and balance sheet data as of March 31, 2015 from our unaudited

condensed consolidated financial statements appearing elsewhere in this prospectus.

| | |

Years

Ended December

31, | | |

Three

Months Ended March

31, | |

| | |

2014 | | |

2013 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

(unaudited) | |

| | |

| |

| Statement of Operations Data: | |

| | | |

| | | |

| | | |

| | |

| Sales, Net | |

$ | 15,279,859 | | |

$ | 25,990,228 | | |

$ | 1,468,621 | | |

$ | 4,792,544 | |

| Cost of Goods

Sold | |

| 14,497,254 | | |

| 16,300,333 | | |

| 1,651,110 | | |

| 3,831,928 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross (Loss) Profit | |

| 782,605 | | |

| 9,689,895 | | |

| (182,489 | ) | |

| 960,616 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 11,126,759 | | |

| 6,464,969 | | |

| 3,243,189 | | |

| 2,769,726 | |

| Advertising | |

| 2,374,329 | | |

| 2,264,807 | | |

| 105,177 | | |

| 367,615 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating

expenses | |

| 13,501,088 | | |

| 8,729,776 | | |

| 3,348,366 | | |

| 3,137,341 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating (loss)

income | |

| (12,718,483 | ) | |

| 960,119 | | |

| (3,530,855 | ) | |

| (2,176,725 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

| | | |

| | | |

| | | |

| | |

| Induced conversion expense | |

| - | | |

| (299,577 | ) | |

| - | | |

| - | |

| Amortization of deferred financing costs | |

| (17,458 | ) | |

| - | | |

| (34,917 | ) | |

| - | |

| Change in fair value of derivative liabilities | |

| - | | |

| - | | |

| (37,965 | ) | |

| - | |

| Interest expense | |

| (348,975 | ) | |

| (383,981 | ) | |

| (378,775 | ) | |

| (28,434 | ) |

| Interest income | |

| - | | |

| - | | |

| 1,316 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Total other expenses | |

| (366,433 | ) | |

| (683,558 | ) | |

| (450,341 | ) | |

| (28,434 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| (LOSS) INCOME BEFORE INCOME TAX (EXPENSE)

BENEFIT | |

| (13,084,916 | ) | |

| 276,561 | | |

| (3,981,196 | ) | |

| (2,205,159 | ) |

| Income tax (expense) benefit | |

| (767,333 | ) | |

| 524,791 | | |

| - | | |

| 752,400 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME | |

$ | (13,852,249 | ) | |

$ | 801,352 | | |

$ | (3,981,196 | ) | |

$ | (1,452,759 | |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC (LOSS) EARNINGS PER COMMON SHARE | |

$ | (4.22 | ) | |

$ | 0.31 | | |

$ | (0.89 | ) | |

$ | (0.45 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| DILUTED (LOSS) EARNINGS PER COMMON SHARE | |

$ | (4.22 | ) | |

$ | 0.30 | | |

$ | (0.89 | ) | |

$ | (0.45 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING – BASIC | |

| 3,283,030 | | |

| 2,563,697 | | |

| 4,494,855 | | |

| 3,253,550 | |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING – DILUTED | |

| 3,283,030 | | |

| 2,637,273 | | |

| 4,494,855 | | |

| 3,253,550 | |

| | |

As

of December 31, | | |

As

of |

|

| | |

2014 | | |

2013 | | |

March

31, 2015 | |

| |

| | | |

| | | |

| (unaudited)

| |

| Balance Sheet Data: | |

| | | |

| | | |

| | |

| Cash | |

$ | 471,194 | | |

$ | 6,570,215 | | |

$ | 1,911,199 | |

Working capital (deficit)

| |

| 127,874 | | |

| 11,657,615 | | |

| (811,970 | ) |

| Intangibles assets, net of accumulated depreciation | |

| - | | |

| - | | |

| 2,058,423 | |

| Goodwill | |

| - | | |

| - | | |

| 15,654,484 | |

| Total assets | |

| 4,928,483 | | |

| 13,962,375 | | |

| 24,052,575 | |

| Senior convertible notes payable –

related parties, net of debt discount | |

| 156,250 | | |

| - | | |

| 468,750 | |

| Convertible notes, net of debt discount | |

| - | | |

| - | | |

| 517,579 | |

| Notes payable – related party | |

| - | | |

| - | | |

| 1,000,000 | |

| Term Loan | |

| 750,000 | | |

| 478,847 | | |

| 523,727 | |

| Total stockholders’ equity | |

$ | 811,810 | | |

$ | 11,751,584 | | |

$ | 17,519,578 | |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before you invest in our securities, you should give careful consideration

to the following risk factors, in addition to the other information included in this prospectus, including our financial statements

and related notes, before deciding whether to invest in our securities. The occurrence of any of the adverse developments described

in the following risk factors could materially and adversely harm our business, financial condition, results of operations or

prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our

ability to continue as a going concern is in substantial doubt absent obtaining adequate new debt or equity financing, successful

completion of this offering or generating sufficient revenue from operations.

