UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 27, 2015

AMARANTUS BIOSCIENCE HOLDINGS, INC.

(Exact name of registrant as specified in

its charter)

| Nevada |

000-55016 |

26-0690857 |

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

IRS Employer

Identification No.) |

|

655 Montgomery Street, Suite 900

San Francisco, CA |

94111 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(408) 737-2734

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On May 27, 2015, Amarantus Bioscience

Holdings, Inc. (the “Company”) gave a business update via telephone conference call. A copy of the Company’s

business update presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed under this Item 7.01,

including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration statement or

other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Amarantus Bioscience Holdings, Inc. Business Update Presentation, dated May 27, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

|

|

AMARANTUS BIOSCIENCE HOLDINGS, INC. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: May 28, 2015 |

|

By: |

/s/ Gerald E. Commissiong |

|

| |

|

|

|

Name: Gerald E. Commissiong |

|

| |

|

|

|

Title: Chief Executive Officer |

|

Exhibit 99.1

1 Developing clinical - stage products in neurology, psychiatry and orphan indications BUSINESS UPDATE CONFERENCE CALL May 27, 2015 OTCQB: AMBS

This presentation contains “ forward - looking statements ” within the meaning of the “ safe - harbor ” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of sales, future international, national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products and services, marketing existing products and services, customer acceptance of existing and new products and services and other factors. Accordingly, although the Company believes that the expectations reflected in such forward - looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to update the forward - looking information contained in this presentation. 2 Forward - Looking Statements

3 Agenda • INTRODUCTION • Q1 FINANCIAL REVIEW • CORPORATE OUTLOOK • THERAPEUTICS DIVISION REVIEW • DIAGNOSTICS DIVISION REVIEW • 2015 EXPECTED MILESTONES • Q&A

Rich Pipeline Expected to Yield Transformational Opportunities 4 Asset Pre - Clinical Phase 1 Phase 2 Phase 3 Value Driving Milestone Potential strategic transaction in 2015 Eltoprazine: PD - LID Phase 2b program clinical data in 2016 ESS*: 50+% TBSA Severe Burns Phase 2 clinical data in 2016 MANF: Retinitis Pigmentosa (Orphan) Potential PoC in orphan ocular in 2018 * = upon exercise of exclusive option to acquire Cutanogen Corporation from Lonza

5 Poised for Next Phase of Growth Therapeutics Division • Eltoprazine on track to commence Phase 2b study before end of 2Q 2015 • Lonza transaction expected to be completed by August 2015, with Phase 2 study of ESS to commence in 3Q 2015 after acquisition* • MANF orphan ocular diseases strategy establishes fastest path to market with GMP manufacturing underway to prepare to commence first human studies in 2016 Diagnostics Division • LymPro Test ® IUO commercialization expected to generate additional collaborations • MSPrecise ® poised for staged near - term commercial opportunity under CLIA • Georgetown assays position company to control significant market share in the emerging AD IUO blood diagnostics market • LymPro and Georgetown assays initial CLIA opportunity in parallel with MSPrecise • Premier suite of diagnostics with robust evaluation underway for exit strategy Prepared to deliver on significant value inflections in near, mid and long term * = upon exercise of exclusive option to acquire Cutanogen Corporation from Lonza

Financial Review 6

Corporate Outlook 7

Path to Up - listing 8 Access to Lincoln Park Capital Facility Series E primarily for ESS and MSPrecise transactions Series G ‘bridge’ financing to NASDAQ NASDAQ IPO(s) Strategic Transaction to fuel pipeline

NASDAQ IPO: Why Now? • Core fundamentals have never been stronger and improving – In spite of achieving recent important milestones, share price has declined – Stock unable to hold gains due to short - term trading interests – Greater access to long - term institutional investors and research analysts – Therapeutics pipeline ‘institution - ready’ w/ Elto Phase 2b initiation – Pending Cutanogen acquisition will further drive institutional interest* – Begin participating in biotech bull market: IPO for AMBS onto NASDAQ • Potential of Diagnostics spinout onto NASDAQ creates leverage in negotiating with potential partners/acquirers – Relationship established with key players – Preparing to initiate formal parallel process : AMDX IPO vs. Sale • Strategic Financial Advisor for Sale • Underwriter for IPO • Better financing/negotiation options for AMBS and AMDX on NASDAQ vs. OTC 9 * = upon exercise of exclusive option to acquire Cutanogen Corporation from Lonza

