UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 29, 2015

BROADWIND ENERGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34278

|

|

88-0409160

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3240 South Central Avenue, Cicero, Illinois 60804

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (708) 780-4800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On June 29, 2015, Broadwind Energy, Inc. and its wholly-owned subsidiaries (collectively, the “Company”) entered into a Seventh Amendment (the “Amendment”) to the August 23, 2012 Loan and Security Agreement between the Company and AloStar Bank of Commerce, as amended (the “Credit Facility”). Among other changes, the Amendment decreased the maximum principal amount of the revolving line of credit (the “Revolver”) under the Credit Facility from $20 million to $15 million, extended the term of the Credit Facility to August 31, 2016, modified the interest rate and reduced the minimum quarterly interest charges under the Revolver.

Concurrently with the Amendment, the Company also executed a Term Loan Rider and Term Note for a term loan in the maximum principal amount of $5 million (the “Term Loan”), which is incorporated into the Credit Facility and is subject to acceleration in accordance with the Credit Facility’s customary event of default provisions. The Term Loan has a per annum interest rate of 30-day LIBOR plus 3.5% and matures on the same date as the expiration date of the Credit Facility.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Amendment, the Term Loan Rider and the Term Note, copies of which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

(d)

|

Exhibits

|

|

|

|

|

EXHIBIT

NUMBER

|

DESCRIPTION

|

|

10.1

|

Seventh Amendment to Loan and Security Agreement, dated June 29, 2015, among the Company, Brad Foote Gear Works, Inc., Broadwind Services, LLC, Broadwind Towers, Inc., 1309 South Cicero Avenue, LLC, 5100 Neville Road, LLC and AloStar Bank of Commerce

|

|

|

|

|

10.2

|

Term Loan Rider, dated June 29, 2015, among the Company, Brad Foote Gear Works, Inc., Broadwind Services, LLC, Broadwind Towers, Inc. and AloStar Bank of Commerce

|

|

|

|

|

10.3

|

Term Note, dated June 29, 2015, from the Company, Brad Foote Gear Works, Inc., Broadwind Services, LLC, and Broadwind Towers, Inc. to AloStar Bank of Commerce

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BROADWIND ENERGY, INC.

|

|

|

|

|

|

July 2, 2015

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Stephanie K. Kushner

|

|

|

|

Executive Vice President & Chief Financial Officer

|

Exhibit 10.1

SEVENTH AMENDMENT TO LOAN AND SECURITY AGREEMENT

This SEVENTH AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Amendment”) is entered into as of June 29, 2015, among BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), 1309 South Cicero Avenue, LLC, a Delaware limited liability company (“South Cicero”), 5100 Neville Road, LLC, a Delaware limited liability company (“Neville” and, together with South Cicero, each a “Guarantor” and collectively the “Guarantors”), and ALOSTAR BANK OF COMMERCE, a state banking institution incorporated or otherwise organized under the laws of the State of Alabama (the “Lender”).

W I T N E S S E T H:

WHEREAS, the Borrowers and the Lender are parties to that certain Loan and Security Agreement dated August 23, 2012 (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”; capitalized terms used herein and not otherwise defined shall have the meanings ascribed to such terms in the Loan Agreement), pursuant to which the Lender has agreed to make the Commitments available to the Borrowers from time to time pursuant to the terms and conditions thereof;

WHEREAS, the Borrowers have requested that the Lender agree to amend certain terms and conditions of the Loan Agreement; and

WHEREAS, subject to the satisfaction of the conditions set forth herein, the Lender is willing to amend the Loan Agreement as set forth herein.

NOW THEREFORE, in consideration of the foregoing premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.Amendments to the Loan Agreement. Subject to the satisfaction of the conditions to effectiveness referred to in Section 3 hereof, the Loan Agreement is hereby amended as follows:

1.1.Section 1.1 (Defined Terms) of the Loan Agreement is hereby amended by replacing the defined term “Inventory Formula Amount” with the following:

““Inventory Formula Amount” means, on any date of determination thereof, an amount equal to the percentage set forth in Item 6(b) of the Terms Schedule of the Value or NOLV (as applicable under Item 6 of the Terms Schedule) of Eligible Inventory on such date.”

1.2.Item 7 (Maximum Revolver Facility Amount) of the Terms Schedule is hereby amended by replacing the amount “$20,000,000” with the amount “$15,000,000”.

1.3.Clause (b) of Item 8 (Interest Rates) of the Terms Schedule is hereby amended by replacing the percentage “4.25%” with the percentage “3.25%”.

