UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

[ ] Preliminary information statement

[ ] Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

X Definitive information statement

CAPSTONE COMPANIES, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

X No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid: N/A

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identifies the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid: N/A

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

CAPSTONE COMPANIES, INC.

350 Jim Moran Boulevard, Suite 120

Deerfield Beach, Florida 33442

Telephone: (804) 644-2182

June 4, 2015

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

To our holders of Common Stock, $0.0001 par value per share, (“Shareholders” or “you”):

Capstone Companies, Inc., a Florida corporation, (“Company,” “we,” “our”) is providing you the accompanying information statement to inform you that our board of directors has approved and the holders of a majority of the outstanding shares of our Common Stock, $0.0001 par value per share, (“Common Stock”), have approved by written consent in lieu of a shareholders’ meeting the following corporate actions:

|

1.

|

Election of the following five nominees of the Company management for election to the board of directors for the term commencing upon their election and assumption of office until the election and assumption of office by their successors at the 2016 annual meeting of Shareholders or other 2016 election of directors:

|

|

2.

|

Ratification of the appointment of Mayer Hoffman McCann, P.C. as our public auditor for the fiscal year ending December 31, 2015.

|

SINCE THE REQUIRED MAJORITY OF THE OUTSTANDING SHARES OF OUR VOTING STOCK HAVE APPROVED THE ABOVE CORPORATE ACTIONS, WE ARE NOT SOLICITING YOUR VOTE OR YOUR PROXY WITH REGARD TO THE ABOVE CORPORATE ACTIONS.

The above corporate actions were approved on June 2, 2015, by written consents representing 384,153,928 shares of Common Stock, or 52.9% of the issued and outstanding shares of Common Stock eligible to vote on these corporate actions (based on 721,989,957 shares of Common Stock being issued and outstanding as of June 2, 2015). As such, no shareholders meeting is required to approve the above corporate actions.

“Information Statement Materials” means this Information Statement and Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We are providing Information Statement Materials to all of our Shareholders at the close of business on the record date for consent to the corporate actions, being May 20, 2015.

We encourage you to read the information statement. It describes in more detail the actions taken by our board of directors and the holders of a majority of the outstanding shares of our Common Stock with regard to the above corporate actions. Any inquiries should be sent to: Aimee C. Gaudet, Secretary, Capstone Companies, Inc., 350 Jim Moran Blvd., #120, Deerfield Beach, Florida 33442, Telephone: (954) 252-3440, ext. 313, email: aimee@capstonecompaniesinc.com.

All of the above corporate actions are effective for federal law purposes forty (40) days after the mailing of the notice of availability of the Information Statement Materials, which mailing should occur on or before June 5, 2015.

In order to save mailing expenses, we incorporate by reference our Form 10-K Annual Report for the fiscal year ended December 31, 2014 and as filed with the U.S. Securities and Exchange Commission or “SEC” on March 27, 2015. The Form 10-K Annual Report is available at the SEC website at http://www.sec.gov and our website at http://www.capstonecompanies.com.

Sincerely,

/s/ Stewart Wallach

Stewart Wallach

Chief Executive Officer, President and Chairman of the Board of Directors

Capstone Companies, Inc.

350 Jim Moran Boulevard, Suite 120

Deerfield Beach, Florida 33442

June 4, 2015

INFORMATION STATEMENT UNDER REGULATION 14C

INFORMATION CONCERNING SHAREHOLDER ACTION BY WRITTEN CONSENT

Dear Common Stock, $0.0001 par value, Shareholders:

This is the Information Statement is filed by Capstone Companies, Inc., a Florida corporation, (“Company,” “we,” “us”) in connection with the following corporate actions taken by written consent of the requisite voting power of the Common Stock: (1) election of 5 nominees directors and (2) ratification of Mayer Hoffman McCann, P.C. as public auditors for fiscal year ending December 31, 2015.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE NOT REQUIRED TO

SEND US A PROXY

The corporate actions taken by written consent on June 2, 2015 were:

|

1.

|

Election of the following five nominees of the Company management for election to the board of directors for the term commencing upon their election and assumption of office until the election and assumption of office by their successors at the 2016 annual meeting of Shareholders or other 2016 election of directors:

|

|

2.

|

Ratification of the appointment of Mayer Hoffman McCann, P.C. as our public auditor for the fiscal year ending December 31, 2015.

|

Record Date. Only Shareholders of record at the close of business on May 20, 2015, the “Record Date,” are entitled to notice of the information disclosed in this Information Statement. There are no dissenters’ rights under Florida law for Shareholders who did not consent to the above corporate actions. Holders of the Common Stock are entitled to one (1) vote per share.

The above corporate actions were approved on June 2, 2015, by written consents representing 384,053,928 shares of Common Stock, or 53.2% of the issued and outstanding shares of Common Stock eligible to vote on these corporate actions (based on 721,989,957 shares of Common Stock being issued and outstanding as of June 2, 2015). As such, no shareholders meeting is required to approve the above corporate actions.

FREQUENTLY ASKED QUESTIONS

Why am I receiving these materials? The Company is sending you this Information Statement to inform you of corporate actions approved by the Company Board of Directors and approved by the written consent of holders of the shares of Common Stock, $0.0001 par value per share, (“Common Stock”) representing more than 50% of the issued and outstanding shares of the Common Stock. You do not need to take any actions in respect of the corporate actions, which consist of the matters set forth on page 1 of this Information Statement.

What vote is required to approve each proposed corporate action? Each of the proposed corporate actions requires the approval of Shareholders representing more than 50% of the issued and outstanding shares of Common Stock as of the Record Date. Written consents representing 384,053,928 shares of Common Stock, or 52.9% (based on 721,989,957 shares of Common Stock being issued and outstanding as of June 2, 2015) of the issued and outstanding shares of Common Stock eligible to vote on or consent to these corporate actions were received by the Company and approved all of the matters to be approved. As such, no shareholders meeting is required to approve the above corporate actions.

