SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934.

BIGLARI

HOLDINGS INC.

(Name of Subject Company (Issuer))

THE LION FUND II, L.P.

(Name of Filing Person (Offeror and Affiliate of Issuer))

Common stock, stated value $0.50 per share

(Title of Class of Securities)

857873103

(CUSIP Number

of Class of Securities)

Sardar Biglari

Chairman

and Chief Executive Officer

Biglari Capital Corp., General Partner of The Lion Fund II, L.P.

17802 IH 10 West, Suite 400

San Antonio, Texas 78257

Telephone: (210) 344-3400

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with copies to:

Edward S. Horton, Esq.

Seward & Kissel LLP

One Battery Park Plaza

New York, NY 10004

(212)

574-1200

CALCULATION OF FILING FEE

|

|

|

| Transaction Valuation*: |

|

Amount of Filing Fee: |

| $241,500,000 |

|

$28,062.30 |

| |

| * |

Estimated for purposes of calculating the amount of the filing fee only. Calculated by multiplying the $420.00 per share tender offer purchase price by 575,000, the maximum number of shares of common stock to be

purchased in the offer. The amount of the filing fee was calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, and equals $116.20 for each $1,000,000 of the value of the transaction. |

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

Amount Previously Paid:

Form or Registration No.:

Filing

Party:

Date Filed:

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

x |

third-party tender offer subject to Rule 14d-1. |

| |

¨ |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

INTRODUCTORY STATEMENT

This Tender Offer Statement on Schedule TO (“Schedule TO”) relates to a Tender Offer (as defined herein) by The Lion Fund II, L.P.,

a Delaware limited partnership (the “Offeror”), to purchase up to 575,000 of the outstanding shares of common stock, $0.50 par value (the “Common Stock”) of Biglari Holdings Inc. (the “Company”), an Indiana corporation

(the “Shares”), at a price of $420.00 per share, net to the seller in cash without interest and subject to any withholding taxes required by applicable law, on the terms and subject to the conditions set forth in the Offer to Purchase

dated as of the date hereof (the “Offer to Purchase”) and in the related Letter of Transmittal and Important Instructions and Information (which together, as they may be amended or supplemented from time to time, constitute the

“Offer”), copies of which are attached to this Schedule TO as Exhibits (a)(1)(i), (a)(1)(ii) and (a)(1)(iii), respectively. The Offeror is an affiliate of the Company, as described below. This Tender Offer Statement on Schedule TO

(including exhibits) is intended to satisfy the reporting requirements of Rules 14d-1 under the Securities Exchange Act of 1934, as amended.

Copies of the Offer to Purchase, the related Letter of Transmittal and Important Instructions and Information, and certain other relevant

documents are filed as exhibits hereto. The information in the Offer to Purchase is hereby incorporated by reference in response to all the items of this Schedule TO, except those items as to which information is specifically provided therein.

Item 1. Summary Term Sheet.

The information set forth in the section of the Offer to Purchase entitled “Summary Term Sheet” is incorporated herein by reference.

Item 2. Subject Company Information.

(a) Name and Address. The name of the subject company to which this Schedule TO relates is Biglari Holdings Inc., an Indiana

corporation. The address of the Company’s principal executive offices is 17802 IH 10 West, Suite 400, San Antonio, Texas 78257. The Company’s telephone number is (210) 344-3400. The information set forth in Section 9

(“Information about Us and the Company”) of the Offer to Purchase is incorporated herein by reference.

(b)

Securities. The information set forth in the section of the Offer to Purchase captioned “Introduction” is incorporated herein by reference.

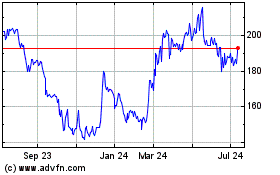

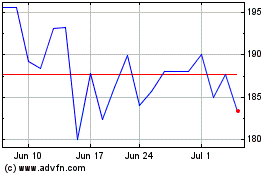

(c) Trading Market and Price. The principal market on which the Shares are traded is the New York Stock Exchange. The information set

forth in the section captioned “Introduction” in the Offer to Purchase is incorporated herein by reference. Section 7 (“Price Range of Shares; Dividends”) of the Offer to Purchase is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

(a-c) Name, Address, Business and Background. The Filing Person for this Schedule TO is The Lion Fund II, L.P., a Delaware private

investment limited partnership, and an affiliate of the Company by virtue of its relationship to the Company’s Chairman of the Board of Directors and Chief Executive Officer, Mr. Sardar Biglari (“Mr. Biglari”). The Company and

its wholly owned subsidiary, Steak n Shake Operations, Inc., own 94.4% of The Lion Fund II, L.P.’s outstanding limited partner interests. Mr. Biglari owns 100% of the interests in Biglari Capital Corp. (“Biglari Capital Corp.”),

which is the general partner of The Lion Fund II, L.P. Mr. Biglari and his affiliates beneficially own and control the voting and investment authority over 405,707 shares of Common Stock. The address of Mr. Biglari, The Lion Fund II, L.P.

and Biglari Capital Corp. is 17802 IH 10 West, Suite 400, San Antonio, Texas 78257 and their telephone number is (210) 344-3400. Mr. Biglari is a citizen of the United States of America.

1

Neither Mr. Biglari, The Lion Fund II, L.P. nor Biglari Capital Corp. has been convicted in

a criminal proceeding during the past five years (excluding traffic violations or similar misdemeanors) and was not a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order

enjoining such persons from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

(d) Tender offer. The Shares subject to the Offer consist of up to 575,000 of the outstanding shares of Common Stock, at a price of

$420.00 per share, net to the seller in cash without interest and subject to any withholding taxes required by applicable law, on the terms and subject to the conditions of the Offer. As of June 3, 2015, there were 2,065,608 shares of Common

Stock issued and outstanding, of which 405,707 shares of Common Stock were and currently are owned by either the Offeror or its officers, directors or affiliates.

The information set forth in Section 9 (“Information about Us and the Company”) and Section 15 (“Material

Agreements”) in the Offer to Purchase is incorporated herein by reference.

Item 4. Terms of the Transaction.

The information set forth in the following sections of the Offer to Purchase is incorporated herein by reference.

| |

• |

|

“Forward-Looking Statements” |

| |

• |

|

Section 1 (“Number of Shares; Purchase Price; Proration”) |

| |

• |

|

Section 2 (“Purpose of the Offer; Certain Effects of the Offer”) |

| |

• |

|

Section 3 (“Procedure for Tendering Shares”) |

| |

• |

|

Section 4 (“Withdrawal Rights”) |

| |

• |

|

Section 5 (“Purchase of Shares; Payment of Purchase Price”) |

| |

• |

|

Section 6 (“Certain Conditions of the Offer”) |

| |

• |

|

Section 7 (“Price Range of Shares; Dividends”) |

| |

• |

|

Section 8 (“Source and Amount of Funds”) |

| |

• |

|

Section 9 (“Information about Us and the Company”) |

| |

• |

|

Section 10 (“Plans and Proposals”) |

| |

• |

|

Section 11 (“Certain Legal Matters; Regulatory Approvals”) |

| |

• |

|

Section 12 (“Certain Federal Income Tax Consequences”) |

| |

• |

|

Section 13 (“Extensions of the Offer; Termination; Amendment”) |

| |

• |

|

Section 14 (“Fees and Expenses”) |

| |

• |

|

Section 15 “(Material Agreements”) |

| |

• |

|

Section 16 (“Miscellaneous”) |

(b) Purchases. The information set

forth in the sections of the Offer to Purchase captioned “Summary Term Sheet” and “Introduction” is incorporated herein by reference. The information set forth in Section 9 (“Information about Us and the Company”)

and Section 15 (“Material Agreements”) in the Offer to Purchase is incorporated herein by reference.

