FORM 6 – K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report on Foreign Issuer

Pursuant to Rule 13a – 16 or 15d – 16

of the Securities Exchange Act of 1934

For the Month of May, 2015

Gilat Satellite Networks Ltd.

(Translation of Registrant’s Name into English)

Gilat House, Yegia Kapayim Street

Daniv Park, Kiryat Arye, Petah Tikva, Israel

(Address of Principal Corporate Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Attached hereto is Registrant’s press release dated May 20, 2015, announcing Gilat’s First Quarter 2015 results.

We consent to the incorporation by reference of the GAAP financial information included herein, in the Registration Statements on Form F-3 (Registration No. 333-195680) and the Registration Statements on Form S-8 (Registration Nos. 333-113932, 333-123410, 333-132649, 333-158476, 333-180552 and 333-187021).

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Gilat Satellite Networks Ltd.

|

|

| |

|

|

|

|

|

By:

|

/s/ Ran Tal |

|

| |

|

Ran Tal

|

|

| |

|

VP General Counsel

|

|

Gilat Announces First Quarter 2015 Results

Management reiterates financial objectives for FY2015

with a strong second half of the year expected, in comparison to a slow first half

Petah Tikva, Israel – May 20, 2015 – Gilat Satellite Networks Ltd. (NASDAQ, TASE: GILT), a worldwide leader in satellite networking technology, solutions and services, today reported its results for the first quarter ended March 31, 2015.

Key Financial Updates:

|

|

·

|

Revenues for the first quarter of 2015 were $45.2 million compared to $50.9 million in the comparable period of 2014.

|

|

|

·

|

EBITDA for the first quarter of 2015 was $0.2 million compared to $2.8 million in the comparable period of 2014.

|

|

|

·

|

Management objectives for 2015: continued growth to revenues between $250 to $260 million and EBITDA between $26 to $28 million

|

Revenues for the first quarter of 2015 were $45.2 million, compared to $50.9 million for the same period in 2014.

On a non-GAAP basis, operating loss was $2.1 million in the first quarter of 2015 as compared to an operating income of $0.5 million in the comparable quarter of 2014.

On a GAAP basis, operating loss was $4.0 million in the first quarter of 2015 as compared to an operating loss of $1.5 million in the comparable quarter of 2014.

On a non-GAAP basis, net loss for the quarter was $3.7 million or $0.09 per diluted share compared to net loss of $0.6 million or $0.01 per diluted share in the same quarter of 2014.

On a GAAP basis, net loss for the quarter was $5.6 million or a loss of $0.13 per diluted share compared to a net loss of $2.7 million or a loss of $0.06 per diluted share in the same quarter of 2014.

EBITDA for the first quarter of 2015 reached $0.2 million compared with $2.8 million in the comparable period in 2014.

“We reiterate our management objectives for FY2015 of a revenue target of $250 - $260 million and an EBITDA target of $26 - $28 million. As we expect, the second half of 2015 will be significantly stronger than the first half,” said Dov Baharav, Interim CEO and Chairman of the Board of Gilat.

“We were pleased to see progress in our strategy of extending broadband internet in rural areas in the first quarter, with the significant award of Peru’s Fitel project. We expect this project to contribute to our growth in 2015 and even more so in 2016. Moreover, we see positive momentum in HTS with a number of new deals, such as JCP in Brazil and in Cellular Backhaul with RuralCom in Canada and others.”

“Looking forward, I am confident that we will see top- and bottom-line growth in 2015, and, given our recent wins, we can expect additional growth in 2016,” Dov Baharav added.

