UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of July, 2015

Commission

File Number 001-33042

Rosetta Genomics Ltd.

(Translation of registrant’s name into English)

10 Plaut Street, Science Park Rehovot

76706, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

CONTENTS

Acquisition of CynoGen Inc.

As previously reported, on April 13, 2015, Rosetta Genomics

Ltd. (the "Company" or "Rosetta") completed its acquisition of CynoGen Inc. ("CynoGen") from Prelude

Corporation, a Fjord Ventures portfolio company.

Additional Financial Information

In connection with the acquisition of CynoGen,

the Company is also providing certain historical and pro forma financial information and data listed in the exhibit table below.

The pro forma financial information gives effect to certain pro forma events related to the acquisition and has been presented

for informational purposes only. It does not purport to project the future financial position or operating results of the post-acquisition

combined company.

The information contained in this Report (including the exhibits

hereto) is hereby incorporated by reference into the Company’s Registration Statements on Form F-3, File Nos. 333-163063,

333-171203, 333-172655, 333-177670 and 333-185338 and the Company’s Registration Statements on Form S-8, File Nos. 333-141525,

333-147805, 333-165722 and 333-191072.

Safe Harbor Statement

This Form 6-K (including exhibits thereto)

contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995 and other Federal Securities laws. Statements preceded by, followed by, or that otherwise include the words

"believes", "expects", "anticipates", "intends", "estimates", "plans",

and similar expressions or future or conditional verbs such as "will", "should", "would", "may"

and "could" are generally forward-looking in nature and not historical facts. For example, when Rosetta discusses the

future growth of revenues or other expected benefits of the acquisition, it is using a forward-looking statement. Because such

statements deal with future events, they are subject to various risks and uncertainties and actual results could differ materially

from Rosetta’s current expectations.

Factors that could cause or contribute

to such differences include, but are not limited to: risks and uncertainties relating to the acquisition of CynoGen, including

costs and difficulties related to integration of acquired businesses, the combined companies’ financial results and performance,

and ability to repay debt and timing thereof; the impact on revenues of economic and political uncertainties and weaknesses in

various regions of the world, including the commencement or escalation of hostilities or acts of terrorism; Rosetta's liquidity

challenges and the need to raise additional capital in the future; any unforeseen developmental or technological difficulties with

regard to Rosetta’s products; changes in the competitive landscape, including new competitors or the impact of competitive

pricing and products; a shift in demand for products such as Rosetta’s products; unknown factors affecting third parties

with which Rosetta has formed business alliances; timely availability and customer acceptance of Rosetta’s new and existing

products; and other factors and risks on which Rosetta may have little or no control. This list is intended to identify only certain

of the principal factors that could cause actual results to differ.

For a more detailed description of the

risks and uncertainties affecting Rosetta, reference is made to Rosetta’s Annual Report on Form 20-F for the year ended December

31, 2014, which is on file with the Securities and Exchange Commission (SEC) and the other risk factors discussed from time to

time by Rosetta in reports filed or furnished to the SEC. Except as otherwise required by law, Rosetta undertakes no obligation

to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Rosetta Genomics Ltd. |

| Date: July 8, 2015 |

|

|

| |

|

|

| |

By: |

/s/ Oded Biran |

| |

Oded Biran |

| |

Chief Legal Officer and Corporate Secretary |

EXHIBIT INDEX

| Exhibit No. |

|

Description of Exhibit |

| |

|

|

| 99.1 |

|

Rosetta Genomics Ltd. unaudited pro forma condensed consolidated financial statements for the year ended December 31, 2014 and notes thereto. |

| |

|

|

|

99.2 |

|

CynoGen Inc. audited financial statements for

the year ended December 31, 2014 and notes thereto |

| |

|

|

|

99.3 |

|

Consent of Ernst & Young LLP |

| |

|

|

|

99.4 |

|

Rosetta Genomics Ltd. audited consolidated financial

statements for the year ended December 31, 2014 and notes thereto (*) |

| (*) | Filed as part of Rosetta Genomics Ltd. Annual Report on Form 20-F for the year ended December 31, 2014 and incorporated

herein by reference. |

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION AS OF

DECEMBER 31, 2014 AND THE YEAR ENDED DECEMBER 31, 2014

Unaudited Pro Forma Financial Information

On April 9, 2015, Rosetta Genomics Inc.

(“Rosetta” or the “Company“), our wholly-owned subsidiary, entered into a Stock Purchase Agreement (the

"SPA") pursuant to which it agreed to acquire CynoGen, Inc. from Prelude Corporation, a Fjord Ventures portfolio company

(“CynoGen”). CynoGen is a rapidly growing molecular diagnostics and services company serving community-based pathologists,

urologists, oncologists and other reference laboratories across the U.S. On April 13, 2015, the Company closed the transaction

(the “Acquisition”).

Under the SPA the total consideration was

comprised of the following: payment of $2 million in cash, issuance of 500,000 of the Company’s ordinary shares at closing

valued at $3.12 per share or $1.56 million, and the provision of support services at cost in total of $1 million. The price per

share of the Company’s ordinary shares was determined in accordance with the terms of the SPA based on the quoted share price

at the closing date.

