Securities Registration (section 12(b)) (8-a12b)

May 27 2015 - 12:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

ONCOSEC MEDICAL INCORPORATED

(Exact name of registrant as specified in its charter)

|

Nevada |

|

98-0573252 |

|

(State of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

9810 Summer Ridge Road, Suite 110

San Diego, California |

|

92121 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

to be so registered |

|

Name of each exchange on which

each class is to be registered |

|

Common Stock,

$0.0001 par value per share |

|

The NASDAQ Stock Market LLC |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box. x

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box. o

Securities Act registration statement file number to which this form relates: Not applicable

Securities to be registered pursuant to Section 12(g) of the Act: None

Item 1. Description of Registrant’s Securities to be Registered.

The following is a summary of the material features of the capital stock of OncoSec Medical Incorporated (the “Company”). The following summary does not purport to be complete and is subject to and qualified in its entirety by the Nevada Revised Statutes and other applicable law, as well as the provisions of the Company’s Articles of incorporation, as amended and as currently in effect (the “Articles of Incorporation”), which are filed or incorporated by reference as Exhibits 3.1, 3.3, 3.4 and 3.5 to the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “Commission”) on October 10, 2014 and Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the Commission on May 12, 2015, 2015, and the Company’s amended and restated bylaws, as amended and as currently in effect (the “Bylaws”), which are filed or incorporated by reference as Exhibit 3.2 to the Company’s Annual Report on Form 10-K filed with the Commission on October 10, 2014. The Company’s stockholders are urged to read the Articles of Incorporation and Bylaws carefully and in their entirety.

Authorized, Issued and Outstanding Capital Stock

Pursuant to the Articles of Incorporation, the Company is authorized to issue 160,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”). As of May 26, 2015, there were approximately 12,350,132 shares of Common Stock issued and outstanding.

Common Stock

Voting Rights

All outstanding shares of Common Stock are fully paid and non-assessable. Holders of shares of Common Stock are entitled to one vote, in person or by proxy, for each share held of record on all matters submitted to a vote of the Company’s stockholders. The Bylaws provide that, except as otherwise provided by the Articles of Incorporation, Bylaws or applicable law, the holders of a majority of the shares of the Company’s capital stock issued and outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at any stockholders meeting, and an action by the stockholders is approved at such a meeting if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. The Bylaws provide that directors shall be elected by a plurality of the votes case and entitled to vote on the election of directors at any stockholders meeting at which a quorum is present and, except as otherwise provided by applicable law, holders of shares of Common Stock are not entitled to cumulative voting of their shares in elections of directors

Dividends

Subject to the provisions of applicable law, including the Nevada Revised Statutes, holders of shares of Common Stock are entitled to receive, when and as declared by the Company’s board of directors, dividends or other distributions (whether payable in cash, property, or securities of the Company) out of the assets of the Company legally available for such dividends or other distributions.

Other Rights

No stockholder of the Company has any preemptive right under the Articles of Incorporation or Bylaws to subscribe for, purchase, or otherwise acquire shares of any class or series of the Company’s capital stock. The shares of Common Stock are not subject to redemption by operation of a sinking fund or otherwise. In the event of any liquidation, dissolution, or winding up of the Company, subject to the rights, if any, of the holders of other classes of the Company’s capital stock, holders of shares of Common Stock would be entitled to receive any of the Company’s assets available for distribution to its stockholders ratably in proportion to the number of shares held by each of them.

1

Exchange Listing

The Common Stock has been approved for listing on The NASDAQ Stock Market LLC’s NASDAQ Capital Market tier, under the symbol “ONCS”.

Liability and Indemnification of Directors and Officers

The Nevada Revised Statutes provide the Company with the power to indemnify any of its directors and officers. To be eligible for such indemnification, the director or officer must have conducted himself/herself in good faith and reasonably believe that his/her conduct was in, or not opposed to, the Company’s best interests. In a criminal action, the director or officer must not have had reasonable cause to believe his/her conduct was unlawful.

Under applicable sections of the Nevada Revised Statutes, advances for expenses may be made by agreement if the director or officer affirms in writing that he/she believes that he/she has met the standards and will personally repay the expenses if it is determined the director or officer did not meet the standards.

If Section 2115 of the California Corporations Code is applicable to us, certain laws of California relating to the indemnification of directors, officer and others also will govern.

