Current Report Filing (8-k)

June 12 2015 - 10:47AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 9, 2015

ODYSSEY MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Nevada |

|

001-31895 |

|

84-1018684 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5215 West Laurel Street

Tampa, Florida 33607

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (813) 876-1776

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

General

Odyssey held an annual meeting of stockholders on June 9, 2015, for the purpose of considering and acting upon the following matters:

| |

• |

|

to elect seven directors to serve as members of the Company’s Board of Directors for one to three-year terms, if the Classified Board Proposal (as defined below) is approved, or, if the Classified Board Proposal is

not approved, for one-year terms until the next Annual Meeting or until their successors are elected (the “Election Proposal”); |

| |

• |

|

to adopt and approve, for purposes of Nasdaq Listing Rule 5635, the Purchase Agreement dated March 11, 2015 (as amended, the “Purchase Agreement”), among the Company, Minera del Norte, S.A. de C.V.

(“MINOSA”), and Penelope Mining LLC (the “Investor”), including the issuance of up to 31,300,297 shares of the Company’s Class AA Preferred Stock and the issuance of up to 31,300,297 shares of the Company’s common stock

issuable upon conversion of the Class AA Preferred Stock, in each case calculated after giving effect to the one-for-six reverse stock split contemplated by the Reverse Split Proposal (as defined below) (the “Transaction Proposal”);

|

| |

• |

|

to adopt an amendment to the Company’s articles of incorporation (the “Articles Amendment Proposal”) with the following sub-proposals: |

| |

• |

|

a proposal to provide that the aggregate number of shares the Company is authorized to issue is 150,000,000 shares of common stock, par value $0.0001 per share, and 50,000,000 shares of preferred stock, par value

$0.0001 per share (the “Authorized Capitalization Proposal”); |

| |

• |

|

a proposal to implement a one-for-six reverse stock split whereby each six issued and outstanding shares of the Company’s common stock will be combined into one share of the Company’s common stock (the

“Reverse Split Proposal”); |

| |

• |

|

a proposal to classify the membership of the Company’s Board of Directors into three classes, as nearly equal in number as possible with one class to be elected annually for staggered three-year terms (the

“Classified Board Proposal”); |

| |

• |

|

a proposal limiting the liability of the Company’s directors and officers to the fullest extent permitted by Nevada law and that requires the expenses of officers and directors incurred in defending any threatened,

pending, or completed action, suit, or proceeding involving alleged acts or omissions of such officer or director be paid as they are incurred (the “Liability Limitation Proposal”); and |

| |

• |

|

a proposal that allocates corporate opportunities among the Company and directors of the Company who are not officers, employees, or other members of management of the Company, and that otherwise modifies the corporate

opportunity policy that previously applied to the Company under its amended and restated bylaws (the “Unaffiliated Director Proposal”); |

| |

• |

|

to hold a non-binding advisory vote to approve named executive officer compensation (the “Compensation Proposal”); |

| |

• |

|

to approve the Company’s 2015 Stock Incentive Plan, as amended (the “Plan Proposal”); |

| |

• |

|

to ratify the appointment of Ferlita, Walsh, Gonzalez & Rodriguez, P.A. as the Company’s independent registered public accounting firm (the “Ratification Proposal”); and |

| |

• |

|

a proposal to grant the chairperson of the Annual Meeting the authority to adjourn or postpone the Annual Meeting, if necessary, in order to solicit additional proxies in the event that (a) there are not sufficient

affirmative votes present at the Annual Meeting to adopt the proposals or (b) a quorum is not present at the Annual Meeting (the “Adjournment Proposal”). |

Voting Results

Election Proposal

With respect to the Election Proposal, the seven individuals named below were elected to serve as directors in accordance with the

following vote:

|

|

|

|

|

|

|

|

|

| Nominee |

|

For |

|

|

Withheld |

|

| John C. Abbott |

|

|

53,497,671 |

|

|

|

751,415 |

|

| Mark D. Gordon |

|

|

53,010,689 |

|

|

|

1,238,397 |

|

| Mark B. Justh |

|

|

52,924,515 |

|

|

|

1,324,571 |

|

| James S. Pignatelli |

|

|

53,501,817 |

|

|

|

747,269 |

|

| David J. Saul |

|

|

52,885,720 |

|

|

|

1,363,366 |

|

| Jon D. Sawyer |

|

|

52,773,546 |

|

|

|

1,475,540 |

|

| Gregory P. Stemm |

|

|

52,789,952 |

|

|

|

1,459,134 |

|

Transaction Proposal

With respect to the Transaction Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 53,408,035 |

|

672,919 |

|

168,132 |

Authorized Capitalization Proposal

With respect to the Authorized Capitalization Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 53,080,226 |

|

978,682 |

|

182,178 |

Reverse Split Proposal

With respect to the Reverse Split Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 77,532,792 |

|

1,409,165 |

|

413,762 |

Classified Board Proposal

With respect to the Classified Board Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 51,687,593 |

|

812,279 |

|

1,749,214 |

Liability Limitation Proposal

With respect to the Liability Limitation Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 52,292,725 |

|

1,728,817 |

|

227,544 |

Unaffiliated Director Proposal

With respect to the Unaffiliated Director Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 52,551,074 |

|

1,528,394 |

|

169,618 |

Compensation Proposal

With respect to the Compensation Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 51,217,991 |

|

1,418,661 |

|

1,612,434 |

Plan Proposal

With respect to the Plan Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 50,741,813 |

|

1,754,503 |

|

1,752,770 |

Ratification Proposal

With respect to the Ratification Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 75,550,829 |

|

888,893 |

|

2,915,997 |

Adjournment Proposal

With respect to the Adjournment Proposal, the results of the vote were as follows:

|

|

|

|

|

| For |

|

Against |

|

Abstain |

| 74,995,681 |

|

1,496,276 |

|

2,863,762 |

Broker Non-Votes

There were 25,106,633 broker non-votes with respect to the Election Proposal, the Transaction Proposal, the Authorized Capitalization Proposal,

the Classified Board Proposal, the Liability Limitation Proposal, the Unaffiliated Director Proposal, the Compensation Proposal, and the Plan Proposal. Broker non-votes were not relevant to the Reverse Split Proposal, the Ratification Proposal, or

the Adjournment Proposal.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ODYSSEY MARINE EXPLORATION, INC. |

|

|

|

|

| Dated: June 12, 2015 |

|

|

|

By: |

|

/s/ Philip S. Devine |

|

|

|

|

|

|

Philip S. Devine |

|

|

|

|

|

|

Chief Financial Officer |

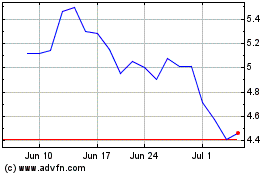

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

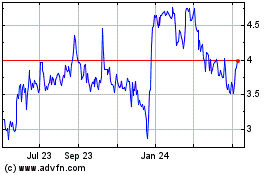

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024