UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

June 8, 2015

Date

of report (Date of earliest event reported)

Universal

Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission

file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Boulevard, Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

ITEM 1.01 Entry into a Material Definitive Agreement

On June 8, 2015, Universal Insurance Holdings, Inc. (“Company”) entered into an agreement with Bradley I. Meier, the Company’s former Chairman,

President and Chief Executive Officer, to purchase all of the outstanding shares of the Company’s Series M Convertible Preferred Stock (“Series M Stock”), thus eliminating the holder’s ability to elect two members to the

Company’s Board of Directors. The Series M Stock will be retired and not available for reissue. Because the Series M Stock was convertible into five shares of common stock, the purchase price for the Series M Stock was approximately

$128.47 per share, which is five times the average closing price of the Company’s common stock over a specified three-day period.

The preceding

summary does not purport to be complete and is qualified in its entirety by reference to the full text of the Repurchase Agreement, which is attached as Exhibit 10.1 and is incorporated by reference. An announcement of the repurchase, which is

attached hereto as Exhibit 99.1, is also incorporated by reference.

ITEM 9.01 Financial Statements and Exhibits

| 10.1 |

Repurchase Agreement, dated June 8, 2015, by and between Mr. Meier and the Company |

| 99.1 |

Press release dated June 9, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

|

|

|

|

|

| Date: June 9, 2015 |

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

|

|

|

/s/ Sean P. Downes |

|

|

|

|

Sean P. Downes |

|

|

|

|

President and Chief Executive Officer |

EXHIBIT 10.1

EXECUTION COPY

REPURCHASE

AGREEMENT

THIS REPURCHASE AGREEMENT (this “Agreement”) is made and entered into as of June 8, 2015, by

and between Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), and Bradley I. Meier, an individual with an address at 229 Ocean Boulevard, Golden Beach, Florida 33160 (“Seller”).

WHEREAS, Seller owns in the aggregate 2,000 shares of Series M Convertible Preferred Stock of the Company, par value $0.01 per share (the

“Shares”);

WHEREAS, Seller desires to sell to the Company, and the Company desires to repurchase from Seller, the

Shares, on the terms and conditions set forth in this Agreement (the “Repurchase”); and

WHEREAS, Seller and the Company

intend the Repurchase to be an isolated transaction between them.

NOW, THEREFORE, for good and valuable consideration, the receipt,

adequacy and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Purchase and Sale.

Contemporaneously with the execution and delivery of this Agreement, Seller hereby sells, assigns and transfers to the Company, and the Company hereby purchases, accepts and acquires from Seller, the Shares in consideration of the payment by the

Company to Seller contemporaneously herewith of U.S. $256,933.00 by wire transfer of immediately available funds to Seller’s designated account (the “Purchase Price”). Seller shall deliver to the Company contemporaneously

herewith stock certificates representing such Shares, accompanied by stock powers and, subject to Section 6(h), bearing or accompanied by all requisite stock transfer stamps.

2. Representations and Warranties of Seller. Seller hereby represents and warrants to the Company as follows:

(a) Seller has full power and authority to execute and deliver this Agreement and to perform Seller’s obligations hereunder. This

Agreement has been duly authorized, executed and delivered by Seller and constitutes the legal, valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to bankruptcy, insolvency and general equitable

principles.

(b) Seller acquired the Shares from the Company in August 1997 and is the holder of record and beneficially owns all of the

Shares.

(c) Upon (i) delivery to the Company of certificates representing the Shares, duly endorsed by Seller for transfer to the

Company or (ii) confirmation reasonably acceptable to the Company of the transfer to the Company of any Shares held by Seller in book-entry position, and upon Seller’s receipt of payment therefor, Seller will have transferred to the

Company good and marketable title to the Shares, free and clear of all liens, encumbrances, claims of third parties, security interests, mortgages, pledges, agreements, options, warrants, rights of first refusal and rights of others of any kind or

nature whatsoever, whether or not filed, recorded or perfected.

(d) Seller is not a party to or subject to any suit or any administrative, arbitration or other

proceeding with respect to the Shares or any judgment, decree or order entered in any suit or proceeding brought by any governmental agency or other person enjoining or otherwise restraining or restricting Seller with respect to the Shares, and, to

the best of Seller’s knowledge, no such suit or proceeding is threatened against Seller.

(e) Other than any required filings under

U.S. securities laws, Seller is not required to give any notice to, make any filing with, or obtain any authorization, consent or approval of any governmental or regulatory authority or any other person in order to consummate any transfer of the

Shares to the Company. The execution, delivery and performance of this Agreement by Seller will not violate, result in the breach of or constitute a default under any contract, instrument or other agreement to which Seller is bound. To the best of

Seller’s knowledge, Seller has in all material respects owned and held the Shares in accordance with all applicable laws and requirements of governmental authorities.