1.4.Item 8 (Interest Rates) of the Terms Schedule is hereby further amended by adding the following after clause (f) therein:

“Notwithstanding anything to the contrary contained herein, subject only to Section 2.5, in the event that the sum of (A) the total amount of accrued interest (including the interest on the Revolver Loans, the Overadvances and the Term Loan), plus (B) the Unused Revolver Fee as determined pursuant to Item 9 below, plus (C) the maintenance fee as determined pursuant to Item 9 below, plus (D) any interest accruing during the two collection days after payments have been applied to the Obligations by the Lender pursuant

to Section 2.7, due and payable during any quarter during the term of this Agreement, is less than $45,000, the Borrowers shall pay on the first day of the immediately following quarter the amount equal to the difference between the amount so paid and $45,000.”

1.5.Item 12 (Term) of the Terms Schedule is hereby amended by replacing the date “August 23, 2015” with the date “August 31, 2016”.

1.6.Clause (a) of Item 16 (Financial Covenants) of the Terms Schedule is hereby amended and restated in its entirety as follows:

“(a)Fixed Charge Coverage Ratio. At the end of each fiscal quarter, commencing with the fiscal quarter ending June 30, 2015, Parent shall have a Fixed Charge Coverage Ratio of not less than 1.20 to 1.00 for the (i) three consecutive calendar month period ending June 30, 2015, (ii) six consecutive calendar month period ending September 30, 2015, (iii) nine consecutive calendar month period ending December 31, 2015 and (iv) twelve consecutive calendar month period ending March 31, 2016, and each fiscal quarter thereafter.”

1.7.Clause (b) of Item 16 (Financial Covenants) of the Terms Schedule is hereby amended and restated in its entirety as follows:

“(b)Minimum Monthly EBITDA. Parent shall achieve EBITDA of at least (i) $3,500,000 during the three consecutive calendar month period ending June 30, 2015, (ii) $7,800,000 during the six consecutive calendar month period ending September 30, 2015, (iii) $9,750,000 during the nine consecutive calendar month period ending December 31, 2015 and (iv) an amount to be agreed based upon a discount of the Borrowers projected operating performance during each subsequent twelve consecutive calendar month period ending at each fiscal quarter end thereafter.”

1.8.Clause (c) of Item 16 (Financial Covenants) of the Terms Schedule is hereby amended and restated in its entirety as follows:

“(c)Capital Expenditures. Parent and its Subsidiaries shall not during any Fiscal Year make Capital Expenditures in an amount exceeding $6,000,000.”

1.9.The Loan Agreement is hereby amended by adding Exhibit A attached hereto as the Term Loan Rider thereto.

2.No Other Amendments. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Lender under the Loan Agreement or any of the other Loan Documents, nor constitute a waiver of any provision of the Loan Agreement or any of the other Loan Documents. Except for the amendment set forth above, the text of the Loan Agreement and all other Loan Documents shall remain unchanged and in full force and effect and each Borrower and each Guarantor hereby ratifies and confirms its obligations thereunder. This Amendment shall not constitute a modification of the Loan Agreement or any of the other Loan Documents or a course of dealing with the Lender at variance with the Loan Agreement or the other Loan Documents such as to require further notice by the Lender to require strict compliance with the terms of the Loan Agreement and the other Loan Documents in the future, except as expressly set forth herein. Each Borrower and each Guarantor acknowledges and expressly agrees that the Lender reserves the right to, and does in fact, require strict compliance with all terms and provisions of the Loan Agreement and the other Loan Documents, as amended herein. No Borrower or Guarantor has knowledge of any challenge to the Lender’s claims arising under the Loan Documents, or to the effectiveness of the Loan Documents.

3.Conditions Precedent to Effectiveness. This Amendment shall be effective as of the date first written above upon the satisfaction of each of the following conditions precedent in a manner acceptable to the Lender in its sole and absolute discretion:

3.1.the Lender shall have received this Amendment, duly executed by each Borrower and each Guarantor, and the same shall be in full force and effect;

3.2.the Lender shall have received the Term Loan Rider and the Term Note, duly executed by Borrowers, and the same shall be in full force and effect;

3.3.the Lender shall have received certified resolutions of the board of directors (or other appropriate governing body) of each Borrower and each Guarantor executing this Amendment, signed by a Senior Officer of such Borrower or such Guarantor, authorizing the execution, delivery and performance of the Loan Documents;

3.4.the Lender shall have received an amendment fee equal to $50,000; and

3.5.no Default or Event of Default shall exist under the Loan Agreement or the other Loan Documents.

4.Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed to be an original and all of which, taken together, shall constitute one and the same agreement. In proving this Amendment in any judicial proceedings, it shall not be necessary to produce or account for more than one such counterpart signed by the party against whom such enforcement is sought. Any signatures delivered by a party by facsimile transmission or by electronic mail transmission shall be deemed an original signature hereto.

