UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): July 1, 2015

PERVASIP CORP.

(Exact name of registrant as specified in its

charter)

| New York |

000-04465 |

13-2511270 |

|

(State or other

jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

430 North Street

White Plains, NY 10605

(Address of principal

executive offices)

(914)

750-9339

(Registrant’s telephone

number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13-4(e) under the Exchange Act (17 CFR 240.13e-4(c))21723200

SECTION 1 REGISTRANT’S

BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

Item 2.01 Completion of Acquisition or Disposition of Assets.

Item 3.02 Unregistered Sales of Equity

Securities.

Item 5.01 Changes in Control of Registrant.

On July 1, 2015,

Pervasip Corp. (the “Company”) executed and closed under a securities purchase agreement with Flux Carbon Corporation

(the “Buyer”), pursuant to which the Company acquired from Buyer 100% of the issued and outstanding equity of Plaid

Canary Corporation, a Delaware corporation (“PCC”), in consideration of the issuance by the Company of 500,000 shares

of Series H preferred stock, par value $0.00001 (the “Series H Preferred Stock”) of the Company.

PCC and the Company

then signed a merger agreement, pursuant to which the Company will be merged into PCC on a one (1) to one (1) basis. Among other

things, the merger agreement calls for each share of Series H Preferred Stock issued and outstanding immediately prior to the merger

to be converted on a one (1) to one (1) basis into one (1) validly issued, fully paid and nonassessable share of PCC Series A Preferred

Stock, which will have the same features as the Series H Preferred Stock. The merger also calls for each share of the Company’s

Common Stock issued and outstanding immediately prior to the merger to be converted on a one (1) to one (1) basis, or into one

(1) validly issued, fully paid and nonassessable share of PCC Common Stock. Upon the completion of the merger, each share of Company

Common Stock and Preferred Stock shall no longer be outstanding and shall automatically be canceled and cease to exist, and each

holder of a certificate representing any share of Company Common Stock and Preferred Stock shall cease to have any rights with

respect thereto other than the right to receive, as the case may be, PCC Common Stock or Preferred Stock to be issued in exchange

therefor upon the surrender of such certificate, properly endorsed to PCC.

For all the terms

and conditions of the securities purchase agreement and merger agreement (the “Agreements”) described above, reference

is hereby made to the Agreements annexed hereto as Exhibit 10.1 and Exhibit 10.2. All statements made herein concerning the foregoing

Agreements are qualified by reference to said exhibits. The Agreements additionally provide for the cancellation of all shares

of Company preferred stock except for shares of the Company’s Series H Preferred Stock, and the completion by the Company

of the appropriate filings to give effect to the merger as described above. The merger can be expected to become effective after

the later of (a) twenty days after the mailing of the relevant Information Statement, which the Company expects to file during

July 2015, and (b) notice from FINRA that the merger will be announced on the Daily List published by FINRA.

The aforementioned

sale of securities was effected in reliance on an exemption from the registration requirements of the Securities Act of 1933, as

amended (the “Act”) for the private placement of securities pursuant to Section 4(2) of the Act on the basis that their

issuance did not involve a public offering, and no underwriting fees or commissions were paid by the Company in connection with

such sale.

SECTION 8 OTHER EVENTS

Item 8.01 Other Events.

On July 2, 2015 the

Company issued a press release announcing the purchase agreement, a copy of which is attached hereto as Exhibit 99.1. The Company

additionally issued a press release on July 8, 2015, a copy of which is attached hereto as Exhibit 99.2.

SECTION 9 FINANCIAL STATEMENT AND

EXHIBITS

Item 9.01 Financial Statements

and Exhibits.

(c) Exhibits.

| 10.1 | Securities Purchase Agreement dated July 1, 2015 by and among Flux Carbon Corporation and Pervasip Corp. |

| 10.2 | Agreement and Plan of Merger dated July 1, 2015 between Plaid Canary Corporation and Pervasip Corp. |

| 99.1 | Press release of Pervasip Corp. dated July 2, 2015. |

| 99.2 | Press release of Pervasip Corp. dated July 8, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

PERVASIP CORP. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: July 8, 2015 |

|

By: |

/s/ Paul H. Riss |

|

| |

|

|

|

Name: Paul H. Riss |

|

| |

|

|

|

Title: Chief Executive Officer |

|

EX 10.1

SECURITIES PURCHASE AGREEMENT

THIS SECURITIES

PURCHASE AGREEMENT (this “Agreement”), is made effective as of JULY 1, 2015 (the “Effective

Date”), by and among FLUX CARBON CORPORATION (“Buyer”) and PERVASIP CORP. (“Company”).

WITNESSETH

WHEREAS, the

Company and the Buyer are executing and delivering this Agreement in reliance upon an exemption from securities registration pursuant

to Section 4(2), Rule 506 of Regulation D (“Regulation D”), as promulgated by the U.S. Securities and Exchange

Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”);

WHEREAS, the

parties desire that, upon the terms and subject to the conditions contained herein, the Company shall issue and sell to the Buyer,

as provided herein, and the Buyer shall purchase the Securities (see definition below).

NOW, THEREFORE,

in consideration of the mutual covenants and other agreements contained in this Agreement the Company and the Buyer hereby agree

as follows:

1.

PURCHASE AND SALE OF SECURITIES

(a)

The Securities. Subject to the terms and conditions set forth in this Agreement, the Buyer shall purchase from the

Company and the Company shall issue to the Buyer 500,000 shares of the Company’s Series H Preferred Stock,

par value $0.00001 (the “Preferred Stock” and together with the Common Stock, the “Securities”) which are

convertible into shares of the Company’s Common Stock (the “Conversion Shares”).

