Current Report Filing (8-k)

June 19 2015 - 4:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 18, 2015

CANNAVEST CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

(Address of principal executive offices,

Zip Code)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_] Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry

into a Material Definitive Agreement.

As previously reported by CannaVEST Corp.

(the “Company”) in its Current Report on Form 8-K (the “Original Form 8-K”) filed with the Securities and

Exchange Commission (the “SEC”) on May 21, 2015, on May 19, 2015 (the “Closing Date”), the Company entered

into a Securities Purchase Agreement (“SPA”) with an institutional accredited investor (“Investor”) pursuant

to which Investor committed to lend to the Company up to $6,500,000 (the “Financing”). On the Closing Date, the Company

issued to Investor a 10% Senior Secured Convertible Promissory Note (the “Initial Note”) in the principal amount of

$510,000, in exchange for payment by Investor of the total sum of $500,000.

In connection with the Financing, and in

addition to the SPA and the Initial Note, on the Closing Date, the Company and Investor entered into a Security Agreement, an Intellectual

Property Security Agreement and a Registration Rights Agreement, and each of the Company’s subsidiary companies entered into

a Subsidiary Guarantee (the “Transaction Documents”). Pursuant to the Financing, and provided the Company is not in

default under the terms of any of the Transaction Documents, Investor will provide funding in up to five additional tranches in

exchange for delivery of additional 10% Senior Secured Convertible Promissory Notes (each, a “Note” and together with

the Initial Note, the “Notes”), as further described in the Original Form 8-K.

Pursuant to the original terms of the Registration

Rights Agreement, within 30 days of the Closing Date (the “Filing Deadline”), the Company was required to file a Registration

Statement with the SEC on Form S-1, seeking to register all of the shares of the Company’s common stock issuable to Investor

upon conversion of the Notes (the “Registration Statement”); which relates to the resale by the holders of all of the

Company’s common stock issued upon conversion of the Notes (or such other number as the SEC shall permit). On June 18, 2015,

the Company and Investor agreed to extend the Filing Deadline an additional 30 days, or until July 18, 2015. As July 18, 2015 is

a Saturday, the Registration Statement must be filed by Monday, July 20, 2015.

The foregoing summary description of the

terms of the Transaction Documents may not contain all information that is of interest to the reader. For further information regarding

the terms of the Transaction Documents, reference is made to such Transaction Documents, which are filed as Exhibits 10.1 –

10.6 to the Original Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 19, 2015

| |

CANNAVEST CORP. |

| |

|

| |

By: |

/s/ Michael Mona, Jr. |

| |

|

Michael Mona, Jr.

President and Chief Executive Officer |

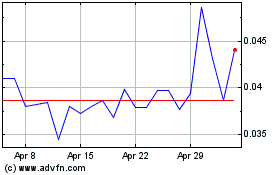

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024