Key Recent Announcements:

|

|

·

|

Gilat Awarded $285 Million Regional Telecommunications Infrastructure Project by Peru’s Fitel

|

|

|

·

|

Gilat's HTS VSAT Network Goes Live at JCP, BRASTRADING’s Telecommunications Subsidiary in Brazil

|

|

|

·

|

Gilat Partners with Intelsat to Enable Rapid Deployment and High Quality 2G/3G Cellular Connectivity to Underserved Regions of the World

|

|

|

·

|

Cellular Carrier RuralCom Selects Gilat as Prime Network Contractor for its Alaska Highway and BC Coast Networks

|

Conference Call and Webcast Details:

Gilat management will host a conference call today at 13:30 GMT / 09:30 EDT / 16:30 IDT to discuss the results. International participants are invited to access the call at (972)3-925-5943, and US-based participants are invited to access the call by dialing (1)866-500-4953. A replay of the conference call will be available beginning at approximately 16:00 GMT/ 12:00 EDT/ 19:00 IDT today, until 16:00 GMT/ 12:00 EDT/ 19:00 IDT May 22, 2015. A replay of the call may also be accessed as a webcast via Gilat’s website at www.gilat.com and will be archived for 30 days.

Notes:

(1) The attached summary financial statements were prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). The attached summary financial statements are unaudited. To supplement the consolidated financial statements presented in accordance with GAAP, the Company presents Gilat's EBITDA before the impact of non-cash share-based payment charges, depreciation and amortization, other income and other costs related to acquisition transactions. Non-GAAP presentations of net income, operating income, EBITDA and earnings per share are provided to enhance the understanding of the Company's historical financial performance and comparability between periods.

(2) Operating income before depreciation, amortization, non-cash stock option expenses as per ASC 718 (formerly SFAS 123(R)) and other costs related to acquisition transactions ('EBITDA') is presented because it is a measure commonly used and is presented solely in order to improve the understanding of the Company's operating results and to provide further perspective on these results. EBITDA, however, should not be considered as an alternative to operating income or net income for the period as an indicator of the operating performance of the Company.

Similarly, EBITDA should not be considered as an alternative to cash flows from operating activities as a measure of liquidity. EBITDA is not a measure of financial performance under generally accepted accounting principles and may not be comparable to other similarly titled measures for other companies. EBITDA may not be indicative of the historic operating results of the Company; nor is it meant to be predictive of potential future results. Reconciliation between the Company's Operating income and EBITDA is presented in the attached summary financial statements.

About Gilat

Gilat Satellite Networks Ltd (NASDAQ, TASE: GILT) is a leading provider of products and services for satellite-based broadband communications. Gilat develops and markets a wide range of high-performance satellite ground segment equipment and VSATs, with an increasing focus on the consumer and Ka-band market. In addition, Gilat enables mobile SOTM (Satellite-on-the-Move) solutions providing low-profile antennas, next generation solid-state power amplifiers and modems. Gilat also provides managed network and satellite-based services for rural telephony and Internet access via its subsidiaries in Peru and Colombia.

With over 25 years of experience, and over a million products shipped to more than 90 countries, Gilat has provided enterprises, service providers and operators with efficient and reliable satellite-based connectivity solutions, including cellular backhaul, banking, retail, e-government and rural communication networks. Gilat also enables leading defense, public security and news organizations to implement advanced, on-the-move tactical communications on board their land, air and sea fleets using Gilat's high-performance SOTM solutions. Gilat’s controlling shareholders are the FIMI Private Equity Funds. For more information, please visit us at www.gilat.com

Certain statements made herein that are not historical are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. The words "estimate", "project", "intend", "expect", "believe" and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties. Many factors could cause the actual results, performance or achievements of Gilat to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, changes in general economic and business conditions, inability to maintain market acceptance to Gilat's products, inability to timely develop and introduce new technologies, products and applications, rapid changes in the market for Gilat's products, loss of market share and pressure on prices resulting from competition, introduction of competing products by other companies, inability to manage growth and expansion, loss of key OEM partners, inability to attract and retain qualified personnel, inability to protect the Company's proprietary technology and risks associated with Gilat's international operations and its location in Israel. For additional information regarding these and other risks and uncertainties associated with Gilat's business, reference is made to Gilat's reports filed from time to time with the Securities and Exchange Commission.

