UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

CYTODYN INC.

(Name of

Issuer)

Common Shares, no par value

(Title of Class of Securities)

23283M101

(CUSIP Number)

Carl Dockery

Alpha

Advisors, LLC

2026 Crystal Wood Drive

Lakeland, FL 33806-2477

(863) 665-8888

Name,

Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

September 26, 2014

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. x

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule,

including all exhibits. See Rule.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. Alpha Venture Capital Partners, L.P.

(“AVCP”) |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (a) ¨ (b) x |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With: |

|

7. |

|

Sole Voting Power

As of September 26, 2014, none. As of the date of filing of this Schedule 13D,

none. |

|

8. |

|

Shared Voting Power

As of September 26, 2014, 5,047,396.

As of the date of filing of this Schedule 13D, 9,501,205. |

|

9. |

|

Sole Dispositive Power

As of September 26, 2014, none. As of the date of filing of this Schedule 13D,

none. |

|

10. |

|

Shared Dispositive Power

As of September 26, 2014, 5,047,396.

As of the date of filing of this Schedule 13D, 9,501,205. |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

As of September 26, 2014, 5,047,396. As of the date of filing of this Schedule 13D, 9,501,205. |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares

¨ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) As of September 26, 2014, 8.3%. As of the date of filing of this Schedule

13D, 12.7%. |

| 14. |

|

Type of Reporting Person

PN |

2

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. Alpha Advisors, LLC (“Alpha Advisors”) |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (a) ¨ (b) x |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

|

Citizenship or Place of

Organization Florida |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With: |

|

7. |

|

Sole Voting Power

As of September 26, 2014, 5,393,550, of which 5,047,396 are directly beneficially owned

by AVCP and 346,154 are directly beneficially owned by Alpha Venture Capital Fund, L.P. (“AV Fund”).

As of the date of filing of this Schedule 13D, 9,847,359, of which 9,501,205 are directly beneficially owned by AVCP and 346,154 are directly beneficially

owned by AV Fund. |

|

8. |

|

Shared Voting Power

As of September 26, 2014, none. As of the date of filing of this Schedule 13D,

none. |

|

9. |

|

Sole Dispositive Power

As of September 26, 2014, 5,393,550, of which 5,047,396 are directly beneficially owned

by AVCP and 346,154 are directly beneficially owned by AV Fund. As of the date of

filing of this Schedule 13D, 9,847,359, of which 9,501,205 are directly beneficially owned by AVCP and 346,154 are directly beneficially owned by AV Fund. |

|

10. |

|

Shared Dispositive Power

As of September 26, 2014, none. As of the date of filing of this Schedule 13D,

none. |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

As of September 26, 2014, 5,393,550. As of the date of filing of this Schedule 13D, 9,847,359. |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares

¨ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) As of September 26, 2014, 8.8%. As of the date of filing of this Schedule

13D, 13.2% |

| 14. |

|

Type of Reporting Person

IA |

3

|

|

|

|

|

|

|

| 1. |

|

Names of

Reporting Persons. Carl Dockery |

| 2. |

|

Check the Appropriate Box if a Member

of a Group (a) ¨ (b) x |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

|

Citizenship or Place of

Organization U.S. Citizen |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With: |

|

7. |

|

Sole Voting Power

As of September 26, 2014, 0.

As of the date of the filing of this Schedule 13D, 46,473. |

|

8. |

|

Shared Voting Power

As of September 26, 2014, 5,393,550 shares, of which 5,047,396 are directly beneficially

owned by AVCP and 346,154 are directly beneficially owned by AV Fund. As of the date

of filing of this Schedule 13D, 9,847,359, of which 9,501,205 are directly beneficially owned by AVCP and 346,154 are directly beneficially owned by AV Fund. |

|

9. |

|

Sole Dispositive Power

As of September 26, 2014, 0.