The following unaudited condensed combined

pro forma balance sheet at December 31, 2014 gives effect to the Acquisition as if it had been completed as of December 31, 2014.

The Acquisition was accounted for under the purchase method of accounting. Accordingly, the assets acquired and liabilities assumed

have been recorded at their estimated fair values at the date of the Acquisition. The purchase price has been allocated to the

assets acquired and the liabilities assumed based upon estimates of their respective fair values, which are subject to adjustment.

The following unaudited condensed combined

pro forma Statements of Operations for the year ended December 31, 2014 give effect to the Acquisition as if it had been completed

on January 1, 2014. For the purposes of the pro forma Statements of Operations, the Company has assumed that the Company had sufficient

cash to make the Acquisition.

The pro forma information has been prepared

by our management and it may not be indicative of the results that actually would have occurred had the transaction been in effect

on the dates indicated, nor does it purport to indicate the results that may be obtained in the future. The pro forma information

is based on provisional amounts allocated by management to various assets and liabilities acquired and may be eventually different

than currently presented.

The pro forma information should be read

in conjunction with the financial statements and notes thereto of CynoGen filed herewith, and the Company’s financial statements

and notes thereto included hereunder, as well as with the Company’s Annual Report on Form 20-F for the year ended December

31, 2014, filed on March 16, 2015.

The pro forma Statements of Operations

do not give effect to planned synergies and/or cost savings related to the Acquisition.

Unaudited Combined Pro-Forma Condensed

Balance Sheet As of December 31, 2014

U.S. dollars in thousands

| | |

Rosetta

Genomics (A) | | |

CynoGen (B) | | |

Pro-forma

Adjustments | | |

Pro-forma combined | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 7,929 | | |

$ | - | | |

$ | (2,000) | | C |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 5,929 | |

| Restricted Cash | |

| 52 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 52 | |

| Short-term bank deposits | |

| 7,650 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,650 | |

| Trade receivables | |

| 338 | | |

| 3,718 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,056 | |

| Other accounts receivable and prepaid expenses | |

| 483 | | |

| 164 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 647 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total current assets | |

| 16,452 | | |

| 3,882 | | |

| (2,000) | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 18,334 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Long Term receivables | |

| 4 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4 | |

| Property and equipment, net | |

| 822 | | |

| 2,751 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,573 | |

| Other assets | |

| - | | |

| 25 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 25 | |

| Intangible assets, net | |

| - | | |

| 937 | | |

| (937) | | D |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total long-term assets | |

| 826 | | |

| 3,713 | | |

| (937) | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,602 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

$ | 17,278 | | |

$ | 7,595 | | |

$ | (2,937) | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 21,936 | |

| | |

Rosetta

Genomics (A) | | |

CynoGen (B) | | |

Pro-forma

Adjustments | | |

Pro-forma combined | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| CURRENT LIABILITIES: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Trade payables | |

$ | 563 | | |

$ | 1,073 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 1,636 | |

| Other accounts payables and accruals | |

| 1,648 | | |

| 824 | | |

| 376 | | F |

| 1,000 | | E |

| - | | |

| - | | |

| - | | |

| 3,848 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total current liabilities | |

$ | 2,211 | | |

$ | 1,897 | | |

$ | 376 | | |

$ | 1,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 5,484 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Warrants related to share purchase agreements | |

| 2 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2 | |

| Other long term liabilities | |

| - | | |

| 19 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 19 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total long-term liabilities | |

| 2 | | |

| 19 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 21 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total liabilities | |

$ | 2,213 | | |

$ | 1,916 | | |

$ | 376 | | |

$ | 1,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 5,505 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total shareholders' equity | |

| 15,065 | | |

| 5,679 | | |

| (376) | | F |

| 1,560 | | G |

| (5,679) | | H |

$ | 1,043 | | I |

| (861) | | |

| 16,431 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total liabilities and shareholders' equity | |

$ | 17,278 | | |

$ | 7,595 | | |

$ | - | | |

$ | 2,560 | | |

$ | (5,679) | | |

$ | 1,043 | | |

$ | (861) | | |

$ | 21,936 | |

Unaudited Combined Pro-Forma Condensed

Statement of Operations for the year ended December 31, 2014

U.S. dollars in thousands

| | |

Rosetta Genomics (J) | | |

CynoGen (K) | | |

Pro forma adjustments | | |

Pro forma combined | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,327 | | |

