Filed Pursuant to Rule 424(b)(3)

Under the Securities Act of 1933, as amended

Registration No. 333-195952

PROSPECTUS

Up to 520,345 Shares of Common Stock

This prospectus relates to the offer and sale of up to 520,344

shares of common stock, par value $0.001, of Amarantus BioScience Holdings, Inc., a Nevada corporation, by the selling stockholders

identified on page 17 of this prospectus. On June 9, 2015, we effected a 1-for-150 reverse stock split of our issued and outstanding

common stock and our authorized common stock.

We are not selling any securities under this prospectus and

will not receive any of the proceeds from the sale of shares by the selling stockholders.

One of the selling stockholders, Lincoln Park Capital Fund,

LLC, or “Lincoln Park”, is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act

of 1933, as amended. The selling stockholders, including Lincoln Park, may sell the shares of common stock described in this prospectus

in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the

selling stockholders may sell the shares of common stock being registered pursuant to this prospectus.

We will pay the expenses incurred in registering the shares,

including legal and accounting fees. See “Plan of Distribution”.

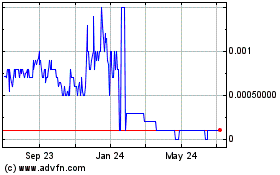

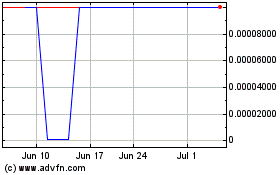

Our common stock is currently quoted on the OTC Markets

under the symbol “AMBS”. On June 22, 2015, the last reported sale price of our common stock on the OTC Markets was

$5.96.

Our business and an investment in our securities involve

a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that

you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is July

10, 2015

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus

or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized

anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may

authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities.

The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this

prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed

since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere

in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before

investing in our securities, you should carefully read this entire prospectus, including our financial statements and the

related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless otherwise stated all references to “us,”

“our,” “Amarantus,” “we,” the “Company” and similar designations refer to, Amarantus

Bioscience Holdings, Inc., a Nevada corporation.

Unless we indicate otherwise, all

information in this prospectus reflects a 1-for 150 reverse stock split of our issued and outstanding and authorized common stock,

options and warrants effected on June 9, 2015 and the corresponding adjustment of all common stock price per share data and stock

option and warrant exercise price per share data.

Overview

We are a California based biopharmaceutical company founded

in January 2008. We own or have exclusive licenses to various product candidates in the biopharmaceutical and diagnostic areas

of the healthcare industry. We are developing our diagnostic product candidates in the field of neurology, and our therapeutic

product candidates in the areas of neurology, psychiatry, ophthalmology and regenerative medicine. Our business model is to develop

our product candidates through various de-risking milestones that we believe will be accretive to shareholder value, and will

position them to be strategically partnered with pharmaceutical companies, diagnostic companies and/or other stakeholders in order

to more efficiently achieve regulatory approval and commercialization.

We have three operating divisions: the diagnostics division;

the therapeutics division; and the other drug discovery division.

Diagnostics Division

Within our diagnostics division, we are

developing the following product candidates:

LymPro Test ®

The Lymphocyte Proliferation Test

(“LymPro Test®”, or “LymPro”) is a diagnostic blood test for Alzheimer’s disease originally

developed by the University of Leipzig in Germany. The test works by evaluating the cell surface marker CD69 on peripheral blood

lymphocytes following a mitogenic stimulation. The underlying scientific basis for LymPro is that Alzheimer’s patients have

a dysfunctional cellular machinery division process that inappropriately allows mature neurons in the brain to enter the mitotic

process (cell division /cell cycle). When this happens the neurons start the cell division process, but cannot complete the process.

As a result, a number of cytokines and other genes are up-regulated, ultimately leading to cell death by apoptosis. This inappropriate

cell division activation process is also present in the lymphocytes of Alzheimer’s patients, as lymphocytes share similar

cellular division machinery with brain neurons. We measure the integrity of this cellular machinery division process by measuring

CD69 up-regulation in response to the mitogenic stimulation. If CD 69 is up-regulated it means that the cellular machinery division

process is correct and Alzheimer’s is not present. If CD69 is not up-regulated, it means there is a dysfunctional cellular

machinery division process, and Alzheimer’s is more likely. Data has been published in peer-reviewed publications on LymPro

with 160 patients, demonstrating 92% co-positivity and 91% co-negativity with an overall 95% accuracy rating for LymPro.

In 2014, we completed a 'Fit-for-Purpose'

assay validation for LymPro at Icon Central Laboratories in Farmingdale, NY, enabling LymPro to be offered to the pharmaceutical

industry for diagnosis of patients entering clinical trials for Alzheimer’s disease, as a means of mitigating the risk of

selecting the wrong patients for inclusion in such clinical studies. Biomarker services using LymPro Test® biomarker data

are now available to the pharmaceutical industry for Investigational Use Only (IUO), in such pharmaceutical therapeutic clinical

development programs.

MSPrecise®

In January 2015, we acquired MSPrecise®,

which is a proprietary next-generation DNA sequencing (NGS) assay for the identification of patients with relapsing-remitting

multiple sclerosis (RRMS) at first clinical presentation. MSPrecise® utilizes next-generation sequencing to measure

DNA mutations found in rearranged immunoglobulin genes in immune cells initially isolated from cerebrospinal fluid. If successful,

MSPrecis® should augment the current standard of care for the diagnosis of MS, by providing a more accurate assessment

of a patient's immune response to a challenge within the central nervous system. MSPrecise® offers a novel method

of measuring changes in adaptive human immunity and may also be able to discern individuals whose disease is more progressive

and requires more aggressive treatment.

Final results from a pivotal clinical validation study demonstrated

that MSPrecise® met the primary study endpoint in patients suspected of having RRMS. MSPrecise®

provided a clear improvement in classifying early-stage RRMS patients when compared with the published performance for the current

diagnostic standard of care by cerebrospinal fluid (CSF) analysis. In this study, MSPrecise® not only performed

well as a standalone test but, when combined with the current standard of diagnosis, oligoclonal banding (OCB), it demonstrated

that it can substantially reduce the number of both false positives and false negatives as compared to use of OCB alone.