Reverse Split Rationale: NASDAQ Listing • Reverse split does not change AMBS stockholder value or market cap • Increased share price will make AMBS more attractive to larger investors while still on OTC preparing for national exchange listing • Post - split share structure meets NASDAQ Capital Market Equity Standard: x $4 share price (post - split ~ $7.50 per share) x $5M in shareholders equity (>$7M including Series G financing) x 2 year operating history (6 years) x 1 million public shares held (post - split 7M public shares) x 300 round lot holders (post - split 3000+ holders) x $15M market value of publicly held shares ($50M) • Achieving up - listing to NASDAQ this year is an integral part of our corporate strategy to maximize the value of Amarantus in near and long term • Timing to NASDAQ: Preparing for listing in the 3Q 2015 10

Therapeutics Division Review 11

Eltoprazine: Recent Milestone Achievements x Published Phase 2a clinical study results in BRAIN for the treatment of PD - LID x Opened an IND with the neurology division of the FDA to advance Eltoprazine into Phase 2b clinical studies x Completed Investigator Meetings in US and EU x Entered into a clinical trial agreement with Chiltern International, a leading global contract research organization, to manage the clinical research and monitoring program services for the Phase 2b study in PD - LID x Preparation underway for opening of first clinical trial site NEXT MILESTONES ▪ Study start: first clinical site open for enrollment ▪ Dosing of first patient 12

Eltoprazine Phase 2b study on Track to Commence 2Q 2015 13 • Double - blind placebo - controlled, dose range finding study • 60 patient, four way crossover (each patient receives all dosing regiments) • Twice daily dosing, 3 weeks per dosing regimen (12 weeks total) • Expert PD centers in US and EU • Evaluation of dose response effect of chronic dosing on safety, tolerability and dyskinesia severity using state - of - the - art rating scales, diaries and motion sensors • PK and PD relationship will be evaluated to guide late stage development in this indication, including optimization of the formulation Q2 - 15 Q3 - 15 Q4 - 15 Q1 - 16 Q2 - 16 Q3 - 16 Launch Phase 2b study X First patient dosing X Study duration X X X X Study data released X X

MANF: Recent Milestone Achievements x Announced the successful delivery and distribution of MANF in a preclinical model to brain areas involved in Parkinson's disease , further solidifying the rationale for its preclinical development as a potential disease - modifying treatment for PD x Entered into a cGMP manufacturing agreement with Catalent Biologics for clinical - grade production of MANF to enable program advancement into human clinical studies in retinitis pigmentosa (RP), retinal artery occlusion, glaucoma and Parkinson's disease x Presented positive preclinical data showing MANF preserves the light - sensing function of photoreceptor cells at ARVO x Received a Notice of Allowance for the MANF U.S. patent application covering compositions of matter and methods of use related to proprietary manufacturing processes for synthetic MANF and its administration for protein therapy and cell therapy x Received European Union Orphan Drug Designation (ODD) for MANF for the treatment of RP, complementing the US ODD obtained in December 2014 14

MANF has “Blue - Sky” Potential • Potential paradigm shift in cell protection and restoration – Collaboration w/ Buck Institute yielding tremendous results – 75+ peer - reviewed publications • $Multi - billion opportunity: Breakthrough science • Lead programs in orphan ocular indications – Retinitis Pigmentosa (orphan granted) – Retinal artery occlusion (pending orphan) – Wolfram’s (potential orphan) • Potential in other indications – Parkinson’s – Diabetes – Myocardial infarction – Hearing loss (potential orphan) – Otology – Other apoptosis - related disorders 15

