UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 18, 2015

AMERICAN INTERNATIONAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8787 |

|

13-2592361 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

175 Water Street

New York, New York 10038

(Address of principal executive offices)

Registrant’s telephone number, including area code: (212) 770-7000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On June 18, 2015, American International Group, Inc. (“AIG”) issued a

press release announcing the commencement of tender offers for 26 series of debt securities of AIG and one of its subsidiaries, AIG Life Holdings, Inc.

A

copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

Exhibit 99.1 Press release

dated June 18, 2015

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN INTERNATIONAL GROUP, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: June 18, 2015 |

|

|

|

By: |

|

/s/ James J. Killerlane III |

|

|

|

|

Name: |

|

James J. Killerlane III |

|

|

|

|

Title: |

|

Associate General Counsel and Assistant Secretary |

-3-

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| Exhibit 99.1 |

|

Press release dated June 18, 2015 |

-4-

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

|

|

|

|

|

|

|

| Press Release AIG

175 Water Street New York, NY

10038 www.aig.com |

|

Contacts: Liz Werner (Investors):

212-770-7074; elizabeth.werner@aig.com Jennifer Hendricks

Sullivan (Media): 212-770-3141; jennifer.sullivan@aig.com |

AIG COMMENCES CASH TENDER OFFERS FOR DEBT SECURITIES

NEW YORK, June 18, 2015 – American International Group, Inc. (NYSE: AIG) today commenced cash tender offers for 26 series of debt securities of AIG

and one of its subsidiaries, AIG Life Holdings, Inc. The complete terms of the tender offers are set forth in two separate offers to purchase and the related letters of transmittal, each dated today. Securities that are accepted in the tender offers

will be purchased, retired and cancelled by AIG or AIG Life Holdings, Inc., as applicable. Consummation of the tender offers is subject to a number of conditions, including the absence of any adverse legal and market developments and, for the

maximum tender offer discussed below, a financing condition (as described in the applicable offer to purchase). Subject to applicable law, AIG may waive certain of these conditions or extend, terminate or otherwise amend one or more of the tender

offers. The tender offers are not cross-conditioned, and AIG may complete some, all or none of them.

Maximum Tender Offer

AIG is offering to purchase the notes and debentures listed in Table I below in an aggregate principal amount (U.S. Dollar equivalent) of up to $3.0 billion.

The early participation date for this tender offer is 5:00 p.m., New York City time, on July 1, 2015 (the “Early Participation Date”), and the expiration date for this tender offer is 11:59 p.m., New York City time, on July 16,

2015 (in each case, subject to extension). As indicated in Table I, the price to be paid for each series of notes and debentures will be either fixed or based on fixed spreads to certain reference benchmarks, as further described below. The prices

to be paid for the “fixed spread” notes and debentures denominated in U.S. Dollars and Sterling will be calculated on the basis of the yield to the applicable call or maturity date of the applicable reference security listed in Table I, at

10:00 a.m., New York City time, for the “fixed spread” notes and debentures denominated in U.S. Dollars, or 3:00 p.m., London time, for the “fixed spread” notes and debentures denominated in Sterling, each on the business

day following the Early Participation Date, plus the fixed spread applicable to such note or debenture as set forth in Table I. The price to be paid for the “fixed spread” notes or debentures denominated in Euros will be calculated on the

basis of the rates payable on certain reference swaps, at 3:00 p.m., London time, on the business day following the Early Participation Date, plus the fixed spread applicable to such note or debenture, as described more fully in the applicable offer

to purchase. Table I also sets forth the fixed price to be paid for the “fixed price” notes listed therein. Holders whose notes and debentures are accepted in this tender offer will also receive a cash payment representing accrued interest

from the most recent interest payment date to, but excluding, the date AIG purchases the notes and debentures. The payment date for this offer will be promptly following its expiration and is expected to be on or about July 20, 2015.

