UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2015

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-13270 |

|

90-0023731 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 10603 W. Sam Houston Pkwy N., Suite 300

Houston, Texas |

|

77064 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 849-9911

NOT APPLICABLE

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On July 21, 2015, Flotek Industries,

Inc. (the “Company”) and its affiliates entered into the Fourth Amendment (the “Amendment”) to Amended and Restated Revolving Credit, Term Loan and Security Agreement with PNC Bank, National Association dated as of May 10,

2013, as amended to date (the “Credit Agreement”). Pursuant to the Amendment, among other things, certain definitions related to the Company’s required financial metrics were revised.

The Company also agreed to pay a fee and expenses of the agent in connection with the Amendment. The description of the changes to the Credit

Agreement effected by the Amendment is qualified in its entirety by reference to the copy thereof filed as Exhibit 10.1 to this Form 8-K, which is incorporated by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Fourth Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement dated July 21, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC. |

|

|

|

| Date: July 23, 2015 |

|

|

|

/s/ Robert M. Schmitz |

|

|

|

|

Robert M. Schmitz |

|

|

|

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Fourth Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement dated July 21, 2015. |

Exhibit 10.1

FOURTH AMENDMENT TO AMENDED AND RESTATED

REVOLVING CREDIT, TERM LOAN AND SECURITY AGREEMENT

THIS FOURTH AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT, TERM LOAN AND SECURITY AGREEMENT (this “Amendment”) is made

and entered into effective as of July 21, 2015 (the “Effective Date”), by and among FLOTEK INDUSTRIES, INC., a corporation organized under the laws of the State of Delaware (“Holdings”), CESI CHEMICAL, INC., a

corporation organized under the laws of the State of Oklahoma (“CESI Chemical”), CESI MANUFACTURING, LLC, a limited liability company organized under the laws of the State of Oklahoma (“CESI Manufacturing”),

MATERIAL TRANSLOGISTICS, INC., a corporation organized under the laws of the State of Texas (“MTI”), TELEDRIFT COMPANY, a corporation organized under the laws of the State of Delaware (“Teledrift”), TURBECO, INC., a

corporation organized under the laws of the State of Texas (“Turbeco”), USA PETROVALVE, INC., a corporation organized under the laws of the State of Texas (“USA Petrovalve”), FLORIDA CHEMICAL COMPANY, INC., a

corporation organized under the laws of the State of Delaware (“Florida Chemical”), SITELARK LLC, a limited liability company organized under the laws of the State of Texas (“Sitelark”), FLOTEK ECUADOR MANAGEMENT

LLC, a limited liability company organized under the laws of the State of Texas (“Ecuador Management”), FLOTEK ECUADOR INVESTMENTS LLC, a limited liability company organized under the laws of the State of Texas (“Ecuador

Investments”), FLOTEK EXPORT, INC., a corporation organized under the laws of the State of Texas (“Export”), ECLIPSE IOR SERVICES, LLC, a limited liability company organized under the laws of the State of Texas

(“EOGA”), FRACMAX ANALYTICS, LLC, a limited liability company organized under the laws of the State of Texas (“Fracmax”), FC PRO, LLC, a limited liability company organized under the laws of the State of Delaware

(“FC PRO”), FLOTEK HYDRALIFT, INC., a corporation organized under the laws of the State of Texas (“Hydralift”); and together with Holdings, CESI Chemical, CESI Manufacturing, MTI, Teledrift, Turbeco, USA Petrovalve,

Florida Chemical, Sitelark, Ecuador Management, Ecuador Investments, Export, EOGA, Fracmax and FC PRO, “Borrowers” and each a “Borrower”) and PNC BANK, NATIONAL ASSOCIATION (“PNC”), as a Lender (as

defined in the hereinafter defined Credit Agreement) and as agent for Lenders (in such capacity, “Agent”).

PRELIMINARY

STATEMENTS

A. Borrowers, Lenders and Agent are parties to that certain Amended and Restated Revolving Credit, Term Loan and Security

Agreement dated May 10, 2013, as amended by that certain First Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement, dated as of December 31, 2013, that certain Second Amendment to Amended and Restated

Revolving Credit, Term Loan and Security Agreement, dated as of December 5, 2014 and that certain Third Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement, dated as of June 19, 2015 (as it may be further

amended, restated, supplemented, or otherwise modified from time to time, the “Credit Agreement”); and

B. Borrowers have

requested that Agent make certain amendments to the Credit Agreement and subject to the terms and conditions set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Agent and

Lenders are willing to do so, all as set forth herein.