What is the purpose of the proposals? Under its by-laws, the Company has to periodically elect directors. We also routinely seek Shareholder ratification of the appointment of a public auditor as part of our policy of seeking qualified and independent public auditors.

Why is there no Annual Meeting of Shareholders? Fewer than 10 Shareholders have sufficient votes to approve or reject any of the proposed corporate actions. Florida law allows the Company to approve these proposals by written consent. As such, holding an annual meeting of shareholders, while has certain ancillary benefits, is not necessary to approve or reject the proposed corporate actions. A written consent avoids the cost of holding an annual meeting, which cost is significant for a smaller reporting company like the Company.

Who is paying for the preparation and mailing of the Information Statement? The cost of preparing and mailing the Information Statement will be borne by the Company. Banks, brokerage houses and other nominees or fiduciaries will be requested to forward the material to their principals, and the Company will, upon request, reimburse them for their expenses in so doing. The Company estimates the cost of preparing and mailing the Information Statement to be $4,500.

When do the proposed corporate actions become effective? For federal law purposes, the corporate actions are effective forty (40) days after the notice of Internet availability of the Information Statement Materials to the Shareholders, which mailing should occur on June 5, 2015.

CORPORATE ACTIONS

Item 1. Election of Directors

On May 20, 2015, the Company’s Board of Directors nominated the following five incumbent directors for election at a board meeting to stand for election to the Company’s Board of Directors until their successors are elected and assume office in fiscal year 2016. On June 2, 2015, the Company received sufficient written consents to elect the five nominees to the Company’s Board of Directors. 384,053,928 shares of Common Stock were voted FOR each of the nominees, which represents 53.2% of the issued and outstanding shares of Common Stock as of June 2, 2015. The profiles of the directors nominated by the Company’s Board of Directors and elected by written consent are:

STEWART WALLACH, age 63, is the Chief Executive Officer and President of the Company since April 23, 2007, a director of the Company since September 22, 2006, and the founder and Chief Executive Officer and Chairman of the Board of Capstone Industries, Inc., a wholly owned subsidiary and principal operating subsidiary of the Company, since September 20, 2006. Mr. Wallach is an American entrepreneur and has founded and operated a number of successful businesses over his 35-year career. Over the past 15 years, Mr. Wallach has been focused on technology-based companies in addition to consumer product businesses, the field in which he has spent most of his career. Prior to founding Capstone Industries, Inc., he sold Systematic Marketing, Inc., which designed, manufactured and marketed automotive consumer products to mass markets, to Sagaz Industries, Inc., a leader in these categories. He served as President of Sagaz Industries, Inc. for 10 years before forming Capstone Industries, Inc. In 1998, Mr. Wallach co-founded Examsoft Worldwide, Inc. (“Examsoft”), which developed and delivered software technology solving security challenges of laptop-based examinations for major educational institutions and state bar examiners. Mr. Wallach remained chairman of Examsoft until it was acquired in late 2009. Mr. Wallach has designed and patented a number

of innovations over the span of his career and has been traveling to China establishing manufacturing and joint venture relationships since the early 1980s.

JAMES “GERRY” MCCLINTON, age 60. Mr. McClinton was appointed as a director of the Company on February 5, 2008. He is currently the Interim Chief Financial Officer and Chief Operating Officer of the Company and its Capstone Industries, Inc. subsidiary. His prior work experience is: (a) President of Capstone Industries, Inc. (2005 -2007); (b) General Manager of Capstone Industries, Inc. (2000-2005); (c) Held senior officer positions with Sagaz Industries, Inc. (1990-2000); and (d) Chief Financial Officer, Firedoor Corporation, a national manufacturer of security and fire doors to the construction industry (1980-1990). Mr. McClinton received a designation from The Royal Institute of Cost and Management Accountants (“I.C.M.A.”), University of Northern Ireland, Belfast, United Kingdom.

DR. JEFFREY POSTAL, age 58, has served as a director of the Company since January of 2004. Dr. Postal presently is a businessman and entrepreneur in the Miami, Florida region. Dr. Postal owns, founded or funded numerous successful businesses over the last few years, including but not limited to: Sportacular Art, a company that was licensed by the National Football League, Major League Baseball and National Hockey League to design and manufacture sports memorabilia for retail distribution in the U.S; Co-Owner of Natures Sleep, LLC, a major distributor of Visco Memory Foam mattresses, both nationally and internationally; Dr. Postal is a Partner in Social Extract, LLC, a Social Media company offering consulting services to many major companies in the U.S.; Dr. Postal is the principal investor of Postal Capital Funding, LLC, a private investment fund whose mission is to find undervalued/under capitalized companies and extend funding to them in exchange for equity and/or capital consideration; and Dr. Postal is the founder of Datastream Card Services, a company that provides innovative billing solutions to companies conducting business on the internet.

JEFFREY GUZY, age 63, was appointed to the Company's Board of Directors on May 3, 2007. Mr. Guzy has a MBA in Strategic Planning and Management from The Wharton School of the University of Pennsylvania; an M.S. in Systems Engineering from the University of Pennsylvania; a B.S. in Electrical Engineering from Penn State University and an Associate Degree in Theology from Georgetown University. He has served as an executive manager or consultant in international business development, sales or management in the telecommunications industry, specifically with IBM Corp., RCA Corp., Sprint International, Bell Atlantic Video Services, Loral Cyberstar and FaciliCom International. He serves on the Board of Directors of: Aprize Satellite, which provides global remote monitoring and control, and Leatt Corporation, a Nevada corporation and an SEC reporting company. Mr. Guzy is also an Advisor to the MIT Enterprise Forum. Mr. Guzy currently serves as Chief Executive Officer and a Director of Central Oil & Gas Corporation of America, a Florida corporation engaged in oil production in Alabama.

LARRY SLOVEN, age 65. Mr. Sloven was appointed as a director on May 3, 2007. A U.S. Citizen, Mr. Sloven resided in Hong Kong for over 18 years. He is a member of the American Chamber of Commerce in Hong Kong. He just finished a five year term as a Director of the American Club in Hong Kong and chaired the Development Committee which was responsible for re-engineering five major multi-million dollar re-development projects for the premier club in Asia.