Additional Diagnostic Biomarkers

In January 2015, we entered into a one-year, option agreement

with Georgetown University for an exclusive license of patent rights related to certain blood based biomarkers for memory loss

that Georgetown University and University of Rochester jointly developed and own (the “Georgetown Biomarkers”). In

the event that we exercise this option, conditions and milestones will be defined; such as, providing Georgetown with development

and commercialization plans for the biomarkers and recruiting a senior executive to lead our diagnostics division, as well as

other requirements defined in the option agreement. The diagnostic technologies subject to this option agreement are based on

metabolic, genetic and exosomal biomarkers. We believe these may hold additional potential for identifying distinguishing factors

in dementia and Alzheimer's disease that will be complementary to our LymPro Test® diagnostic for Alzheimer’s

disease. With the potential addition of the Georgetown Biomarkers to our Alzheimer's diagnostics portfolio, we

are positioning ourselves to provide all three modalities (cell cycle dysregulation, lipidomics and exosomes) for diagnosis

of Alzheimer’s disease.

In May 2013, we acquired the intellectual

property rights to two diagnostic blood test platforms known as NuroPro and BC-SeraPro from the bankruptcy estate of Power3 Medical

Products. NuroPro is a neurodegenerative disease diagnostic platform with a lead application in Parkinson’s disease. BC-SeraPro

is an oncology diagnostic platform with a lead application in breast cancer. Further development of our NuroPro and BC-SeraPro

diagnostic platforms are on hold, as we apply our resources to the continuing development of our LymPro Test® and

MSPrecise diagnostics, as well as our planned development of the Georgetown Biomarkers.

Therapeutics Division

Within the therapeutics division, we are

developing the following product candidates:

Eltoprazine

Eltoprazine is a small molecule 5HT1a/1b

partial agonist in clinical development for the treatment of Parkinson's disease levodopa-induced dyskinesia (PD LID) and Adult

Attention Deficit Hyperactivity Disorder (“Adult ADHD”). Eltoprazine has been evaluated in over 600 human subjects

to date, with a very strong and well-established safety profile. Eltoprazine was originally developed by Solvay Pharmaceuticals

for the treatment of aggression. Solvay out-licensed the Eltoprazine program to PsychoGenics. PsychoGenics licensed Eltoprazine

to Amarantus following successful Phase 2a studies in both PD-LID and Adult ADHD, in which both primary and secondary endpoints

were met.

In September 2014, we submitted a request to the FDA for a

review and written feedback of our Phase 2b program clinical trial design for Eltoprazine in PD LID. We have received feedback

from the FDA on our trial design, and are in the process of preparing a full IND submission for this important therapeutic indication.

Following initiation of our Phase 2b program clinical study of Eltoprazine in PD LID, we will submit a request to the FDA regarding

further clinical development of Eltoprazine in Adult ADHD. In March 2015, the company received notification of approval from the

FDA that IND 124224 was approved and allows the company to commence this clinical trial.

MANF

MANF (mesencephalic-astrocyte-derived neurotrophic factor)

is believed to have broad potential because it is a naturally-occurring protein produced by the body for the purpose of reducing

and preventing apoptosis (cell death) in response to injury or disease, via the unfolded protein response. MANF was discovered

by the Company’s Chief Scientific Officer, Dr. John Commissiong. By manufacturing MANF and administering it to the body,

Amarantus is seeking to use a regenerative medicine approach to assist the body with higher quantities of MANF when needed. Amarantus

is the front-runner and primary holder of intellectual property around MANF, and is focusing on the development of MANF-based

protein therapeutics. MANF has demonstrated efficacy as a disease-modifying treatment in various animal models, including retinitis

pigmentosa, Parkinson’s disease, cardiac ischemia and stroke.

We made a strategic decision to focus the development of MANF

in orphan indications. The FDA Orphan Drug Designation program provides a special status to drugs and biologics intended to treat,

diagnose or prevent so-called orphan diseases and disorders that affect fewer than 200,000 people in the U.S. This designation

provides for a seven-year marketing exclusivity period against competition, as well as certain incentives, including federal grants,

tax credits and a waiver of PDUFA filing fees.

In December 2014, the FDA granted MANF orphan drug designation

for the treatment of retinitis pigmentosa (RP). RP refers to a group of inherited diseases causing retinal degeneration often

leading to blindness. Pre-clinical data showed that MANF provided protective functional effects in an animal model of RP. Moreover,

toxicology studies have demonstrated that MANF was well tolerated following a single intravitreal administration of a therapeutically

relevant dose. Our goal is to continue to build value in our MANF program by seeking other orphan drug designations for MANF,

and by continuing work to advance this promising product candidate toward clinical testing in multiple therapeutic areas.

Option to Acquire Additional Product

Candidate - Engineered Skin Substitute

In November 2014, we entered into an exclusive option agreement

to acquire Engineered Skin Substitute (ESS), an autologous skin replacement product for the treatment of Stage 3 and Stage 4 intractable

severe burns. As part of the option agreement, we have also agreed to engage Lonza Walkersville, Inc., a subsidiary of Lonza Group

Ltd., to produce ESS for human clinical trials and subsequent commercial distribution.

ESS is a tissue-engineered skin prepared from autologous (patient's

own) skin cells. It is a combination of cultured epithelium with a collagen-fibroblast implant that produces a skin substitute

that contains both epidermal and dermal components. This model has been shown in preclinical studies to generate a functional

skin barrier. Most importantly, the researchers consider self-to-self skin grafts for autologous skin tissue to be ideal because

they are less likely to be rejected by the immune system of the patient, unlike with porcine or cadaver grafts in which immune

system rejection is an important possibility.

ESS has the potential to become a revolutionary new treatment

for severe burns. The product is produced from a small sample of the patient's own healthy skin. The sample is harvested from

a portion of healthy skin remaining on a burn patient's body and is then shipped to Lonza’s central laboratory facility

for expansion. The proprietary ESS technology can then be applied to produce an expanded sample or graft that is sufficiently

large enough to close severe wounds covering the majority of an individual's body, including both the epidermal and dermal layers

of the skin. The expanded skin samples are then shipped back in rectangular shapes, with the dimensions of approximately 10 inches

by 10 inches, to the severe burn center for surgical transplantation onto the original patient to facilitate wound closure. Wound

closure is of critical importance in this setting to promote healing and to reduce the risk of a variety of infections, including

sepsis.

ESS is being developed with support from

a grant from the Armed Forces Institute for Regenerative Medicine (AFIRM). The AFIRM grant was awarded to support the IND

and initial clinical studies. Upon execution of our option to acquire ESS, we anticipate initiating, during the second quarter

of 2015, a 10 patient Phase 2 clinical study to evaluate the efficacy of ESS versus meshed split thickness autograft, the current

standard of care for the treatment of Stage 3 and Stage 4 intractable severe burns.