(b)

The Purchase Price. Buyer shall purchase the Securities in exchange for 10,000,000 shares of PLAID CANARY

CORPORATION (“PCC”) common stock, representing 100% of the issued and outstanding capital stock of PCC

(the “Purchase Price”).

(c)

The Closing. The Closing of the purchase and sale of the Securities shall take place at 9:00 a.m. Eastern Standard

Time on the second (2nd) business day following the date hereof, subject to notification of satisfaction of the conditions

to the Closing set forth herein and in Sections 6 and 7 below (or such later date as is mutually agreed to by the Company and the

Buyer) (the “Closing Date”).

2.

BUYER’S REPRESENTATIONS AND WARRANTIES

Buyer represents

and warrants that:

(a)

Investment Purpose. Buyer is acquiring the Securities and, upon conversion of Preferred Stock, the Buyer will acquire

the Conversion Shares then issuable, for its own account for investment only and not with a view towards, or for resale in connection

with, the public sale or distribution thereof, except pursuant to sales registered or exempted under the Securities Act; provided,

however, that by making the representations herein, such Buyer reserves the right to dispose of the Common Stock and the Conversion

Shares at any time in accordance with or pursuant to an effective registration statement covering such Conversion Shares or an

available exemption under the Securities Act.

(b)

Accredited Investor Status. Buyer is an “Accredited Investor” as that term is defined in Rule

501(a)(3) of Regulation D.

(c)

Information. Buyer and its advisors (and his or, its counsel), if any, have been furnished with all materials relating

to the business, finances and operations of the Company and information he deemed material to making an informed investment decision

regarding his purchase of the Securities and the Conversion Shares, which have been requested by Buyer. Buyer and its advisors,

if any, have been afforded the opportunity to ask questions of the Company and its management. Neither such inquiries nor any other

due diligence investigations conducted by Buyer or its advisors, if any, or its representatives shall modify, amend or affect Buyer’s

right to rely on the Company’s representations and warranties contained in Section 3 below. Buyer understands that its investment

in the Securities and the Conversion Shares involves a high degree of risk. Buyer is in a position regarding the Company, which,

based upon employment, family relationship or economic bargaining power, enabled and enables Buyer to obtain information from the

Company in order to evaluate the merits and risks of this investment. Buyer has

sought such accounting, legal and tax

advice, as it has considered necessary to make an informed investment decision with respect to its acquisition of the Securities

and the Conversion Shares.

(d)

Authorization, Enforcement. This Agreement has been duly and validly authorized, executed and delivered on behalf

of such Buyer and is a valid and binding agreement of Buyer enforceable in accordance with its terms, except as such enforceability

may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and

other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(e)

Due Formation of Corporate and Other Buyer. Buyer has been formed and validly exists and has not been organized for

the specific purpose of purchasing the Securities and is not prohibited from doing so.

3.

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company represents

and warrants to the Buyer that, except as set forth in the SEC Documents (as defined herein):

(a)

Organization and Qualification. The Company and its Active Subsidiaries are corporations duly organized and validly

existing in good standing under the laws of the jurisdiction in which they are incorporated, and have the requisite corporate power

to own their properties and to carry on their business as now being conducted. Each of the Company and its Active Subsidiaries

is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which the nature of

the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be

in good standing would not have a material adverse effect on the Company and its Active Subsidiaries taken as a whole.

(b)

Authorization, Enforcement, Compliance with Other Instruments. (i) The Company has the requisite corporate power

and authority to enter into and perform this Agreement and the other Transaction Documents and to issue the Securities and the

Conversion Shares in accordance with the terms hereof and thereof, (ii) the execution and delivery of the Transaction Documents

by the Company and the consummation by it of the transactions contemplated hereby and thereby, including, without limitation, the

issuance of the Securities the Conversion Shares and the reservation for issuance and the issuance of the Conversion Shares issuable

upon conversion or exercise thereof, have been duly authorized by the Company’s Board of Directors and no further consent

or authorization is required by the Company, its Board of Directors or its stockholders, (iii) the Transaction Documents have been

duly executed and delivered by the Company, (iv) the Transaction Documents constitute the valid and binding obligations of the

Company enforceable against the Company in accordance with their terms, except as such enforceability may be limited by general

principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to,

or affecting generally, the enforcement of creditors’ rights and remedies.

(c)

Capitalization. The authorized capital stock of the Company consists of 8,978,999,990 shares of Common Stock,

par value $0.00001 per share, of which about 4,702,630,209 shares of Common Stock are issued and outstanding as of the date

hereof. All of such outstanding shares have been validly issued and are fully paid and nonassessable. Except as disclosed in the

SEC Documents, no shares of Common Stock are subject to preemptive rights or any other similar rights or any liens or encumbrances

suffered or permitted by the Company. Except as disclosed in the SEC Documents, as of the date of this Agreement, (i) there are

no outstanding options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating either

to or rights convertible into any shares of capital stock of the Company or any of its subsidiaries, or contracts, commitments,

understandings or arrangements by which the Company or any of its subsidiaries is or may become bound to issue additional shares

of capital stock of the Company or any of its subsidiaries or options, warrants, scrip, rights to subscribe to, calls or commitments

of any character whatsoever relating to, or securities or rights convertible into, any shares of capital stock of the Company or

any of its subsidiaries, (ii) there are no agreements or arrangements under which the Company or any of its subsidiaries is obligated

to register the sale of any of their securities under the Securities Act (except pursuant to an S-8 Registration Statement) and

(iii) there are no outstanding registration statements (except for an S-8 Registration Statement and there are no outstanding comment

letters from the SEC or any other regulatory agency. There are no securities or

instruments containing anti-dilution

or similar provisions that will be triggered by the issuance of the Securities as described in this Agreement. The Company has

furnished to the Buyer true and correct copies of the Company’s Articles of Incorporation, as amended and as in effect on

the date hereof (the “Articles of Incorporation”), and the Company’s By-laws, as in effect on the date

hereof (the “By-laws”), and the terms of all securities convertible into or exercisable for Common Stock and

the material rights of the holders thereof in respect thereto other than stock options issued to employees and consultants.