Our

liquidity and capital resources have decreased significantly as a result of our net operating losses. Although we completed a

Private Placement and received net proceeds of approximately $1.46 million as of June 22, 2015 and have taken other actions to

manage our cash on hand and working capital and to increase cash flows from operating and financing activities, there is no assurance

we will have sufficient liquidity and capital resources to fund our business. As of March 31, 2015, we had negative working capital

of approximately $(811,970) compared to $127,874 at December 31, 2014, a decrease of approximately $940,000. Our consolidated

financial statements for the year ended December 31, 2014 indicate there is substantial doubt about our ability to continue as

a going concern as we require additional equity and/or debt financing to continue our operations. As of the date of this prospectus,

we believe we have enough cash on hand to fund our operations for three months.

The underwriters are offering

the Units on a “best efforts” basis. The underwriters are not required to sell any specific number or dollar amount

of Units, but will use their best efforts to sell the Units. As a “best efforts” offering, there can be no assurance

that the offering contemplated hereby will ultimately be consummated or will result in any proceeds being made to us. The success

of this offering will impact our ability to finance operations over the next 12 months. If no Units are sold in this offering,

or if we sell only a minimum number of Units yielding insufficient gross proceeds, we may be unable to successfully fund our operations,

or execute on our business plan. This would result in a material adverse effect on our business, prospects, financial condition,

and results of operations.

We

have incurred losses in the past and cannot assure you that we will achieve or maintain profitable operations.

As

of March 31, 2015, we had an accumulated deficit of approximately $19.2 million. Our accumulated deficit is primarily due to,

among other reasons, the establishment of our business infrastructure and operations, stock-based compensation expenses and increases

in our marketing expenditures. Additionally, Vapor did not anticipate the shift from e-cigarettes which caused in part the large

losses beginning in 2014. For the three months ended March 31, 2015 and 2014, we had net losses of $3,981,196 and $1,452,759,

respectively. For the year ended December 31, 2014, we had a net loss of $13,852,249 compared to net income of $801,352 for the

year ended December 31, 2013. Unless we raise at least $11 million in this offering, there is no assurance we will have sufficient

liquidity and capital resources available to fund our business for the next 12 months. Our liquidity and capital resources have

decreased significantly as a result of the net operating losses we incurred during the year ended December 31, 2014. We cannot

assure you that we will be able to generate operating profits in the future on a sustainable basis or at all as we continue to

expand our infrastructure, open additional retail stores, further develop our marketing efforts and otherwise implement our growth

initiatives. Working capital limitations continue to impinge on our day-to-day operations, thus contributing to continued operating

losses.

Because

of changes in our industry, it is difficult to accurately predict our future sales and appropriately budget our expenses.

We

acquired Smoke Anywhere, a distributor of electronic cigarettes, in November 2009 and Vaporin in March 2015. Smoke Anywhere commenced

its business in 2008 and Vaporin commenced its operations in 2013. Because our industry is still evolving, it is difficult to

accurately predict our future sales and appropriately budget our expenses. Additionally, our operations will be subject to risks

inherent in the establishment of a developing new business as well as a new business model of deploying new vape stores, including,

among other things, efficiently deploying our capital, costs or difficulties relating to the integration of the merger with Vaporin,

developing our products, opening retail stores, developing and implementing our marketing campaigns and strategies and developing

brand awareness and acceptance of our products. Our ability to generate future sales will be dependent on a number of factors,

many of which are beyond our control, including the pricing of competing products, overall demand for our products, changes in

consumer preferences, market competition and government regulation. Assuming we are successful in raising funds in this offering,

we will expand our vape stores and marketing and advertising campaigns and operational expenditures in anticipation of future

sales growth. If our sales do not increase as anticipated, we could incur significant losses due to our higher infrastructure

expense levels if we are not able to decrease our advertising and operating expenses in a timely manner to offset any shortfall

in future sales.

The

potential regulation of vaporizers and electronic cigarettes by the United States Food and Drug Administration may materially

adversely affect our business.

On

April 24, 2014, the United States Food and Drug Administration, or the FDA, released proposed rules that would extend its

regulatory authority to vaporizers, electronic cigarettes and certain other tobacco products under the Family Smoking Prevention

and Tobacco Control Act of 2009, or the Tobacco Control Act. Our references to electronic cigarettes in these risk factors are

intended to include vaporizers, unless otherwise clear from the context. We note that the proposed rules would require that electronic

cigarette manufacturers (i) register with the FDA and report electronic cigarette product and ingredient listings; (ii) market

new electronic cigarette products only after FDA review; (iii) only make direct and implied claims of reduced risk if the FDA

confirms that scientific evidence supports the claim and that marketing the electronic cigarette product will benefit public health

as a whole; (iv) not distribute free samples; (v) implement minimum age and identification restrictions to prevent sales to individuals

under age 18; (vi) include a health warning; and (vii) not sell electronic cigarettes in vending machines, unless in a facility

that never admits youth.

More

recently, on July 1, 2015, the FDA published a document entitled “Advanced Notice of Proposed Rulemaking,” or the

Advance. Through the Advance, the FDA solicited public comments on whether it should issue rules with respect to nicotine exposure

warning and child-resistant packaging for e-liquids containing nicotine. Following public comment, the FDA may issue proposed

rules in furtherance of the purposes outlined in the Advance and ultimately pass the rules as proposed or in modified form.