Contact:

Gilat Satellite Networks

Joelle Inowlocki

JoelleI@gilat.com

KCSA Strategic Communications

Phil Carlson, Vice President

(212) 896-1233

pcarlson@kcsa.com

| |

|

|

|

|

|

| GILAT SATELLITE NETWORKS LTD. |

|

|

|

|

| CONDENSED CONSOLIDATED BALANCE SHEET |

|

|

|

|

| US dollars in thousands |

|

|

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

30,365 |

|

|

|

27,726 |

|

|

Restricted cash

|

|

|

13,900 |

|

|

|

25,983 |

|

|

Restricted cash held by trustees

|

|

|

3,680 |

|

|

|

15,441 |

|

|

Trade receivables, net

|

|

|

55,900 |

|

|

|

57,728 |

|

|

Inventories

|

|

|

29,003 |

|

|

|

25,112 |

|

|

Other current assets

|

|

|

12,324 |

|

|

|

14,760 |

|

|

Total current assets

|

|

|

145,172 |

|

|

|

166,750 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM INVESTMENTS AND RECEIVABLES:

|

|

|

|

|

|

|

|

|

|

Long-term restricted cash

|

|

|

191 |

|

|

|

216 |

|

|

Severance pay funds

|

|

|

7,900 |

|

|

|

8,085 |

|

|

Other long term receivables

|

|

|

10,450 |

|

|

|

12,124 |

|

|

Total long-term investments and receivables

|

|

|

18,541 |

|

|

|

20,425 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET

|

|

|

89,046 |

|

|

|

90,893 |

|

| |

|

|

|

|

|

|

|

|

|

INTANGIBLE ASSETS, NET

|

|

|

21,505 |

|

|

|

22,970 |

|

| |

|

|

|

|

|

|

|

|

|

GOODWILL

|

|

|

63,870 |

|

|

|

63,870 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

338,134 |

|

|

|

364,908 |

|

| |

|

|

|

|

|

| GILAT SATELLITE NETWORKS LTD. |

|

|

|

|

| CONDENSED CONSOLIDATED BALANCE SHEET |

|

|

|

|

| US dollars in thousands |

|

|

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

Short-term bank credit and loans

|

|

|

4,720 |

|

|

|

15,857 |

|

|

Current maturities of long-term loans

|

|

|

4,528 |

|

|

|

4,595 |

|

|

Trade payables

|

|

|

22,321 |

|

|

|

22,850 |

|

|

Accrued expenses

|

|

|

19,816 |

|

|

|

22,475 |

|

|

Short-term advances from customers, held by trustees

|

|

|

6,989 |

|

|

|

12,858 |

|

|

Other current liabilities

|

|

|

25,410 |

|

|

|

21,527 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

83,784 |

|

|

|

100,162 |

|

| |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accrued severance pay

|

|

|

7,872 |

|

|

|

8,157 |

|

|

Long-term loans, net of current maturities

|

|

|

21,875 |

|

|

|

26,271 |

|

|

Other long-term liabilities

|

|

|

4,937 |

|

|

|

5,179 |

|

| |

|

|

|

|

|

|

|

|

|

Total long-term liabilities

|

|

|

34,684 |

|

|

|

39,607 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

EQUITY:

|

|

|

|

|

|

|

|

|

|

Share capital - ordinary shares of NIS 0.2 par value

|

|

|

1,982 |

|

|

|

1,966 |

|

|

Additional paid-in capital

|

|

|

877,932 |

|

|

|

876,624 |

|

|

Accumulated other comprehensive loss

|

|

|

(2,611 |

) |

|

|

(1,420 |

) |

|

Accumulated deficit

|

|

|

(657,637 |

) |

|

|

(652,031 |

) |

| |

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

219,666 |

|

|

|

225,139 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY

|

|

|

338,134 |

|

|

|

364,908 |

|

|

GILAT SATELLITE NETWORKS LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

FOR COMPARATIVE PURPOSES

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. dollars in thousands (except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended |

|

|

Three months ended |

|

| |

|

|

31 March 2015 |

|

|

31 March 2014 |

|

| |

|

|

GAAP

|

|

|

Adjustments (1)

|

|

|

Non-GAAP

|

|

|

GAAP

|

|

|

Adjustments (1)

