As filed with the Securities and Exchange Commission on June 2, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

AMENDMENT NO. 6 TO FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________________________________________

KRAIG BIOCRAFT LABORATORIES, INC.

(Exact Name of Small Business Issuer in its Charter)

|

Wyoming

|

|

2820

|

|

83-0459707

|

|

(State of Incorporation)

|

|

(Primary Standard Classification Code)

|

|

(IRS Employer ID No.)

|

120 N. Washington Square, Suite 805,

Lansing, Michigan 48933

(517) 336-0807

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Kim Thompson, CEO

Kraig Biocraft Laboratories, Inc.

120 N. Washington Square, Suite 805,

Lansing, Michigan 48933

(517) 336-0807

(Name, Address and Telephone Number of Agent for Service)

Copies to:

Hunter Taubman Fischer, LLC

1450 Broadway, 26th Floor

New York, New York 10018

Telephone: (917) 512-0848

Facsimile: (212) 202-6380

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

|

(Do not check if a smaller reporting company)

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities to be Registered

|

|

Amount to be

Registered (1)

|

|

|

Proposed Maximum

Aggregate

Offering Price

per share (2)

|

|

|

Proposed Maximum

Aggregate

Offering Price (3)

|

|

|

Amount of

Registration fee

|

|

|

Class A Common Stock, no par value

|

|

|

110,000,000

|

|

|

$

|

0.0401

|

|

|

$

|

4,411,000

|

|

|

$

|

512.56

|

|

(1) In the event of a stock split, stock dividend, or similar transaction involving the common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act. The amount of shares to be registered represents the Company’s good faith estimate of the number of shares that the registrant may issue pursuant to a Letter Agreement with the selling security holder.

(2) The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rules 457(c) and 457(h) under the Securities Act of 1933. Our common stock is quoted under the symbol “KBLB” on the OTC Markets, Inc. OTCQB. As of October 31, 2014, the last sale reported price was $0.0401 per share. Accordingly, the registration fee is $512.56 based on $0.0401 per share.

(3) This amount represents the maximum aggregate market value of common stock which may be put to the selling shareholder by the registrant pursuant to the terms and conditions of a Letter Agreement between the selling shareholder and the registrant.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold by the selling stockholders publicly until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and no offer to buy these securities is being solicited in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED June 2, 2015

PRELIMINARY PROSPECTUS

KRAIG BIOCRAFT LABORATORIES, INC.

110,000,000 shares of Class A Common Stock

This prospectus relates to the resale of up to 110,000,000 shares of the common stock of Kraig Biocraft Laboratories, Inc., a Wyoming corporation, which shares will be offered and sold by the selling shareholder, Calm Seas Capital, LLC, a Nevada limited liability company (“Calm Seas”), pursuant to a “put right” under a letter agreement for an equity line financing, that we entered into with Calm Seas on October 2, 2014 (the “Letter Agreement”). The Letter Agreement permits us to “put” up to an aggregate of $7,500,000 in shares of our Class A common stock to Calm Seas during a two year period ending on the second anniversary of the effective date of the registration statement covering the resale of the put shares. We will not receive any proceeds from the sale of these shares of our Class A common stock. However, we will receive proceeds from the sale of securities pursuant to our exercise of the put right offered by Calm Seas under the Letter Agreement. We will bear all costs associated with this registration.

Calm Seas is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”) in connection with the resale of our Class A common stock sold to it by our exercise of the put right under the Letter Agreement. Each month we may put up to $200,000 of our Class A common stock under the Letter Agreement, which will purchase such shares at a price per share equal to 80% of the lowest price of our Class A common stock during the five consecutive trading days immediately following the date the notice of our election to put shares pursuant to the Letter Agreement is delivered to Calm Seas (the date of delivery of such notice is referred to as the “put date”). Notwithstanding the aggregate $200,000 ceiling for monthly puts under the Letter Agreement, if both we and Calm Seas agree, we may submit one or more additional puts during any given month to the extent we need additional capital for our operations and/or our product development. We can only submit such additional put(s) if Calm Seas Capital agrees to it. Furthermore, the additional put is subject to the aggregate $7,500,000 limitation of this offering. The additional put allows us to obtain additional capital in the event that our product development proceeds quicker than we expect.

