- Revenue for Fiscal First Quarter of 2016 was

$353 million -

- Adjusted EBITDA for Fiscal First Quarter was

$5.1 million -

- Company Reiterates Annual Fiscal 2016

Modeling Assumptions -

Titan Machinery Inc. (Nasdaq: TITN), a leading network of

full-service agricultural and construction equipment stores, today

reported financial results for the fiscal first quarter ended

April 30, 2015.

Fiscal 2015 First Quarter Results

For the first quarter of fiscal 2016, revenue was $353.2

million, compared to $465.5 million in the first quarter last year.

Equipment sales were $245.0 million for the first quarter of fiscal

2016, compared to $345.0 million in the first quarter last year.

Parts sales were $61.5 million for the first quarter of fiscal

2016, compared to $68.4 million in the first quarter last year.

Revenue generated from service was $32.9 million for the first

quarter of fiscal 2016, compared to $37.1 million in the first

quarter last year. Revenue from rental and other decreased to $13.8

million for the first quarter of fiscal 2016 from $15.0 million in

the first quarter last year.

Gross profit for the first quarter of fiscal 2016 was $60.4

million, compared to $75.9 million in the first quarter last year,

primarily reflecting a decrease in Agriculture equipment revenue.

The Company’s gross profit margin was 17.1% in the first quarter of

fiscal 2016, compared to 16.3% in the first quarter last year. This

increase in gross profit margin primarily reflects a larger portion

of gross profit coming from the Company's higher margin parts,

service, and rental and other businesses. Gross profit from parts

and service for the first quarter of fiscal 2016 was 65.3% of

overall gross profit, compared to 56.7% in the first quarter last

year.

Operating expenses were 16.2% of revenue or, $57.1 million, for

the first quarter of fiscal 2016, compared to 15.3% of revenue or,

$71.2 million, for the first quarter of last year. The decrease in

operating expenses was primarily due to cost savings associated

with the Company's realignment activities implemented in the first

quarters of fiscal 2016 and 2015. The increase in operating

expenses as a percentage of revenue was primarily due to the

deleveraging of fixed expenses as total revenue decreased from the

prior year.

In the first quarter of fiscal 2016, the Company recognized

impairment and realignment costs of $1.6 million, primarily related

to store closings and headcount reductions as part of the Company's

realignment plan. In the first quarter of fiscal 2015, the Company

recognized impairment and realignment costs of $2.8 million. The

Company recognized charges of $2.0 million and $3.1 million from

the balance sheet impact of the Ukrainian hryvnia devaluation in

the first quarters of 2016 and 2015, respectively.

Floorplan interest expense was $4.6 million for both the first

quarter of fiscal 2016 and first quarter of fiscal 2015.

In the first quarter of fiscal 2016, the Company generated $5.1

million in adjusted EBITDA, compared to $7.6 million in the first

quarter of last year. The Company includes floorplan interest

expense in its EBITDA calculation.

Pre-tax loss for the first quarter of fiscal 2016 was $8.8

million, which is essentially flat compared to pre-tax loss of $8.6

million in the first quarter of last year. Excluding all non-GAAP

adjustments, adjusted pre-tax loss for the first quarter of fiscal

2016 was $4.6 million. For the first quarter of 2015, excluding the

non-GAAP adjustments, adjusted pre-tax loss was $2.3 million.

Adjusted pre-tax Agriculture segment loss was $0.4 million for the

first quarter of fiscal 2016, compared to adjusted pre-tax income

of $4.2 million in the first quarter last year. Adjusted pre-tax

Construction segment loss was $2.9 million for the first quarter of

fiscal 2016, compared to adjusted pre-tax loss of $3.7 million in

the first quarter last year. Adjusted pre-tax International segment

loss was $2.3 million for the first quarter of fiscal 2016,

compared to adjusted pre-tax loss of $2.1 million in the first

quarter last year.

