UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2015

CYTODYN INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Colorado |

|

000-49908 |

|

75-3056237 |

| (state or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1111 Main Street, Suite 660

Vancouver, Washington |

|

98660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (360) 980-8524

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry Into a Material Definitive Agreement. |

On June 23, 2015 (the

“Execution Date”), CytoDyn Inc. (the “Company”), Alpha Venture Capital Management, LLC (“AVCM”) and Alpha Venture Capital Partners, LP (“AVCP”) entered into a Debt Conversion and

Termination Agreement (the “Conversion and Termination Agreement”) pursuant to which (i) AVCP agreed to convert the $3,535,627.15 in aggregate indebtedness (the “Note Debt”) owed to AVCP as of June 23,

2015 under the Convertible Notes (as defined below) in exchange for 5,237,966 shares of the Company’s common stock, no par value (“Common Stock” and such shares, the “Note Shares”); (ii) subject to the

conversion of the Note Debt, the Company agreed to issue AVCP an additional five-year warrant award to purchase 1,000,000 shares of Common Stock at an exercise price of $0.675 per share (the “Inducement Warrant”); and

(iii) subject to the AVCP’s receipt of the Note Shares and Inducement Warrant, the parties agreed to (a) terminate the Subscription Agreements (as defined below); and (b) release and discharge each other party from all claims and

obligations arising under the Convertible Notes, the Note Debt and/or the Subscription Agreements.

In particular, under the terms of the

Conversion and Termination Agreement, AVCP agreed to convert the indebtedness owed to AVCP by the Company under the $2,000,000 Convertible Promissory Note and the $1,500,000 Convertible Promissory Note that were issued to AVCP by the Company on

September 26, 2014 and February 6, 2015, respectively (collectively the “Convertible Notes”), into 5,237,966 Note Shares at a conversion price of $0.675 per share (the “Debt Conversion”) within one

(1) business day of the Execution Date. The Company also agreed to issue AVCP the Inducement Warrant within five (5) business days of the Debt Conversion, which will have an exercise price of $0.675 per share, will be exercisable

immediately after its issuance and will have a term of exercise equal to five years after its issuance date. The number of shares of Common Stock into which the Inducement Warrant is exercisable and the exercise price therefor are subject to

adjustment as set forth in the Inducement Warrant, including adjustments for stock subdivisions or combinations. Finally, subject to the Company’s issuance of both the Inducement Warrant and Note Shares, the parties agreed to (a) terminate

their respective rights and obligations under that certain (i) Subscription and Investor Rights Agreement by and between AVCM (on behalf of one or both of AVCP and Alpha Venture Capital Fund, LP (“AVCF”)) and the Company, as

modified by that certain Side Letter Agreement between AVCM and the Company dated September 26, 2014; and (ii) Subscription and Investor Rights Agreement between AVCM (on behalf of one or both of AVCP and AVCF) and the Company dated

February 6, 2015, as modified by that certain Letter of Understanding between AVCP and the Company dated February 10, 2015 (collectively, the “Subscription Agreements”); and (b) release and discharge each other party

from all claims and obligations arising under the Convertible Notes, the Note Debt and/or the Subscription Agreements

The issuance and

sale of the Note Shares, the Inducement Warrant and the shares of Common Stock issuable upon the exercise of the Inducement Warrant (collectively, the “Securities”) has not been, and will not upon issuance be, registered under the

Securities Act of 1933, as amended (the “Securities Act”), and the Securities may not be offered or sold in the United States absent registration under or exemption from the Securities Act and any applicable state securities laws.

The Securities will be issued and sold in reliance upon an exemption from registration afforded by Section 4(a)(2) of the Securities Act based on the following facts: AVCP has represented that it is an accredited investor as defined in Rule 501

promulgated under the Securities Act, that it is acquiring the Securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof in violation of applicable securities laws and that

it has sufficient investment experience to evaluate the risks of the investment; the Company used no advertising or general solicitation in connection with the issuance and sale of the Securities to AVCP; and the Securities will be issued as

restricted securities. This Current Report on Form 8-K is not and shall not be deemed to be an offer to sell or the solicitation of an offer to buy any of the Securities.

Carl C. Dockery, the sole member of Alpha Advisors, LLC, the investment advisor for AVCP and AVCF, and the managing member of AVCM, the

general partner of AVCP and AFCF, is a member of the Company’s Board of Directors. The Debt Conversion and Termination Agreement was approved by a unanimous vote of the disinterested members of the Company’s Board of Directors on

June 19, 2015.

The foregoing description of the Debt Conversion and Termination Agreement and Inducement Warrant does not purport to

be complete and is qualified in its entirety by reference to the copies of the Debt Conversion and Termination Agreement and form of Inducement Warrant filed herewith as Exhibits 10.1 and 10.2 respectively, to this Current Report on

Form 8-K, which are incorporated herein by reference.

-2-

| Item 3.02 |

Unregistered Sales of Equity Securities. |

Reference is made to the disclosure set forth

in Item 1.01 of this Current Report on Form 8-K, which disclosure is incorporated by reference into this Item 3.02.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Debt Conversion and Termination Agreement between CytoDyn Inc., Alpha Venture Capital Management, LLC and Alpha Venture Capital Partners, LP dated June 23, 2015. |

|

|

| 10.2 |

|

Form of Inducement Warrant |

-3-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CytoDyn Inc. |

|

|

|

|

| Date: June 25, 2015 |

|

|

|

By: |

|

/s/ Michael D. Mulholland |

|

|

|

|

Name: |

|

Michael D. Mulholland |

|

|

|

|

Title: |

|

Chief Financial Officer |

-4-

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Debt Conversion and Termination Agreement between CytoDyn Inc., Alpha Venture Capital Management, LLC and Alpha Venture Capital Partners, LP dated June 23, 2015. |

|

|

| 10.2 |

|

Form of Inducement Warrant |

-5-

EXHIBIT 10.1

DEBT CONVERSION AND TERMINATION AGREEMENT

This Debt Conversion and Termination Agreement (“Agreement”) made as of this 23rd day of June, 2015 between CytoDyn Inc. (the

“Company”), Alpha Venture Capital Management, LLC (“AVCM”) and Alpha Venture Capital Partners, LP (“AVCP”).

RECITALS

A.

WHEREAS, the Company issued AVCP that certain Convertible Promissory Note dated September 26, 2014 (the “2014 Convertible Note”) pursuant to the terms and conditions of that certain Subscription and Investor Rights

Agreement by and between AVCM (on behalf of one or both of AVCP and Alpha Venture Capital Fund, LP (“AVCF”)) and the Company, as modified by that certain Side Letter Agreement between AVCM and the Company dated September 26,

2014 (the “2014 Side Letter”, and such subscription agreement as modified by the 2014 Side Letter, the “2014 Subscription Agreement”);

B. WHEREAS, the Company issued AVCP that certain Convertible Promissory Note dated February 6, 2015 (the “2015 Convertible

Note”, and together with the 2014 Convertible Note, the “Convertible Notes”) pursuant to the terms and conditions of that certain Subscription and Investor Rights Agreement between AVCM (on behalf of one or both of AVCP and

AVCF) and the Company dated February 6, 2015, as modified by that certain Letter of Understanding between AVCP and the Company dated February 10, 2015 (the “2015 Side Letter”, and such subscription agreement as modified by

the 2015 Side Letter, the “2015 Subscription Agreement”, and together with the 2014 Subscription Agreement, the “Subscription Agreements”);