The Bylaws include an indemnification provision under which the Company must indemnify any of its directors or officers, or any of its former directors or officers, to the full extent permitted by law.

At present, there is no pending litigation or proceeding involving any of the Company’s directors or officers for which indemnification by the Company is sought, nor is the Company aware of any threatened litigation that is likely to result in claims for indemnification. The Company also maintains insurance policies that indemnify its directors and officers against various liabilities, including liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), which may be incurred by any director or officer in his or her capacity as such.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted for directors, officers or persons controlling the Company pursuant to the foregoing provisions, or otherwise, the Company has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Anti-Takeover Provisions

Some features of the Nevada Revised Statutes, which are further described below, may have the effect of deterring third parties from making takeover bids for control of the Company or may be used to hinder or delay such a takeover bid. This would decrease the chance that the Company’s stockholders could realize a premium over the market price for their shares of Common Stock as a result of such a takeover bid.

Acquisition of Controlling Interest

The Nevada Revised Statutes contain provisions governing acquisition of a controlling interest of a Nevada corporation. These provisions provide generally that any person or entity that acquires a certain percentage of the outstanding voting shares of a Nevada corporation may be denied voting rights with respect to the acquired shares, unless certain criteria are satisfied. The Bylaws provide that these provisions will not apply to the Company or to any existing or future stockholder or stockholders.

Combination with Interested Stockholder

The Nevada Revised Statutes contain provisions governing the combination of a Nevada corporation that has 200 or more stockholders of record with an interested stockholder. These provisions may have the effect of delaying or making it more difficult to affect a change in control of the Company.

2

A corporation affected by these provisions may not engage in a combination within three years after the interested stockholder acquires his, her or its shares unless the combination or purchase is approved by the corporation’s board of directors before the interested stockholder acquired such shares. Generally, if approval is not obtained, then after the expiration of the three-year period, the business combination may be consummated with the approval of the corporation’s board of directors before the person became an interested stockholder or a majority of the voting power held by disinterested stockholders, or if the consideration to be received per share by disinterested stockholders is at least equal to the highest of:

· the highest price per share paid by the interested stockholder within the three years immediately preceding the date of the announcement of the combination or within three years immediately before, or in, the transaction in which he, she or it became an interested stockholder, whichever is higher;

· the market value per share on the date of announcement of the combination or the date the person became an interested stockholder, whichever is higher; or

· if higher for the holders of preferred stock, the highest liquidation value of the preferred stock, if any.

Generally, these provisions define an interested stockholder as a person who is the beneficial owner, directly or indirectly of 10% or more of the voting power of the outstanding voting shares of a corporation, and define a combination to include any merger or consolidation with an interested stockholder, or any sale, lease, exchange, mortgage, pledge, transfer or other disposition, in one transaction or a series of transactions, with an interested stockholder of assets of the corporation:

· having an aggregate market value equal to 5% or more of the aggregate market value of the assets of the corporation;

· having an aggregate market value equal to 5% or more of the aggregate market value of all outstanding shares of the corporation; or

· representing 10% or more of the earning power or net income of the corporation.

Articles of Incorporation and Amended and Restated Bylaws

There are no provisions in the Articles of Incorporation or Bylaws that would delay, defer or prevent a change in control of the Company and that would operate only with respect to an extraordinary corporate transaction involving the Company, such as a merger, reorganization, tender offer, liquidation or sale or transfer of substantially all of its assets.

Item 2. Exhibits.

Pursuant to the Instructions as to Exhibits with respect to Form 8-A, no exhibits are required to be filed herewith because no other securities of the Company are registered on The NASDAQ Stock Market LLC and the securities registered hereby are not being registered pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended.

3

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: May 27, 2015 |

ONCOSEC MEDICAL INCORPORATED |

|

|

|

|

|

|

|

|

By: |

/s/ Punit Dhillon |

|

|

Name: |

Punit Dhillon |

|

|

Title: |

President & Chief Executive Officer |

4

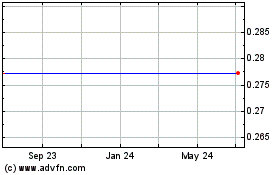

OncoSec Medical (NASDAQ:ONCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

OncoSec Medical (NASDAQ:ONCS)

Historical Stock Chart

From Apr 2023 to Apr 2024