Drug Discovery Division

MANF was discovered utilizing our proprietary PhenoGuard™

protein discovery technology, and we believe that this drug discovery platform can be used to discover other, similar neurrotrophic

factors. Our PhenoGuard™ technology currently consists of 88 cell lines, and we intend to expand the number of such cell

lines as we conduct research directed towards the discovery of such additional neurotrophic factors.

The Transactions under which the shares included in this

Prospectus may be or were issued

Lincoln Park

On March 7, 2014, we entered into a purchase agreement with

Lincoln Park, which we refer to in this prospectus as the “Purchase Agreement”, pursuant to which Lincoln Park has

agreed to purchase from us up to $20,000,000 of our common stock (subject to certain limitations) from time to time over a 30-month

period. Also on March 7, 2014, we entered into a registration rights agreement, or the “Registration Rights Agreement”,

with Lincoln Park, pursuant to which we filed a registration statement under the Securities Act of 1933, as amended, or the Securities

Act with the SEC to allow for resale of the shares that we may issue and sell under the Purchase Agreement. The registration statement

registered for resale 600,000 shares that have been or may be issued to Lincoln Park under the Purchase Agreement and was declared

effective on June 17, 2014. As of the date of this prospectus, 436,322 shares have been issued and sold to Lincoln Park under

the Purchase Agreement.

This prospectus covers 163,678 shares of our common stock which

represents the remainder of the 600,000 shares we registered on the Registration Statement that may be issued to Lincoln Park

in the future pursuant to the Purchase Agreement and 115 shares of our common stock, which we refer to in this prospectus as the

“Additional Commitment Shares”, that we are required to issue proportionally in the future, as an additional commitment

fee, if and when we sell shares to Lincoln Park pursuant to the Purchase Agreement. The Additional Commitment Shares are issued

pro rata as Lincoln Park purchases = additional shares of our common stock as directed by us. For example, if we elect, at our

sole discretion, to require Lincoln Park to purchase $100,000 of our stock then we would issue 115 Additional Commitment Shares,

which is the product of $100,000 (the amount we have elected to sell) divided by $19,600,000 (the = total amount we can sell Lincoln

Park pursuant to the Purchase Agreement multiplied by 23,333 (the total number of Additional Commitment Shares). The Additional

Commitment Shares will only be issued pursuant to this formula as and when we elect at our discretion to sell stock to Lincoln

Park.

Pursuant to the Purchase Agreement, we may, from time to time

and at our sole discretion, direct Lincoln Park to purchase up to 6,667 shares of our common stock on any business day, which

amount may be increased to up to 16,667 shares, provided the closing price of our common stock exceeds certain thresholds set

forth in the Purchase Agreement, with a maximum limit of up to $500,000 worth of our common stock on any single business day.

Additionally, we may direct Lincoln Park to purchase an additional “accelerated amount” under certain circumstances

set forth in the Purchase Agreement. Except as described in this prospectus, there are no trading volume requirements or restrictions

under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Lincoln Park. The

purchase price of the shares that may be sold to Lincoln Park pursuant to the Purchase Agreement will be based on the market price

of our common stock immediately preceding the time of sale as computed pursuant to the Purchase Agreement without any fixed discount;

provided that in no event will such shares be sold to Lincoln Park when our closing sale price is less than $6.00 per share, subject

to adjustment as provided in the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization,

recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the business days used to compute

such price. We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business

days’ notice. Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

Issuances of our common stock in this offering will not affect

the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders

will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders

own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding

shares after any such issuance to Lincoln Park.

Memory Dx

On April 29, 2014, we entered into an asset purchase agreement

with Memory Dx, LLC, pursuant to which we purchased all of the assets of Memory Dx, including all right, title and interest in certain

cell-based technique for the detection, diagnosis or prognostic testing related to any neurodegenerative disorder, including,

Alzheimer’s disease, which is referred to as the LymPro Technology. The assets acquired include all intellectual property,

goodwill, patents and all copyrights owned by MDx, subject to certain exclusions and further described in the asset purchase agreement.

As consideration for transfer of the assets pursuant to the

asset purchase agreement, we agreed to pay to Memory Dx (i) $50,000 upon execution of the asset purchase agreement, (ii) $50,000

upon the date 60 days after execution of the asset purchase agreement, and (iii) $50,000 on the date 120 days after execution

of the asset purchase agreement. Additionally, we agreed to issue to Memory Dx upon delivery of the assets, 10,000 shares of our

common stock, which stock will have piggy-back registration rights.

Contingent upon (i) the Company entering into a direct licensing

agreement with the University of Leipzig or Leipzig, pursuant to which Leipzig would grant the Company a direct license to certain

assets now licensed to Memory Dx by Leipzig, and (ii) MDx terminating the license agreement it currently holds with Leipzig as

it relates to such licensed assets with the Company’s prior written consent, we shall issue to Memory Dx, upon the date

10 days after the execution of a direct license agreement between the Company and Leipzig, 43,333 shares of the Company’s

common stock and shall provide Memory Dx with piggy-back registration rights as it related to such shares.

PGI Drug Discovery

Effective January 14, 2014, we entered into a License Agreement

with PGI Drug Discovery, LLC or PGI, pursuant to which we were granted an exclusive license (with a right to sublicense) to certain

intellectual property, including clinical and pre-clinical data concerning licensed compounds for CNS related therapeutic applications,

referred to as the Eltoprozine Program covering the use of Eltoprazine and certain of its related compounds in all therapeutic

indications.

Pursuant to the terms of the License Agreement, we agreed to:

(i) pay PGI $100,000 in cash for the license within 20 days of the execution of the License Agreement, (ii) pay PGI up to an aggregate

of $4 million in development milestones through NDA submission, (iii) pay a research support payment to PGI as partial reimbursement

for costs incurred for earlier research and management of CIAS, ADHD and levodopa induced dyskinesia (LID) clinical trials totaling

up to $650,000 to be paid in a mixture of cash and shares of our common stock, and (iv) reimburse PGI for the Eltoprazine clinical

supply inventory up to $500,000 payable upon the earlier of the initiation of a Phase IIb clinical study or 6 months after the

date of the License Agreement. As further consideration for the license, we will pay a single digit royalty to PGI of the annual

worldwide aggregate net sales by the Company.