(f) Seller has such knowledge and experience in business and financial matters that Seller is capable of evaluating the merits and risks of the

Repurchase.

(g) Seller is an “accredited investor” as such term is defined in Rule 501(a) of Regulation D promulgated by the

Securities and Exchange Commission under the Securities Act of 1933, as amended.

(h) Seller acknowledges that the Company is in possession

of material nonpublic information regarding the Company not known to Seller. Contemporaneously herewith, Seller has delivered to the Company an executed “big boy” letter in the form previously agreed by Seller and the Company.

(i) Seller and his advisors have had an opportunity to ask questions of, and to receive information from, the Company and persons acting on its

behalf concerning the terms of this Agreement and the terms and conditions of the Repurchase as set forth herein. Seller participated in the drafting and negotiation of, has carefully read and is familiar with this Agreement. Seller acknowledges

that he has had an opportunity to consult with counsel and other advisors about this Agreement and the Repurchase. Seller has received no representations or warranties from the Company, its affiliates, employees, agents or attorneys in making his

decision to enter into this Agreement, other than as set forth herein.

3. Representations and Warranties of the Company. The

Company represents and warrants to Seller as follows:

(a) The Company has full power and authority to execute and deliver this Agreement

and to perform its obligations hereunder and consummate the transactions contemplated hereby. This Agreement has been duly executed and delivered by the Company, and constitutes the legal, valid and binding obligation of the Company, enforceable

against the Company in accordance with its terms, subject to bankruptcy, insolvency and general equitable principles.

2

(b) The Company is the issuer of the Shares.

(c) Other than any required filings under U.S. securities laws or the Delaware General Corporation Law, the Company is not required to give any

notice to, make any filing with, or obtain any authorization, consent or approval of any governmental or regulatory authority or any other person in order to consummate the transfer of the Shares. The execution, delivery and performance of this

Agreement by the Company will not violate, result in the breach of or constitute a default under any contract, instrument or other agreement to which the Company is bound, or result in the violation of any provision of its charter, bylaws or similar

organizational documents.

(d) The Company is not a party to or subject to any suit or any administrative, arbitration or other proceeding

or any judgment, decree or order entered in any suit or proceeding brought by any governmental agency or other person enjoining or otherwise restraining or restricting the Company with respect to the transactions contemplated hereby, and, to the

best of the Company’s knowledge, no such suit or proceeding is threatened against the Company.

4. Termination and Survival.

Notwithstanding anything to the contrary contained herein, this Agreement and the rights and obligations of the parties hereunder shall be deemed revoked, annulled, rescinded and of no force or effect (and any Shares previously delivered to the

Company shall be returned to Seller), if the Company shall have failed to deliver to Seller the Purchase Price within forty-eight (48) hours after the execution and delivery of this Agreement by the parties hereto. All representations and

warranties of Seller and the Company contained in this Agreement shall survive indefinitely to the extent this Agreement is not otherwise terminated in accordance with this Section 4.

5. Dividends and Distributions. Seller shall be entitled to receive all dividends and distributions paid by the Company in respect of

the Shares to the extent the record date for such dividends and distributions is on or prior to the consummation of the related purchase and sale of such Shares hereunder.

6. Miscellaneous Provisions.

(a) Further Assurances. Each of the parties hereto shall take, or cause to be taken, all action, and to do, or cause to be done, all

things reasonably necessary, proper or advisable under applicable laws and existing agreements or otherwise reasonably required to be taken or done by it to consummate the transactions contemplated hereby in accordance with the terms hereof and to

more fully and effectively vest in the Company title to the Shares.

(b) Successors and Assigns. This Agreement will be binding upon

and inure to the benefit of the parties to this Agreement and the successors and assigns of the parties hereto; provided, however, that, no rights, obligations or liabilities hereunder will be assignable by any party without the prior

written consent of the other parties.

(c) No Third Party Beneficiaries. This Agreement is not intended to confer any rights or

remedies hereunder upon, and will not be enforceable by, any other person or entity, other than the parties to this Agreement.

3

(d) Controlling Law. This Agreement shall be governed by, construed and enforced in

accordance with the laws of the State of Delaware, without giving effect to the choice of law provisions thereof.

(e) Entire Agreement;

Amendments; Waiver. This Agreement constitutes the entire contract between the parties hereto pertaining to the subject matter hereof, and supersedes all prior and contemporaneous agreements, understandings, negotiations and discussions, whether

written or oral, of the parties. There are no representations, warranties or other agreements between the parties in connection with the subject matter hereof except as specifically set forth herein. No supplement, modification or waiver of this

Agreement shall be binding unless executed in writing by the parties to be bound thereby. Any agreement on the part of the parties to waive any term or provision of this Agreement shall be valid only if set forth in an instrument in writing signed

on behalf of the party against whom the waiver is to be effective. No such waiver shall constitute a waiver of, or estoppel with respect to, any subsequent or other inaccuracy, breach or failure to strictly comply with the provisions of this

Agreement.