Cutanogen Acquisition Could Add Significant Value* • Autologous, skin graft replacement for 50+% TBSA severe burns • Biologics/drug regulatory pathway in office of combination products • Orphan Drug Designation received in 2012 • Active IND as of May 2014 • Partially funded by US Gov’t grant: AFIRM • Project has been partially funded by DoD for last 5+ years • Patient Population: ~2000 average patients per year – Cost of treatment per patient : $1.6M, w/ complications: $10M+ • Secondary applications: pediatric burn 30%+ burns, diabetic foot ulcers, cosmetics • 10 patient Phase 2 clinical trial once acquisition of Cutanogen is completed • Transaction expected to be completed in 3Q 2015 16 * = upon exercise of exclusive option to acquire Cutanogen Corporation from Lonza

17

Diagnostic Candidates Clinical Validation Analytical Performance Commercialization LymPro Test ® MSPrecise ® Georgetown Assays* Alzheimer's Disease Multiple Sclerosis Alzheimer’s Disease Exploring Strategic Options for Monetization Preparing for “Exit Strategy” to Unlock Value 18 *Upon exercise of exclusive option

Diagnostics Division: Pipeline Achievements LymPro Test ® • Initiated business development activity with the pharmaceutical industry for Investigational Use Only (IUO) LymPro Test biomarker services • Established the first Investigational Use Only (IUO) Alzheimer's biomarker services collaboration with Anavex Life Sciences Corp. to evaluate the effects of ANAVEX - 273 on LymPro scores measured from blood samples in Alzheimer’s patients • Entered into a Letter of Intent with Anavex Life Sciences Corp. to plan the additional scope of further biomarker services for its potential Phase 3 AD clinical trial • Presented positive LymPro data at the 12th International Conference on Alzheimer's and Parkinson's Diseases and Related Neurological Disorders MSPrecise ® • Acquired MS diagnostics company Diogenix , Inc. • Reported preliminary data from a blood - based version of MSPrecise showing it has statistically significant sensitivity and specificity for classifying presentation of MS Georgetown Assays • Entered into a one - year, exclusive option agreement with Georgetown University to license patent rights for blood based biomarkers for AD and memory loss 19

• Currently available as IUO for clinical trials • Completed multivariate analysis to support CLIA pathway • Two late - breaking abstract submitted to expected to be presented at AAIC • Business development initiative gaining traction Business Development Update 20 Commence due diligence Initial Contact Sign Confidentiality Agreement Finalize Negotiations Complete Transaction 6 - 12 month sales cycle initiated at CTAD (November 2014)

21 “Exit” Strategy Accelerated as a Priority • In process of engaging investment bank(s) to evaluating strategic options for the diagnostics business unit • Potential options under consideration – Potential sale of the division for cash (and maintain a royalty) – IPO or RTO – License the technologies to a third party – Evaluate a combination of the above • Intend to focus on maintaining a significant financial interest in the diagnostics business • Will allow us to focus internal resources on Therapeutics division Transaction expected to fuel advancement of Therapeutics pipeline

Expected Milestones • Initiate Phase 2 b clinical study of Eltoprazine in PD - LID in 2 Q 2015 • Complete enrollment of Phase 2 b clinical study of Eltoprazine in PD - LID • Complete acquisition of Cutanogen – Initiate Phase 2 study of ESS expected in 3 Q 2015 • MANF progression towards first - in - man : – GMP Manufacture initiated in 2 Q 2015 – Preparing RP Clinical Development Pathway – RAO ODD applications from the FDA and EU • Execute strategic transaction for Diagnostics division • Pursuing National stock exchange up - listing 22

23 Developing clinical - stage products in neurology, psychiatry and orphan indications OTCQB: AMBS

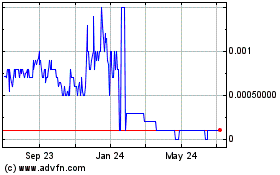

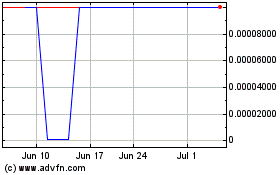

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024