Net loss attributable to common stockholders for the first

quarter of fiscal 2016 was $6.2 million, or loss per diluted share

of $0.29, compared to $6.5 million, or $0.31 per diluted share, for

the first quarter of fiscal 2015. The net loss for the first

quarter of fiscal 2016 includes adjustments totaling $3.3 million,

or $0.16 per diluted share, compared to adjustments totaling $5.0

million, or $0.24 per diluted share, for the first quarter of

fiscal 2015. Excluding all non-GAAP adjustments, adjusted net loss

attributable to common stockholders for the first quarter of fiscal

2016 was $2.9 million, or $0.13 per diluted share, compared to

adjusted net loss attributable to common stockholders for the first

quarter of fiscal 2015 of $1.5 million, or $0.07 per diluted

share.

Balance Sheet

The Company ended the first quarter of fiscal 2016 with cash of

$104.4 million. The Company’s inventory level, including amounts

classified as held for sale, was $890.0 million as of

April 30, 2015, compared to inventory of $1.1 billion as of

April 30, 2014. The Company had, including amounts classified

as held for sale, $608.0 million outstanding floorplan payables on

$1.1 billion total discretionary floorplan lines of credit as of

April 30, 2015, reflecting a decrease of $190.5 million from

the balance of $798.5 million as of April 30, 2014. The

reduced floorplan levels has improved the Company's total

liabilities to tangible net worth to 2.6 as of April 30, 2015

from 3.2 as of April 30, 2014.

First Quarter Fiscal 2016 Realignment

In order to better align its business in certain markets, the

Company previously announced that during the first quarter of

fiscal 2016 it reduced headcount by approximately 14%, which

includes headcount reductions at stores in each of its operating

segments and its Shared Resource Center. This included the closing

of three Agriculture stores and one Construction store. In

addition, the Company has reduced discretionary spending levels

across all parts of the business and is restructuring certain

employee compensation and benefit programs to better align pay for

performance. The realignment costs associated with the headcount

reductions and store closings are estimated to total approximately

$2.0 million. The Company recognized $0.1 million in the fourth

quarter of fiscal 2015 and $1.9 million (or $0.05 per diluted

share) is expected to be recognized in fiscal 2016. The full-year

pro forma benefit to pre-tax earnings of this headcount reduction

is estimated to be approximately $21 million (or $0.59 per share),

which equates to a pro forma benefit of approximately $20 million

(or $0.56 per share) for fiscal 2016.

Management Comments

David Meyer, Titan Machinery’s Chairman and Chief Executive

Officer, stated, “Our financial results in the first quarter were

in-line with our expectations, as ongoing headwinds in the

agriculture industry continue to impact our results. In the first

quarter, we remained focused on managing the controllable aspects

of our business, including implementing a realignment plan that

significantly reduces our operating costs and is expected to

generate approximately $20 million in cost savings beginning in the

current fiscal year. We also continue to diligently manage our

inventory levels and expect to achieve meaningful reductions in

fiscal 2016."

Mr. Meyer continued, “We believe that we have taken the

necessary steps to navigate the challenging macroeconomic

conditions by better aligning our cost structure with the current

environment. While we continue to face a number of headwinds, we

are focused on execution in all three business segments and

strengthening our balance sheet. We remain confident that we are on

the right track to improve our long-term financial performance and

capitalize on future growth opportunities."

Fiscal 2016 Modeling Assumptions

The Company is reiterating the following modeling assumptions

for fiscal 2016 that it believes will provide investors with

relevant information about expectations regarding financial results

and business trends:

- Agriculture Same Store Sales Down 20.0%

to 25.0%

- Construction Same Store Sales Flat

- International Same Store Sales

Flat

- Equipment Margins Between 7.7% and

8.3%

- Expects to be profitable on an adjusted

diluted earnings per share basis

Conference Call and Presentation Information

The Company will host a conference call and audio webcast today

at 7:30 a.m. Central time (8:30 a.m. Eastern time). A copy of the

presentation that will accompany the prepared remarks from the

conference call is available on the Company’s website under

Investor Relations at www.titanmachinery.com. An archive of the

audio webcast will be available on the Company’s website under

Investor Relations at www.titanmachinery.com for 30 days following

the audio webcast.

