Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AMARIN CORPORATION PLC

(Exact name of registrant as specified in its charter)

|

|

|

| England and Wales |

|

Not Applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Amarin Corporation plc

2 Pembroke House

Upper

Pembroke Street 28-32

Dublin 2, Ireland

(Address of principal executive offices)

Amarin Corporation plc 2011 Stock Incentive Plan, as amended

(Full title of the plans)

John Thero

President

and Chief Executive Officer

Amarin Corporation plc

c/o Amarin Pharma, Inc.

1430 Route 206

Bedminster, NJ 07921

(908) 719-1315

(Name,

address, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Michael H. Bison

Goodwin Procter LLP

Exchange Place

Boston,

MA 02109

Tel. (617) 570-1933

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of securities

to be registered |

|

Amount

to be

registered |

|

Proposed

maximum

offering price

per share |

|

Proposed

maximum

aggregate

offering price |

|

Amount of

registration fee |

| Ordinary Shares, par value 50 pence each (1) |

|

20,000,000(2) |

|

$2.31(3) |

|

$46,200,000(3) |

|

$5,368.44 |

| |

| |

| (1) |

American Depositary Shares (“ADSs”), evidenced by American Depositary Receipts, issuable upon deposit of Ordinary Shares, par value 50 pence each (“Ordinary Shares”), of Amarin Corporation plc are

registered on a separate registration statement. Each ADS represents one Ordinary Share. |

| (2) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional Ordinary Shares which become issuable under the Amarin

Corporation plc 2011 Stock Incentive Plan, as amended by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which results in an increase in the number of our

outstanding Ordinary Shares. |

| (3) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rules 457(c) and 457(h)(i) of the Securities Act of 1933, as amended. The proposed maximum aggregate offering price is based upon

the average of the high and low sales prices of the ADSs, as reported on the Nasdaq Capital Market on July 23, 2015. |

EXPLANATORY STATEMENT

In March 2015, the Board of Directors of Amarin Corporation plc (the “Company”) approved, subject to shareholder approval, an

amendment (the “Plan Amendment”) to the Amarin Corporation plc 2011 Stock Incentive Plan (the “Plan”) which increased the aggregate number of Ordinary Shares authorized for issuance under the Plan by 20,000,000 Ordinary Shares.

At the Company’s 2015 Annual General Meeting held on July 6, 2015, the Company’s shareholders approved the Plan Amendment. The contents of the Company’s Registration Statement on Form S-8 (File No. 333-176877) filed with the

Securities and Exchange Commission (the “Commission”) on September 16, 2011 and the Company’s Registration Statement on Form S-8 (File No. 333-183160) filed with the Commission on August 8, 2012, each relating to the

Plan, are incorporated by reference into this Registration Statement pursuant to General Instruction E to Form S-8.

Part I

The information required by Part I to be contained in a Section 10(a) prospectus is omitted from this Registration Statement in

accordance with Rule 428 under the Securities Act and the Note to Part I of Form S-8.

INFORMATION REQUIRED IN THE SECTION

10(a) PROSPECTUS

Item 1. Plan Information. *

Item 2. Registrant Information and Employee Plan Annual Information.*

| * |

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act, as amended, and the “Note”

to Part I of Form S-8. |

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The Company hereby incorporates by reference in this Registration Statement the following documents previously filed by the Company with the Commission:

| |

1. |

The Company’s Annual Report on Form 10-K for the year ended December 31, 2014; |

| |

2. |

The Company’s annual Proxy Statement on Schedule 14A relating to its Annual General Meeting of shareholders, filed with the Commission on April 24, 2015 (with respect to those portions incorporated by

reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2014); |

| |

3. |

The Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2015; |

| |

4. |

The Company’s Current Reports on Form 8-K filed with the Commission on January 12, 2015, February 3, 2015, March 3, 2015, March 11, 2015, March 30,

2015, April 28, 2015, May 7, 2015, May 29, 2015 and July 10, 2015; and |

| |

5. |

The section entitled “Description of Registrant’s Securities to be Registered” contained in the Company’s Registration Statement on Form 8-A filed with the Commission on March 19, 1993,

including any amendment or report filed for the purpose of updating such description. |

ITEM 8. EXHIBITS.

|

|

|

| Exhibit No. |

|

Description of Exhibit |

|

|

| 4.1 |

|

Articles of Association of Amarin Corporation plc (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2013, filed with the Securities Exchange

Commission on August 8, 2013, File No. 000-21392). |

|

|

| 4.2 |

|

Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.4 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2011, filed with the Securities Exchange

Commission on August 9, 2011, File No. 000-21392). |

|

|

| 4.3 |

|

Amendment No. 1 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.1 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the