$ | 6,550 | | |

| - | | |

$ | 7,877 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 1,310 | | |

| 6,382 | | |

| - | | |

| 7,692 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 17 | | |

| 168 | | |

| - | | |

| 185 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

| 1,927 | | |

| - | | |

| - | | |

| 1,927 | |

| Selling, general and administrative | |

| 12,342 | | |

| 8,368 | | |

| - | | |

| 20,710 | |

| Other income | |

| - | | |

| - | | |

| (1,043) | | I |

| (1,043) | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 14,269 | | |

| 8,368 | | |

| (1,043) | | |

| 21,594 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| 14,252 | | |

| 8,200 | | |

| (1,043) | | |

| 21,409 | |

| | |

| | | |

| | | |

| | | |

| | |

| Financial expenses, net | |

| 259 | | |

| 6 | | |

| - | | |

| 265 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before taxes on income | |

| 14,511 | | |

| 8,206 | | |

| (1,043) | | |

| 21,674 | |

| | |

| | | |

| | | |

| | | |

| | |

| Tax expenses | |

| 15 | | |

| - | | |

| - | | |

| 15 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | 14,526 | | |

$ | 8,206 | | |

$ | (1,043) | | |

$ | 21,689 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per Ordinary Share from continuing operations | |

$ | 1.29 | | |

| | | |

| | | |

$ | 1.85 | |

| Weighted average number of Ordinary Shares used to compute basic and diluted net loss per Ordinary Share | |

| 11,239,892 | | |

| | | |

| 500,000 | | L |

| 11,739,892 | |

| A. | Rosetta Genomics audited consolidated balance sheet as

of December 31, 2014 |

| B. | The audited balance sheet of CynoGen as of December

31, 2014 |

| C. | To record the cash paid for the acquisition |

| D. | To record the elimination of CynoGen intangible assets,

net, based on the termination of a license agreement immediately on April 13, 2015 (the "Closing date"). |

| E. | To reflect the commitment to provide support services

at cost as part of the acquisition agreement |

| F. | To record the costs associated with the acquisition |

| G. | To record the effect of the acquisition on shareholder's

equity |

| H. | To record elimination of CynoGen equity |

| I. | To record the adjustment of a gain from bargain purchase |

| Purchase price: | |

| |

| Cash | |

$ | 2,000 | |

| Issuance of shares | |

| 1,560 | |

| Support services at cost | |

| 1,000 | |

| | |

| 4,560 | |

| | |

| | |

| Net book value as of April 13, 2015 (the “Closing date”) | |

| 5,603 | |

| | |

| | |

| Gain from a bargain purchase | |

$ | (1,043 | ) |

The

gain from a bargain purchase represents the amount in which the acquisition date fair value of the identifiable assets acquired

and liabilities assumed exceeds the consideration transferred. The fair value was determined by management based on initial

valuation. The final valuation may be different than currently presented.

| J. | Reflects Rosetta Genomics' consolidated statement

of operations for the year ended December 31, 2014 |

| K. | Reflects CynoGen statement of operations for the year

ended December 31, 2014 |

| L. | To reflect the issuance of shares as part of the acquisition. |

Exhibit 99.2

INDEX TO FINANCIAL STATEMENTS

Report of Independent Auditors

To The Management of Abbott Laboratories

We have audited the accompanying financial

statements of CynoGen, Inc., a subsidiary of Abbott Laboratories, which comprise the balance sheets as of December 31, 2014 and

2013, and the related statements of operations, changes in parent company investment in CynoGen, and cash flows for the years then

ended, and the related notes to the financial statements.

Management’s Responsibility for

the Financial Statements

Management is responsible for the preparation

and fair presentation of these financial statements in conformity with U.S. general accepted accounting principles; this includes

the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements

that are free of material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion

on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted

in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement.

An audit involves performing procedures

to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s

judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error.

In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation

of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose

of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion.

An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements

referred to above present fairly, in all material respects, the financial position of CynoGen, Inc. at December 31, 2014 and 2013,

and the results of its operations and its cash flows for the years then ended in conformity with U.S. generally accepted accounting

principles.

Emphasis of a Matter

As described in Note 1, the accompanying

financial statements have been derived from the consolidated financial statements and accounting records of Abbott Laboratories.

The financial statements also include expense allocations for certain corporate functions historically provided by Abbott Laboratories.

These allocations may not be reflective of the actual expense which would have been incurred had CynoGen, Inc. operated as a separate

entity apart from Abbott Laboratories.

/s/ Ernst & Young LLP

Chicago, Illinois

June 29, 2015

CynoGen, Inc.

Statements of Operations

(in thousands)

| | |

Year Ended December 31 | |

| | |

2014 | | |

2013 | |

| Net Sales | |

$ | 6,550 | | |

$ | 1,652 | |

| Cost of services provided | |

| 6,382 | | |

| 3,447 | |

| Selling, general and administrative | |

| 8,368 | | |

| 5,767 | |

| Total Operating Cost and Expenses | |

| 14,750 | | |

| 9,214 | |

| Operating (Loss) | |

| (8,200 | ) | |

| (7,562 | ) |

| Interest expense | |

| 6 | | |

| 7 | |

| Other (income) expense, net | |

| — | | |

| 1 | |

| (Loss) Before Taxes | |

| (8,206 | ) | |

| (7,570 | ) |

| Tax Benefit | |

| — | | |

| — | |

| Net Loss and Comprehensive Loss | |

$ | (8,206 | ) | |

$ | (7,570 | ) |

The accompanying notes to the financial statements

are an integral part of this statement.