We will automatically withdraw our put notice to Calm Seas if the lowest price used to determine the purchase price of the put shares is not at least equal to seventy-five percent (75%) of the average closing “bid” price for our Class A common stock for the ten (10) trading days prior to the put date.

Our shares of Class A common stock are traded on the OTC Markets, Inc. OTCQB under the symbol “KBLB.” On June 1, 2015, the closing sale price of our common stock was $0.04 per share.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See "Risk Factors" beginning on page 4.

Our principal executive offices are located at 120 N. Washington Square, Suite 805, Lansing, Michigan 48933. Our telephone number is (517) 336-0807.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 2, 2015

Explanatory Note: This Post-Effective Amendment No. 6 to the registration statement on Form S-1 (File No. 333-199820) (the “Registration Statement”), is being filed in response to verbal comments the Company received from the Securities and Exchange Commission (“SEC”) regarding the Registration Statement. Pursuant to the verbal comments, we re-filed Exhibit 23.2 as Exhibit 5.1, as required by Item 601(b)(5) of Regulation S-K and clarified Hunter Taubman Fischer, LLC’s acting as a legal expert, as well as removing the reference to an opinion from Ofsink, LLC. This Amendment No.6 does not reflect events that may have occurred after the filing of Amendment No. 5 on May 15, 2015, nor does it modify or update those disclosures present therein, except with regard to the modification described in this Explanatory Note. As much, this Amendment No. 6 continues to speak as of May 15, 2015, unless otherwise noted. Accordingly, this Amendment No. 6 should be read in conjunction with the Amendment No. 5.

TABLE OF CONTENTS

| |

|

PAGE

|

|

|

Interests of Named Experts and Counsel

|

|

5 |

|

|

Part II

|

|

6

|

|

|

Item 16.Exhibits and Financial Statement Schedule

|

|

6

|

|

|

Item 17.Undertakings

|

|

8

|

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not, and the selling security holder has not, authorized anyone to provide you with different information. If anyone provides you with different information, you should not rely on it. We are not, and the selling security holder is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. In this prospectus, “Kraig”, “Kraig Biocraft” “KBLB”, “the Company”, “we”, “us” and “our” refer to Kraig Biocraft Laboratories, Inc., a Wyoming corporation, unless the context otherwise requires.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Legal Matters

Certain legal matters with respect to the shares of common stock offered hereby will be passed upon for us by Hunter Taubman Fischer LLP, New York, New York 10018.

Experts

The financial statements for the years ended December 31, 2014 and 2013 included in this prospectus and the registration statement have been audited by M&K CPAS, PLLC, to the extent and for the periods set forth in its report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of the said firm as expert in auditing and accounting.

PART II – INFORMATION NOT REQUIRED IN THE PROSPECTUS

ITEM. 16 EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

|

EXHIBIT NUMBER

|

|

DESCRIPTION

|

| |

|

|

|

3.1

|

|

Articles of Incorporation (1)

|

| |

|

|

|

3.2

|

|

Articles of Amendment (3)

|

| |

|

|

|

3.3

|

|

Articles of Amendment, filed with the Wyoming Secretary of State on November 15, 2013 (6)

|

| |

|

|

|

3.2

|

|

Articles of Amendment, filed with the Wyoming Secretary of State on December 17, 2013 (7)

|

| |

|

|

|

3.3

|

|

By-Laws (1)

|

| |

|

|

|

4.1

|

|

Form of Warrant issued Mr. Jonathan R. Rice (12)