NOW, THEREFORE, in consideration of the premises herein contained and other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound, agree as follows:

ARTICLE I

DEFINITIONS

1.01 Capitalized terms used in this Amendment are defined in the Credit Agreement, as amended hereby, unless otherwise stated.

ARTICLE II

AMENDMENT

2.01

Amendment to Section 1.2 – Amended Definitions. Effective as of June 1, 2015, the following definitions contained in Section 1.2 of the Credit Agreement, are hereby deleted in their entirety and replaced with

the following:

“Adjusted EBITDA” shall mean for any period the sum of (a) net income (or loss) of Holdings

and its Subsidiaries on a consolidated basis for such period (excluding extraordinary gains), plus (b) all interest expense of Holdings and its Subsidiaries on a consolidated basis for such period, plus (c) all charges against income of

Holdings and its Subsidiaries for such period for federal, state and local taxes plus (d) depreciation expenses for such period, plus (e) amortization expenses for such period, plus (f) non-cash income reduction adjustments derived

from or related to stock-based compensation, plus (g) charges related to the write-down or impairment of Inventory and fixed assets for such period (up to a maximum amount of $23,000,000 for the fiscal year ending December 31, 2015).

“Fixed Charge Coverage Ratio” shall mean, with respect to any fiscal period, the ratio of (a) Adjusted EBITDA of Holdings

and its Subsidiaries on a consolidated basis, minus total Unfunded Capital Expenditures made during such period other than (provided no Trigger Event has occurred and is then continuing) (i) up to $7,500,000 in Unfunded Capital Expenditures

during the fiscal year ending December 31, 2015 and (ii) up to $5,000,000 in Unfunded Capital Expenditures during the fiscal year ending December 31, 2016, in each case, solely to the extent incurred with the construction and

build-out of Borrowers’ domestic research and innovation facilities, minus cash taxes paid during such period, minus all cash distributions and cash dividends made during such period to (b) all Debt Payments during such period.

2

2.02 Amendment to Section 6.5(a). Section 6.5(a) of the Credit

Agreement is hereby amended and restated in its entirety and replaced with the following:

(a) Fixed Charge

Coverage Ratio. Commencing on June 30, 2015, cause to be maintained, a Fixed Charge Coverage Ratio of not less than 1.10 to 1.00 as of the last day of each fiscal quarter for the four (4) fiscal quarter period then ending.

ARTICLE III

CONDITIONS PRECEDENT

3.01 Conditions to Effectiveness. The effectiveness of this Amendment is subject to the satisfaction of the following conditions

precedent, unless specifically waived in writing by Agent:

(a) Agent shall have received the following documents or

items, each in form and substance satisfactory to Agent and its legal counsel:

(i) this Amendment duly executed by each

Borrower; and

(ii) a $50,000.00 amendment fee, in immediately available funds, which fee shall be distributed ratably

amongst the Lenders and shall be fully earned and non-refundable as of the date hereof.

(b) The representations and

warranties contained herein and in the Credit Agreement and the Other Documents, as each is amended hereby, shall be true and correct as of the date hereof, as if made on the date hereof; and

(c) No Default or Event of Default shall have occurred and be continuing.

3.02 No Waiver. Nothing contained in this Amendment shall be construed as a waiver by Agent or any Lender of any covenant or

provision of the Credit Agreement (as amended hereby), the Other Documents, this Amendment, or of any other contract or instrument between any Borrower and Agent or any Lender, and the failure of Agent or any Lender at any time or times hereafter to

require strict performance by any Borrower of any provision thereof shall not waive, affect or diminish any right of Agent to thereafter demand strict compliance therewith. Agent and each Lender hereby reserve all rights granted under the Credit

Agreement, the Other Documents, this Amendment and any other contract or instrument between any Borrower, Lenders and Agent.

3

ARTICLE IV

RATIFICATIONS, REPRESENTATIONS, WARRANTIES AND OTHER AGREEMENTS

4.01 Ratifications. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and

provisions set forth in the Credit Agreement and the Other Documents, and, except as expressly modified and superseded by this Amendment, the terms and provisions of the Credit Agreement and the Other Documents are ratified and confirmed and shall

continue in full force and effect. Each Borrower hereby agrees that all liens and security interest securing payment of the Obligations under the Credit Agreement are hereby collectively renewed, ratified and brought forward as security for the

payment and performance of the Obligations. Each Borrower and Agent agree that the Credit Agreement and the Other Documents, as amended hereby, shall continue to be legal, valid, binding and enforceable in accordance with their respective terms.

