UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 11, 2015

(Exact name of registrant as specified in its charter)

|

| | | |

Delaware | 001-16383 | 95-4352386 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

700 Milam Street, Suite 1900 Houston, Texas | 77002 |

(Address of principal executive offices) | (Zip Code) |

|

Registrant's telephone number, including area code: (713) 375-5000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 11, 2015, the Board of Directors (the “Board”) of Cheniere Energy, Inc. (the “Company”) approved the Cheniere Energy, Inc. Retirement Policy (the “Retirement Policy”), effective June 11, 2015. The Retirement Policy is limited to employees located in the United States and certain other jurisdictions. The Retirement Policy is not applicable in the United Kingdom or any jurisdictions in which it would be a violation of applicable laws. The Retirement Policy also does not apply to the Company’s Chief Executive Officer. Under the Retirement Policy, an employee who (i) retires with a combined sum of the employee’s age and full years of service with the Company and/or its affiliates equal to at least 72 years and (ii) is at least 60 years old and has at least 4 full years of service with the Company and/or its affiliates, will have the continuous employment requirement waived for the vesting of regular long-term incentive awards held by the employee, which awards will otherwise remain subject to all other vesting conditions. Except as otherwise determined by the Compensation Committee of the Board on a case-by-case basis, the Retirement Policy will not apply to new hire awards or special retention awards or other awards not part of any long-term incentive compensation program or to awards under any annual cash bonus program.

The foregoing summary of the Retirement Policy in this report does not purport to be complete and is qualified by reference to such policy, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

On June 11, 2015, the Compensation Committee of the Board approved an amendment (“Amendment No. 1 to Assignment Letter”) to the Assignment Letter dated July 30, 2013 (the “Assignment Letter”) on behalf of Cheniere Energy Shared Services, Inc., a wholly owned subsidiary of the Company, for Meg A. Gentle. The Assignment Letter was previously disclosed in the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on July 30, 2013. Amendment No. 1 to Assignment Letter confirmed the transfer of Ms. Gentle’s assignment from Cheniere Supply & Marketing, Inc. to Cheniere Marketing Limited, each a wholly owned subsidiary of the Company, and extends the duration of the assignment from August 18, 2015 to August 18, 2016. All other terms of the Assignment Letter, as amended by Amendment No. 1 to Assignment Letter, remain unchanged.

The foregoing summary of Amendment No. 1 to Assignment Letter in this report does not purport to be complete and is qualified by reference to such agreement, which is filed as Exhibit 10.2 hereto and incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 11, 2015, the Board voted to amend the Amended and Restated Bylaws of the Company (“Amendment No. 1”), effective as of June 11, 2015. Amendment No. 1 provides that all compensation-related matters submitted for shareholder vote through September 17, 2022 will be subject to a majority of the shares present and entitled to vote standard (pursuant to which abstentions will be counted as the functional equivalent of “no” votes and broker non-votes will not be considered in determining the outcome of the resolution, but will be counted for purposes of establishing a quorum).

The foregoing description of Amendment No. 1 is qualified in its entirety by the actual amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

| |

Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The Company held its annual meeting of shareholders on June 11, 2015, with 211,200,061 shares of the Company's common stock present or represented by proxy at the meeting. This represented approximately 89% of the Company's shares of common stock outstanding as of the record date of the meeting. Four proposals, as described in the Company's Proxy Statement dated April 24, 2015 (the “2015 Proxy Statement”), were voted upon at the meeting. The following is a brief description of the matters voted upon and the final voting results.

|

| | | | | | |

ITEM 1: | ELECTION OF DIRECTORS | |

| |

Director | Number of Votes For | Number of Votes Withheld | Number of Abstentions | Number of Broker Non-Votes |