(d)

Issuance of Securities. The Securities are duly authorized and, upon issuance in accordance with the terms hereof,

shall be duly issued, fully paid and nonassessable, are free from all taxes, liens and charges with respect to the issue thereof.

The Conversion Shares issuable upon conversion of the Securities have been duly authorized and reserved for issuance. Upon conversion

or exercise in accordance with the Securities the Conversion Shares will be duly issued, fully paid and nonassessable.

(e)

No Conflicts. Except as disclosed in the SEC Documents, the execution, delivery and performance of the Transaction

Documents by the Company and the consummation by the Company of the transactions contemplated hereby will not (i) result in a violation

of the Certificate of Incorporation, any certificate of designations of any outstanding series of preferred stock of the Company

or the By-laws or (ii) conflict with or constitute a default (or an event which with notice or lapse of time or both would become

a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture

or instrument to which the Company or any of its subsidiaries is a party, or result in a violation of any law, rule, regulation,

order, judgment or decree (including federal and state securities laws and regulations and the rules and regulations of The National

Association of Securities Dealers Inc.’s OTC Bulletin Board on which the Common Stock is quoted) applicable to the Company

or any of its subsidiaries or by which any property or asset of the Company or any of its subsidiaries is bound or affected. Except

as disclosed in the SEC Documents, neither the Company nor its subsidiaries is in violation of any term of or in default under

its Articles of Incorporation or By-laws or their organizational charter or by-laws, respectively, or any material contract, agreement,

mortgage, indebtedness, indenture, instrument, judgment, decree or order or any statute, rule or regulation applicable to the Company

or its subsidiaries. The business of the Company and its subsidiaries is not being conducted, and shall not be conducted in violation

of any material law, ordinance, or regulation of any governmental entity. Except as specifically contemplated by this Agreement

and as required under the Securities Act and any applicable state securities laws, the Company is not required to obtain any consent,

authorization or order of, or make any filing or registration with, any court or governmental agency in order for it to execute,

deliver or perform any of its obligations under or contemplated by this Agreement in accordance with the terms hereof or thereof.

Except as disclosed in the SEC Documents, all consents, authorizations, orders, filings and registrations which the Company is

required to obtain pursuant to the preceding sentence have been obtained or effected on or prior to the date hereof. The Company

and its subsidiaries are unaware of any facts or circumstance, which might give rise to any of the foregoing.

(f)

SEC Documents: Financial Statements. The Company shall file all reports, schedules, forms, statements and other

documents required to be filed by it with the SEC under of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) (all of the foregoing filed prior to the date hereof or amended after the date hereof and all exhibits included

therein and financial statements and schedules thereto and documents incorporated by reference therein, being hereinafter referred

to as the “SEC Documents”). The Company has delivered to the Buyer or their representatives, or made available

through the SEC’s website at http://www.sec.gov, true and complete copies of the

SEC Documents. As of their respective dates, the financial statements of the Company disclosed in the SEC Documents (the “Financial

Statements”) complied as to form in all material respects with applicable accounting requirements and the published

rules and regulations of the SEC with respect thereto. Such financial statements have been prepared in accordance with generally

accepted accounting principles, consistently applied, during the periods involved (except (i) as may be otherwise indicated in

such Financial Statements or the notes thereto, or (ii) in the case of unaudited interim statements, to the extent they may exclude

footnotes or may be condensed or summary statements) and, fairly present in all material respects the financial position of the

Company as of the dates thereof and the results of its operations and cash flows for the periods then ended (subject, in the case

of unaudited statements, to normal year-end audit adjustments). No other information provided by or on behalf of the Company to

the Buyer which is not included in the SEC Documents, including, without limitation, information referred to in this Agreement,

contains any untrue

statement of a material fact or omits

to state any material fact necessary in order to make the statements therein, in the light of the circumstances under which they

were made, not misleading.

(g)

10(b)-5. The SEC Documents do not include any untrue statements of material fact, nor do they omit to state any material

fact required to be stated therein necessary to make the statements made, in light of the circumstances under which they were made,

not misleading.

(h)

Absence of Litigation. Except as disclosed in the SEC Documents, there is no action, suit, proceeding, inquiry or

investigation before or by any court, public board, government agency, self-regulatory organization or body pending against or

affecting the Company, the Common Stock or any of the Company’s subsidiaries, wherein an unfavorable decision, ruling or

finding would (i) have a material adverse effect on the transactions contemplated hereby (ii) adversely affect the validity or

enforceability of, or the authority or ability of the Company to perform its obligations under, this Agreement or any of the documents

contemplated herein, or (iii) except as expressly disclosed in the SEC Documents, have a material adverse effect on the business,

operations, properties, financial condition or results of operations of the Company and its subsidiaries taken as a whole.

(i)

Acknowledgment Regarding Buyer’s Purchase of the Securities. The Company acknowledges and agrees that the Buyer

is acting solely in the capacity of an arm’s length purchaser with respect to this Agreement and the transactions contemplated

hereby. The Company further acknowledges that the Buyer is not acting as a financial advisor or fiduciary of the Company (or in

any similar capacity) with respect to this Agreement and the transactions contemplated hereby and any advice given by the Buyer

or any of their respective representatives or agents in connection with this Agreement and the transactions contemplated hereby

is merely incidental to such Buyer’s purchase of the Securities or the Conversion Shares. The Company further represents

to the Buyer that the Company’s decision to enter into this Agreement has been based solely on the independent evaluation

by the Company and its representatives.

