American International Group, Inc. (NYSE:AIG) today announced

the pricing for two series of debt securities issued by AIG subject

to its previously announced cash Tender Offers, pursuant to its

offer to purchase dated June 18, 2015 (the “Offer to

Purchase”).

Title of Security and

Security Identifier

Reference Yield

Reference Security /

Interpolated Swap

Fixed Spread (basis

points)

Total

Consideration(1)

5.450% Medium-Term Notes, Series MP,

Matched Investment Program, Due May 18, 2017CUSIP: 02687QBW7ISIN:

US02687QBW78

0.676%

0.625% U.S.Treasury dueMay 31, 2017

60 USD 1,076.62

5.000 per cent. notes due

2017*ISIN: XS0307512722

0.121%

June 2017InterpolatedSwap Rate

18 EUR 1,092.15 ________ * Listed on the Official List of

the Irish Stock Exchange and traded on its regulated market.

(1) Assuming payment is made on July 7, 2015. Per USD 1,000 or EUR

1,000 principal amount of notes.

The Reference Yield for the 5.450% Medium-Term Notes corresponds

to the bid-side price of the 0.625% U.S. Treasury due May 31, 2017,

as of 10:00 a.m., New York City time, today. The Reference Yield

for the 5.000 per cent. notes corresponds to the June 2017

Interpolated Swap Rate, as described in further detail in the Offer

to Purchase, as of 3:00 p.m., London time, today. The Reference

Yields will be used to determine the consideration paid for the

5.450% Medium-Term Notes and the 5.000 per cent. notes that are

accepted for purchase after expiration of the Tender Offers.

The Expiration Date of the Tender Offers is 5:00 p.m., New York

City time, today, unless extended. Holders who have not already

tendered their securities may continue to do so at any time prior

to 5:00 p.m., New York City time, today, in accordance with the

procedures described in the Offer to Purchase and the related

letter of transmittal. Holders who validly tender and do not

withdraw their 5.450% Medium-Term Notes or their 5.000 per cent.

notes prior to 5:00 p.m., New York City time, today, unless

extended, and whose notes are accepted for purchase pursuant to the

Tender Offers, will receive the applicable Total Consideration set

forth above. Tenders of notes may be validly withdrawn at any time

at or prior to 5:00 p.m., New York City time, today, but not

thereafter. AIG expects to accept all notes validly tendered and

not withdrawn (including notes accepted for purchase pursuant to

the guaranteed delivery procedures, if any) and to make payment on

or about July 7, 2015.

The complete terms of the Tender Offers, including capitalized

terms used but not defined herein, are set forth in the Offer to

Purchase, the related letter of transmittal and the notice of

guaranteed delivery.

Copies of the Offer to Purchase, the related letter of

transmittal and the notice of guaranteed delivery are available at

the following web address: http://www.gbsc-usa.com/aig/.

This press release is qualified in its entirety by the Offer to

Purchase, related letter of transmittal and the notice of

guaranteed delivery.

AIG has retained Barclays Bank PLC, Barclays Capital Inc.,

Credit Suisse Securities (Europe) Limited and Credit Suisse

Securities (USA) LLC as the Joint Lead Dealer Managers. Global

Bondholder Services Corporation is the Information Agent and

Depositary. For additional information regarding the terms of the

Tender Offers, please contact: Barclays Bank PLC at +44 (0)

207 773 8990 (international); Barclays Capital Inc. at (800)

438-3242 (toll-free) or (212) 528-7581 (collect); Credit Suisse

Securities (Europe) Limited at +44 (0) 207 888 5564; or Credit

Suisse Securities (USA) LLC at (800) 820-1653 (toll-free) or (212)

538-2147 (collect). Requests for documents and questions regarding

the tendering of Securities may be directed to Global Bondholder

Services Corporation by telephone at (212) 430-3774 (for banks and

brokers only), (866) 924-2200 (for all others toll-free) or +001

(212) 430-3774 (international), by email at aig@gbsc-usa.com or to

the Joint Lead Dealer Managers at their respective telephone

numbers.

This news release does not constitute an offer or an invitation

by AIG to participate in the Tender Offers in any jurisdiction in

which it is unlawful to make such an offer or solicitation in such

jurisdiction.

Certain statements in this press release, including those

describing the completion of the Tender Offers, constitute

forward-looking statements. These statements are not historical

facts but instead represent only AIG’s belief regarding future

events, many of which, by their nature, are inherently uncertain

and outside AIG’s control. It is possible that actual results will

differ, possibly materially, from the anticipated results indicated

in these statements. Factors that could cause actual results to

differ, possibly materially, from those in the forward-looking

statements are discussed throughout AIG’s periodic filings with the

SEC pursuant to the Securities Exchange Act of 1934.

American International Group, Inc. (AIG) is a leading global

insurance organization serving customers in more than 100 countries

and jurisdictions. AIG companies serve commercial, institutional,

and individual customers through one of the most extensive

worldwide property-casualty networks of any insurer. In addition,

AIG companies are leading providers of life insurance and

retirement services in the United States. AIG common stock is

listed on the New York Stock Exchange and the Tokyo Stock

Exchange.

Additional information about AIG can be found at www.aig.com |

YouTube: www.youtube.com/aig | Twitter: @AIGinsurance | LinkedIn:

http://www.linkedin.com/company/aig.

AIG is the marketing name for the worldwide property-casualty,

life and retirement, and general insurance operations of American

International Group, Inc. For additional information, please visit

our website at www.aig.com. All products and services are written

or provided by subsidiaries or affiliates of American International

Group, Inc. Products or services may not be available in all

countries, and coverage is subject to actual policy language.

Non-insurance products and services may be provided by independent

third parties. Certain property-casualty coverages may be provided

by a surplus lines insurer. Surplus lines insurers do not generally

participate in state guaranty funds, and insureds are therefore not

protected by such funds.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150701006097/en/

American International Group, Inc.Investors:Liz Werner,

212-770-7074elizabeth.werner@aig.comorMedia:Jennifer Hendricks

Sullivan, 212-770-3141jennifer.sullivan@aig.com

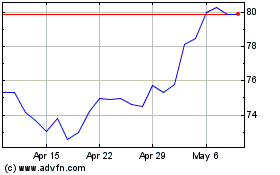

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

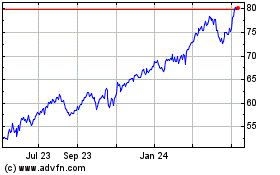

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024