Mr. Sloven's company was a product development and purchasing agent for Capstone Companies, Inc., and was the purchasing agent for Dick's Sporting Goods, Inc. chain. He also helped develop private label hardware and accessory line for now defunct Circuit City, Inc. and a camcorder and cellular phone battery line for Spectrum Brands, Inc. (formerly, "Rayovac Corp."). In 1993, Mr. Sloven helped set up a joint venture factory producing cellular battery packs for AT&T along with the first cellular alkaline battery pack for Duracell. He participated in the outsourcing of the production of the one-hour NMH-fast charger for the Duracell Corporation. In the mid 1990's, he helped set up a joint venture with Rayovac Corp. and the largest alkaline consumer battery factory in China. Mr. Sloven also assisted in the outsourcing of video games for Atari, Inc., and arranging for Chinese manufacture of The Stanley Works' garage door motors and products.

Item 2. Ratification of Mayer Hoffman & McCann, P.C. as public auditors

The appointment of Mayer Hoffman McCann P.C. as the public auditors of the Company for fiscal year 2014 was ratified by written consents as of June 2, 2015. Mayer Hoffman & McCann, P.C. has been the public auditor of the Company since December 2014. There are no pending disputes between the Company and Mayer Hoffman & McCann, P.C. Mayer Hoffman & McCann, P.C. is a national accounting firm. The audit office of Mayer Hoffman & McCann, P.C. for the Company is located at 1675 N. Military Trail 5th Floor, Boca Raton, Florida 33486 (website: http://www.mhmcpa.com).

Prior Public Auditor. On December 9, 2014, Company and Company’s Audit Committee of the Board of Directors were advised by Company’s then current independent registered public accounting firm, Robison Hill & Co. (“RHC”), that RHC could not perform the audit for fiscal year ending December 31, 2014, due to internal changes in RHC that ended RHC’s SEC audit services and RHC declined appointment as the Company’s independent public auditor for fiscal year ending December 31, 2014. On December 9, 2014, the resignation was confirmed in a letter delivered to the Audit Committee of the Company’s Board of Directors (“Audit Committee”) and accepted.

On December 9, 2014, the Audit Committee approved the appointment of Mayer Hoffman McCann, P.C. of Boca Raton, Florida (“MHM”) as the Company’s new independent registered public accounting firm, effective immediately.

Audit/Taxes/SEC Related Fees. The fees billed or incurred by MHM for professional services rendered in connection with the audit of our annual consolidated financial statements for 2014, were approximately $49,000 respectively. The fees associated with the review of the consolidated financial statements included in our quarterly reports on Form 10-Q, the review of SEC filings, corporate taxation service fees and the review and consent for our other filings in 2014 were approximately $36,000.00. Mayer Hoffman McCann, PC was not paid any fees for other services to the Company.

Pre-Approval of Non-Audit Services. The Audit Committee has established a policy governing our use of MHM for non-audit services. Under the policy, management may use MHM for non-audit services that are permitted under the rules and regulations of the Commission, provided that management obtains the Audit Committee’s prior written approval before such services are rendered.

No Dissenters’ Rights. Florida law does not provide for dissenter’s rights in connection with any of the corporate actions described in this Information Statement.

VOTING RIGHTS AND SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Each share of Common Stock of the Company as of June 2, 2015, that are issued and outstanding enjoys one vote on all matters presented for their vote. The table below sets forth, as of June 2, 2015, (“Record Date”), certain information with respect to the Common Stock beneficially owned by (i) each Director, nominee and executive officer of the Company; (i) each person who owns beneficially more than 5% of the Common Stock; and (iii) all Directors, nominees and executive officers as a group. There were shares 721,989,957 of Common Stock outstanding on the Record Date.

On May 5, 2015, Involve, LLC converted 1,000 shares of Company Series C Convertible Preferred Stock, $1.00 par value, (“Series C Stock”) shares into 67,979,425 shares of Company Common Stock, which 1,000 shares represented all of the issued and outstanding shares of that series. The shares were issued without restrictive legends pursuant to Rule 144 under the Securities Act. Involve, LLC is an “accredited investor” under Rule 501(a) of Regulation D under the Securities Act.

|

OWNERSHIP OF OFFICERS, DIRECTORS AND PRINCIPAL SHAREHOLDERS

|

|

as of June 2, 2015

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

ALL OPTION WARRANT SHARES

|

|

NAME, ADDRESS & TITLE

|

STOCK OWNERSHIP

|

PERCENTAGE OF STOCK OWNERSHIP

|

STOCK OWNERSHIP AFTER CONVERSION OF ALL OPTIONS & WARRANTS PLUS THOSE EXERCISEABLE WITHIN THE NEXT 60 DAYS

|

% OF STOCK OWNERSHIP AFTER CONVERSION OF ALL OPTIONS & WARRANTS PLUS THOSE EXERCISEABLE WITHIN THE NEXT 60 DAYS

|

VESTED

|

EXPIRED

|

NOT VESTED

|

| |

|

|

|

|

|

|

|

|

Stewart Wallach, CEO, 350 Jim Moran Blvd, Suite 120, Deerfield Beach, FL 33442 (2)

|

147,618,822

|

22.6%

|

172,116,861

|

23.6%

|

24,498,039

|

0

|

0

|

| |

|

|

|

|

|

|

|

|

Gerry McClinton, CFO, COO & Director, 350 Jim Moran Blvd, Suite 120, Deerfield Beach, FL 33442 (3)

|

504,949

|

0.1%

|

32,754,949

|

4.5%

|

32,250,000

|

0

|

0

|

| |

|

|

|

|

|

|

|

|

Jeff Postal, Director, 350 Jim Moran Blvd, Suite 120, Deerfield Beach, FL 33442 (5)