Charif Souki | 178,477,154 | 3,921,740 | 1,226,554 | 27,574,613 |

Vicky A. Bailey | 126,802,905 | 55,919,342 | 903,201 | 27,574,613 |

G. Andrea Botta | 134,368,107 | 48,687,803 | 569,538 | 27,574,613 |

Nuno Brandolini | 171,549,815 | 11,163,755 | 911,878 | 27,574,613 |

David I. Foley | 181,651,758 | 1,074,445 | 899,245 | 27,574,613 |

David B. Kilpatrick | 171,847,850 | 11,210,573 | 567,025 | 27,574,613 |

Donald F. Robillard, Jr. | 182,494,160 | 565,597 | 565,691 | 27,574,613 |

Neal A. Shear | 181,952,978 | 1,103,807 | 568,663 | 27,574,613 |

Heather R. Zichal | 181,901,205 | 1,173,490 | 550,753 | 27,574,613 |

Each of the nominated directors was elected as a director to serve for a one-year term until the 2016 annual meeting of shareholders or until his or her successor is duly elected and qualified.

|

| | | | | |

ITEM 2: | ADVISORY AND NON-BINDING VOTE TO APPROVE EXECUTIVE COMPENSATION FOR 2014 |

| | | | |

| Number of Votes For | Number of Votes Against | Number of Abstentions | Number of Broker Non-Votes |

| 115,094,745 | 67,538,351 | 992,352 | 27,574,613 |

In an advisory and non-binding vote, the shareholders approved the compensation paid for 2014 to the Company's executive officers named in the Summary Compensation Table, as disclosed in the 2015 Proxy Statement.

|

| | | | | |

ITEM 3: | RATIFICATION OF KPMG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| | | | |

| Number of Votes For | Number of Votes Against | Number of Abstentions | Number of Broker Non-Votes |

| 210,027,146 | 537,518 | 635,397 | — |

The shareholders ratified the appointment of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2015.

|

| | | | | |

ITEM 4: | SHAREHOLDER PROPOSAL RECOMMENDING THAT THE BOARD ADOPT A PROXY ACCESS BYLAW |

| | | | |

| Number of Votes For | Number of Votes Against | Number of Abstentions | Number of Broker Non-Votes |

| 115,431,715 | 67,383,572 | 810,161 | 27,574,613 |

The shareholders approved the shareholder proposal recommending that the Board adopt a proxy access bylaw.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

| |

3.1* | Amendment No. 1 to Amended and Restated Bylaws of Cheniere Energy, Inc. |

| |

10.1* | Cheniere Energy, Inc. Retirement Policy. |

| |

10.2* | Amendment No. 1 to Assignment Letter, dated June 17, 2015. |

_______________

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | CHENIERE ENERGY, INC. | |

Date: | June 17, 2015 | | By: | /s/ Michael J. Wortley | |

| | | Name: | Michael J. Wortley | | |

| | | Title: | Senior Vice President and | | |

| | | | Chief Financial Officer | | |

EXHIBIT INDEX

Exhibit

| |

3.1* | Amendment No. 1 to Amended and Restated Bylaws of Cheniere Energy, Inc. |

| |

10.1* | Cheniere Energy, Inc. Retirement Policy. |

| |

10.2* | Amendment No. 1 to Assignment Letter, dated June 17, 2015. |

_______________

*Filed herewith

Exhibit 3.1

AMENDMENT NO.1 TO

AMENDED AND RESTATED BYLAWS OF

CHENIERE ENERGY, INC.

WHEREAS, Cheniere Energy, Inc. (the “Corporation”) has heretofore adopted the Amended and Restated Bylaws of the Corporation (the “Amended and Restated Bylaws”); and

WHEREAS, the Corporation desires to amend the Bylaws as set forth herein;

NOW, THEREFORE, the Bylaws are hereby amended, effective as of June 11, 2015 as follows:

1. The following is hereby added as the last paragraph of Section 2.8 of the Bylaws:

“Notwithstanding the foregoing provisions of this Section 2.8, on any compensation-related matter presented to the stockholders on or before September 17, 2022 at a meeting at which a quorum is present, then such compensation-related matter shall be decided by the affirmative vote of the holders of a majority in voting power of the shares of stock entitled to vote on the matter, present in person or by proxy (with abstentions counting as votes against the matter and broker non-votes not counting as shares entitled to vote on the matter).”

