UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2015

Commission file number 1-33867

TEEKAY

TANKERS LTD.

(Exact name of Registrant as specified in its charter)

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40- F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No

x

TEEKAY TANKERS LTD.

REPORT ON FORM 6-K FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2015

INDEX

2

TEEKAY TANKERS LTD.

MARCH 31, 2015

PART I

– FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

TEEKAY TANKERS LTD.

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

(in thousands of U.S. dollars, except share and per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, 2015

$ |

|

|

Three Months Ended

March 31, 2014

$ |

|

| REVENUES |

|

|

|

|

|

|

|

|

| Time charter revenues (note 9a) |

|

|

10,517 |

|

|

|

21,482 |

|

| Net pool revenues (note 9a) |

|

|

80,509 |

|

|

|

30,163 |

|

| Voyage charter revenues |

|

|

7,528 |

|

|

|

996 |

|

| Interest income from investment in term loans |

|

|

— |

|

|

|

9,118 |

|

| Other revenues (note 12) |

|

|

5,324 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

103,878 |

|

|

|

61,759 |

|

|

|

|

| Voyage expenses (note 9a) |

|

|

(3,834 |

) |

|

|

(1,439 |

) |

| Vessel operating expenses (note 9a) |

|

|

(22,441 |

) |

|

|

(22,794 |

) |

| Time-charter hire expense |

|

|

(15,003 |

) |

|

|

(1,052 |

) |

| Depreciation and amortization |

|

|

(13,672 |

) |

|

|

(12,502 |

) |

| General and administrative (note 9a) |

|

|

(3,300 |

) |

|

|

(3,192 |

) |

| Restructuring charge (note 12) |

|

|

(5,324 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

40,304 |

|

|

|

20,780 |

|

|

|

|

| Interest expense |

|

|

(2,365 |

) |

|

|

(2,347 |

) |

| Interest income |

|

|

31 |

|

|

|

138 |

|

| Realized and unrealized (loss) gain on derivative instruments (note 5) |

|

|

(1,587 |

) |

|

|

1,644 |

|

| Equity income (note 3) |

|

|

2,582 |

|

|

|

2,594 |

|

| Other income |

|

|

20 |

|

|

|

3,623 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

38,985 |

|

|

|

26,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per common share amounts (note 10) |

|

|

|

|

|

|

|

|

| - Basic earnings attributable to shareholders of Teekay Tankers |

|

|

0.34 |

|

|

|

0.32 |

|

| - Diluted earnings attributable to shareholders of Teekay Tankers |

|

|

0.34 |

|

|

|

0.31 |

|

| - Cash dividends declared |

|

|

0.03 |

|

|

|

0.03 |

|

|

|

|

| Weighted-average number of Class A and Class B common shares outstanding (note 10) |

|

|

|

|

|

|

|

|

|

|

|

| - Basic |

|

|

115,044,039 |

|

|

|

83,617,408 |

|

| - Diluted |

|

|

115,633,035 |

|

|

|

83,973,172 |

|

|

|

|

| Related party transactions (note 9) |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

3

TEEKAY TANKERS LTD.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

As at

March 31, 2015

$ |

|

|

As at

December 31, 2014

$ |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

40,513 |

|

|

|

162,797 |

|

| Pool receivable from affiliates, net (note 9b) |

|

|

36,774 |

|

|

|

35,254 |

|

| Accounts receivable |

|

|

9,833 |

|

|

|

4,178 |

|

| Due from affiliates (note 9b) |

|

|

44,059 |

|

|

|

42,502 |

|

| Prepaid expenses |

|

|

18,030 |

|

|

|

8,883 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

149,209 |

|

|

|

253,614 |

|

|

|

|

| Vessels and equipment |

|

|

|

|

|

|

|

|

| At cost, less accumulated depreciation of $315.2 million (2014 - $301.6 million) |

|

|

1,047,231 |

|

|

|

828,291 |

|

| Investment in and advances to equity accounted investments (note 3) |

|

|

75,979 |

|

|

|

73,397 |

|

| Derivative asset (note 5) |

|

|

4,617 |

|

|

|

4,657 |

|

| Other non-current assets |

|

|

2,428 |

|

|

|

5,400 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

1,279,464 |

|

|

|

1,165,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

3,637 |

|

|

|

1,899 |

|

| Accrued liabilities |

|

|

20,761 |

|

|

|

17,565 |

|

| Current portion of long-term debt (note 4) |

|

|

147,004 |

|

|

|

41,959 |

|

| Current portion of derivative instruments (note 5) |

|

|

6,251 |

|

|

|

7,263 |

|

| Deferred revenue |

|

|

1,095 |

|

|

|

637 |

|

| Due to affiliates (note 9b) |

|

|

14,863 |

|

|

|

10,395 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

193,611 |

|

|

|

79,718 |

|

|

|

|

| Long-term debt (note 4) |

|

|

564,912 |

|

|

|

614,104 |

|

| Derivative instruments (note 5) |

|

|

11,055 |

|

|

|

10,962 |

|

| Other long-term liabilities (note 6) |

|

|

4,862 |

|

|

|

4,852 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

774,440 |

|

|

|

709,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies (note 3, 4 and 5) |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Common share and additional paid-in capital (300 million shares authorized, 98.5 million Class A and 16.7 million Class

B shares issued and outstanding as of March 31, 2015 and 95.3 million Class A and 16.7 million Class B shares issued and outstanding as of December 31, 2014) (note 8) |

|

|

816,657 |

|

|

|

802,650 |

|

| Accumulated deficit |

|

|

(311,633 |

) |

|

|

(346,927 |

) |

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

505,024 |

|

|

|

455,723 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

|

1,279,464 |

|

|

|

1,165,359 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

4

TEEKAY TANKERS LTD.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, 2015

$ |

|

|

Three Months Ended

March 31, 2014

$ |

|

| Cash and cash equivalents provided by (used for) |

|

|

|

|

|

|

|

|

|

|

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| Net income |

|

|

38,985 |

|

|

|

26,432 |

|

| Non-cash items: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

13,672 |

|

|

|

12,502 |

|

| Unrealized gain on derivative instruments |

|

|

(877 |

) |

|

|

(4,091 |

) |

| Equity income |

|

|

(2,582 |

) |

|

|

(2,594 |

) |

| Other |

|

|

562 |

|

|

|

(2,427 |

) |

| Change in operating assets and liabilities |

|

|

(8,009 |

) |

|

|

(23,143 |

) |

| Expenditures for dry docking |

|

|

(1,996 |

) |

|

|

(1,817 |

) |

|

|

|

|

|

|

|

|

|

| Net operating cash flow |

|

|

39,755 |

|

|

|

4,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| Proceeds from long-term debt, net of issuance costs |