FOR IMMEDIATE RELEASE

The following is a brief summary of certain key elements of this tender offer:

| • |

|

Holders who validly tender and who do not validly withdraw their notes or debentures at or prior to 5:00 p.m., New York City time on July 1, 2015 (subject to extension), the Early Participation Date, and whose

tenders are accepted for purchase, will receive the Total Consideration. |

| • |

|

Holders who validly tender their notes or debentures after 5:00 p.m., New York City time on the Early Participation Date but at or prior to the expiration date, and whose securities are accepted for purchase, will only

be eligible to receive the Tender Offer Consideration, which is equal to the Total Consideration less the Early Participation Amount (as defined in the applicable offer to purchase and set forth in Table I below). |

| • |

|

Tenders of notes or debentures may be validly withdrawn at any time at or prior to 5:00 p.m., New York City time, on July 1, 2015 (subject to extension), but not thereafter. |

| • |

|

AIG reserves the right, but is under no obligation, to increase the maximum amount of notes and debentures sought in this tender offer. In the event of any such increase, AIG will not be obligated (except as required by

applicable law) to extend the Early Participation Date, the withdrawal date or the expiration date. |

| • |

|

If this tender offer is oversubscribed, AIG will accept for payment all securities validly tendered in accordance with the acceptance priority levels set forth in Table I. If there are sufficient remaining funds to

purchase some, but not all, of the remaining tendered notes or debentures at any acceptance priority level, AIG will accept for payment such tendered notes or debentures on a prorated basis. |

| • |

|

This tender offer is subject to conditions, including a financing condition that provides that the tender offer is conditioned on AIG having issued and sold, in one or more capital markets financing transactions, on

terms satisfactory in AIG’s reasonable judgment, debt securities providing net proceeds at least equal to a material portion, in AIG’s reasonable judgment, of the aggregate principal amount of the notes and debentures accepted in this

tender offer. |

Any and All Tender Offers

AIG is also offering to purchase any and all of the notes listed in Tables II and III below. These offers will expire at 5:00 p.m., New York City time, on

July 1, 2015, subject to extension. Table II sets forth the fixed prices to be paid for each series of notes listed therein. The prices to be paid for each series of notes listed in Table III will be based on fixed spreads to certain reference

benchmarks, determined on July 1, 2015, as described in the applicable offer to purchase. Tenders of notes may be validly withdrawn at any time at or prior to the expiration date but not thereafter. Holders whose notes are accepted in these

tender offers will also receive, where applicable, a cash payment representing accrued interest from the most recent interest payment date to, but excluding, the date AIG purchases the notes. The payment date for each any and all tender offer will

be promptly following its expiration and is expected to be on or about July 7, 2015.

FOR IMMEDIATE RELEASE

Copies of the offer to purchase, the related letter of transmittal and the notice of guaranteed delivery for

the any and all tender offers are available at the following web address: http://www.gbsc-usa.com/aig/.

#

# #

This press release is qualified in its entirety by the offers to purchase and related letters of

transmittal.

AIG has retained Barclays Bank PLC, Barclays Capital Inc., Credit Suisse Securities (Europe) Limited and Credit Suisse Securities (USA) LLC

as the Joint Lead Dealer Managers. Global Bondholder Services Corporation is the Information Agent and Depositary. For additional information regarding the terms of the tender offers, please contact: Barclays Bank PLC at +44 (0) 207 773 8990

(international); Barclays Capital Inc. at (800) 438-3242 (toll-free) or (212) 528-7581 (collect); Credit Suisse Securities (Europe) Limited at +44 (0) 207 888 5564; or Credit Suisse Securities (USA) LLC at (800) 820-1653

(toll-free) or (212) 538-2147 (collect). Requests for documents and questions regarding the tendering of Securities may be directed to Global Bondholder Services Corporation by telephone at (212) 430-3774 (for banks and brokers only),

(866) 924-2200 (for all others toll-free) or +001 (212) 430-3774 (international), by email at aig@gbsc-usa.com or to the Joint Lead Dealer Managers at their respective telephone numbers.

This news release does not constitute an offer or an invitation by AIG to participate in the tender offers in any jurisdiction in which it is unlawful to make

such an offer or solicitation in such jurisdiction.