Simultaneous with the execution of the License Agreement, the

Company and PGI entered into a Services Agreement pursuant to which PGI will provide certain services to us related to PGI’s

proprietary analytical systems as will be set forth in certain study plans. We agreed to a payment commitment of $450,000 at a

minimum annual rate of $150,000 for each of three years. The Services Agreement is for a term of the later of 3 years or the completion

of any study plan accepted by the parties under the Services Agreement.

As partial consideration of the research support payment by

the Company to PGI, the Company entered into a Securities Purchase Agreement with PGI, pursuant to which PGI subscribed for 26,667

shares of our common stock. Pursuant to the SPA, the Company granted PGI certain piggy-back registration rights.

Warrants

On March 7, 2014, we accepted elections to exercise certain

warrants in the aggregate amount of 400,000 shares of common stock for gross proceeds of $3,600,000. Pursuant to the offer to

exercise dated February 13, 2014 as supplemented on March 6, 2014, the holders of outstanding warrants to purchase shares of our

common stock at a price of $9.00, the “Original Warrants,” were offered the opportunity to exercise their Original

Warrants and receive warrants (the “New Warrants”) to purchase three (3) shares of our common stock for every four

(4) Original Warrants exercised. The New Warrants are exercisable at a price of $18.00 for a term of five (5) years. The New Warrants

are callable by the Company if the volume weighted average price of our common stock for each of 20 consecutive trading days exceeds

$27.00 and certain equity conditions are met. We may also call the New Warrants if the closing price of the Company’s common

stock exceeds $27.00 on the date that is the earlier of the receipt by the Company of an approval letter for listing of our common

stock on an exchange or listing of our common stock on an exchange. The holders of the New Warrants were also granted piggyback

registration rights.

Risks Associated With Our Business

Our business is subject to numerous risks described in the

section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before

making an investment. Some of these risks include:

| |

· |

We are largely dependent

on the success of our lead product candidates, LymPro Eltoprazine, and MANF, and we may not be able to successfully commercialize

these products; |

| |

· |

If we fail to obtain U.S. regulatory

approval of LymPro, Eltoprazine, MANF or any of our other current or future product candidates, we will be unable to commercialize

these potential products in the United States; |

| |

· |

Our proprietary rights

may not adequately protect our intellectual property and product candidates and if we cannot obtain adequate protection of

our intellectual property and product candidates, we may not be able to successfully market our product candidates; |

| |

· |

If our product candidates,

including LymPro, Eltoprazine, MANF, do not gain market acceptance among physicians, patients and the medical community, we

will be unable to generate significant revenue, if any.; |

| |

· |

Our independent registered

public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder

our ability to obtain future financing; |

| |

· |

We are at an early stage of development

as a company and currently have no source of revenue and may never become profitable.

|

| |

|

|

| |

|

We do not have any products that

are approved for commercial sale and therefore do not expect to generate any revenues from product sales in the foreseeable

future, if ever; |

| |

· |

We have incurred significant losses

since inception and anticipate that we will incur continued losses for the foreseeable future; |

| |

· |

We will need to raise substantial

additional capital to fund our operations, and our failure to obtain funding when needed may force us to delay, reduce

or eliminate certain product development programs;

We may require additional financing

to sustain our operations and without it we may not be able to continue operations. |

| |

· |

If we are unable to hire and retain

key personnel, we may not be able to implement our business plan; |

| |

· |

Our stock price may be volatile; |

| |

· |

We have not and do not anticipate paying

any dividends on our common stock; |

| |

· |

If we fail to establish and maintain

an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any

inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading

price of our common stock;

|

| |

|

|

| |

|

Our common stock is currently

deemed a “penny stock,” which makes it more difficult for our investors to sell their shares; |

| |

· |

Offers or availability for sale of

a substantial number of shares of our common stock may cause the price of our common stock to decline; |

| |

· |

Our certificate of incorporation allows for our board to create

new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the

holders of our common stock; |

| |

· |

The sale or issuance of our common

stock to Lincoln Park may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception

that such sales may occur, could cause the price of our common stock to fall.; |

Corporate Information

We were incorporated on January 14, 2008 in the state

of Delaware and were reincorporated in Nevada on March 22, 2013. The Company is a development stage biopharmaceutical drug development

holding company dedicated to sourcing high-potential therapeutic and diagnostic platform technologies and aligning their development

with complementary biopharmaceutical assets to reduce overall enterprise risk. Our principal executive offices are located at 655

Montgomery Street, Suite 900, San Francisco, CA 94111 and our telephone number is (415) 688-4484. Our website address

is http:// http://www.amarantus.com/. The information on, or that can be accessed through, our website is not part of this prospectus.

Summary of the Offering

| Common stock to be offered by the selling stockholders

|

|

520,345 shares including (i) 163,678 shares,

which we may issue under the Purchase Agreement with Lincoln Park; (ii) 56,667 shares of common stock which have been issued

or maybe issued to PGI Drug Discovery or Memory Dx, and (iii) 300,000 shares issuable upon exercise of warrants. |

| |

|

|

| Common stock outstanding prior to this offering |

|

7,067,610 shares |

| |

|

|

| Common stock to be outstanding after this offering (1) |

|

7,531,288 shares |

| |

|

|

| Use of Proceeds |

|

We will receive no proceeds from the sale of shares of common stock

by the selling stockholders in this offering. However, we may receive up to $20,000,000 under the Purchase Agreement

with Lincoln Park, of which we have already received $5,493,881. Also, we may receive the exercise price of any common stock

we issue to the selling stockholders who hold the warrants included in this prospectus, upon exercise of their outstanding

warrants. However, the holders may exercise their warrants on a cashless basis if at any time after the six months anniversary

there is no effective registration statement or current prospectus available for the resale of the shares underlying the Warrants,

in which case we will not receive any proceeds from such exercise. |

| |

|

|

| |

|

Any proceeds that we receive from sales to Lincoln Park under the

Purchase Agreement and exercise of the warrants will be used for research and development, product acquisition and general

corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Risk factors |

|

This investment involves a high degree of risk. See “Risk

Factors” for a discussion of factors you should consider carefully before making an investment decision. |

| |

|

|

| Symbol on OTC Markets |

|

AMBS |

| |

(1) |

Assumes the issuance and sale of the 163,678 shares that may be

issued and sold to Lincoln Park pursuant to the Purchase Agreement and the exercise of the warrants by the holders of the

warrants that are offered in this prospectus. |

RISK FACTORS

Any investment in our securities involves

a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this

prospectus before deciding whether to purchase our securities. Our business, financial condition and results of operations could

be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

We are largely dependent on the

success of our lead product candidates, LymPro, Eltoprazine and MANF, and we may not be able to successfully commercialize these

products.

