Current Report Filing (8-k)

June 16 2015 - 2:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

June 8, 2015

|

Chesapeake Utilities Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-11590

|

51-0064146

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

909 Silver Lake Boulevard, Dover, Delaware

|

|

19904

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

302.734.6799

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

(i) Eastern Shore Natural Gas Company Proposed System Reliability Project

On June 8, 2015, Eastern Shore Natural Gas Company ("Eastern Shore"), a wholly owned subsidiary of Chesapeake Utilities Corporation ("Chesapeake" or the "Company"), received notification that the Federal Energy Regulatory Commission ("FERC") had accepted and publicly noticed its application for a Certificate of Public Convenience and Necessity ("Certificate") for its proposed System Reliability Project, as hereinafter defined. Previously, on May 22, 2015, Eastern Shore submitted an application to the FERC requesting a Certificate for authorization to construct, own, operate and maintain additional facilities that will improve the overall reliability and flexibility of its pipeline system for the benefit of all customers ("System Reliability Project" or "Project").

The pipeline facilities associated with the System Reliability Project include (i) approximately 10.1 miles of sixteen-inch pipeline looping and appurtenant auxiliary facilities in New Castle and Kent Counties, Delaware and (ii) the installation of a new compressor at Eastern Shore’s existing Bridgeville Compressor Station in Sussex County, Delaware. The Project will benefit Eastern Shore’s customers by modifying the current transmission pipeline system to be more adaptive to operational conditions, including conditions like those experienced during the last two winter seasons. The proposed facilities would support deliveries of maximum contract quantities under all firm transportation and storage service agreements.

The estimated cost of the System Reliability Project is $32.1 million. In its FERC application, Eastern Shore requested a predetermination of rolled-in rate treatment for the capital spent in conjunction with the Project at the time of its next rate case. Eastern Shore is required to file its next rate case by January of 2017.

Eastern Shore requested that the FERC issue an order granting the Certificate for the Project by December, 2015. Assuming the Project receives FERC approval in December, 2015, the targeted in-service date of the System Reliability Project is the third quarter of 2016.

(ii) Capital Budget Update for Chesapeake Utilities Corporation

In the Company’s first quarter Form 10-Q, filed with the Securities and Exchange Commission on May 6, 2015, the Company disclosed details surrounding the Company’s 2015 Capital Budget, which totaled $223.4 million. The Company indicated that its actual capital spending over each of the last three years had ranged from 82-88 percent of the original capital budgets disclosed at the beginning of each year. Based upon the timeline of the System Reliability Project described above and based upon updated timelines for other capital expenditures included in the 2015 Capital Budget, the Company now forecasts its 2015 capital expenditures to be in the range of $160-190 million.

Over 75 percent of the decline in the expected capital expenditures represents a shift in the timing of capital expenditures from 2015 to 2016. Neither the 2015 Capital Budget amount of $223.4 million nor the current 2015 forecasted capital range of $160-190 million includes the Company’s purchase of Gatherco, Inc. at a net purchase price of $52.8 million, which occurred on April 1, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Chesapeake Utilities Corporation

|

|

|

|

|

|

|

|

June 16, 2015

|

|

By:

|

|

Beth W. Cooper

|

|

|

|

|

|

|

|

|

|

|

|

Name: Beth W. Cooper

|

|

|

|

|

|

Title: Senior Vice President and Chief Financial Officer

|

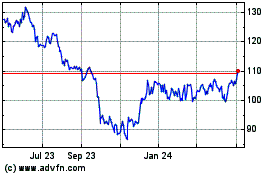

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Apr 2023 to Apr 2024