5.Reference to and Effect on the Loan Documents. Upon the effectiveness of this Amendment, on and after the date hereof, each reference in the Loan Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Loan Agreement, and each reference in the other Loan Documents to “the Loan Agreement”, “thereunder”, “thereof” or words of like import referring to the Loan Agreement, shall mean and be a reference to the Loan Agreement as amended hereby.

6.Entire Agreement. This Amendment and the other Loan Documents constitute the entire agreement and understanding between the parties hereto with respect to the transactions contemplated hereby and thereby and supersede all prior negotiations, understandings and agreements between such parties with respect to such transactions.

7.GOVERNING LAW. THE VALIDITY, INTERPRETATION AND ENFORCEMENT OF THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE INTERNAL LAWS OF THE STATE OF NEW YORK.

8.Loan Document. This Amendment shall be deemed to be a Loan Document for all purposes.

[remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have executed and delivered this Amendment as of the day and year first written above.

|

|

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

GUARANTORS:

|

|

1309 SOUTH CICERO AVENUE, LLC

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

5100 NEVILLE ROAD, LLC

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

LENDER:

|

|

ALOSTAR BANK OF COMMERCE

|

|

|

|

By:

|

/s/ Megan E. Enlow

|

|

|

|

Name:

|

Megan E. Enlow

|

|

|

|

Title:

|

Director

|

Exhibit A

TERM LOAN RIDER

THIS TERM LOAN RIDER ("Rider") dated June 29, 2015, is made a part of and incorporated into that certain Loan and Security Agreement between ALOSTAR BANK OF COMMERCE, a state banking institution organized under the laws of the State of Alabama (together with successors and assigns, "Lender"), BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), dated August 23, 2012 (together with all schedules, Riders and exhibits annexed thereto and all amendments, restatements, supplements or other modifications with respect thereto, the "Loan Agreement").

1.Definitions. Capitalized terms contained in this Rider, unless otherwise defined herein, shall have the meanings attributable to such terms under the Loan Agreement.

2.Term Loan. Subject to the terms and conditions of the Loan Agreement and this Rider, Lender agrees to make a term loan to the Borrowers in the principal amount of FIVE MILLION AND 00/100 DOLLARS ($5,000,000) (the "Term Loan"), which shall be evidenced by a promissory note to be executed and delivered by the Borrowers in favor of Lender in the form of Exhibit A attached hereto (as at any time amended, renewed or extended, the “Term Note”). The Term Loan shall be funded by Lender on June 30, 2015. The proceeds of the Term Loan shall be used by the Borrowers solely for the purchase of machinery and equipment and for general working capital purposes. The Borrowers shall not be entitled to reborrow any amounts repaid with respect to the Term Loan.

3.Interest. The principal balance of the Term Loan outstanding from time to time shall bear interest from the date such principal amount is advanced until paid (whether at stated maturity, on acceleration, or otherwise) at a variable rate per annum equal to the sum of 3.50% plus the Applicable Variable Rate in effect from time to time. The Applicable Variable Rate shall be determined daily on each Business Day and shall be increased or decreased, as applicable, automatically as of the opening of business on the date of each such determination. All interest chargeable with respect to the Term Loan shall be computed on the basis of the actual number of days elapsed in a year of 360 days. At any time that an Event of Default exists, the principal amount of the Term Loan outstanding shall bear interest at a rate equal to the interest rate that otherwise would be in effect at such time hereunder in the absence of such Event of Default plus the default margin set forth in Item 8(d) of the Terms Schedule. The rate of interest in effect hereunder, expressed in simple interest terms as of the date hereof, is 3.68660%.

4.Payments. Payments with respect to the Term Loan shall be made in Dollars and in immediately available funds, without any offset or counterclaim, as follows:

(a)The principal amount of the Term Loan shall be paid in consecutive monthly installments equal to $59,523.81 per month and shall be due and payable on the first day of each month, commencing August 1, 2015; provided, however, that the Term Loan, if not sooner paid, shall be due and payable in full on the earlier to occur of (x) August 31, 2016 and (y) Commitment Termination Date.

(b)Interest accrued on the principal balance of the Term Loan shall be due and payable (x) on the first day of each month, computed through the last day of the preceding month, and (y) on the Commitment Termination Date.