2

Item 5. Past Contracts, Transactions, Negotiations and Agreements.

(e) Agreements Involving the Subject Company’s Securities. The information set forth in Section 9 (“Information about Us and the

Company”) and Section 15 (“Material Agreements”) of the Offer to Purchase is incorporated herein by reference.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a) Purposes. The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” is

incorporated herein by reference. The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the Offer”) of the Offer to Purchase is incorporated herein by reference.

(b) Use of securities acquired. The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the

Offer”) of the Offer to Purchase is incorporated herein by reference.

(c) Plans. The information set forth in

Section 2 (“Purpose of the Offer; Certain Effects of the Offer”), Section 7 (“Price Range of Shares; Dividends”) and Section 10 (“Plans and Proposals”) of the Offer to Purchase is incorporated herein by

reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a) Source of funds. The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” is

incorporated herein by reference. The information set forth in Section 8 (“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference.

(b) Conditions. The information set forth in Section 8 (“Source and Amount of Funds”) of the Offer to Purchase is

incorporated herein by reference. The Offeror has no alternative financing arrangements or plans relating to the Offer other than those described herein.

(d) Borrowed funds. Not applicable.

Item 8. Interest in Securities of the Subject Company.

(a) Securities ownership. The information set forth in Section 9 (“Information About Us and the Company”) and

Section 15 (“Material Agreements”) of the Offer to Purchase is incorporated herein by reference.

(b) Securities

transactions. The information set forth in Section 9 (“Information About Us and the Company”) and Section 15 (“Material Agreements”) of the Offer to Purchase is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) Solicitations or recommendations. The information set forth in Section 14 (“Fees and Expenses”) of the Offer to

Purchase is incorporated herein by reference.

Item 10. Financial Statements.

(a) The information set forth in “Section 9 (Information About Us and the Company—Information About Us—Financial

Information”) and Annex B of the Offer to Purchase is incorporated herein by reference.

(b) Not applicable.

3

Item 11. Additional Information.

(a) Agreements, regulatory requirements and legal proceedings. The information set forth in Section 2 (“Purpose of the

Offer; Certain Effects of the Offer”), Section 9 (“Certain Information Concerning Us”), Section 11 (“Certain Legal Matters; Regulatory Approvals”), Section 15 (“Material Contracts”) and

Section 16 (“Miscellaneous”) of the Offer to Purchase is incorporated herein by reference. The Lion Fund II, L.P. will amend this Schedule TO to reflect material changes to information provided in the Schedule TO, including that

provided through the Offer to Purchase, to the extent required by Rule 14d-3(b). To the knowledge of The Lion Fund II, L.P., no material legal proceedings relating to the Offer are pending.

(c) Other material information. The information in the Offer to Purchase and the related Letter of Transmittal is incorporated

herein by reference.

Item 12. Exhibits.

See the Exhibit Index immediately following the signature page, which Exhibit Index is incorporated herein by reference.

Item 13. Information Required by Schedule 13E-3.

Not Applicable.

4

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

| Date: June 4, 2015 |

|

|

|

The Lion Fund II, L.P. |

|

|

|

|

|

|

|

By: Biglari Capital Corp., its General Partner |

|

|

|

|

|

|

|

|

By: |

|

/s/ Sardar Biglari |

|

|

|

|

|

|

Name: Sardar Biglari |

|

|

|

|

|

|

Title: Chairman and Chief Executive Officer |

5

EXHIBIT INDEX

|

|

|

| (a)(1)(i) |

|

Offer to Purchase, dated June 4, 2015* |

|

|

| (a)(1)(ii) |

|

Letter of Transmittal* |

|

|

| (a)(1)(iii) |

|

Important Instructions and Information* |

|

|

| (a)(1)(iv) |

|

Notice of Guaranteed Delivery* |

|

|

| (a)(1)(v) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

|

|

| (a)(1)(vi) |

|

Form of Summary Advertisement* |

|

|

| (a)(5)(i) |

|

Press release announcing the commencement of the Offer, dated June 4, 2015* |

|

|

| (d)(1) |

|

Stock Purchase Agreement, dated July 1, 2013, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on July 2, 2013. |

|

|

| (d)(2) |

|

Shared Services Agreement, dated July 1, 2013, by and between Biglari Holdings Inc. and Biglari Capital Corp., incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by the Company on July 2,

2013. |

|

|

| (d)(3) |

|

Amended and Restated Incentive Bonus Agreement, dated as of September 28, 2010, by and between the Company and Sardar Biglari, incorporated by reference to Annex A to the Company’s definitive Proxy Statement dated September 28,

2011. |

|

|

| (d)(4) |

|

First Amendment, dated as of July 1, 2013, to the Amended and Restated Incentive Bonus Agreement, dated as of September 28, 2010, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to Exhibit 10.3 to

the Current Report on Form 8-K filed by the Company on July 2, 2013. |

|

|

| (d)(5) |

|

Trademark License Agreement, dated as of January 11, 2013, by and between Biglari Holdings Inc. and Sardar Biglari, incorporated by reference to the Current Report on Form 8-K filed by the Company on January 11, 2013. |

|

|

| (d)(6) |

|

Trademark Sublicense Agreement, entered as of May 14, 2013, by and among Biglari Holdings Inc., Steak n Shake, LLC and Steak n Shake Enterprises, Inc., incorporated by reference to the Quarterly Report on Form 10-Q for the quarterly

period ended April 10, 2013 filed by the Company on May 17, 2013. |

|

|

| (d)(7) |

|

Amended and Restated Partnership Agreement of The Lion Fund II, L.P., as amended on June 3, 2015, incorporated by reference to the Current Report on Form 8-K filed by the Company on June 4, 2015. |

| * |

Filed as an exhibit to this Schedule TO. |

6

Exhibit (a)(1)(i)

THE LION FUND II, L.P.

OFFER TO PURCHASE FOR CASH

UP TO 575,000 SHARES OF COMMON STOCK OF BIGLARI HOLDINGS INC.

AT A PURCHASE PRICE OF $420.00 PER SHARE

THE OFFER, PRORATION PERIOD AND WITHDRAWAL RIGHTS

EXPIRE AT 11:59 P.M., NEW YORK CITY TIME, ON JULY 1 2015,

UNLESS THE OFFER IS EXTENDED OR WITHDRAWN (SUCH DATE AS IT MAY BE

EXTENDED, THE “EXPIRATION DATE”)

The Lion Fund II, L.P., a Delaware limited partnership, (the “Offeror,” “we,” “us,” or “our”), is

hereby offering to purchase up to 575,000 shares (the “Shares”) of the common stock, $0.50 par value per share (the “Common Stock”) of Biglari Holdings Inc. (the “Company”), in cash, at a price of $420.00 per share (the

“Purchase Price”), net to you, less any applicable withholding taxes and without interest, and subject to the terms and conditions set forth in this Offer to Purchase and the related Letter of Transmittal (the “Letter of

Transmittal”) and the Important Instructions and Information (the “Important Instructions and Information”) included with this Offer to Purchase. Together this Offer to Purchase and the related Letter of Transmittal and Important

Instructions and Information constitute the “Offer.”

We will purchase all Shares properly tendered and not properly withdrawn on

the terms and subject to the conditions of the Offer, including the proration provisions. Shares not purchased in the Offer will be returned to the tendering shareholders at our expense promptly after the Expiration Time. We will not accept shares

of Common Stock subject to conditional tenders, such as acceptance of all or none of the Shares tendered by any tendering shareholder. We are not offering to purchase, and will not accept, any fractional Shares in the Offer.

