Report of Foreign Issuer (6-k)

June 11 2015 - 9:23AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2015

Commission File Number: 001-35147

RENREN INC.

1/F, North Wing

18 Jiuxianqiao Middle Road

Chaoyang District, Beijing, 100016

People’s Republic of China

+86 (10) 8448-1818

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):________________

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):________________

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Renren Inc. |

| |

|

|

|

| |

By |

: |

/s/

Joseph Chen |

| |

Name |

: |

Joseph Chen |

| |

Title |

: |

Chief Executive Officer |

Date: June 11, 2015

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| 99.1 |

|

Press release |

Exhibit 99.1

Renren Announces

Receipt of Preliminary Non-Binding “Going Private” Proposal

BEIJING, June 10, 2015 — Renren Inc. (NYSE: RENN)

(“Renren” or the “Company”), a leading real-name social networking internet platform in China, announced

that its Board of Directors (the “Board”) has received a non-binding proposal letter, dated June 10, 2015, from Mr.

Joseph Chen (“Mr. Chen”), Chairman of the Board and Chief Executive Officer of the Company, and Mr. James Jian Liu, a

member of the Board and Chief Operating Officer of the Company, proposing a “going-private” transaction (the “Transaction”)

to acquire all of the outstanding ordinary shares of the Company not already owned by Mr. Chen or Mr. Liu for US$4.20 in cash per

American depositary share (“ADS”), or US$1.40 per ordinary share, which represents approximately 22% above the average

closing price of the Company’s ADSs over the last 30 trading days up to and including June 9, 2015.

Mr. Chen and Mr. Liu currently beneficially own approximately

32% of ordinary shares of the Company, representing approximately 49% in the Company's shareholder voting power.

According to the proposal letter, Mr. Chen and Mr. Liu intend

to fund the consideration payable in the Transaction with a combination of debt and equity capital, and rollover equity in the

Company. A copy of the proposal letter is attached hereto as Annex A.

The Board intends to form a special committee consisting of

independent directors to consider this proposal.

The Board cautions the Company’s shareholders and others

considering trading in its securities that the Board just received the non-binding proposal letter from Mr. Chen and Mr. Liu and

no decisions have been made with respect to the Company’s response to the Transaction. There can be no assurance that any

definitive offer will be made, that any agreement will be executed or that this or any other transaction will be approved or consummated.

The Company does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required

under applicable law.

About Renren Inc.

Renren Inc. (NYSE: RENN) operates a leading real name social

networking internet platform in China. It enables users to connect and communicate with each other, share information and user

generated content, play online games, and enjoy a wide range of other features and services. Renren’s businesses primarily

include the main social networking website renren.com and the game operating platform Renren Games. Renren.com had approximately

225 million activated users as of March 31, 2015. Renren’s American depositary shares, each of which represents three Class

A ordinary shares, trade on NYSE under the symbol “RENN”.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “may,”

“intend,” “confident,” “is currently reviewing,” “it is possible,” “subject

to” and similar statements. Renren may also make written or oral forward-looking statements in its reports filed or furnished

with the U.S. Securities and Exchange Commission, including Forms 20-F and 6-K, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Renren’s beliefs and expectations, are forward-looking statements

and are subject to change. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could

cause actual results to differ materially from those contained, either expressly or impliedly, in any of the forward-looking statements

in this press release. Potential risks and uncertainties are outlined in Renren’s filings with the U.S. Securities and Exchange

Commission. All information provided in this press release is current as of the date of this press release, and Renren does not

undertake any obligation to update any such information, except as required under applicable law.

For more information, please contact:

Cynthia Liu

Investor Relations Department

Renren Inc.

Tel: +86 (10) 8448-1818 x1300

Email: ir@renren-inc.com

Renren (NYSE:RENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

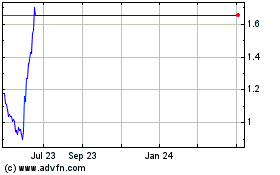

Renren (NYSE:RENN)

Historical Stock Chart

From Apr 2023 to Apr 2024