C. WHEREAS, as of the date hereof, the aggregate indebtedness owed to AVCP under the Convertible Notes is $3,535,627.15, consisting of

principal accrued and unpaid interest from the date of issuance through the date of conversion pursuant to Section 1 below (the “Note Debt”); and

D. WHEREAS, the parties to this Agreement have agreed to (i) convert the Note Debt into shares of the Company’s common stock,

no par value per share (“Common Stock”); and (ii) terminate the Subscription Agreements, in each case upon the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the agreements and promises contained herein and other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound, hereby agree as follows:

| 1. |

Debt Conversion. Within one (1) business days of the date hereof, AVCP shall convert the full amount of the Note Debt into 5,237,966 shares of Common Stock (the “Note Shares”) at a

conversion price of $0.675 per share by completing, executing and delivering the notices of conversion attached hereto as Exhibits A and B (the “Notices”) to the Company, together with the original Convertible Notes.

|

| 2. |

Stock Certificates; Inducement Warrant. |

| |

a. |

Stock Certificates; Inducement Warrant. Within five (5) business days of the date the Company receives both Notices, the Company shall issue (i) one or more stock certificates evidencing the Note Shares

to the party(s) designated by AVCP to receive such Notes Shares in the applicable Notice; and (ii) in consideration of AVCP’s and AVCM’s entrance into this Agreement and in reliance upon AVCP’s representations and warranties set

forth in Section 5 below, AVCP an additional five-year warrant award, substantially in the form attached hereto as Exhibit C, to purchase 1,000,000 shares of Common Stock at an exercise price of $0.675 per share (the “Inducement

Warrant”). |

| |

b. |

Legends. In accordance with the terms and conditions of the Convertible Notes, all certificates evidencing Note Shares shall be stamped or imprinted with a legend in substantially the following form:

|

“THE SHARES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE

“SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED, OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OR

(2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE STATE SECURITIES LAWS AND THE SECURITIES LAWS OF OTHER JURISDICTIONS AND, IN THE CASE OF A TRANSACTION EXEMPT FROM

REGISTRATION, UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSACTION DOES NOT REQUIRE REGISTRATION UNDER THE SECURITIES ACT OR SUCH OTHER APPLICABLE LAWS.”

| 3. |

Termination of Subscription Agreements. Subject to and effective upon the date the Company issues the Note Shares and Inducement Warrant in accordance with Section 2 above (such date, the

“Termination Date”), the parties agree and acknowledge that the Subscription Agreements (and the parties’ respective rights and obligations thereunder) shall terminate in their entirety and, from and after the Termination Date,

the Subscription Agreements shall have no further force or effect. From the date hereof through the Termination Date, AVCM agrees to refrain from exercising its participation rights set forth in Section 7.1 of each of the Subscription

Agreements. |

| 4. |

Mutual Release: On the Termination Date, each party, on its behalf on the behalf of all of its respective successors in interest, and all its agents, officers, directors, affiliates, employees, representatives,

attorneys, assigns, and/or their successors in interest, shall forever release and discharge each other party hereto and all of its respective successors in interest, and all such other party’s agents, officers, directors, affiliates,

employees, representatives, attorneys, assigns, and/or their successors in interest from any and all claims, obligations, liabilities, demands, causes of action, damages, costs or expenses, in each case (i) regardless of whatever character or

nature, at law, in equity or otherwise, and whether known or unknown, discoverable or undiscoverable, suspected or unsuspected, disclosed or undisclosed, fixed or contingent; and (ii) arising under or relating to the Convertible Notes, the Note

Debt and/or the Subscription Agreements. |

-2-

| 5. |

Representations and Warranties of AVCP |

| |

a. |

AVCP was not contacted for purposes of acquiring the Inducement Warrant through use of any form of general or public advertising, such as media, public seminars or presentations, the Internet, or other means generally

available to the public. |

| |

b. |

AVCP is aware of the Company’s business affairs and financial condition, and has acquired information about the Company sufficient to reach an informed and knowledgeable decision to acquire the Inducement Warrant.

AVCP is acquiring the Inducement Warrant for its own account for investment purposes only and not with a view to, or for the resale in connection with, any “distribution” thereof for purposes of the Securities Act of 1933, as amended (the

“Securities Act”). AVCP is an “accredited investor” as that term is defined in Securities and Exchange Commission Rule 501(a) of Regulation D. |

| |

c. |

AVCP understands that neither the Inducement Warrant nor the shares of Common Stock issuable upon its exercise have been registered under the Securities Act in reliance upon a specific exemption therefrom, which

exemption depends upon, among other things, the bona fide nature of AVCP’s investment intent as expressed herein. |

| |

d. |

AVCP further understands that the Inducement Warrant must be held indefinitely unless subsequently registered under the Securities Act and any applicable state securities laws, or unless exemptions from registration are

otherwise available. |

| |

e. |

AVCP is aware of the provisions of Rule 144, promulgated under the Securities Act, which, in substance, permit limited public resale of “restricted securities” acquired, directly or indirectly, from the issuer

(or from an affiliate of such issuer), in a non-public offering subject to the satisfaction of certain conditions, if applicable, including, among other things, the availability of certain public information about the Company and the resale

occurring not less than six (6) months after the party has purchased and paid for the securities to be sold. |

| |

f. |

AVCP further understands that at the time its wishes to sell Inducement Warrant or the shares of Common Stock issuable upon the exercise of the Inducement Warrant there may be no public market upon which to make such a

sale, and that, even if such a public market then exists, the Company may not have filed all reports and other materials required under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, other than certain Form 8-K reports,

during the preceding 12 months, and that, in such event, because the Company used to be a “shell company” as contemplated under Rule 144(i), Rule 144 will not be available to AVCP. |

| |

g. |

AVCP further understands that in the event all of the requirements of Rule 144 are not satisfied, registration under the Securities Act, compliance

with Regulation A, or some other registration exemption will be required; and that, notwithstanding the fact |

-3-

| |

that Rule 144 is not exclusive, the staff of the Securities and Exchange Commission has expressed its opinion that persons proposing to sell private placement securities other than in a

registered offering and otherwise than pursuant to Rule 144 will have a substantial burden of proof in establishing that an exemption from registration is available for such offers or sales, and that such persons and their respective brokers who

participate in such transactions do so at their own risk. |

| |

a. |

Amendment; Waiver. This Agreement cannot be changed or terminated or any performance or condition waived in whole or in part except by a writing signed by the party against whom enforcement of the change,

termination or waiver is sought. The waiver of any breach of any term or condition of this Agreement shall not be deemed to constitute the waiver of any other breach of the same or any other term or condition. |

| |

b. |

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original. Signatures transmitted by facsimile or e-mail shall have the same effect as the delivery of

original signatures and shall be binding upon and enforceable against the parties hereto as if such facsimile or scanned documents were an original. |

| |

c. |

Entire Agreement. Except as expressly set forth herein, this Agreement contains the entire understanding of the parties with respect to the subject matter hereof and thereof, and supersede all prior agreements,

understandings, discussions and representations, oral or written, with respect to such matters. |

| |

d. |

Applicable Law. This Agreement shall be governed by the laws of the state of Florida, without regard to its principles of conflicts of laws. |

[Signature Page Follows]

-4-

IN WITNESS WHEREOF, Alpha Venture Capital Partners, LP, Alpha Venture Capital Management,