CynoGen, Inc.

Balance Sheets

(in thousands)

| | |

December 31 | |

| | |

2014 | | |

2013 | |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Trade receivables, less allowances of—2014: $1,100; 2013: $2,500 | |

$ | 3,718 | | |

$ | 726 | |

| Prepaid expenses and other current assets | |

| 164 | | |

| 68 | |

| Total Current Assets | |

| 3,882 | | |

| 794 | |

| Property and Equipment, at Cost: | |

| | | |

| | |

| Leasehold improvements | |

| 631 | | |

| 1,357 | |

| Equipment | |

| 3,098 | | |

| 2,190 | |

| | |

| 3,729 | | |

| 3,547 | |

| Less: accumulated depreciation | |

| (978 | ) | |

| (1,773 | ) |

| Net Property and Equipment | |

| 2,751 | | |

| 1,774 | |

| Intangible assets, net of amortization | |

| 937 | | |

| — | |

| Other assets | |

| 25 | | |

| 25 | |

| Total Assets | |

$ | 7,595 | | |

$ | 2,593 | |

| Liabilities and Net Parent Company Investment in CynoGen | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Trade accounts payable | |

$ | 1,073 | | |

$ | 651 | |

| Salaries, wages, and commissions | |

| 651 | | |

| 220 | |

| Other accrued liabilities | |

| 173 | | |

| 79 | |

| Total Current Liabilities | |

| 1,897 | | |

| 950 | |

| Long-term Liabilities | |

| 19 | | |

| — | |

| Commitments and Contingencies | |

| | | |

| | |

| Common stock, 1,000 shares authorized, issued, and outstanding, no par value | |

| — | | |

| — | |

| Net parent company investment in CynoGen | |

| 5,679 | | |

| 1,643 | |

| Total Net Parent Company Investment in CynoGen | |

| 5,679 | | |

| 1,643 | |

| Total Liabilities and Net Parent Company Investment in CynoGen | |

$ | 7,595 | | |

$ | 2,593 | |

The accompanying notes to the financial statements

are an integral part of this statement.

CynoGen, Inc.

Statements of Changes in Parent Company Investment

in CynoGen

(in thousands)

| | |

2014 | | |

2013 | |

| Beginning balance | |

$ | 1,643 | | |

$ | 1,687 | |

| Net loss | |

| (8,206 | ) | |

| (7,570 | ) |

| Net transactions with Abbott Laboratories | |

| 12,242 | | |

| 7,526 | |

| Ending balance | |

$ | 5,679 | | |

$ | 1,643 | |

The accompanying notes to the financial statements

are an integral part of this statement.

CynoGen, Inc.

Statements of Cash Flows

(in thousands)

| | |

Year Ended December 31 | |

| | |

2014 | | |

2013 | |

| Cash Flow (Used in) Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (8,206 | ) | |

$ | (7,570 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities— | |

| | | |

| | |

| Depreciation | |

| 558 | | |

| 571 | |

| Amortization of intangible assets | |

| 63 | | |

| — | |

| Share-based compensation | |

| 112 | | |

| 131 | |

| Trade receivables | |

| (2,992 | ) | |

| (267 | ) |

| Prepaid expenses and other assets | |

| (96 | ) | |

| (76 | ) |

| Trade accounts payable and other liabilities | |

| 971 | | |

| 532 | |

| Net Cash (Used In) Operating Activities | |

| (9,590 | ) | |

| (6,679 | ) |

| | |

| | | |

| | |

| Cash Flow (Used in) Investing Activities: | |

| | | |

| | |

| Acquisitions of property and equipment | |

| (1,540 | ) | |

| (716 | ) |

| Acquisition of intangible assets | |

| (1,000 | ) | |

| — | |

| Net Cash (Used in) Investing Activities | |

| (2,540 | ) | |

| (716 | ) |

| | |

| | | |

| | |

| Cash Flow Provided by Financing Activities: | |

| | | |

| | |

| Net cash inflows from transactions with Abbott Laboratories | |

| 12,130 | | |

| 7,395 | |

| Net Cash Provided by Financing Activities | |

| 12,130 | | |

| 7,395 | |

| | |

| | | |

| | |

| Net

Increase (Decrease) in Cash and Cash Equivalents | |

$ | — | | |

$ | — | |

The accompanying notes to the financial statements

are an integral part of this statement.

CynoGen, Inc.

Notes to the Financial Statements

Note 1—Basis of Presentation

On April 13, 2015, Abbott Molecular, Inc., a

subsidiary of Abbott Laboratories (Abbott) entered into a Stock Purchase Agreement (the Agreement) with Minuet Diagnostics, Inc.

(Minuet), a subsidiary of Prelude Corporation (Prelude) whereby Abbott sold its wholly-owned subsidiary, CynoGen, Inc. (“CynoGen”

or the “Company”), for $1 million. Prelude subsequently sold the Company to Rosetta Genomics, Ltd., who will combine

its business with that of the Company.