(j)

No General Solicitation. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf,

has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D under the Securities

Act) in connection with the offer or sale of the Securities or the Conversion Shares.

(k)

No Integrated Offering. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf

has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances

that would require registration of the Securities or the Conversion Shares under the Securities Act or cause this offering of the

Securities or the Conversion Shares to be integrated with prior offerings by the Company for purposes of the Securities Act.

(l)

Internal Accounting Controls. Except as set forth in the SEC Documents, the Company and each of its subsidiaries

maintain a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed

in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit

preparation of financial statements in conformity with generally accepted accounting principles and to maintain asset accountability,

and (iii) the recorded amounts for assets is compared with the existing assets at reasonable intervals and appropriate action is

taken with respect to any differences.

(m)

No Material Adverse Breaches, etc. Except as set forth in the SEC Documents, neither the Company nor any of its subsidiaries

is subject to any charter, corporate or other legal restriction, or any judgment, decree, order, rule or regulation which in the

judgment of the Company’s officers has or is expected in the future to have a material adverse effect on the business, properties,

operations, financial condition, results of operations or prospects of the Company or its subsidiaries. Except as set forth in

the SEC Documents, neither the Company nor any of its subsidiaries is in breach of any contract or agreement which breach, in the

judgment of the Company’s officers, has or is expected to have a material adverse effect on the business, properties, operations,

financial condition, results of operations or prospects of the Company or its subsidiaries.

(n)

Tax Status. Except as set forth in the SEC Documents, the Company and each of its subsidiaries has made and filed

all federal and state income and all other tax returns, reports and declarations required by any jurisdiction to which it is subject

and (unless and only to the extent that the Company and each of its subsidiaries has set aside on its books provisions reasonably

adequate for the

payment of all unpaid and unreported

taxes) has paid all taxes and other governmental assessments and charges that are material in amount, shown or determined to be

due on such returns, reports and declarations, except those being contested in good faith and has set aside on its books provision

reasonably adequate for the payment of all taxes for periods subsequent to the periods to which such returns, reports or declarations

apply. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the

officers of the Company know of no basis for any such claim.

(o)

Certain Transactions. Except as set forth in the SEC Documents, and except for arm’s length transactions pursuant

to which the Company makes payments in the ordinary course of business upon terms no less favorable than the Company could obtain

from third parties and other than the grant of stock options disclosed in the SEC Documents, none of the officers, directors, or

employees of the Company is presently a party to any transaction with the Company (other than for services as employees, officers

and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing

for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee

or, to the knowledge of the Company, any corporation, partnership, trust or other entity in which any officer, director, or any

such employee has a substantial interest or is an officer, director, trustee or partner.

4.

COVENANTS

(a)

Reporting Status. Until the earlier of (i) the date as of which the Buyer may sell all of the Conversion Shares without

restriction pursuant to Rule 144(k) promulgated under the Securities Act (or successor thereto), or (ii) the date on which (A)

the Buyer shall have sold all the Conversion Shares and (B) none of the Securities are outstanding (the “Registration

Period”), the Company shall file in a timely manner all reports required to be filed with the SEC pursuant to the Exchange

Act and the regulations of the SEC thereunder, and the Company shall not terminate its status as an issuer required to file reports

under the Exchange Act even if the Exchange Act or the rules and regulations thereunder would otherwise permit such termination.

(d) Reservation

of Shares. The Company shall issue no shares of Company Common Stock or other class or series of Company capital stock (e.g.,

preferred stock) that is not currently reserved for in the absence of the Buyer’s prior written consent. Notwithstanding

the foregoing, the Company shall take all action reasonably necessary to at all times have authorized, and reserved for the purpose

of issuance, such number of shares of Common Stock as shall be necessary to effect the issuance of all of the Conversion Shares

due to Buyer upon conversion of the Debenture (and any other Company debenture held by Buyer); provided, however, that the Company

shall take no action to increase its authorized shares of Common Stock, or to implement a reverse or forward stock split, or to

otherwise amend the Company’s Articles of Incorporation in respect of any existing or new class of Company capital stock

in the absence of the Buyer’s prior written consent, which shall not be unreasonably withheld.

(b)

Listings or Quotation. The Company shall promptly secure the listing or quotation of the Conversion Shares upon each

national securities exchange, automated quotation system or The National Association of Securities Dealers Inc.’s Over-The-Counter

Marketplace (“OTCQB”) or other market, if any, upon which shares of Common Stock are then listed or quoted (subject

to official notice of issuance) and shall use its best efforts to maintain, so long as any other shares of Common Stock shall be

so listed, such listing of all Conversion Shares from time to time issuable under the terms of this Agreement. The Company shall

maintain the Common Stock’s authorization for quotation on the OTCQB.

(c)

Corporate Existence. So long as any of the Securities remain outstanding, the Company shall not directly or indirectly

consummate any merger, reorganization, restructuring, reverse stock split, consolidation, sale of all or substantially all of the

Company’s assets or any similar transaction or related transactions (each such transaction, an “Organizational Change”)

unless, prior to the consummation an Organizational Change, the Company obtains the written consent of the Buyer, which consent

shall not be unreasonably withheld. In any such case, the Company shall make appropriate provision with respect to Buyer’s

rights and interests to insure that the provisions of the Transaction Documents will thereafter be applicable to the Securities.

(d)

Transfer Agent. The Company covenants and agrees that, in the event that the Company’s agency relationship

with the transfer agent should be terminated for any reason prior to a date

which is two (2) years after the Closing

Date, the Company shall immediately appoint a new transfer agent and shall require that the new transfer agent execute and agree

to be bound by the terms of the Transfer Agent Instructions (as defined herein).