2. Except as modified herein, the Bylaws are hereby specifically ratified and affirmed.

Exhibit 10.1

Cheniere Energy, Inc. Retirement Policy

Purpose: This Retirement Policy (this “Policy”) is designed to reward eligible employees of Cheniere Energy, Inc. and its subsidiaries (collectively, the “Company”) for their service and tenure. This Policy is limited to employees located in the United States and certain other jurisdictions. This Policy is not applicable in the United Kingdom or any jurisdictions in which benefits only to retirees would be a violation of applicable laws.

Definition of Qualifying Retirement

A “Qualifying Retirement” is a voluntary resignation by an employee who satisfies the Rule of 72 based on the sum of (i) the employee’s age and (ii) full years of service with the Company and/or its affiliates, provided that the employee also meets the following criteria:

| |

• | Employee must be at least age 60 and have at least 4 years of service with the Company and/or its affiliates. |

| |

• | Employee must provide Human Resources with a written notice of his or her planned retirement date at least three (3) months in advance thereof, but the Company may eliminate, or decrease the length of, the notice period in its sole discretion. |

| |

• | The Chief Executive Officer of the Company is not eligible for a Qualifying Retirement under this Policy, and accordingly, no retirement by the Chief Executive will be deemed to be a Qualifying Retirement. |

| |

• | Employees in the United Kingdom are not eligible for Qualifying Retirements under this Policy. |

| |

• | Employees in jurisdictions in which benefits only to retirees would be a violation of applicable laws (as determined by the Company in its sole discretion) are not eligible for Qualifying Retirements under this Policy. |

The determination of whether an employee satisfies the criteria for a Qualifying Retirement shall be determined by the Company in its sole discretion.

Retirement Treatment

The Company will waive the continuous employment vesting provisions for Covered Incentive Awards (as described below) that are held by employees who satisfy the criteria for Qualifying Retirements, as determined by the Company in its sole discretion.

Following a Qualifying Retirement, Covered Incentive Awards will continue to vest on their original schedule notwithstanding any continuous service conditions; however, except as otherwise determined by the Company, Covered Incentive Awards will remain subject to the applicable performance-based vesting conditions, if any.

Notwithstanding anything in the Policy to the contrary, the Company may not waive any performance-based vesting conditions in Covered Incentive Awards for any Employees who could potentially be “Covered Employees” the Committee in its sole discretion) under Code Section 162(m).

Covered Incentive Awards

The Retirement provisions and this Policy will apply to all long-term equity and cash-based awards outstanding on the effective date of this Policy and, except as otherwise provided in this Policy or determined by the Committee, to long-term equity and cash-based awards granted after the effective date of this Policy (collectively, “Covered Incentive Awards”).

The Retirement provisions are intended to be applied only to regular long-term incentive awards and not one-time, special, and/or retention-based awards, subject to the discretion of the Committee.

Accordingly, except as otherwise determined by the Committee on a case-by-case basis, this Policy will not apply to, and “Covered Incentive Awards” shall not include, new hire awards or special retention awards or other awards not part of any long-term incentive compensation program or to awards under any annual cash bonus program.

For the avoidance of doubt, the Retirement provisions, and this Policy, will apply to the following awards outstanding on the effective date of this Policy:

| |

• | All outstanding Long-Term Cash Awards under Trains 1-2; |

| |

• | All outstanding Restricted Stock Awards under Trains 1-2; |

| |

• | All outstanding Restricted Stock Awards under Trains 3-4; and/or |

| |

• | All outstanding Phantom Unit Awards under the 2014-2018 Long-Term Cash Incentive Program. |

In addition, the Retirement provisions, and this Policy, will apply to any long-term cash and/or phantom unit awards granted after the effective date of this Policy under the 2014-2018 Long-Term Cash Incentive Program or any other annual or long-term incentive compensation plan or program adopted after the effective date of this Policy, except as otherwise determined by the Committee on a case-by-case basis or otherwise provided in the applicable plan, program or award agreements.