|

|

221,587 |

|

|

|

30,998 |

|

| Repayments of long-term debt |

|

|

(5,092 |

) |

|

|

(5,091 |

) |

| Prepayment of long-term debt |

|

|

(161,592 |

) |

|

|

(5,000 |

) |

| Equity contribution from Teekay Corporation |

|

|

— |

|

|

|

1,267 |

|

| Cash dividends paid |

|

|

(3,452 |

) |

|

|

(2,508 |

) |

| Proceeds from equity offering, net of offering costs (note 8) |

|

|

13,665 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net financing cash flow |

|

|

65,116 |

|

|

|

19,666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| Expenditures for vessels and equipment |

|

|

(226,916 |

) |

|

|

(365 |

) |

| Investment in Tanker Investments Ltd. (note 3b) |

|

|

— |

|

|

|

(25,000 |

) |

| Loan repayments from equity accounted investment |

|

|

— |

|

|

|

1,150 |

|

| Term loan advance recoveries |

|

|

— |

|

|

|

1,179 |

|

| Investment in Teekay Tanker Operations Ltd. (note 3c) |

|

|

(239 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net investing cash flow |

|

|

(227,155 |

) |

|

|

(23,036 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| (Decrease) increase in cash and cash equivalents |

|

|

(122,284 |

) |

|

|

1,492 |

|

| Cash and cash equivalents, beginning of the period |

|

|

162,797 |

|

|

|

25,646 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of the period |

|

|

40,513 |

|

|

|

27,138 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

5

TEEKAY TANKERS LTD.

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(in thousands of U.S. dollars, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Common Stock and Additional

Paid-in Capital |

|

|

|

|

|

|

|

| |

|

Thousands

of Common

Shares

# |

|

|

Class A

$ |

|

|

Class B

$ |

|

|

Accumulated

Deficit

$ |

|

|

Total

$ |

|

| Balance as at December 31, 2014 |

|

|

112,064 |

|

|

|

785,515 |

|

|

|

17,135 |

|

|

|

(346,927 |

) |

|

|

455,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

38,985 |

|

|

|

38,985 |

|

| Proceeds from issuance of Class A common shares (note 8) |

|

|

3,000 |

|

|

|

13,665 |

|

|

|

— |

|

|

|

— |

|

|

|

13,665 |

|

| Value adjustment to share issuance to Teekay Corporation for purchase of Teekay Tanker Operations Ltd. (note 3c) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(239 |

) |

|

|

(239 |

) |

| Dividends declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,452 |

) |

|

|

(3,452 |

) |

| Equity-based compensation (note 8) |

|

|

158 |

|

|

|

342 |

|

|

|

— |

|

|

|

— |

|

|

|

342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as at March 31, 2015 |

|

|

115,222 |

|

|

|

799,522 |

|

|

|

17,135 |

|

|

|

(311,633 |

) |

|

|

505,024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

6

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

The unaudited interim consolidated financial statements have been prepared in conformity with United States generally accepted

accounting principles (or GAAP). These financial statements include the accounts of Teekay Tankers Ltd. and its wholly-owned subsidiaries and equity accounted investments (collectively the Company). The preparation of financial

statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Certain information and footnote disclosures required by GAAP for complete annual financial statements have been omitted and,

therefore, these interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements filed on Form 20-F for the year ended December 31, 2014. In the opinion of management, these interim

unaudited consolidated financial statements reflect all adjustments, consisting solely of a normal recurring nature, necessary to present fairly, in all material respects, the Company’s consolidated financial position, results of operations,

and cash flows for the interim periods presented. The results of operations for the interim periods presented are not necessarily indicative of those for a full fiscal year. Significant intercompany balances and transactions have been eliminated

upon consolidation.

| 2. |

Accounting Pronouncements |

In April 2014, the Financial Accounting Standards Board (or FASB) issued Accounting Standards Update 2014-08, Reporting

Discontinued Operations and Disclosures of Disposals of Components of an Entity (or ASU 2014-08), which raises the threshold for disposals to qualify as discontinued operations. A discontinued operation is defined now as: (i) a component

of a company or group of components that has been disposed of or classified as held for sale and represents a strategic shift that has or will have a major effect on a company’s operations and financial results; or (ii) an acquired

business that is classified as held for sale on the acquisition date. ASU 2014-08 also requires additional disclosures regarding discontinued operations, as well as material disposals that do not meet the definition of discontinued operations. ASU

2014-08 was adopted on January 1, 2015. The impact, if any, of adopting ASU 2014-08 on the Company’s financial statements will depend on the occurrence and nature of disposals that occur after ASU 2014-08 is adopted. There was no impact

during the quarter ended March 31, 2015.

In May 2014, FASB issued Accounting Standards Update 2014-09, Revenue from

Contracts with Customers (or ASU 2014-09). ASU 2014-09 will require companies to recognize revenue when they transfer promised goods or services to customers in an amount that reflects the consideration to which the company expects to be

entitled in exchange for those goods or services. This update creates a five-step model that requires companies to exercise judgment when considering the terms of the contract(s) which include (i) identifying the contract(s) with the customer,

(ii) identifying the separate performance obligations in the contract, (iii) determining the transaction price, (iv) allocating the transaction price to the separate performance obligations, and (v) recognizing revenue when each

performance obligation is satisfied. ASU 2014-09 is effective for interim and annual periods beginning after December 15, 2016 and shall be applied at the Company’s option retrospectively to each period presented or as a cumulative-effect

adjustment as of the date of adoption. Early adoption is not permitted. The Company is evaluating the effect of adopting this new accounting guidance.

In February 2015, the FASB issued Accounting Standards Update 2015-02, Amendments to the Consolidation Analysis (or ASU

2015-02), which eliminates the deferral of certain consolidation standards for companies considered to be investment companies, modifies the consolidation analysis performed on limited partnerships and modifies the impact of fee arrangements and

related parties on the determination of the primary beneficiary of a variable interest entity. ASU 2015-02 is effective for interim and annual periods beginning after December 15, 2015. ASU 2015-02 may be applied using a modified retrospective

approach by recording a cumulative-effect adjustment to equity as of the beginning of the fiscal year of adoption. A reporting company also may apply ASU 2015-02 retrospectively. The Company is evaluating the effect of adopting this new accounting

guidance.