Securities Exchange Commission on August 8, 2012, File No. 333-176897). |

|

|

| 4.4 |

|

Amendment No. 2 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.2 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the

Securities Exchange Commission on August 8, 2012, File No. 333-167897). |

|

|

| 4.5 |

|

Amendment No. 3 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.5 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the

Securities Exchange Commission on February 28, 2012, File No. 333-167897). |

|

|

| 4.6 |

|

Amendment No. 4 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated by reference to Annex A to the Registrant’s annual Proxy Statement on Schedule 14A relating to its Annual General Meeting of shareholders, filed

with the Commission on April 24, 2015, File No. 000-21392). |

|

|

| *4.7 |

|

Amendment No. 5 to Amarin Corporation plc 2011 Stock Incentive Plan. |

|

|

| 4.8 |

|

Form of Amended and Restated Deposit Agreement, dated as of November 4, 2011, among the Company, Citibank, N.A., as Depositary, and all holders from time to time of American Depositary Receipts issued thereunder (incorporated

herein by reference to Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Securities and Exchange Commission on February 29, 2012). |

|

|

| 4.9 |

|

Form of Ordinary Share certificate (incorporated herein by reference to Exhibit 2.4 to the Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2002, filed with the Securities and Exchange

Commission on April 24, 2003). |

|

|

| 4.10 |

|

Form of American Depositary Receipt evidencing ADSs (incorporated herein by reference to Exhibit 4.4 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Securities and

Exchange Commission on February 29, 2012). |

|

|

| *5.1 |

|

Opinion of K&L Gates LLP, counsel to the Registrant, as to the validity of the Ordinary Shares. |

|

|

| *23.1 |

|

Consent of Ernst & Young LLP, independent registered public accounting firm. |

|

|

| *23.2 |

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm. |

|

|

| *23.3 |

|

Consent of K&L Gates LLP (included in Exhibit 5.1). |

|

|

| *24.1 |

|

Power of Attorney (included in the Registration Statement under “Signatures”). |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the city of Bedminster, New Jersey, on July 24, 2015.

|

|

|

|

|

Amarin Corporation plc |

|

|

| By: |

|

/s/ John F. Thero |

|

|

John F. Thero, President and Chief Executive Officer |

SIGNATURES AND POWER OF ATTORNEY

We, the undersigned officers and directors of Amarin Corporation plc, hereby severally constitute and appoint John F. Thero and Joseph T.

Kennedy, and each of them singly (with full power to each of them to act alone), our true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution in each of them for him and in his name, place and stead, and in

any and all capacities, to sign for us and in our names in the capacities indicated below any and all amendments (including post-effective amendments) to this registration statement on Form S-8 (or any other registration statement for the same

offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended), and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as full to all intents and purposes

as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form S-8 has been signed by the

following persons in the capacities and on the dates indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ John F. Thero |

|

Director, President and Chief Executive |

|

July 24, 2015 |

| John F. Thero |

|

Officer (Principal Executive Officer) |

|

|

|

|

|

| /s/ Michael J. Farrell |

|

Vice President, Finance |

|

July 24, 2015 |

| Michael J. Farrell |

|

(Principal Financial and Account Officer) |

|

|

|

|

|

| /s/ Lars G. Ekman, M.D., Ph.D. |

|

Director |

|

July 24, 2015 |

| Lars G. Ekman, M.D., Ph.D. |

|

|

|

|

|

|

|

| /s/ James I. Healy, M.D., Ph.D. |

|

Director |

|

July 24, 2015 |

| James I. Healy, M.D., Ph.D. |

|

|

|

|

|

|

|

| /s/ David Stack |

|

Director |

|

July 24, 2015 |

| David Stack |

|

|

|

|

|

|

|

| /s/ Joseph S. Zakrzewski |

|

Director |

|

July 24, 2015 |

| Joseph S. Zakrzewski |

|

|

|

|

|

|

|

| /s/ Jan van Heek |

|

Director |

|

July 24, 2015 |

| Jan van Heek |

|

|

|

|

|

|

|

|

|

|

|

|

| /s/ Kristine Peterson |

|

Director |

|

July 24, 2015 |

| Kristine Peterson |

|

|

|

|

|

|

|

| /s/ Patrick J. O’Sullivan |

|

Director |

|

July 24, 2015 |

| Patrick J. O’Sullivan |

|

|

|

|

|

|

|

| /s/ John F. Thero |

|

Authorized Representative in the U.S. |

|

July 24, 2015 |

| John F. Thero |

|

|

|

|

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description of Exhibit |

|

|

| 4.1 |

|

Articles of Association of Amarin Corporation plc (incorporated herein by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2013, filed with the Securities Exchange

