UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2015

The Sherwin-Williams Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Ohio |

|

1-04851 |

|

34-0526850 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.) |

|

|

|

| 101 West Prospect Avenue

Cleveland, Ohio |

|

44115 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(216) 566-2000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 16, 2015, The Sherwin-Williams Company issued a press release announcing its financial results for the second quarter ended

June 30, 2015 and certain other information. A copy of this press release is furnished with this Report as Exhibit 99 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following

Exhibit is furnished with this Report:

|

|

|

| Exhibit No. |

|

Exhibit Description |

|

|

| 99 |

|

Press Release of The Sherwin-Williams Company, dated July 16, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE SHERWIN-WILLIAMS COMPANY |

|

|

|

|

| July 16, 2015 |

|

|

|

By: |

|

/s/ Catherine M. Kilbane |

|

|

|

|

|

|

Catherine M. Kilbane |

|

|

|

|

|

|

Senior Vice President, General Counsel and

Secretary |

3

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Exhibit Description |

|

|

| 99 |

|

Press Release of The Sherwin-Williams Company, dated July 16, 2015. |

4

EXHIBIT 99

NEWS:

The Sherwin-Williams Company • 101

West Prospect Avenue •

Cleveland, Ohio 44115 • (216) 566-2140

The Sherwin-Williams Company Reports 2015 Second Quarter and First Six Months Financial Results

| |

• |

|

Consolidated net sales increased 2.9% to a record $3.13 billion in the quarter and increased 3.2% to a record $5.58 billion in six months |

| |

• |

|

Net sales from stores open more than twelve calendar months increased 3.9% in the quarter |

| |

• |

|

Diluted net income per common share increased 25.9% to a record $3.70 per share in the quarter and increased 25.1% to a record $5.08 per share in six months |

| |

• |

|

Anticipates 3Q15 sales increase of 3% to 5% and EPS in the range of $3.75 to $3.90 |

| |

• |

|

Updating FY15 EPS guidance to $10.60 to $11.00 per share vs. $8.78 per share in 2014 |

CLEVELAND,

OHIO, July 16, 2015 – The Sherwin-Williams Company (NYSE: SHW) announced its financial results for the second quarter and six months ended June 30, 2015. Compared to the same periods in 2014, consolidated net sales increased

$89.1 million, or 2.9%, to $3.13 billion in the quarter and increased $172.9 million, or 3.2%, to $5.58 billion in six months due primarily to higher paint sales volume in our Paint Stores and Consumer Groups. Unfavorable

currency translation rate changes decreased consolidated net sales 3.0% in the quarter and six months.

Diluted net income per common share in the quarter

increased to $3.70 per share from $2.94 per share in 2014 and increased in six months to $5.08 per share from $4.06 per share last year. The increases in second quarter and six month diluted net income per common share were due primarily to improved

operating results of the Paint Stores and Consumer Groups. Currency translation rate changes decreased diluted net income per common share by $.07 per share in the quarter and $.11 in six months.

Net sales in the Paint Stores Group increased 5.4% to $1.98 billion in the quarter and increased 6.3% to $3.45 billion in six months due primarily

to higher architectural paint sales volume across all end market segments. Net sales from stores open for more than twelve calendar months increased 3.9% in the quarter and increased 5.0% in six months over last year’s comparable periods. Paint

Stores Group segment profit increased $57.5 million to $433.4 million in the quarter from $375.9 million last year and increased $87.8 million to $610.0 million in six months from $522.1 million last year due primarily

to higher paint sales volume. Segment profit as a percent to net sales increased in the quarter to 21.8% from 20.0% last year and increased in six months to 17.7% from 16.1% in 2014.

Net sales of the Consumer Group increased 13.1% to $490.0 million in the quarter and increased 11.0% to $841.7 million in six months due primarily

to shipments of HGTV HOME® by Sherwin-Williams paint to Lowe’s stores. Segment profit increased to $114.2 million in the quarter from $92.5 million last year and increased to

$169.7 million in six months from $143.6 million last year due primarily to improved operating efficiencies. As a percent to net external sales, segment profit increased in the quarter to 23.3% from 21.3% last year and increased in six months

to 20.2% from 18.9% last year.