4.02 Representations and Warranties with respect to Other Documents. Each Borrower hereby represents and warrants to

Agent that (a) the execution, delivery and performance of this Amendment and any and all Other Documents executed and/or delivered in connection herewith have been authorized by all requisite corporate action on the part of each Borrower and

will not violate the Articles or Certificate of Incorporation or By-Laws or the Certificate of Formation or Operating Agreement of any Borrower; (b) the representations and warranties contained in the Credit Agreement, as amended hereby, and

the Other Documents are true and correct on and as of the date hereof and on and as of the date of execution hereof as though made on and as of each such date; (c) no Default or Event of Default under the Credit Agreement, as amended hereby,

has occurred and is continuing, unless such Default or Event of Default has been specifically waived in writing by Agent; and (d) each Borrower is in full compliance with all covenants and agreements contained in the Credit Agreement and the

Other Documents, as amended hereby.

ARTICLE V

MISCELLANEOUS PROVISIONS

5.01 Survival of Representations and Warranties. All representations and warranties made in the Credit Agreement or the Other

Documents, including, without limitation, any document furnished in connection with this Amendment, shall survive the execution and delivery of this Amendment and the Other Documents, and no investigation by Agent or any closing shall affect the

representations and warranties or the right of Agent to rely upon them.

5.02 Reference to Credit Agreement. Each of

the Credit Agreement and the Other Documents, and any and all other agreements, documents or instruments now or hereafter executed and delivered pursuant to the terms hereof or pursuant to the terms of the Credit Agreement, as amended hereby, are

hereby amended so that any reference in the Credit Agreement and such Other Documents to the Credit Agreement shall mean a reference to the Credit Agreement as amended hereby.

5.03 Expenses of Agent. Each Borrower jointly and severally agrees to pay on demand all reasonable costs and expenses incurred

by Agent in connection with any and all amendments, modifications, and supplements to the Other Documents, including, without limitation, the costs and fees of Agent’s legal counsel, and all costs and expenses incurred by

4

Agent in connection with the enforcement or preservation of any rights under the Credit Agreement, as amended hereby, or any Other Documents, including, without, limitation, the costs and fees of

Agent’s legal counsel.

5.04 Severability. Any provision of this Amendment held by a court of competent jurisdiction to

be invalid or unenforceable shall not impair or invalidate the remainder of this Amendment and the effect thereof shall be confined to the provision so held to be invalid or unenforceable.

5.05 Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of Agent, Lenders and each Borrower

and their respective successors and assigns, except that no Borrower may assign or transfer any of its rights or obligations hereunder without the prior written consent of Agent.

5.06 Counterparts. This Amendment may be executed in one or more counterparts, each of which when so executed shall be deemed to

be an original, but all of which when taken together shall constitute one and the same instrument.

5.07 Effect of

Waiver. No consent or waiver, express or implied, by Lenders or Agent to or for any breach of or deviation from any covenant or condition by any Borrower shall be deemed a consent to or waiver of any other breach of the same or any other

covenant, condition or duty.

5.08 Headings. The headings, captions, and arrangements used in this Amendment are for

convenience only and shall not affect the interpretation of this Amendment.

5.09 Applicable Law. THIS AMENDMENT AND ALL

OTHER AGREEMENTS EXECUTED PURSUANT HERETO SHALL BE DEEMED TO HAVE BEEN MADE AND TO BE PERFORMABLE IN AND SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS.

5.10 Final Agreement. THE CREDIT AGREEMENT AND THE OTHER DOCUMENTS, EACH AS AMENDED HEREBY, REPRESENT THE ENTIRE EXPRESSION

OF THE PARTIES WITH RESPECT TO THE SUBJECT MATTER HEREOF ON THE DATE THIS AMENDMENT IS EXECUTED. THE CREDIT AGREEMENT AND THE OTHER DOCUMENTS, AS AMENDED HEREBY, MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL

AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES. NO MODIFICATION, RESCISSION, WAIVER, RELEASE OR AMENDMENT OF ANY PROVISION OF THIS AMENDMENT SHALL BE MADE, EXCEPT BY A WRITTEN AGREEMENT SIGNED BY BORROWERS AND

AGENT.