Certain statements in this press release, including those describing the completion of the tender

offers, constitute forward-looking statements. These statements are not historical facts but instead represent only AIG’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside AIG’s control.

It is possible that actual results will differ, possibly materially, from the anticipated results indicated in these statements. Factors that could cause actual results to differ, possibly materially, from those in the forward-looking statements are

discussed throughout AIG’s periodic filings with the SEC pursuant to the Securities Exchange Act of 1934.

# #

#

American International Group, Inc. (AIG) is a leading global insurance organization serving customers in more than 100

countries and jurisdictions. AIG companies serve commercial, institutional, and individual customers through one of the most extensive worldwide property-casualty networks of any insurer. In addition, AIG companies are leading providers of life

insurance and retirement services in the United States. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

Additional information about AIG can be found at www.aig.com | YouTube: www.youtube.com/aig | Twitter: @AIGinsurance | LinkedIn:

http://www.linkedin.com/company/aig.

FOR IMMEDIATE RELEASE

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance

operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or

services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus

lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.

Table I – Maximum Tender Offer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITIES

SUBJECT TO THE TENDER OFFER |

| |

|

Fixed Spread Securities |

|

Fixed Price Securities |

| Title of

Security |

|

Issuer |

|

Security

Identifier |

|

Applicable

Call /

Maturity

Date |

|

Principal

Amount

Outstanding

(millions) |

|

Acceptance

Priority

Level |

|

Authorized

Denominations |

|

Early

Participation

Amount(1) |

|

Reference

Security/

Interpolated

Rate |

|

Bloomberg

Reference

Page

/Screen |

|

Fixed

Spread

(basis

points) |

|

Hypothetical

Total

Consideration(2) |

|

Fixed

Price(3) |

|

Total

Consideration(3) |

| 5.850% Medium-Term Notes, Series G, due January 16, 2018 |

|

AIG |

|

CUSIP:

02687QDG0ISIN:

US02687QDG01 |

|

January 16,

2018 |

|

$2,411.0 |

|

1 |

|

$2,000

and

integral

multiples

of

$1,000

in excess

thereof |

|

$50 |

|

1.125%

U.S.

Treasury

due

06/15/2018 |

|

Bloomberg

PX1 |

|

55 |

|

$1,101.77 |

|

— |

|

— |

| 6.400% Notes Due 2020 |

|

AIG |

|

CUSIP:

026874BW6ISIN:

US026874BW66 |

|

December 15,

2020 |

|

$1,250.9 |

|

2 |

|

$2,000

and

integral

multiples

of

$1,000

in excess

thereof |

|

$50 |

|

1.500%

U.S.

Treasury

due

05/31/2020 |

|

Bloomberg

PX1 |

|

100 |

|

$1,184.93 |

|

— |

|

— |

| 3.375% Notes due 2020 |

|

AIG |

|

CUSIP:

026874CX3ISIN:

US026874CX31 |

|

August 15,

2020 |

|

$1,000.0 |

|

3 |

|

$2,000

and

integral

multiples

of

$1,000

in excess

thereof |

|

$50 |

|

1.500%

U.S.

Treasury

due

05/31/2020 |

|

Bloomberg

PX1 |

|

95 |

|

$1,034.26 |

|

— |

|

— |

| 8.000% Series A-7 Junior Subordinated Debentures† |

|

AIG |

|

ISIN:

XS0365324838

(144A)XS0365323608

(Reg. S) |

|

May 22, 2018 |

|

€13.5 |

|

4 |

|

€50,000

and

integral

multiples

thereof |

|

€50 |

|

May 2018

Interpolated

Swap Rate |

|

Bloomberg

ICAE1 |

|

215 |

|

€1,152.10 |

|

— |

|

— |

| 8.625% Series A-8 Junior Subordinated Debentures† |

|

AIG |

|

ISIN:

XS0365317113

(144A)XS0365314284

(Reg. S) |

|

May 22, 2018 |

|

£5.6 |

|

5 |

|

£50,000

and

integral

multiples

thereof |

|

£50 |

|

5.000% UK

Treasury

due

03/07/2018 |

|

Bloomberg

DMO2 |

|

230 |

|

£1,148.92 |

|

— |

|

— |

| 5.60% Medium-Term Notes, Series G, due October 18, 2016 |

|

AIG |

|

CUSIP:

02687QBC1ISIN:

US02687QBC15 |

|

October 18,

2016 |

|

$645.6 |

|

6 |

|

$1,000

and

integral

multiples

thereof |

|

$50 |

|

0.625%

U.S.