Commission on August 8, 2013, File No. 000-21392). |

|

|

| 4.2 |

|

Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.4 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2011, filed with the Securities Exchange

Commission on August 9, 2011, File No. 000-21392). |

|

|

| 4.3 |

|

Amendment No. 1 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.1 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the

Securities Exchange Commission on August 8, 2012, File No. 333-176897). |

|

|

| 4.4 |

|

Amendment No. 2 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.2 to the Registrant’s Quarterly Report on Form 10-Q for the period ended June 30, 2012, filed with the

Securities Exchange Commission on August 8, 2012, File No. 333-167897). |

|

|

| 4.5 |

|

Amendment No. 3 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated herein by reference to Exhibit 10.5 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the

Securities Exchange Commission on February 28, 2012, File No. 333-167897). |

|

|

| 4.6 |

|

Amendment No. 4 to Amarin Corporation plc 2011 Stock Incentive Plan (incorporated by reference to Annex A to the Registrant’s annual Proxy Statement on Schedule 14A relating to its Annual General Meeting of shareholders, filed

with the Commission on April 24, 2015, File No. 000-21392). |

|

|

| *4.7 |

|

Amendment No. 5 to Amarin Corporation plc 2011 Stock Incentive Plan. |

|

|

| 4.8 |

|

Form of Amended and Restated Deposit Agreement, dated as of November 4, 2011, among the Company, Citibank, N.A., as Depositary, and all holders from time to time of American Depositary Receipts issued thereunder (incorporated

herein by reference to Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Securities and Exchange Commission on February 29, 2012). |

|

|

| 4.9 |

|

Form of Ordinary Share certificate (incorporated herein by reference to Exhibit 2.4 to the Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2002, filed with the Securities and Exchange

Commission on April 24, 2003). |

|

|

| 4.10 |

|

Form of American Depositary Receipt evidencing ADSs (incorporated herein by reference to Exhibit 4.4 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Securities and

Exchange Commission on February 29, 2012). |

|

|

| *5.1 |

|

Opinion of K&L Gates LLP, counsel to the Registrant, as to the validity of the Ordinary Shares. |

|

|

| *23.1 |

|

Consent of Ernst & Young LLP, independent registered public accounting firm. |

|

|

| *23.2 |

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm. |

|

|

| *23.3 |

|

Consent of K&L Gates LLP (included in Exhibit 5.1). |

|

|

| *24.1 |

|

Power of Attorney (included in the Registration Statement under “Signatures”). |

Exhibit 4.7

AMARIN CORPORATION PLC

AMENDMENT NO. 5 TO

2011

STOCK INCENTIVE PLAN

The Amarin Corporation plc 2011 Stock Incentive Plan (the “Plan”) is hereby amended by the Board of

Directors and shareholders of Amarin Corporation plc as follows:

Section 7(a) of the Plan is hereby amended, such that

Section 7(a) of the Plan, as so amended, shall read in its entirety as follows:

Section 7. Change of Control

| |

(a) |

Each of the following events shall constitute a “Change of Control” for purposes of the Plan: |

(i) any person or company (either alone or together with any person or company acting in concert with him or it) (an

“Acquiring Company”)) obtaining Control of the Company,

(ii) any person or company that Controls the Company

becoming bound or entitled to acquire Shares under sections 974 to 991 of the UK Companies Act 2006,

(iii) any court

sanctioning a compromise or arrangement under section 899 of the UK Companies Act 2006,

(iv) a resolution being tabled for

the voluntary winding-up of the Company,

(v) any Acquiring Company acquiring all or substantially all of the assets of the

Company,

(vii) any merger, reorganization, consolidation or other similar transaction pursuant to which the holders of the

Company’s outstanding voting power and outstanding stock immediately prior to such transaction do not own a majority of the outstanding voting power and outstanding stock or other equity interests of the Company or any resulting or successor

entity (or its ultimate parent, if applicable) immediately upon completion of such transaction,

(viii) the sale of all of

the Shares of the Company to an unrelated person, entity or group thereof acting in concert, and

(ix) any other similar

transaction which the Board determines should constitute a Change of Control for the purposes of the Plan.

ADOPTED BY BOARD OF DIRECTORS: July 6,

2015

Exhibit 5.1

|

|

|

|

|

K&L GATES LLP ONE NEW CHANGE

LONDON EC4M 9AF T +44 (0)20 7648 9000

F +44 (0)20 7648 9001 klgates.com |

|

|

| Amarin Corporation Plc

One New Change London

EC4M 9AF |

|

Tom Sibert tom.sibert@klgates.com

T +44 (0)20 7360 8197

Our ref 6002745.00111

LDE No 58 London/Chancery Lane 24 July 2015 |

Dear Sirs

AMARIN CORPORATION

PLC (THE “COMPANY”)

This opinion is being delivered to you in connection with a filing by the Company of a registration statement on

Form S-8 (the “Registration Statement”) to be filed with the United States Securities and Exchange Commission (the “SEC”) under the United States Securities Act of 1933 as amended (the “US Securities

Act”) on or about 24 July 2015.