In April 2015, the FASB issued Accounting Standards Update 2015-03, Simplifying the Presentation of Debt

Issuance Costs (or ASU 2015-03), which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt

discounts. ASU 2015-03 is effective for interim and annual periods beginning after December 15, 2015 and is to be applied on a retrospective basis. The Company is evaluating the effect of adopting this new accounting guidance.

| 3. |

Investments in and Advances to Equity Accounted Investments |

|

|

|

|

|

|

|

|

|

| |

|

As at

March 31, 2015

$ |

|

|

As at

December 31, 2014

$ |

|

| High-Q Joint Venture |

|

|

19,494 |

|

|

|

18,948 |

|

| Tanker Investments Ltd. |

|

|

38,684 |

|

|

|

36,915 |

|

| Teekay Tanker Operations Ltd. |

|

|

17,801 |

|

|

|

17,534 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

75,979 |

|

|

|

73,397 |

|

|

|

|

|

|

|

|

|

|

| |

a. |

The Company has a joint venture arrangement with Wah Kwong Maritime Transport Holdings Limited (or Wah Kwong), whereby the Company has a 50%

economic interest in the High-Q joint venture, which is jointly controlled by the Company and Wah Kwong. The High-Q joint venture owns one Very Large Crude Carrier (or VLCC), which is trading on a fixed time charter-out contract expiring in

2018. Under this contract, the vessel earns a fixed daily rate and an additional amount if the daily rate of any sub-charter earned exceeds a certain threshold. |

7

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

In March 2012, the joint venture entered into a $68.6 million loan with a

financial institution. As at March 31, 2015, the loan had an outstanding balance of $58.5 million (December 31, 2014 – $60.0 million). The loan is secured by a first-priority mortgage on the VLCC owned by the joint venture and 50% of the

outstanding loan balance is guaranteed by the Company. The joint venture has an interest rate swap agreement with a notional amount of $58.5 million that expires in June 2018, 50% of which is guaranteed by the Company. The interest rate swap

exchanges a receipt of floating interest based on 3-months LIBOR for a payment of a fixed rate of 1.47% every three months.

| |

b. |

In January 2014, the Company and Teekay Corporation (or Teekay) formed Tanker Investment Ltd. (or TIL), which seeks to

opportunistically acquire, operate and sell modern second-hand tankers to benefit from an expected recovery of the tanker market. In January 2014, the Company purchased 2.5 million shares of common stock for $25.0 million and received a stock

purchase warrant entitling it to purchase up to 750,000 additional shares of common stock of TIL (see note 5). The stock purchase warrant is a derivative asset which had a value of $4.6 million as at March 31, 2015. The Company also received

one preferred share which entitles the Company to elect one board member of TIL. The preferred share does not give the Company a right to any dividends or distributions of TIL. The Company accounts for its investment in TIL using the equity method.

As of March 31, 2015, the Company’s ownership interest in TIL was 9.29%. |

| |

c. |

In August 2014, the Company purchased from Teekay a 50% interest in Teekay Tanker Operations Ltd. (or TTOL), which owns conventional tanker

commercial management and technical management operations, including direct ownership in three commercially managed tanker pools, for an aggregate price of approximately $23.7 million. |

As consideration for this acquisition, the Company issued to Teekay 4.2 million of its Class B common shares with an

approximate value of $17.0 million on the acquisition closing date. In addition, the Company reimbursed Teekay for $6.7 million, of which $0.2 million was realized in the quarter ended March 31, 2015, of working capital it assumed from Teekay

in connection with the purchase. The book value of the assets acquired, including working capital, was $16.9 million on the date of acquisition. The excess of the purchase price over the Company’s proportionate interest in the book value of the

net assets acquired, which amounted to $6.8 million, is accounted for as an equity distribution to Teekay. The Company accounts for its ownership interest in TTOL using the equity method.

|

|

|

|

|

|

|

|

|

| |

|

As at

March 31, 2015

$ |

|

|

As at

December 31, 2014

$ |

|

| Revolving Credit Facilities due through 2018 |

|

|

442,000 |

|

|

|

508,593 |

|

| Term Loans due through 2021 |

|

|

269,916 |

|

|

|

147,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

711,916 |

|

|

|

656,063 |

|

| Less current portion |

|

|

(147,004 |

) |

|

|

(41,959 |

) |

|

|

|

|

|

|

|

|

|

| Total |

|

|

564,912 |

|

|

|

614,104 |

|

|

|

|

|

|

|

|

|

|

As at March 31, 2015, the Company had two revolving credit facilities (or the

Revolvers), which, as at such date, provided for aggregate borrowings of up to $602.2 million, of which $160.2 million was undrawn (December 31, 2014 – $634.8 million, of which $126.2 million was undrawn). Interest payments are based on

LIBOR plus margins, which, at March 31, 2015, ranged between 0.45% and 0.60% (December 31, 2014: 0.45% and 0.60%). The total amount available under the Revolvers reduces by $88.2 million (remainder of 2015), $89.1 million (2016), $395.9 million

(2017), $29.0 million (2018). As at March 31, 2015, the Revolvers were collateralized by 19 of the Company’s vessels, together with other related security. One of the Revolvers requires that the Company’s applicable subsidiary

maintain a minimum hull coverage ratio of 105% of the total outstanding drawn balance for the facility period. As at March 31, 2015, this ratio was 146%. The vessel value used in this ratio is an appraised value prepared by the Company based on

second-hand sale and purchase market data. A decline in the tanker market could negatively affect the ratio. In addition, one of the Revolvers requires the Company and certain of its subsidiaries to maintain a minimum liquidity (cash, cash

equivalents and undrawn committed revolving credit lines with at least six months to maturity) of $35.0 million and at least 5.0% of the Company’s total consolidated debt. One of the Revolvers is guaranteed by Teekay and contains covenants that

require Teekay to maintain the greater of (a) free cash (cash and cash equivalents) of at least $100.0 million and (b) an aggregate of free cash and undrawn committed revolving credit lines with at least six months to maturity of at least

7.5% of Teekay’s total consolidated debt which has recourse to Teekay. As at March 31, 2015, the Company and Teekay were in compliance with all their covenants in respect of the Revolvers.