The principal business of CynoGen is the performance

of laboratory tests. All of CynoGen’s services are provided in the United States, and its services are primarily marketed

to physician groups, hospitals, and other health care providers. CynoGen’s services are primarily billed to health care insurers,

who reimburse CynoGen based on contractually agreed rates.

The accompanying financial statements have been

prepared on a stand-alone basis and are derived from Abbott’s consolidated financial statements and accounting records. The

financial statements reflect CynoGen’s financial position, results of operations, and cash flows as its business was operated

as part of Abbott for the periods presented, in conformity with U.S. generally accepted accounting principles.

Since its inception, CynoGen has generated significant

losses and CynoGen expects to incur additional losses as it continues to grow its customer base and related revenues. Historically,

its cash needs for operating expenses have been principally met by proceeds from Abbott through the date of the Agreement. Rosetta

Genomics, Ltd. has represented that it has the positive intent and ability to provide all necessary financial support to CynoGen

to ensure that CynoGen will continue as a going concern for at least one year after the date of these financial statements. The

accompanying financial statements have been prepared under the presumption that CynoGen would continue as a going concern.

The financial statements include the allocation

of certain assets and liabilities that have historically been maintained at the Abbott corporate level but which are specifically

identifiable or allocable to CynoGen. Cash, cash equivalents, and short-term investment securities held by Abbott were excluded

from CynoGen’s financial statements. Per the terms of the Agreement between Abbott and Minuet, no cash was transferred. All

intercompany transactions between CynoGen and Abbott are considered to be effectively settled in the accompanying financial statements

at the time the transaction is recorded. The total net effect of the settlement of these intercompany transactions is reflected

in the Statement of Cash Flows as a financing activity and in the balance sheet as Net parent company investment in CynoGen.

CynoGen’s financial statements include

an allocation of expenses related to certain Abbott corporate functions, including senior management, legal, human resources, finance,

and information technology. These expenses have been allocated to CynoGen based on direct usage or benefit where identifiable,

with the remainder allocated on a pro rata basis of revenues, headcount, number of transactions or other reasonable measures. CynoGen

considers the expense allocation methodology and results to be reasonable for all periods presented. However, the allocations may

not be indicative of the actual expense that would have been incurred had CynoGen operated as an independent company for the periods

presented.

Abbott maintains various benefit and stock-based

compensation plans at a corporate level and other benefit plans for its United States-based employees. CynoGen employees participate

in those programs and the portion of the cost of those plans which is attributed to CynoGen is included in CynoGen’s financial

statements. However, CynoGen’s balance sheets do not include any equity related to stock-based compensation plans or any

net benefit plan assets or obligations because the plans do not only cover CynoGen employees and CynoGen is not the plan sponsor.

See Note 5 and Note 6 for a further description of the accounting for stock-based compensation and benefit plans.

Note 2—Summary of Significant Accounting Policies

CONCENTRATION OF RISK— CynoGen is reimbursed

by health care insurers and patients for the performance of laboratory tests. At December 31, 2014, Medicare and Blue Cross/Blue

Shield comprised 31% and 26% of outstanding receivables, respectively, and 44% and 21% of revenue recognized for the year ended

December 31, 2014, respectively. At December 31, 2013, Medicare and Blue Cross/Blue Shield comprised 33% and 16% of outstanding

receivables, respectively, and 38% and 14% of revenue recognized for the year ended December 31, 2013, respectively.

CONTINGENCIES AND GUARANTEES— CynoGen

has no material exposures to off-balance sheet arrangements; no special purpose entities; nor activities that include non-exchange-traded

contracts accounted for at fair value. CynoGen has not provided any guarantees of its performance to third parties; however, Abbott

is a guarantor of CynoGen’s obligations under its facility lease. See Note 8 for a further description of CynoGen’s

property lease.

USE OF ESTIMATES—The financial statements

have been prepared in accordance with generally accepted accounting principles in the United States and necessarily include amounts

based on estimates and assumptions by management. Actual results could differ from those amounts. Significant estimates include

the net amount reimbursed by insurance providers, amounts for income taxes, valuation of intangible assets, and accounts receivable

exposures.

REVENUE RECOGNITION—CynoGen recognizes

revenue when persuasive evidence of an arrangement exists, services have been provided, the sales price is fixed or determinable,

and collectability of the sales price is reasonably assured. Billings for services reimbursed by third-party payors are recorded

as revenues net of allowances for differences between amounts billed and the estimated receipts from such payors. Historical data

is readily available and reliable, and is used for estimating the amount of the reduction in gross sales.

In May 2014, the Financial Accounting Standards

Board (FASB) issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, which provides a single

comprehensive model for accounting for revenue from contracts with customers and will supersede most existing revenue recognition

guidance. Early adoption is not permitted. The standard becomes effective for CynoGen in the first quarter of 2018, or 2019 if

the FASB defers the effective date for one year as it has proposed. CynoGen is currently evaluating the effect, if any, that the

standard will have on its financial statements and related disclosures.