As of June 3, 2015, the Company had 2,065,608 shares of Common Stock outstanding, of which 1,658,355 shares of Common Stock were not

owned by us and our affiliates or the Company or their officers, directors, managers and affiliates. If the Offer is fully subscribed, we will purchase 575,000 Shares, which would represent approximately 27.8% of the issued and outstanding Shares

and would result in certain of our affiliates, including Biglari Capital Corp. and Mr. Biglari, beneficially owning an aggregate of approximately 980,707 Shares of Common Stock, which would represent approximately 47.5% of the issued and outstanding

Shares. Sardar Biglari will have the sole power to vote and dispose of these Shares. Because of the proration provisions described in this Offer to Purchase, less than all of the Shares tendered may be purchased if more than 575,000 Shares are

properly tendered and not properly withdrawn.

We reserve the right, in our sole discretion, to change the Purchase Price and the number

of shares to be acquired by us in this offer, subject to applicable law. In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we may increase the number of Shares accepted for payment in the Offer by up to 2%

of the outstanding shares of Common Stock without amending or extending the Offer. See Section 1. This could result in the total number of Shares sought in the Offer increasing by up to approximately 41,312 Shares.

The Offer is not conditioned on any minimum number of shares being tendered. The Offer is, however, conditioned upon, among other things,

certain conditions described in Section 6 of this Offer to Purchase.

The Shares are listed for trading on the New York Stock

Exchange under the trading symbol “BH”. On June 3, 2015, the last full trading day prior to the commencement of the Offer, the last reported sale price of the Shares was $369.69 per Share. You are urged to obtain current market

quotations for the Shares before deciding whether to tender your Shares. See Section 7.

1

None of the Offeror, Biglari Capital Corp., Computershare Inc. (“Computershare”), in

its capacity as depositary and paying agent, Okapi Partners LLC, in its capacity as information agent, nor Houlihan Lokey Capital, Inc., in its capacity as dealer manager, make any recommendation to you as to whether to tender or refrain from

tendering your Shares and have not authorized any person to make any such recommendation. No later than ten business days from the date of this Offer to Purchase, the Company is required by law to publish, send or give to you a statement disclosing

whether its board of directors either recommends acceptance or rejection of the Offer, expresses no opinion and remains neutral toward the Offer or is unable to take a position with respect to the Offer. You should carefully read the information set

forth in that statement before you tender your Shares in the Offer. You must make your own decision whether to tender Shares, and if so, how many Shares to tender. In doing so, you should read and evaluate carefully the information in this Offer to

Purchase and in the related Letter of Transmittal and Important Instructions and Information, including our reasons for making the Offer, and should discuss whether to tender your shares with your financial, tax or other advisors.

THIS TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS

THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS

UNLAWFUL.

Questions, requests for assistance and requests for additional copies of this Offer to Purchase or the Letter of

Transmittal and Important Instructions and Information may be directed to Okapi Partners LLC, the information agent (the “Information Agent”) for the Offer, by telephone toll-free at (877) 629-6357. Questions about the Offer may be

directed to the Dealer Manager (the “Dealer Manager)” for the Offer at the contact information set forth below.

The

Dealer Manager for the Offer is:

HOULIHAN LOKEY CAPITAL, INC.

245 Park Avenue

20th Floor

New York, New York 10167

(212)

331-8220

Offer to Purchase dated June 4, 2015.

2

Important

If you want to tender all or any portion of your Shares, you must do one of the following prior to 11:59 p.m., New York City time, on July 1,

2015 (unless the Offer is extended):

| |

• |

|

Registered Holders; if your Shares are registered in your name, deliver (by regular mail or overnight courier) a properly completed and duly executed Letter of Transmittal, together with any required signature

guarantees, and any other required documents to Computershare, the depositary (the “Depositary”) for the Offer in the enclosed envelope; |

| |

• |

|

Holders Whose Shares are Held by Brokers: if your Shares are registered in the name of a broker, dealer, commercial bank, trust company, custodian or other nominee (each, a “Custodian”), contact your

Custodian and request that your Custodian tender your Shares for you according to the procedures described in Section 3 of this Offer to Purchase; or |

| |

• |

|

Depository Trust Company Participants: if you are an institution participating in DTC, tender your Shares according to the procedure for book-entry transfer described in Section 3 of this Offer to Purchase.

|

Even if the delivery of Shares is made by book-entry transfer to the Paying Agent’s account at DTC, you must also

submit a written Letter of Transmittal to the Depositary in the enclosed envelope. If a Custodian holds your Shares, it may have an earlier deadline for accepting the Offer. We urge you to contact the Custodian that holds your Shares as soon as

possible to find out its deadline.

If you want to tender your Shares but (a) your certificates for the Shares are not immediately

available, or cannot be delivered to the Depositary by the Expiration Date, (b) you cannot comply with the procedure for book-entry transfer by the Expiration Date, or (c) your other required documents cannot be delivered to the Depositary

by the Expiration Date, you may still tender your Shares if you comply with the guaranteed delivery procedure described in Section 3.

We are not making the Offer to, and will not accept any tendered Shares from, shareholders in any state or other jurisdiction where it would

be illegal to do so. However, we may, at our discretion, take any actions necessary for us to make the Offer to shareholders in any such state or other jurisdiction.

If you have any questions regarding the Offer, please contact Okapi Partners LLC, the Information Agent for the Offer, toll free at

(877) 629-6357 (banks and brokers may call collect at (212) 297-0720, or Houlihan Lokey Capital, Inc., the Dealer Manager for the Offer, at (212) 331-8220).

We have not authorized any person or firm to make any recommendation on our behalf as to whether you should tender or refrain from tendering

your shares. You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information or to make any representation in connection with this offer other than

those contained in this Offer to Purchase or in the related Letter of Transmittal and Important Instructions and Information. If anyone makes any recommendation or gives any information or representation, you must not rely upon that recommendation,

information or representation as having been authorized by us or our general partner, Biglari Capital Corp.

3

SUMMARY TERM SHEET:

QUESTIONS AND ANSWERS ABOUT OUR OFFER

We are providing

this summary for your information. It highlights material information in this document, but it does not describe all of the details of our offer to the same extent described in the body of this document. We urge you to read carefully this entire

Offer to Purchase and the related Letter of Transmittal and Important Instructions and Information, because they contain the full details of our offer. Where helpful, we have included section references to direct you to a more complete discussion of

the topics in this summary.

Who is offering to purchase my Shares?

The Lion Fund II, L.P. (referred to herein as “us,” “we,” “our” or the “Offeror”) is making this tender offer. We are a

Delaware limited partnership and an affiliate of the Company. Our limited partners are the Company, Steak n Shake Operations, Inc., a wholly owned subsidiary of the Company and The Lion Fund, L.P., the general partner of which is also Biglari

Capital Corp. Our general partner is Biglari Capital Corp. whose Chairman, Chief Executive Officer and sole owner is Sardar Biglari (“Mr. Biglari”). Mr. Biglari is also the Chairman and Chief Executive Officer of the Company. As of

March 31, 2015, the Company and its subsidiaries held a 92.7% limited partner interest in us, including 22.7% through Steak n Shake Operations, Inc. As of March 31, 2015, the Company and its subsidiaries beneficially owned a 58.7% limited

partner interest in The Lion Fund, L.P. The Lion Fund, L.P. owns 365,726 shares of the Company’s Common Stock, representing approximately 17.7% of the outstanding Shares of Common Stock. For more information about the Offeror, see

Section 9 of this Offer to Purchase.