As at March 31, 2015, the Company had four term loans outstanding, which totaled $269.9 million (December 31, 2014 –

$147.5 million). Interest payments on the term loans are based on a combination of fixed and variable rates where fixed rates range from 4.06% to 4.90% and variable rates are based on LIBOR plus a margin. At March 31, 2015, the margins ranged

from 0.30% to 2.50% (December 31, 2014 – 0.30% to 1.0%). The term loan repayments are made in quarterly or semi-annual payments and three of the term loans have balloon or bullet repayments due at maturity in 2016, 2019 and 2021. The term loans

are collateralized by first-priority mortgages on 11 of the Company’s vessels, together with certain other related security. Three of the term loans require that certain specified subsidiaries of the Company maintain minimum hull coverage

ratios of 120%, 130% and 135%, respectively, of the total outstanding balance for the facility period. As at March 31, 2015, the loan-to-value ratios ranged from 182% to 765%. The vessel values used in these ratios are appraised values prepared

by the Company based on second-hand sale and purchase market data. A decline in the tanker market could negatively affect the ratios. The term loans are guaranteed by Teekay and contain covenants that require Teekay to maintain the greater of

(a) free cash (cash and cash equivalents) of at least $100.0 million and (b) an aggregate of free cash and undrawn committed revolving credit lines with at least six months to maturity of at least 7.5% of Teekay’s total consolidated

debt which has recourse to Teekay. As at March 31, 2015, the Company and Teekay were in compliance with all their covenants in respect of these term loans.

8

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

The Company and certain other subsidiaries of Teekay are borrowers under one

term loan arrangement and one revolving credit facility. Under these arrangements, each of the borrowers is obligated on a joint and several basis. For accounting purposes, obligations resulting from long-term debt joint and several liability

arrangements are measured at the sum of the amount the Company agreed to pay, on the basis of its arrangement with its co-obligor, and any additional amount the Company expects to pay on behalf of its co-obligor. As of March 31, 2015, the term

loan arrangement had an outstanding balance of $186.6 million, of which $91.0 million was the Company’s share. As of March 31, 2015, the revolving credit facility had an outstanding balance of $87.9 million, of which $35.0 million was the

Company’s share. The Company does not expect to pay any amount on behalf of its co-obligors. Teekay has agreed to indemnify the Company in respect of any losses and expenses arising from any breach by co-obligors of the terms and conditions of

the term loan or revolving credit facility.

The weighted-average effective interest rate on the Company’s long-term

debt as at March 31, 2015 was 1.4% (December 31, 2014 – 1.1%). This rate does not reflect the effect of the Company’s interest rate swap agreements (see note 5).

The aggregate annual long-term principal repayments required to be made by the Company under the Revolvers and term loans

subsequent to March 31, 2015 are $24.3 million (remaining 2015), $155.2 million (2016), $415.3 million (2017), $53.1 million (2018) and $23.2 million (2019) and $40.8 million (thereafter).

| 5. |

Derivative Instruments |

The Company uses derivatives in accordance with its overall risk management policies. The Company enters into interest rate

swap agreements which exchange a receipt of floating interest for a payment of fixed interest to reduce the Company’s exposure to interest rate variability on its outstanding floating-rate debt. The Company has not designated, for accounting

purposes, its interest rate swaps as cash flow hedges of its U.S. Dollar LIBOR-denominated borrowings.

Realized and

unrealized gains or losses relating to the Company’s interest rate swaps have been reported in realized and unrealized (loss) gain on non-designated derivative instruments in the consolidated statements of income. During the three months ended

March 31, 2015, the Company recognized a realized loss of $2.4 million and unrealized gain of a $0.9 million relating to its interest rate swaps. During the three months ended March 31, 2014, the Company recognized a realized loss of $2.5

million and an unrealized gain of $1.7 million relating to its interest rate swaps.

The following summarizes the

Company’s interest rate swap positions as at March 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Interest Rate Index |

|

|

Notional

Amount

$ |

|

|

Fair Value /

Carrying

Amount of

Asset

(Liability)

$ |

|

|

Remaining

Term

(years) |

|

|

Fixed

Interest

Rate

(%) (1) |

|

| LIBOR-Based Debt: |

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Dollar-denominated interest rate swap |

|

|

USD LIBOR 6M |

|

|

|

200,000 |

|

|

|

(5,744 |

) |

|

|

1.5 |

|

|

|

2.61 |

|

| U.S. Dollar-denominated interest rate swap |

|

|

USD LIBOR 3M |

|

|

|

100,000 |

|

|

|

(11,562 |

) |

|

|

2.5 |

|

|

|

5.55 |

|

| |

(1) |

Excludes the margin the Company pays on its variable-rate debt, which, as of March 31, 2015, ranged from 0.30% to 2.50%.

|

The Company is potentially exposed to credit loss in the event of non-performance by the counterparty

to the interest rate swap agreements in the event that the fair value results in an asset being recorded. In order to minimize counterparty risk, the Company only enters into interest rate swap agreements with counterparties that are rated A- or

better by Standard & Poor’s or A3 or better by Moody’s at the time transactions are entered into.

The

Company has a stock purchase warrant entitling it to purchase up to 750,000 shares of common stock of TIL at a fixed price of $10 per share. Alternatively, if the shares of TIL’s common stock trade on a National Stock Exchange or

over-the-counter market denominated in Norwegian Kroner, the Company may also exercise the stock purchase warrant at 61.67 Norwegian Kroner (or NOK) per share. The stock purchase warrant expires on January 23, 2019. For purposes of

vesting, the stock purchase warrant is divided into four equally sized tranches. If the shares of TIL’s common stock trade on a National Stock Exchange or over-the-counter market denominated in Norwegian Kroner, each tranche will vest and

become exercisable when and if the fair market value of a share of the TIL common stock equals or exceeds 77.08 NOK, 92.50 NOK, 107.91 NOK and 123.33 NOK, respectively, for such tranche for any ten consecutive trading days, subject to certain

trading value requirements. As at March 31, 2015, the fair value of the stock purchase warrant was $4.6 million, which is reflected as a derivative asset on the Company’s consolidated balance sheet. The stock purchase warrant had an

initial value of $3.4 million on issuance in January 2014 and such amount is reflected in the other income (expenses) in the Company’s 2014 consolidated statements of income. During the three months ended March 31, 2015, the Company

recognized an unrealized loss of $40 thousand relating to the changes in the value of the warrant. Unrealized gains and losses are reflected in realized and unrealized (loss) gain on derivative instruments in the Company’s consolidated

statements of income.

9

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

| 6. |

Other Long-Term Liabilities |

The Company recognizes freight tax expense in other income in its consolidated statements of income. The Company does not

presently anticipate its uncertain tax positions will significantly increase or decrease in the next 12 months; however, actual developments could differ from those currently expected.