LLC and CytoDyn Inc. have caused their respective signature page to this Debt Conversion and Termination Agreement to be duly executed as of the date first set forth above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CytoDyn Inc. |

|

|

|

Alpha Venture Capital Management, LLC |

|

|

|

Alpha Venture Capital Partners, LP |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

Alpha Venture Capital Management, LLC |

|

|

|

|

|

|

|

|

| By: |

|

/s/ Nader Pourhassan |

|

|

|

By: |

|

/s/ Carl Dockery |

|

|

|

By: |

|

/s/ Carl Dockery |

| Name: |

|

Nader Pourhassan |

|

|

|

Name: |

|

Carl Dockery |

|

|

|

Name: |

|

Carl Dockery |

| Title: |

|

President and CEO |

|

|

|

Title: |

|

Manager |

|

|

|

Title: |

|

Manager |

[SIGNATURE PAGE TO DEBT

CONVERSION AND TERMINATION AGREEMENT]

EXHIBIT A

2014 CONVERTIBLE NOTE

NOTICE OF CONVERSION

(please print)

1. In accordance with the terms of that certain Convertible Promissory Note

issued by CYTODYN INC. to ALPHA VENTURE CAPITAL PARTNERS, L.P., on September 26, 2014 (the “ Note”), the undersigned hereby elects to convert $2,000,000.00 of the principal amount of the Note, together with any related accrued but

unpaid interest, into Shares.

2. Please issue a certificate or certificates representing the Shares in the name of the undersigned or in

such other name or names as are specified below:

3. The undersigned represents that the aforesaid Shares are being acquired for the account of the undersigned

for investment and not with a view to, or for resale in connection with, the distribution thereof and that the undersigned has no present intention of distributing or reselling such Shares. In support thereof, the undersigned has executed an

Investment Representation Statement attached hereto as Schedule 1.

4. All capitalized terms used but not defined herein shall have the

meaning ascribed to such terms in the Note.

|

| 6/24/15 |

| (Date) |

|

| Contact telephone: |

|

| Email: |

SCHEDULE 1

INVESTMENT REPRESENTATION STATEMENT

|

|

|

| Purchaser: |

|

ALPHA VENTURE CAPITAL PARTNERS, L.P. |

| Company |

|

CYTODYN INC. |

| Security: |

|

Common Stock |

| Amount: |

|

|

| Date: |

|

|

In connection with the purchase of the above-listed securities (the “Shares”) pursuant to that

certain Convertible Promissory Note issued by CYTODYN INC. to the Purchaser set forth above, on September 26, 2014 (the “ Note”), Purchaser represents to the Maker as follows:

| |

(a) |

The Purchaser is aware of the Maker’s business affairs and financial condition, and has acquired information about the Maker sufficient to reach an informed and knowledgeable decision to acquire the Shares. The

Purchaser is acquiring the Shares for its own account for investment purposes only and not with a view to, or for the resale in connection with, any “distribution” thereof for purposes of the Securities Act. The Purchaser is an

“accredited investor” as that term is defined in Securities and Exchange Commission Rule 501(a) of Regulation D. |

| |

(b) |

The Purchaser understands that the Shares have not been registered under the Securities Act in reliance upon a specific exemption therefrom, which exemption depends upon, among other things, the bona fide nature of the

Purchaser’s investment intent as expressed herein. |

| |

(c) |

The Purchaser further understands that the Shares must be held indefinitely unless subsequently registered under the Securities Act and any applicable state securities laws, or unless exemptions from registration are

otherwise available. |

| |

(d) |

The Purchaser is aware of the provisions of Rule 144, promulgated under the Securities Act, which, in substance, permit limited public resale of “restricted securities” acquired by non-affiliates of the issuer

thereof, directly or indirectly, from the issuer (or from an affiliate of such issuer), in a non-public offering subject to the satisfaction of certain conditions, if applicable, including, among other things, the availability of certain public

information about the Maker and the resale occurring not less than six (6) months after the party has purchased and paid for the securities to be sold. |

| |

(e) |

The Purchaser further understands that at the time Purchaser wishes to sell the Shares there may be no public market upon which to make such a sale, and that, even if such a public market then exists, the Maker may not

have filed all reports and other materials required under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, other than Form 8-K reports, during the preceding 12 months, and

that, in such event, because the Maker used to be a “shell company” as contemplated under Rule 144(i), Rule 144 will not be available to the Purchaser. |

| |

(f) |

The Purchaser further understands that in the event all of the requirements of Rule 144 are not satisfied, registration under the Securities Act, compliance with Regulation A, or some other registration exemption will

be required; and that, notwithstanding the fact that Rule 144 is not exclusive, the staff of the Securities and Exchange Commission has expressed its opinion that persons proposing to sell private placement securities other than in a registered

offering and otherwise than pursuant to Rule 144 will have a substantial burden of proof in establishing that an exemption from registration is available for such offers or sales, and that such persons and their respective brokers who participate in

such transactions do so at their own risk. |

All capitalized terms used but not defined herein shall have the meaning

ascribed to such terms in the Note.

EXHIBIT B

2015 CONVERTIBLE NOTE

NOTICE OF CONVERSION

(please print)

To: CYTODYN INC.

1. In accordance with the terms of that certain Convertible Promissory Note issued by CYTODYN INC. to ALPHA VENTURE CAPITAL PARTNERS, L.P., on

February 6, 2015 (the “Note”), the undersigned hereby elects to convert $1,500,000.00 of the principal amount of the Note, together with any related accrued but unpaid interest, into Shares.

2. Please issue a certificate or certificates representing the Shares in the name of the undersigned or in such other name or names as are

specified below:

3. The undersigned represents that the aforesaid Shares are being acquired for the account of the undersigned

for investment and not with a view to, or for resale in connection with, the distribution thereof and that the undersigned has no present intention of distributing or reselling such Shares. In support thereof, the undersigned has executed an

Investment Representation Statement attached hereto as Schedule 1.

4. All capitalized terms used but not defined herein shall have the

meaning ascribed to such terms in the Note.

SCHEDULE 1

INVESTMENT REPRESENTATION STATEMENT

|

|

|

| Purchaser: |

|

ALPHA VENTURE CAPITAL PARTNERS, L.P. |

| Company |

|

CYTODYN INC. |

| Security: |

|

Common Stock |

| Amount: |

|

|

| Date: |

|

|

In connection with the purchase of the above-listed securities (the “Shares”) pursuant to that

certain Convertible Promissory Note issued by CYTODYN INC. to the Purchaser set forth above, on February 6, 2015 (the “Note”), Purchaser represents to the Maker as follows:

| |

(a) |

The Purchaser is aware of the Maker’s business affairs and financial condition, and has acquired information about the Maker sufficient to reach an informed and knowledgeable decision to acquire the Shares. The

Purchaser is acquiring the Shares for its own account for investment purposes only and not with a view to, or for the resale in connection with, any “distribution” thereof for purposes of the Securities Act. The Purchaser is an

“accredited investor” as that term is defined in Securities and Exchange Commission Rule 501(a) of Regulation D. |

| |

(b) |

The Purchaser understands that the Shares have not been registered under the Securities Act in reliance upon a specific exemption therefrom, which exemption depends upon, among other things, the bona fide nature of the