Treasury

due

05/31/2017 |

|

Bloomberg

PX1 |

|

40 |

|

$1,055.22 |

|

— |

|

— |

| 4.375 per cent. Notes due 26 April 2016† |

|

AIG |

|

ISIN:

XS0252366702 |

|

April 26,

2016 |

|

€750.0 |

|

7 |

|

€50,000

and

integral

multiples

thereof |

|

€50 |

|

— |

|

— |

|

— |

|

— |

|

€982.40 |

|

€1,032.40 |

| 5.75% Series A-2 Junior Subordinated Debentures |

|

AIG |

|

CUSIP:

026874BF3ISIN:

XS0291641420 |

|

March 15,

2017 |

|

£161.7 |

|

8 |

|

£50,000

and

integral

multiples

thereof |

|

£50 |

|

1.750% UK

Treasury

due

01/22/2017 |

|

Bloomberg

DMO2 |

|

215 |

|

£1,048.37 |

|

— |

|

— |

I-1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITIES

SUBJECT TO THE TENDER OFFER |

| |

|

Fixed Spread Securities |

|

Fixed Price Securities |

| Title of

Security |

|

Issuer |

|

Security Identifier |

|

Applicable

Call /

Maturity

Date |

|

Principal

Amount

Outstanding

(millions) |

|

Acceptance

Priority

Level |

|

Authorized

Denominations |

|

Early

Participation

Amount(1) |

|

Reference

Security/

Interpolated

Rate |

|

Bloomberg

Reference

Page

/Screen |

|

Fixed

Spread

(basis

points) |

|

Hypothetical

Total

Consideration(2) |

|

Fixed

Price(3) |

|

Total

Consideration(3) |

| 4.875% Series A-3 Junior Subordinated Debentures |

|

AIG |

|

CUSIP: 026874BG1

ISIN:

XS0291642154 |

|

March 15,

2017 |

|

€306.2 |

|

9 |

|

€50,000

and

integral

multiples

thereof |

|

€50 |

|

March

2017

Interpolated

Swap Rate |

|

Bloomberg

ICAE1 |

|

210 |

|

€1,042.24 |

|

— |

|

— |

| 6.765% Sterling Notes Due November 15, 2017† |

|

AIG |

|

ISIN:XS0827565663

XS0702072900

(144A)

XS0702072819

(Reg. S) |

|

November 15,

2017 |

|

£281.4 |

|

10 |

|

£100,000

and

integral

multiples

of

£1,000

in excess

thereof |

|

£50 |

|

1.000% UK

Treasury

due

09/07/2017 |

|

Bloomberg

DMO2 |

|

75 |

|

£1,120.07 |

|

— |

|

— |

| 6.797% Euro Notes Due November 15, 2017† |

|

AIG |

|

ISIN:

XS0827566711XS0702072140

(144A)

XS0702071928

(Reg. S) |

|

November 15,

2017 |

|

€61.8 |

|

11 |

|

€100,000

and

integral

multiples

of

€1,000

in excess

thereof |

|

€50 |

|

November

2017

Interpolated

Swap Rate |

|

Bloomberg

ICAE1 |

|

50 |

|

€1,140.22 |

|

— |

|

— |

| 8 1⁄2% Junior Subordinated Debentures due 2030 |

|

AIG Life

Holdings,

Inc.* |

|

CUSIP:

00138GAA7ISIN:

US00138GAA76 |

|

July 1, 2030 |

|

$116.4 |

|

12 |

|

$1,000

and

integral

multiples

thereof |

|

$50 |

|

2.125%

U.S.