What will the purchase price for the Shares be and what will be the form of payment?

We will purchase Shares for $420.00 per share (the “Purchase Price”). If your Shares are purchased in the Offer, we will pay you the

Purchase Price, in cash, net to you, less applicable withholding taxes and without interest.

How many Shares will we purchase in the Offer?

We are offering to purchase up to 575,000 of the Company’s outstanding shares of Common Stock (the “Shares”). Currently, there

are 1,658,355 outstanding shares of Common Stock that are not owned by us and our affiliates or the Company or their officers, directors, managers and affiliates, and 2,065,608 total outstanding shares of Common Stock. See

the Introduction to this Offer to Purchase.

In accordance with the rules of the SEC, we may increase the number of Shares

accepted for payment in the Offer by up to 2% of the outstanding shares of Common Stock without amending or extending the Offer.

The

Offer is not conditioned on any minimum number of Shares being tendered. See Section 1 and Section 6.

What will happen if more than 575,000

shares are tendered?

If more than 575,000 Shares are properly tendered and not properly withdrawn, we will purchase Shares properly

tendered and not properly withdrawn on a pro rata basis with appropriate adjustments to avoid the purchase of fractional Shares. If proration of Shares is required, we will announce the final results of proration promptly after the expiration

of the Offer.

In addition, in accordance with rules promulgated by the SEC, we may increase the number of Shares accepted for payment in

the Offer by up to 2% of the outstanding Shares without amending or extending the Offer. This could result in the total number of Shares sought in the Offer increasing by up to approximately 41,312 Shares.

If we are required to prorate, the Depositary will determine the proration factor as promptly as practicable following the Expiration Date.

Proration for each shareholder tendering Shares will be based on the ratio of the

4

number of Shares properly tendered and not properly withdrawn by the shareholder to the total number of Shares properly tendered and not properly withdrawn by all shareholders with appropriate

adjustments to avoid purchases of fractional Shares. The preliminary results of any proration will be announced by press release as promptly as practicable after the Expiration Date.

For more information, see Section 1.

If I decide not to tender, how will the Offer affect me?

If you decide not to tender your Shares, you will still own the same amount of Shares, and the Company will still be a public company listed on

the New York Stock Exchange (“NYSE”). As a result, you will continue to participate in the future performance of the Company. Shareholders that do not tender their Shares pursuant to the Offer may be able to sell their Shares in the future

on the NYSE, or otherwise, at a net price higher or lower than the Purchase Price. In addition, we can give no assurance as to the price at which a Company shareholder may be able to sell his, her or its Shares in the future. See Section 2 and

Section 7.

How long do I have to tender my shares? Can the Offer be extended, amended or terminated?

You may tender your shares until the Expiration Date. The Expiration Date is July 1, 2015 at 11:59 p.m., New York City time, unless we

extend it. We may choose to extend the Offer at any time and for any reason, subject to applicable law. We cannot assure you that we will extend the Offer or indicate the length of any extension that we may provide. If we extend the Offer, we

will delay the acceptance of any shares that have been tendered. We can also amend the Offer in our sole discretion or terminate the Offer under certain circumstances. See Section 13 of this Offer to Purchase. In accordance with rules

promulgated by the Securities and Exchange Commission, the Offeror may increase the number of Shares accepted for payment in the Offer by up to 2% of the outstanding shares of Common Stock without amending or extending the Offer. This could result

in the dollar value of the Offer increasing by up to approximately $17.4 million.

How will I be notified if the Offeror extends the Offer or amends

the terms of the Offer?

If we extend the Offer, we will issue a press release announcing the extension and the new Expiration Time by

9:00 a.m., New York City time, on the business day after the previously scheduled Expiration Date. We will announce any amendment to the Offer by making a public announcement of the amendment. See Section 13.

What is the purpose of the Offer?

We are

making the Offer because we would like to acquire an ownership interest in the Company. In addition, the Offer provides the shareholders wishing to sell with an efficient way to sell their Shares without incurring broker’s fees or commissions

with open market sales.

Does the Offeror have the financial resources to make payment?

Assuming that the Offer is fully subscribed, the value of Shares purchased in the Offer will be approximately $241.5 million, subject to our

ability to increase the number of Shares accepted for payment in the Offer by up to 2% of the outstanding Shares (resulting in a commensurate increase in the dollar amount by approximately $17.4 million) without amending or extending the Offer in

accordance with rules promulgated by the SEC. Assuming that we do not increase the number of Shares accepted for payment, we expect that the maximum aggregate cost of these purchases, including all fees and expenses applicable to the Offer, will be

approximately $243.0 million. We will fund the aggregate purchase price of the Shares in the Offer and all related fees and expenses with cash on our balance sheet. See Section 8 and Section 9. Following our acceptance of Shares for

payment, we will deposit the aggregate Purchase Price for all purchased Shares with the Depositary

5

for the Offer, which will act as your agent for the purpose of receiving payment for your Shares. Our deposit of the aggregate Purchase Price (less any withholding of applicable taxes) with the

Depositary will satisfy our obligation to pay for Shares purchased in the Offer.

Do I have appraisal or dissenter’s rights?

There are no appraisal or dissenter’s rights available in connection with the Offer.

What are the most significant conditions to the Offer?

The Offer is not conditioned on any minimum number of Shares being tendered. The Offer is subject to the satisfaction of certain other

conditions set forth in this Offer to Purchase, including (i) all applicable consents or approvals required in connection with the Offer are obtained; (ii) no statute, rule, regulation, judgment or order is enacted, enforced, amended,

issued or deemed applicable to the Offer, and no suit, action or proceeding has been brought by any government entity that, directly or indirectly, (a) makes illegal, restrains, prohibits or delays the consummation of the Offer,

(b) imposes material limitations on the ability of the Offeror to effectively acquire, hold or exercise full rights of ownership of the Shares (including, without limitation, the right to vote any Shares acquired or owned by the Offeror

pursuant to the Offer on all matters properly presented to the Company’s shareholders), (c) requires divestiture by the Offeror or any of its affiliates of any of the securities of the Company held by the Offeror or any of its affiliates

or (d) otherwise has or would reasonably be expected to have a material adverse effect on the business, assets, liabilities, financial condition, capitalization, operations or results of operations of the Company or would reasonably be expected

to result in a material diminution in the value of the Common Stock; (iii) no change has occurred, is occurring or is threatened to occur in the business, assets, liabilities, financial condition, capitalization, operations or result of

operations of the Company that would reasonably be expected to be materially adverse to the Company; (iv) no disruption in the markets, banking moratorium or limitation on the extension of credit by financial institutions exists or is

threatened; (v) any change in the general political, market, economic or financial conditions, domestically or internationally, that could reasonably be expected to materially and adversely affect the trading in the Common Stock; (vi) no

other tender offer or exchange offer, and no merger, acquisition, consolidation, reorganization, sale of assets, liquidation or dissolution involving the Company is made or proposed; and (vii) the Company has not taken any actions or made any

change in connection with its Common Stock, such as a split, combination, redemption, sale, new issuance or declaration or payment of a dividend or any other action adverse to the interests of the Offeror.

Will there be a subsequent offering period?

Pursuant to Rule 14d-11 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), because the Offer is not for all

of the outstanding shares of Common Stock that we do not own, we will not provide for a subsequent offering period following the expiration of the Offer.

How do I tender Shares that are registered in my name?