You have informed us that, on 6 July 2015, the Company, by resolution of the

Company’s shareholders (the “Resolution”), adopted and approved an amendment to the Amarin Corporation Plc 2011 Stock Incentive Plan (the “Plan”) to increase the Plan Limit (as such term is defined in the Plan)

and to increase the annual limit on individual option grants (the “Annual Individual Limit”). This opinion relates, and is limited, to those ordinary shares of £0.50 each in the capital of the Company (“Ordinary

Shares”) which we understand from the Company are reserved for issue pursuant to the Plan as at the date of this opinion following the passing of the Resolution (together the “Shares”), being:

| |

(a) |

31,500,000 Ordinary Shares; |

| |

(b) |

3,074,680 Ordinary Shares (being those Ordinary Shares which remained available for grants under the Amarin Corporation Plc 2002 Stock Option Plan (the “2002 Plan”) as of 12 July 2011, but which

following the adoption of the Plan were reserved for issue under the Plan); and |

| |

(c) |

those Ordinary Shares subject to grants under the 2002 Plan that were outstanding as of 12 July 2011 (which we understand from the Company comprised a total of 10,167,337 Ordinary Shares) and which subsequently

expire or are forfeited, surrendered, cancelled or otherwise terminated, which Ordinary Shares, we understand from the Company, may then be made available for subsequent grants under the Plan, |

subject to an overall limit in respect of the issue of Ordinary Shares pursuant to Incentive Stock Options (as such term is defined in the

Plan) of 14,314,887 Ordinary Shares (subject to adjustment as provided in the Plan) and subject to an annual limit on individual option grants of 10,000,000 Ordinary Shares.

K&L Gates LLP is a limited liability partnership registered in England and Wales under number OC309508 and is authorised and regulated by the Solicitors

Regulation Authority. Any reference to a partner in relation to K&L Gates LLP is a reference to a member of that LLP. A list of the names of the members and their professional qualifications may be inspected at our registered office: One New

Change, London, EC4M 9AF, England. A reference to any office other than our London and Paris offices is a reference to an office of an associated firm.

|

|

|

|

|

Page

2

24 July 2015 |

For the purposes of this opinion, we have examined only the following:

| 1.1 |

a certificate (the “Secretary’s Certificate”) from the Company Secretary of the Company (the “Secretary”) of the same date as this opinion confirming, inter alia, (i) that the

copy of the Articles (referred to in paragraph 1.2 below) attached to the Secretary’s Certificate is correct and up-to-date; (ii) that the board meeting referred to in paragraph 1.6 below was duly convened and held and that the resolutions

set out in the extract of the minutes of the meeting (the “Board Resolutions”) were duly passed; (iii) that the Company no longer has an authorised but unissued share capital, and that there are no other limits under the

constitution of the Company on the powers of the directors to allot shares or to grant rights to acquire shares; (iv) the nominal amount of shares which the directors are authorised to allot or grant rights to acquire under section 551 of the

UK Companies Act 2006 (the “2006 Act”); (v) the extent of the powers to allot equity securities conferred on the directors under section 570 of the 2006 Act; (vi) the number of Ordinary Shares remaining available for

grants under the 2002 Plan as of 12 July 2011; and (vii) the number of Ordinary Shares subject to grants under the 2002 Plan that were outstanding as of 12 July 2011; |

| 1.2 |

copies of the certificate of incorporation, certificates of incorporation on change of name and articles of association (the “Articles”) of the Company, copies of which are attached to the

Secretary’s Certificate; |

| 1.3 |

a copy of the resolutions of the Company’s shareholders dated 6 July 2015, authorising the directors of the Company to allot shares and to grant rights to subscribe for or otherwise acquire shares and

empowering the directors to allot equity securities, a copy of which is attached to the Secretary’s Certificate; |

| 1.4 |

a copy of the resolution of the Company’s shareholders dated 12 July 2011, adopting and approving the Plan, a copy of the resolution of the Company’s shareholders dated 10 July 2012, amending the

Plan to increase the Plan Limit and a copy of the resolution of the Company’s shareholders dated 6 July 2015 amending the Plan to further increase the Plan Limit and to increase the Annual Individual Limit (together, the