|

|

|

Non-GAAP

|

|

| |

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

45,190 |

|

|

|

- |

|

|

|

45,190 |

|

|

|

50,851 |

|

|

|

- |

|

|

|

50,851 |

|

|

Cost of revenues

|

|

|

31,998 |

|

|

|

(1,251 |

) |

|

|

30,747 |

|

|

|

30,876 |

|

|

|

(1,267 |

) |

|

|

29,609 |

|

|

Gross profit

|

|

|

|

13,192 |

|

|

|

1,251 |

|

|

|

14,443 |

|

|

|

19,975 |

|

|

|

1,267 |

|

|

|

21,242 |

|

| |

|

|

|

29 |

% |

|

|

|

|

|

|

32 |

% |

|

|

39 |

% |

|

|

|

|

|

|

42 |

% |

|

Research and development expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses incurred

|

|

|

6,534 |

|

|

|

(110 |

) |

|

|

6,424 |

|

|

|

7,239 |

|

|

|

(122 |

) |

|

|

7,117 |

|

|

Less - grants

|

|

|

|

190 |

|

|

|

- |

|

|

|

190 |

|

|

|

354 |

|

|

|

- |

|

|

|

354 |

|

| |

|

|

|

6,344 |

|

|

|

(110 |

) |

|

|

6,234 |

|

|

|

6,885 |

|

|

|

(122 |

) |

|

|

6,763 |

|

|

Selling and marketing expenses

|

|

|

6,263 |

|

|

|

(337 |

) |

|

|

5,926 |

|

|

|

9,690 |

|

|

|

(342 |

) |

|

|

9,348 |

|

|

General and administrative expenses

|

|

|

4,591 |

|

|

|

(241 |

) |

|

|

4,350 |

|

|

|

4,912 |

|

|

|

(303 |

) |

|

|

4,609 |

|

|

Operating income (loss)

|

|

|

(4,006 |

) |

|

|

1,939 |

|

|

|

(2,067 |

) |

|

|

(1,512 |

) |

|

|

2,034 |

|

|

|

522 |

|

|

Financial expenses, net

|

|

|

(1,351 |

) |

|

|

- |

|

|

|

(1,351 |

) |

|

|

(1,034 |

) |

|

|

- |

|

|

|

(1,034 |

) |

|

Loss before taxes on income

|

|

|

(5,357 |

) |

|

|

1,939 |

|

|

|

(3,418 |

) |

|

|

(2,546 |

) |

|

|

2,034 |

|

|

|

(512 |

) |

|

Taxes on income

|

|

|

249 |

|

|

|

- |

|

|

|

249 |

|

|

|

90 |

|

|

|

- |

|

|

|

90 |

|

|

Net loss from continuing operations

|

|

|

(5,606 |

) |

|

|

1,939 |

|

|

|

(3,667 |

) |

|

|

(2,636 |

) |

|

|

2,034 |

|

|

|

(602 |

) |

|

Net loss from discontinued operations

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(51 |

) |

|

|

51 |

|

|

|

- |

|

|

Net loss

|

|

|

|

(5,606 |

) |

|

|

1,939 |

|

|

|

(3,667 |

) |

|

|

(2,687 |

) |

|

|

2,085 |

|

|

|

(602 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net loss per share from continuing operations

|

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

|

|

(0.06 |

) |

|

|

|

|

|

|

|

|

|

Basic net loss per share from discontinued operations

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

(0.00 |

) |

|

|

|

|

|

|

|

|

|

Basic net loss per share

|

|

|

(0.13 |

) |

|

|

|

|

|

|

(0.09 |

) |

|

|

(0.06 |

) |

|

|

|

|

|

|

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net loss per share from continuing operations

|

|

|

(0.13 |

) |

|

|

|

|

|

|

|

|

|

|

(0.06 |

) |

|

|

|

|

|

|

|

|

|

Diluted net loss per share from discontinued operations

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

(0.00 |

) |

|

|

|

|

|

|

|

|

|

Diluted net loss per share

|

|

|

(0.13 |

) |

|

|

|

|

|

|

(0.09 |

) |

|

|

(0.06 |

) |

|

|

|

|

|

|

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

computing net loss per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

42,883,469 |

|

|

|

|

|

|

|

42,883,469 |

|

|

|

42,175,937 |

|

|

|

|

|

|

|

42,175,937 |

|

| Diluted |

|

|

42,883,469 |

|

|

|

|

|

|

|

42,883,469 |

|

|

|

42,175,937 |

|

|

|

|

|

|

|

42,175,937 |

|

|

(1)

|

Adjustments reflect the effect of non-cash stock based compensation as per ASC 718, amortization of intangible assets related toShares acquisition transactions, and net income (loss) from discontinued operations.