If you would like us to purchase your Shares or a portion of your Shares that are registered in your name, you must properly complete and sign

the Letter of Transmittal according to the Important Instructions and Information and deliver it, together with your original certificate(s), any required signature guarantees and any other documents required by the Letter of Transmittal to the

Depositary using the enclosed envelope.

Unless the Offer is extended, the completed and executed Letter of Transmittal must be received before 11:59

p.m., New York City Time, on July 1, 2015. We have not provided for and will not accept Shares tendered via guaranteed delivery or hand delivery. See Section 3.

6

How do I tender Shares that I hold through a broker, dealer, commercial bank, trust company, custodian or

other nominee?

If you hold your Shares in a brokerage account or otherwise through a Custodian and you are not the holder of record on

our books, you must contact your Custodian and comply with their policies and procedures and provide them with any necessary paperwork in order to have them tender your Shares. Shareholders holding their Shares through a Custodian must not deliver a

Letter of Transmittal directly to the Depositary. The Custodian holding your Shares must submit the Letter of Transmittal that pertains to your Shares to the Depositary on your behalf. If the Letter of Transmittal is signed by trustees, executors,

administrators, guardians, attorneys-in-fact, agents, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing, and proper evidence satisfactory to the Depositary of their

authority so to act must be submitted. If a Custodian holds your Shares, it may have an earlier deadline for accepting the Offer. We urge you to contact the Custodian that holds your Shares as soon as possible to find out its deadline. See

Section 3.

Will I be notified of any defects in the documents I submit?

To the extent practicable, the Offeror will attempt to give notice of any defects or irregularities in tenders, provided, however, that neither

the Offeror nor any other person will be obligated to give notice of any defects or irregularities in tenders, nor will any of them incur any liability for failure to give any such notice. Any notice given will be in the form of a letter. The

Offeror will not be liable for failure to waive any condition of the Offer or any defect or irregularity in any tender of Shares. It is the risk and responsibility of a tendering shareholder to ensure the proper completion and timely delivery of all

materials necessary to properly tender their Shares. Therefore, we encourage shareholders to carefully complete their tender materials and submit them as early as possible after you have considered the information in this Offer to Purchase, so that

you will have as much time as possible prior to the Expiration Date to correct any defects or irregularities in your tender. See Section 3.

How

do I withdraw shares I previously tendered?

You may withdraw any or all Shares tendered at any time prior to the Expiration Time. To

withdraw your tendered Shares, you must properly submit a written notice of withdrawal (a “Withdrawal Letter”) and deliver it, together with any required signature guarantees and any other required documents, to the Depositary at the

appropriate address shown in the Important Instructions and Information. Please note that a Withdrawal Letter delivered via a method of delivery other than U.S. mail or overnight courier service will not be accepted. See Section 4.

Can I tender shares subject to the condition that a specified number of my shares must be purchased, or other conditions?

We will not accept Shares subject to conditional tenders, such as acceptance of all or a certain number of Shares from a shareholder. We are

not offering to purchase and will not accept fractional Shares.

What is the position of our general partner, Biglari Capital Corp., the Company and

other participants on the Offer?

None of the Offeror, Biglari Capital Corp., Computershare, in its capacity as depositary and paying

agent, Okapi Partners LLC, in its capacity as information agent, nor Houlihan Lokey Capital, Inc., in its capacity as dealer manager, make any recommendation to you as to whether to tender or refrain from tendering your Shares and have not

authorized any person to make any such recommendation. No later than ten business days from the date of this Offer to Purchase, the Company is required by law to publish, send or give to you a statement disclosing whether its board of directors

either recommends acceptance or rejection of the Offer, expresses no opinion and remains neutral toward the Offer or is unable to take a position with respect to the Offer. You should carefully read the information set forth in that statement before

you tender your Shares in the Offer. You must make your own decision whether to tender Shares, and if so, how many Shares to tender. In doing so, you should

7

read and evaluate carefully the information in this Offer to Purchase and in the related Letter of Transmittal and Important Instructions and Information, including our reasons for making the

Offer, and should discuss whether to tender your shares with your financial, tax or other advisors.

Will affiliates of the Offeror or the

Company’s officers, directors, and affiliates tender Shares in the Offer?

Our affiliates and the Company’s officers,

directors, and affiliates have advised us that they do not intend to tender any shares in the Offer. Accordingly, if we complete the Offer, the proportional holdings of our affiliates and the Company’s officers, directors, managers and

affiliates will increase. See Section 9.

When and how will you pay me for the Shares I tender?

Promptly after the Expiration Date, we will pay the Purchase Price net to the seller, in cash, less applicable withholding taxes and without

interest, for the Shares, if any, we purchase. We will announce the preliminary results of the Offer, including price and preliminary information about any expected proration, on the business day following the Expiration Date. We do not expect,

however, to announce the final results of any proration and begin paying for tendered Shares until at least five business days after the Expiration Date, assuming that Shares are tendered by use of the procedures for guaranteed delivery. We will pay

for the Shares accepted for purchase by depositing the aggregate purchase price with the Depositary, promptly after the Expiration Date. The Depositary will act as your agent and will transmit to you the payment for all of your Shares accepted for

payment. See Sections 1 and 5.

What is the recent market price of my Shares?

The Shares are listed for trading on the New York Stock Exchange under the trading symbol “BH”. On June 3, 2015, the last full

trading day prior to the commencement of the Offer, the last reported sale price of the Shares was $369.69 per Share. The trading price of the Company’s shares may be higher or lower than the Purchase Price. Shareholders are urged to obtain

current market quotations for the Shares before deciding whether and at what purchase price or purchase prices to tender their Shares.

Will I have to

pay brokerage commissions if I tender my Shares?

If you are the holder of record of your Shares and you tender your Shares directly,

you will not incur any brokerage fees or commissions. If you hold your Shares through a Custodian and that person tenders Shares on your behalf, that person may charge you a fee for doing so. We urge you to consult your Custodian to determine

whether any such charges will apply. See Sections 3 and 14.

Will I have to pay stock transfer tax if I tender my Shares?

If you instruct the Depositary in the Letter of Transmittal to make the payment for the Shares to the registered holder, you will not incur any

stock transfer tax. See Section 5.

Must I tender all of my Shares to participate in the Offer?

No. You may tender all of your Shares, a portion of your Shares or none of your Shares. You are able to tender your Shares regardless of how long you have

owned them. See Section 1.

8

Are there any governmental or regulatory approvals, consents or filings to be made or obtained in connection

with the Offer?

We are not aware of any approval or other action by any governmental, administrative or regulatory authority or

agency, domestic, foreign or supranational that would be required for our acquisition or ownership of Shares as contemplated by the Offer. Should any such approval or other action or notice filings be required, we presently contemplate that we will

seek that approval or other action and make or cause to be made such notice filings. We cannot predict whether we will be required to delay the acceptance for payment of or payment for Shares tendered in the Offer pending the outcome of any such

approval or other action. There can be no assurance that any such approval or other action, if needed, would be obtained or would be obtained without substantial cost or conditions or that the failure to obtain the approval or other action might not

result in adverse consequences to our business and financial condition. Our obligations under the Offer to accept for payment and pay for Shares are subject to the satisfaction of certain conditions. See Section 6 and 11.

What are the U.S. federal income tax consequences if I tender my Shares?

If you are a U.S. Holder (as defined in Section 12), your receipt of cash from us in exchange for the Shares you tender will be a

taxable transaction for U.S. federal income tax purposes. The cash you receive for your tendered Shares generally will be treated for U.S. federal income tax purposes either as consideration received in respect of a sale or other

disposition of the Shares. See Sections 3 and 12.