5.Prepayments. The Borrowers may, at their option, prepay any portion of the Term Loan in whole at any time or in part from time to time, in an amount not less than $50,000 or any greater integral multiple of $50,000, by paying the principal amount to be prepaid together with interest accrued thereon to the date of prepayment. The Borrowers shall prepay the Term Loan concurrently with, and by an amount equal to, (i) the net proceeds received in connection with any Permitted Asset Disposition of any Collateral consisting of Equipment; provided, however, that no such prepayment shall be required unless and until the aggregate net book value of the Collateral sold is greater than or equal to $1,000,000, (ii) proceeds of insurance or condemnation awards paid in

respect of any Collateral consisting of Equipment, and (iii) net proceeds derived from the issuance of Equity Interests by the Borrowers. All partial prepayments shall be applied to installments of principal in respect of the Term Loan in the inverse order of their maturities. The Borrowers shall be obligated to pay a prepayment premium in respect of the principal amount that the Borrowers elect, but are not obligated, to pay equal to 1.0% of the principal amounts prepaid, which prepayment premium shall be due and payable concurrently with the principal amount so prepaid; provide, however, that if such prepayment is made during prior to the last 60 days of the Term no such prepayment premium shall be due.

6.Collateral. The prompt payment and performance of the Term Loan shall be secured by all of the Collateral.

7.Cross-Default. The Borrowers’ failure duly and punctually to pay the Term Loan in accordance with the terms of this Rider and the Term Note shall constitute an Event of Default.

8.Incorporation by Reference. The terms, covenants and conditions of the Loan Agreement are incorporated into and made a part of this Rider. This Rider shall form a part of the Loan Agreement and, together with the Term Note, shall constitute a part of the Loan Documents.

9.Miscellaneous. This Rider may be executed in multiple counterparts, each of which shall be deemed an original document and all of which taken together shall constitute one and the same instrument; shall be deemed to have been executed and made in the State of Georgia and shall be governed in all respects by and construed in accordance with the internal laws of the State of Georgia; and shall be binding upon and inure to the benefit of the parties and their respective successors and permitted assigns. The Borrowers hereby waive notice of Lender's acceptance hereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed this Term Loan Rider on the date first written above.

|

|

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

LENDER:

|

|

ALOSTAR BANK OF COMMERCE

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Megan E. Enlow

|

|

|

|

Title:

|

Director

|

EXHIBIT A TO TERM LOAN RIDER

TERM NOTE

______________ ____, 20___

U.S. $______________________ Atlanta, Georgia

FOR VALUE RECEIVED, the undersigned, BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), hereby jointly and severally promise to pay to the order of [Lender] (herein, together with any subsequent holder hereof, called "Lender"), the principal sum of _________________________________ AND NO/100 DOLLARS ($_________________), or such lesser sum as may be advanced by Lender as a Term Loan under the Rider (defined below), on the date on which such outstanding principal amounts become due and payable pursuant to Section 4(a) of the Rider in strict accordance with the terms thereof. Borrowers likewise unconditionally promise to pay to Lender interest from and after the date hereof on the outstanding principal amount of the Term Loan at such interest rates, payable at such times and computed in such manner as are specified in Sections 3 and 4(b) of the Rider and in strict accordance with the terms thereof.

This Term Note (“Note”) is issued pursuant to, and is the "Term Note" referred to in, the Term Loan Rider dated June [29], 2015, between Borrowers, the lenders party thereto from time to time and AloStar Bank of Commerce (in such capacity, “Lender”) (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Rider”), which Rider is attached to and incorporated in that certain Loan and Security Agreement dated August 23, 2012, between Borrowers and Lender (together with all schedules, riders and exhibits thereto and all amendments, restatements, modifications or supplements with respect thereto, the “Loan Agreement”) and Lender is and shall be entitled to all benefits thereof and of all other Loan Documents executed and delivered in connection therewith. All capitalized terms used herein, unless otherwise defined herein or in the Rider, shall have the meanings ascribed to such terms under the Loan Agreement.

The entire unpaid principal balance and all accrued interest on this Note shall be due and payable immediately upon the Commitment Termination Date. All payments of principal and interest shall be made in Dollars and in immediately available funds as specified in the Loan Agreement.

Upon or after the occurrence of an Event of Default and for so long as such Event of Default exists, the principal balance and all accrued interest of this Note may be declared (or shall become) due and payable in the manner and with the effect provided in the Loan Agreement, and the unpaid principal balance hereof shall bear interest at the default rate as and when provided in the Rider. If this Note is collected by or through an attorney at law, then Borrowers shall be obligated to pay, in addition to the principal balance of and accrued interest on this Note, all costs of collection, including, without limitation, reasonable attorneys' fees and court costs.

The principal amount of the Term Loan made by Lender to Borrowers pursuant to the Loan Agreement, and all accrued and unpaid interest thereon, shall be deemed evidenced by this Note and shall continue to be owing by Borrowers until paid in accordance with the terms of this Note and the Loan Agreement.