The following is a roll-forward of the Company’s freight tax expense which is recorded in its consolidated balance sheet

in other long-term liabilities:

|

|

|

|

|

|

|

|

|

| |

|

As at

March 31, 2015

$ |

|

|

As at

March 31, 2014

$ |

|

| Balance at the beginning of the period |

|

|

4,852 |

|

|

|

5,351 |

|

| Freight tax expense |

|

|

10 |

|

|

|

54 |

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

|

4,862 |

|

|

|

5,405 |

|

|

|

|

|

|

|

|

|

|

| |

a. |

Fair Value Measurements |

For a description of how the Company estimates fair value and for a description of the fair value hierarchy levels, see Note 11

to the Company’s audited consolidated financial statements filed with its Annual Report on the Form 20-F for the year ended December 31, 2014.

The following table includes the estimated fair value and carrying value of those assets and liabilities that are measured at

fair value on a recurring and non-recurring basis as well as the estimated fair value of the Company’s financial instruments that are not accounted for at the fair value on a recurring basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

March 31, 2015 |

|

|

December 31, 2014 |

|

| |

|

Fair Value

Hierarchy

Level |

|

Carrying

Amount Asset /

(Liability)

$ |

|

|

Fair Value

Asset /

(Liability)

$ |

|

|

Carrying

Amount Asset /

(Liability)

$ |

|

|

Fair Value

Asset /

(Liability)

$ |

|

| Recurring: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

Level 1 |

|

|

40,513 |

|

|

|

40,513 |

|

|

|

162,797 |

|

|

|

162,797 |

|

| Derivative instruments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate swap agreements |

|

Level 2 |

|

|

(17,306 |

) |

|

|

(17,306 |

) |

|

|

(18,225 |

) |

|

|

(18,225 |

) |

| Stock purchase warrant |

|

Level 3 |

|

|

4,617 |

|

|

|

4,617 |

|

|

|

4,657 |

|

|

|

4,657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan to joint venture |

|

Note (1) |

|

|

14,980 |

|

|

|

Note (1) |

|

|

|

14,980 |

|

|

|

Note (1) |

|

| Long-term debt, including current portion |

|

Level 2 |

|

|

(711,916 |

) |

|

|

(678,378 |

) |

|

|

(656,063 |

) |

|

|

(617,761 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) |

The Company’s loan to the High-Q joint venture and the Company’s equity investment in the joint venture are included in the carrying

value of the Company’s interest in equity accounted investments in these consolidated financial statements. The fair value of the individual components of such aggregate interest as at March 31, 2015 and December 31, 2014 was not

determinable. |

Changes in fair value during the three months ended March 31, 2015 and 2014 for the

Company’s derivative instrument, the TIL stock purchase warrant, which is described below and is measured at fair value on the recurring basis using significant unobservable inputs (Level 3), are as follows:

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31, 2015

$ |

|

|

March 31, 2014

$ |

|

| Fair value at the beginning of the period |

|

|

4,657 |

|

|

|

— |

|

| Fair value on issuance |

|

|

— |

|

|

|

3,420 |

|

| Unrealized (loss) gain included in earnings |

|

|

(40 |

) |

|

|

2,437 |

|

|

|

|

|

|

|

|

|

|

| Fair value at the end of the period |

|

|

4,617 |

|

|

|

5,857 |

|

|

|

|

|

|

|

|

|

|

10

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

During January 2014, the Company received a stock purchase warrant entitling

it to purchase up to 750,000 shares of the common stock of TIL (see note 5). The estimated fair value of the stock purchase warrant was determined using a Monte-Carlo simulation and is based, in part, on the historical price of common shares of TIL,

the risk-free interest rate, vesting conditions and the historical volatility of comparable companies. The estimated fair value of the stock purchase warrant as of March 31, 2015 is based on the historical volatility of comparable companies of

61.58%. A higher or lower volatility would result in a higher or lower fair value of this derivative asset.

The following table contains a summary of the Company’s financing receivables by type and the method by which the Company

monitors the credit quality of its financing receivables on a quarterly basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Class of Financing Receivable |

|

Credit Quality Indicator |

|

Grade |

|

March 31, 2015

$ |

|

|

December 31, 2014

$ |

|

| Advances to equity accounted investments |

|

Other internal metrics |

|

Performing |

|

|

14,980 |

|

|

|

14,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,980 |

|

|

|

14,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8. |

Capital Stock and Stock-Based Compensation |

The authorized capital stock of the Company at March 31, 2015 and December 31, 2014 was 100,000,000 shares of

preferred stock, with a par value of $0.01 per share, 200,000,000 shares of Class A common stock, with a par value of $0.01 per share, and 100,000,000 shares of Class B common stock, with a par value of $0.01 per share. A share of Class A

common stock entitles the holder to one vote per share while a share of Class B common stock entitles the holder to five votes per share, subject to a 49% aggregate Class B common stock voting power maximum. As of March 31, 2015, the Company

had 98.5 million shares of Class A common stock (December 31, 2014 – 95.3 million), 16.7 million shares of Class B common stock (December 31, 2014 – 16.7 million) and no shares of preferred stock (December 31, 2014 –

nil) issued and outstanding.

In January 2015, the Company issued 3 million shares of its Class A common stock

for net proceeds of $13.7 million upon the exercise by the underwriters of their options to purchase additional shares in connection with the Company’s December 2014 public offering. In March 2015, a total of 38,961 shares of Class A

common stock, with an aggregate value of $0.2 million, were granted to the Company’s non-management directors as part of their annual compensation for 2015. These Class A common stock were issued from the 4,000,000 shares of Class A

common stock reserved under the Teekay Tankers Ltd. 2007 Long-Term Incentive Plan and distributed to the directors.

The

Company also grants stock options and restricted stock units as incentive-based compensation under the Teekay Tankers Ltd. 2007 Long-Term Incentive Plan to certain non-management directors of the Company and to certain employees of Teekay

subsidiaries that provide services to the Company. The Company measures the cost of such awards using the grant date fair value of the award and recognizes that cost, net of estimated forfeitures, over the requisite service period. The requisite

service period consists of the period from the grant date of the award to the earlier of the date of vesting or the date the recipient becomes eligible for retirement. For stock-based compensation awards subject to graded vesting, the Company

calculates the value for the award as if it was one single award with one expected life and amortizes the calculated expense for the entire award on a straight-line basis over the requisite service period. The compensation cost of the Company‘s

stock-based compensation awards is reflected in general and administrative expenses in the Company’s consolidated statements of income.