We have incurred and

will continue to incur significant costs relating to the development of our lead product candidates, LymPro, Eltoprazine and MANF.

We have not obtained approval to commercialize LymPro, Eltoprazine and MANF in any jurisdiction and we may never be able to obtain

approval or, if approvals are obtained, to commercialize LymPro, Eltoprazine and MANF successfully.

If we fail to successfully

commercialize our products, we may be unable to generate sufficient revenue to sustain and grow our business, and our business,

financial condition and results of operations will be adversely affected.

If we fail to obtain U.S. regulatory

approval of LymPro, Eltoprazine, MANF or any of our other current or future product candidates, we will be unable to commercialize

these potential products in the United States.

The development, testing,

manufacturing and marketing of our product candidates are subject to extensive regulation by governmental authorities in the United

States. In particular, the process of obtaining FDA approval is costly and time consuming, and the time required for such approval

is uncertain. Our product candidates must undergo rigorous preclinical and clinical testing and an extensive regulatory approval

process mandated by the FDA. Such regulatory review includes the determination of manufacturing capability and product performance.

Generally, only a small percentage of pharmaceutical products are ultimately approved for commercial sale.

We can give no assurance

that our current or future product candidates will be approved by the FDA or any other governmental body. In addition, there can

be no assurance that all necessary approvals will be granted for future product candidates or that FDA review or actions will

not involve delays caused by requests for additional information or testing that could adversely affect the time to market for

and sale of our product candidates. Further failure to comply with applicable regulatory requirements can, among other things,

result in the suspension of regulatory approval as well as possible civil and criminal sanctions.

Our proprietary rights may not adequately

protect our intellectual property and product candidates and if we cannot obtain adequate protection of our intellectual property

and product candidates, we may not be able to successfully market our product candidates.

Our commercial success

will depend in part on obtaining and maintaining intellectual property protection for our technologies and product candidates.

We will only be able to protect our technologies and product candidates from unauthorized use by third parties to the extent that

valid and enforceable patents cover them, or those other market exclusionary rights apply.

While we have issued

enforceable patents covering our product candidates, the patent positions of life sciences companies, like ours, can be highly

uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. No consistent

policy regarding the breadth of claims allowed in such companies' patents has emerged to date in the United States. The general

patent environment outside the United States also involves significant uncertainty. Accordingly, we cannot predict the breadth

of claims that may be allowed or that the scope of these patent rights would provide a sufficient degree of future protection

that would permit us to gain or keep our competitive advantage with respect to these products and technology.

Our issued patents

may be subject to challenge and possibly invalidated by third parties. Changes in either the patent laws or in the interpretations

of patent laws in the United States or other countries may diminish the market exclusionary ability of our intellectual property.

In addition, others

may independently develop similar or alternative compounds and technologies that may be outside the scope of our intellectual

property. Should third parties obtain patent rights to similar compounds or radiolabeling technology, this may have an adverse

effect on our business.

To the extent that

consultants or key employees apply technological information independently developed by them or by others to our product candidates,

disputes may arise as to the proprietary rights of the information, which may not be resolved in our favor. Consultants and key

employees that work with our confidential and proprietary technologies are required to assign all intellectual property rights

in their discoveries to us. However, these consultants or key employees may terminate their relationship with us, and we cannot

preclude them indefinitely from dealing with our competitors. If our trade secrets become known to competitors with greater experience

and financial resources, the competitors may copy or use our trade secrets and other proprietary information in the advancement

of their products, methods or technologies. If we were to prosecute a claim that a third party had illegally obtained and was

using our trade secrets, it would be expensive and time consuming and the outcome would be unpredictable. In addition, courts

outside the United States are sometimes less willing to protect trade secrets than courts in the United States. Moreover, if our

competitors independently develop equivalent knowledge, we would lack any contractual claim to this information, and our business

could be harmed.

If our product candidates, including

LymPro, Eltoprazine, MANF, do not gain market acceptance among physicians, patients and the medical community, we will be unable

to generate significant revenue, if any.

The products that

we develop may not achieve market acceptance among physicians, patients, third-party payers and others in the medical community.

If we, or any of our partners, receive the regulatory approvals necessary for commercialization, the degree of market acceptance

will depend upon a number of factors, including:

| |

- |

limited indications of regulatory approvals; |

| |

- |

the establishment and demonstration

in the medical community of the clinical efficacy and safety of our product candidates and their potential advantages over

existing diagnostic compounds; |

| |

- |

the prevalence and severity of any

side effects; |

| |

- |

our ability to offer our product candidates

at an acceptable price; |

| |

- |

the relative convenience and ease of

administration of our products; |

| |

- |

the strength of marketing and distribution

support; and |

| |

- |

sufficient third-party coverage or

reimbursement. |

The market may not accept LymPro, Eltoprazine

or MANF based products based on any number of the above factors. The market may choose to continue utilizing the existing products

for any number of reasons, including familiarity with or pricing of these existing products. The failure of any of our product

candidates to gain market acceptance could impair our ability to generate revenue, which could have a material adverse effect

on our future business and prevent us from obtaining the necessary partnerships to further our business strategy.

Risks Associated with Our Financial Condition

Our independent registered public accounting firm has

expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our consolidated financial statements as

of December 31, 2014 were prepared under the assumption that we will continue as a going concern for the next twelve months.

Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our

projected future losses along with recurring losses from operations and expressing substantial doubt in our ability to continue

as a going concern without additional capital becoming available. Our ability to continue as a going concern is dependent upon

our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately,

to generate revenue. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are at an early stage of development as a company

and currently have no source of revenue and may never become profitable.

We are a development stage biopharmaceutical

company. Currently, we have no products approved for commercial sale and, to date, we have not generated any revenue. Our ability

to generate revenue depends heavily on:

| |

- |

demonstration in future clinical trials

that our product candidate, MANF for the treatment of PD is safe and effective; |

| |

- |

our ability to seek and obtain regulatory

approvals, including with respect to the indications we are seeking; |

| |

- |

successful manufacture and commercialization

of our product candidates; and |

| |

- |

market acceptance of our products. |

All of our existing product candidates

are in various stages of development and will require extensive additional preclinical and clinical evaluation, regulatory review

and approval, significant marketing efforts and substantial investment before they could provide us with any revenue. As a result,

if we do not successfully develop, achieve regulatory approval and commercialize LymPro, Eltoprazine and/or MANF, we will be unable

to generate any revenue for many years, if at all. We do not anticipate that we will generate revenue for several years, at the

earliest, or that we will achieve profitability for at least several years after generating material revenue, if at all. If we

are unable to generate revenue, we will not become profitable, and we may be unable to continue our operations.