In no contingency or event whatsoever, whether by reason of advancement of the proceeds of the Term Loan or otherwise, shall the amount paid or agreed to be paid to Lender for the use, forbearance or detention of the Term Loan exceed the highest lawful rate permitted under any law which a court of competent jurisdiction may deem applicable hereto; and, in the event of any such payment inadvertently paid by Borrowers or inadvertently received by Lender, such excess sum shall be returned to Borrower forthwith or credited as a payment of principal, but shall not be applied to the payment of interest. It is the intent hereof that Borrowers not pay or contract to pay, and that Lender not receive or contract to receive, directly or indirectly in any manner whatsoever, interest in excess of that which may be paid by Borrowers under applicable law.

Time is of the essence with respect to this Note. To the fullest extent permitted by applicable law, each Borrower, for itself and its legal representatives, successors and assigns, expressly waives presentment, demand, protest, notice of dishonor, notice of non-payment, notice of maturity, notice of protest, presentment for the purpose of accelerating maturity, diligence in collection, and the benefit of any exemption or insolvency laws.

Wherever possible each provision of this Note shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Note shall be prohibited or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity without invalidating the remainder of such provision or remaining provisions of this Note. No delay or failure on the part of Lender in the exercise of any right or remedy hereunder shall operate as a waiver thereof, nor as an acquiescence in any default, nor shall any single or partial exercise by Lender of any right or remedy preclude any other right or remedy. Lender, at its option, may enforce its rights against any Collateral securing this Note without enforcing its rights against any Borrower, any Guarantor or any other property or indebtedness due or to become due to any Borrower. Each Borrower agrees that, without releasing or impairing such Borrower's liability hereunder, Lender may at any time release, surrender, substitute or exchange any Collateral securing this Note and may at any time release any party primarily or secondarily liable for the indebtedness evidenced by this Note.

The rights of Lender and obligations of Borrowers hereunder shall be construed in accordance with and governed by the laws (without giving effect to the conflict of law principles thereof) of the State of Georgia. This Note is intended to take effect as an instrument under seal under Georgia law.

To the fullest extent permitted by applicable law, each Borrower and, by its acceptance hereof, Lender, each hereby waives the right to trial by jury in any action, suit, proceeding or counterclaim of any kind arising out of, related to or based in any way upon this Note or any of the matters contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Borrowers have caused this Note to be executed and delivered by their respective duly authorized officers on the date first above written.

|

|

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

Exhibit 10.2

TERM LOAN RIDER

THIS TERM LOAN RIDER ("Rider") dated June 29, 2015, is made a part of and incorporated into that certain Loan and Security Agreement between ALOSTAR BANK OF COMMERCE, a state banking institution organized under the laws of the State of Alabama (together with successors and assigns, "Lender"), BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), dated August 23, 2012 (together with all schedules, Riders and exhibits annexed thereto and all amendments, restatements, supplements or other modifications with respect thereto, the "Loan Agreement").

1.Definitions. Capitalized terms contained in this Rider, unless otherwise defined herein, shall have the meanings attributable to such terms under the Loan Agreement.

2.Term Loan. Subject to the terms and conditions of the Loan Agreement and this Rider, Lender agrees to make a term loan to the Borrowers in the principal amount of FIVE MILLION AND 00/100 DOLLARS ($5,000,000) (the "Term Loan"), which shall be evidenced by a promissory note to be executed and delivered by the Borrowers in favor of Lender in the form of Exhibit A attached hereto (as at any time amended, renewed or extended, the “Term Note”). The Term Loan shall be funded by Lender on June 30, 2015. The proceeds of the Term Loan shall be used by the Borrowers solely for the purchase of machinery and equipment and for general working capital purposes. The Borrowers shall not be entitled to reborrow any amounts repaid with respect to the Term Loan.

3.Interest. The principal balance of the Term Loan outstanding from time to time shall bear interest from the date such principal amount is advanced until paid (whether at stated maturity, on acceleration, or otherwise) at a variable rate per annum equal to the sum of 3.50% plus the Applicable Variable Rate in effect from time to time. The Applicable Variable Rate shall be determined daily on each Business Day and shall be increased or decreased, as applicable, automatically as of the opening of business on the date of each such determination. All interest chargeable with respect to the Term Loan shall be computed on the basis of the actual number of days elapsed in a year of 360 days. At any time that an Event of Default exists, the principal amount of the Term Loan outstanding shall bear interest at a rate equal to the interest rate that otherwise would be in effect at such time hereunder in the absence of such Event of Default plus the default margin set forth in Item 8(d) of the Terms Schedule. The rate of interest in effect hereunder, expressed in simple interest terms as of the date hereof, is 3.68660%.

4.Payments. Payments with respect to the Term Loan shall be made in Dollars and in immediately available funds, without any offset or counterclaim, as follows:

(a)The principal amount of the Term Loan shall be paid in consecutive monthly installments equal to $59,523.81 per month and shall be due and payable on the first day of each month, commencing August 1, 2015; provided, however, that the Term Loan, if not sooner paid, shall be due and payable in full on the earlier to occur of (x) August 31, 2016 and (y) Commitment Termination Date.