It

is not known how long the regulatory process to finalize and implement any of these rules may take. Accordingly, although we cannot

predict the content of any final rules from the proposed rules or the impact they may have, we believe that if the final rules

enacted are materially more stringent then the proposed rules they could have a material adverse effect on our business, financial

conditions and results of operations.

For

a description of risks related to other government regulations, please see “Risks Related to Government Regulation”

in this Section.

The

recent development of electronic cigarettes has not allowed the medical profession to study the long-term health effects of electronic

cigarette use.

Because

electronic cigarettes were recently developed the medical profession has not had a sufficient period of time to study the long-term

health effects of electronic cigarette use. Currently, therefore, there is no way of knowing whether or not electronic cigarettes

are safe for their intended use. If the medical profession were to determine conclusively that electronic cigarette usage poses

long-term health risks, electronic cigarette usage could decline, which could have a material adverse effect on our business,

results of operations and financial condition.

Our

business, results of operations and financial condition could be adversely affected if our products are taxed like other tobacco

products or if we are required to collect and remit sales tax on certain of our Internet sales.

Presently

the sale of electronic cigarettes is not subject to federal, state and local excise taxes like the sale of conventional cigarettes

or other tobacco products, all of which have faced significant increases in the amount of taxes collected on their sales. Should

federal, state and local governments and or other taxing authorities impose excise taxes similar to those levied against conventional

cigarettes and tobacco products on our products, it may have a material adverse effect on the demand for our products, as consumers

may be unwilling to pay the increased costs for our products.

We

may be unable to establish the systems and processes needed to track and submit the excise and sales taxes we collect through

Internet sales, which would limit our ability to market our products through our websites which would have a material adverse

effect on our business, results of operations and financial condition. A number of states including New York, North Carolina,

Texas and California have begun collecting sales taxes on Internet sales where companies have used independent contractors in

those states to solicit sales from residents of that state. The requirement to collect, track and remit sales taxes based on independent

affiliate sales may require us to increase our prices, which may affect demand for our products or conversely reduce our net profit

margin, either of which would have a material adverse effect on our business, results of operations and financial condition.

The

market for electronic cigarettes is a niche market, subject to a great deal of uncertainty and is still evolving.

Vaporizers

and electronic cigarettes, having recently been introduced to market, are at an early stage of development, represent a niche

market and are evolving rapidly and are characterized by an increasing number of market entrants. Our future sales and any future

profits are substantially dependent upon the widespread acceptance and use of electronic cigarettes. Rapid growth in the use of,

and interest in, electronic cigarettes is recent, and may not continue on a lasting basis. The demand and market acceptance for

these products is subject to a high level of uncertainty. Therefore, we are subject to all of the business risks associated with

a new enterprise in a niche market, including risks of unforeseen capital requirements, failure of widespread market acceptance

of electronic cigarettes, in general or, specifically our products, failure to establish business relationships and competitive

disadvantages as against larger and more established competitors.

Because

we face intense competition from big tobacco companies and other competitors, our failure to compete effectively could have a

material adverse effect on our business, results of operations and financial condition.

Competition

in the electronic cigarette industry is intense. The nature of our competitors is varied as the market is highly fragmented and

the barriers to entry into the business are low.

We

compete primarily on the basis of product quality, brand recognition, brand loyalty, service, marketing, advertising and price.

We are subject to highly competitive conditions in all aspects of our business. The competitive environment and our competitive

position can be significantly influenced by weak economic conditions, erosion of consumer confidence, competitors’ introduction

of low-priced products or innovative products, cigarette excise taxes, higher absolute prices and larger gaps between price categories,

and product regulation that diminishes the ability to differentiate tobacco products.

Our

principal competitors are “big tobacco”, U.S. cigarette manufacturers of both conventional tobacco cigarettes and

electronic cigarettes like Altria Group, Inc., Lorillard, Inc. and Reynolds American Inc. We compete against “big tobacco”

which offers not only conventional tobacco cigarettes and electronic cigarettes but also smokeless tobacco products such as “snus”

(a form of moist ground smokeless tobacco that is usually sold in sachet form that resembles small tea bags), chewing tobacco

and snuff. Furthermore, we believe that “big tobacco” will devote more attention and resources to developing and offering

electronic cigarettes (including vaporizers) as the market grows. Because of their well-established sales and distribution channels,

marketing expertise and significant financial and marketing resources, “big tobacco” is better positioned than small

competitors like us to capture a larger share of the electronic cigarette market. We also compete against numerous other smaller

manufacturers or importers of cigarettes. There can be no assurance that we will be able to compete successfully against any of

our competitors, some of whom have far greater resources, capital, experience, market penetration, sales and distribution channels

than us. If our major competitors were, for example, to significantly increase the level of price discounts offered to consumers,

we could respond by offering price discounts, which could have a materially adverse effect on our business, results of operations

and financial condition.

Sales

of conventional tobacco cigarettes have been declining, which could have a material adverse effect on our business.