|

| |

|

|

|

|

Three months ended

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

| |

|

|

|

|

31 March 2015

|

|

|

|

|

|

|

|

|

31 March 2014

|

|

|

|

|

| |

|

|

|

|

Unaudited

|

|

|

|

|

|

|

|

|

Unaudited

|

|

|

|

|

|

Non-cash stock-based compensation expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

|

|

|

58 |

|

|

|

|

|

|

Research and development

|

|

|

|

|

|

|

110 |

|

|

|

|

|

|

|

|

|

|

|

122 |

|

|

|

|

|

|

Selling and marketing

|

|

|

|

|

|

|

125 |

|

|

|

|

|

|

|

|

|

|

|

130 |

|

|

|

|

|

|

General and administrative

|

|

|

|

|

|

|

241 |

|

|

|

|

|

|

|

|

|

|

|

303 |

|

|

|

|

|

| |

|

|

|

|

|

|

528 |

|

|

|

|

|

|

|

|

|

|

|

613 |

|

|

|

|

|

|

Amortization of intangible assets related to acquisition transactions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

|

|

|

|

1,199 |

|

|

|

|

|

|

|

|

|

|

|

1,209 |

|

|

|

|

|

|

Selling and marketing

|

|

|

|

|

|

|

212 |

|

|

|

|

|

|

|

|

|

|

|

212 |

|

|

|

|

|

| |

|

|

|

|

|

|

1,411 |

|

|

|

|

|

|

|

|

|

|

|

1,421 |

|

|

|

|

|

|

GILAT SATELLITE NETWORKS LTD.

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

U.S. dollars in thousands (except share and per share data)

|

|

|

|

| |

|

Three months ended |

|

| |

|

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

|

45,190 |

|

|

|

50,851 |

|

|

Cost of revenues

|

|

|

31,998 |

|

|

|

30,876 |

|

|

Gross profit

|

|

|

13,192 |

|

|

|

19,975 |

|

| |

|

|

|

|

|

|

|

|

|

Research and development expenses:

|

|

|

|

|

|

|

|

|

|

Expenses incurred

|

|

|

6,534 |

|

|

|

7,239 |

|

|

Less - grants

|

|

|

190 |

|

|

|

354 |

|

| |

|

|

6,344 |

|

|

|

6,885 |

|

|

Selling and marketing expenses

|

|

|

6,263 |

|

|

|

9,690 |

|

|

General and administrative expenses

|

|

|

4,591 |

|

|

|

4,912 |

|

|

Operating loss

|

|

|

(4,006 |

) |

|

|

(1,512 |

) |

|

Financial expenses, net

|

|

|

(1,351 |

) |

|

|

(1,034 |

) |

|

Loss before taxes on income

|

|

|

(5,357 |

) |

|

|

(2,546 |

) |

|

Taxes on income

|

|

|

249 |

|

|

|

90 |

|

|

Net loss from continuing operations

|

|

|

(5,606 |

) |

|

|

(2,636 |

) |

|

Net loss from discontinued operations

|

|

|

- |

|

|

|

(51 |

) |

|

Net loss

|

|

|

(5,606 |

) |

|

|

(2,687 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss per share from continuing operations (basic and diluted)

|

|

|

(0.13 |

) |

|

|

(0.06 |

) |

|

Net loss per share from discontinued operations (basic and diluted)

|

|

|

- |

|

|

|

(0.00 |

) |

|

Net loss per share (basic and diluted)

|

|

|

(0.13 |

) |

|

|

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in

|

|

|

|

|

|

|

|

|

|

computing net loss per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

42,883,469 |

|

|

|

42,175,937 |

|

|

Diluted

|

|

|

42,883,469 |

|

|

|

42,175,937 |

|

|

GILAT SATELLITE NETWORKS LTD.