Investors interested in participating in the live call can dial

(888) 505-4369 from the U.S. International callers can dial (719)

785-1765. A telephone replay will be available approximately two

hours after the call concludes and will be available through

Thursday, June 11, 2015, by dialing (877) 870-5176 from the U.S.,

or (858) 384-5517 from international locations, and entering

confirmation code 1050277.

Non-GAAP Financial Measures

Within this announcement, the Company makes reference to certain

adjusted financial measures, which have directly comparable GAAP

financial measures as identified in this release. These adjusted

measures are provided so that investors have the same financial

data that management uses with the belief that it will assist the

investment community in properly assessing the underlying

performance of the Company for the periods being reported. This

includes adjusted EBITDA, which the Company defines as net income

(loss) including noncontrolling interest, adjusted for net interest

(excluding floorplan interest expense), income taxes, depreciation,

amortization, and items included in its non-GAAP pre-tax income

(loss) reconciliation for each of the respective periods. The

presentation of this additional information is not meant to be

considered a substitute for measures prepared in accordance with

GAAP. Investors are encouraged to review the reconciliations of

adjusted financial measures used in this press release to their

most directly comparable GAAP financial measures as provided with

the financial statements attached to this press release.

About Titan Machinery Inc.

Titan Machinery Inc., founded in 1980 and headquartered in West

Fargo, North Dakota, is a multi-unit business with mature locations

and newly-acquired locations. The Company owns and operates a

network of full service agricultural and construction equipment

stores in the United States and Europe. The Titan Machinery network

consists of 92 North American dealerships in North Dakota, South

Dakota, Iowa, Minnesota, Montana, Nebraska, Wyoming, Wisconsin,

Colorado, Arizona, and New Mexico, including three outlet stores,

and 16 European dealerships in Romania, Bulgaria, Serbia, and

Ukraine. The Titan Machinery dealerships represent one or more of

the CNH Industrial Brands (CNHI), including CaseIH, New Holland

Agriculture, Case Construction, New Holland Construction, and CNH

Capital. Additional information about Titan Machinery Inc. can be

found at www.titanmachinery.com.

Forward Looking Statements

Except for historical information contained herein, the

statements in this release are forward-looking and made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements made herein, which

include statements regarding Agriculture, Construction, and

International segment initiatives and improvements, segment revenue

realization, growth and profitability expectations, inventory

expectations, leverage expectations, and modeling assumptions and

expected results of operations for the fiscal year ending

January 31, 2016, involve known and unknown risks and

uncertainties that may cause Titan Machinery’s actual results in

current or future periods to differ materially from the forecasted

assumptions and expected results. The Company’s risks and

uncertainties include, among other things, a substantial dependence

on a single distributor, the continued availability of organic

growth and acquisition opportunities, potential difficulties

integrating acquired stores, industry supply levels, fluctuating

agriculture and construction industry economic conditions, the

success of recently implemented initiatives within the Company’s

operating segments, the uncertainty and fluctuating conditions in

the capital and credit markets, difficulties in conducting

international operations, foreign currency risks, governmental

agriculture policies, seasonal fluctuations, the ability of the

Company to reduce inventory levels, climate conditions, disruption

in receiving ample inventory financing, and increased competition

in the geographic areas served. These and other risks are more

fully described in Titan Machinery’s filings with the Securities

and Exchange Commission, including the Company’s most recently

filed Annual Report on Form 10-K. Titan Machinery conducts its

business in a highly competitive and rapidly changing environment.

Accordingly, new risk factors may arise. It is not possible for

management to predict all such risk factors, nor to assess the

impact of all such risk factors on Titan Machinery’s business or

the extent to which any individual risk factor, or combination of

factors, may cause results to differ materially from those

contained in any forward-looking statement. Titan Machinery

disclaims any obligation to update such factors or to publicly

announce results of revisions to any of the forward-looking

statements contained herein to reflect future events or

developments.

