UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 9, 2015

Dynavax Technologies Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34207

|

Delaware |

|

33-0728374 |

|

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

2929 Seventh Street, Suite 100

Berkeley, CA 94710-2753

(Address of principal executive offices, including zip code)

(510) 848-5100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

Dynavax Technologies Corporation (the “Company”, “Dynavax” or “we”) estimates that its cash, cash equivalents and marketable securities were approximately $93.4 million as of June 30, 2015. The Company’s cash, cash equivalents and marketable securities balance as of June 30, 2015 does not include net proceeds of $28.8 million in additional cash resulting from stock sales under the Company’s at-the-market sales agreement (“ATM agreement”) following the end of the quarter. The ATM agreement has concluded because the Company has reached $50 million of gross proceeds as specified in the ATM agreement. As of July 8, 2015, the Company had approximately 31,400,000 shares of common stock outstanding and approximately 17,000 shares of preferred stock outstanding, which are convertible into approximately 1,700,000 shares of common stock. These amounts are preliminary, unaudited, subject to change upon completion of our quarterly review, and may differ from what will be reflected in our consolidated financial statements as of and for the quarter ended June 30, 2015. Additional information and disclosures would be required for a more complete understanding of our financial position and results of operations as of June 30, 2015.

The information with respect to item 2.02 in this current report shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this current report shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 8.01. Other Events

On July 9, 2015, we issued a press release titled “Dynavax Announces Third Independent DSMB Recommendation to Continue Phase 3 Study of HEPLISAV-B™ and Updates Financial Status." A copy of the press release is attached as Exhibit 99.1 to this current report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit is filed herewith:

99.1 Press Release, dated July 9, 2015, titled “Dynavax Announces Third Independent DSMB Recommendation to Continue Phase 3 Study of HEPLISAV-B™ and Updates Financial Status"

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dynavax Technologies Corporation |

|

Date: July 9, 2015 |

|

|

By: |

|

/s/ DAVID JOHNSON |

|

|

|

|

|

|

David Johnson |

|

|

|

|

|

|

Vice President |

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

|

|

EX-99.1

|

|

Press Release, dated July 9, 2015, titled “Dynavax Announces Third Independent DSMB Recommendation to Continue Phase 3 Study of HEPLISAV-B™ and Updates Financial Status" |

|

|

|

|

Exhibit 99.1

DYNΛVAX

INNOVATING IMMUNOLOGY

2929 Seventh Street, Suite 100

Berkeley, CA 94710

|

|

|

|

Contact: |

|

|

|

Michael S. Ostrach |

|

|

|

Chief Financial Officer |

|

|

|

510-665-7257 |

|

|

|

mostrach@dynavax.com |

|

|

DYNAVAX Announces Third Independent DSMB Recommendation to Continue PHASE 3 STUDY of HEPLISAV-B™ and Updates financial status

BERKELEY, CA – July 9, 2015 – Dynavax Technologies Corporation (NASDAQ: DVAX) today announced that the independent Data and Safety Monitoring Board (DSMB) charged with periodically reviewing safety data from HBV-23, the ongoing Phase 3 clinical study of HEPLISAV-B, Dynavax’s investigational adult hepatitis B vaccine, has completed its third prespecified review and has recommended that the study continue unchanged.

The third DSMB review included safety data for all enrolled subjects collected through the data cut-off in June. As of the cut-off, all continuing subjects who had received the second immunization (which was the last active dose for HEPLISAV-B subjects) had reached at least 8 months of the requisite one year follow-up after the second immunization. The DSMB reviewed unblinded tables and listings presenting key safety data. Based on this review, the DSMB recommended continuing HBV‑23 with no change to the study.

Over 2,200 subjects have completed their final study visit and all study visits for HBV-23 are expected to be completed by October 2015. Top line results are expected to be released by early 2016.

Separately, Dynavax announced that its cash, cash equivalents and marketable securities at June 30, 2015 were approximately $93.4 million, which does not include approximately $28.8 million in additional cash resulting from stock sales following the end of the quarter under the Company’s at-the-market sales agreement (“ATM agreement”). The ATM agreement has concluded because the Company has reached $50 million of gross proceeds as specified in the ATM agreement. At July 8, 2015, the Company had approximately 31,400,000 shares of common stock outstanding and approximately 17,000 shares of preferred stock outstanding which are convertible into approximately 1,700,000 shares of common stock.

About HEPLISAV-B

HEPLISAV-B is an investigational adult hepatitis B vaccine that combines hepatitis B surface antigen with a proprietary Toll-like Receptor 9 agonist to enhance the immune response. Dynavax has worldwide commercial rights to HEPLISAV-B.

About Dynavax

Dynavax, a clinical-stage biopharmaceutical company, uses TLR biology to discover and develop novel vaccines and therapeutics in the areas of infectious and inflammatory diseases and oncology. Dynavax's lead product candidates are HEPLISAV-B, a Phase 3 investigational adult hepatitis B vaccine and SD-101, an investigational cancer immunotherapeutic currently in several Phase 1/2 studies. For more information visit www.dynavax.com.

Forward-Looking and Cautionary Statements

This press release contains "forward-looking" statements, including expectations for the conduct and timing of HBV-23 and financial projections. Actual results may differ materially from those set forth in this press release due to the risks and uncertainties inherent in our business, including whether HBV-23 can be completed as expected, whether the endpoints of the study will be achieved and the final results otherwise be satisfactory, whether successful clinical and regulatory development and review and approval of HEPLISAV-B and our process for its manufacture can occur without significant delay or additional studies, whether our financial resources will be adequate without the need to obtain additional financing and other risks detailed in the "Risk Factors" section of our current periodic reports filed with the SEC. We undertake no obligation to revise or update information herein to reflect events or circumstances in the future, even if new information becomes available.

Projected cash, cash equivalent and marketable securities amounts stated above are preliminary, unaudited, subject to change upon completion of our quarterly review, and may differ from what will be reflected in our consolidated financial statements. Additional information and disclosures would be required for a more complete understanding of our financial position and results of operations. Information on Dynavax's website at www.dynavax.com is not incorporated by reference in our current periodic reports filed with the SEC.

# # #

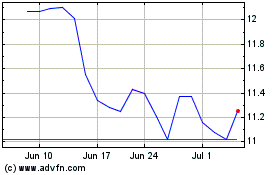

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

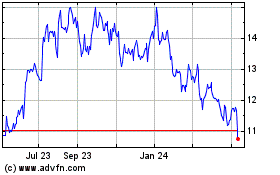

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024