During March 2015, the Company granted 58,434 stock options with an exercise price of $5.39 per share to an officer of the

Company. Each stock option granted in March 2015 has a ten-year term and vests equally over three years from the grant date.

The weighted-average grant-date fair value of the stock options granted was $1.97 per option, estimated on the grant date

using the Black-Scholes option pricing model. The following assumptions were used in computing the fair value of the stock options granted: expected volatility of 49.0%; expected life of five years; dividend yield of 2.09%; and risk-free interest

rate of 1.38%. The expected life of the stock options granted was estimated using the historical exercise behavior of employees of Teekay that receive stock options from Teekay. The expected volatility was based on historical volatility as

calculated using historical data during the five years prior to the grant date.

During March 2015, the Company also

granted 187,746 restricted stock units to the officers of the Company and certain employees of Teekay subsidiaries that provide services to the Company with an aggregate fair value of $1.0 million. Each restricted stock unit is equal to one share of

the Company’s common shares plus reinvested distributions from the grant date to the vesting date. The restricted stock units vest equally over three years from the grant date. Any portion of a restricted stock unit award that is not vested on

the date of the recipient’s termination of service is cancelled, unless their termination arises as a result of the recipient’s retirement and, in this case, the restricted stock unit award will continue to vest in accordance with the

vesting schedule. Upon vesting, the value of the restricted stock unit awards, net of withholding taxes, is paid to each recipient in the form of common shares.

During the three months ended March 31, 2015, the Company recorded $0.7 million of expenses related to the restricted

stock units and stock options. During the three months ended March 31, 2015, a total of 203,100 restricted stock units with a market value of $1.2 million vested and that amount was paid to the grantees by issuing 119,311 shares of Class A

common stock, net of withholding taxes.

11

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

| 9. |

Related Party Transactions |

| |

a. |

Teekay and its wholly-owned subsidiary Teekay Tankers Management Services Ltd., which is the Company’s manager (or the Manager),

provide commercial, technical, strategic and administrative services to the Company. In addition, certain of the Company’s vessels participate in pooling arrangements that are managed in whole or in part by subsidiaries of Teekay (collectively

the Pool Managers). For additional information about these arrangements, please read “Item 7 – Major Shareholders and Related Party Transactions – Related Party Transactions” in our Annual Report on Form 20-F for the year

ended December 31, 2014. Amounts received and paid by the Company for such related party transactions for the periods indicated were as follows: |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31, 2015

$ |

|

|

March 31, 2014

$ |

|

| Time-charter revenues (i) |

|

|

— |

|

|

|

3,631 |

|

| Pool management fees and commissions (ii) |

|

|

(2,392 |

) |

|

|

(1,012 |

) |

| Commercial management fees (iii) |

|

|

(203 |

) |

|

|

(253 |

) |

| Vessel operating expenses - technical management fee (iv) |

|

|

(1,500 |

) |

|

|

(1,398 |

) |

| Strategic and administrative service fees |

|

|

(1,942 |

) |

|

|

(2,169 |

) |

| |

(i) |

The Company chartered-out the Pinnacle Spirit and the Summit Spirit to Teekay under fixed-rate time-charter contracts, which expired

in November and December of 2014, respectively. |

| |

(ii) |

The Company’s share of the Pool Managers’ fees that are reflected as a reduction to net pool revenues from affiliates on the

Company’s consolidated statements of income. |

| |

(iii) |

The Manager’s commercial management fees for vessels on time-charter out contracts and spot-traded vessels not included in the pool, which are

reflected in voyage expenses on the Company’s consolidated statements of income. |

| |

(iv) |

The cost of ship management services provided by the Manager has been presented as vessel operating expenses. |

| |

b. |

The Manager and other subsidiaries of Teekay collect revenues and remit payments for expenses incurred by the Company’s vessels. Such amounts,

which are presented on the Company’s consolidated balance sheets in due from affiliates or due to affiliates, are without interest or stated terms of repayment. The amounts owing from the Pool Managers for monthly distributions are reflected in

the consolidated balance sheets as pool receivables from affiliates, are without interest and are repayable upon the terms contained within the applicable pool agreement. The Company had also advanced $38.0 million and $36.2 million as at

March 31, 2015 and December 31, 2014, respectively, to the Pool Managers for working capital purposes. These amounts, which are reflected in the consolidated balance sheets in due from affiliates, are without interest and are repayable

when applicable vessels leave the pools. |

| |

c. |

On August 1, 2014, the Company purchased from Teekay a 50% interest in TTOL, which owns conventional tanker commercial management and

technical management operations, including the direct ownership in three commercially managed tanker pools, for an aggregate price of approximately $23.7 million, including $6.7 million in net working capital (see note 3c). |

Basic earnings per share is computed based on the weighted average number of shares of common stock outstanding during the

period. Diluted earnings per share is computed based on the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period using the treasury stock method. The components of basic

and diluted earnings per share are as follows:

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31, 2015

$ |

|

|

March 31, 2014

$ |

|

| Net income |

|

|

38,985 |

|

|

|

26,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares - basic |

|

|

115,044,039 |

|

|

|

83,617,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dilutive effect of stock-based awards |

|

|

588,996 |

|

|

|

355,764 |

|

| Weighted average number of common shares - diluted |

|

|

115,633,035 |

|

|

|

83,973,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

| - Basic |

|

|

0.34 |

|

|

|

0.32 |

|

| - Diluted |

|

|

0.34 |

|

|

|

0.31 |

|

12

TEEKAY TANKERS LTD.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(all tabular amounts stated in thousands of U.S. dollars, other than share or per share data)

| 11. |

Shipbuilding Contracts |

On April 8, 2013, the Company entered into agreements with STX Offshore & Shipbuilding Co., Ltd (or STX)

of South Korea to construct four, fuel-efficient 113,000 dead-weight tonne Long Range 2 (or LR2) product tanker newbuildings plus options to order up to an additional 12 vessels. The payment of the Company’s first shipyard installment

was contingent on the Company receiving acceptable refund guarantees for the shipyard installment payments. In May 2013, STX commenced a voluntary financial restructuring with its lenders, and as a result, STX’s refund guarantee applications

were temporarily suspended. In October and November 2013, the Company exercised its options to order eight additional newbuildings, in aggregate, under option agreements relating to the original STX LR2 shipbuilding agreements signed in April 2013.