We do not have any products that are approved for commercial

sale and therefore do not expect to generate any revenues from product sales in the foreseeable future, if ever.

We currently do not have any products that

are approved for commercial sale. To date, we have funded our operations primarily from grants and sales of our securities. We

have not received, and do not expect to receive for at least the next several years in the case of Eltoprazine and MANF and

until the first half of 2015 in the case of LymPro, if at all, any revenues from the commercialization of our product candidates.

To obtain revenues from sales of our product candidates, we must succeed, either alone or with third parties, in developing, obtaining

regulatory approval for, manufacturing and marketing drugs with commercial potential. We may never succeed in these activities,

and may not generate sufficient revenues to continue our business operations or achieve profitability.

We have incurred significant losses since inception and

anticipate that we will incur continued losses for the foreseeable future.

As of December 31, 2014 we had an accumulated

deficit of approximately $55 million. We have incurred significant losses since inception. We expect to incur significant and

increasing operating losses for the next several years as we expand our research and development, advance product candidates into

clinical development, complete clinical trials, seek regulatory approval and, if we receive FDA approval, commercialize our products.

Because of the numerous risks and uncertainties associated with product development efforts, we are unable to predict the extent

of any future losses or when we will become profitable, if at all. If we are unable to achieve and then maintain profitability,

the market value of our common stock will likely decline.

We will need to raise substantial additional capital

to fund our operations, and our failure to obtain funding when needed, may force us to delay, reduce or eliminate certain product

development programs.

We expect to continue to spend substantial

amounts to:

| |

- |

continue development of our product

candidates; |

| |

- |

finance our general and administrative

expenses; |

| |

- |

license or acquire additional technologies; |

| |

- |

manufacture product for clinical trials; |

| |

- |

launch and commercialize our product

candidates, if any such product candidates receive regulatory approval; and |

| |

- |

develop and implement commercial manufacturing,

sales, marketing and distribution capabilities. |

We will be required to raise additional

capital to complete the development and commercialization of our product candidates and to continue to fund operations at the

current cash expenditure levels. Our future funding requirements will depend on many factors, including, but not limited to:

| |

- |

the rate of progress and cost of our

clinical trials and other development activities; |

| |

- |

any future decisions we may make about

the scope and prioritization of the programs we pursue; |

| |

- |

the costs of filing, prosecuting, defending

and enforcing any patent claims and other intellectual property rights; |

| |

- |

the costs of manufacturing product; |

| |

- |

the costs and timing of regulatory

approval; |

| |

- |

the costs of establishing sales, marketing

and distribution capabilities; |

| |

- |

the effect of competing technological

and market developments; |

| |

- |

the terms and timing of any collaborative,

licensing and other arrangements that we may establish; and |

| |

- |

general market conditions for offerings

from biopharmaceutical companies. |

Worldwide economic conditions and the international

equity and credit markets have recently significantly deteriorated and may remain depressed for the foreseeable future. These

developments could make it more difficult for us to obtain additional equity or credit financing, when needed.

We cannot be certain that funding will

be available on acceptable terms, or at all. To the extent that we raise additional funds by issuing equity securities, our stockholders

may experience significant dilution. Any debt financing, if available, may involve restrictive covenants that impact our ability

to conduct our business. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly

delay, scale back or discontinue the development and/or commercialization of one or more of our product candidates. We also may

be required to:

| |

- |

seek collaborators for our product

candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise

be available; and/or |

| |

- |

relinquish license or otherwise dispose

of rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves

on unfavorable terms. if we are unable to fund our operations, we may be forced to discontinue and wind down our business. |

We may require additional financing to sustain our operations

and without it we may not be able to continue operations.

At December 31, 2014, we had a working

capital deficit of $5,900,000. We have never had positive operating cash flow. For the year ended December 31, 2014, we incurred

an operating cash flow deficit of $11,331,000. We do not currently have sufficient financial resources to fund our operations

or those of our subsidiaries. Therefore, we need additional funds to continue these operations.

We may direct Lincoln Park to purchase

up to an additional $14,506,119 worth of shares of our common stock under our agreement generally in amounts up to 6,667 shares

of our common stock on any such business day, which amounts may be increased to up to 16,667, provided the closing price of our

common stock exceeds a certain threshold with a maximum limit of up to $500,000 worth of our common stock on any single business

day, plus an additional “accelerated amount” under certain circumstances. However, Lincoln Park shall not purchase

any shares of our common stock on any business day that the closing sale price of our common stock is less than $6.00 per share,

subject to adjustment as set forth in the Purchase Agreement. Assuming a purchase price of $12.33 per share (the closing sale

price of the common stock on December 31, 2014) and the purchase by Lincoln Park of the full 510,000 purchase shares under the

purchase agreement, proceeds to us would only be $6,288,300. As of June 111, 2015, the Company had received $5,493,881 from Lincoln

Park in consideration for the issuance of an aggregate of 436,322 Company common shares, of which 6,410 shares were for commitment

fees.

The extent we rely on Lincoln Park as a

source of funding will depend on a number of factors including, the prevailing market price of our common stock and the extent

to which we are able to secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove

unavailable or prohibitively dilutive, we will need to secure another source of funding in order to satisfy our working capital

needs. Even if we sell all $20,000,000 under the Purchase Agreement to Lincoln Park, we will need additional capital to fully

implement our business, operating and development plans. Should the financing we require to sustain our working capital needs

be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business,

operating results, financial condition and prospects.

Risks Associated with Management

If we are unable to hire and retain key personnel,

we may not be able to implement our business plan.

Due to the specified nature of our business,

having certain key personnel is essential to the development and marketing of the products we plan to sell and thus to the entire

business itself. Consequently, the loss of any of those individuals may have a substantial effect on our future success or failure.

We may have to recruit qualified personnel with competitive compensation packages, equity participation, and other benefits that

may affect the working capital available for our operations. Management may have to seek to obtain outside independent professionals

to assist them in assessing the merits and risks of any business proposals as well as assisting in the development and operation

of many company projects. No assurance can be given that we will be able to obtain such needed assistance on terms acceptable

to us. Our failure to attract additional qualified employees or to retain the services of key personnel could have a material

adverse effect on our operating results and financial condition.