(e)

Further Assurances; Cooperation. The Company shall use its best efforts to cooperate with the Company and to diligently

perform under the Transaction Documents. At and after the Closing, the Company shall execute and deliver such further instruments

of conveyance and transfer as Buyer may reasonably request to convey and transfer effectively to Buyer the Securities and any and

all amounts and shares of Common Stock due and payable thereunder.

(f) Preferred

Shares. All shares of Company preferred stock with the exception of all shares of the Company’s Series H Preferred Stock

shall be surrendered to the Company and cancelled within 30 days of the Closing hereunder.

5.

[INTENTIONALLY OMITTED]

6.

[INTENTIONALLY OMITTED]

7.

INDEMNIFICATION

In consideration of

the Buyer’s execution and delivery of this Agreement and acquiring the Securities and the Conversion Shares hereunder, and

in addition to all of the Company’s other obligations under this Agreement, the Company shall defend, protect, indemnify

and hold harmless the Buyer and each other holder of the Securities and the Conversion Shares, all of their officers, directors,

employees and agents (including, without limitation, those retained in connection with the transactions contemplated by this

Agreement), and any Designee (collectively, the “Buyer Indemnitees”) from and against any and all actions, causes

of action, suits, claims, losses, costs, penalties, fees, liabilities and damages, and expenses in connection therewith (irrespective

of whether any such Buyer Indemnitee is a party to the action for which indemnification hereunder is sought), and including reasonable

attorneys’ fees and disbursements (the “Indemnified Liabilities”), incurred by the Buyer Indemnitees or

any of them as a result of, or arising out of, or relating to (a) any misrepresentation or breach of any representation or warranty

made by the Company in this Agreement, the other Transaction Documents or any other certificate, instrument or document contemplated

hereby or thereby, (b) any breach of any covenant, agreement or obligation of the Company contained in this Agreement, the other

Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby, or (c) any cause of action,

suit or claim brought or made against such Indemnitee and arising out of or resulting from the execution, delivery, performance

or enforcement of this Agreement or any other instrument, document or agreement executed pursuant hereto by any of the Indemnities,

any transaction financed or to be financed in whole or in part, directly or indirectly, with the proceeds of the issuance of the

Securities or the status of the Buyer or holder of the Securities the Conversion Shares, as a Buyer of Securities in the Company.

To the extent that the foregoing undertaking by the Company may be unenforceable for any reason, the Company shall make the maximum

contribution to the payment and satisfaction of each of the Indemnified Liabilities, which is permissible under applicable law.

8.

GOVERNING LAW: MISCELLANEOUS

(a)

Governing Law. This Agreement shall be governed by and interpreted in accordance with the laws of the State of New

Jersey, without regard to the principles of conflict of laws. The Company and the Buyer expressly consent to the jurisdiction and

venue of the Superior Court of New Jersey, Bergen County, for any litigation between the parties.

(b)

Specific Performance. The parties hereto recognize that any breach of the terms this Agreement may give rise to irreparable

harm for which money damages would not be an adequate remedy, and accordingly agree that any non-breaching party shall be entitled

to enforce the terms of this Agreement by a decree of specific performance without the necessity of proving the inadequacy as a

remedy of money damages. If specific performance is elected as a remedy hereunder, such remedy shall be in addition to any other

remedies available at law or equity.

(c)

Counterparts. This Agreement may be executed in two or more identical counterparts, all of which shall be considered

one and the same agreement and shall become effective when counterparts

have been signed by each party and delivered

to the other party. In the event any signature page is delivered by facsimile transmission, the party using such means of delivery

shall cause four (4) additional original executed signature pages to be physically delivered to the other party within five (5)

days of the execution and delivery hereof.

(d)

Headings; Severability. The headings of this Agreement are for convenience of reference and shall not form part of,

or affect the interpretation of, this Agreement. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction,

such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement in that

jurisdiction or the validity or enforceability of any provision of this Agreement in any other jurisdiction.

(e)

Entire Agreement, Amendments. This Agreement supersedes all other prior oral or written agreements between the Buyer,

the Company, their affiliates and persons acting on their behalf with respect to the matters discussed herein, and this Agreement

and the instruments referenced herein contain the entire understanding of the parties with respect to the matters covered herein

and therein and, except as specifically set forth herein or therein, neither the Company nor any Buyer makes any representation,

warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be waived or amended other than

by an instrument in writing signed by the party to be charged with enforcement.

(f)

Notices. Any notices, consents, waivers, or other communications required or permitted to be given under the terms

of this Agreement must be in writing and will be deemed to have been delivered (i) upon receipt, when delivered personally; (ii)

upon confirmation of receipt, when sent by facsimile; (iii) three (3) days after being sent by U.S. certified mail, return receipt

requested, or (iv) one (1) day after deposit with a nationally recognized overnight delivery service, in each case properly addressed

to the party to receive the same. Each party shall provide five (5) days’ prior written notice to the other party of any

change in address or facsimile number.

(g)

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective

successors and assigns. Neither the Company nor any Buyer shall assign this Agreement or any rights or obligations hereunder without

the prior written consent of the other party hereto.

(h)

No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective

permitted successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

(i)

Publicity. The Company shall issue no press release or public disclosure involving the Transaction Documents and/or

the Financing in the absence of the Buyer’s prior written consent.

(j)

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and

things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may

reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions

contemplated hereby.