The

overall U.S. market for conventional tobacco cigarettes has generally been declining in terms of volume of sales, as a result

of restrictions on advertising and promotions, funding of smoking prevention campaigns, increases in regulation and excise taxes,

a decline in the social acceptability of smoking, and other factors, and such sales are expected to continue to decline. In September

2014, CVS, a leading national drug store chain ceased selling tobacco products. If other national drug store chains also decide

to cease selling tobacco products, cigarette sales could decline further. While the sales of vaporizers have been increasing over

the last several years, the vaporizer and electronic cigarettes market is only developing and is a fraction of the size of the

conventional tobacco cigarette market. A continual decline in cigarette sales may adversely affect the growth of the vaporizer

and electronic cigarette market, which could have a material adverse effect on our business, results of operations and financial

condition.

If

we are subject to further intellectual property litigation or if the present suit becomes actively litigated, we may incur substantial

additional costs which will adversely affect our results of operations.

The

cost to prosecute infringements of our intellectual property or the cost to defend our products against patent infringement or

other intellectual property litigation by others could be substantial. We cannot assure you that:

| |

●

|

pending

and future patent applications will result in issued patents; |

| |

|

|

| |

●

|

patents

we own or which are licensed by us will not be challenged by competitors; |

| |

|

|

| |

●

|

the

patents will be found to be valid or sufficiently broad to protect our technology or provide us with a competitive advantage;

and |

| |

|

|

| |

●

|

we

will be successful in defending against current and future patent infringement claims asserted against our products as described

in the next risk factor. |

Both

the patent application process and the process of managing patent disputes can be time consuming and expensive. In addition, changes

in the U.S. patent laws could prevent or limit us from filing patent applications or patent claims to protect our products and/or

technologies or limit the exclusivity periods that are available to patent holders. In September 2011, the Leahy-Smith America

Invents Act, or the Leahy-Smith Act, was signed into law and includes a number of significant changes to U.S. patent law, including

the transaction from a “first-to-invent’ system to a “first-to-file” system and changes to the way issued

patents are challenged. These changes may favor larger and more established companies that have more resources than we do to devote

to patent application filing and prosecution. The U.S. Patent and Trademark Office issued new Regulations effective March 16,

2013 to administer the Leahy-Smith Act. Accordingly, it is not clear what, if any, impact the Leahy-Smith Act will ultimately

have on the cost of prosecuting our patent applications, our ability to obtain patents based on our discoveries and our ability

to enforce or defend our issued patents. However, it is possible that in order to adequately protect our patents under the “first-to-file”

system, we will have to allocate significant additional resources to the establishment and maintenance of a new patent application

process designed to be more streamlined and competitive in the context of the new “first-to-file” system, which would

divert valuable resources from other areas of our business. In addition to pursuing patents on our technology, we have taken steps

to protect our intellectual property and proprietary technology by entering into confidentiality agreements and intellectual property

assignment agreements with our employees, consultants, and corporate partners. Such agreements may not be enforceable or may not

provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure

or other breaches of the agreements, and we may not be able to prevent such unauthorized disclosure. Monitoring unauthorized disclosure

is difficult, and we do not know whether the steps we have taken to prevent such disclosure are, or will be, adequate.

If

a third party asserts that we are infringing on its intellectual property, whether successful or not, it could subject us to costly

and time-consuming litigation or require us to obtain expensive licenses, and our business may be adversely affected.

Although

we have filed patent applications, we do not own any patents relating to our vaporizers and electronic cigarettes. The vaporizer

and electronic cigarette industry is nascent and third parties may claim patent rights over one or more types of vaporizers and

electronic cigarettes. For example, Ruyan Investment (Holdings) Limited, which we refer to as “Ruyan”, a Chinese company,

has made certain public claims as to their ownership of patents relating to our products and has filed a number of separate lawsuits

against us. We and Ruyan settled the first lawsuit, and another lawsuit has been stayed along with other patent infringement lawsuits

filed by Ruyan against other defendants pending the results of an inter parties reexamination requested by one of the defendants

in the other lawsuits. Additionally, in 2014, Ruyan filed three separate lawsuits against the Company alleging that we infringed

on their patents. These three complaints were consolidated and the trial is currently scheduled for November 2015. For a description

of Ruyan’s lawsuits against us, please see the section titled “Legal Proceedings” contained in this prospectus.

We currently purchase our products from Chinese manufacturers other than Ruyan.

Ruyan’s

lawsuits as well as any other third party lawsuits alleging our infringement of patents, trade secrets or other intellectual property

rights could cause us to do one or more of the following:

| |

●

|

stop

selling products or using technology that contains the allegedly infringing intellectual property; |

| |

|

|

| |

●

|

incur

significant legal expenses; |

| |

|

|

| |

●

|

cause

our management to divert substantial time to our defenses; |

| |

| |

●

|

pay

substantial damages to the party whose intellectual property rights we may be found to be infringing; |

| |

|

|

| |

●

|

indemnify distributors and customers; |

| |

|

|

| |

●

|

redesign

those products that contain the allegedly infringing intellectual property; or |

| |

|

|

| |

●

|

attempt

to obtain a license to the relevant intellectual property from third parties, which may not be available to us on reasonable

terms or at all. |

Third

party lawsuits alleging our infringement of patents, trade secrets or other intellectual property rights could have a material

adverse effect on our business, results of operations and financial condition.