(f) Counterparts. This Agreement may be executed in one or more counterparts, including by facsimile or other electronic

delivery, each of which shall be considered an original instrument, but all of which shall be considered one and the same agreement.

(g)

Notices. All notices and other communications hereunder shall be in writing and shall be deemed given (i) upon delivery, if delivered in person, (ii) upon receipt of written confirmation of transmission, if transmitted by facsimile

or other electronic communication (with written confirmation and a copy of the notice or other communication mailed by express courier or certified or registered mail, return receipt requested) or (iii) one (1) business day after it

is sent, if delivered by an express courier (with written confirmation), to the parties at the following addresses:

If to the Company:

Universal Insurance Holdings, Inc.

1110 West Commercial Boulevard

Fort Lauderdale, Florida 33309

| |

Attention: |

Stephen J. Donaghy |

| |

Facsimile: |

(954) 958-1201 |

| |

E-mail: |

sd0826x2@universalproperty.com |

with a copy (which shall not constitute notice) to:

K&L Gates LLP

1601 K

Street, NW

Washington, DC 20006

| |

Attention: |

Alan J. Berkeley |

| |

Facsimile: |

(202) 778-9100 |

| |

E-mail: |

alan.berkeley@klgates.com |

4

If to Seller:

Bradley I. Meier

229 Ocean

Boulevard

Golden Beach, Florida 33160

| |

Facsimile: |

(954) 990-4292 |

| |

E-mail: |

bmeier311@aol.com |

with a copy (which shall not constitute notice) to:

Vedder Price P.C.

222 North

LaSalle Street

Chicago, Illinois 60601

| |

Attention: |

Michael A. Nemeroff |

| |

Facsimile: |

(312) 609-5005 |

| |

E-mail: |

mnemeroff@vedderprice.com |

(h) Expenses. Except as otherwise provided herein, all costs

and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses. Seller and the Company shall pay their respective brokerage fees, commissions and

finder’s fees, if any, and shall indemnify and hold the other party harmless from and against any and all other claims or liabilities for brokerage fees, commissions and finder’s fees incurred by reason of any action taken by such party.

Notwithstanding the foregoing, all transfer and documentary taxes relating to the purchase and sale of the Shares hereunder shall be borne by the Company.

[Signatures follow on the next page.]

5

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written

above.

|

|

|

| UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

| By: |

|

/s/ Sean P. Downes |

|

|

Name: Sean P. Downes |

|

|

Title: President and Chief Executive Officer |

|

|

|

|

|

| By: |

|

/s/ Bradley I. Meier |

|

|

Bradley I. Meier |

[Repurchase

Agreement]

Exhibit 99.1

FOR IMMEDIATE RELEASE

Universal Insurance Holdings, Inc. Repurchases and Retires Series M Convertible

Preferred Stock

Fort Lauderdale, FL,

June 9, 2015 - Universal Insurance Holdings, Inc. (NYSE: UVE) announced today that it has entered into an agreement to repurchase all of the Company’s Series M Convertible Preferred Stock owned by Bradley I. Meier, the Company’s

former Chairman, President and Chief Executive Officer. Each share of Series M Stock was convertible at the option of Mr. Meier into five shares of Company common stock. The repurchase constitutes all of the 2,000 outstanding shares of Series M

Stock at a purchase price of $256,933.

Prior to the repurchase, as the holder of Series M Stock, Mr. Meier was entitled to elect two members to the

Company’s Board of Directors. As a result of the repurchase, the Series M Shares will be retired and cancelled and no shares of Series M Stock are outstanding.

“The repurchase of our outstanding Series M preferred shares continues our focus on governance matters and simplifies our equity structure,” said

Sean P. Downes, the Company’s Chairman, President and Chief Executive Officer. “This transaction reflects our continued belief in our business model and reaffirms our focus to deliver increasing value to our shareholders.”

About Universal Insurance Holdings, Inc.

Universal

Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company

(UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts,

Maryland, Delaware, Indiana and Pennsylvania. American Platinum Property and Casualty Insurance Company, also a wholly-owned subsidiary, currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are

limits and coverages currently not targeted through its affiliate UPCIC. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press

release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify

forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and

assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described and the Company

undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the

Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2014 and the Form 10-Q for the quarter ended March 31, 2015.

Investor Contact:

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

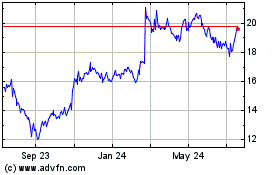

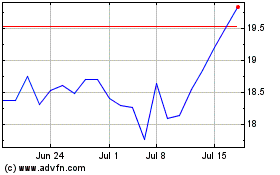

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024