(k)

Termination. In the event that the Closing shall not have occurred with respect to the Buyer on or before five (5)

business days from the date hereof due to the Company’s failure to satisfy the conditions set forth above (and the non-breaching

party’s failure to waive such unsatisfied condition(s)), the non-breaching party shall have the option to terminate this

Agreement with respect to such breaching party at the close of business on such date without liability of any party to any other

party; provided, however, that if this Agreement is terminated by the Company, the Company shall remain obligated to reimburse

the Buyer for $5,000 in fees and expenses.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

- SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF the parties

have duly executed, or caused their duly authorized representative, to execute this Securities Purchase Agreement.

| |

FLUX CARBON CORPORATION |

| |

|

| |

|

| |

By: /s/ Kevin Kreisler |

| |

Name: Kevin Kreisler |

| |

Title: Chief Executive Officer |

| |

|

| PERVASIP CORP. |

|

| |

|

| |

|

| By: /s/ Paul Riss |

|

| Name: Paul Riss |

|

| Title: Chief Executive Officer |

|

| |

|

EX 10.2

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER,

dated as of JULY 1, 2015 (the "Merger Agreement"), between PERVASIP, CORP., a New York corporation

("PVSP"), and PLAID CANARY CORPORATION, a Delaware corporation and wholly-owned subsidiary of the PVSP

("PCC" and, together with the PVSP, the “Parties”).

WHEREAS, PVSP has authority to

issue 8,978,999,990 shares of common stock, par value $0.00001 per share (the "PVSP Common Stock"), of which 4,702,630,209

shares are issued and outstanding;

WHEREAS, PCC has authority to

issue 10,000,000 shares of Common Stock, par value $0.00001 per share (the "PCC Common Stock"), of which 10,000,000

shares are issued and outstanding;

WHEREAS, the respective boards

of directors of PVSP and PCC have determined that it is advisable and in the best interests of each company that PVSP merge with

and into PCC upon the terms and subject to the conditions set forth herein, and whereby the transaction is intended to qualify

as a tax free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “IRC”),

to the extent permitted by applicable law;

WHEREAS, in

furtherance of such combination, the boards of directors of the Parties have each approved the merger of PVSP with and into PCC

(the “Merger”), upon the terms and subject to the conditions set forth herein, in accordance with the applicable

provisions of the Delaware General Corporation Law (the “DGCL”); and,

WHEREAS, the Parties have obtained

any approvals required under the DGCL for the completion of the Merger as described above and subject to the terms and conditions

hereof.

NOW, THEREFORE, in consideration

of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties

agree as follows:

| 1. | Merger. At the Effective Time (as hereinafter defined) and subject to and upon the terms

and conditions of this Agreement and the DGCL, the Merging shall be merged with and into the PCC. Following the Merger, PCC shall

continue as the surviving corporation (the “Surviving Corporation”) and the separate corporate existence of

PVSP shall cease. As part of the Merger and as more fully described Section 3 below, the issued and outstanding PVSP Common Stock

and PVSP Preferred Stock shall be exchanged for PCC Common Stock at the relevant exchange ratios. The Merger shall be consummated

as promptly as practicable after satisfaction of all conditions to the Merger set forth herein, by filing with the Secretary of

State of the State of Delaware of a certificate of merger or similar document (the “Certificate of Merger”),

and all other appropriate documents, executed in accordance with the relevant provisions of the DGCL. The Merger shall become effective

upon the filing of the Certificate of Merger with the Secretary of the State of the State of Delaware. The time of such filing

shall be referred to herein as the “Effective Time.” |

| 2. | Effects of Merger. At the Effective Time, all the rights, privileges, immunities, powers

and franchises of PVSP and all property, real, personal and mixed, and every other interest of, or belonging to or due to each

of PVSP shall vest in the Surviving Corporation, and all debts, liabilities, obligations and duties of PVSP shall become the debts,

liabilities, obligations and duties of the Surviving Corporation without further act or deed, all in the manner and to the full

extent provided by the DGCL. Whenever a conveyance, assignment, transfer, deed or other instrument or act is necessary to vest

any property or right in the Surviving Corporation, the directors and officers of the respective constituent corporations shall

execute, acknowledge and deliver such instruments and perform such acts, for which purpose the separate existence of the constituent

corporations and the authority of their respective directors and officers shall continue, notwithstanding the Merger. The Certificate

of Incorporation of PCC, as in effect immediately prior to the Effective Time, shall be the Certificate of Incorporation of the

Surviving Corporation and thereafter may be amended or repealed in accordance with its terms and applicable law. The parties intend

that the Merger shall be treated as a tax-free reorganization pursuant to Section 368(a) of the IRC, to the extent permitted by

applicable law. |

| 3. | Capital Stock. As of the Effective Time, by virtue of the Merger and without any action

on the part of any Party or the holders of any shares of the capital stock of PVSP or PCC: |

| a. | Preferred Stock. Each share of PVSP Series H Preferred Stock issued and outstanding immediately

prior to the Effective Time shall be converted on a ONE (1) to ONE (1) basis (the “SH Stock Exchange Ratio”),

or into ONE (1) validly issued, fully paid and nonassessable share of PCC Series A Preferred Stock. As of the Effective Time, each

share of PVSP Series H Preferred Stock shall no longer be outstanding and shall automatically be canceled and cease to exist, and

each holder of a certificate representing any share of PVSP Series H Preferred Stock shall cease to have any rights with respect

thereto other than the right to receive PCC Series A Preferred Stock to be issued in exchange therefor upon the surrender of such

certificate, properly endorsed to PCC. |

| b. | Common Stock. Each share of PVSP Common Stock issued and outstanding immediately prior to

the Effective Time shall be converted on a ONE (1) to ONE (1) basis (the “Common Stock Exchange Ratio”),

or into ONE (1) validly issued, fully paid and nonassessable share of PCC Common Stock. As of the Effective Time, each share of

PVSP Common Stock shall no longer be outstanding and shall automatically be canceled and cease to exist, and each holder of a certificate

representing any share of PVSP Common Stock shall cease to have any rights with respect thereto other than the right to receive