Purchaser’s investment intent as expressed herein. |

| |

(c) |

The Purchaser further understands that the Shares must be held indefinitely unless subsequently registered under the Securities Act and any applicable state securities laws, or unless exemptions from registration are

otherwise available. |

| |

(d) |

The Purchaser is aware of the provisions of Rule 144, promulgated under the Securities Act, which, in substance, permit limited public resale of “restricted securities” acquired by non-affiliates of the issuer

thereof, directly or indirectly, from the issuer (or from an affiliate of such issuer), in a non-public offering subject to the satisfaction of certain conditions, if applicable, including, among other things, the availability of certain public

information about the Maker and the resale occurring not less than six (6) months after the party has purchased and paid for the securities to be sold. |

| |

(e) |

The Purchaser further understands that at the time Purchaser wishes to sell the Shares there may be no public market upon which to make such a sale, and that, even if such a public market then exists, the Maker may not

have filed all reports and other materials required under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, other than Form 8-K reports, during the preceding 12 months, and

that, in such event, because the Maker used to be a “shell company” as contemplated under Rule 144(i), Rule 144 will not be available to the Purchaser. |

| |

(f) |

The Purchaser further understands that in the event all of the requirements of Rule 144 are not satisfied, registration under the Securities Act, compliance with Regulation A, or some other registration exemption will

be required; and that, notwithstanding the fact that Rule 144 is not exclusive, the staff of the Securities and Exchange Commission has expressed its opinion that persons proposing to sell private placement securities other than in a registered

offering and otherwise than pursuant to Rule 144 will have a substantial burden of proof in establishing that an exemption from registration is available for such offers or sales, and that such persons and their respective brokers who participate in

such transactions do so at their own risk. |

All capitalized terms used but not defined herein shall have the meaning

ascribed to such terms in the Note.

EXHIBIT C

Form of Inducement Warrant

PURCHASE WARRANT

Issued to:

Alpha Venture Capital Partners, LP

Exercisable to Purchase

1,000,000 Shares of Common Stock

of

CYTODYN INC.

Warrant No. A-80

Void after

June 24, 2020

THIS WARRANT HAS NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933

AND IS NOT TRANSFERABLE

EXCEPT

AS PROVIDED HEREIN

This is to certify that, for value received and subject to the terms and conditions set forth

below, the Warrantholder (hereinafter defined) is entitled to purchase, and the Company (hereinafter defined) promises and agrees to sell and issue to the Warrantholder, at any time on or after the Issue Date and on or before the fifth anniversary

of the Issue Date, up to 1,000,000 shares of Common Stock (hereinafter defined) at the per share Exercise Price (hereinafter defined).

This Warrant Certificate is issued subject to the following terms and conditions:

1. Definitions of Certain Terms. Except as may be otherwise clearly required by the context, the following terms have the following

meanings:

(a) “Cashless Exercise” means an exercise of a Warrant in which, in lieu of payment of the Exercise Price in cash,

the Warrantholder elects to receive a lesser number of Securities in payment of the Exercise Price, as determined in accordance with Section 2(b).

(b) “Closing Date” means the date or dates on which a closing under the Offering occurs.

(c) “Commission” means the Securities and Exchange Commission.

(d) “Common Stock” means the common stock, no par value, of the Company.

(e) “Company” means CytoDyn Inc., a Colorado corporation.

(f) “Exercise Price” means the price at which the Warrantholder may purchase one share of Common Stock or other Securities upon

exercise of a Warrant as determined from time to time pursuant to the provisions hereof, multiplied by the number of Securities as to which the Warrant is being exercised. The Exercise Price is $0.675 per share of Common Stock.

(g) “Issue Date” means the Closing Date on which this Warrant is issued.

(h) “Rules and Regulations” means the rules and regulations of the Commission adopted under the Securities Act.

(i) “Securities” means the securities obtained or obtainable upon exercise of the Warrant or securities obtained or obtainable upon

exercise, exchange, or conversion of such securities.

(j) “Securities Act” means the Securities Act of 1933, as amended.

(k) “Warrant” means the warrant evidenced by this certificate, or any certificate obtained upon transfer or partial exercise of the

Warrant evidenced by any such certificate.

(l) “Warrant Certificate” means a certificate evidencing the Warrant.

(m) “Warrantholder” means a record holder of the Warrant or Securities.

2. Exercise of Warrant.

(a) All or any part of the Warrant represented by this Warrant Certificate may be exercised commencing on the Issue Date and ending at 5:00

p.m. Pacific Time on June 24, 2020 (the “Expiration Date”) by surrendering this Warrant Certificate, together with the Exercise Price and appropriate instructions, duly executed by the Warrantholder or by its duly authorized attorney,

at the office of the Company, 1111 Main Street, Suite 660, Vancouver, Washington, 98660; or at such other office or agency as the Company may designate. The date on which such instructions are received by the Company shall be the date of exercise.

If the Warrantholder has elected a Cashless Exercise, such instructions shall so state.

(b) If the Warrantholder elects a Cashless

Exercise, the Warrantholder may surrender in payment of the Exercise Price, shares of Common Stock equal in value to the Exercise Price by surrender of this Warrant at the principal office of the Company together with notice of such election, in

which event the Company shall issue to the Warrantholder a number of shares of Common Stock computed using the following formula:

|

|

|

|

|

| Where: |

|

X = |

|

The number of shares of Common Stock to be issued to the Warrantholder pursuant to this Cashless Exercise |

|

|

|

|

|

Y = |

|

The number of shares of Common Stock in respect of which the Cashless Exercise election is made |

|

|

|

|

|

A = |

|

The fair market value of one share of Common Stock at the time the Cashless Exercise election is made |

|

|

|

|

|

B = |

|

The Exercise Price (as adjusted to the date of the Cashless Exercise) |

For purposes of this Section 2(b), the fair market value of one share of Common Stock as of a particular date shall be

determined as follows: (i) if traded on a securities exchange, the value shall be deemed to be the average of the closing prices of the Common Stock on such exchange over the thirty (30) day period ending one (1) day prior to the

Cashless Exercise; (ii) if traded over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) of the Common Stock over the thirty (30) day period ending one (1) day prior

to the Cashless Exercise; and (iii) if there is no active public market, the value shall be the fair market value thereof, as determined in good faith by the Board of Directors of the Company.

(c) Subject to the provisions below, upon receipt of notice of exercise, the Company shall promptly prepare or cause the preparation of

certificates for the Securities to be received by the Warrantholder upon completion of the Warrant exercise. After such certificates are prepared, the Company shall notify the Warrantholder and, upon payment in full by the

Warrantholder, in lawful money of the United States, of the Exercise Price payable with respect to the Securities being purchased, or, in the case of a Cashless Exercise, upon deemed surrender of

Securities equal in value to the Exercise Price, deliver such certificates to the Warrantholder, or as per the Warrantholder’s instructions, promptly after such funds are available, if applicable, and otherwise promptly thereafter. The

Securities to be obtained on exercise of the Warrant will be deemed to have been issued, and any person exercising the Warrant will be deemed to have become a holder of record of those Securities, as of the date of receipt by the Company of

(a) available funds in cash in payment of the Exercise Price, or (b) notice of Cashless Exercise.

(d) If fewer than all the

Securities purchasable under the Warrant are purchased, the Company will, upon such partial exercise, execute and deliver to the Warrantholder a new Warrant Certificate (dated the date hereof), in form and tenor similar to this Warrant Certificate,

evidencing that portion of the Warrant not exercised.

(e) Notwithstanding the foregoing, in no event shall such Securities be issued, and

the Company is authorized to refuse to honor the exercise of the Warrant, if such exercise would result in the opinion of the Company’s Board of Directors, upon advice of counsel, in the violation of any law.