|

128,381,748

|

19.6%

|

134,881,748

|

18.5%

|

5,000,000

|

4,000,000

|

1,500,000

|

| |

|

|

|

|

|

|

|

|

Aimee Gaudet, Secretary, 350 Jim Moran Blvd, Suite 120, Deerfield Beach, FL 33442 (11)

|

0

|

0.0%

|

300,000

|

0.0%

|

150,000

|

0

|

150,000

|

| |

|

|

|

|

|

|

|

|

Jeff Guzy, Director,Director, 3130 19th St North, Arlington, VA 22201 (7)

|

832,000

|

0.1%

|

8,332,000

|

1.1%

|

6,000,000

|

0

|

1,500,000

|

| |

|

|

|

|

|

|

|

|

Larry Sloven, Director, 350 Jim Moran Blvd, Suite 120, Deerfield Beach, FL 33442 (8)

|

792,000

|

0.1%

|

3,792,000

|

0.5%

|

3,000,000

|

0

|

0

|

| |

|

|

|

|

|

|

|

|

TOTAL ALL OFFICERS & DIRECTORS AS A GROUP

|

278,129,519

|

42.5%

|

352,177,558

|

48.4%

|

70,898,039

|

4,000,000

|

3,150,000

|

EXECUTIVE COMPENSATION

Set forth below is the approved compensation of each officer for fiscal years 2016, 2015, 2014, 2013 and 2012. Each of the officers served as a director of the Company in fiscal year 2014, but they were not compensated for director service.

|

Name & Principal Position

|

Year

|

Salary $

|

Bonus $

|

Stock Awards $

|

Non-Equity Incentives $

|

All Others $

|

Total $

|

|

Stewart Wallach

Chief Executive Officer

(1,2,4,5)

|

|

|

|

|

| |

2016

|

$ 332,426

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 332,426

|

| |

2015

|

$ 316,597

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 316,597

|

| |

2014

|

$ 301,521

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 301,521

|

| |

2013

|

$ 287,162

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 287,162

|

| |

2012

|

$ 273,488

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 273,488

|

|

Gerry McClinton

Chief Financial Office

(1,3,6,7)

|

|

|

|

|

| |

2016

|

$ 221,618

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 221,618

|

| |

2015

|

$ 211,065

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 211,065

|

| |

2014

|

$ 201,013

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 201,013

|

| |

2013

|

$ 191,442

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 191,442

|

| |

2012

|

$ 182,325

|

$ -

|

$ -

|

$ -

|

$ -

|

$ 182,325

|

Executive Compensation Philosophy, Strategy and Objectives

The principal objectives of our senior officer compensation plan are to attract, motivate and retain the services of qualified officers who can lead the Company to achieve its business goals and enhance public shareholder value. The Company’s business goals are to achieve consistent profitability in operations and attain long-term profitability. Our approach is based on the following compensation philosophies:

|

1.

|

Align Shareholder and Officer Interests: Besides a base salary sufficient to attract qualified personnel, we provide non-qualified, long term stock options to tie the interest to our officers with the interests of the shareholders in a long-term profitability of the Company.

|

|

2.

|

Performance Bases Compensation: Our grant of options and stock are designed to reward and encourage officers to achieve Company goals in financial and business performance.

|

Competitive Market

We have one independent director: Jeffrey Guzy. From time to time, we request that Mr. Guzy, our outside legal counsel and/or a consultant compare our compensation for management with other microcap companies in consumer goods. In 2015, we did not benchmark management compensation. Compensation was last benchmarked in 2014, when an independent director and outside legal counsel reviewed compensation of executives at several peer companies holding equivalent positions or having similar responsibilities as our senior officers. The peer companies utilized in the 2014 analysis were engaged in some segment of consumer goods and were microcap companies (some having less or greater resources and operating income than our company). The companies reviewed were:

|

4.

|

Lighting Science Group Corp.

|

We use peer group and available survey data to analyze our executive compensation (overall, base salary, annual bonus and long-term incentives) relative to the 50th percentile, or median, of the benchmark data. While we use the data to ensure competitiveness and reasonableness, we do not rely solely or primarily on benchmarking in establishing executive compensation levels. Variations in the actual compensation we set may be based on achievement of short-term and long-term goals, local salary ranges for executives in comparable positions, salary surveys, the competitive environment, talent and level or responsibility of each senior officer.

Role of the Compensation Committee. The Company Nominating and Compensation Committee operates independently of management and currently consists of one independent director, Jeffrey Guzy who are is independent under applicable SEC standards and are an “Outside Director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Nominating and Compensation Committee receives recommendations from our Chief Executive Officer regarding the compensation of the senior officers (other than the compensation of the Chief Executive Officer).

The Nominating and Compensation Committee or “Committee” is responsible for establishing and implementing our executive compensation plans as well as continually monitoring adherence to and effectiveness of those plans, including:

|

●

|

reviewing the structure and competiveness of our executive compensation programs to attract and retain superior executive officers, motivate officers to achieve business goals and objectives, and align the interests of executive officers with the long-term interests of our shareholders;

|

|

●

|

reviewing and evaluating annually the performance of officers in light of company goals and objectives and approving their compensation packages, including base salaries (if at issue or in consideration), long-term incentive and stock based compensation and perquisites;

|

|

●

|

monitoring the effectiveness of the Company’s sole incentive stock option plan and approving annual financial targets for officers; and

|

|

●

|

determining whether to award incentive bonuses that qualify as “performance-based compensation” for executive officers whose compensation is covered by Code Section 162(m), the elements of such compensation, whether performance goals have been attained and, if appropriate, certifying in writing prior to payment of such compensation that the performance goals have been met.

|

Role of Management. The Company believes that it is important to have our Chief Executive Officer’s input in the design of compensation programs for management. The Chief Executive Officer reviews compensation programs annually with the Committee, evaluating the adequacy relative to the marketplace, inflation, internal equity, external competitiveness, business and motivational challenges and opportunities facing the Company and its executives. In particular, he considers base salary a critical component of compensation to remain competitive and retain his executives, and meeting pre-established goals for an annual incentive bonuses. All final decisions regarding compensation for the Chief Executive Officer and other executives are made by the Committee. The Chief Executive Officer does not make recommendations with regard to his own compensation.