5.11 Release. EACH BORROWER HEREBY ACKNOWLEDGES THAT IT HAS NO DEFENSE, COUNTERCLAIM, OFFSET, CROSS-COMPLAINT, CLAIM OR DEMAND

5

OF ANY KIND OR NATURE WHATSOEVER THAT CAN BE ASSERTED TO REDUCE OR ELIMINATE ALL OR ANY PART OF ITS LIABILITY TO REPAY ANY LOANS OR EXTENSIONS OF CREDIT FROM AGENT AND LENDERS TO SUCH BORROWER

UNDER THE CREDIT AGREEMENT OR THE OTHER DOCUMENTS OR TO SEEK AFFIRMATIVE RELIEF OR DAMAGES OF ANY KIND OR NATURE FROM LENDERS AND AGENT. EACH BORROWER HEREBY VOLUNTARILY AND KNOWINGLY RELEASES AND FOREVER DISCHARGES LENDERS, AGENT, THEIR

PREDECESSORS, AGENTS, EMPLOYEES, SUCCESSORS AND ASSIGNS, FROM ALL POSSIBLE CLAIMS, DEMANDS, ACTIONS, CAUSES OF ACTION, DAMAGES, COSTS, EXPENSES, AND LIABILITIES WHATSOEVER, KNOWN OR UNKNOWN, ANTICIPATED OR UNANTICIPATED, SUSPECTED OR UNSUSPECTED,

FIXED, CONTINGENT, OR CONDITIONAL, AT LAW OR IN EQUITY, ORIGINATING IN WHOLE OR IN PART ON OR BEFORE THE DATE THIS AMENDMENT IS EXECUTED, WHICH SUCH BORROWER MAY NOW OR HEREAFTER HAVE AGAINST LENDERS AND AGENT, THEIR PREDECESSORS, AGENTS, EMPLOYEES,

SUCCESSORS AND ASSIGNS, IF ANY, AND IRRESPECTIVE OF WHETHER ANY SUCH CLAIMS ARISE OUT OF CONTRACT, TORT, VIOLATION OF LAW OR REGULATIONS, OR OTHERWISE, AND ARISING FROM ANY LOANS OR EXTENSIONS OF CREDIT FROM LENDERS AND AGENT TO SUCH BORROWER UNDER

THE CREDIT AGREEMENT OR THE OTHER DOCUMENTS, INCLUDING, WITHOUT LIMITATION, ANY CONTRACTING FOR, CHARGING, TAKING, RESERVING, COLLECTING OR RECEIVING INTEREST IN EXCESS OF THE HIGHEST LAWFUL RATE APPLICABLE, THE EXERCISE OF ANY RIGHTS AND REMEDIES

UNDER THE CREDIT AGREEMENT OR OTHER DOCUMENTS, AND NEGOTIATION FOR AND EXECUTION OF THIS AMENDMENT.

5.12 Guarantors Consent,

Ratification and Release. Each of the undersigned Guarantors hereby consents to the terms of this Amendment, confirms and ratifies the terms of that certain Guaranty dated as of May 10, 2013 (the “FTK Guaranty”)

executed by each of the undersigned in favor of Agent and the other Lenders. Each of the undersigned Guarantors acknowledges that its Guaranty is in full force and effect and ratifies the same, acknowledges that such undersigned has no defense,

counterclaim, set-off or any other claim to diminish such undersigned’s liability under such documents, that such undersigned’s consent is not required to the effectiveness of the within and foregoing Amendment, and that no consent by any

such undersigned is required for the effectiveness of any future amendment, modification, forbearance or other action with respect to the Obligations, the Collateral, or any of the Other Documents. EACH OF THE UNDERSIGNED HEREBY VOLUNTARILY AND

KNOWINGLY RELEASES AND FOREVER DISCHARGES AGENT AND LENDERS, THEIR PREDECESSORS, AGENTS, EMPLOYEES, SUCCESSORS AND ASSIGNS, FROM ALL POSSIBLE CLAIMS, DEMANDS, ACTIONS, CAUSES OF ACTION, DAMAGES, COSTS, EXPENSES, AND LIABILITIES WHATSOEVER, KNOWN OR

UNKNOWN, ANTICIPATED OR UNANTICIPATED, SUSPECTED OR UNSUSPECTED, FIXED, CONTINGENT, OR CONDITIONAL, AT LAW OR IN EQUITY, ORIGINATING IN WHOLE OR IN PART ON OR BEFORE THE DATE THIS AMENDMENT AND THIS CONSENT ARE EXECUTED, WHICH EACH SUCH UNDERSIGNED

MAY NOW OR

6

HEREAFTER HAVE AGAINST AGENT, DOCUMENTATION AGENT OR ANY LENDER, THEIR PREDECESSORS, AGENTS, EMPLOYEES, SUCCESSORS AND ASSIGNS, IF ANY, AND IRRESPECTIVE OF WHETHER ANY SUCH CLAIMS ARISE OUT OF