3. Adjustments in Certain Events. The number, class, and price of Securities for which this Warrant Certificate may be exercised are

subject to adjustment from time to time upon the happening of certain events as follows:

(a) If the outstanding shares of the

Company’s Common Stock are divided into a greater number of shares or a dividend in stock is paid on the Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable will be proportionately increased and the

Exercise Price will be proportionately reduced; and, conversely, if the outstanding shares of Common Stock are combined into a smaller number of shares of Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable

will be proportionately reduced and the Exercise Price will be proportionately increased. The increases and reductions provided for in this Section 3(a) will be made with the intent and, as nearly as practicable, the effect that neither the

percentage of the total equity of the Company obtainable on exercise of the Warrants nor the price payable for such percentage upon such exercise will be affected by any event described in this Section 3(a).

(b) In case of any change in the Common Stock through merger, consolidation, reclassification, reorganization, partial or complete

liquidation, purchase of substantially all the assets of the Company, or other change in the capital structure of the Company, then, as a condition of such change, lawful and adequate provision will be made so that the Warrantholder will have the

right thereafter to receive upon the exercise of the Warrant the kind and amount of shares of stock or other securities or property to which the Warrantholder would have been entitled if, immediately prior to such event, the Warrantholder had held

the number of shares of Common Stock obtainable upon the exercise of the Warrant. In any such case, appropriate adjustment will be made in the application of the provisions set forth herein with respect to the rights and interest thereafter of the

Warrantholder, to the end that the provisions set forth herein will thereafter be applicable, as nearly as reasonably may be, in relation to any shares of stock or other securities or property thereafter deliverable upon the

exercise of the Warrant. The Company will not permit any change in its capital structure to occur unless the issuer of the shares of stock or other securities to be received by the holder of this

Warrant Certificate, if not the Company, agrees to be bound by and comply with the provisions of this Warrant Certificate.

(c) When any

adjustment is required to be made in the number of shares of Common Stock, other securities, or the property purchasable upon exercise of the Warrant, the Company will promptly determine the new number of such shares or other securities or property

purchasable upon exercise of the Warrant and (i) prepare and retain on file a statement describing in reasonable detail the method used in arriving at the new number of such shares or other securities or property purchasable upon exercise of

the Warrant and (ii) cause a copy of such statement to be mailed to the Warrantholder within thirty (30) days after the date of the event giving rise to the adjustment.

(d) No fractional shares of Common Stock or other Securities will be issued in connection with the exercise of the Warrant, and the number of

shares of Common Stock to be issued shall be rounded to the nearest whole number.

(e) If securities of the Company or securities of any

subsidiary of the Company are distributed pro rata to holders of Common Stock, such number of securities will be distributed to the Warrantholder or its assignee upon exercise of its rights hereunder as such Warrantholder or assignee would have been

entitled to if this Warrant had been exercised prior to the record date for such distribution. The provisions with respect to adjustment of the Common Stock provided in this Section 3 will also apply to the securities to which the Warrantholder

or its assignee is entitled under this Section 3(e).

(f) Notwithstanding anything herein to the contrary, there will be no

adjustment made hereunder on account of the sale by the Company of the Common Stock or any other Securities purchasable upon exercise of the Warrant.

4. Reservation of Securities. The Company agrees that the number of shares of Common Stock or other Securities sufficient to provide

for the exercise of the Warrant upon the basis set forth above will, at all times during the term of the Warrant, be reserved for issuance.

5. Validity of Securities. All Securities delivered upon the exercise of the Warrant will be duly and validly issued in accordance with

their terms and, upon payment of the Exercise Price, will be fully paid and non-assessable. The Company will pay all documentary and transfer taxes, if any, in respect of the original issuance thereof upon exercise of the Warrant.

6. Transferability. Neither this Warrant Certificate, the Warrant, or the shares of Common Stock issuable upon its exercise may offered

for sale, sold, transferred or assigned unless and until (i) the Warrantholder shall have delivered to the Company (if requested by the Company) an opinion of counsel to the Warrantholder, in a form reasonably acceptable to the Company, to the

effect that such Warrant Certificate, Warrant or Securities to be sold, transferred or assigned may be transferred or assigned pursuant to an exemption from registration under the Securities Act; or (ii) the Warrantholder provides the Company

with reasonable assurance (which may include customary representation letters) that such Warrant Certificate, Warrant or Securities can be sold, assigned or transferred pursuant to Rule 144 or Rule 144A promulgated under the Securities Act.

7. Securities Act Compliance. The Warrantholder hereby represents: (a) that this

Warrant and any Common Stock to be acquired by the Warrantholder on exercise of the Warrant will be acquired for investment for the Warrantholder’s own account and not with a view to the resale or distribution of any part thereof, and

(b) that the Warrantholder is an accredited investor as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. In addition, as a condition of its delivery of certificates for the Common Stock, the Company will require the

Warrantholder to deliver to the Company representations regarding the Warrantholder’s sophistication, investor status, investment intent, acquisition for its own account and such other matters as are reasonable and customary for purchasers of

securities in an unregistered private offering as set forth in the attached Exercise Form. The Company may place conspicuously upon each certificate representing the Common Stock a legend substantially in the following form, the terms of which are

agreed to by the Warrantholder:

“THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF

1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER

THE SECURITIES ACT OR (2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE STATE SECURITIES LAWS AND THE SECURITIES LAWS OF OTHER JURISDICTIONS AND, IN THE CASE OF A

TRANSACTION EXEMPT FROM REGISTRATION, UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSACTION DOES NOT REQUIRE REGISTRATION UNDER THE SECURITIES ACT AND SUCH OTHER APPLICABLE LAWS.”

8. No Rights as a Shareholder. Except as otherwise provided herein, the Warrantholder will not, by virtue of ownership of the Warrant,

be entitled to any rights of a shareholder of the Company but will, upon written request to the Company, be entitled to receive such quarterly or annual reports as the Company distributes to its shareholders.

9. Notice. Any notices required or permitted to be given hereunder will be in writing and may be served personally or by mail,

including by e-mail; and if served will be addressed as follows:

|

|

|

| If to the Company: |

|

CytoDyn Inc. Attn: Michael D. Mulholland

1111 Main Street, Suite 660 Vancouver, Washington, 98660

Email: mmulholland@cytodyn.com |

|

|

|

| with a copy to: |

|

Lowenstein Sandler, LLP Attn: Steven M.

Skolnick 65 Livingston Avenue Roseland, New Jersey 07068

Email: sskolnick@lowenstein.com |

|

|

| If to the Warrantholder: |

|

c/o Carl C. Dockery Alpha Advisors, LLC

P.O. Box 2477 Lakeland, FL 33806-2477 |

Any notice so given by mail will be deemed effectively given 48 hours after mailing when deposited in the

United States mail, registered or certified mail, return receipt requested, postage prepaid and addressed as specified above. Any notice given by e-mail must be accompanied by confirmation of receipt, and will be deemed effectively given upon

confirmation of such receipt. Any party may by written notice to the other specify a different address for notice purposes.

10.

Applicable Law. This Warrant Certificate will be governed by and construed in accordance with the laws of the State of Oregon, without reference to conflict of laws principles thereunder. All disputes relating to this Warrant Certificate

shall be tried before the courts of Oregon located in Multnomah County, Oregon to the exclusion of all other courts that might have jurisdiction.

