Current Report Filing (8-k)

July 23 2015 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2015

CytoDyn Inc.

(Exact

name of registrant as specified in charter)

|

|

|

|

|

| Colorado |

|

000-49908 |

|

75-3056237 |

| (State or other jurisdiction

of incorporation) |

|

(SEC File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1111 Main Street, Suite 660

Vancouver, Washington |

|

98660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (360) 980-8524

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

From June 30, 2015 through July 23, 2015, CytoDyn

Inc. (the “Company”) conducted closings (the “Closings”) of a private placement offering to accredited investors (the “Offering”) of the Company’s common stock, no par value (“Common Stock”), and

five-year warrants to purchase shares of Common Stock at an exercise price of $0.75 per share (“Warrants”). The purchase price for each share of Common Stock was $0.75 and included 50% warrant coverage for each share of Common Stock

purchased.

In connection with the Closings, the Company entered into definitive subscription agreements (the “Subscription Agreements”) with

accredited investors (the “Investors”) and issued an aggregate of 4,767,649 shares of Common Stock and Warrants to purchase an aggregate 2,383,813 shares of Common Stock for aggregate gross proceeds to the Company of $3,575,750 In

connection with the Offering, the Company entered into a Registration Rights Agreement with the Investors pursuant to which the Company has granted the Investors certain registration rights. The net proceeds to the Company from the Closings, after

deducting the placement agent fees described below and other estimated Offering expenses, were $3,081,903.

The Company entered into a Placement Agent

Agreement with a registered broker dealer which acted as the Company’s exclusive placement agent (the “Placement Agent”) for the Offering. Pursuant to the terms of the Placement Agent Agreement, in connection with the Closing, the

Company paid the Placement Agent an aggregate cash fee of $489,848, including an expense advance of $25,000, and will issue to the Placement Agent or its designees warrants (substantially similar in form to the Warrants) to purchase

619,794 shares of Common Stock at $0.75 per share.

The securities issued in the Offering as described above, including the Common Stock, Warrants

and the placement agent warrants, have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and were made pursuant to the exemptions from registration provided by Section 4(a)(2) of the Securities

Act and/or Rule 506(b) of Regulation D promulgated thereunder. Such securities are therefore restricted in accordance with Rule 144 under the Securities Act.

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any security. The securities described herein have

not been registered under the Securities Act or applicable state securities laws and may not be offered or sold in the United States or any state thereof absent registration under the Securities Act and applicable state securities laws or an

applicable exemption from registration requirements.

The material agreements described in this Current Report on Form 8-K will be filed as exhibits in

our next periodic report due to be filed under the Exchange Act of 1934.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The number of securities issued, the nature of the transaction

and the nature and amount of consideration received by the Company are described in Item 1.01 of this Form 8-K, which is incorporated by reference into this Item 3.02.

Each of the investors in the Offering has represented to the Company that it is an “accredited

investor” as that term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act. The Company relied on the exemption from registration afforded by Section 4(a)(2) of the Securities Act in connection with the

issuance of the Note and Warrants.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CytoDyn Inc. |

|

|

|

|

| Dated: July 23, 2015 |

|

|

|

By: |

|

/s/ Michael D. Mulholland |

|

|

|

|

|

|

Michael D. Mulholland |

|

|

|

|

|

|

Chief Financial Officer |

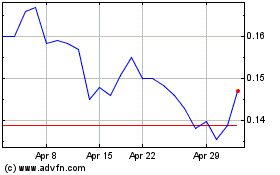

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

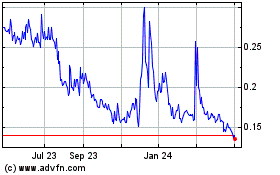

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024