INCOME TAXES—In CynoGen’s financial

statements, income tax expense and deferred tax balances have been calculated on a separate tax return basis although CynoGen’s

operations have historically been included in the tax returns filed by Abbott. In the future, CynoGen may file tax returns on its

own behalf and its deferred taxes and effective tax rate may differ from those in the historical periods.

CynoGen does not maintain an income taxes payable

to/from account with Abbott. These settlements are reflected as changes in Net parent company investment in CynoGen. Deferred income

taxes are provided for the tax effect of temporary differences between the tax bases of assets and liabilities and their reported

amounts in the financial statements at the enacted statutory rate expected to be in effect when the taxes are paid. Valuation allowance

is recorded to reduce deferred tax assets to the amount that is more likely than not realizable based on the weight of all positive

and negative evidence.

CynoGen recognizes tax benefits that are more

likely than not based on their technical merits and measures recognized tax benefits at the maximum benefit that is more likely

than not anticipated to be sustained based on the cumulative probability of alternative outcomes.

PENSION AND POST-EMPLOYMENT BENEFITS—Abbott

provides pension and post-employment health care benefits to CynoGen employees. These plans are accounted for as multiemployer

benefit plans and are not reflected in CynoGen’s balance sheets. CynoGen statements of operations include expense allocations

for these benefits. These expenses were funded through intercompany transactions with Abbott which are reflected within Net parent

company investment in CynoGen.

INTANGIBLE ASSETS—Purchased intangible

assets are recorded at fair value at the date of purchase. CynoGen reviews the recoverability of definite-lived intangible assets

each quarter using an undiscounted net cash flow approach.

SHARE-BASED COMPENSATION—Abbott maintains

an incentive stock program for the benefit of its officers, directors, and certain employees, including certain CynoGen employees.

The value of restricted stock awards and units are amortized over their service period, which could be shorter than the vesting

period if an employee is retirement eligible, with a charge to compensation expense.

TRADE RECEIVABLE VALUATIONS—Accounts receivable

are stated at their net realizable value. The allowance against gross trade receivables reflects the best estimate of probable

losses inherent in the receivables portfolio determined on the basis of historical experience, allowances for the differences between

amounts billed and amounts expected to be received, specific allowances for known troubled accounts and other currently available

information. Accounts receivable are charged off after all reasonable means to collect the full amount (including litigation, where

appropriate) have been exhausted.

PROPERTY AND EQUIPMENT—Depreciation is

provided on a straight-line basis over the estimated useful lives of the assets.

Long-lived assets are reviewed for impairment

when events and circumstances indicate that such assets may be impaired and the projected undiscounted net cash flows to be generated

by those assets are less than their carrying amounts. If estimated future undiscounted cash flows are not sufficient to recover

the carrying value of the assets, the assets are adjusted to the lesser of its net book value or fair value. Fair value is determined

based on discounting the estimated future undiscounted cash flows after taking into consideration how a market participant would

utilize the assets. The significant inputs into the fair value calculation are the estimates of cash flows to be generated and

the discount rate utilized to discount the cash flows. As both the cash flow estimates and discount rate utilize significant unobservable

inputs, the fair value measurement under the impairment test would be classified as a Level 3 measurement.

The following table shows estimated useful lives

of property and equipment:

| Classification | |

Estimated Useful Lives |

| Leasehold Improvements | |

lesser of lease term or life of asset |

| Office Equipment | |

7 years |

| Computer Software | |

5 years |

| Computer Equipment | |

5 to 10 years (weighted average 9 years) |

| Laboratory Equipment | |

7 to 10 years (weighted average 8 years) |

Note 3—Supplemental Financial Information

Other accrued liabilities as of December 31,

2014 and December 31, 2013 includes approximately $46 thousand and $43 thousand, respectively, of accrued self-insurance reserves,

$34 thousand and zero of accrued tax withholdings, respectively, $43 thousand and $30 thousand of accrued non-income taxes, and

$18 thousand and $1 thousand, respectively, of deferred rent.

Note 4—Intangible Assets

The gross amount of amortizable intangible assets

was $1 million and zero as of December 31, 2014 and 2013, respectively and the associated accumulated amortization was $63 thousand

and zero as of December 31, 2014 and 2013, respectively. The acquired intangible assets relate to the rights to sell a certain

proprietary laboratory test. The term of the agreement expires on December 31, 2019, and can be renewed by mutual agreement with

the counterparty. In the event that the agreement is not renewed, the rights to commercialize the laboratory test would revert

back to the counterparty and CynoGen would be entitled to receive payments of 25% of 2019 sales in 2020, 20% of 2019 sales in 2021,

and 15% of 2019 sales in 2022.

The estimated annual amortization expense for

intangible assets recorded at December 31, 2014 is approximately $188 thousand per year from 2015 through 2019. Intangible

asset amortization is included in Cost of services provided in the Statement of Operations.

Note 5—Incentive Stock Program

Abbott maintains an incentive stock program

for the benefit of its officers, directors, and certain employees, including certain CynoGen employees. The following disclosures

represent the portion of Abbott’s program in which CynoGen employees participate. All awards granted under the program consist

of Abbott common shares. Accordingly, the amounts presented are not necessarily indicative of future performance and do not necessarily

reflect the results that CynoGen would have experienced as an independent company for the periods presented.

