Current Report Filing (8-k)

July 13 2015 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 10, 2015

ANI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-31812 |

|

58-2301143 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

210 Main Street West

Baudette, Minnesota |

|

56623 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (218) 634-3500

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

|

Entry into

a Material Definitive Agreement. |

On July 10, 2015, ANI Pharmaceuticals, Inc.,

a Delaware corporation (the "Company" or "ANI"), Teva Pharmaceuticals USA, Inc., a Delaware corporation and

certain affiliates of Teva Pharmaceuticals USA, Inc. (collectively, "Teva"), entered into a second amendment (the "Second

Amendment") to the December 26, 2013 Asset Purchase Agreement, as amended, (the "Agreement") by and between the

Company and Teva.

Under the Second Amendment, Company agreed

to acquire all of Teva's right, title and interest, within the United States and its territories, under Abbreviated New Drug Applications

(collectively the "ANDAs" and each a "Product ANDA") and documents relating thereto (together with the ANDAs,

the "Purchased Assets") relating to 22 previously marketed generic drug products for a total purchase price of $25 million

plus a royalty on future gross profits from product sales for each product manufactured by the Company pursuant to a Product ANDA.

The Company assumes all liabilities and

obligations for the Purchased Assets from and after the date such Purchased Assets are acquired.

The Asset Purchase Agreement, as amended,

contains various representations, warranties and covenants, as well as provisions relating to insurance, confidential information

and confidentiality and other matters that are customary for such a transaction.

| Item 9.01 |

|

Financial Statements and Exhibits. |

(d) Exhibits

| No. |

|

Description |

| |

|

|

| 99.1 |

|

Press release, dated July 13, 2015, issued by ANI |

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANI PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Charlotte C. Arnold |

| |

|

Charlotte C. Arnold |

| |

|

Vice President, Finance, and Chief Financial Officer |

| Dated: July 13, 2015 |

|

ANI Pharmaceuticals Acquires 22 Generic Drug Products from Teva Pharmaceuticals for $25 million

BAUDETTE, Minn., July 13, 2015 /PRNewswire/ -- ANI Pharmaceuticals, Inc. ("ANI") (NASDAQ: ANIP) today announced that it has acquired 22 previously marketed generic drug products from Teva Pharmaceuticals for $25 million in cash and a percentage of future gross profits from product sales. The acquisition includes 19 solid-oral dosage products, and 3 oral suspension products. ANI will initially focus to tech transfer four products that qualify as CBE30 filings into ANI's two manufacturing facilities; these four products have a combined trailing twelve month market value of $210 million, according to IMS Health. The total market value for the 22 products

is $650 million on a trailing twelve month basis, per IMS Health. The acquisition is being funded through cash on hand.

Arthur S. Przybyl, President and CEO of ANI Pharmaceuticals, stated, "I am excited to add this group of approved products to our generic portfolio and to further leverage our manufacturing capabilities. Importantly, we will be manufacturing one of the initial products out of our containment facility for potent compounds. This acquisition meaningfully expands our product pipeline to 68 products with a total market value of $3.9B per IMS Health. We are pleased at the opportunity to extend our collaboration with Teva beyond the three transactions we have previously completed over the past eighteen months."

Robert W. Schrepfer, VP of Business Development, commented, "This transaction further illustrates ANI's ability to execute strategic

acquisitions that leverage our internal capabilities and expand our approved product portfolio. We are fortunate to have developed this strategic relationship with an industry leader such as Teva."

About ANI

ANI Pharmaceuticals, Inc. (the "Company" or "ANI") is an integrated specialty pharmaceutical company developing, manufacturing, and marketing branded and generic prescription pharmaceuticals. The Company's targeted areas of product development currently include narcotics, oncolytics (anti-cancers), hormones and steroids, and complex formulations involving extended release and combination products. For more information, please visit our website www.anipharmaceuticals.com.

Forward-Looking Statements

To the extent any statements made in this release deal with information that is not historical, these are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about price increases, the Company's future operations, products financial position, operating results and prospects , the Company's pipeline or potential markets therefore, and other statements that are not historical in nature, particularly those that utilize terminology such as "anticipates," "will," "expects," "plans," "potential," "future," "believes," "intends," "continue," other words of similar meaning, derivations of such words and the use of future dates.

Uncertainties and risks may cause the Company's actual results

to be materially different than those expressed in or implied by such forward-looking statements. Uncertainties and risks include, but are not limited to, the risk that the Company may face with respect to importing raw materials; increased competition; delays or failure in obtaining product approval from the U.S. Food and Drug Administration; general business and economic conditions; market trends; products development; regulatory and other approvals and marketing.

More detailed information on these and additional factors that could affect the Company's actual results are described in the Company's filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as well as its proxy statement. All forward-looking statements in this news release speak only as of the date of this news release and

are based on the Company's current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

For more information about ANI, please contact:

Investor Relations

IR@anipharmaceuticals.com

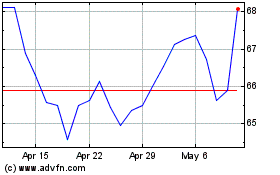

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Apr 2023 to Apr 2024