The Global Finishes Group’s net sales stated in U.S. dollars decreased 7.1% to $505.8 million in the quarter and

decreased 6.4% to $975.3 million in six months. Unfavorable currency translation rate changes decreased net sales by 7.7% in the quarter and 7.3% in six months. Stated in U.S. dollars, segment profit increased in the quarter to

$57.3 million from $54.9 million last

1

year due primarily to higher paint sales volume and charges in the second quarter 2014 related to the exit of our business in Venezuela partially offset by unfavorable currency translation rate

changes. Six month segment profit decreased to $96.2 million from $101.3 million last year due primarily to unfavorable currency translation rate changes. Second quarter and six months 2014 segment profit included a $4.5 million

charge related to the exit of our business in Venezuela. Unfavorable currency translation rate changes reduced segment profit $8.3 million in the quarter and $12.7 million in six months. As a percent to net external sales, segment profit

was 11.3% in the quarter versus 10.1% last year and 9.9% in six months compared to 9.7% in 2014.

The Latin America Coatings Group’s net sales stated

in U.S. dollars decreased 17.2% to $150.1 million in the quarter and decreased 13.0% to $316.3 million in six months due primarily to unfavorable currency translation rate changes partially offset by selling price increases. Unfavorable

currency translation rate changes decreased net sales by 17.4% in the quarter and 15.6% in six months. Stated in U.S. dollars, segment profit decreased in the quarter to $4.0 million from $5.7 million last year and decreased in six months

to $13.5 million from $15.6 million last year due primarily to increasing raw material costs and unfavorable currency translation rate changes partially offset by selling price increases. Unfavorable currency translation rate changes

decreased segment profit $2.3 million in the quarter and $5.7 million in six months. As a percent to net external sales, segment profit decreased in the quarter to 2.7% from 3.1% last year and remained flat at 4.3% in six months.

The Company acquired 2.25 million shares of its common stock through open market purchases in the six months ended June 30, 2015. The Company had

remaining authorization at June 30, 2015 to purchase 2.98 million shares.

Commenting on the financial results, Christopher M. Connor,

Chairman and Chief Executive Officer, said, “Our Paint Stores Group posted another quarter of positive operating results and architectural volume growth across all end market segments. Consumer Group improved its operating results through

improved operating efficiencies. The HGTV HOME® by Sherwin-Williams paint program rollout was completed in all Lowe’s stores by May 1 and continued to ramp up to expected volumes

throughout the quarter. Our Global Finishes and Latin America Coatings Groups are managing through the negative effects of currency devaluation and weak end market demand in some geographies. In total, it is gratifying to report another quarter of

record sales and earnings per share.

“We continued to invest in our business by opening twenty-two net new locations in the Paint Stores Group in

the first six months. During the quarter, we continued to buy shares of our stock, and we increased the dividend rate to $.67 from $.55 last year. Our balance sheet remains flexible and is positioned well for future acquisitions and other

investments in our business.

“For the third quarter, we anticipate our consolidated net sales will increase three to five percent compared to last

year’s third quarter. At that anticipated sales level, we estimate diluted net income per common share in the third quarter of 2015 to be in the range of $3.75 to $3.90 per share compared to $3.35 per share earned in the third quarter of 2014.

For the full year 2015, we expect consolidated net sales to increase three to five percent compared to full year 2014. With annual sales at that level, we are updating our guidance that diluted net income per common share for 2015 to be in the range

of $10.60 to $11.00 per share compared to $8.78 per share earned in 2014.”

The Company will conduct a conference call to discuss its financial

results for the second quarter, and its outlook for the third quarter and full year 2015, at 11:00 a.m. EDT on Thursday, July 16, 2015. The conference call will be webcast simultaneously in the listen only mode by Vcall. To listen to the

webcast on the Sherwin-Williams website, www.sherwin.com, click on About Us, choose Investor Relations, then select Press Releases and click on the webcast icon following the reference to the July 16th release. The webcast will also be

available at Vcall’s Investor Calendar website, www.investorcalendar.com. An archived replay of the live webcast will be available at www.sherwin.com beginning approximately two hours after the call ends and will be available

until August 6, 2015 at 5:00 p.m. EDT.

Founded in 1866, The Sherwin-Williams Company is a global leader in the manufacture, development,

distribution, and sale of coatings and related products to professional, industrial, commercial, and retail customers. The company manufactures products under well-known brands such as

Sherwin-Williams®, HGTV HOME® by Sherwin-Williams, Dutch Boy®, Krylon®,

2

Minwax®, Thompson’s® Water

Seal®, and many more. With global headquarters in Cleveland, Ohio, Sherwin-Williams® branded products are sold exclusively through a

chain of more than 4,100 company-operated stores and facilities, while the company’s other brands are sold through leading mass merchandisers, home centers, independent paint dealers, hardware stores, automotive retailers, and industrial

distributors. The Sherwin-Williams Global Finishes Group distributes a wide range of products in more than 115 countries around the world. For more information, visit www.sherwin.com.

