Chesapeake Energy Corporation (NYSE:CHK) today announced an

updated financial strategy. Highlights include:

- Elimination of common stock dividend

effective 2015 third quarter

- Sale of CHK Cleveland Tonkawa,

L.L.C. properties and adjacent assets anticipated to close in 2015

third quarter; redemption of preferred shares in CHK Cleveland

Tonkawa subsidiary

- Declaration of preferred stock

dividends

Due to the current commodity price environment for oil, natural

gas and natural gas liquids, and the resulting reduction in capital

available to invest in its high-quality assets, Chesapeake Energy

will eliminate its common dividend effective 2015 third quarter and

redirect the cash into its 2016 capital program to maximize the

return available to its shareholders.

Doug Lawler, Chesapeake’s Chief Executive Officer, commented,

“We received approval from our Board of Directors to eliminate the

common stock dividend of $0.35 per share annually, which is

applicable to the 2015 third quarter. We believe this decision is

prudent as we continue to invest and redirect as much capital as

possible into our world-class assets. The elimination of the common

stock dividend will save approximately $240 million annually. This,

along with the redemption of the preferred shares in our CHK

Cleveland Tonkawa subsidiary, is part of a broader disciplined

approach that began two years ago to decrease the company’s

financial complexity and increase our liquidity. The company’s

liquidity position remains extremely strong with more than $2

billion of unrestricted cash on our balance sheet and an undrawn $4

billion revolving credit facility as of June 30, 2015. We continue

to move forward with multiple opportunities that will strengthen

our cash flow generation capabilities, and I look forward to future

announcements regarding the ways we are creating additional value

in the months ahead.”

Chesapeake to Eliminate Future Financial and Drilling

Obligations with the Sale of Properties and Redemption of Preferred

Shares in CHK Cleveland-Tonkawa Subsidiary

Chesapeake, through one of its affiliates, has signed a

definitive agreement to sell substantially all of the properties

held by CHK Cleveland Tonkawa, L.L.C. (the “LLC”) to FourPoint

Energy, LLC (“FourPoint”). Chesapeake will use the proceeds from

this sale, plus other cash from the LLC, to redeem its preferred

interest in the LLC. Other than customary adjustments to the

purchase price and certain indemnity obligations in connection with

the sale, Chesapeake will not be required to pay any additional

amounts for the redemption. Upon closing of the transaction,

Chesapeake will eliminate approximately $75 million in annual

preferred dividend payments, the 3.75% overriding royalty interest

payments associated with the properties and all related future

drilling and override conveyance commitments. Additionally,

Chesapeake signed a definitive agreement to sell noncore adjacent

properties centered in Roger Mills and Ellis counties in Oklahoma

to FourPoint for approximately $90 million in cash. Chesapeake’s

net production from the combined assets was approximately 15

thousand barrels of oil equivalent per day in the 2015 second

quarter.

Chesapeake’s Board of Directors Declared Dividends on Its

Outstanding Convertible Preferred Stock

4.50%

5% (2005B) 5.75%

5.75% (Series A) NYSE Symbol CHK Pr D

N/A N/A N/A

Date of

Original Issue September 14, 2005

November 8, 2005 May 17, 2010 May 17,

2010

Registered CUSIP 165167842

165167826 165167768 165167750

144A

CUSIP N/A 165167834

165167776 165167784

RegS CUSIP

N/A N/A U16450204

U16450113

Clean (no legends) CUSIP N/A

N/A 165167768 165167750

Par

Value per Share $0.01 $0.01

$0.01 $0.01

Shares Outstanding

2,558,900 2,095,615 1,497,000

1,100,000

Liquidation Preference per Share

$100 $100 $1,000

$1,000

Record Date September 1, 2015

August 1, 2015 August 1, 2015

August 1, 2015

Payment Date September

15, 2015 August 15, 2015 August 15,

2015 August 15, 2015

Amount per Share

$1.125 $1.25 $14.375

$14.375

2015 Second Quarter Financial and Operational Results

Conference Call Information

The company has scheduled to release its 2015 second quarter

operational update and financial results before market open on

Wednesday, August 5, 2015. A conference call to discuss the results

has been scheduled for the same day at 9:00 am EDT. The telephone

number to access the conference call is 913-312-0648 or

toll-free 800-930-1344. The passcode for the call is

8058511. We encourage those who would like to participate in

the call to place calls between 8:50 and 9:00 am EDT. For those

unable to participate in the live conference call, a replay will be

available for audio playback at 2:00 pm EDT on Wednesday, August 5,

2015, and will run through 2:00 pm EDT on Wednesday, August 19,

2015. The number to access the conference call replay is

719-457-0820 or toll-free 888-203-1112. The passcode

for the replay is 8058511. The conference call will also be

webcast live at www.chk.com in the “Investors” section of the

company’s website. The webcast of the conference will be available

on the website for one year.