STX did not produce shipbuilding contracts within the specified timeframe of the option declarations and informed the Company that there was no prospect of the refund guarantees being provided under any of the firm or option agreements. Therefore,

STX is in breach of the option agreements. In December 2013, the Company terminated the newbuilding agreements and in February 2014, the Company terminated the option agreements. In February 2014, the Company commenced a legal action against STX for

damages. In November 2014, the Company placed $0.6 million in an escrow account as cash security pending the resolution of this matter. These funds are classified as cash and cash equivalents in the Company’s consolidated balance sheet as of

March 31, 2015 and December 31, 2014.

| 12. |

Restructuring Charges |

During the three months ended March 31, 2015, the Company incurred $5.3 million of restructuring costs which related to

the termination of the employment of certain seafarers upon the expiration of a time-charter out contract. This charge is 100% recoverable from the customer and is reflected in other revenues on the Consolidated Statements of Income.

At March 31, 2015, $1.5 million of restructuring liabilities were owed to seafarers and are recorded in accrued

liabilities on the consolidated balance sheet and $1.5 million of receivables are recoverable from the customer and are recorded in accounts receivable on the consolidated balance sheet.

13

TEEKAY TANKERS LTD.

MARCH 31, 2015

PART I

– FINANCIAL INFORMATION

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read

in conjunction with the consolidated financial statements and accompanying notes contained in Item 1 – Financial Statements of this Report on Form 6-K and with our audited consolidated financial statements contained in Item 18

– Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 5 – Operating and Financial Review and Prospects of our Annual Report on Form 20-F for the year ended

December 31, 2014.

General

Our

business is to own crude oil and product tankers and we employ a chartering strategy that seeks to capture upside opportunities in the tanker spot market while using fixed-rate time charters to reduce downside risks. As of March 31, 2015, a

total of seven of our vessels operated under fixed-rate time-charter out contracts, one of our vessels and one in-chartered vessel operated in the spot market, one in-chartered vessel has been offhire since early January 2015 and 24 of our vessels

and eight in-chartered vessels operated in the spot market in pooling arrangements, a majority of which are managed in whole or in part by subsidiaries of Teekay Corporation (or Teekay). As at March 31, 2015, our fleet was comprised of

the following vessels:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Owned

Vessels (1) |

|

|

Chartered-

in Vessels (2) |

|

|

Total |

|

| Fixed-rate: |

|

|

|

|

|

|

|

|

|

|

|

|

| Aframax Tankers |

|

|

7 |

|

|

|

— |

|

|

|

7 |

|

| VLCC Tankers(3) |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Fixed-Rate Fleet(4) |

|

|

8 |

|

|

|

— |

|

|

|

8 |

|

| Spot-rate: |

|

|

|

|

|

|

|

|

|

|

|

|

| Suezmax Tankers |

|

|

10 |

|

|

|

— |

|

|

|

10 |

|

| Aframax Tankers(5) |

|

|

5 |

|

|

|

8 |

|

|

|

13 |

|

| LR2 Product Tankers(6) |

|

|

7 |

|

|

|

2 |

|

|

|

9 |

|

| MR Product Tankers(7) |

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

| Total Spot Fleet(8) |

|

|

25 |

|

|

|

10 |

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Teekay Tankers Fleet |

|

|

33 |

|

|

|

10 |

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1. |

Vessels owned by Tanker Investments Ltd. (or TIL), in which we have a minority equity interest are excluded from the fleet list.

|

| 2. |

In addition to the in-chartered vessels included in the table, in January and February 2015, we entered into agreements to in-charter one

additional Aframax tanker which was delivered in April 2015 and one additional LR2 product tanker which is expected to deliver before the end of June 2015. |

| 3. |

Very Large Crude Carrier (or VLCC) owned through a 50/50 joint venture. |

| 4. |

Three time-charter out contracts are scheduled to expire in 2015 and four in 2016, including one Aframax tanker currently in dry dock and is

expected to start its out-charter agreement, which is scheduled to expire in 2016. |

| 5. |

Eight Aframax tankers are currently time-chartered in for periods from 12 to 33 months, four of these periods end during 2015, three in 2016 and

one in 2017; some of these contracts include options to extend at escalating rates. One of the in-chartered tankers has been off-hire since early January 2015. |

| 6. |

Long Range 2 (or LR2) product tankers. Two LR2 tankers are currently time-chartered in for a period of 12 months ending in 2015; all of

these contracts have options to extend at escalating rates. |

| 7. |

Medium Range (or MR) product tankers. |

| 8. |

As at March 31, 2015, the five vessel class pooling arrangements in which we participate were comprised of a total of 25 Suezmax tankers, 37

Aframax tankers, 16 LR2 tankers and 42 MR tankers, respectively, including vessels owned by other pool members. |

Significant

Developments in 2015

Additional Time Chartered-in Vessels

During the three months ended March 31, 2015, we entered into new in-charter contracts for one Aframax tanker and one LR2 product tanker.

The Aframax tanker was delivered in April 2015 and the LR2 tanker is expected to deliver to us before the end of June 2015. These contracts will bring our total number of time chartered-in vessels to 12 and will increase our exposure to the spot

market.

14

Time Charter-Out Vessel

In April 2015, Teekay Tankers entered into a time charter-out contract for one Aframax vessel. The new time charter-out contract has a daily

rate of $24,000 and a firm contract period of 12 months.

New Fleet Deliveries

During the three months ended March 31, 2015, we acquired four modern LR2 product tankers and one Aframax tanker for an aggregate price of

$230.3 million. Three of the vessels were delivered in February while the remaining two vessels were delivered in March. All four LR2 product tankers are trading in the Taurus LR2 pool and the Aframax tanker is on voyage charter until vetting

inspections are completed for joining the Aframax RSA.

New Loan Facility

In January 2015, we secured a new loan facility of $126.6 million which matures on January 29, 2016. The loan facility is secured by the

four LR2 product tankers and one Aframax tanker which we acquired during the quarter ended March 31, 2015 and has a variable interest rate of LIBOR plus a margin of 2.50% to 2.80%. Repayments are to be made in four equal quarterly installments

of $3.0 million with a balloon repayment due at maturity.

Potential Fleet Acquisition Status

In December 2014, we announced that we were in preliminary discussions for an acquisition of a company that would more than double the number

of vessels comprising our fleet. Discussions regarding that potential transaction have ceased and we are no longer pursuing that opportunity.

Results

of Operations

There are a number of factors that should be considered when evaluating our historical financial performance and

assessing our future prospects, and we use a variety of financial and operational terms and concepts when analyzing our results of operations. These can be found in Item 5 – Operating and Financial Review and Prospects in our Annual Report

on Form 20-F for the year ended December 31, 2014.