“Shareholder Resolutions”), copies of which are attached to the Secretary’s Certificate; |

| 1.5 |

information on the file held at Companies House in respect of the Company disclosed by an online search of such file carried out by us at Companies House at 10.00 a.m. on 24 July 2015 (the “Companies

Registry Search”); |

| 1.6 |

a copy of the minutes of a meeting of the board of directors of the Company dated 9 March 2015, which approved the amendment to the Plan set out in the Resolution, subject to the approval of the members of the

Company, a copy of which is attached to the Secretary’s Certificate; and |

| 1.7 |

a copy of the Plan, a copy of which is attached to the Secretary’s Certificate and certified by the Secretary to be true, complete and up-to-date. |

|

|

|

|

|

Page

3

24 July 2015 |

For the purposes of this opinion we have assumed without investigation:

| 2.1 |

the authenticity, accuracy and completeness of all documents submitted to us as originals or copies, the genuineness of all signatures and the conformity to original documents of all copies; |

| 2.2 |

the capacity, power and authority of each of the parties (other than the Company) to any documents reviewed by us; |

| 2.3 |

the due execution and delivery of any documents reviewed by us in compliance with all requisite corporate authorisations; |

| 2.4 |

that all agreements and documents examined by us are on the date of this opinion legal, valid and binding under the laws by which they are (or are expressed to be) governed; |

| 2.5 |

that the contents of the Secretary’s Certificate were true and not misleading when given and remain true and not misleading as at the date of this opinion and that there is no matter not referred to in the

Secretary’s Certificate which would make any of the information in the Secretary’s Certificate incorrect or misleading; |

| 2.6 |

that the Board Resolutions were duly passed at a meeting of the board of directors which was duly convened and held, that such resolutions have not been and will not be amended or rescinded and are and will remain in

full force and effect and that the minutes of such meeting have been signed by the chairman of the meeting and filed in the Company’s minute book; |

| 2.7 |

that each of the Shareholder Resolutions was duly passed at a meeting of the shareholders which was duly convened and held, that such resolutions have not been and will not be amended or rescinded and are and will

remain in full force and effect, and that the minutes of each such meeting have been signed by the chairman of the meeting and filed in the Company’s minute book; |

| 2.8 |

that the directors present at the meeting referred to in paragraph 2.6 above duly declared any personal interest in the business transacted and were entitled to count in the quorum and to vote in respect of the

resolutions passed at the meeting and that in approving the Plan and any awards made or to be made under the Plan, the directors were and will be acting in good faith and without any conflict of interest which was not fully disclosed and properly

approved; |

| 2.9 |

having undertaken the Companies Registry Search, having telephoned the Companies Court in England and made oral enquiries regarding any entry in

respect of the Company on the Central Index of Winding Up Petitions at 11:00 a.m. on 24 July 2015 (the “Central Index Search”) and having made enquiries of the Secretary (together, the “Searches and Enquiries”)

(but having made no other searches or enquiries) and the Searches and Enquiries not revealing any of the same, that on the date of this opinion no members or creditors’ voluntary winding up resolution has been passed and no petition has been

|

|

|

|

|

|

Page

4

24 July 2015 |

| |

presented and no order has been made for the administration, winding up or dissolution of the Company and no receiver, administrative receiver, administrator, liquidator, provisional liquidator,

trustee or similar officer has been appointed in relation to the Company or any of its assets and that none of the foregoing will occur between the date of this opinion and the date of allotment and issue of any Shares; |

| 2.10 |

that no change has occurred to the information on the file at Companies House in respect of the Company since the time of the Companies Registry Search; |

| 2.11 |

that the Companies Registry Search revealed all matters required by law to be notified to the Registrar of Companies and that the information revealed is complete and accurate as of the date of the Companies Registry

Search and that further searches would not have revealed additional or different matters that could have affected the opinions contained in this opinion; |

| 2.12 |

that the information revealed by the Central Index Search is complete and accurate as of the date of such search and that further searches would not have revealed additional or different matters that could have affected

the opinions contained in this opinion; |

| 2.13 |

that the centre of main interests, as such term is defined in Article 3(1) of the European Regulation on Insolvency Proceedings (EC No. 1346/2000), of the Company is and remains in England; |

| |

(a) |

the Articles, a copy of which is attached to the Secretary’s Certificate, were adopted by special resolution passed by the requisite majority of the members of the Company at a general meeting of the Company, duly

convened and held, at which a quorum was present; |

| |

(b) |

no alteration had been or shall have been made to the Articles as at each date of allotment and issue of, or grant of rights to acquire, any Shares; and |

| |

(c) |

at the time of each allotment and issue of any Shares the Company shall have received in full ‘cash consideration’ (as such term is defined in section 583(3) of the 2006 Act) equal to the subscription price