Role of the Compensation Consultant. While we may consult industry sources on compensation for executives, we have not engaged a consultant to analyze our compensation levels in 2014 or 2015.

Executive Compensation Components. For 2014, the principal components of compensation for each officer were:

|

●

|

long-term incentive compensation (restricted stock award); and

|

|

●

|

perquisites and other benefits.

|

Our company endeavors to strike an appropriate balance between long-term and current cash compensation. The current executives are key to the ability of the Company to conduct its business because of their individual experience and relationships in our current business line. Their compensation reflects their individual value to the ability of the Company to conduct its current business.

Base Salary. Base salary is considered a critical component of compensation at all levels. The appropriate establishment of this component relative to the marketplace is essential to enable us to attract and retain qualified individuals, which are important considerations in the current competitive industry market. Base salaries provide a stable source of income regardless of stock price performance so that our senior officers can focus on a variety of important business metrics in addition to our stock price. The reliance on base salary is also necessitated by the relatively flat performance of our Common Stock in the market over the past several years. As a smaller reporting company, base salary is the key compensation element in any compensation package.

The annual salaries paid to Company senior officers are set based on the assessment of each executive’s overall contribution to the achievement of our business objectives, respective responsibilities, longevity with the Company as well as comparisons to comparable positions in peer group companies as provided periodically by an external market study.

ESPP: The Company does not have an Employee Stock Purchase Plan that provides employees with the opportunity to purchase shares of the Common Stock.

Benefits: The Company provides the following benefits to our senior executives generally on the same basis as the benefits provided to all employees: (1) health care and dental insurance; and (2) paid personal and vacation leave. The Compensation and Nominating Committee believes that these benefits are consistent with those offered by other companies and specifically with those companies with which we compete for employees.

Risk/Reward Issues. The Board of Directors does not believe that the current structure of the Company’s compensation policies promotes unnecessary or inappropriate short-term or long-term risks. The cash compensation paid to the Company’s executive officers consists of fixed salaries and possible performance bonuses. These performance bonuses (if any) will be granted in hindsight by the Board of Directors based on operational and financial performance.

In the future, the Board may base the vesting of stock options and perhaps cash bonuses on specific performance criteria that will be determined in advance based on the Company’s prior year performance as reflected in its financial statements included within its annual report on Form 10-K for the appropriate fiscal year end. Such a determination is deemed appropriate when and if the Company has sustained revenue growth and/or profitability.

EMPLOYMENT AGREEMENTS

On March 1, 2013, the Company amended the terms of the employment agreements for Stewart Wallach and Gerry McClinton, extending the agreement term to February 5, 2016. These Employment Agreements stipulate a 5% increase in salary annually. These amended agreements supersede any existing employment agreements and are the only employment agreements with the following Company senior officers:

(1) Stewart Wallach, Chairman of the Board of Directors, Chief Executive Officer and President. The 2013 employment agreement provides for an annual salary of $273,489 with minimum annual increase in base salary of 5%. Mr. Wallach may, at his option, elect to receive restricted shares of Common Stock in lieu of cash compensation, which share subject to piggyback registration rights.

(2) James Gerry McClinton, Chief Operating Officer and Interim Chief Financial Officer. The 2013 employment agreement provides for an annual salary of $182,326 with minimum annual increase in base salary of 5%. Mr. McClinton may, at his option, elect to receive restricted shares of Common Stock in lieu of cash compensation, which shares are subject to piggyback registration rights.

Common Provisions in both Employment Agreements: The following provisions are contained in each of the above employment agreements:

If the officer’s employment is terminated by death or disability, the Company is obligated to pay to the officer’s estate or the officer, as the case may be, a lump sum payment equal to (a) the officer’s base salary through the termination date, plus a pro rata portion of the officer bonus for the fiscal year in which the termination occurred and (b) a lump sum payment equivalent to the sum of (i) one-year’s salary at the annual base salary rate officer was earning as of the date of termination; (ii) the bonus payment(s) officer received in the preceding fiscal year; and (iii) the cost of officer’s health and dental insurance premiums for the preceding fiscal year.

If the employment is terminated without cause by the Company or for “good reason” (as defined in the employment agreement) by the officer, then the Company must pay to the officer’s estate or the officer, a lump-sum payment equal to the greater of: (aa) the sum of (i) one-year’s salary at the annual base salary rate that the officer was earning as of the date of termination and (ii) the bonus payment(s) officer received in the preceding fiscal year; and (bb) the sum of (i) the base salary that the officer would have earned had he remained employed through the remainder of the employment period and (ii) the bonus payment(s) officer received in the preceding fiscal year multiplied by the number of years remaining in the employment period (and adjusted on a pro rata basis for any partial year remaining in the employment period.

The employment agreements have a three-year term, but have been amended to extend the term for an additional 3 years (from February 5, 2013 until February 5, 2016). These employment agreements can be extended by mutual consent of the parties for up to three (3) additional years. The employment agreements have an anti-competition provision for 18 months after the end of employment.

The above summary of the employment agreements is qualified by reference to the actual employment agreements, which are filed as exhibits to the Annual Report on Form 10K by the Company for fiscal year ended December 31, 2013.

The following table summarizes option grants during the fiscal year ended December 31, 2012, to each of the executive officers named in the Summary Compensation Table herein. These grants have exercise periods extending to April 27, 2017. There were no option grants to officers of the Company in the fiscal year ending December 31, 2014.

SUMMARY TABLE OF OPTION GRANTS TO OFFICERS OF COMPANY

|

Name

|

No. of Shares

Underlying

|

% of Total Options

Granted Employees

in FY2012

|

Expiration

Date

|

Restricted

Stock Grants

|

No. Shares

underlying Options

Options Granted

in FY2012

|

|

Stewart Wallach

|

24,498,039

|

-0-

|

4/27/2017

|

-0-

|

-0-

|

|

Gerry McClinton

|

32,250,000

|

-0-

|

4/27/2017

|

-0-

|

-0-

|

ADVISORY VOTE ON EXECUTIVE COMPENSATION

On November 5, 2013, shareholders acting by written consent approved an advisory vote on executive compensation on a three-year frequency.