In accordance with GAAP, we report gross revenues in our consolidated statements

of income and include voyage expenses among our operating expenses. However, ship-owners base economic decisions regarding the deployment of their vessels upon anticipated “time-charter equivalent” (or TCE) rates, which represent

net revenues (or revenue less voyage expenses) divided by revenue days, and industry analysts typically measure bulk shipping freight rates in terms of TCE rates. This is because under time-charter out contracts the customer usually pays the voyage

expenses, while under voyage charters the ship-owner usually pays the voyage expenses, which typically are added to the hire rate at an approximate cost. Accordingly, the discussion of revenue below focuses on net revenues and TCE rates where

applicable.

Three Months Ended March 31, 2015 versus Three Months Ended March 31, 2014

The following table presents our operating results for the three months ended March 31, 2015 and 2014, and compares net revenues, a

non-GAAP financial measure, for those periods to revenues, the most directly comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| (in thousands of U.S. dollars) |

|

March 31, 2015 |

|

|

March 31, 2014 |

|

| Revenues |

|

|

103,878 |

|

|

|

52,641 |

|

| Interest income from investment in term loans |

|

|

— |

|

|

|

9,118 |

|

| Less: Voyage expenses |

|

|

(3,834 |

) |

|

|

(1,439 |

) |

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

100,044 |

|

|

|

60,320 |

|

|

|

|

| Vessel operating expenses |

|

|

(22,441 |

) |

|

|

(22,794 |

) |

| Time-charter hire expense |

|

|

(15,003 |

) |

|

|

(1,052 |

) |

| Depreciation and amortization |

|

|

(13,672 |

) |

|

|

(12,502 |

) |

| General and administrative |

|

|

(3,300 |

) |

|

|

(3,192 |

) |

| Restructuring charge |

|

|

(5,324 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

40,304 |

|

|

|

20,780 |

|

|

|

|

| Interest expense |

|

|

(2,365 |

) |

|

|

(2,347 |

) |

| Interest income |

|

|

31 |

|

|

|

138 |

|

| Realized and unrealized (loss) gain on derivative instruments |

|

|

(1,587 |

) |

|

|

1,644 |

|

| Equity income |

|

|

2,582 |

|

|

|

2,594 |

|

| Other income |

|

|

20 |

|

|

|

3,623 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

38,985 |

|

|

|

26,432 |

|

15

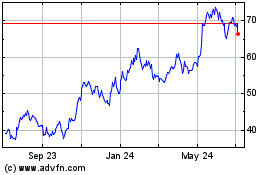

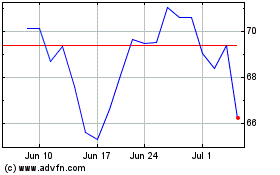

Tanker Market

The positive momentum in crude tanker spot rates during the fourth quarter of 2014 continued into the first quarter of 2015, with rates

reaching the highest average first quarter levels since 2008. The strength in crude tanker spot rates was primarily a result of continued low global oil prices, high crude oil supply and winter weather delays. Low global oil prices and high crude

oil supply have positively impacted tanker rates in a number of ways, including the following:

| |

• |

|

Lower oil prices are driving onshore strategic and commercial stockpiling, particularly in China where the government continues to fill the second

stage of its Strategic Petroleum Reserves; |

| |

• |

|

Refinery throughput has remained high as refiners take advantage of strong refining margins; and |

| |

• |

|

Reduced bunker fuel prices have been positive for tanker earnings due to lower voyage operating costs. |

Crude tanker rates have been counter-seasonally strong in the first half of the second quarter of 2015 due to increased oil demand which has

resulted from ongoing low oil prices, record-high Saudi Arabian oil production, and a relatively light refinery maintenance schedule as refiners defer scheduled maintenance to take advantage of strong refining margins.

LR2 product tanker rates in the first quarter of 2015 averaged the highest for a first quarter since 2006. LR2 product tanker rates have been

supported by the ramp up of new refineries in the Middle East, which has encouraged long-haul product exports, while Asian naphtha imports remain historically strong. Low oil prices continue to put downward pressure on naphtha prices in relation to

liquefied petroleum gas (or LPG), which has led some petrochemical plants to consume naphtha rather than LPG for feedstock purposes.

The global tanker fleet grew by 3.3 million deadweight tonnes (or mdwt), or 0.7%, in the first quarter of 2015. The global Suezmax

fleet grew by four vessels, or 0.8%, while the uncoated Aframax fleet grew by only one vessel, or 0.2%, and the LR2 fleet grew by 0.8 mdwt, or 2.8%. Looking ahead, the global tanker fleet is forecast to grow 1.5 to 2.5% in 2015, with growth again

weighted towards the product tanker sectors. Another year of negative fleet growth is expected for the Suezmax and uncoated Aframax sectors in 2015.

In April 2015, the International Monetary Fund (or IMF) held its outlook for 2015 global economic growth at 3.5%, consistent with its

January 2015 forecast. This marks a modest improvement from global economic growth of 3.4% in 2014. Based on an average of forecasts from the International Energy Agency, the Energy Information Administration, and OPEC, global oil demand is forecast

to grow by 1.1 million barrels day (or mb/d) in 2015, which is 0.3 mb/d higher than demand growth in 2014.

The outlook for

crude tanker fleet utilization and spot tanker rates is expected to remain positive in 2015 based on a shrinking mid-size crude tanker fleet and a continued increase in long-haul tanker demand as more crude oil moves from the Atlantic to Pacific

basin. The impact of low prices is also expected to provide support for tanker demand in the first half of 2015.

Fleet and TCE Rates

As at March 31, 2015, we owned 32 double-hulled conventional oil and product tankers, time-chartered in eight Aframax and two LR2 vessels

from third parties, and owned a 50% interest in one VLCC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, 2015 |

|

|

Three Months Ended March 31, 2014 |

|

| |

|

Net Revenues (1) (2) |

|

|

Revenue

Days |

|

|

Average TCE

per Revenue

Day |

|

|

Net Revenues (3) (4) |

|

|

Revenue

Days |

|

|

Average TCE

per Revenue

Day |

|

| |

|

(in thousands) |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Voyage-charter contracts - Suezmax |

|

$ |

35,227 |

|

|

|

893 |

|

|

$ |

39,433 |

|

|

$ |

19,227 |

|

|

|

685 |

|

|

$ |

28,079 |

|

| Voyage-charter contracts - Aframax |

|

$ |

31,573 |

|

|

|

1,060 |

|

|

$ |