TITAN MACHINERY INC. Consolidated Balance

Sheets (in thousands, except per share data)

(Unaudited)

April 30, 2015 January 31, 2015 Assets Current

Assets Cash $ 104,355 $ 127,528 Receivables, net 64,892 76,382

Inventories 880,060 879,440 Prepaid expenses and other 5,179 10,634

Income taxes receivable 3,003 166 Deferred income taxes 18,488

19,025 Assets held for sale 14,946 15,312 Total

current assets 1,090,923 1,128,487 Intangibles and

Other Assets Intangible assets, net of accumulated amortization

5,360 5,458 Other 6,649 7,122 Total intangibles and

other assets 12,009 12,580 Property and Equipment,

net of accumulated depreciation 194,788 208,680

Total Assets $ 1,297,720 $ 1,349,747

Liabilities and Stockholders' Equity Current Liabilities

Accounts payable $ 17,539 $ 17,659 Floorplan payable 606,673

627,249 Current maturities of long-term debt 24,677 7,749 Customer

deposits 26,247 35,090 Accrued expenses 33,362 35,496 Income taxes

payable — 3,529 Liabilities held for sale 1,540 2,835

Total current liabilities 710,038 729,607 Long-Term

Liabilities Senior convertible notes 133,245 132,350 Long-term

debt, less current maturities 45,660 67,123 Deferred income taxes

39,244 38,996 Other long-term liabilities 3,488 3,312

Total long-term liabilities 221,637 241,781

Stockholders' Equity Common stock — — Additional paid-in-capital

240,505 240,180 Retained earnings 131,114 137,418 Accumulated other

comprehensive loss (5,729 ) (1,099 ) Total Titan Machinery Inc.

stockholders' equity 365,890 376,499 Noncontrolling interest 155

1,860 Total stockholders' equity 366,045

378,359

Total Liabilities and Stockholders' Equity $

1,297,720 $ 1,349,747

TITAN

MACHINERY INC. Consolidated Statements of Operations

(in thousands, except per share data) (Unaudited)

Three Months Ended April

30, 2015 2014 Revenue Equipment $ 244,983 $ 345,045 Parts 61,520

68,379 Service 32,902 37,084 Rental and other 13,791 14,955

Total Revenue 353,196 465,463 Cost of Revenue

Equipment 227,033 316,282 Parts 43,571 48,014 Service 11,360 14,403

Rental and other 10,797 10,825 Total Cost of Revenue

292,761 389,524 Gross Profit 60,435 75,939 Operating

Expenses 57,110 71,152 Impairment and Realignment Costs 1,601

2,801 Income from Operations 1,724 1,986 Other Income

(Expense) Interest income and other income (expense) (2,124 )

(2,578 ) Floorplan interest expense (4,599 ) (4,593 ) Other

interest expense (3,827 ) (3,441 ) Loss Before Income Taxes (8,826

) (8,626 ) Benefit from Income Taxes (1,936 ) (1,733 ) Net Loss

Including Noncontrolling Interest (6,890 ) (6,893 ) Less: Net Loss

Attributable to Noncontrolling Interest (586 ) (344 ) Net Loss

Attributable to Titan Machinery Inc. (6,304 ) (6,549 ) Net Loss

Allocated to Participating Securities 105 60 Net Loss

Attributable to Titan Machinery Inc. Common Stockholders $ (6,199 )

$ (6,489 ) Earnings (Loss) per Share - Diluted $ (0.29 ) $

(0.31 ) Weighted Average Common Shares - Diluted 21,044

20,951

TITAN MACHINERY INC.

Consolidated Condensed Statements of Cash Flows (in

thousands) (Unaudited)

Three Months Ended April 30, 2015 2014 Operating

Activities Net loss including noncontrolling interest $ (6,890 ) $

(6,893 ) Adjustments to reconcile net income including

noncontrolling interest to net cash used for operating activities

Depreciation and amortization 6,667 6,729 Impairment 152 — Deferred

income taxes 497 232 Other, net 2,522 978 Changes in assets and

liabilities Inventories 522 (41,963 ) Manufacturer floorplan

payable 12,980 (17,308 ) Other working capital (2,144 ) 3,623

Net Cash Provided by (Used for) Operating Activities 14,306

(54,602 ) Investing Activities Property and equipment

purchases (2,282 ) (5,707 ) Proceeds from sale of property and

equipment 634 471 Other, net 198 (887 ) Net Cash Used for

Investing Activities (1,450 ) (6,123 ) Financing Activities Net

change in non-manufacturer floorplan payable (30,001 ) 65,305 Net

proceeds from (payments on) long-term debt borrowings (4,876 )