As of the date of the filing of this Schedule 13D, 46,473. |

|

10. |

|

Shared Dispositive Power

As of September 26, 2014, 5,393,550, of which 5,047,396 are directly beneficially owned

by AVCP and 346,154 are directly beneficially owned by AV Fund. As of the date of

filing of this Schedule 13D, 9,847,359 shares, of which 9,501,205 are directly beneficially owned by AVCP and 346,154 are directly beneficially owned by AV Fund. |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

As of September 26, 2014, 5,393,550. As of the date of filing of this Schedule 13D, 9,899,832. |

| 12. |

|

Check if the Aggregate Amount in Row

(11) Excludes Certain Shares

¨ |

| 13. |

|

Percent of Class Represented by Amount

in Row (11) As of September 26, 2014, 8.8%. As of the date of filing of this Schedule

13D, 13.3% |

| 14. |

|

Type of Reporting Person

IN, HC |

4

| ITEM 1. |

SECURITY AND ISSUER |

This Schedule 13D (this “Schedule”) relates to the

common stock, no par value (“Common Stock”), of CytoDyn Inc., a Colorado corporation (the “Company”). The address of the Company’s principal executive offices is 1111 Main Street, Suite 660, Vancouver, Washington 98660.

| ITEM 2. |

IDENTITY AND BACKGROUND |

(a) This Schedule 13D is being filed on behalf of Alpha Venture

Capital Partners, L.P. (“AVCP”), Alpha Advisors, LLC (“Alpha Advisors”) and Carl C. Dockery (each of the AVCP, Alpha Advisors and Dockery, a “Reporting Person” and collectively, the “Reporting Persons”) to

identify Dockery’s appointment to the Company’s Board of Directors and certain other matters identified herein.

(b) The address

of the principal business office of the Reporting Persons is:

2026 Crystal Wood Drive

Lakeland, FL 33806-2477

(c)

AVCP is a private investment fund engaged in the business of investing in securities. Alpha Advisors is an investment adviser registered in the state of Florida. Alpha Advisors has the exclusive power to make all investment decisions on behalf of

AVCP. Dockery is the President of Alpha Advisors and holds a majority of the outstanding membership interests of Alpha Advisors. As such, Dockery is in a position indirectly to determine the investment and voting decisions made by Alpha Advisors.

Effective as of September 26, 2014, Dockery was appointed as a member of the Board of Directors of the Company.

(d) During the last

five years, no Reporting Person was convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During

the last five years, no Reporting Person was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) AVCP is organized as a limited partnership under the laws of the State of Delaware. Alpha Advisers is organized as a limited liability

company under the laws of the State of Florida. Dockery is a U.S. citizen.

| ITEM 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

As disclosed in the Reporting

Persons’ Schedule 13G filed September 9, 2014, AVCP and Alpha Venture Capital Fund, L.P. (“AV Fund”), a private fund for which Alpha Advisors serves as investment advisor, acquired, in the aggregate, 2,095,700 shares of Common

Stock and warrants to purchase 1,047,850 shares of Common Stock for approximately $1,362,205 in October 2013. This acquisition was funded by the personal funds of the limited partners of AVCP and AV Fund.

On September 26, 2014, AVCP acquired a convertible promissory note in the principal amount of $2 million and a warrant to purchase

250,000 shares of Common Stock for an aggregate purchase price of $2 million (the “First Note”). This loan was funded by the personal funds of the AVCP’s limited partners.

On October 6, 2014, the Company issued Dockery options to purchase 33,973 shares of Common Stock, subject to certain vesting

restrictions, in consideration for Dockery’s services as a member of the Company’s Board of Directors.

On February 6,

2015, AVCP acquired a convertible promissory note in the principal amount of $1.5 million (the “Second Note”) and a warrant to purchase 75,000 shares of Common Stock for an aggregate purchase price of $1.5 million. This loan was funded by

the personal funds of AVCP’s limited partners.

On May 5, 2015, the Company issued to AVCP 104,153 shares of Common Stock in

lieu of cash for interest payable on the Second Note.

On June 1, 2015, the Company issued to Dockery option to purchase 50,000

shares of Common Stock, subject to certain vesting restrictions, in consideration for Dockery’s services as a member of the Company’s Board of Directors. 12,500 of the shares underlying this option grant are exercisable within sixty days

of the date of filing of this Schedule 13D.

5

On June 5, 2015, the Company issued to AVCP 36,690 shares of Common Stock in lieu of cash

for interest payable on the Second Note.

On June 24, 2015, in discharge of $3,535,627.15 in indebtedness to AVCP under the First

Note and Second Note, the Company issued to AVCP 5,237,966 shares of Common Stock and agreed to issue AVCP a warrant to purchase 1,000,000 shares of Common Stock (the “Conversion and Discharge”).

| ITEM 4. |

PURPOSE OF TRANSACTION |

The Reporting Persons acquired their positions in the Common

Stock in the belief that they are a good investment or, for the shares with respect to which Dockery is the sole beneficial owner, Dockery acquired his position in consideration for serving on the Company’s Board of Directors. The Reporting

Persons may acquire or dispose of shares of Common Stock or securities convertible into or exercisable for shares of Common Stock from time to time for personal reasons. Commencing upon Dockery’s appointment to the Company’s Board of

Directors, Dockery may, in the ordinary course of acting in his capacity as a member of the Board of Directors, engage in activities which relate to or would result in any or all of the items listed in Item 4(a) – (j).