|

| |

|

|

|

5.1

|

|

Opinion of Hunter Taubman Fischer, LLC*

|

| |

|

|

|

10.1

|

|

Employment Agreement, dated November 10, 2010, by and between Kraig Biocraft Laboratories, Inc. and Kim Thompson (8)

|

| |

|

|

|

10.2

|

|

Securities Purchase Agreement between Kraig Biocraft Laboratories and Worth Equity Fund, L.P. and Mutual Release (1)

|

| |

|

|

|

10.3

|

|

Securities Purchase Agreement between Kraig Biocraft Laboratories and Lion Equity (1)

|

| |

|

|

|

10.4

|

|

Amended Letter Agreement, dated September 14, 2009, by and between Kraig Biocraft Laboratories and Calm Seas Capital, LLC (3)

|

| |

|

|

|

10.5

|

|

Exclusive License Agreement, effective as of May 8, 2006, by and between The University of Wyoming and Kraig Biocraft Laboratories, Inc. (2)

|

| |

|

|

|

10.6

|

|

Addendum to the Founder’s Stock Purchase and Intellectual Property Transfer Agreement, dated December 26, 2006, and the Founder’s Stock Purchase and Intellectual Property Transfer Agreement dated April 26, 2006 (3)

|

| |

|

|

|

10.7

|

|

Intellectual Property/Collaborative Research Agreement, dated March 20, 2010, by and between Kraig Biocraft Laboratories and The University of Notre Dame du Lac. (2)

|

| |

|

|

|

10.8

|

|

Letter Agreement, dated June 28, 2011, by and between Kraig Biocraft Laboratories and Calm Seas Capital, LLC (4)

|

| |

|

|

|

10.9

|

|

Letter Agreement, dated April 30, 2013, by and between Kraig Biocraft Laboratories and Calm Seas Capital, LLC (5)

|

| |

|

|

|

10.10

|

|

Letter Agreement, dated October 2, 2014, by and between Kraig Biocraft Laboratories and Calm Seas Capital, LLC (9)

|

| |

|

|

|

10.11

|

|

License Agreement, dated October 28, 2011, between the Company and University of Notre Dame du Lac. (11)

|

| |

|

|

|

10.12

|

|

Intellectual Property / Collaborative Research Agreement, dated June 6, 2012, between the Company and University of Notre Dame du Lac. (11)

|

| |

|

|

|

10.13

|

|

Collaborative Yarn and Textile Development Agreement, dated September 30, 2013, between the Company and Warwick Mills, Inc. (11)

|

| |

|

|

|

10.14

|

|

Employment Agreement, dated January 19, 2015, between the Company and Mr. Jonathan R. Rice. (10)

|

| |

|

|

|

10.15

|

|

Intellectual Property / Collaborative Research Agreement, dated March 4, 2015, between the Company and University of Notre Dame du Lac. (12)

|

| |

|

|

|

23.1

|

|

Consent of M&K CPAs (13)

|

| |

|

|

|

23. 2

|

|

Consent of Hunter Taubman Fischer, LLC, contained in Exhibit 5.1

|

(1) Incorporated by reference to our Registration Statement on Form SB-2 (Reg. No. 333-146316) filed with the SEC on September 26, 2007.

(2) Incorporated by reference to our Annual Report on Form 10-K for the year ended December 31, 2009 filed with the SEC on April 15, 2010.

(3) Incorporated by reference to our Registration Statement on Form S-1 (Reg. No. 333-162316) filed with the SEC on October 2, 2009.

(4) Incorporated by reference to our Current Report on Form 8-K filed with the SEC on June 29, 2011.

(5) Incorporated by reference to our Quarterly Report on Form 10-Q filed with the SEC on May 15, 2013.

(6) Incorporated by reference to our Current Report on Form 8-K filed with the SEC on November 22, 2013.

(7) Incorporated by reference to our Current Report on Form 8-K filed with the SEC on December 19, 2013.

(8) Incorporated by reference to our Registration Statement on Form S-1 (Reg. No. 333-175936) filed with the SEC on August 1, 2011.