(b)Interest accrued on the principal balance of the Term Loan shall be due and payable (x) on the first day of each month, computed through the last day of the preceding month, and (y) on the Commitment Termination Date.

5.Prepayments. The Borrowers may, at their option, prepay any portion of the Term Loan in whole at any time or in part from time to time, in an amount not less than $50,000 or any greater integral multiple of $50,000, by paying the principal amount to be prepaid together with interest accrued thereon to the date of prepayment. The Borrowers shall prepay the Term Loan concurrently with, and by an amount equal to, (i) the net proceeds received in connection with any Permitted Asset Disposition of any Collateral consisting of Equipment; provided, however, that no such prepayment shall be required unless and until the aggregate net book value of the Collateral sold is greater than or equal to $1,000,000, (ii) proceeds of insurance or condemnation awards paid in

respect of any Collateral consisting of Equipment, and (iii) net proceeds derived from the issuance of Equity Interests by the Borrowers. All partial prepayments shall be applied to installments of principal in respect of the Term Loan in the inverse order of their maturities. The Borrowers shall be obligated to pay a prepayment premium in respect of the principal amount that the Borrowers elect, but are not obligated, to pay equal to 1.0% of the principal amounts prepaid, which prepayment premium shall be due and payable concurrently with the principal amount so prepaid; provide, however, that if such prepayment is made during prior to the last 60 days of the Term no such prepayment premium shall be due.

6.Collateral. The prompt payment and performance of the Term Loan shall be secured by all of the Collateral.

7.Cross-Default. The Borrowers’ failure duly and punctually to pay the Term Loan in accordance with the terms of this Rider and the Term Note shall constitute an Event of Default.

8.Incorporation by Reference. The terms, covenants and conditions of the Loan Agreement are incorporated into and made a part of this Rider. This Rider shall form a part of the Loan Agreement and, together with the Term Note, shall constitute a part of the Loan Documents.

9.Miscellaneous. This Rider may be executed in multiple counterparts, each of which shall be deemed an original document and all of which taken together shall constitute one and the same instrument; shall be deemed to have been executed and made in the State of Georgia and shall be governed in all respects by and construed in accordance with the internal laws of the State of Georgia; and shall be binding upon and inure to the benefit of the parties and their respective successors and permitted assigns. The Borrowers hereby waive notice of Lender's acceptance hereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed this Term Loan Rider on the date first written above.

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

LENDER:

|

|

|

ALOSTAR BANK OF COMMERCE

|

|

|

|

By:

|

/s/ Megan E. Enlow

|

|

|

|

Name:

|

Megan E. Enlow

|

|

|

|

Title:

|

Director

|

EXHIBIT A TO TERM LOAN RIDER

TERM NOTE

______________ ____, 20___

U.S. $______________________ Atlanta, Georgia

FOR VALUE RECEIVED, the undersigned, BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), hereby jointly and severally promise to pay to the order of [Lender] (herein, together with any subsequent holder hereof, called "Lender"), the principal sum of _________________________________ AND NO/100 DOLLARS ($_________________), or such lesser sum as may be advanced by Lender as a Term Loan under the Rider (defined below), on the date on which such outstanding principal amounts become due and payable pursuant to Section 4(a) of the Rider in strict accordance with the terms thereof. Borrowers likewise unconditionally promise to pay to Lender interest from and after the date hereof on the outstanding principal amount of the Term Loan at such interest rates, payable at such times and computed in such manner as are specified in Sections 3 and 4(b) of the Rider and in strict accordance with the terms thereof.

This Term Note (“Note”) is issued pursuant to, and is the "Term Note" referred to in, the Term Loan Rider dated June [29], 2015, between Borrowers, the lenders party thereto from time to time and AloStar Bank of Commerce (in such capacity, “Lender”) (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Rider”), which Rider is attached to and incorporated in that certain Loan and Security Agreement dated August 23, 2012, between Borrowers and Lender (together with all schedules, riders and exhibits thereto and all amendments, restatements, modifications or supplements with respect thereto, the “Loan Agreement”) and Lender is and shall be entitled to all benefits thereof and of all other Loan Documents executed and delivered in connection therewith. All capitalized terms used herein, unless otherwise defined herein or in the Rider, shall have the meanings ascribed to such terms under the Loan Agreement.

The entire unpaid principal balance and all accrued interest on this Note shall be due and payable immediately upon the Commitment Termination Date. All payments of principal and interest shall be made in Dollars and in immediately available funds as specified in the Loan Agreement.