Abbott’s 2009 Incentive Stock Program

authorizes the granting of nonqualified stock options, restricted stock awards, restricted stock units, performance awards, foreign

benefits and other share-based awards. Restricted stock units vest over three years and upon vesting, the recipient receives one

share of Abbott stock for each vested restricted stock unit. The aggregate fair market value of restricted stock units is recognized

as expense over the service period.

With respect to CynoGen employees, the number

of restricted stock units outstanding and the weighted-average grant-date fair value at December 31, 2014 and December 31,

2013 was 4.1 thousand and $36.93 and 6.0 thousand and $31.96, respectively. The number of restricted stock units, and the weighted-average

grant-date fair value, that were granted and vested during 2014 were 3.9 thousand and $39.12, and 2.6 thousand and $30.58, respectively.

The number of restricted stock units and the weighted-average grant date fair value that were cancelled in 2014 was 3.2 thousand

and $35.33, respectively. The fair market value of restricted stock units vested in 2014 and 2013 was $102 thousand and $45 thousand,

respectively. The total unrecognized compensation cost related to restricted stock units was $111 thousand at December 31, 2014,

and will be earned over a weighted-average period of 3 years.

Total non-cash compensation expense charged

against income in 2014 and 2013 for share-based plans was approximately $112 thousand and $131 thousand, respectively.

Note 6—Post-Employment Benefits

CynoGen employees participate in defined benefit

pension and other postretirement plans sponsored by Abbott Laboratories, which include participants of Abbott Laboratories’

other businesses. Such plans are accounted for as multiemployer plans in the accompanying financial statements. As a result, no

asset or liability was recorded by CynoGen to recognize the funded status of these plans. CynoGen recognized expense of $390 thousand

and $453 thousand for the years ended December 31, 2014 and 2013, respectively, for Abbott’s allocation of pension and

other postretirement benefit costs related to CynoGen’s employees. As of December 31, 2014 and 2013, there were no required

contributions outstanding.

Additionally, CynoGen employees participate

in the Abbott Stock Retirement Plan, which is sponsored by Abbott Laboratories and include participants of Abbott Laboratories’

other businesses. CynoGen recognized expense of $199 thousand and $133 thousand for the years ended December 31, 2014 and 2013,

respectively, for Abbott’s allocation of its contributions to this plan on behalf of CynoGen employees.

Note 7—Taxes on Losses

In CynoGen’s financial statements, income

tax benefit and deferred tax balances have been calculated on a separate tax return basis although CynoGen’s operations have

historically been included in the consolidated tax returns filed by Abbott. In the future, CynoGen may file tax returns on its

own behalf and its deferred taxes and effective tax rate may differ from those in the historical periods.

CynoGen does not maintain an income taxes payable

to/from account with Abbott. CynoGen is deemed to settle current tax balances with the Abbott tax paying entities in the respective

jurisdictions. These settlements are reflected as changes in Net parent company investment in CynoGen.

Taxes on losses are based on currently enacted

rates and include interest and penalties for unrecognized tax benefits (if any). Deferred income taxes reflect the tax consequences

on future years of differences between the tax bases of assets and liabilities and their financial reporting amounts.

The losses before taxes were as follows:

| | |

2014 | | |

2013 | |

| | |

(in thousands) | |

| Losses Before Taxes: | |

| | | |

| | |

| Domestic | |

$ | (8,206 | ) | |

$ | (7,570 | ) |

| Foreign | |

| — | | |

| — | |

| Total | |

$ | (8,206 | ) | |

$ | (7,570 | ) |

As a result of the losses before taxes, CynoGen

had no current tax liability and recorded a full valuation allowance against deferred tax assets for the years ending December

31, 2014 and 2013. Accordingly, CynoGen recognized zero tax benefit for the years ending December 31, 2014 and 2013.

Differences between the effective income tax

rate and the U.S. statutory tax rate were as follows:

| | |

2014 | | |

2013 | |

| U.S. statutory tax rate on losses | |

| 35.0 | % | |

| 35.0 | % |

| Valuation Allowance | |

| (37.5 | )% | |

| (37.7 | )% |

| State taxes, net of federal benefit | |

| 2.6 | % | |

| 2.8 | % |

| All other, net | |

| (0.1 | )% | |

| (0.1 | )% |

| Effective tax rate on losses | |

| 0.0 | % | |

| 0.0 | % |

As of December 31, 2014 and 2013, gross

deferred tax assets were $10.0 million and $6.97 million, respectively. There were no material deferred tax liabilities as of December

31, 2014 or 2013. Valuation allowances for recorded gross deferred tax assets reduced the net deferred tax assets to zero as of