Dated as of June 24, 2015

|

|

|

|

|

| CYTODYN INC. |

|

|

| By: |

|

|

|

|

Name: |

|

Nader Z. Pourhassan |

|

|

Title: |

|

President and Chief Executive Officer |

EXERCISE FORM

(To Be Executed by the Warrantholder

to Exercise the Warrant)

| 1. |

The undersigned hereby irrevocably elects to exercise the right to purchase 1,000,000 shares of Common Stock, represented by Warrant No. A-80 as follows: |

| |

[ ] |

Exercise for Cash. Pursuant to Section 2(a) of the Warrant, the Holder hereby elects to exercise the Warrant for cash and tenders payment herewith (or has made a wire transfer) to the order of CytoDyn Inc.

in the amount of $ . |

| 2. |

|

[ ] |

Cashless Exercise. Pursuant to Section 2(b) of the Warrant, the Holder hereby elects to exercise the Warrant on a cashless basis.

|

| 3. |

The undersigned requests that the applicable number of shares of Common Stock be issued and delivered to the following address: |

|

|

|

|

|

| Name: |

|

|

|

|

|

|

|

| Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Email: |

|

|

|

|

|

|

|

| SSN: |

|

|

|

|

| 4. |

The undersigned understands, agrees and recognizes that: |

| |

(a) |

No federal or state agency has made any finding or determination as to the fairness of the investment or any recommendation or endorsement of the securities. |

| |

(b) |

All certificates evidencing the shares of Common Stock, if any, may bear a legend substantially similar to the legend set forth in Section 7 of the Warrant regarding resale restrictions. |

Representations of the undersigned.

| 5. |

The undersigned acknowledges that the undersigned has received, read and understood the Warrant and agrees to abide by and be bound by its terms and conditions. |

| 6. |

(i) The undersigned has such knowledge and experience in business and financial matters that the undersigned is capable of evaluating the Company and the proposed activities thereof, and the risks and merits of this

prospective investment. |

[ ] YES [ ] NO

(ii) If “No”, the undersigned is represented by a “purchaser representative,” as that term is defined in Regulation D under

the Securities Act of 1933, as amended (the “Securities Act”).

[ ] YES [ ] NO

| 7. |

(i) The undersigned is an “accredited investor,” as that term is defined in the Securities Act. |

[ ] YES [ ] NO

(ii) If “Yes,” the undersigned comes within the following category of that definition (check one):

| |

[ ] |

The undersigned is a natural person whose present net worth (or whose joint net worth with his or her spouse), excluding the value of the undersigned’s primary residence, exceeds $1,000,000. For purposes of

calculating the undersigned’s present net worth, the undersigned has included the following as liabilities: (i) any indebtedness that is secured by the undersigned’s primary residence in excess of the estimated fair market value of

the undersigned’s primary residence at the time of the sale of the shares, and (ii) any incremental debt secured by the undersigned’s primary residence that was incurred in the 60 days before the sale of the shares, other than as a

result of the acquisition of the undersigned’s primary residence. |

| |

[ ] |

The undersigned is a natural person who had individual income in excess of $200,000 in each of the last two years or joint income with the undersigned’s spouse in excess of $300,000 during such two years, and the

undersigned reasonably expects to have the same income level in the current year. |

| |

[ ] |

The undersigned is an officer or director of the Company. |

| |

[ ] |

The undersigned is a corporation or partnership not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000. |

| |

[ ] |

The undersigned is a trust with total assets in excess of $5,000,000 whose purchase is directed by a person with such knowledge and experience in financial and business matters that such person is capable of evaluating

the merits and risks of the prospective investment. |

| |

[ ] |

The undersigned is an entity, all of whose equity owners are accredited investors under one or more of the categories above. |

| 8. |

The undersigned understands that the shares purchased hereunder have not been registered under the Securities Act, in reliance upon the exemption from the registration requirements under the Securities Act pursuant to

Section 4(a)(2) of the Securities Act and Rule 506 promulgated thereunder; and, therefore, that the undersigned must bear the economic risk of the investment for an indefinite period of time since the securities cannot be sold, transferred or

assigned to any person or entity without compliance with the provisions of the Securities Act |

Dated:

, 20 .

|

|

|

| By: |

|

|

| Name: |

|

|

| Print: |

|

|

|

| Note: Signature must correspond with the name as written upon the face of the Warrant in all respects, without alteration or enlargement or any change whatsoever. |

EXHIBIT 10.2

Form of Inducement Warrant

PURCHASE WARRANT

Issued to:

Alpha Venture Capital Partners, LP

Exercisable to Purchase

1,000,000 Shares of Common Stock

of

CYTODYN INC.

Warrant No. A-80

Void after

June 24, 2020

THIS WARRANT HAS NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933

AND IS NOT TRANSFERABLE

EXCEPT

AS PROVIDED HEREIN

This is to certify that, for value received and subject to the terms and conditions set forth

below, the Warrantholder (hereinafter defined) is entitled to purchase, and the Company (hereinafter defined) promises and agrees to sell and issue to the Warrantholder, at any time on or after the Issue Date and on or before the fifth anniversary

of the Issue Date, up to 1,000,000 shares of Common Stock (hereinafter defined) at the per share Exercise Price (hereinafter defined).

This Warrant Certificate is issued subject to the following terms and conditions:

1. Definitions of Certain Terms. Except as may be otherwise clearly required by the context, the following terms have the following

meanings:

(a) “Cashless Exercise” means an exercise of a Warrant in which, in lieu of payment of the Exercise Price in cash,

the Warrantholder elects to receive a lesser number of Securities in payment of the Exercise Price, as determined in accordance with Section 2(b).

(b) “Closing Date” means the date or dates on which a closing under the Offering occurs.

(c) “Commission” means the Securities and Exchange Commission.

(d) “Common Stock” means the common stock, no par value, of the Company.

(e) “Company” means CytoDyn Inc., a Colorado corporation.

(f) “Exercise Price” means the price at which the Warrantholder may purchase one share of Common Stock or other Securities upon

exercise of a Warrant as determined from time to time pursuant to the provisions hereof, multiplied by the number of Securities as to which the Warrant is being exercised. The Exercise Price is $0.675 per share of Common Stock.

(g) “Issue Date” means the Closing Date on which this Warrant is issued.

(h) “Rules and Regulations” means the rules and regulations of the Commission adopted under the Securities Act.

(i) “Securities” means the securities obtained or obtainable upon exercise of the Warrant or securities obtained or obtainable upon

exercise, exchange, or conversion of such securities.

(j) “Securities Act” means the Securities Act of 1933, as amended.

(k) “Warrant” means the warrant evidenced by this certificate, or any certificate obtained upon transfer or partial exercise of the

Warrant evidenced by any such certificate.

(l) “Warrant Certificate” means a certificate evidencing the Warrant.

(m) “Warrantholder” means a record holder of the Warrant or Securities.

2. Exercise of Warrant.

(a) All or any part of the Warrant represented by this Warrant Certificate may be exercised commencing on the Issue Date and ending at 5:00

p.m. Pacific Time on June 24, 2020 (the “Expiration Date”) by surrendering this Warrant Certificate, together with the Exercise Price and appropriate instructions, duly executed by the Warrantholder or by its duly authorized attorney,

at the office of the Company, 1111 Main Street, Suite 660, Vancouver, Washington, 98660; or at such other office or agency as the Company may designate. The date on which such instructions are received by the Company shall be the date of exercise.

If the Warrantholder has elected a Cashless Exercise, such instructions shall so state.