Except as set forth above, the Reporting Persons do not, as of the date of this Schedule 13D, have any present plans or proposals which relate

to or would result in any or all of the items listed in Items 4(a) – (j).

| ITEM 5. |

INTEREST IN SECURITIES OF THE ISSUER |

(a) As of the date of this Schedule 13D, the

Reporting Persons may be deemed to beneficially own, in the aggregate, 9,899,832 shares of Common Stock (including Shares underlying options and warrants that are exercisable within sixty days), representing approximately 13.3% of the Company’s

outstanding shares of Common Stock, which is based upon (i) the 63,544,348 shares of Common Stock stated to be outstanding as of May 28, 2015 in the Company’s S-1 filed with the SEC on June 8, 2015 plus (ii) the

5,237,966 shares of Common Stock issued to AVCP in the Conversion and Discharge plus (iii) 4,792,173 shares of Common Stock underlying options and warrants held by the Reporting Persons plus (iv) 1,000,000 shares of Common

Stock underlying a warrant issued to AVCP in the Conversion and Discharge.

(b) Dockery has sole voting power and sole dispositive power

with regard to 46,473 shares of Common Stock underlying options. Dockery is the sole beneficial owner of such shares.

Alpha Advisers has

sole voting and sole dispositive power with regards to (i) the 9,501,205 shares of Common Stock (including shares of Common Stock underlying options and warrants that are exercisable within sixty days) that are directly beneficially owned by

AVCP and (ii) the 346,154 shares of Common Stock (including Shares of Common Stock underlying options and warrants that are exercisable within sixty days) that are directly beneficially owned by AV Fund. Each of Dockery, AVCP and AV Fund has

shared voting power and shared dispositive power with regard to such Shares. Dockery, by virtue of his relationship with Alpha Advisers, AVCP and AV Fund (as disclosed in Item 2), may be deemed to indirectly beneficially own the 9,501,205

shares and 346,154 shares of Common Stock (including, in each case, Shares underlying options and warrants that are exercisable within sixty days) directly beneficially owned by AVCP and AV Fund, respectively. Dockery disclaims beneficial ownership

of the shares of Common Stock directly beneficially owned by AVCP and AV Fund for all other purposes.

(c) The following table sets forth

all transactions with respect to shares of Common Stock effected during the past sixty (60) days by any of the Reporting Persons.

|

|

|

|

|

|

|

|

|

|

|

| Name of Reporting

Person |

|

Date of Transaction |

|

Amount of Securities |

|

Price Per Share |

|

Where and How

Effected |

|

Notes |

| Dockery |

|

6/1/2015 |

|

Option to purchase 50,000 shares of Common Stock |

|

$0.975 exercise price per share |

|

Company issuance of option in consideration for services as a member of the Company’s Board of Directors |

|

All shares underlying option subject to vesting |

|

|

|

|

|

|

| AVCP |

|

6/5/2015 |

|

36,690 shares of Common Stock |

|

0.50 |

|

Issued by Company in lieu of cash for interest payable under Second Note |

|

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVCP |

|

6/24/2015 |

|

5,237,966 shares of Common Stock |

|

0.675 |

|

Issued in discharge of $3,535,627.15 in indebtedness to AVCP under the First Note and Second Note |

|

|

|

|

|

|

|

|

| AVCP |

|

6/24/2015 |

|

Warrant to purchase 1,000,000 shares of Common Stock |

|

$0.675 exercise price per share |

|

Issued as inducement to Conversion and Discharge |

|

|

(d) Other than AV Fund and AVCP and except as set forth in this Item 5, no person is known to have the

right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Shares.

(e) Not applicable.

| ITEM 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

Stock Purchase Agreement between CytoDyn Inc., AVCP, dated October 18, 2013.

Warrant issued by CytoDyn Inc. to AVCP, dated October 23, 2013, and, to reflect partial transfer to AV Fund, replacement warrants

issued to AVCP and AV Fund dated October 23, 2013.

Warrant issued by CytoDyn Inc. to AVCP on September 24, 2014.

Stock Option Award Agreement between CytoDyn Inc. and Dockery, dated October 6, 2014.