PCC Common Stock to be issued in exchange therefor upon the surrender of such certificate, properly endorsed to PCC. |

| c. | No Fractional Shares. No certificates or scrip representing fractional shares of PCC Common

Stock shall be issued upon the surrender for exchange of certificates and such fractional share shall not entitle the record or

beneficial owner thereof to vote or to any other rights as a stockholder of the Company. Any fractional shares held by a shareholder

of PVSP as a result of the Merger shall be rounded up to one full PCC Common Stock share. |

| d. | Further Assurances. If at any time after the Effective Time the Surviving Corporation shall

consider or be advised that any deeds, bills of sale, assignments or assurances or any other acts or things are necessary, desirable

or proper (a) to vest, perfect or confirm, of record or otherwise, in the Surviving Corporation, its right, title or interest in,

to or under any of the rights, privileges, powers, franchises, properties or assets of PVSP or (b) otherwise to carry out the purposes

of this Agreement, the Surviving Corporation and its proper officers and directors or their designees shall be authorized (to the

fullest extent allowed under applicable law) to execute and deliver, in the name and on behalf of PVSP, all such deeds, bills of

sale, assignments and assurances and do, in the name and on behalf of PVSP, all such other acts and things necessary, desirable

or proper to vest, perfect or confirm its right, title or interest in, to or under any of the rights, privileges, powers, franchises,

properties or assets of PVSP, as applicable, and otherwise to carry out the purposes of this Agreement. |

| 4. | Directors. The directors and the members of the various committees of the Board of the PVSP

immediately prior to the Effective Time shall be the directors and members of such committees of the Surviving Corporation at and

after the Effective Time to serve until the expiration of their respective terms and until their successors are duly elected and

qualified. |

| 5. | Officers. The officers of the PVSP immediately preceding the Effective Time shall resign

upon completion of the Merger without further action. The officers of the Surviving Corporation shall be the officers at and after

the Effective Time until their successors are duly elected and qualified. |

| 6. | Employee Option and Benefit Plans. Each option or other right to purchase or otherwise acquire

shares of Merging evidenced by an option agreement (an "Option") or granted under any employee option, stock purchase

or other benefit plan of the PVSP (collectively, the "Plans") which is outstanding immediately prior to the Effective

Time shall, by virtue of |

the Merger and without any action

on the part of the holder thereof, be converted into and become an option or right to acquire (and the PCC hereby assumes the obligation

to deliver) 1/20th number of shares of Surviving Common Stock, at an exercise price equal to twenty times the exercise

price specified before the Merger, resulting in approximately the same aggregate price being required to be paid thereof upon exercise

as immediately preceding the Merger, and upon the same terms, and subject to the same conditions, as set forth in the respective

Plan as in effect immediately prior to the Effective Time. The same number of shares of Surviving Common Stock shall be reserved

for purposes of the Plans as is equal to the proportional number of shares of Merging so reserved immediately prior to the Effective

Time. The PCC hereby assumes, as of the Effective Time, (i) the Plans and all obligations of the PVSP under the Plans, including

the outstanding options, stock purchase rights or awards or portions thereof granted pursuant to the Plans and the right to grant

additional options and stock purchase rights thereunder, (ii) all obligations of the PVSP under all other benefit plans in effect

as of the Effective Time with respect to which employee rights or accrued benefits are outstanding as of the Effective Time and

(iii) all obligations of the PVSP under any Options.

| 7. | Conditions to the Merger. The consummation of the Merger and the other transactions herein

provided is subject to receipt prior to the Effective Time of the requisite approval of the Merger by the holders of Merging pursuant

to the DGCL. |

| 8. | Certificates. At and after the Effective Time, all of the outstanding certificates which

immediately prior thereto represented shares of Merging Common Stock or other securities of the PVSP shall be deemed for all purposes

to evidence ownership of and to represent the shares of Surviving Common Stock or other securities of the PCC, as the case may

be, into which the shares of Merging or other securities of the PVSP represented by such certificates have been converted as herein

provided and shall be so registered on the books and records of the Surviving Corporation or its transfer agent. The registered

owner of any such outstanding certificate shall, until such certificate shall have been surrendered for transfer or otherwise accounted

for to the Surviving Corporation or its transfer agent, have and be entitled to exercise any voting and other rights with respect

to, and to receive any dividends and other distributions upon, the shares of Surviving Common Stock or other securities of the

PCC, as the case may be, evidenced by such outstanding certificate, as above provided. |

| 9. | Amendment. The parties hereto, by mutual consent of their respective boards of directors,

may amend, modify or supplement this Merger Agreement prior to the Effective Time; provided, however, that no amendment, modification

or supplement may be made after the adoption of this Merger Agreement by the stockholders of the PVSP which changes this Merger

Agreement in a way which, in the judgment of the Board of Directors of the PVSP, would have a material adverse effect on the stockholders

of the PVSP, unless such amendment, modification or supplement is approved by such stockholders. |

| 10. | Termination. This Merger Agreement may be terminated, and the Merger and the other transactions

provided for herein may be abandoned, at any time prior to the Effective Time, whether before or after approval of this Merger

Agreement by the stockholders of the PVSP, by action of the Board of Directors of the PVSP if the Board of Directors of the PVSP

determines for any reason, in its sole judgment and discretion, that the consummation of the merger would be inadvisable or not

in the best interests of the PVSP and its stockholders. |

| 11. | Governing Law. This Merger Agreement shall be governed by and construed in accordance with

the laws of the State of Delaware. |

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

- SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF the parties have duly executed, or caused

their duly authorized representative, to execute this Securities Purchase Agreement.

| |

PLAID CANARY CORPORATION |

| |

|

| |

|

| |

By: /s/ Kevin Kreisler |

| |

Name: Kevin Kreisler |

| |

Title: Chief Executive Officer |

| |

|

| PERVASIP CORP. |

|

| |

|

| |

|

| By: /s/ Paul Riss |

|

| Name: Paul Riss |

|

| Title: Chief Executive Officer |

|

| |

|

Exhibit 99.1

PERVASIP ACQUIRES PLAID CANARY CORPORATION

WHITE PLAINS, N.Y., July 2, 2015

– Pervasip Corp. (USOTC: PVSP) (“Pervasip” or the “Company”) announced today its execution and closing

of agreements to acquire 100% of the issued and outstanding equity of Plaid Canary Corporation (“Canary”), a special

purpose consolidation company focused on acquiring, developing and supporting companies and technologies in emerging agricultural

markets.