CONTRACT, TORT, VIOLATION OF LAW OR REGULATIONS, OR OTHERWISE, AND ARISING FROM ANY “LOANS”, INCLUDING, WITHOUT LIMITATION, ANY CONTRACTING FOR, CHARGING, TAKING, RESERVING, COLLECTING OR RECEIVING INTEREST IN EXCESS OF THE HIGHEST LAWFUL

RATE APPLICABLE, THE EXERCISE OF ANY RIGHTS AND REMEDIES UNDER THE REVOLVING CREDIT AND SECURITY AGREEMENT, AS AMENDED BY THIS AMENDMENT, OR THE OTHER DOCUMENTS, AND NEGOTIATION FOR AND EXECUTION OF THIS AMENDMENT AND THIS CONSENT.

[REMAINDER OF PAGE INTENTIONALLY BLANK; SIGNATURE

PAGES FOLLOW.]

7

IN WITNESS WHEREOF, each of the parties hereto has executed this Amendment as of the Effective

Date.

|

|

|

|

|

| BORROWERS: |

|

|

|

|

FLOTEK INDUSTRIES, INC., a Delaware corporation |

|

|

|

|

|

By: |

|

/s/ John Chisholm |

|

|

Name: |

|

John Chisholm |

|

|

Title: |

|

CEO and President |

|

|

|

|

CESI CHEMICAL, INC., an Oklahoma corporation |

|

|

|

|

|

By: |

|

/s/ John Chisholm |

|

|

Name: |

|

John Chisholm |

|

|

Title: |

|

CEO |

|

|

|

|

CESI MANUFACTURING, LLC, an Oklahoma limited liability company |

|

|

|

|

|

By: |

|

/s/ John Chisholm |

|

|

Name: |

|

John Chisholm |

|

|

Title: |

|

CEO |

|

|

|

|

MATERIAL TRANSLOGISTICS, INC., a Texas corporation |

|

|

|

|

|

By: |

|

/s/ John Chisholm |

|

|

Name: |

|

John Chisholm |

|

|

Title: |

|

CEO and President |

|

|

|

|

TELEDRIFT COMPANY, a Delaware corporation |

|

|

|

|

|

By: |

|

/s/ John Chisholm |

|

|

Name: |

|

John Chisholm |

|

|

Title: |

|

CEO and President |

8

|

|

|

| TURBECO, INC., a Texas corporation |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| USA PETROVALVE, INC., a Texas corporation |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FLORIDA CHEMICAL COMPANY, INC., a Delaware corporation |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| SITELARK LLC, a Texas limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO |

|

| FLOTEK ECUADOR MANAGEMENT LLC, a Texas limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FLOTEK ECUADOR INVESTMENTS LLC, a Texas limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

9

|

|

|

| FLOTEK EXPORT, INC., a Texas corporation |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FLOTEK HYDRALIFT, INC., a Texas corporation |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FRACMAX ANALYTICS, LLC, a Texas limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FC PRO, LLC, a Delaware limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO |

|

| ECLIPSE IOR SERVICES, LLC, a Texas limited liability company |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO |

10

|

|

|

| GUARANTORS: |

|

| FLOTEK PAYMASTER, INC. |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| PADKO INTERNATIONAL INCORPORATED |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| PETROVALVE, INC. |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

|

| FLOTEK INTERNATIONAL, INC. |

|

|

| By: |

|

/s/ John Chisholm |

| Name: |

|

John Chisholm |

| Title: |

|

CEO and President |

11

|

|

|

| AGENT: |

|

| PNC BANK, NATIONAL ASSOCIATION, as Agent and Lender |

|

|

| By: |

|

/s/ Anita Inkollu |

| Name: |

|

Anita Inkollu |

| Title: |

|

Vice President |

12

|

|

|

| LENDERS: |

|

| CAPITAL ONE BUSINESS CREDIT CORP., as Lender |

|

|

| By: |

|

/s/ Lawrence J. Cannariato |

| Name: |

|

Lawrence J. Cannariato |

| Title: |

|

Vice President |

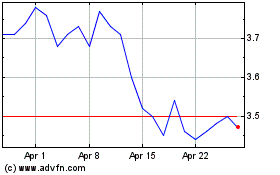

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

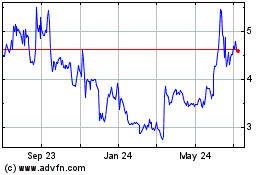

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024