If

we cannot protect our intellectual property rights, we may be unable to compete with competitors developing similar technologies.

We

believe that patents, trademarks, trade secrets and other intellectual property we use and are developing are important to sustaining

and growing our business. We utilize third party manufacturers to manufacture our products in China, where the validity, enforceability

and scope of protection available under intellectual property laws are uncertain and still evolving. Implementation and enforcement

of Chinese intellectual property-related laws have historically been deficient, ineffective and hampered by corruption and local

protectionism. Accordingly, we may not be able to adequately protect our intellectual property in China, which could have a material

adverse effect on our business, results of operations and financial condition. Furthermore, policing unauthorized use of our intellectual

property in China and elsewhere is difficult and expensive, and we may need to resort to litigation to enforce or defend our intellectual

property or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation

and an adverse determination in any such litigation, if any, could result in substantial costs and diversion of resources and

management attention, which could harm our business and competitive position.

If

vaporizers continue to face intense media attention and public pressure, our operations may be adversely affected.

Since

the introduction of electronic cigarettes and vaporizers, certain members of the media, politicians, government regulators and

advocate groups, including independent medical physicians, have called for an outright ban of all electronic cigarettes and vaporizers,

pending regulatory review and a demonstration of safety. A partial or outright ban would have a material adverse effect on our

business, results of operations and financial condition and we may have to shut down our operations in the locations implemented

any such ban.

If

we fail to retain our key personnel, we may not be able to achieve our anticipated level of growth and our business could suffer.

Our

future depends, in part, on our ability to attract and retain key personnel and the continued contributions of our executive officers,

each of whom may be difficult to replace. In particular, Jeffrey Holman, our Chief Executive Officer, Gregory Brauser, our President,

and James Martin, our Chief Financial Officer, are important to the management of our business and operations and the development

of our strategic direction. The loss of the services of any of these officers and the process to replace any key personnel would

involve significant time and expense and may significantly delay or prevent the achievement of our business objectives.

We

may experience product liability claims in our business, which could adversely affect our business.

The

tobacco industry in general has historically been subject to frequent product liability claims. As a result, we may experience

product liability claims from the marketing and sale of electronic cigarettes. Any product liability claim brought against us,

with or without merit, could result in:

| |

● |

liabilities

that substantially exceed our product liability insurance, which we would then be required to pay from other sources, if available;

|

| |

|

|

| |

● |

an

increase of our product liability insurance rates or the inability to maintain insurance coverage in the future on acceptable

terms, or at all; |

| |

|

|

| |

● |

damage

to our reputation and the reputation of our products, resulting in lower sales; |

| |

|

|

| |

● |

regulatory

investigations that could require costly recalls or product modifications; |

| |

|

|

| |

● |

litigation

costs; and |

| |

|

|

| |

● |

the

diversion of management’s attention from managing our business. |

Any

one or more of the foregoing could have a material adverse effect on our business, results of operations and financial condition.

If

we experience product recalls, we may incur significant and unexpected costs and our business reputation could be adversely affected.

We

may be exposed to product recalls and adverse public relations if our products are alleged to cause illness or injury, or if we

are alleged to have violated governmental regulations. A product recall could result in substantial and unexpected expenditures

and could harm our reputation, which could have a material adverse effect on our business, results of operations and financial

condition. In addition, a product recall may require significant management time and attention and may adversely impact on the

value of our brands. Product recalls may lead to greater scrutiny by federal or state regulatory agencies and increased litigation,

which could have a material adverse effect on our business, results of operations and financial condition.

If

we experience a high amount of product exchanges, returns and warranty claims, our business will be adversely affected.

If

we are unable to maintain an acceptable degree of quality control of our products, we will incur costs associated with the exchange

and return of our products as well as servicing our customers for warranty claims. In addition, customers may require us to take

back unsold products which we may be unable to resell. Any of the foregoing on a significant scale may have a material adverse

effect on our business, results of operations and financial condition.

If

the economy declines, such decline may adversely affect the demand for our products.

Vaporizers

and electronic cigarettes may be regarded by users as a novelty item and expendable as such demand for our products may be extra

sensitive to economic conditions. When economic conditions are prosperous, discretionary spending typically increases; conversely,

when economic conditions are unfavorable, discretionary spending often declines. Any significant decline in economic conditions

that affects consumer spending could have a material adverse effect on our business, results of operations and financial condition.

Generating

foreign sales will result in additional costs and expenses and may expose us to a variety of risks.

Generating

sales of our products foreign jurisdictions will require us to incur additional costs and expenses. Furthermore, our entry into

foreign jurisdictions may expose us to various risks, which differ in each jurisdiction, and any of such risks may have a material

adverse effect on our business, financial condition and results of operations. Such risks include the degree of competition, fluctuations

in currency exchange rates, difficulty and costs relating to compliance with different commercial, legal, regulatory and tax regimes

and political and economic instability.

Our

future growth and profitability will depend in large part upon the effectiveness of our marketing and advertising expenditures.