(b) If the Warrantholder elects a Cashless

Exercise, the Warrantholder may surrender in payment of the Exercise Price, shares of Common Stock equal in value to the Exercise Price by surrender of this Warrant at the principal office of the Company together with notice of such election, in

which event the Company shall issue to the Warrantholder a number of shares of Common Stock computed using the following formula:

|

|

|

|

|

| Where: |

|

X = |

|

The number of shares of Common Stock to be issued to the Warrantholder pursuant to this Cashless Exercise |

|

|

|

|

|

Y = |

|

The number of shares of Common Stock in respect of which the Cashless Exercise election is made |

|

|

|

|

|

A = |

|

The fair market value of one share of Common Stock at the time the Cashless Exercise election is made |

|

|

|

|

|

B = |

|

The Exercise Price (as adjusted to the date of the Cashless Exercise) |

For purposes of this Section 2(b), the fair market value of one share of Common Stock as of a particular date shall be

determined as follows: (i) if traded on a securities exchange, the value shall be deemed to be the average of the closing prices of the Common Stock on such exchange over the thirty (30) day period ending one (1) day prior to the

Cashless Exercise; (ii) if traded over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) of the Common Stock over the thirty (30) day period ending one (1) day prior

to the Cashless Exercise; and (iii) if there is no active public market, the value shall be the fair market value thereof, as determined in good faith by the Board of Directors of the Company.

(c) Subject to the provisions below, upon receipt of notice of exercise, the Company shall promptly prepare or cause the preparation of

certificates for the Securities to be received by the Warrantholder upon completion of the Warrant exercise. After such certificates are prepared, the Company shall notify the Warrantholder and, upon payment in full by the

Warrantholder, in lawful money of the United States, of the Exercise Price payable with respect to the Securities being purchased, or, in the case of a Cashless Exercise, upon deemed surrender of

Securities equal in value to the Exercise Price, deliver such certificates to the Warrantholder, or as per the Warrantholder’s instructions, promptly after such funds are available, if applicable, and otherwise promptly thereafter. The

Securities to be obtained on exercise of the Warrant will be deemed to have been issued, and any person exercising the Warrant will be deemed to have become a holder of record of those Securities, as of the date of receipt by the Company of

(a) available funds in cash in payment of the Exercise Price, or (b) notice of Cashless Exercise.

(d) If fewer than all the

Securities purchasable under the Warrant are purchased, the Company will, upon such partial exercise, execute and deliver to the Warrantholder a new Warrant Certificate (dated the date hereof), in form and tenor similar to this Warrant Certificate,

evidencing that portion of the Warrant not exercised.

(e) Notwithstanding the foregoing, in no event shall such Securities be issued, and

the Company is authorized to refuse to honor the exercise of the Warrant, if such exercise would result in the opinion of the Company’s Board of Directors, upon advice of counsel, in the violation of any law.

3. Adjustments in Certain Events. The number, class, and price of Securities for which this Warrant Certificate may be exercised are

subject to adjustment from time to time upon the happening of certain events as follows:

(a) If the outstanding shares of the

Company’s Common Stock are divided into a greater number of shares or a dividend in stock is paid on the Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable will be proportionately increased and the

Exercise Price will be proportionately reduced; and, conversely, if the outstanding shares of Common Stock are combined into a smaller number of shares of Common Stock, the number of shares of Common Stock for which the Warrant is then exercisable

will be proportionately reduced and the Exercise Price will be proportionately increased. The increases and reductions provided for in this Section 3(a) will be made with the intent and, as nearly as practicable, the effect that neither the

percentage of the total equity of the Company obtainable on exercise of the Warrants nor the price payable for such percentage upon such exercise will be affected by any event described in this Section 3(a).

(b) In case of any change in the Common Stock through merger, consolidation, reclassification, reorganization, partial or complete

liquidation, purchase of substantially all the assets of the Company, or other change in the capital structure of the Company, then, as a condition of such change, lawful and adequate provision will be made so that the Warrantholder will have the

right thereafter to receive upon the exercise of the Warrant the kind and amount of shares of stock or other securities or property to which the Warrantholder would have been entitled if, immediately prior to such event, the Warrantholder had held

the number of shares of Common Stock obtainable upon the exercise of the Warrant. In any such case, appropriate adjustment will be made in the application of the provisions set forth herein with respect to the rights and interest thereafter of the

Warrantholder, to the end that the provisions set forth herein will thereafter be applicable, as nearly as reasonably may be, in relation to any shares of stock or other securities or property thereafter deliverable upon the

exercise of the Warrant. The Company will not permit any change in its capital structure to occur unless the issuer of the shares of stock or other securities to be received by the holder of this

Warrant Certificate, if not the Company, agrees to be bound by and comply with the provisions of this Warrant Certificate.

(c) When any

adjustment is required to be made in the number of shares of Common Stock, other securities, or the property purchasable upon exercise of the Warrant, the Company will promptly determine the new number of such shares or other securities or property

purchasable upon exercise of the Warrant and (i) prepare and retain on file a statement describing in reasonable detail the method used in arriving at the new number of such shares or other securities or property purchasable upon exercise of

the Warrant and (ii) cause a copy of such statement to be mailed to the Warrantholder within thirty (30) days after the date of the event giving rise to the adjustment.

(d) No fractional shares of Common Stock or other Securities will be issued in connection with the exercise of the Warrant, and the number of

shares of Common Stock to be issued shall be rounded to the nearest whole number.

(e) If securities of the Company or securities of any

subsidiary of the Company are distributed pro rata to holders of Common Stock, such number of securities will be distributed to the Warrantholder or its assignee upon exercise of its rights hereunder as such Warrantholder or assignee would have been

entitled to if this Warrant had been exercised prior to the record date for such distribution. The provisions with respect to adjustment of the Common Stock provided in this Section 3 will also apply to the securities to which the Warrantholder

or its assignee is entitled under this Section 3(e).

(f) Notwithstanding anything herein to the contrary, there will be no

adjustment made hereunder on account of the sale by the Company of the Common Stock or any other Securities purchasable upon exercise of the Warrant.

4. Reservation of Securities. The Company agrees that the number of shares of Common Stock or other Securities sufficient to provide

for the exercise of the Warrant upon the basis set forth above will, at all times during the term of the Warrant, be reserved for issuance.

5. Validity of Securities. All Securities delivered upon the exercise of the Warrant will be duly and validly issued in accordance with

their terms and, upon payment of the Exercise Price, will be fully paid and non-assessable. The Company will pay all documentary and transfer taxes, if any, in respect of the original issuance thereof upon exercise of the Warrant.

6. Transferability. Neither this Warrant Certificate, the Warrant, or the shares of Common Stock issuable upon its exercise may offered

for sale, sold, transferred or assigned unless and until (i) the Warrantholder shall have delivered to the Company (if requested by the Company) an opinion of counsel to the Warrantholder, in a form reasonably acceptable to the Company, to the

effect that such Warrant Certificate, Warrant or Securities to be sold, transferred or assigned may be transferred or assigned pursuant to an exemption from registration under the Securities Act; or (ii) the Warrantholder provides the Company

with reasonable assurance (which may include customary representation letters) that such Warrant Certificate, Warrant or Securities can be sold, assigned or transferred pursuant to Rule 144 or Rule 144A promulgated under the Securities Act.