If you are a Non-U.S. Holder (as defined in Section 12), we do not

expect that you will be subject to U.S. federal withholding tax on the gross payments you receive pursuant to the Offer However, there is a possibility that the Offeror (or Computershare) will be required to withhold 30% of the gross payments,

(subject to reduction or elimination by applicable treaty, as evidenced by forms that you furnish to the Depositary (or other applicable withholding agent)). A Non-U.S. Holder may be eligible to receive from the Internal Revenue Service a refund of

any withheld U.S. federal income tax to the extent such withholding resulted in an overpayment over taxes. See Sections 3 and 12.

We urge

you to consult your tax advisor as to the particular tax consequences to you of the Offer.

Whom can I talk to if I have questions?

Questions and requests for assistance by institutional shareholders may be directed to the Dealer Manager and questions and requests for

assistance by retail shareholders may be directed to the Information Agent, at the telephone numbers and addresses set forth on the back cover of this Offer to Purchase. You may request additional copies of this Offer to Purchase, the Letter of

Transmittal and Important Instructions and Information and other Offer documents from the Information Agent at the telephone number on the back cover of this Offer to Purchase. The Information Agent will promptly furnish to shareholders additional

copies of these materials at the Offeror’s expense. Shareholders may also contact their Custodian and/or financial advisor for assistance concerning the Offer.

9

FORWARD-LOOKING STATEMENTS

This Offer to Purchase and the related Offer materials contain or incorporate by reference certain forward-looking statements and information

relating to the Company that are based on the beliefs of our general partner as well as assumptions made by, and information currently available to, us. These statements include, but are not limited to, statements dealing with the benefits that the

Offer may provide to the Company’s shareholders, the date on which we will announce the final proration or pay for tendered shares, the fees and expenses we will incur in connection with the Offer, the listing and tradability of the Common

Stock after the Offer is completed, our possession of sufficient capital to complete the Offer, the purchase of additional Shares or the payment of cash distributions on our partner interests in the future, our strategies, plans, programs,

objectives, goals, expectations, intentions, expenditures and assumptions, and other statements that are not historical facts. When used in this document, words such as “believe,” “estimate,” “expect,”

“anticipate,” “intend,” “plan,” “project,” “will” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

Although we believe the expectations reflected in any forward-looking statements are reasonable, readers are cautioned that forward-looking

statements involve known and unknown risks and uncertainties, are not guarantees of future performance and that actual events, results, performance or achievements may differ materially from any future events, results, performance or achievements

expressed or implied by such forward-looking statements. These differences may result from actions taken by us, as well as from risks and uncertainties out of our control, including:

| |

• |

|

changes in general economic, business, and political conditions, and changes in conditions of United States and the markets where our portfolio companies operate; |

| |

• |

|

changes in the ownership of shares of Common Stock of the Company, particularly any substantial accumulations by persons who are not affiliated with us; |

| |

• |

|

our ability to complete the Offer, the occurrence of any of the conditions to completing the Offer, and our decision to waive the occurrence of any condition to completing the Offer; and |

| |

• |

|

the risk factors detailed in the Company’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q and other documents filed with the SEC. |

These forward-looking statements reflect our expectations as of the date of this Offer to Purchase. We undertake no obligation to update the

information provided herein, whether as a result of new information, future events or otherwise, unless required by law.

10

INTRODUCTION

To the Shareholders of Biglari Holdings Inc.

The

Lion Fund II, L.P. hereby offers to purchase up to 575,000 of the outstanding shares of Biglari Holdings Inc., an Indiana corporation (the “Shares”). The Company is a holding company owning subsidiaries engaged in a number of diverse

business activities, including media, property and casualty insurance, as well as restaurants. The Company’s largest operating subsidiaries are involved in the franchising and operating of restaurants. We will purchase the Shares at a purchase

price of $420.00 per share (the “Purchase Price”) net to you in cash, less applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of

Transmittal and Important Instructions and Information. Together this Offer to Purchase and the related Letter of Transmittal and Important Instructions and Information constitute the Offer. As used in this Offer to Purchase, the terms

“we,” “us” or “our,” as the context requires, refer to The Lion Fund II, L.P.

The Offer is not conditioned

on any minimum number of Shares being tendered. The Offer is, however, subject to certain other conditions. See Section 6.

The

Common Stock is listed for trading on the New York Stock Exchange under the trading symbol “BH”. On June 3, 2015, the last full trading day prior to the commencement of the Offer, the last reported sale price of the Shares was $369.69

per Share. Shareholders are urged to obtain current market quotations for the Shares before deciding whether to tender their Shares. See Section 7.

The Offer will expire at 11:59 p.m., New York City time, on July 1, 2015, unless the Offer is extended or withdrawn (such date, as it may be

extended, the “Expiration Date”). Subject to applicable law, including the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”), we expressly reserve the right, in our sole discretion, at any

time and from time to time, (a) to extend the period of time during which the Offer is open and thereby delay acceptance for payment of, and the payment for, any Shares, (b) to decrease or increase the number of Shares sought in the Offer,

(c) to amend the Offer in any respect prior to the Expiration Date, and (d) if any condition specified in Section 6 is not satisfied or waived prior to the Expiration Date, to terminate the Offer and not accept any Shares for payment.

Notice of any such extension, amendment or termination may be made at any time and from time to time by public announcement of such change. In the case of an extension, the notice of extension shall be published no later than 9:00 a.m., New

York City time, on the next business day after the last previously scheduled or announced Expiration Date. Any public announcement made pursuant to the Offer will be disseminated promptly to shareholders in a manner reasonably designed to inform

shareholders of the change. Without limiting the manner in which we may choose to make a public announcement, except as required by applicable law, we will have no obligation to publish, advertise or otherwise communicate any public announcement

other than by issuing a press release to PRNewswire. See Section 13. In the event of an over-subscription of the Offer, Shares tendered at or prior to the Expiration Date will be subject to proration as described in Section 1. The

proration period and withdrawal rights also expire on the Expiration Date, subject to applicable law.

None of the Offeror, Biglari

Capital Corp., Computershare, in its capacity as depositary and paying agent, Okapi Partners LLC, in its capacity as information agent, nor Houlihan Lokey Capital, Inc., in its capacity as dealer manager, make any recommendation to you as to whether

to tender or refrain from tendering your Shares and have not authorized any person to make any such recommendation. No later than ten business days from the date of this Offer to Purchase, the Company is required by law to publish, send or give to

you a statement disclosing whether its board of directors either recommends acceptance or rejection of the Offer, expresses no opinion and remains neutral toward the Offer or is unable to take a position with respect to the Offer. You should

carefully read the information set forth in that statement before you tender your Shares in the Offer. You must make your own decision whether to tender Shares, and if so, how many Shares to tender. In doing so, you should read and evaluate

carefully the information in this Offer to Purchase and in the related Letter of Transmittal, including our reasons for making the Offer, and should discuss whether to tender your shares with your financial, tax or other advisors.

11

Our affiliates and the Company’s officers, directors, managers and affiliates have advised

us that they do not intend to tender any shares in the Offer. Accordingly, if we complete the Offer, the proportional holdings of our affiliates and the Company’s officers, directors, managers and affiliates will increase. All partners,

members, affiliates and associates of us and Mr. Biglari beneficially own, in the aggregate, 407,253 shares of Common Stock or 19.6% of the Company’s 2,065,608 outstanding shares of Common Stock as of June 3, 2015. If the Offer is

fully subscribed we will purchase an additional 575,000 shares of Common Stock. In this case we and our affiliates would beneficially own 982,253 shares of Common Stock, representing approximately 47.6% of the Company’s outstanding Common

Stock. These entities or individuals will therefore have a greater influence on certain matters voted on by shareholders.