Treasury

due

05/15/2025 |

|

Bloomberg

PX1 |

|

280 |

|

$1,345.73 |

|

— |

|

— |

| 7.57% Junior Subordinated Deferrable Interest Debentures, Series A |

|

AIG Life

Holdings,

Inc.* |

|

CUSIP: 00138GAB5

ISIN:

US00138GAB59 |

|

December 1,

2045 |

|

$78.9 |

|

13 |

|

$100,000

and

integral

multiples

of

$1,000

in excess

thereof |

|

$50 |

|

2.500%

U.S.

Treasury

due

02/15/2045 |

|

Bloomberg

PX1 |

|

265 |

|

$1,258.44 |

|

— |

|

— |

| 8 1⁄8% Junior Subordinated Deferrable Interest Debentures, Series B |

|

AIG Life

Holdings,

Inc.* |

|

CUSIP: 00138GAC3

ISIN:

US00138GAC33 |

|

March 15,

2046 |

|

$227.3 |

|

14 |

|

$100,000

and

integral

multiples

of

$1,000

in excess

thereof |

|

$50 |

|

2.500%

U.S.

Treasury

due

02/15/2045 |

|

Bloomberg

PX1 |

|

265 |

|

$1,338.81 |

|

— |

|

— |

| † |

Listed on the Official List of the Irish Stock Exchange and traded on its regulated market. |

| (1) |

The total consideration payable for each $1,000, £1,000 or €1,000 principal amount of notes or debentures validly tendered on or prior to 5:00 p.m., New York City time, on July 1, 2015 and accepted for

purchase by AIG includes the Early Participation Amount set forth above. In addition, holders whose notes or debentures are accepted will also receive accrued interest on such note or debenture. |

| (2) |

Per $1,000, £1,000 or €1,000 principal amount of notes or debentures and shows a hypothetical total consideration assuming that the yield of the reference security listed above had been measured at 10:00

a.m., New York City time (or 3:00 p.m., London time), on June 17, 2015 (see Schedule B of the offer to purchase for the maximum tender offer). |