POLICY REGARDING BOARD ATTENDANCE

Company directors are expected to attend all annual and special board meetings per Company policy. An attendance rate of less than 75% over any 12-month period is grounds for removal from the Board of Directors. In fiscal year 2014, all directors attended at least 75% of all board meetings.

DIVERSITY

The Board does not have a formal policy with respect to Board nominee diversity. In recommending proposed nominees to the full Board, the Compensation and Nominating Committee is charged with building and maintaining a board that has an ideal mix of talent and experience to achieve our business objectives in the current environment. The Compensation and Nominating Committee is focused on relevant subject matter expertise, depth of knowledge in key areas that are important to us, and diversity of thought, background, perspective and experience so as to facilitate robust debate and broad thinking on strategies and tactics pursued by us.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS.

During the past ten years, none of the persons serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to be disclosed pursuant to Item 401(f) of Regulation S-K including: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; or (e) any sanction or order of any self-regulatory organization or registered entity or equivalent exchange, association or entity. Further, no such legal proceedings are believed to be contemplated by governmental authorities against any director or executive officer.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of securities ownership and changes in such ownership with the SEC. Executive officers, directors and greater than ten percent shareholders also are required by rules promulgated by the SEC to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of such forms furnished to the Company or other written representations, the Company believes that all of Section 16(a) filing requirements were met during fiscal year 2014 by the Company’s directors and officers.

ROLE OF THE BOARD OF DIRECTORS IN CORPORATE GOVERNANCE

The Board of Directors is responsible for overseeing the Chief Executive Officer and other senior management in order to assure that such officers are competent and ethical in running the Company on a day-to-day basis and to assure that the long-term interests of the Shareholders are being served by such management. The directors must take a pro-active focus and approach to their obligation in order to set and enforce standards to ensure that the Company is committed to business success through maintenance of the highest standards of responsibility and ethics.

Code of Ethics. The Company has adopted a Code of Ethics, which is posted on the Company's Website. The contents of the Company Website are not incorporated herein by reference and that Website URL provided in this Information Statement is intended to be an inactive textual reference only.

Audit Committee. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. It is primarily responsible for overseeing the services performed by the Company's independent public auditors, evaluating the Company's accounting policies and its system of internal controls and reviewing significant financial transactions. The members of the Audit Committee in fiscal year 2013 were Jeffrey Guzy and Jeffrey Postal. The Company believes that Mr. Guzy is an independent director and the sole independent director under applicable standards.

Director’s Meetings. The Board of Directors had four official meetings in fiscal year 2014 three official meetings in fiscal year 2015. During fiscal year 2014 all of the directors attended 75% or more of all meetings of the Board, which were held during the period of time that such person served on the Board or such committee.

Board Leadership Structure and Board’s Role in Risk Oversight. The Company’s Board of Directors endorses the view that one of its primary functions is to protect stockholders’ interests by providing independent oversight of management, including the Chief Executive Officer and Chief Operating Officer (who also holds the Chief Financial Officer position). The Chief Financial Officer is allowed and encouraged to address the Board of Directors on any issues affecting the Company or its public shareholders. The Company also allows outside counsel to participate in some of the board meetings in order to provide legal counsel and an outside perspective on corporate governance and risk issues.

Independent Directors: The Board of the Company is currently comprised of five directors, one of whom are independent directors under SEC rules. The Company has sought unsuccessfully in 2014 to recruit additional qualified independent directors, especially for the Audit Committee. Company will continue such recruitment efforts in 2015. Although we have D&O insurance, and we believe such coverage is adequate, we also believe that our chronic losses and chronically low public stock market price discourages qualified candidates from serving as independent directors. This is a problem commonly faced by micro-cap, “penny stock” companies like our company.

Risk Assessment. Risk is inherent with every business, and how well a business manages risk can ultimately determine its success or survival. The Company faces a number of risks, including, without limit: (1) persistent net losses in consecutive fiscal quarters and years, which losses require outside funding or financing through the sale of our securities or insider loans to the Company (all of which usually dilute our existing shareholders and discourage public investors in investing in our Common Stock); (2) chronically low public stock market price, which hinders our ability to fund and grow our business; (3) reliance on regional and national distributors and retailers to sell our products in a highly competitive market filled with competitors who possess significantly greater resources and market share than our company; (4) low profit margin consumer goods business as our primary business line; (5) customary operational risks; (6) lack of a strong brand name for our products; (7) reliance on key personnel and the lack of key man insurance that pays for replacements; (8) lack of primary markets and lack of institutional support for our publicly traded Common Stock; (9) low market price of our Common Stock hindering our ability to consummate or attract merger and acquisition candidates and customary “penny stock” risks; (10) lack of assets (other than accounts receivable) to attain commercially reasonable financing for operations; and (11) the risks faced by any product company in today’s challenging environment.

Our senior officers are responsible for the day-to-day management of risks the Company faces, while the Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. To do this, the Chairman of the Board and other non-officer directors met quarterly on average with management to discuss strategy and the risks facing the Company. Senior management, each member being also a director, attends the Board meetings and is available to address any questions or concerns raised by the Board on risk management and any other matters. The Chairman of the Board and members of the Board work together to provide what is perceived as strong, independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings of directors. Since most of the directors are located in the same area, informal meetings between directors and officers also occur to discuss business risk and appropriate responses.

Jeffrey Postal, a Company director, is responsible for Sarbanes Oxley Act of 2002 compliance.

Director’s Minimum Qualifications: The Nominating and Compensation Committee has adopted a set of criteria that it considers when it selects individuals not currently on the Board of Directors to be nominated for election to the Board of Directors. A candidate must also meet any qualification requirements set forth in Company Bylaws and in any Board or committee governing documents.