Warrant issued by CytoDyn Inc. to AVCP on February 6, 2015.

Stock Option Award Agreement between CytoDyn Inc. and Dockery, dated June 1, 2015.

Debt Conversion and Termination Agreement between CytoDyn Inc., Alpha Venture Capital Management, LLC and Alpha Venture Capital Partners, LP

dated June 23, 2015.

Warrant issued by CytoDyn Inc. to AVCP on June 24, 2015.

Pursuant to Rule 13d-1(k), the Reporting Persons have entered into an agreement with respect to the joint filing of this statement, any

amendment or amendments hereto.

Dockery currently serves on the Company’s Board of Directors.

Except as described herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named

in Item 2 and between such persons and any person with respect to any securities of the Company, including but not limited to transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or

calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

| ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS |

99.1 Warrant issued by CytoDyn Inc. to AVCP, dated

October 23, 2013. Incorporated by reference to Exhibit 4.4 to the Company’s Registration Statement on Form S-1 filed November 15, 2013.

99.2 Warrant issued by CytoDyn Inc. to AVCP on September 24, 2014. Incorporated by reference to Exhibit 4.2 to the Company’s

Quarterly Report on Form 10-Q for the quarter ended August 31, 2014.

99.3 Stock Option Award Agreement between CytoDyn Inc. and

Dockery, dated October 6, 2014. Incorporated by reference to Exhibit 10.13 to the Company’s Quarterly Report on Form 10-Q for the quarter ended August 31, 2014.

99.4 Warrant issued by CytoDyn Inc. to AVCP on February 6, 2015. Incorporated by reference to Exhibit 4.2 of the Company’s Current

Report on Form 8-K filed on February 11, 2015.

99.5 Stock Option Award Agreement between CytoDyn Inc. and Dockery, dated

June 1, 2015. Incorporated by reference to Exhibit 10.13 to the Company’s Quarterly Report on Form 10-Q for the quarter ended August 31, 2014.

99.6 Warrant issued by CytoDyn Inc. to AVCP on June 24, 2015. Incorporated by reference to Exhibit 10.2 to the Company’s Current

Report on Form 8-K filed on June 25, 2015.

99.7 Joint Filing Agreement of Reporting Persons.

7

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: July 15, 2015

|

|

|

|

|

| ALPHA VENTURE CAPITAL PARTNERS, L.P. |

|

|

|

|

By: Alpha Venture Capital Management, LLC |

|

|

Title: General Partner |

|

|

|

|

|

|

|

By: /s/ Carl C. Dockery |

|

|

|

|

Name: Carl C. Dockery |

|

| ALPHA ADVISORS, LLC |

|

|

|

|

|

|

|

By: /s/ Carl C. Dockery |

|

|

|

|

Name: Carl C. Dockery |

|

|

|

|

Title: Manager |

|

| /s/ Carl C. Dockery |

| Carl C. Dockery |

8

Exhibit 99.7

JOINT FILING AGREEMENT FOR SCHEDULE 13D

PURSUANT TO RULE 13d-1(k)(1)

The

undersigned acknowledge and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to this statement on Schedule 13D shall be filed on behalf of each of the undersigned

without the necessity of filing additional joint filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the information concerning it contained

therein, but shall not be responsible for the completeness and accuracy of the information concerning the others, except to the extent that it knows or has reason to believe that such information is inaccurate. This Agreement may be executed in any

number of counterparts and all of such counterparts taken together shall constitute one and the same instrument.

Dated: July 15, 2015

|

|

|

|

|

| ALPHA VENTURE CAPITAL PARTNERS, L.P. |

|

|

|

|

By: Alpha Venture Capital Management, LLC |

|

|

Title: General Partner |

|

|

|

|

|

|

|

By: /s/ Carl C. Dockery |

|

|

|

|

Name: Carl C. Dockery |

|

| ALPHA ADVISORS, LLC |

|

|

|

|

|

|

|

By: /s/ Carl C. Dockery |

|

|

|

|

Name: Carl C. Dockery |

|

|

|

|

Title: Manager |

|

| /s/ Carl C. Dockery |

| Carl C. Dockery |

9

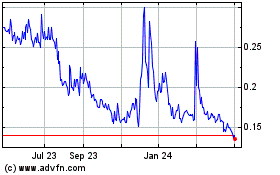

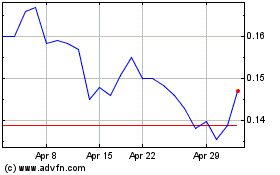

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024