Risks Related to Our Common Stock

Our stock price may be volatile.

The stock market,

particularly in recent years, has experienced significant volatility particularly with respect to pharmaceutical, biotechnology

and other life sciences company stocks. The volatility of pharmaceutical, biotechnology and other life sciences company stocks

often does not relate to the operating performance of the companies represented by the stock. Factors that could cause this volatility

in the market price of our common stock include:

| |

- |

results from and any delays in our

clinical trials; |

| |

- |

failure or delays in entering additional

product candidates into clinical trials; |

| |

- |

failure or discontinuation of any of

our research programs; |

| |

- |

research publications that are unfavorable; |

| |

- |

delays in establishing new strategic

relationships; |

| |

- |

delays in the development or commercialization

of our potential products; |

| |

- |

market conditions in the pharmaceutical

and biotechnology sectors and issuance of new or changed securities analysts' reports or recommendations; |

| |

- |

actual and anticipated fluctuations

in our financial and operating results; |

| |

- |

developments or disputes concerning

our intellectual property or other proprietary rights; |

| |

- |

introduction of technological innovations

or new commercial products by us or our competitors; |

| |

- |

issues in manufacturing our potential

products; |

| |

- |

market acceptance of our potential

products; |

| |

- |

third-party healthcare reimbursement

policies; |

| |

- |

FDA or other domestic or foreign regulatory

actions affecting us or our industry; |

| |

- |

litigation or public concern about

the safety of our product candidates; and |

| |

- |

additions or departures of key personnel. |

These and other external

factors may cause the market price and demand for our common stock to fluctuate substantially, which may limit or prevent investors

from readily selling their shares of common stock and may otherwise negatively affect the liquidity of our common stock. In the

past, when the market price of a stock has been volatile, holders of that stock have instituted securities class action litigation

against the company that issued the stock. If any of our stockholders brought a lawsuit against us, we could incur substantial

costs defending the lawsuit. Such a lawsuit could also divert the time and attention of our management.

We have not and do not anticipate

paying any dividends on our common stock.

We have paid no dividends

on our common stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable

future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently

anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan.

As an investor, you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and

could significantly affect the value of any investment in our Company.

If we fail to establish and maintain

an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any

inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading

price of our common stock.

Effective internal

control is necessary for us to provide reliable financial reports and prevent fraud. We have not performed an in-depth

analysis to determine if historical un-discovered failures of internal controls exist, and may in the future discover areas of

our internal control that need improvement. If we cannot provide reliable financial reports or prevent fraud, we may not be able

to manage our business as effectively as we would if an effective control environment existed, and our business and reputation

with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely

affect our financial condition, results of operation and access to capital.

Our common stock is currently deemed

a “penny stock,” which makes it more difficult for our investors to sell their shares.

Our common stock is subject to the “penny

stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies

whose common stock is not listed on The Nasdaq Stock Market or other national securities exchange and trades at less than $5.00

per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible

net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules

require, among other things, that brokers who trade penny stock to persons other than “established customers” complete

certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading

in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers

have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers

willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any

significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are

subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number

of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts

of our common stock in the public market upon the expiration of any statutory holding period, under Rule 144, or issued upon the

exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang”

and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether

or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through

the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our certificate of incorporation allows for our board

to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights

of the holders of our common stock.

Our board of directors has the authority

to fix and determine the relative rights and preferences of preferred stock and has designated 250,000 preferred shares as Series

A Convertible Preferred Stock, 3,000,000 as Series B Convertible Preferred Stock, 750,000 as Series C Convertible Preferred Stock,

1,300 as Series D 8% Convertible Preferred Stock, 13,335 as Series E 12% Convertible Preferred Stock, and 10,000 as Series G Preferred

Stock. Our board of directors also has the authority to issue additional shares of our preferred stock without further stockholder

approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to

holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed

to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption

of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has

greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting

power of our common stock or result in dilution to our existing stockholders.

The sale or issuance of our common stock to Lincoln Park

may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may

occur, could cause the price of our common stock to fall

On March 7, 2014, we entered into the Purchase

Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $20,000,000 of our common stock. Concurrently

with the execution of the Purchase Agreement on March 7, 2014, we issued 26,667 shares of our common stock to Lincoln Park for

a total purchase price of $400,000 in the Initial Purchase under the Purchase Agreement and 40,000 Initial Commitment Shares to

Lincoln Park as a fee for its commitment to purchase additional shares of our common stock under the Purchase Agreement. The additional

shares that may be sold pursuant to the Purchase Agreement may be sold by us to Lincoln Park at our discretion from time to time

over a 30-month period commencing June 17, 2014. As of June 11, 2015 we have issued an aggregate of 436,322 shares of common stock,

of which 6,410 shares were for commitment fees.

Other than with respect to the Initial

Purchase by Lincoln Park under the Purchase Agreement, the purchase price for the shares that we may sell to Lincoln Park under

the Purchase Agreement will fluctuate based on the market price of our common stock. Depending on market liquidity at the time,

sales of such shares may cause the market price of our common stock to fall.

We generally have the right to control

the timing and amount of any sales of our shares to Lincoln Park, except that, pursuant to the terms of our agreements with Lincoln

Park, we would be unable to sell shares to Lincoln Park if and when the closing sale price of our common stock is below $6.00

per share, subject to adjustment as set forth in the Purchase Agreement. Additional sales of our common stock, if any, to Lincoln

Park will depend upon market conditions and other factors to be determined by us. As such, other than the Initial Purchase, Lincoln

Park may ultimately purchase all, some or none of the shares of our common stock that may be sold pursuant to the Purchase Agreement

and, after it has acquired shares, Lincoln Park may sell all, some or none of those shares. Therefore, sales to Lincoln Park by

us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial

number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to

sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS AND INDUSTRY DATA

This prospectus contains forward-looking statements. Such forward-looking

statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise

are not statements of historical fact. These forward-looking statements are based on our current expectations and projections

about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments

to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements

by terminology, such as “expects”, “anticipates”, “intends”, “estimates”, “plans”,

“potential”, “possible”, “probable”, “believes”, “seeks”, “may”,

“will”, “should”, “could” or the negative of such terms or other similar expressions. Accordingly,

these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those

expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout

this prospectus.

