Report of Foreign Issuer (6-k)

July 06 2015 - 7:01AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of July 2015

Commission File Number: 000-13345

CALEDONIA MINING CORPORATION

(Translation of registrant’s name into English)

Suite 1000

36 Toronto Street

Toronto, ON, M5C 2C5

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F x Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ______

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Caledonia Mining Corporation

(Registrant)

By: /s/ Steve Curtis

|

|

Dated: July 6, 2015

|

Name: Steve Curtis

Title: CEO and Director

|

Exhibit Index

|

Exhibit

|

Description

|

| |

|

|

|

Q2 2015 Production update

|

Exhibit 99.1

Caledonia Mining Corporation

(TSX: CAL, OTCQX: CALVF, AIM: CMCL)

Q2 2015 Production update

July 6, 2015: Caledonia Mining Corporation (“Caledonia”) announces gold production from its 49 per cent owned subsidiary, the Blanket Mine (“Blanket”) in Zimbabwe for the quarter ended June 30, 2015 (“Q2 2015” or the “Quarter”). All numbers are expressed on a 100 per cent basis.

|

|

·

|

Gold production in the first six months of 2015 remains on track to achieve target production for 2015 of 42,000 ounces

|

|

|

·

|

10,424 ounces of gold were produced during Q2 2015, representing a 4.7 per cent increase on the gold produced in Q1 2015 (9,960 ounces) and a 7.1 per cent decrease on the gold produced in Q2 2014 (11,223 ounces). Production in the Quarter is based on mine assays and is subject to adjustment following third party assays.

|

Commenting on the production for Q2 2015, Steve Curtis, Caledonia’s Chief Executive Officer said:

“The increased production reflects the improved management control over grade and tonnage. It is anticipated that production will increase somewhat in the second half of 2015 following completion of the tramming loop on 22 Level in June. The completed tramming loop will increase the underground haulage capacity and allow for an increase in development activity, which is expected to result in an increase in future production.

“Sinking of the no 6 Winze has been completed and work has commenced on equipping the completed shaft prior to the start of horizontal development toward the ore bodies. The start of initial production from the No. 6 Winze remains on target for January 2016.

“The pre-sink at Central Shaft has commenced and the shaft collar is being concreted after which shaft sinking can resume.

“We are confident that the revised investment plan, which was announced on November 3, 2014, will result in progressive increases in production from 2016 onwards when we expect to see the first production from below 750 meters – initially from the No. 6 Winze and subsequently from the Central shaft”

Caledonia expects that its results for Q2 2015 will be released on August 13, 2015.

Caledonia is debt-free and at March 31, 2015 had cash of $26.1m. Blanket is a low-cost producer: in 2014 Blanket’s on-mine costs were US$652 per ounce of gold produced and its all-in sustaining cost was US$969 per ounce of gold produced. Caledonia expects to publish its results for the quarter to June 30, 2015 on August 13, 2015.

For further information please contact:

|

Caledonia Mining Corporation

Mark Learmonth

Tel: +27 11 447 2499

marklearmonth@caledoniamining.com

|

WH Ireland

Adrian Hadden/Nick Prowting

Tel: +44 20 7220 1751

|

| |

|

|

Blytheweigh

Tim Blythe/Halimah Hussain/Megan Ray

Tel: +44 20 7138 3204

|

|

Cautionary Note Concerning Forward-Looking Information

Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of applicable securities legislation that involve risks and uncertainties relating, but not limited to Caledonia’s current expectations, intentions, plans, and beliefs. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “target”, “intend”, “estimate”, “could”, “should”, “may” and “will” or the negative of these terms or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Examples of forward-looking information in this news release include: production guidance, estimates of future/targeted production rates, and our plans and timing regarding further exploration and drilling and development. This forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual results, performance or achievements to be materially different from those expressed or implied by forward-looking information. Such factors and assumptions include, but are not limited to: failure to establish estimated resources and reserves, the grade and recovery of ore which is mined varying from estimates, success of future exploration and drilling programs, reliability of drilling, sampling and assay data, assumptions regarding the representativeness of mineralization being inaccurate, success of planned metallurgical test-work, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and other factors.

Potential shareholders and prospective investors should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. Such factors include, but are not limited to: risks relating to estimates of mineral reserves and mineral resources proving to be inaccurate, fluctuations in gold price, risks and hazards associated with the business of mineral exploration, development and mining, risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company does business; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards, employee relations; relationships with and claims by local communities and indigenous populations; political risk; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including the risks of obtaining or maintaining necessary licenses and permits, diminishing quantities or grades of mineral reserves as mining occurs; global financial condition, the actual results of current exploration activities, changes to conclusions of economic evaluations, and changes in project parameters to deal with unanticipated economic or other factors, risks of increased capital and operating costs, environmental, safety or regulatory risks, expropriation, the Company’s title to properties including ownership thereof, increased competition in the mining industry for properties, equipment, qualified personnel and their costs, risks relating to the uncertainty of timing of events including targeted production rate increase and currency fluctuations. Shareholders are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events will not occur. Caledonia undertakes no obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

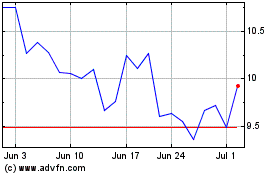

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

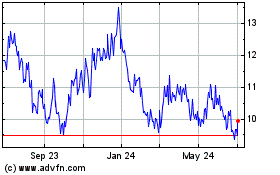

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024