(9) Incorporated by reference to our Amendment No. 1 to Registration Statement on Form S-1/A (Reg. No. 333-199820) filed with the SEC on January 7, 2015.

(10) Incorporated by reference to our Current Report on Form 8-K filed with the SEC on January 21, 2015.

(11) Incorporated by reference to our Amendment No. 2 to Registration Statement on Form S-1/A (Reg. No. 333-199820) filed with the SEC on January 30, 2015.

(12) Incorporated by reference to our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 31, 2015.

(13) Incorporated by reference to our Amendment No. 5 to Registration Statement on Form S-1/A (Reg. No. 333-199820) filed with the SEC on May 15, 2015.

* Filed herewith

ITEM 17. UNDERTAKINGS.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

i. To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

ii. To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement.

iii. To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(5) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

i. Each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

SIGNATURES

In accordance with the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-1/A and authorized this registration statement to be signed on its behalf by the undersigned on June 2, 2015.

| |

KRAIG BIOCRAFT LABORATORIES, INC.

|

|

| |

|

|

|

|

June 2, 2015

|

By:

|

/s/ Kim Thompson

|

|

| |

|

Kim Thompson

|

|

| |

|

President, Chief Executive Officer

|

|

| |

|

Principal Financial and Accounting Officer

and Chairman of the Board of Directors

|

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following person(s) in the capacities and on the dates indicated:

| |

KRAIG BIOCRAFT LABORATORIES, INC.

|

|

| |

|

|

|

|

June 2, 2015

|

By:

|

/s/ Kim Thompson

|

|

| |

|

Kim Thompson

|

|

| |

|

President, Chief Executive Officer,

Principal Financial and Accounting Officer

and Chairman of the Board of Directors

|

|

| |

|

|

|

9

Exhibit 5.1

Hunter Taubman Fischer

1450 Broadway

Floor 26

New York, New York 10018

(212) 732-7184 Fax: (212) 202-6380

E-mail: ltaubman@htflawyers.com

June 2, 2015

Kraig Biocraft Laboratories, Inc.

120 N. Washington Square, Suite 805,

Lansing, Michigan 48933

Ladies and Gentlemen:

We have acted as counsel to Kraig Biocraft Laboratories, Inc, a Wyoming corporation (the "Company"), in connection with the preparation and filing with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act"), of Amendment No. 6 to the Registration Statement on Form S-1 (File No. 333-199820) (the "Registration Statement"), relating to the proposed registration of 110,000,000 shares of the Company's common stock (the "Common Stock").

In so acting, we have examined and relied upon the originals or copies, certified or otherwise identified to our satisfaction, of such Company records, documents, certificates and other instruments as in our judgment are necessary or appropriate to enable us to render the opinions expressed below. Based upon the foregoing and such examination of law as we have deemed necessary, we are of the opinion that the Common Stock to be offered by the selling shareholders, when sold under the circumstances contemplated in the Registration Statement, will be legally issued, fully paid and non-assessable.

The opinions we express herein are limited to matters involving the Wyoming corporate law and the federal laws of the United States and are further expressly limited to the matters set forth above and we render no opinion, whether by implication or otherwise as to any other matters relating to the Company or the Common Stock.

We consent to the use of this letter as an Exhibit to the Registration Statement and to the use of our name under the heading “Legal Matters” included in the Prospectus forming a part of the Registration Statement.

Sincerely,

Hunter Taubman Fischer

By: /s/ Louis Taubman

Louis Taubman

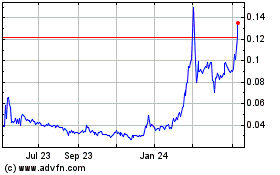

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

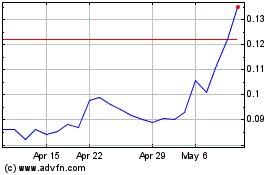

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Apr 2023 to Apr 2024