You should read this prospectus and the documents that we reference

herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and

with the understanding that our actual future results may be materially different from what we expect. You should assume

that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because

the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking

statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. These risks

and uncertainties, along with others, are described above under the heading “Risk Factors” beginning on page 8 of

this prospectus. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict

which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We qualify all of the information presented in this prospectus, and particularly our forward-looking statements, by these cautionary

statements.

This prospectus also includes estimates of market size and

industry data that we obtained from industry publications and surveys and internal company sources. The industry publications

and surveys used by management to determine market size and industry data contained in this prospectus have been obtained from

sources believed to be reliable.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that

may be offered and sold from time to time by the selling stockholders. We will receive no proceeds from the sale of shares of

common stock by the selling stockholders in this offering. The proceeds from the sales will belong to the selling stockholders.

However, we may receive up to $20,000,000 under the Purchase Agreement with Lincoln Park, of which we have already received $5,493,881

from the sale of 429,913 shares. Also, we may receive the exercise price of any common stock we issue to the selling stockholders

who hold the warrants included in this prospectus, upon exercise of their outstanding warrants. However, the holders may exercise

the warrants on a cashless basis if at any time after the six months anniversary, there is no effective registration statement

or current prospectus available for the resale of the shares underlying the warrants, in which case we will not receive any proceeds

from such exercise.

We estimate that the net proceeds to us from the sale of

our common stock to Lincoln Park pursuant to the Purchase Agreement will be up to $19,600,000 over an approximately 30-month period,

assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Lincoln Park

under that agreement and other estimated fees and expenses. However, we are registering for resale under this prospectus, only

a portion of the shares we may sell to Lincoln Park under the Purchase Agreement and anticipate that based upon the closing price

of the Company’s common stock on June 22, 2015, that we will receive up to a maximum of $975,520 from the sale of those

shares. Since proceeds from the sale of the shares to Lincoln Park are based on the trading price of our common stock on the date

the sales are made under the Purchase Agreement, we may receive less than the $900,229 from the sale of the shares included in

this prospectus. Factors which might negatively impact the price we receive also include the possibility of: general negative

market reaction to the presence of a large selling shareholder; and many other tangible and intangible factors regarding acceptance

of our products by consumers and our ability to execute our business plan. We may also receive proceeds of $5,400,000 upon the

exercise of the warrants included in this prospectus, assuming the warrants are not exercised on cash-less basis. See “Plan

of Distribution” elsewhere in this prospectus for more information.

We expect to use any proceeds that we receive under the Purchase

Agreement and the exercise of the Warrants for research and development, product acquisition and for general corporate purposes.

The amounts and timing of our actual expenditures will depend on numerous factors, including the status of our product sales and

marketing efforts, the amount of proceeds actually raised from sales under the Purchase Agreement, upon exercise of the Warrants

and the amount of cash generated through our existing strategic collaborations and any additional strategic collaborations into

which we may enter. Accordingly, our management will have significant flexibility in applying any net proceeds that we receive

pursuant to the Purchase Agreement.

SELLING STOCKHOLDERS

This prospectus relates to the possible

resale by the selling stockholders. We are filing the registration statement of which this prospectus forms a part pursuant to

(i) the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park on March 7, 2014 concurrently

with our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales

by Lincoln Park of the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement;

and (ii) piggy-back registration rights granted to the other selling stockholders. The selling stockholders, may, from time to

time, offer and sell pursuant to this prospectus any or all of the shares that they holder or that may be acquired by them from

the Company. The selling stockholders may sell some, all or none of their shares. We do not know how long the selling stockholders

will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling

stockholders regarding the sale of any of the shares.

The following table presents information regarding the selling

stockholders and the shares that they may offer and sell from time to time under this prospectus. The table is prepared based

on information supplied to us by the selling stockholders, and reflects their holdings as of June 5, 2015. None of the selling

stockholders nor any of their affiliates has held a position or office, or had any other material relationship, with us or any

of our predecessors or affiliates. As used in this prospectus, the term “selling stockholders” includes each of the

selling stockholder s and any donees, pledgees, transferees or other successors in interest selling shares received after the

date of this prospectus from the selling stockholders as a gift, pledge or other non-sale related transfer. Beneficial ownership

is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially

owned prior to the offering is based on 7,067,610 shares of our common stock actually outstanding as of June 5, 2015.

| Selling Stockholder

| |

Shares

Beneficially

Owned

Before this

Offering

| | |

Percentage of

Outstanding

Shares

Beneficially

Owned Before

this

Offering(1)

| | |

Shares to be

Sold in this

Offering

| | |

Percentage of

Outstanding

Shares

Beneficially

Owned After

this Offering

(2)

| |

| Lincoln Park Capital Fund, LLC (3) | |

| 136,140 | | |

| 1.90 | % | |

| 163,678 | | |

| 0 | |

| Memory Dx, LLC (4) | |

| 0 | | |

| *

| | |

| 30,000 | | |

| 0 | |

| PGI Drug Discovery, LLC (5) | |

| 26,667 | | |

| 0.38 | % | |

| 26,667 | | |

| 0 | |

| Dominion Capital, LLC (6) | |

| 393,425 | | |

| 4.99 | % | |

| 138,889 | | |

| * | |

| Dustin Ray Johns (7) | |

| 20,486 | | |

| 0.29 | % | |

| 20,486 | | |

| * | |

| International Infusion, Inc. (8) | |

| 374,569 | | |

| 5.07 | % | |

| 54,514 | | |

| * | |

| Joseph Rubinfeld (9) | |

| 31,182 | | |

| 0.44 | % | |

| 1,389 | | |

| * | |

| Nicholas Nurse (10) | |

| 8,333 | | |

| 0.12 | % | |

| 8,333 | | |

| * | |

| Robert F. Johnston Living Trust (11) | |

| 20,833 | | |

| 0.29 | % | |

| 20,833 | | |

| * | |

| Gemini Master Fund, Ltd. (12) | |

| 55,556 | | |

| 0.78 | % | |

| 55,556 | | |

| * | |

| TOTAL | |

| | | |

| | | |

| 520,345 | | |

| | |

* Less than 1%

| (1) | Based

on 7,067,610 outstanding shares of our common stock as of June 16, 2015. |

| (2) | Assumes

the sale of all the shares offered by the selling stockholders. |

| (3) | The

selling stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

Josh Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are deemed to be beneficial owners of all

of the shares of common stock owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment

power over the shares being offered under the prospectus filed with the SEC in connection with the transactions contemplated under

the Purchase Agreement. Lincoln Park Capital, LLC is not a licensed broker dealer or an affiliate of a licensed broker dealer. |

| (4) | William