Our

future growth and profitability will depend in large part upon our media performance, including our ability to:

| |

● |

create

greater awareness of our products and stores; |

| |

|

|

| |

● |

identify

the most effective and efficient level of spending in each market and specific media vehicle; |

| |

|

|

| |

● |

determine

the appropriate creative message and media mix for advertising, marketing, and promotional expenditures; and |

| |

|

|

| |

● |

effectively

manage marketing costs (including creative and media). |

Our

planned marketing expenditures may not result in increased revenue. If our media performance is not effective, our future results

of operations and financial condition will be adversely affected.

If

we are unable to promote and maintain our brands, our results of operations will be adversely affected.

We

believe that establishing and maintaining the brand identities of our products is a critical aspect of attracting and expanding

a large customer base. Promotion and enhancement of our brands will depend largely on our success in continuing to provide high

quality products. If our customers and end users do not perceive our products to be of high quality, or if we introduce new products

or enter into new business ventures that are not favorably received by our customers and end users, we will risk diluting our

brand identities and decreasing their attractiveness to existing and potential customers.

Moreover,

in order to attract and retain customers and to promote and maintain our brand equity in response to competitive pressures, we

may have to increase substantially our financial commitment to creating and maintaining a distinct brand loyalty among our customers.

If we incur significant expenses in an attempt to promote and maintain our brands, our business, results of operations and financial

condition could be adversely affected.

If

we cannot manage our vape stores as we grow, we may incur substantial operating losses and adversely affect our financial condition.

Our

business model is focusing on expanding the number of vape stores beyond the 10 we presently operate. As we expand the number

of vape stores and their location, it will be more difficult to manage them and our promotional costs will increase. None of our

senior managers has experience in operating a significant number of retail stores in different locations. If we expand our vape

stores beyond our capabilities, we may be materially and adversely affected.

We

rely on the efforts of third party agents to generate sales of our products, and loss of any such agents may be time consuming

to replace.

We

rely on the efforts of independent distributors to purchase and distribute our products to wholesalers and retailers. No single

distributor currently accounts for a material percentage of our sales and we believe that should any of these relationships terminate

we would be able to find suitable replacements and do so on a timely basis. However, any loss of distributors or our ability to

timely replace any given distributor could have a material adverse effect on our business, financial condition and results of

operations.

We

rely, in part, on the efforts of independent salespersons who sell our products to distributors and major retailers and Internet

sales affiliates to generate sales of products. No single independent salesperson or Internet affiliate currently accounts for

a material percentage of our sales and we believe that should any of these relationships terminate we would be able to find suitable

replacements and do so on a timely basis. However, any loss of independent sales persons or Internet sales affiliates or our ability

to timely replace any one of them could have a material adverse effect on our business, financial condition and results of operations.

We

may not be able to establish sustainable relationships with large retailers or national chains.

We

believe the best way to develop brand and product recognition and increase sales volume is to establish relationships with large

retailers and national chains. We currently have established relationships with several large retailers and national chains and

in connection therewith we have agreed to pay such retailers and chains fees, known as “slotting fees”, to carry and

offer our products for sale based on the number of stores our products will be carried in. These existing relationships are “at-will”

meaning that either party may terminate the relationship for any reason or no reason at all. We may not be able to sustain these

relationships or establish other relationships with large retailers or national chains or, even if we do so, sustain such other

relationships. Our inability to develop and sustain relationships with large retailers and national chains will impede our ability

to develop brand and product recognition and increase sales volume and, ultimately, require us to pursue and rely on local and

more fragmented sales channels, which will have a material adverse effect on our business, results of operations and financial

condition.

If

we are unable to adapt to trends in our industry, our results of operations will be adversely affected.

We

may not be able to adapt as the vaporizer and electronic cigarette industry and customer demand evolve, whether attributable to

regulatory constraints or requirements, a lack of financial resources or our failure to respond in a timely and/or effective manner

to new technologies, customer preferences, changing market conditions or new developments in our industry. Any of the failures

to adapt for the reasons cited herein or otherwise could make our products obsolete and would have a material adverse effect on

our business, financial condition and results of operations.

If

our third party manufacturers produce unacceptable or defective products or do not provide products in a timely manner, our business

will be adversely affected.

We

depend on third party manufacturers for our electronic cigarettes, vaporizers and accessories. Our customers associate certain

characteristics of our products including the weight, feel, draw, unique flavor, packaging and other attributes of our products

to the brands we market, distribute and sell. Any interruption in supply, consistency of our products may adversely impact our

ability to deliver our products to our wholesalers, distributors and customers and otherwise harm our relationships and reputation

with customers, and have a materially adverse effect on our business, results of operations and financial condition.

Although

we believe that several alternative sources for the components, chemical constituents and manufacturing services necessary for

the production of our products are available, any failure to obtain any of the foregoing would have a material adverse effect

on our business, results of operations and financial condition.

Because

we rely on Chinese manufacturers to produce our products, we are subject to potential adverse safety and other issues.

The

majority of our manufacturers are based in China. Certain Chinese factories and the products they export have recently been the

source of safety concerns and recalls, which is generally attributed to lax regulatory, quality control and safety standards.

Should Chinese factories continue to draw public criticism for exporting unsafe products, whether those products relate to our

products or not we may be adversely affected by the stigma associated with Chinese production, which could have a material adverse

effect on our business, results of operations and financial condition.