3,327 Other, net (443 ) (207 ) Net Cash Provided by (Used for)

Financing Activities (35,320 ) 68,425 Effect of Exchange

Rate Changes on Cash (709 ) 69 Net Change in Cash (23,173 ) 7,769

Cash at Beginning of Period 127,528 74,242 Cash at

End of Period $ 104,355 $ 82,011

TITAN MACHINERY INC. Segment Results (in

thousands) (Unaudited) Three

Months Ended April 30, 2015 2014

% Change

Revenue Agriculture $ 239,855 $ 344,381

(30.4 )% Construction 81,171 91,765 (11.5 )% International 32,170

29,317 9.7 % Total $ 353,196 $ 465,463

(24.1 )%

Income (Loss) Before Income Taxes

Agriculture $ (1,086 ) $ 3,505 (131.0 )% Construction (3,565 )

(5,993 ) 40.5 % International (4,371 ) (5,265 ) 17.0 % Segment

income (loss) before income taxes (9,022 ) (7,753 ) (16.4 )% Shared

Resources 196 (873 ) 122.5 % Loss Before Income Taxes $

(8,826 ) $ (8,626 ) (2.3 )%

TITAN MACHINERY

INC. Non-GAAP Reconciliations (in thousands, except

per share data) (Unaudited)

Three Months Ended April 30, 2015 2014

Pre-Tax

Loss Loss Before Income Taxes $ (8,826 ) $ (8,626 ) Non-GAAP

Adjustments Debt Issuance Cost Write-Off 539 — Realignment / Store

Closing Costs 1,601 3,205 Ukraine Remeasurement 2,040 3,122

Total Non-GAAP Adjustments 4,180 6,327

Adjusted Pre-Tax Loss $ (4,646 ) $ (2,299 )

Adjusted

EBITDA Net Loss Including Noncontrolling Interest $ (6,890 ) $

(6,893 ) Adjustments Interest Expense, Net of Interest Income 3,097

3,211 Benefit from Income Taxes (1,936 ) (1,733 ) Depreciation and

amortization 6,667 6,729 Total Non-GAAP Adjustments to Pre-Tax

Income (Loss) 4,180 6,327 Total Adjustments 12,008

14,534 Adjusted EBITDA $ 5,118 $ 7,641

Net Loss Attributable to Titan Machinery Inc. Common

Stockholders Net Loss Attributable to Titan Machinery Inc.

Common Stockholders $ (6,199 ) $ (6,489 ) Non-GAAP Adjustments (1)

Debt Issuance Cost Write-Off 318 — Realignment / Store Closing

Costs 945 1,896 Ukraine Remeasurement 2,006 3,078

Total Non-GAAP Adjustments $ 3,269 $ 4,974 Adjusted

Net Loss Attributable to Titan Machinery Inc. Common Stockholders $

(2,930 ) $ (1,515 )

Earnings (Loss) per Share -

Diluted Earnings (Loss) per Share - Diluted $ (0.29 ) $ (0.31 )

Non-GAAP Adjustments (1) Debt Issuance Cost Write-Off 0.02 —

Realignment / Store Closing Costs 0.04 0.09 Ukraine Remeasurement

0.10 0.15 Total Non-GAAP Adjustments $ 0.16 $

0.24 Adjusted Earnings (Loss) per Share - Diluted $ (0.13 )

$ (0.07 ) (1) Adjustments are net of the impact of amounts

related to income taxes, attributable to noncontrolling interests,

and allocated to participating securities.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150528005368/en/

Investor Relations:ICR, Inc.John Mills,

Partner310-954-1105jmills@icrinc.com

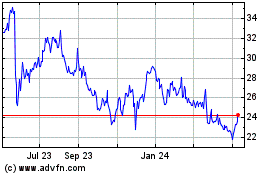

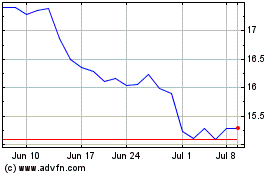

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Apr 2023 to Apr 2024