December 31, 2014 and 2013. The tax effect of the differences that give rise to deferred tax assets and liabilities were as follows:

| | |

2014 | | |

2013 | |

| | |

(in thousands) | |

| Trade receivable reserves | |

$ | 416 | | |

$ | 952 | |

| Compensation and employee benefits | |

| 149 | | |

| 120 | |

| Depreciation of fixed assets | |

| 12 | | |

| (1 | ) |

| Net Operating Losses | |

| 9,429 | | |

| 5,895 | |

| Other | |

| — | | |

| 1 | |

| Valuation allowance | |

| (10,006 | ) | |

| (6,967 | ) |

| Total | |

$ | — | | |

$ | — | |

CynoGen reviews the likelihood that it will

realize the benefit of its deferred tax assets and, therefore, the need for valuation allowances. In determining the need for,

and amount of, a valuation allowance, the historical and projected financial results of the legal entity, as if it had filed a

separate return, are considered, along with all other positive and negative evidence. If, based upon the weight of the available

evidence, it is more likely than not the deferred tax assets will not be realized, a valuation allowance is recorded to reduce

the deferred tax asset to the net amount that is more likely than not realizable.

CynoGen has no material unrecognized tax benefits.

Note 8 – Lease Commitments

The Company leases its office and laboratory

space. In December 2013, CynoGen entered into a new lease for office and laboratory space for a five year term ending in November

2018. The lease contains two renewal options which allow for the renewal of the lease for an additional three years each. If exercised,

the rental payments for the renewal periods would be equal to the then-existing fair market rental for similar space.

Rental expense for operating leases was $379

thousand and $198 thousand for the years ended December 31, 2014, and December 31, 2013, respectively.

As of December 31, 2014, the future minimum

lease payments for noncancelable operating leases were as follows:

| Years Ended December 31, | |

(in thousands) | |

| 2015 | |

$ | 284 | |

| 2016 | |

| 293 | |

| 2017 | |

| 302 | |

| 2018 | |

| 284 | |

| Thereafter | |

| — | |

| Total minimum payments required | |

$ | 1,163 | |

Abbott has provided a guarantee to the lessor

of CynoGen’s office and laboratory space that would require it to make payments on behalf of CynoGen in the event that CynoGen

did not make its rental payments. This guarantee was discontinued upon the sale of CynoGen to Minuet.

Note 9—Related Party Transactions

Abbott provides CynoGen certain services, which

include administration of treasury, payroll, employee compensation and benefits, travel and meeting services, public and investor

relations, real estate services, internal audit, telecommunications, information technology, corporate income tax and selected

legal services. Some of these services will be provided to CynoGen on a temporary basis after the divestiture. The financial information

in these financial statements does not necessarily include all the expenses that would have been incurred had CynoGen been a separate,

stand-alone entity. As such, the financial information herein may not necessarily reflect the financial position, results of operations

and cash flows of CynoGen in the future or what they would have been had CynoGen been a separate, stand-alone entity during the

periods presented. Management believes that the methods used to allocate expenses to CynoGen are reasonable. The allocation methods

include relative sales, headcount, number of transactions or other reasonable measures. These allocations totaled $740 thousand

and $458 thousand for the years ended December 31, 2014, and 2013, respectively. These allocations are included in cost of

services provided and selling, general, and administrative expenses on the statement of operations.

In addition, CynoGen purchased from Abbott Molecular

equipment that it utilizes in performing laboratory tests. CynoGen paid $17 thousand and $102 thousand to Abbott Molecular for

the years ending December 31, 2014 and December 31, 2013, respectively, for this equipment.

Note 10—Subsequent Events

On April 13, 2015, as part of the sale of CynoGen,

Abbott discontinued its guarantee of CynoGen’s performance under the lease of CynoGen’s office and laboratory space.

CynoGen evaluated subsequent events for recognition

or disclosure through June 29, 2015, the date the financial statements were available to be issued.

Exhibit 99.3

Consent of Independent Auditors

We consent to the incorporation by reference

in the Registration Statements on Form F-3 (Nos. 333-163063, 333-171203, 333-172655, 333-177670 and 333-185338) and Form S-8 (Nos.

333-141525, 333-147805, 333-165722 and 333-191072) of Rosetta Genomics Ltd. of our report dated June 29, 2015, with respect to

the financial statements of CynoGen, Inc. for the years ended December 31, 2014 and 2013 (which report expresses an unmodified

opinion and includes an emphasis-of-matter paragraph relating to expense allocations from the consolidated financial statements

and accounting records of Abbott Laboratories) included in this Current Report on Form 6-K dated July 8, 2015, filed with the Securities

and Exchange Commission.

Chicago, Illinois

July 8, 2015

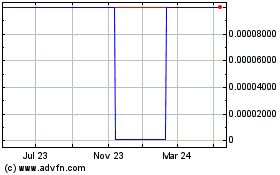

Rosetta Genomics (CE) (USOTC:ROSGQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

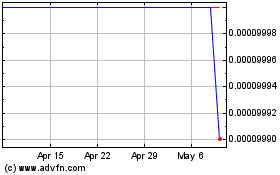

Rosetta Genomics (CE) (USOTC:ROSGQ)

Historical Stock Chart

From Apr 2023 to Apr 2024