Upon or after the occurrence of an Event of Default and for so long as such Event of Default exists, the principal balance and all accrued interest of this Note may be declared (or shall become) due and payable in the manner and with the effect provided in the Loan Agreement, and the unpaid principal balance hereof shall bear interest at the default rate as and when provided in the Rider. If this Note is collected by or through an attorney at law, then Borrowers shall be obligated to pay, in addition to the principal balance of and accrued interest on this Note, all costs of collection, including, without limitation, reasonable attorneys' fees and court costs.

The principal amount of the Term Loan made by Lender to Borrowers pursuant to the Loan Agreement, and all accrued and unpaid interest thereon, shall be deemed evidenced by this Note and shall continue to be owing by Borrowers until paid in accordance with the terms of this Note and the Loan Agreement.

In no contingency or event whatsoever, whether by reason of advancement of the proceeds of the Term Loan or otherwise, shall the amount paid or agreed to be paid to Lender for the use, forbearance or detention of the Term Loan exceed the highest lawful rate permitted under any law which a court of competent jurisdiction may deem applicable hereto; and, in the event of any such payment inadvertently paid by Borrowers or inadvertently received by Lender, such excess sum shall be returned to Borrower forthwith or credited as a payment of principal, but shall not be applied to the payment of interest. It is the intent hereof that Borrowers not pay or contract to pay, and that Lender not receive or contract to receive, directly or indirectly in any manner whatsoever, interest in excess of that which may be paid by Borrowers under applicable law.

Time is of the essence with respect to this Note. To the fullest extent permitted by applicable law, each Borrower, for itself and its legal representatives, successors and assigns, expressly waives presentment, demand, protest, notice of dishonor, notice of non-payment, notice of maturity, notice of protest, presentment for the purpose of accelerating maturity, diligence in collection, and the benefit of any exemption or insolvency laws.

Wherever possible each provision of this Note shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Note shall be prohibited or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity without invalidating the remainder of such provision or remaining provisions of this Note. No delay or failure on the part of Lender in the exercise of any right or remedy hereunder shall operate as a waiver thereof, nor as an acquiescence in any default, nor shall any single or partial exercise by Lender of any right or remedy preclude any other right or remedy. Lender, at its option, may enforce its rights against any Collateral securing this Note without enforcing its rights against any Borrower, any Guarantor or any other property or indebtedness due or to become due to any Borrower. Each Borrower agrees that, without releasing or impairing such Borrower's liability hereunder, Lender may at any time release, surrender, substitute or exchange any Collateral securing this Note and may at any time release any party primarily or secondarily liable for the indebtedness evidenced by this Note.

The rights of Lender and obligations of Borrowers hereunder shall be construed in accordance with and governed by the laws (without giving effect to the conflict of law principles thereof) of the State of Georgia. This Note is intended to take effect as an instrument under seal under Georgia law.

To the fullest extent permitted by applicable law, each Borrower and, by its acceptance hereof, Lender, each hereby waives the right to trial by jury in any action, suit, proceeding or counterclaim of any kind arising out of, related to or based in any way upon this Note or any of the matters contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Borrowers have caused this Note to be executed and delivered by their respective duly authorized officers on the date first above written.

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

____________________

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

Exhibit 10.3

TERM NOTE

June 29, 2015

U.S. $5,000,000 Atlanta, Georgia

FOR VALUE RECEIVED, the undersigned, BROADWIND ENERGY, INC., a Delaware corporation (“Parent”), BRAD FOOTE GEAR WORKS, INC., an Illinois corporation (“Brad Foote”), BROADWIND SERVICES, LLC, a Delaware limited liability company (“Broadwind Services”), BROADWIND TOWERS, INC., a Wisconsin corporation (“Broadwind Towers” and, together with Parent, Brad Foote and Broadwind Services, each a “Borrower” and collectively the “Borrowers”), hereby jointly and severally promise to pay to the order of ALOSTAR BANK OF COMMERCE (herein, together with any subsequent holder hereof, called "Lender"), the principal sum of FIVE MILLION AND 00/100 DOLLARS ($5,000,000), or such lesser sum as may be advanced by Lender as a Term Loan under the Rider (defined below), on the date on which such outstanding principal amounts become due and payable pursuant to Section 4(a) of the Rider in strict accordance with the terms thereof. Borrowers likewise unconditionally promise to pay to Lender interest from and after the date hereof on the outstanding principal amount of the Term Loan at such interest rates, payable at such times and computed in such manner as are specified in Sections 3 and 4(b) of the Rider and in strict accordance with the terms thereof.