We

expect that new products and/or brands we develop will expose us to risks that may be difficult to identify until such products

and/or brands are commercially available.

We

are currently developing, and in the future will continue to develop, new products and brands, the risks of which will be difficult

to ascertain until these products and/or brands are commercially available. For example, we are developing new formulations, packaging

and distribution channels. Any negative events or results that may arise as we develop new products or brands may adversely affect

our business, financial condition and results of operations.

If

we are unable to manage our anticipated future growth, our business and results of operations could suffer materially.

Our

business has grown rapidly during our limited operating history. Our future operating results depend to a large extent on our

ability to successfully manage our anticipated growth. To manage our anticipated growth, including that arising from our recent

merger with Vaporin, we believe we must effectively, among other things:

| |

●

|

hire,

train, and manage additional employees; |

| |

|

|

| |

●

|

expand

our marketing and distribution capabilities; |

| |

|

|

| |

●

|

increase

our product development activities; |

| |

|

|

| |

●

|

add

additional qualified finance and accounting personnel; and |

| |

|

|

| |

●

|

implement

and improve our administrative, financial and operational systems, procedures and controls. |

We

are increasing our investment in marketing and distribution channels and other functions to grow our business. We are likely to

incur the costs associated with these increased investments earlier than some of the anticipated benefits and the return on these

investments, if any, may be lower, may develop more slowly than we expect or may not materialize.

If

we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new products,

and we may fail to satisfy product requirements, maintain product quality, execute our business plan or respond to competitive

pressures, any of which could have a material adverse effect on our business, results of operations and financial condition.

We

face competition from foreign importers who do not comply with government regulation which may result in the loss of customers

and result in adverse affect to our results of operations.

We

face competition from foreign sellers of electronic cigarettes and vaporizers that may illegally ship their products into the

United States for direct delivery to customers. These market participants will not have the added cost and expense of complying

with U.S. regulations and taxes and as a result will be able to offer their product at a more competitive price than us and potentially

capture market share. Moreover, should we be unable to sell certain of our products during any regulatory approval process we

have no assurances that we will be able to recapture those customers that we lost to our foreign domiciled competitors during

any “blackout” periods, during which we are not permitted to sell our products. This competitive disadvantage may

have a material adverse effect on our business, results of operations and our financial condition.

Information

technology system failures or interruptions or breaches of our network security may interrupt our operations, subject us to increased

operating costs and expose us to litigation.

At

present we generate a portion of our sales through e-commerce sales on our websites. We manage our websites and e-commerce platform

internally and as a result any compromise of our security or misappropriation of proprietary information could have a material

adverse effect on our business, financial condition and results of operations. We rely on encryption and authentication technology

licensed from third parties to provide the security and authentication necessary to effect secure Internet transmission of confidential

information, such as credit and other proprietary information. Despite our implementation of security measures, all of our technology

systems are vulnerable to damage, disability or failures due to hacking or physical theft, fire, power loss, telecommunications

failure or other catastrophic events, as well as from internal and external security breaches, denial of service attacks, viruses,

worms and other disruptive problems caused by hackers. If our technology systems were to fail, and we were unable to recover in

a timely way, we could experience an interruption in our operations. Furthermore, if unauthorized access to or use of our systems

were to occur, data related to our proprietary information and personal information of customers could be compromised. The occurrence

of any of these incidents could have a material adverse effect on our business, financial condition and results of operations.

To the extent that some of our reporting systems require or rely on manual processes, it could increase the risk of a breach.

We may be required to expend significant capital and other resources to protect against security breaches or to minimize problems

caused by security breaches. To the extent that our activities or the activities of others involve the storage and transmission

of proprietary information, security breaches could damage our reputation and expose us to a risk of loss and/or litigation. Our

security measures may not prevent security breaches. Our failure to prevent these security breaches may result in consumer distrust,

expose us to litigation either of which would adversely affect our business, results of operations and financial condition.

Our

results of operations could be adversely affected by currency exchange rates and currency devaluations.

Our

functional currency is the U.S. dollar; substantially all of our purchases and sales are currently generated in U.S. dollars.

However, our manufacturers and suppliers are located in China. The Chinese currency, the renminbi, has appreciated significantly

against the U.S. dollar in recent years. Fluctuations in exchange rates between our respective currencies could result in higher

production and supply costs to us which would have a material adverse effect on our results of operations if we are not willing

or able to pass those costs on to our customers.

Risks

Related to Government Regulation

Changes

in laws, regulations and other requirements could adversely affect our business, results of operations or financial condition.