The Purchase

Price will be paid in cash, less any applicable withholding taxes and without interest, to tendering shareholders for all Shares purchased. Tendering shareholders who hold Shares registered in their own name and who tender their Shares directly to

the Depositary will not be obligated to pay brokerage commissions, solicitation fees or, except as set forth in Section 5 hereof, stock transfer taxes on the purchase of Shares by us pursuant to the Offer. Shareholders holding Shares through a

broker, dealer, commercial bank, trust company or other nominee are urged to consult such broker, dealer, commercial bank, trust company or other nominee to determine whether any charges may apply if Shares are tendered through such nominee and not

directly to the Depositary. See Section 5.

Also, any tendering shareholder who fails to timely complete, sign and return to the

Depositary the Internal Revenue Service (“IRS”) Form W-9 or Form W-8BEN or Form W-8BEN-E obtained from the Depositary, as applicable (or such other

IRS form as may be applicable), may be subject to U.S. federal backup withholding tax (or, alternatively, U.S. dividend or “FATCA” withholding taxes) on the gross proceeds paid to the shareholder pursuant to the Offer. See Sections 3

and 12.

We will pay all fees and expenses incurred in connection with the Offer by the Depositary, the Information Agent and the Dealer

Manager. See Section 14.

As of June 3, 2015, there were 2,065,608 Shares outstanding. At the Purchase Price of $420.00 per

Share, we could purchase 575,000 Shares if the Offer is fully subscribed, which would represent approximately 27.8% of the Company’s outstanding Shares as of June 3, 2015. The Shares are listed for trading on the New York Stock Exchange

under the trading symbol “BH”. On June 3, 2015, the last full trading day prior to the commencement of the Offer, the last reported sale price of the Shares was $369.69 per Share. Shareholders are urged to obtain current market

quotations for the Shares before deciding whether and at what purchase price or purchase prices to tender their Shares. See Section 7.

The address of Mr. Biglari, us and Biglari Capital Corp. is 17802 IH 10 West, Suite 400, San Antonio, Texas 78257 and their

telephone number is (210) 344-3400.

References in this Offer to Purchase to “dollars” and “$” are to the lawful

currency of the United States of America, unless otherwise indicated or the context suggests otherwise.

12

THE OFFER

Section 1. Number of Shares; Purchase Price; Proration.

General

Upon the

terms and subject to the conditions of the Offer, we will purchase up to 575,000 Shares, or such lower number of Shares equal to the number of the Shares properly tendered and not properly withdrawn in accordance with Section 4 before the

Expiration Date, at a price of $420.00, net to the seller in cash, less any applicable withholding taxes and without interest.

The term

“Expiration Date” means 11:59 p.m., New York City time, on July 1, 2015, unless and until we, in our sole discretion in accordance with applicable law, shall have extended the period of time during which the Offer will remain open, in

which event the term “Expiration Date” shall refer to the latest time and date at which the Offer, as so extended by us, shall expire. See Section 13 for a description of our right to extend, delay, terminate or amend the Offer.

We will only purchase Shares properly tendered and not properly withdrawn. However, because of proration we may not purchase all of the Shares

tendered if more than 575,000 Shares are properly tendered and not properly withdrawn. We will return all Shares tendered and not purchased pursuant to the Offer, including Shares not purchased because of proration, to the tendering shareholders at

our expense, promptly following the Expiration Date.

Subject to applicable law, including the applicable rules and regulations of the

SEC, we expressly reserve the right, in our sole discretion, at any time and from time to time, (a) to extend the period of time during which the Offer is open and thereby delay acceptance for payment of, and the payment for, any Shares,

(b) to decrease or increase the number of Shares sought in the Offer, (c) to amend the Offer in any respect prior to the Expiration Date, and (d) if any condition specified in Section 6 is not satisfied or waived prior to the

Expiration Date, to terminate the Offer and not accept any Shares for payment. In accordance with the rules of the SEC, we may increase the number of Shares purchased in the Offer and thereby increase the number of Shares accepted for payment in the

Offer by no more than 2% of the outstanding shares of Common Stock without amending or extending the Offer. However, if we purchase an additional number of Shares in excess of 2% of the outstanding shares of Common Stock, we will amend and extend

the Offer in compliance with applicable law. See Section 13.

In the event of an over-subscription of the Offer as described below,

Shares tendered at or prior to the Expiration Date will be subject to proration. The proration period and withdrawal rights also expire on the Expiration Date, subject to applicable law.

Shares acquired pursuant to the Offer will be acquired by us free and clear of all liens, charges, encumbrances, security interests, claims,

restrictions and equities whatsoever, together with all rights and benefits arising therefrom, provided that any dividends or distributions which may be declared, paid, issued, distributed, made or transferred on or in respect of such Shares to

shareholders of record prior to the date on which the Shares are taken up and paid for under the Offer shall be for the account of such shareholders.

Shareholders may tender all of their Shares or a portion of their Shares specified as a number of Shares that is less than all of their

Shares. A shareholder will be able to tender his, her or its Shares to us regardless of when the shareholder first purchased the Shares.

We are not offering to purchase, and will not accept, any fractional Shares in the Offer. In the event the Offer is oversubscribed,

appropriate adjustments to the proration factor will be made in order to avoid purchases of fractional Shares.

13

Purchase Price

The Purchase Price is $420.00 per share, net to you, less any applicable withholding taxes and without interest. The Purchase Price represents

a premium of approximately 14% over the last reported sale price of the Shares on June 3, 2015 of $369.69. We expressly reserve the right, in our sole discretion, to increase the Purchase Price, subject to applicable law. See Section 13.

Priority of Purchases

Upon the terms and subject to the conditions of the Offer, if more than 575,000 Shares are properly tendered and not properly withdrawn prior

to the Expiration Date, we will purchase up to 575,000 Shares on a pro rata basis, with appropriate adjustments to avoid purchases of fractional Shares, as described below; provided that we may increase the number of Shares purchased by up to 2% of

the outstanding Shares without amending or extending the Offer which, if we do so, could commensurately increase the total number of Shares purchased by up to approximately 41,312 Shares. As a result, it is possible that all Shares tendered by a

shareholder may not be purchased.

Proration

If proration of tendered Shares is required, we will determine the proration factor promptly following the Expiration Date. Proration for each

shareholder tendering Shares will be based on the ratio of the number of Shares properly tendered and not properly withdrawn by such shareholder to the total number of Shares properly tendered and not properly withdrawn by all shareholders. Because

of the difficulty in determining the number of Shares properly tendered and not withdrawn, and because of the guaranteed delivery procedure described in Section 3, we expect that we will not be able to announce the final proration factor or

commence payment for any Shares purchased pursuant to the Offer until at least five business days after the Expiration Date, assuming that Shares are tendered by use of the procedures for guaranteed delivery. The preliminary results of any proration

will be announced by press release as promptly as practicable after the Expiration Date. After the Expiration Date, shareholders may obtain preliminary proration information from the Information Agent and also may be able to obtain the information

from their brokers.

As described in Section 12, the number of Shares that we will purchase from a shareholder pursuant to the Offer

may affect the U.S. federal income tax consequences to the shareholder of the purchase and, therefore, may be relevant to a shareholder’s decision whether to tender Shares. The Letter of Transmittal affords each shareholder who tenders

Shares registered in such shareholder’s name directly to the Depositary the opportunity to designate the order of priority in which Shares tendered are to be purchased in the event of proration as well as the ability to condition such tender on

a minimum number of Shares being purchased.