payable for such Shares and shall have entered the holder or holders thereof in the register of members of the Company showing that all such Shares shall have been fully paid up as to their nominal value and any premium thereon as at the date of

their allotment; |

| |

(a) |

in relation to any allotment and issue of Shares pursuant to the Plan, the Award (as such term is defined in the Plan) in connection with which such Shares will be allotted and issued has or will have vested in

accordance with the terms of the Plan, the Company has or will have received a valid notice of exercise of such Award from the relevant Participant (as such term is defined in the Plan) and such Participant has or will have complied with all other

requirements of the Plan in connection with the exercise of such Award; |

|

|

|

|

|

Page

5

24 July 2015 |

| |

(b) |

any Shares will be allotted and issued in accordance with the terms set out in the Plan and in accordance with the Articles; |

| |

(c) |

a meeting of the board of directors of the Company (or a duly constituted and empowered committee thereof) was or shall have been duly convened and held and a valid resolution passed at such meeting, or a valid written

resolution of the directors or a duly constituted and empowered committee thereof was or shall have been passed, to approve each allotment and issue of Shares and each grant of rights to acquire any Shares; |

| |

(d) |

as at each date of allotment and issue of Shares and grant of rights to subscribe for Shares, the directors of the Company had or shall have sufficient authority and powers conferred on them to allot and issue such

Shares and grant such rights (as applicable) under section 551 of the 2006 Act and under section 570 of the 2006 Act as if section 561 of the 2006 Act did not apply to such allotment and issue or grant, and the directors of the Company shall not

allot or issue (or purport to allot or issue) Shares and shall not grant rights (or purport to grant rights) to acquire Shares in excess of such powers or in breach of any other limitation on their powers to allot and issue Shares or grant rights to

acquire Shares; |

| |

(e) |

the directors of the Company have used and will use all their authorities and have exercised and will exercise all their powers in connection with each allotment and issue of Shares and each grant of rights to acquire

Shares bona fide in the interests of the Company and in a way most likely to promote the success of the Company for the benefit of its members as a whole; |

| |

(f) |

the directors of the Company present at each meeting referred to in paragraph 2.15(c) above duly declared or shall duly declare any personal interest in the business transacted at the meeting and were or shall be

entitled to count in the quorum and to vote in respect of the resolutions passed or to be passed at the meeting and that in approving the allotment and issue of Shares or grant of rights to acquire any Shares, as the case may be, the directors were

and will be acting in good faith and without any conflict of interest which was not fully disclosed and properly approved; and |

| |

(g) |

no Shares shall be allotted or issued, or are or shall be committed to be allotted or issued, at a discount to their nominal value (whether in pounds sterling or equivalent in any other currency); |

| 2.16 |

that as at each date of allotment and issue of Shares and grant of rights to acquire Shares, save for the amendment to the Plan Limit and the Annual Individual Limit pursuant to the Resolution, no alteration shall have

been made to the form of the Plan attached to the Secretary’s Certificate; |

|

|

|

|

|

Page

6

24 July 2015 |

| 2.17 |

that no Shares or rights to subscribe for Shares have been or shall be offered to the public in the United Kingdom in breach of the Financial Services and Markets Act 2000 (“FSMA”) or of any other UK

laws or regulations concerning the offer of securities to the public, and no communication has been or shall be made in relation to the Shares in breach of section 21 of FSMA or any other UK laws or regulations relating to offers or invitations to

subscribe for, or to acquire rights to subscribe for or otherwise acquire, shares or other securities; |

| 2.18 |

that no shares or securities of the Company are listed on any recognised investment exchange in the United Kingdom (as defined in section 285 of FSMA) or traded on any prescribed market (as defined in the Financial

Services and Markets Act 2000 (Prescribed Markets and Qualifying Investments) Order 2001); |

| 2.19 |

that in issuing and allotting and granting rights to acquire Shares and administering the Plan the Company is not carrying on a regulated activity for the purposes of section 19 of FSMA; |

| 2.20 |

that the Company’s place of central management and control is not in the UK, the Channel Islands or the Isle of Man for the purposes of the City Code on Takeovers and Mergers; |

| 2.21 |

that the Plan has the same meaning and effect as if it was governed by English law; |

| 2.22 |

that the Company has complied and will comply with all applicable anti-terrorism, anti-corruption, anti-money laundering, sanctions and human rights laws and regulations and that each allotment and issue of Shares and

grant of rights to acquire Shares pursuant to the Plan will be consistent with all such laws and regulations; and |

| 2.23 |

that, under the laws of the State of New York, any award of Restricted Stock Units (including any Performance-Based Awards) (as such terms are defined in the Plan) pursuant to Section 6(b) of the Plan and any award

under Section 6(b)(iv) of the Plan constitutes or will constitute the award of a cash bonus so as to give rise to a liability for a liquidated sum from the Company to the recipient of such award which pursuant to the terms of the Plan is

capable of settlement by either the payment of cash or the issue of Shares to such recipient. |

| 3.1 |

Based upon and subject to the foregoing, and subject to the reservations mentioned below and to any matters not disclosed to us, we are of the opinion that upon allotment and issue thereof and payment therefor, when the