If the candidate is deemed eligible for election to the Board of Directors, the Nominating and Compensation Committee will then evaluate the prospective nominee to determine if he or she possesses the following qualifications, qualities or skills:

|

●

|

contributions to the range of talent, skill and expertise appropriate for the Board of Directors;

|

|

●

|

financial, regulatory and business experience, knowledge of the operation of public companies and ability to read and understand financial statements;

|

|

●

|

familiarity with the Company’s market;

|

|

●

|

personal and professional integrity, honesty and reputation;

|

|

●

|

the ability to represent the best interests of the shareholders of the Company and the best institution;

|

|

●

|

the ability to devote sufficient time and energy to the performance of his or her duties and;

|

|

●

|

Independence under applicable SEC and other regulatory definitions.

|

The Nominating and Compensation Committee will also consider any other factors it deems relevant. With respect to nominating an existing director for re-election to the Board of Directors, the Nominating and Compensation Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Director Nomination Process: The process that the Nominating and Compensation Committee follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

For purposes of identifying nominees for the Board of Directors, the Nominating and Compensation Committee relies on personal contacts of the committee members and other members of the Board of Directors, and will consider director candidates recommended by Shareholders, Company legal counsel, Company public auditors in accordance with the policy and procedures set forth above. The Nominating and Compensation Committee has not used an independent search firm to identify nominees due the cost and probable success recruitment of a director.

In evaluating potential nominees, the Nominating and Compensation Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria, which are discussed in more detail above. If such individual fulfills these criteria, the Nominating and Compensation Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board of Directors.

Consideration of Recommendation by Stockholders: It is the policy of the Nominating and Compensation Committee of the Board of Directors of the Company to consider director candidates recommended by shareholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating and Compensation Committee may choose not to consider an unsolicited recommendation if no vacancy exists in the Board of Directors and the Nominating and Compensation Committee does not perceive a need to increase the size of the Board of Directors. To avoid the unnecessary use of the Nominating and Compensation Committee’s resources, the Nominating and Compensation Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Shareholder Proposal Procedures: To submit a recommendation of a director candidate to the Nominating and Compensation Committee, a stockholder should submit the following information in writing, addressed to the Chairperson of the Nominating and Compensation Committee, care of the Corporate Secretary, at the main office of the Company:

|

1.

|

The name of the person recommended as director candidate;

|

|

2.

|

All information relating to such person that is required to be disclosed in solicitation of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934;

|

|

3.

|

The written consent of the person being recommended as a director candidate to being named in the Information Statement as a nominee and to serving as a director if elected;

|

|

4.

|

The name and address of the Shareholder making the recommendation, as they appear on the Company’s books; provided, however, that if the stockholder is not a registered holder of the Company’s Common Stock, the Shareholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s Common Stock detailing his, her or its ownership of shares of Company’s Common Stock; and

|

|

5.

|

A statement disclosing whether such Shareholder is acting with or on behalf of any other person and, if applicable, identify of such person.

|

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, when and if one is held, or to be considered prior to a written consent vote on director nominees, the recommendation must be received by the Nominating and Compensation Committee by December 31st for an annual meeting or written consent in the following year.

OTHER MATTERS

No director of the Company has informed the Company in writing that he intends to oppose any action to be taken by the Company. No proposals have been received from security holders.

Stockholder Communications to the Board. Shareholders who are interested in communicating directly with members of the Board of Directors, or the Board of Directors as a group, may do so by writing directly to the individual Board member or to the Board of Directors at: Capstone Companies, Inc., 350 Jim Moran Blvd., Suite 120, Deerfield Beach, Florida 33442, Attn: Aimee Gaudet, Secretary. The Company’s Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to a particular member, the communication will be forwarded to a Board member to bring to the attention of the Board of Directors. The Company’s Secretary will review all communications before forwarding them to the appropriate Board member.

Recent Private Placement of Securities. None.

INCORPORATION BY REFERENCE

Statements contained in this Information Statement, or in any document incorporated in this Information Statement by reference regarding the contents or other document, are not necessarily complete and each such statement is qualified in its entirety by reference to that document or contract filed as an exhibit with the SEC. The SEC allows us to “incorporate by reference” into this Information Statement certain documents we file with the SEC. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this Information Statement, and later information that we file with the SEC will update and supersede that information. We incorporate by reference the documents listed below and any documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this Information Statement. These include periodic reports, such as Annual Reports on Form 10K, Quarterly Reports on Form 10Q and Current Reports on Form 8K, as well as information or proxy statements (except for information furnished to the SEC that is not deemed to be “filed” for purposes of the Securities Exchange Act of 1934). Notwithstanding the foregoing, information furnished under Items 2.02

and 7.01 of any Current Report on Form 8K, including the related exhibits, is not incorporated by reference into this Information Statement.

Any recipient of this Information Statement should rely only on information contained in or incorporated by reference in this Information Statement. No persons have been authorized to give any information or to make any representations other than those contained in this Information Statement and, if given or made, such information or representations must not be relied upon as having been authorized by us or any other person.

Forward-Looking Statements. This Information Statement and the related materials may contain certain “forward-looking” statements, as defined in the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements.

Such forward-looking statements include statements about our expectations, beliefs or intentions regarding actions contemplated by this Information Statement, our potential business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made and are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” or “will,” and similar expressions or variations. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. Furthermore, such forward-looking statements speak only as of the date of this Information Statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

INTEREST OF PERSONS IN MATTERS TO BE ACTED UPON

No officer, director or principal stockholder has a substantial or material interest in the favorable outcome of the matters approved by written consent, other than as discussed herein.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

We will only deliver one set of Information Statement Materials to multiple security holders sharing an address unless we have received contrary instructions from one or more of the security holders. Upon written or oral request, we will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered.

COSTS OF THE INFORMATION STATEMENT

We are mailing this Information Statement and will bear the costs associated therewith. We are not making any solicitation. We will reimburse banks, brokerage firms, other custodians, nominees and fiduciaries for reasonable expenses incurred in sending the Information Statement or Information Statement Materials to beneficial owners of the Common Stock.