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

US dollars in thousands

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Cash flows from continuing operations

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net loss

|

|

|

(5,606 |

) |

|

|

(2,687 |

) |

|

Net loss from discontinued operations

|

|

|

- |

|

|

|

(51 |

) |

|

Net loss from continuing operations

|

|

|

(5,606 |

) |

|

|

(2,636 |

) |

|

Adjustments required to reconcile net loss to net cash generated provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

3,658 |

|

|

|

3,684 |

|

|

Stock-based compensation

|

|

|

528 |

|

|

|

613 |

|

|

Accrued severance pay, net

|

|

|

(101 |

) |

|

|

(122 |

) |

|

Accrued interest and exchange rate differences on short and long-term restricted cash, net

|

|

|

43 |

|

|

|

86 |

|

|

Exchange rate differences on long-term loans

|

|

|

(329 |

) |

|

|

6 |

|

|

Capital loss from disposal of property and equipment

|

|

|

- |

|

|

|

17 |

|

|

Deferred income taxes

|

|

|

(41 |

) |

|

|

(36 |

) |

|

Decrease (increase) in trade receivables, net

|

|

|

721 |

|

|

|

(2,040 |

) |

|

Decrease (increase) in other assets (including short-term, long-term and deferred charges)

|

|

|

2,934 |

|

|

|

(7,783 |

) |

|

Decrease (increase) in inventories

|

|

|

(4,182 |

) |

|

|

670 |

|

|

Decrease in trade payables

|

|

|

(195 |

) |

|

|

(2,050 |

) |

|

Increase (decrease) in accrued expenses

|

|

|

(2,173 |

) |

|

|

1,675 |

|

Increase (decrease) in advances from customers, held by trustees

|

|

|

(5,178 |

) |

|

|

4,228 |

|

|

Increase (decrease) in other current liabilities and other long term liabilities

|

|

|

4,250 |

|

|

|

(2,243 |

) |

|

Net cash used in operating activities

|

|

|

(5,671 |

) |

|

|

(5,931 |

) |

|

GILAT SATELLITE NETWORKS LTD.

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

US dollars in thousands

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(741 |

) |

|

|

(525 |

) |

|

Investment in restricted cash held by trustees

|

|

|

- |

|

|

|

(4,228 |

) |

|

Proceeds from restricted cash held by trustees

|

|

|

10,922 |

|

|

|

2,950 |

|

|

Investment in restricted cash (including long-term)

|

|

|

(10,052 |

) |

|

|

- |

|

|

Proceeds from restricted cash (including long-term)

|

|

|

22,117 |

|

|

|

76 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash Provided by (used in) investing activities

|

|

|

22,246 |

|

|

|

(1,727 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Capital lease payments

|

|

|

(102 |

) |

|

|

- |

|

|

Issuance of restricted stock units and exercise of stock options

|

|

|

793 |

|

|

|

293 |

|

|

Short term bank credit, net

|

|

|

(10,007 |

) |

|

|

1,652 |

|

|

Repayment of long-term loans

|

|

|

(4,135 |

) |

|

|

(4,165 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

(13,451 |

) |

|

|

(2,220 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

(485 |

) |

|

|

33 |

|

| |

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

|

|

2,639 |

|

|

|

(9,845 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

27,726 |

|

|

|

58,424 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period

|

|

|

30,365 |

|

|

|

48,579 |

|

|

GILAT SATELLITE NETWORKS LTD.

|

|

|

|

|

|

|

CONDENSED EBITDA

|

|

|

|

|

|

|

|

US dollars in thousands

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

Operating loss

|

|

|

(4,006 |

) |

|

|

(1,512 |

) |

|

Add:

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expenses

|

|

|

528 |

|

|

|

613 |

|

|

Depreciation and amortization

|

|

|

3,658 |

|

|

|

3,684 |

|

|

EBITDA

|

|

|

180 |

|

|

|

2,785 |

|

12

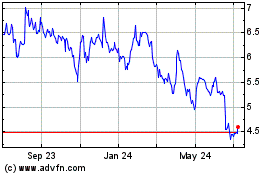

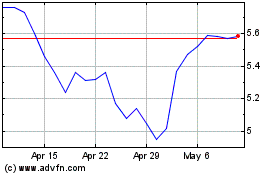

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024