Conditions to Retirement Treatment

The Company’s waiver of the continuous employment vesting conditions of any Covered Incentive Awards is subject to the employee’s execution and non-revocation of a release of claims in the form provided by the Company at (or within a specified time after) the time of retirement, and continued vesting is subject to compliance with the restrictive covenant provisions described below and any applicable performance vesting conditions that may apply to the Covered Incentive Awards. The restrictive covenant provisions will apply for the duration of the vesting schedule for any unvested Covered Incentive Award(s), and the employee’s failure to comply with the restrictive covenant provisions will result in the immediate forfeiture of any then-outstanding Covered Incentive Awards.

Restrictive Covenants

| |

• | If, during employment or subsequent to a Qualifying Retirement, the employee violates any of the restrictions below, he or she will immediately forfeit all unvested Covered Incentive Awards covered by this Policy. |

| |

• | During employment or subsequent to a Qualifying Retirement, the employee will not, directly or indirectly, do any of the following or assist any other person, firm or entity to do any of the following: (a) solicit on behalf of another person or entity, the employment or services of, or hire or retain, any person who is employed by or is a substantially full-time consultant or independent contractor to the Company or any of its subsidiaries or affiliates, or was within six (6) months prior to the action; or (b) otherwise knowingly interfere in any material respect with the business of the Company or any of its subsidiaries or affiliates or the relationship with any vendor or supplier that existed prior to the date of termination of the employee’s employment with the Company. |

| |

• | During employment or subsequent to a Qualifying Retirement, the employee shall not make or publish any disparaging statements (whether written, electronic or oral) regarding, or otherwise malign the business reputation of, the Company, its present and former owners, officers, employees, shareholders, directors, partners, attorneys, agents and assignees, and all other persons, firms, partnerships, or corporations in control of, under the direction of, or in any way presently or formerly associated with the Company (each, a “Released Party” and collectively the “Released Parties”). |

| |

• | During employment or subsequent to a Qualifying Retirement, the employee shall maintain the confidentiality of the following information: proprietary technical and business information relating to any Company plans, analyses or strategies concerning international or domestic acquisitions, possible acquisitions or new ventures; development plans or introduction plans for products or services; unannounced products or services; operation costs; pricing of products or services; research and development; personnel information; manufacturing processes; installation, service, and distribution procedures and processes; customer lists; any know-how relating to the design, manufacture, and marketing of any of the Company's services and products, including components and parts thereof; non-public information acquired by the Company concerning the requirements and specifications of any of the Company's agents, vendors, contractors, customers and potential customers; non-public financial information, business and marketing plans, pricing and price lists; non-public matters relating to employee benefit plans; quotations or proposals given to agents or customers or received from suppliers; documents relating to any of the Company's legal rights and obligations; the work product of any attorney employed by or retained by the Company; and any other information which is sufficiently confidential, proprietary, secret to derive economic value from not being generally known including with respect to intellectual property inventions, and work product. The foregoing shall not apply to information that the employee is required to disclose by applicable law, regulation or legal process (provided that the employee provides the Company with prior notice of the contemplated disclosure and cooperates with the Company at its expense in seeking a protective order or other appropriate protection of such information). |

| |

• | The Committee (in its sole discretion) may elect to subject employees to additional or other restrictive covenants in consideration for the special treatment of their long-term equity and cash awards under this Policy or otherwise. These covenants shall be without limitation to such additional or other restrictions. |

Tax Matters; No Guarantee of Tax Consequences

In the event this Policy results in a taxable event for a retiree or eligible employee with respect to the foregoing Covered Incentive Awards, except as otherwise agreed in writing by the employee and the Company, any federal, state and local income, employment and other taxes required to be withheld by the Company in connection with the vesting of such restricted stock awards, or sooner upon the lapse of a substantial risk of forfeiture thereon for purposes of Code Section 83 of the Internal Revenue Code of 1986, as amended Internal Revenue Code of 1986, as amended (the “Code”) shall be effectuated, as specified by the Committee, by either the Company withholding delivery of a number of shares of common stock of the Company having a fair market value equal to the minimum amount of such tax withholding obligations determined at the time of taxation at the minimum withholding tax rate required by the Code or by the employee writing a check to the Company equal to such amount.