AVAILABLE INFORMATION

The Company files annual, quarterly and current reports, information statements and other information with the SEC. You may read and copy any reports, statements or other information that the Company has filed at the SEC’s public reference rooms at 100 F Street, NE, Washington, D.C., 20549. Please call the commission at (800) SEC-0330 for further information on the public reference rooms. The Commission also maintains a web site at www.sec.gov, which reports information statements and other information (including this Information Statement) regarding the Company. The Company’s SEC filings can also be accessed through the Company’s website at https://www.capstonecompaniesindustries.com. The Company will deliver at no charge and promptly upon written or oral request a separate hardcopy of the Form 10K Annual Report for fiscal year ending December 31, 2014, and this Information Statement if such request is made to the Company at the address or phone number set forth on the first page of this Information Statement.

CAPSTONE COMPANIES, INC.

350 Jim Moran Boulevard, Suite 120, Deerfield Beach, Florida 33442

Telephone: (954) 252-3440

June 4, 2015

NOTICE OF INTERNET AVAILABILITY OF INFORMATION STATEMENT MATERIALS

Dear holders of Common Stock, $0.0001 par value per share (“Common Stock”) of Capstone Companies, Inc., a Florida corporation, (“Company”):

The corporate actions by the Company described under “Corporate Actions” below were approved on June 2, 2015 by written consents of holders of the Common Stock possessing sufficient voting power to approve those corporate actions.

Pursuant to Securities and Exchange Commission Rule 14a-16(a) (and as required by Rule 14c-2) under the Securities Exchange Act of 1934, as amended, you are receiving this notice that the Information Statement Materials are available on the Internet. This communication provides only a brief overview of the more complete information in the Information Statement Materials. We encourage you to access and review all of the important information contained in the Information Statement Materials. The Company is not soliciting proxy or consent authority, but is furnishing an information statement pursuant to 17 C.F.R. §240.14c-2. In accordance with 17 C.F.R. §240.14c-2(f), this notice is being sent separately from other types of security holder communications and does not accompany any other documents or materials. The Company is making the Information Statement Materials available through the Internet rather than utilizing the full set delivery option in an attempt to save additional expenses associated with the printing and mailing of the Information Statement Materials. “Information Statement Materials” means this Information Statement and Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We are providing Information Statement Materials to all of our Shareholders at the close of business on the record date for consent to the corporate actions, being May 20, 2015.

Follow these instructions below to view the Information Statement Materials or request printed or email copies of the Information Statement Materials: This Notice of Internet Availability of Information Statement Materials (including the Information Statement) are available through the Investor link of Capstone Companies, Inc. Website at: www.capstonecompaniesinc.com.

If you want to receive a paper or emailed copy of these documents, you must request one. There is no charge to you for requesting a paper or emailed copy. Please make your request prior to June 30, 2015.

|

1.

|

Send an Email to aimee@capstonecompaniesinc.com;

|

|

2.

|

Send letter or request to Aimee C. Gaudet, Secretary, Capstone Companies, Inc., 350 Jim Moran Blvd., Suite 120, Deerfield Beach, Florida 33442; or

|

|

3.

|

Call Aimee C. Gaudet, Secretary, Capstone Companies, Inc. at (888) 570-8889 ext. 313.

|

Corporate Actions: On June 2, 2015, nine holders of record with an aggregate number of 384,153,928 shares of Common Stock, or 52.9% of the issued and outstanding shares of Common Stock eligible to vote on these corporate actions (based on 721,989,957 shares of Common Stock being issued and outstanding as of June 2, 2015), approved by written consents the following corporate actions. Each share has one (1) vote on all matters presented for Shareholder approval.

1. Election of the following five nominees of the Company management for election to the board of directors, all such nominees being current directors of the Company, for the term commencing upon their election and assumption of office until the election and assumption of office by their successors at the 2016 annual meeting of Shareholders or other 2016 election of directors:

2. Ratification of the appointment of Mayer Hoffman McCann, P.C. as our public auditor for the fiscal year ending December 31, 2015. Mayer Hoffman McCann, P.C. is a national public auditing firm and its audit office for the Company located at 1675 N. Military Trail 5th Floor, Boca Raton, Florida 33486 (website: http://www.mhmcpa.com).

Prior Public Auditor. On December 9, 2014, Company and Company’s Audit Committee of the Board of Directors were advised by Company’s then current independent registered public accounting firm, Robison Hill & Co. (“RHC”), that RHC could not perform the audit for fiscal year ending December 31, 2014, due to internal changes in RHC that ended RHC’s SEC audit services and RHC declined appointment as the Company’s independent public auditor for fiscal year ending December 31, 2014. On December 9, 2014, the resignation was confirmed in a letter delivered to the Audit Committee of the Company’s Board of Directors and accepted. On December 9, 2014, the Audit Committee approved the appointment of Mayer Hoffman McCann, P.C. as the Company’s new independent registered public accounting firm, effective immediately.

WE ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY SINCE THE REQUIRED MAJORITY OF THE OUTSTANDING SHARES OF OUR VOTING STOCK HAVE APPROVED THE ABOVE CORPORATE ACTIONS. WE ARE NOT SOLICITING YOUR VOTE OR YOUR PROXY FOR THESE MATTERS.

All of the above corporate actions are effective for federal law purposes forty (40) calendar days after the mailing of the notice of availability of the Information Statement Materials, which mailing should occur on or before June 5, 2015 and which effective date should be on or after July 20, 2015.

Sincerely,

/s/ Stewart Wallach

Stewart Wallach

Chief Executive Officer, President and Chairman of the Board of Directors

Deerfield Beach, Florida

June 4, 2015

2

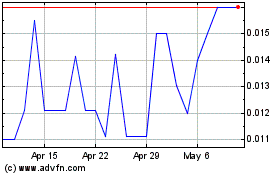

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Apr 2023 to Apr 2024