7. Securities Act Compliance. The Warrantholder hereby represents: (a) that this

Warrant and any Common Stock to be acquired by the Warrantholder on exercise of the Warrant will be acquired for investment for the Warrantholder’s own account and not with a view to the resale or distribution of any part thereof, and

(b) that the Warrantholder is an accredited investor as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. In addition, as a condition of its delivery of certificates for the Common Stock, the Company will require the

Warrantholder to deliver to the Company representations regarding the Warrantholder’s sophistication, investor status, investment intent, acquisition for its own account and such other matters as are reasonable and customary for purchasers of

securities in an unregistered private offering as set forth in the attached Exercise Form. The Company may place conspicuously upon each certificate representing the Common Stock a legend substantially in the following form, the terms of which are

agreed to by the Warrantholder:

“THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF

1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER

THE SECURITIES ACT OR (2) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE STATE SECURITIES LAWS AND THE SECURITIES LAWS OF OTHER JURISDICTIONS AND, IN THE CASE OF A

TRANSACTION EXEMPT FROM REGISTRATION, UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSACTION DOES NOT REQUIRE REGISTRATION UNDER THE SECURITIES ACT AND SUCH OTHER APPLICABLE LAWS.”

8. No Rights as a Shareholder. Except as otherwise provided herein, the Warrantholder will not, by virtue of ownership of the Warrant,

be entitled to any rights of a shareholder of the Company but will, upon written request to the Company, be entitled to receive such quarterly or annual reports as the Company distributes to its shareholders.

9. Notice. Any notices required or permitted to be given hereunder will be in writing and may be served personally or by mail,

including by e-mail; and if served will be addressed as follows:

|

|

|

| If to the Company: |

|

CytoDyn Inc. Attn: Michael D. Mulholland

1111 Main Street, Suite 660 Vancouver, Washington, 98660

Email: mmulholland@cytodyn.com |

|

|

|

| with a copy to: |

|

Lowenstein Sandler, LLP Attn: Steven M.

Skolnick 65 Livingston Avenue Roseland, New Jersey 07068

Email: sskolnick@lowenstein.com |

|

|

| If to the Warrantholder: |

|

c/o Carl C. Dockery Alpha Advisors, LLC

P.O. Box 2477 Lakeland, FL 33806-2477 |

Any notice so given by mail will be deemed effectively given 48 hours after mailing when deposited in the

United States mail, registered or certified mail, return receipt requested, postage prepaid and addressed as specified above. Any notice given by e-mail must be accompanied by confirmation of receipt, and will be deemed effectively given upon

confirmation of such receipt. Any party may by written notice to the other specify a different address for notice purposes.

10.

Applicable Law. This Warrant Certificate will be governed by and construed in accordance with the laws of the State of Oregon, without reference to conflict of laws principles thereunder. All disputes relating to this Warrant Certificate

shall be tried before the courts of Oregon located in Multnomah County, Oregon to the exclusion of all other courts that might have jurisdiction.

Dated as of June 24, 2015

|

|

|

|

|

| CYTODYN INC. |

|

|

| By: |

|

|

|

|

Name: |

|

Nader Z. Pourhassan |

|

|

Title: |

|

President and Chief Executive Officer |

EXERCISE FORM

(To Be Executed by the Warrantholder

to Exercise the Warrant)

| 1. |

The undersigned hereby irrevocably elects to exercise the right to purchase 1,000,000 shares of Common Stock, represented by Warrant No. A-80 as follows: |

| |

[ ] |

Exercise for Cash. Pursuant to Section 2(a) of the Warrant, the Holder hereby elects to exercise the Warrant for cash and tenders payment herewith (or has made a wire transfer) to the order of CytoDyn Inc.

in the amount of $ . |

| 2. |

|

[ ] |

Cashless Exercise. Pursuant to Section 2(b) of the Warrant, the Holder hereby elects to exercise the Warrant on a cashless basis.

|

| 3. |

The undersigned requests that the applicable number of shares of Common Stock be issued and delivered to the following address: |

|

|

|

|

|

| Name: |

|

|

|

|

|

|

|

| Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Email: |

|

|

|

|

|

|

|

| SSN: |

|

|

|

|

| 4. |

The undersigned understands, agrees and recognizes that: |

| |

(a) |

No federal or state agency has made any finding or determination as to the fairness of the investment or any recommendation or endorsement of the securities. |

| |

(b) |

All certificates evidencing the shares of Common Stock, if any, may bear a legend substantially similar to the legend set forth in Section 7 of the Warrant regarding resale restrictions. |

Representations of the undersigned.

| 5. |

The undersigned acknowledges that the undersigned has received, read and understood the Warrant and agrees to abide by and be bound by its terms and conditions. |

| 6. |

(i) The undersigned has such knowledge and experience in business and financial matters that the undersigned is capable of evaluating the Company and the proposed activities thereof, and the risks and merits of this

prospective investment. |

[ ] YES [ ] NO

(ii) If “No”, the undersigned is represented by a “purchaser representative,” as that term is defined in Regulation D under

the Securities Act of 1933, as amended (the “Securities Act”).

[ ] YES [ ] NO

| 7. |

(i) The undersigned is an “accredited investor,” as that term is defined in the Securities Act. |

[ ] YES [ ] NO

(ii) If “Yes,” the undersigned comes within the following category of that definition (check one):

| |

[ ] |

The undersigned is a natural person whose present net worth (or whose joint net worth with his or her spouse), excluding the value of the undersigned’s primary residence, exceeds $1,000,000. For purposes of

calculating the undersigned’s present net worth, the undersigned has included the following as liabilities: (i) any indebtedness that is secured by the undersigned’s primary residence in excess of the estimated fair market value of

the undersigned’s primary residence at the time of the sale of the shares, and (ii) any incremental debt secured by the undersigned’s primary residence that was incurred in the 60 days before the sale of the shares, other than as a

result of the acquisition of the undersigned’s primary residence. |

| |

[ ] |

The undersigned is a natural person who had individual income in excess of $200,000 in each of the last two years or joint income with the undersigned’s spouse in excess of $300,000 during such two years, and the

undersigned reasonably expects to have the same income level in the current year. |

| |

[ ] |

The undersigned is an officer or director of the Company. |

| |

[ ] |

The undersigned is a corporation or partnership not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000. |

| |

[ ] |

The undersigned is a trust with total assets in excess of $5,000,000 whose purchase is directed by a person with such knowledge and experience in financial and business matters that such person is capable of evaluating

the merits and risks of the prospective investment. |

| |

[ ] |

The undersigned is an entity, all of whose equity owners are accredited investors under one or more of the categories above. |

| 8. |

The undersigned understands that the shares purchased hereunder have not been registered under the Securities Act, in reliance upon the exemption from the registration requirements under the Securities Act pursuant to

Section 4(a)(2) of the Securities Act and Rule 506 promulgated thereunder; and, therefore, that the undersigned must bear the economic risk of the investment for an indefinite period of time since the securities cannot be sold, transferred or

assigned to any person or entity without compliance with the provisions of the Securities Act |

Dated:

, 20 .

|

|

|

| By: |

|

|

| Name: |

|

|

| Print: |

|

|

|

| Note: Signature must correspond with the name as written upon the face of the Warrant in all respects, without alteration or enlargement or any change whatsoever. |

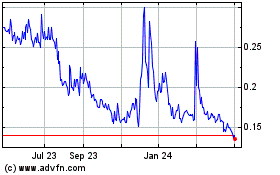

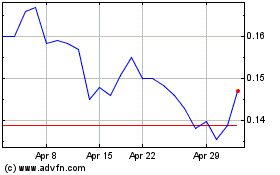

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024