The Covered Incentive Awards subject to this Policy are subject to all federal, state and local income, employment, and other taxes, and any required withholding in connection with such taxes. This Policy is intended to be exempt from, or to comply with, the requirements of Section 409A of the Code, and this Policy shall be interpreted accordingly; provided that in no event whatsoever shall the Company or any of its Affiliates be liable for any additional tax, interest or penalties that may be imposed on an employee by Code Section 409A or any damages for failing to comply with Code Section 409A or damages for noncompliance. The Company makes no commitment or guarantee to the employee that any federal or state tax treatment will apply or be available to any person eligible for benefits under this Agreement. Notwithstanding anything in this Policy to the contrary, in the event that an employee is deemed to be a “specified employee” within the meaning of Code Section 409A(a)(2)(B)(i), no payments hereunder that are “deferred compensation” subject to Code Section 409A shall be made to the employee prior to the date that is six (6) months after the date of the employee’s “separation from service” (as defined in Section 409A) or, if earlier, the employee’s date of death. Following any applicable six (6) month delay, all such delayed payments will be paid in a single lump sum on the earliest date permitted under Code Section 409A that is also a business day.

Effective Date of Policy

This Policy is effective as of June 11, 2015.

Amendment; Termination

This Policy can be amended, modified, or terminated at any time at the discretion of the Committee or the Board, provided it shall not affect any employees who retire or have previously delivered written notice of retirement prior to such amendment, modification, or termination.

EXHIBIT 10.2

|

| | | |

| Cheniere Energy Shared Services, Inc. 700 Milam Street, Suite 1900 Houston, Texas 77002 phone: 713.375.5000 fax: 713.375.6000

| | |

STRICTLY PRIVATE AND CONFIDENTIAL

Meg Gentle

506 S Park Grove

Houston TX 77007

June 16, 2015

Dear Meg,

Proposed extension to your assignment to the United Kingdom

We refer to your assignment letter dated 30 July 2013 (the “Assignment Letter”), pursuant to which you were assigned to work for Cheniere Supply & Marketing Inc. (U .K. Branch) (“CSMI”) in the UK. As you will be aware, the employees of CSMI were transferred to Cheniere Marketing Limited (“CML”) with effect from 1 April 2015 pursuant to the Transfer of Undertakings (Protection of Employment) Regulations 2006. In light of this transfer, we are writing to confirm that your assignment will be transferred with immediate effect from CSMI to CML and therefore any references to “Host Company” in the Assignment Letter should now be read as references to CML.

Further to our recent discussions, we would also like to extend your Assignment (as defined in the Assignment Letter) for a further period of one year. We set out below the proposed amendments to the Assignment Letter:

| |

1. | The words “18 August 2016” shall replace “18 August 2015” in paragraph 1. |

The remaining terms of your Assignment Letter shall be unaffected by these changes.

Please indicate your acceptance of these changes by signing and returning the attached copy of this letter to Ann Raden. The changes shall be effective from and including 18 August 2015. You should keep your signed copy of this letter safe together with your Assignment Letter, which shall be amended by this letter.

If you have any questions, please contact Ann Raden.

Yours sincerely

/s/ Michael J. Wortley

Signed for and on behalf of Home Company

I hereby agree that my Assignment Letter shall be varied by the revised terms set out in this letter with effect from and including 18 August 2015.

|

| | |

/s/ Meg A. Gentle | | 17 June 2015 |

Meg Gentle | | Date

|

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

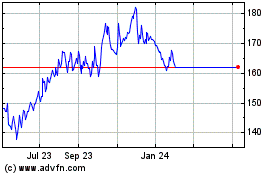

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024