This Offer to Purchase and the related Letter of Transmittal will be mailed to record holders

of the Shares and will be furnished to brokers, dealers, commercial banks, trust companies and other nominees and similar persons whose names, or the names of whose nominees, appear on our shareholder list or, if applicable, who are listed as

participants in a clearing agency’s security position listing for subsequent transmittal to beneficial owners of Shares.

Section 2. Purpose of the Offer; Certain Effects of the Offer.

Purpose of the Offer

We are making the Offer because we would like to acquire an ownership interest in the Company. In addition, the Offer provides the shareholders

wishing to sell with an efficient way to sell their Shares without incurring broker’s fees or commissions with open market sales.

14

None of the Offeror, Biglari Capital Corp., Computershare, in its capacity as depositary and

paying agent, Okapi Partners LLC, in its capacity as information agent, nor Houlihan Lokey Capital, Inc., in its capacity as dealer manager, make any recommendation to you as to whether to tender or refrain from tendering your Shares and have not

authorized any person to make any such recommendation. No later than ten business days from the date of this Offer to Purchase, the Company is required by law to publish, send or give to you a statement disclosing whether its board of directors

either recommends acceptance or rejection of the Offer, expresses no opinion and remains neutral toward the Offer or is unable to take a position with respect to the Offer. You should carefully read the information set forth in that statement before

you tender your Shares in the Offer. You must make your own decision whether to tender Shares, and if so, how many Shares to tender. In doing so, you should read and evaluate carefully the information in this Offer to Purchase and in the related

Letter of Transmittal, including our reasons for making the Offer, and should discuss whether to tender your shares with your financial, tax or other advisors.

Following the completion or termination of the Offer, we may, from time to time, purchase Shares on the open market or through private or

public transactions in accordance with applicable law. Rule 14e-5 under the Exchange Act generally prohibits us and our affiliates from purchasing any Shares, other than in the Offer, until the Expiration Date, except pursuant to certain

limited exceptions including as provided in Exchange Act Rule 14e-5.

Our affiliates and or the Company’s officers, directors,

and affiliates have advised us that they do not intend to tender any shares in the Offer.

Certain Effects of the Offer; Plans for

the Company After the Offer

Shareholders who do not tender their shares pursuant to the offer and shareholders who otherwise

retain an equity interest in us as a result of a partial tender of shares or a proration will retain an equity interest in the Company. These shareholders will also continue to bear the risks associated with owning the Shares, including risks

resulting from our purchase of Shares in the Offer. Shareholders may be able to sell non-tendered Shares in the future on the NYSE or otherwise, at a net price significantly higher or lower than the Purchase Price in the Offer. We can give no

assurance, however, as to the price at which a shareholder may be able to sell his or her Shares in the future.

Our affiliates and the

Company’s officers, directors, managers and affiliates have advised us that they do not intend to tender any shares in the Offer. Accordingly, if the Offer is fully subscribed and we purchase an additional 575,000 Shares of Common Stock, the

proportional holdings of our affiliates and the Company’s officers, directors, managers and affiliates will increase. In this case, we, Mr. Biglari, and all partners, members, affiliates and associates of us or Mr. Biglari would

beneficially own, in the aggregate, 982,253 Shares of Common Stock or approximately 47.6% of the Company’s 2,065,608 outstanding Shares of Common Stock. These entities or individuals will therefore have a greater influence on certain matters

voted on by shareholders.

Except as disclosed or incorporated by reference in this Offer to Purchase, including in Section 10,

neither the Offeror nor Biglari Capital Corp., nor, to the best knowledge of the Offeror, the Company or the Company’s or its executive officers, directors or affiliates (including executive officers and directors of the Company’s

affiliates) currently have any plans, proposals, or negotiations underway that relate to or would result in:

| |

• |

|

any extraordinary transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries; |

| |

• |

|

any purchase, sale or transfer of a material amount of assets of the Company or any of its subsidiaries; |

| |

• |

|

any material change in the present dividend policy, or indebtedness or capitalization of the Company; |

| |

• |

|

any change in the present Board of Directors or management of the Company, including, but not limited to, any plans or proposals to change the number or the terms of directors or to fill any existing vacancies on the

Board or to change any material term of the employment contract of any executive officer, other than the continuous review of Board size and director qualifications in the ordinary course; |

15

| |

• |

|

any other material change in the Company’s corporate structure or business; |

| |

• |

|

any class of equity securities of the Company to be delisted from a national securities exchange or cease to be authorized to be quoted in an automated quotation system operated by a national securities exchange;

|

| |

• |

|

any class of equity securities of the Company becoming eligible for termination of registration under Section 12(g)(4) of the Exchange Act; |

| |

• |

|

the suspension of the Company’s obligation to file reports under Section 15(d) of the Exchange Act; |

| |

• |

|

any changes in the Company’s Articles of Incorporation or Bylaws, in each case as currently in effect, or other governing instruments or other actions that could impede the acquisition of control of the Company; or

|

| |

• |

|

the acquisition by any person of additional securities of the Company, or the disposition by any person of securities of the Company, other than purchases and dispositions related to the exercise of outstanding options

to purchase Shares and the vesting of restricted stock granted to certain employees (including directors and officers) and the periodic grant of options to purchase Shares and of restricted stock, under the Company’s equity plans and programs

to certain employees (including directors and officers). |

We expect that from time to time there may be significant

developments or transactions involving our portfolio companies (including the Company) or their securities, or offers, proposals or discussions related thereto, which may involve acquisitions or sales by us of our holdings in such entities

(including the Company) or acquisitions or sales of securities, assets or business operations by such entities.

We intend to review on a

continuing basis our investment in the Common Stock and take such actions with respect to our investment as we deem appropriate in light of the circumstances existing from time to time. Such actions could include, among other things, additional

purchases of Common Stock pursuant to one or more open-market purchase programs, through private transactions or through tender offers or otherwise, subject to applicable law. Future purchases may be on the same terms or on terms that are more or

less favorable to the Company’s shareholders than the terms of the Offer. Any possible future purchases will depend on many factors, including the results of the Offer, the market price of the Common Stock, our business and financial position,

and general economic and market conditions. In addition, following the consummation of the Offer, we may also determine to dispose of our shares of Common Stock, in whole or in part, at any time and from time to time, subject to applicable laws. Any

such decision would be based on our assessment of a number of different factors, including, without limitation, the business, prospects and affairs of the Company, the market for the Common Stock, the condition of the securities markets, general

economic and industry conditions and other opportunities available to us.

Nothing in the Offer will preclude us or the Company from

pursuing, developing, or engaging in future plans, proposals or negotiations that relate to or would result in one or more of the foregoing events, subject to applicable law. Although we do not currently have any plans, other than as disclosed or

incorporated by reference in this Offer to Purchase, that relate to or would result in any of the events discussed above, we may undertake or plan actions that relate to or could result in one or more of these events. Furthermore, such events may

result from circumstances outside of our control. Shareholders tendering Shares in the Offer may run the risk of foregoing the benefit of any appreciation in the value or market price of the Shares resulting from such potential future events.

However, there can be no assurance that we will decide to undertake any such event in the future or such event will otherwise occur or be beneficial to the value or market price of the Shares.

Section 3. Procedure for Tendering Shares.

If your Shares are registered in your name (for example, you are an individual who is the record and beneficial owner of the Shares) and you

would like to tender all or a portion of your Shares, you must properly

16

complete and sign the enclosed Letter of Transmittal and deliver it, together with your original stock certificate(s) and any other documents required by the Letter of Transmittal, to the

Depositary in the enclosed envelope.