Chesapeake Energy Corporation (NYSE:CHK) is the

second-largest producer of natural gas and the 11th largest

producer of oil and natural gas liquids in the U.S.

Headquartered in Oklahoma City, the company's operations are

focused on discovering and developing its large and geographically

diverse resource base of unconventional oil and natural gas assets

onshore in the U.S. The company also owns substantial

marketing and compression businesses. Further information is

available at www.chk.com where Chesapeake routinely

posts announcements, updates, events, investor information,

presentations and news releases.

This news release and the accompanying Outlook include

"forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements are

statements other than statements of historical fact. They include

statements that give our current expectations or forecasts of

future events, production, production growth and well connection

forecasts, estimates of operating costs, planned development

drilling and expected drilling cost reductions, capital

expenditures, expected efficiency gains, anticipated assets sales

and proceeds to be received therefrom, projected cash flow and

liquidity, business strategy and other plans and objectives for

future operations, and the assumptions on which such statements are

based. Although we believe the expectations and forecasts reflected

in the forward-looking statements are reasonable, we can give no

assurance they will prove to have been correct. They can be

affected by inaccurate or changed assumptions or by known or

unknown risks and uncertainties.

Factors that could cause actual results to differ materially

from expected results include those described under "Risk Factors”

in Item 1A of our annual report on Form 10-K and any updates to

those factors set forth in Chesapeake's subsequent quarterly

reports on Form 10-Q or current reports on Form 8-K (available at

http://www.chk.com/investors/sec-filings). These risk factors

include the volatility of oil, natural gas and NGL prices;

write-downs of our oil and natural gas carrying values due to

declines in prices; the availability of operating cash flow and

other funds to finance reserve replacement costs; our ability to

replace reserves and sustain production; uncertainties inherent in

estimating quantities of oil, natural gas and NGL reserves and

projecting future rates of production and the amount and timing of

development expenditures; our ability to generate profits or

achieve targeted results in drilling and well operations; leasehold

terms expiring before production can be established; commodity

derivative activities resulting in lower prices realized on oil,

natural gas and NGL sales; the need to secure derivative

liabilities and the inability of counterparties to satisfy their

obligations; adverse developments or losses from pending or future

litigation and regulatory proceedings, including royalty claims;

the limitations our level of indebtedness may have on our financial

flexibility; charges incurred in response to market conditions and

in connection with actions to reduce financial leverage and

complexity; drilling and operating risks and resulting liabilities;

effects of environmental protection laws and regulation on our

business; legislative and regulatory initiatives further regulating

hydraulic fracturing; our need to secure adequate supplies of water

for our drilling operations and to dispose of or recycle the water

used; federal and state tax proposals affecting our industry;

potential OTC derivatives regulation limiting our ability to hedge

against commodity price fluctuations; impacts of potential

legislative and regulatory actions addressing climate change;

competition in the oil and gas exploration and production industry;

a deterioration in general economic, business or industry

conditions; negative public perceptions of our industry; limited

control over properties we do not operate; pipeline and gathering

system capacity constraints and transportation interruptions; cyber

attacks adversely impacting our operations; and interruption in

operations at our headquarters due to a catastrophic event.

In addition, disclosures concerning the estimated contribution

of derivative contracts to our future results of operations are

based upon market information as of a specific date. These market

prices are subject to significant volatility. Our production

forecasts are also dependent upon many assumptions, including

estimates of production decline rates from existing wells and the

outcome of future drilling activity. Expected asset sales may not

be completed in the time frame anticipated or at all. We caution

you not to place undue reliance on our forward-looking statements,

which speak only as of the date of this news release, and we

undertake no obligation to update any of the information provided

in this release or the accompanying Outlook, except as required by

applicable law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150721005466/en/

Chesapeake Energy CorporationInvestor Contact:Brad

Sylvester, CFA, 405-935-8870ir@chk.comorMedia Contact:Gordon

Pennoyer, 405-935-8878media@chk.com

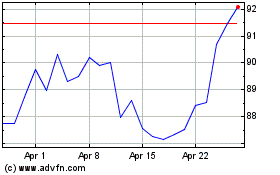

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

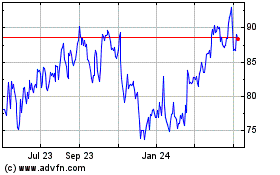

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024