Among Canary’s current holdings

is a 60% stake of Grow Big Supply LLC (“Grow Big”), a retail distribution company servicing the hydroponic and indoor

grow facility market in Denver, Colorado. Founded in 2011, Grow Big has established itself as a key partner and supplier to the

grower community, relying on its entrepeneurial, knowledge-based approach as it grew to in excess of $5 million per year in sales.

Grow Big hasn’t lost sight of its roots despite its growth, and its experienced leadership and team continues to be immersed

in the grower community’s culture and needs.

“We are proud and excited to complete

this acquisition,” said Paul Riss, Pervasip’s Chief Executive Officer. “We believe that the opportunities in

this market are simply remarkable. We plan to expand Grow Big’s reach and to establish its Denver footprint as a model for

long-term growth in other regional markets as conditions warrant.”

“We have already begun to work

towards that objective. We have identified additional acquisition and joint venture targets, and we plan to assimilate a portfolio

of technologies, including advanced chemical detection, growth, sterilization, oil extraction and other technologies designed to

improve grow conditions, yields and value. Additional information on our continuing efforts on each front will be provided in the

coming days and weeks as we execute the relevant agreements.”

Pervasip acquired 100% of the equity

of Canary from FLUX Carbon Corporation (“FCC”) in exchange for Pervasip preferred shares corresponding to 50% of Pervasip’s

issued and outstanding equity, bringing FCC’s ownership to about 60% of the Company’s issued and outstanding capital

stock. Importantly, FCC has also agreed to absorb 100% of the dilutive impact of common stock issued by the Company to its secured

debt holders who choose to convert their debt into shares of common stock.

Additional information regarding Pervasip’s

acquisition of Canary will be provided in a new shareholder letter and a Current Report on Form 8K to be filed next week.

About Pervasip Corp.

Pervasip develops and delivers proprietary

products and technologies to emerging markets, with a focus on emerging agricultural markets.

Forward Looking Statements

The information contained herein includes

forward-looking statements. These statements relate to future events or to our future financial performance, and involve

known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or

achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied

by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve

known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could, and likely

will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects

our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating

to our operations, results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise

these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated

in these forward-looking statements, even if new information becomes available in the future.

Additional Information

Pervasip Corp.

Paul H. Riss, CEO

paul@growbigsupply.com

914-750-9339

Exhibit 99.2

PERVASIP TO MERGE WITH PLAID CANARY

CORPORATION

WHITE PLAINS, N.Y., July 8, 2015

– Pervasip Corp. (USOTC: PVSP) (“Pervasip” or the “Company”) announced today its execution of an

agreement to merge with and into the Company’s wholly-owned subsidiary, Plaid Canary Corporation (“Canary”),

a special purpose consolidation company focused on acquiring, developing and supporting companies and technologies in emerging

agricultural markets.

The merger agreement provides for the

Company to merged into Canary on a one to one basis such that each share of Company stock outstanding prior to the merger will

be exchanged for one share of Canary stock after the merger. Canary will be the surviving company of the merger, and its share

structure after the merger will be idential to the Company’s share structure immediately before the merger.

“The merger is an essential part

of our plans as we continue to position ourselves to consolidate strategically-compatible companies and technologies,” said

Paul Riss, Pervasip’s Chief Executive Officer. “We are focused on building value in part by growing our business, refinacning

and eliminating debt, and improving our share structure. As we do so, we want prospective investors, partners, owners of targeted

acquisitions, and other stakeholders to look past Pervasip’s historical operations to Canary’s current and projected

future operations and value. We believe that completion of the Canary merger is important to meeting our objectives in that regard.”

The merger will be effective after the

later of (a) twenty days after the mailing of the relevant Information Statement, which the Company expects to file during July

2015, and (b) notice from FINRA that the merger will be announced on the Daily List published by FINRA. Additional information

regarding the merger will be available in a Current Report on Form 8K to be filed on July 8, 2015.

About Pervasip Corp.

Pervasip develops and delivers products

and technologies to emerging agricultural markets, with a focus on improving grow conditions, yields and value in hydroponic and

other indoor grow facility applications.

Forward Looking Statements

The information contained herein includes

forward-looking statements. These statements relate to future events or to our future financial performance, and involve

known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or

achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied

by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve

known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could, and likely

will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects

our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating

to our operations, results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise

these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated

in these forward-looking statements, even if new information becomes available in the future.

Additional Information

Pervasip Corp.

Paul H. Riss, CEO

paul@growbigsupply.com

914-750-9339

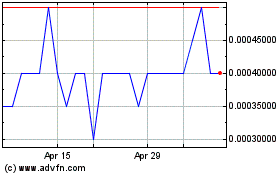

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

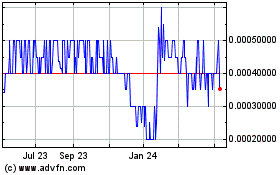

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Apr 2023 to Apr 2024