In

addition to the anticipated regulation of our business by the FDA, our business, results of operations or financial condition

could be adversely affected by new or future legal requirements imposed by legislative or regulatory initiatives, including, but

not limited to, those relating to health care, public health and welfare and environmental matters. For example, in recent years,

states and many local and municipal governments and agencies, as well as private businesses, have adopted legislation, regulations

or policies which prohibit, restrict, or discourage smoking; smoking in public buildings and facilities, stores, restaurants and

bars; and smoking on airline flights and in the workplace. At present, it is not clear if electronic cigarettes, which omit no

smoke or noxious odors, are subject to such restrictions. Furthermore, some states and localities prohibit and others are prohibiting

the sales of electronic cigarettes and vaporizers to minors. Other similar laws and regulations are currently under consideration

and may be enacted by state and local governments in the future. If electronic cigarettes and vaporizers are subject to restrictions

on smoking in public and other places, our business, operating results and financial condition could be materially and adversely

affected. New legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent

such requirements increase the prices of goods and services because of increased costs or reduced availability. We cannot predict

whether such legislative or regulatory initiatives will result in significant changes to existing laws and regulations and/or

whether any changes in such laws or regulations will have a material adverse effect on our business and localities, results of

operations or financial condition.

Restrictions

on the public use of vaporizers and electronic cigarettes may reduce the attractiveness and demand for our products.

Certain

states, cities, businesses, providers of transportation and public venues in the U.S. have already banned the use of vaporizers

and electronic cigarettes, while others are considering banning their use. If the use of vaporizers and electronic cigarettes

are banned anywhere the use of traditional tobacco burning cigarettes is banned, our products may lose their appeal as an alternative

to traditional tobacco burning cigarettes, which may reduce the demand for our products and, thus, have a material adverse effect

on our business, results of operations and financial condition.

Limitation

by states on sales of vaporizers and electronic cigarettes may have a material adverse effect on our ability to sell our products.

On

February 15, 2010, in response to a civil investigative demand from the Office of the Attorney General of the State of Maine,

we voluntarily executed an assurance of discontinuance with the State of Maine, which prohibits us from selling electronic cigarettes

in the State of Maine until such time as we obtain a retail tobacco license in the state. While suspending sales to residents

of Maine is not material to our operations, other electronic cigarette companies have entered into similar agreements with other

states, such as the State of Oregon. If one or more states from which we generate or anticipate generating significant sales bring

actions to prevent us from selling our products unless we obtain certain licenses, approvals or permits and if we are not able

to obtain the necessary licenses, approvals or permits for financial reasons or otherwise and/or any such license, approval or

permit is determined to be overly burdensome to us then we may be required to cease sales and distribution of our products to

those states, which would have a material adverse effect on our business, results of operations and financial condition.

The

FDA has issued an import alert which has limited our ability to import certain of our products.

As

a result of FDA import alert 66-41 (which allows the detention of unapproved drugs promoted in the U.S.), the U.S. Customs has

from time to time temporarily and in some instances indefinitely detained products sent to us by our Chinese suppliers. If the

FDA modifies the import alert from its current form which allows U.S. Customs discretion to release our products to us, to a mandatory

and definitive hold we will no longer be able to ensure a supply of saleable product, which will have a material adverse effect

on our business, results of operations and financial condition. We believe this FDA import alert will become less relevant to

us as and when the FDA regulates electronic cigarettes and vaporizers under the Tobacco Control Act.

The

application of the Prevent All Cigarette Trafficking Act and/or the Federal Cigarette Labeling and Advertising Act to vaporizers

and/or electronic cigarettes would have a material adverse affect on our business.

At

present, neither the Prevent All Cigarette Trafficking Act (which prohibits the use of the U.S. Postal Service to mail most tobacco

products and which amends the Jenkins Act, which would require individuals and businesses that make interstate sales of cigarettes

or smokeless tobacco to comply with state tax laws) nor the Federal Cigarette Labeling and Advertising Act (which governs how

cigarettes can be advertised and marketed) apply to vaporizers and/or electronic cigarettes. The application of either or both

of these federal laws to either vaporizers and/or electronic cigarettes could result in additional expenses, could prohibit us

from selling products through the Internet and require us to change our advertising and labeling and method of marketing our products,

any of which would have a material adverse effect on our business, results of operations and financial condition.

We

have been named as defendants in litigation brought under California Proposition 65 which, if resolved adversely to us, could

have a material adverse impact on our financial condition.

On

June 22, 2015, the Center for Environment Health, as plaintiff, filed suit against a number of defendants including us, our wholly-owned

subsidiary, the Vape Store, Inc., Vaporin and another wholly-owned subsidiary, Vaporin Florida, Inc. The lawsuit was filed in

the Superior Court of the State of California, County of Alameda. The suit seeks relief under California Proposition 65 which

makes it unlawful for businesses to knowingly and intentionally expose individuals in California to chemicals known to cause birth

defects or other harm without providing clear and reasonable warnings. All of the defendants are alleged to have sold products

containing significant quantities of nicotine in violation of Proposition 65. The plaintiff is seeking a civil penalty against

these defendants in the amount of $2,500 per day for each violation of Proposition 65, together with attorneys’ fees and

costs.

The Company

and its subsidiaries are in the process of hiring counsel and intend to defend the allegations. We believe that all of the e-liquid

products derived from nicotine sold by Vapor Corp. have always contained an appropriate warning. We are gathering information

on sales by Vaporin and its former subsidiaries. We cannot assure you that we will prevail in this litigation. If the case is

resolved adversely to us and we are the subject of substantial civil penalties, it could have a material adverse impact on our

financial condition. Even if the litigation is dismissed or ultimately resolved in our favor, the cost of litigating could be

substantial and adversely affect our financial condition.

We