Shares are allotted and issued pursuant to the Plan, such Shares will be validly issued, fully paid and non-assessable. |

| 3.2 |

For the purposes of this opinion we have assumed that the term “non-assessable” in relation to the Shares means under English law that holders of such Shares, in respect of which all amounts due on such Shares

as to the nominal amount and any premium thereon have been fully paid, will be under no obligation to contribute to the liabilities of the Company solely in their capacity as holders of such Shares. |

|

|

|

|

|

Page

7

24 July 2015 |

Our reservations are as follows:

| 4.1 |

no allotment of any Shares has (we understand) yet taken place and no such allotment may ever take place; |

| 4.2 |

we express no opinion as to matters of United Kingdom taxation or any liability to tax which may arise or be incurred as a result of or in connection with the allotment and issue of the Shares pursuant to the Plan or

the transactions contemplated thereby, or as to tax matters generally; |

| 4.3 |

we express no opinion on European Community law as it affects any jurisdiction other than England. We also express no opinion as to whether or not a foreign court (applying its own conflict of laws rules) will act in

accordance with the choice of law and/or choice of jurisdiction expressed in the Plan; |

| 4.4 |

the obligations of the Company are subject to all laws from time to time in effect relating to bankruptcy, insolvency, liquidation, administration, reorganisation or any other laws (or other legal or equitable remedies)

or legal procedures affecting the rights of creditors or their enforcement; |

| 4.5 |

we have relied entirely on the facts, statements and confirmations contained in the Secretary’s Certificate and we have not undertaken any independent investigation or verification of the matters referred to in the

Secretary’s Certificate; |

| 4.6 |

we express no opinion as to any law other than English law in force, and as interpreted, at the date of this opinion. We are not qualified to, and we do not, express an opinion on the laws of any other jurisdiction. In

particular and without prejudice to the generality of the foregoing, we have not independently investigated the laws of the United States of America or the State of New York or the rules of any non-UK regulatory body (including, without limitation,

the SEC) or any investment exchange outside the United Kingdom (including, without limitation, the NASDAQ Stock Market LLC) for the purpose of this opinion; |

| 4.7 |

this opinion deals exclusively with the statutory authorities and powers required by the directors of the Company to allot the Shares and not with any contractual restrictions which may be binding on the Company or its

directors or any investing institutions’ guidelines; |

| 4.8 |

the Companies Registry Search may not completely and accurately reflect the situation of the Company at the time it was made due to (i) failure of the Company to file documents that ought to be filed,

(ii) statutory prescribed time-periods within which documents evidencing actions may be filed, (iii) the possibility of additional delays (beyond the statutory time-limits) between the taking of the action and the necessary filing with the

Registrar of Companies, (iv) the possibility of delays by the Registrar of Companies or his staff in the registration of documents and their subsequent copying onto public records and (v) errors and mis-filing that may occur;

|

|

|

|

|

|

Page

8

24 July 2015 |

| 4.9 |

the Central Index Search may not completely and accurately reveal whether or not petitions for winding-up orders or administration orders have been lodged, since (i) whilst in relation to winding-up petitions it

should show all such petitions issued in England and Wales, it is limited to petitions for administration issued in London only, (ii) there may be delays in entering details of petitions on the index, (iii) County Courts may not notify the

Central Index immediately (if at all) of petitions which they have issued, (iv) enquiries of the Central Index, in any event, only show petitions presented since June 1994 and (v) errors and mis-filing may occur; |

| 4.10 |

the list of members maintained by the Company’s registrars does not disclose details of the payment up of any Shares, such details being recorded by or on behalf of the Company in a separate register of allotments

which contains certain of the information required under the 2006 Act, and we assume that the same procedure will be adopted in relation to the Shares; |

| 4.11 |

we have not reviewed the terms of the Plan or any award agreement entered into pursuant to the Plan and we express no opinion in relation to the legality, enforceability or validity of the Plan or any award agreement.