This press release contains certain “forward-looking statements”, as defined under U.S. federal securities laws, with respect to sales, earnings and

other matters. These forward-looking statements are based upon management’s current expectations, estimates, assumptions and beliefs concerning future events and conditions. Readers are cautioned not to place undue reliance on any

forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the Company, that could cause actual results to differ materially from such statements

and from the Company’s historical results and experience. These risks, uncertainties and other factors include such things as: general business conditions, strengths of retail and manufacturing economies and the growth in the coatings industry;

changes in the Company’s relationships with customers and suppliers; changes in raw material availability and pricing; unusual weather conditions; and other risks, uncertainties and factors described from time to time in the Company’s

reports filed with the Securities and Exchange Commission. Since it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results, the above list should not be considered a complete list. Any

forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Investor Relations Contact:

Bob Wells

Senior Vice President – Corporate Communications and Public Affairs

Sherwin-Williams

Direct: 216.566.2244

rjwells@sherwin.com

Media Contact:

Mike Conway

Director – Corporate Communications

Sherwin-Williams

Direct: 216.515.4393

Pager: 216.422.3751

mike.conway@sherwin.com

3

The Sherwin-Williams Company and Subsidiaries

Statements of Consolidated Income (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| Thousands of dollars, except per share data |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

| Net sales |

|

$ |

3,132,139 |

|

|

$ |

3,042,995 |

|

|

$ |

5,582,423 |

|

|

$ |

5,409,551 |

|

| Cost of goods sold |

|

|

1,602,153 |

|

|

|

1,633,342 |

|

|

|

2,919,988 |

|

|

|

2,933,997 |

|

| Gross profit |

|

|

1,529,986 |

|

|

|

1,409,653 |

|

|

|

2,662,435 |

|

|

|

2,475,554 |

|

| Percent to net sales |

|

|

48.8% |

|

|

|

46.3% |

|

|

|

47.7% |

|

|

|

45.8% |

|

| Selling, general and administrative expenses |

|

|

999,224 |

|

|

|

969,183 |

|

|

|

1,928,421 |

|

|

|

1,853,271 |

|

| Percent to net sales |

|

|

31.9% |

|

|

|

31.8% |

|

|

|

34.5% |

|

|

|

34.3% |

|

| Other general expense - net |

|

|

9,971 |

|

|

|

770 |

|

|

|

8,298 |

|

|

|

198 |

|

| Interest expense |

|

|

12,885 |

|

|

|

16,374 |

|

|

|

25,236 |

|

|

|

32,768 |

|

| Interest and net investment income |

|

|

(553 |

) |

|

|

(757 |

) |

|

|

(975 |

) |

|

|

(1,346 |

) |

| Other expense (income) - net |

|

|

677 |

|

|

|

(5,147 |

) |

|

|

432 |

|

|

|

(4,644 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

507,782 |

|

|

|

429,230 |

|

|

|

701,023 |

|

|

|

595,307 |

|

| Income taxes |

|

|

157,845 |

|

|

|

137,783 |

|

|

|

219,682 |

|

|

|

188,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

349,937 |

|

|

$ |

291,447 |

|

|

$ |

481,341 |

|

|

$ |

406,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

3.78 |

|

|

$ |

3.00 |

|

|

$ |

5.18 |

|

|

$ |

4.14 |

|

|

|

|

|

|

| Diluted |

|

$ |

3.70 |

|

|

$ |

2.94 |

|

|

$ |

5.08 |

|

|

$ |

4.06 |

|

|

|

|

|

|

| Average shares outstanding - basic |

|

|

92,260,367 |

|

|

|

96,599,869 |

|

|

|

92,500,213 |

|

|

|

97,716,539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shares and equivalents outstanding - diluted |

|

|

94,124,695 |

|

|

|

98,541,909 |

|

|

|

94,427,191 |

|

|

|

99,688,557 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional information regarding the Company’s financial condition, operating segment results and other information can be

found on the Sherwin-Williams website, “www.sherwin.com”, by clicking on About Us, choosing Investor Relations, then selecting Press Releases and clicking on the reference to the July 16th release.

4

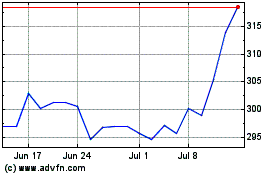

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

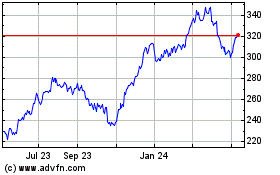

Sherwin Williams (NYSE:SHW)

Historical Stock Chart

From Apr 2023 to Apr 2024