| (3) |

Per €1,000 principal amount of the 4.375 per cent. Notes due 26 April 2016. |

I-2

Table II—Any and All Tender Offers—Fixed Price Securities

|

|

|

|

|

|

|

|

|

| Title of Security and Security Identifier |

|

Issuer |

|

Principal Amount

Outstanding

(millions) |

|

Authorized

Denominations |

|

Fixed Price Per

Reference Principal

Amount of Securities |

| 2.275% Fixed Rate Notes Due 8 August 2016

ISIN: XS0263983040 |

|

AIG |

|

JPY 2,000.0 |

|

JPY 100,000,000 and integral multiples thereof |

|

JPY 1,027.50 |

| 2.275% Fixed Rate Notes due 8 August 2016

ISIN: XS0263873373 |

|

AIG |

|

JPY 300.0 |

|

JPY 100,000,000 and integral multiples thereof |

|

JPY 1,027.50 |

| 8.59% Fixed Rate Notes due September 15, 2016*

ISIN: XS0266561769 |

|

AIG |

|

MXN 265.1 |

|

MXN 1,000,000 and integral multiples of MXN 1,000 in excess thereof |

|

MXN 1,061.25 |

| Fixed Rate Notes due 24 October 2016

ISIN: XS0287306830 |

|

AIG |

|

JPY 20,000.0 |

|

JPY 10,000,000,000 and integral multiples thereof |

|

JPY 1,051.25 |

| 2.75 per cent. Notes due 2016†

ISIN: CH0027962825 |

|

AIG |

|

CHF 53.0 |

|

CHF 5,000 and integral multiples thereof |

|

CHF 1,057.50 |

| 7.98% Fixed Rate Notes due 15 June 2017*

ISIN: XS0305757337 |

|

AIG |

|

MXN 752.0 |

|

MXN 1,000,000 and integral multiples of MXN 1,000 in excess thereof |

|

MXN 1,075.00 |

| 3.375 per cent. Notes due 2017†

ISIN: CH0031390476 |

|

AIG |

|

CHF 34.5 |

|

CHF 5,000 and integral multiples thereof |

|

CHF 1,086.25 |

| Fixed Rate Notes due 22 November 2017

ISIN: XS0309312469 |

|

AIG |

|

JPY 20,000.0 |

|

JPY 100,000,000 and integral multiples thereof |

|

JPY 1,065.00 |

II-1

|

|

|

|

|

|

|

|

|

| Title of Security and Security Identifier |

|

Issuer |

|

Principal Amount

Outstanding

(millions) |

|

Authorized

Denominations |

|

Fixed Price Per

Reference Principal

Amount of Securities |

| Fixed Rate Notes due April 24, 2018

ISIN: XS0309298296 |

|

AIG |

|

JPY 20,000.0 |

|

JPY 10,000,000,000 and integral multiples thereof |

|

JPY 1,080.00 |

| Fixed Rate Notes due 23 August 2018

ISIN: XS0309312113 |

|

AIG |

|

JPY 20,000.0 |

|

JPY 100,000,000 and integral multiples thereof |

|

JPY 1,080.00 |

| * |

Listed on the Official List of the Irish Stock Exchange and traded on its regulated market. |

| † |

Listed on the SIX Swiss Exchange. |

II-2

Table III—Any and All Tender Offers—Fixed Spread Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Security and Security

Identifier |

|

Issuer |

|

Principal

Amount

Outstanding

(millions) |

|

Authorized

Denominations |

|

Applicable

Maturity

Date |

|

Reference

Security /

Interpolated Swap |

|

Bloomberg

Reference

Page / Screen |

|

Fixed

Spread

(basis

points) |

|

Hypothetical

Total

Consideration(1) |

| 5.450% Medium-Term Notes, Series MP, Matched Investment Program, Due May 18,

2017(2) CUSIP: 02687QBW7

ISIN: US02687QBW78 |

|

AIG |

|

USD 243.7 |

|

USD 1,000 and

integral multiples

thereof |

|

May 18,

2017 |

|

0.625% U.S.

Treasury due

May 31, 2017 |

|

Bloomberg

PX1 |

|

60 |

|

USD 1,075.81 |

| 5.000 per cent. notes due 2017(3)* ISIN: XS0307512722 |

|

AIG |

|

EUR 370.2 |

|

EUR 50,000 and

integral multiples

thereof |

|

June 26,

2017 |

|

June 2017

Interpolated Swap

Rate |

|

Bloomberg

ICAE1

|

|

18 |

|

EUR 1,091.40 |

| * |

Listed on the Official List of the Irish Stock Exchange and traded on its regulated market. |

| (1) |

Per USD 1,000 or EUR 1,000 principal amount of notes and shows a hypothetical total consideration assuming that the yield of the reference security listed above has been measured at 10:00 a.m., New York City time and

3:00 p.m., London time, respectively, on June 17, 2015 (see Schedule B of the offer to purchase for the any and all tender offer). Actual total consideration may differ. |

| (2) |

The price paid for these notes will be an amount that would reflect, on the date of purchase, a yield to the applicable maturity date equal to the sum of the yield of the reference security listed above at 10:00 a.m.,

New York City time, on July 1, 2015, plus the Fixed Spread set forth above. |

| (3) |

The price paid for these notes will be an amount that would reflect, on the date of purchase, a yield to the applicable maturity date equal to the sum of the interpolated swap rate indicated above at 3:00 p.m., London

time, on July 1, 2015, plus the Fixed Spread set forth above. |

III-1

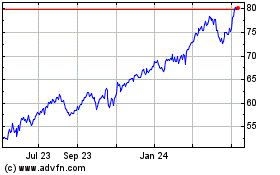

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

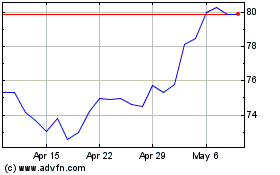

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024