This Term Note (“Note”) is issued pursuant to, and is the "Term Note" referred to in, the Term Loan Rider dated June 29, 2015, between Borrowers, the lenders party thereto from time to time and AloStar Bank of Commerce (in such capacity, “Lender”) (as the same may be amended, restated, supplemented or otherwise modified from time to time, the “Rider”), which Rider is attached to and incorporated in that certain Loan and Security Agreement dated August 23, 2012, between Borrowers and Lender (together with all schedules, riders and exhibits thereto and all amendments, restatements, modifications or supplements with respect thereto, the “Loan Agreement”) and Lender is and shall be entitled to all benefits thereof and of all other Loan Documents executed and delivered in connection therewith. All capitalized terms used herein, unless otherwise defined herein or in the Rider, shall have the meanings ascribed to such terms under the Loan Agreement.

The entire unpaid principal balance and all accrued interest on this Note shall be due and payable immediately upon the Commitment Termination Date. All payments of principal and interest shall be made in Dollars and in immediately available funds as specified in the Loan Agreement.

Upon or after the occurrence of an Event of Default and for so long as such Event of Default exists, the principal balance and all accrued interest of this Note may be declared (or shall become) due and payable in the manner and with the effect provided in the Loan Agreement, and the unpaid principal balance hereof shall bear interest at the default rate as and when provided in the Rider. If this Note is collected by or through an attorney at law, then Borrowers shall be obligated to pay, in addition to the principal balance of and accrued interest on this Note, all costs of collection, including, without limitation, reasonable attorneys' fees and court costs.

The principal amount of the Term Loan made by Lender to Borrowers pursuant to the Loan Agreement, and all accrued and unpaid interest thereon, shall be deemed evidenced by this Note and

shall continue to be owing by Borrowers until paid in accordance with the terms of this Note and the Loan Agreement.

In no contingency or event whatsoever, whether by reason of advancement of the proceeds of the Term Loan or otherwise, shall the amount paid or agreed to be paid to Lender for the use, forbearance or detention of the Term Loan exceed the highest lawful rate permitted under any law which a court of competent jurisdiction may deem applicable hereto; and, in the event of any such payment inadvertently paid by Borrowers or inadvertently received by Lender, such excess sum shall be returned to Borrower forthwith or credited as a payment of principal, but shall not be applied to the payment of interest. It is the intent hereof that Borrowers not pay or contract to pay, and that Lender not receive or contract to receive, directly or indirectly in any manner whatsoever, interest in excess of that which may be paid by Borrowers under applicable law.

Time is of the essence with respect to this Note. To the fullest extent permitted by applicable law, each Borrower, for itself and its legal representatives, successors and assigns, expressly waives presentment, demand, protest, notice of dishonor, notice of non-payment, notice of maturity, notice of protest, presentment for the purpose of accelerating maturity, diligence in collection, and the benefit of any exemption or insolvency laws.

Wherever possible each provision of this Note shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Note shall be prohibited or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity without invalidating the remainder of such provision or remaining provisions of this Note. No delay or failure on the part of Lender in the exercise of any right or remedy hereunder shall operate as a waiver thereof, nor as an acquiescence in any default, nor shall any single or partial exercise by Lender of any right or remedy preclude any other right or remedy. Lender, at its option, may enforce its rights against any Collateral securing this Note without enforcing its rights against any Borrower, any Guarantor or any other property or indebtedness due or to become due to any Borrower. Each Borrower agrees that, without releasing or impairing such Borrower's liability hereunder, Lender may at any time release, surrender, substitute or exchange any Collateral securing this Note and may at any time release any party primarily or secondarily liable for the indebtedness evidenced by this Note.

The rights of Lender and obligations of Borrowers hereunder shall be construed in accordance with and governed by the laws (without giving effect to the conflict of law principles thereof) of the State of Georgia. This Note is intended to take effect as an instrument under seal under Georgia law.

To the fullest extent permitted by applicable law, each Borrower and, by its acceptance hereof, Lender, each hereby waives the right to trial by jury in any action, suit, proceeding or counterclaim of any kind arising out of, related to or based in any way upon this Note or any of the matters contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Borrowers have caused this Note to be executed and delivered by their respective duly authorized officers on the date first above written.

|

|

|

|

|

|

|

|

|

BORROWERS:

|

|

BROADWIND ENERGY, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

BRAD FOOTE GEAR WORKS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND SERVICES, LLC

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

BROADWIND TOWERS, INC.

|

|

|

|

By:

|

/s/ Stephanie K. Kushner

|

|

|

|

Name:

|

Stephanie K. Kushner

|

|

|

|

Title:

|

Authorized Signatory

|

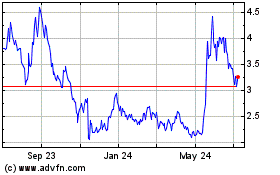

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

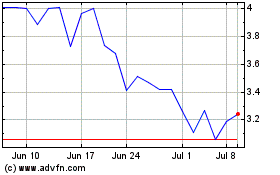

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Apr 2023 to Apr 2024