In particular, but without prejudice to the generality of the foregoing, we have assumed that Shares to be allotted under the Plan or any award agreement will be paid up in full (as to their nominal value and any premium) in cash (within the meaning

of section 583(1) of the 2006 Act), and we express no opinion as to whether any consideration other than ‘cash consideration’ (as such term is defined in section 583(3) of the 2006 Act) which might be paid, or purport to be paid, for the

Shares would result in the Shares being validly issued, fully paid and non-assessable; |

| 4.12 |

any surrender of Ordinary Shares pursuant to Section 6(a)(iii)(c) of the Plan would require a reduction of the Company’s share capital in accordance with the provisions of Chapter 10 of Part 17 of the 2006 Act

(including, inter alia, an application to the court for an order confirming the reduction) or a repurchase of such Ordinary Shares in accordance with Part 18 of the 2006 Act and any allotment of Shares as fully or partly paid up for a consideration

other than ‘cash consideration’ (as such term is defined in section 583(3) of the 2006 Act) would require, inter alia, such consideration to have been independently valued pursuant to section 593 of the 2006 Act. We express no opinion in

relation to the ability of the Company to complete any such reduction of its share capital or repurchase of shares, or as to whether a purported surrender of Ordinary Shares pursuant to Section 6(a)(iii)(c) of the Plan would constitute

sufficient consideration for the allotment and issue of Shares for the purposes of the 2006 Act; |

| 4.13 |

if any award of Restricted Stock Units (including any Performance-Based Awards) pursuant to Section 6(b) of the Plan or any award under Section 6(b)(iv) of the Plan does not constitute the award of a cash

bonus so as to create a liability for a liquidated sum, any Shares purported to be allotted and issued pursuant to any such award will not have been validly allotted and issued for cash in accordance with the requirements of the 2006 Act and may not

therefore be fully paid and non-assessable; |

| 4.14 |

we express no opinion on the compliance of the Plan, or the compliance of any award made under the Plan, with the Code (as defined in the Plan) or the rules or regulations of the NASDAQ Stock Market LLC or of any other

securities exchange that are applicable to the Company; |

|

|

|

|

|

Page

9

24 July 2015 |

| 4.15 |

in relation to the assumption at paragraph 2.13 above, we understand that the Company moved its tax residence to the Republic of Ireland in 2008 and we have not considered the effect this change in tax residence may

have on any of the matters covered by this opinion; and |

| 4.16 |

a member of a company incorporated under the laws of England and Wales may apply to the English courts under Part 30 of the 2006 Act on the grounds that the affairs of the company are being or have been conducted in a

manner unfairly prejudicial to members’ interests, and in such circumstances, the court may (inter alia) require the company to refrain from doing or continuing an act complained of by the petitioner and such an order may extend to the

allotment or issue of Shares or the grant of rights to acquire Shares. |

| 4.17 |

This opinion speaks only as at the date hereof. Notwithstanding any reference herein to future matters or circumstances, we have no obligation to advise the addressee (or any third party) of any changes in the law or

facts that may occur or become known to us after the date of this opinion. |

This opinion is given on condition that it is governed by and

shall be construed in accordance with English law as in force and as interpreted at the date of this opinion and that the English courts shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with this

opinion.

This opinion is given solely in connection with the filing of the Registration Statement by or on behalf of the Company. We hereby consent to

the filing of this opinion in its full form as an exhibit to the Registration Statement.

In giving such consent, if and to the extent that this might

otherwise apply in relation to the giving of an opinion governed by English law, we do not admit that we are in the category of persons whose consent is required under Section 7 of the US Securities Act or the Rules and Regulations thereunder.

Yours faithfully,

|

| /s/ K&L Gates LLP |

| K&L Gates LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 333-00000) pertaining to the Amarin Corporation plc 2011 Stock

Incentive Plan of our reports dated March 3, 2015 with respect to the consolidated financial statements of Amarin Corporation plc and the effectiveness of internal control over financial reporting of Amarin Corporation plc included in its Annual

Report (Form 10-K) for the year ended December 31, 2014, filed with the Securities and Exchange Commission.

|

| /s/ Ernst & Young LLP |

| MetroPark, New Jersey July 24,

2015 |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated February 27, 2014, relating to the consolidated

financial statements as of December 31, 2013 and for each of the two years in the period ended December 31, 2013 of Amarin Corporation plc and subsidiaries, appearing in the Annual Report on Form 10-K of Amarin Corporation plc for the year ended

December 31, 2014.

/s/ Deloitte & Touche LLP

Parsippany, New Jersey

July 24, 2015

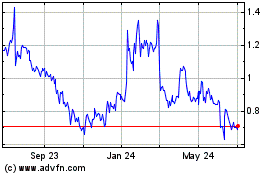

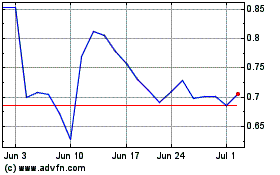

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024