UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

[X] Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended March 31, 2015

OR

[ ] Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ____________ to ____________.

|

| | |

| Commission File Number 0-13928 | |

| | |

| U.S. GLOBAL INVESTORS, INC. | |

| (Exact name of registrant as specified in its charter) | |

|

| | |

Texas | | 74-1598370 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| |

7900 Callaghan Road San Antonio, Texas | | 78229-1234 (Zip Code) |

(Address of principal executive offices) | | |

(210) 308-1234

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ X ] | Smaller Reporting Company [ ] |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X]

On May 5, 2015, there were 13,866,421 shares of Registrant’s class A nonvoting common stock issued and 13,312,314 shares of Registrant’s class A nonvoting common stock issued and outstanding, no shares of Registrant’s class B nonvoting common shares outstanding, and 2,069,127 shares of Registrant’s class C voting common stock issued and outstanding.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | | |

| | March 31, 2015 | | June 30, 2014 |

Assets | | (UNAUDITED) | | |

(dollars in thousands) | | | | |

Current Assets | | | | |

Cash and cash equivalents | | $ | 3,671 |

| | $ | 5,910 |

|

Trading securities, at fair value | | 16,443 |

| | 17,817 |

|

Receivables | | 1,900 |

| | 2,513 |

|

Prepaid expenses | | 499 |

| | 525 |

|

Deferred tax asset | | 213 |

| | 51 |

|

Total Current Assets | | 22,726 |

| | 26,816 |

|

Net Property and Equipment | | 2,804 |

| | 3,024 |

|

Other Assets | | | | |

Deferred tax asset, long term | | 709 |

| | 298 |

|

Investment securities available-for-sale, at fair value | | 4,303 |

| | 6,196 |

|

Other investments | | 2,413 |

| | 1,413 |

|

Intangible assets, net | | 52 |

| | 86 |

|

Other assets, long term | | 11 |

| | 13 |

|

Total Other Assets | | 7,488 |

| | 8,006 |

|

Total Assets | | $ | 33,018 |

| | $ | 37,846 |

|

Liabilities and Shareholders’ Equity | | | | |

Current Liabilities | | | | |

Accounts payable | | $ | 185 |

| | $ | 219 |

|

Accrued compensation and related costs | | 444 |

| | 581 |

|

Dividends payable | | 231 |

| | 232 |

|

Other accrued expenses | | 733 |

| | 1,064 |

|

Total liabilities held related to discontinued operations | | — |

| | 47 |

|

Total Current Liabilities | | 1,593 |

| | 2,143 |

|

Commitments and Contingencies (Note 12) | |

|

| |

|

|

Shareholders’ Equity | | | | |

Common stock (class A) - $0.025 par value; nonvoting; authorized, 28,000,000 shares; issued, 13,866,421 and 13,866,361 shares at March 31, 2015, and June 30, 2014, respectively | | 347 |

| | 347 |

|

Common stock (class B) - $0.025 par value; nonvoting; authorized, 4,500,000 shares; no shares issued | | — |

| | — |

|

Convertible common stock (class C) - $0.025 par value; voting; authorized, 3,500,000 shares; issued, 2,069,127 and 2,069,187 shares at March 31, 2015, and June 30, 2014, respectively | | 52 |

| | 52 |

|

Additional paid-in-capital | | 15,690 |

| | 15,669 |

|

Treasury stock, class A shares at cost; 557,555 and 501,518 shares at March 31, 2015, and June 30, 2014, respectively | | (1,467 | ) | | (1,280 | ) |

Accumulated other comprehensive income (loss), net of tax | | (462 | ) | | 906 |

|

Retained earnings | | 16,706 |

| | 19,376 |

|

Total U.S. Global Investors, Inc. Shareholders' Equity | | 30,866 |

| | 35,070 |

|

Non-Controlling Interest in Subsidiary | | 559 |

| | 633 |

|

Total Shareholders' Equity | | 31,425 |

| | 35,703 |

|

Total Liabilities and Shareholders’ Equity | | $ | 33,018 |

| | $ | 37,846 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended March 31, | | Three Months Ended March 31, |

(dollars in thousands, except per share data) | | 2015 | | 2014 | | 2015 | | 2014 |

Operating Revenues | | | | | | | | |

Mutual fund advisory fees | | $ | 5,359 |

| | $ | 5,737 |

| | $ | 1,248 |

| | $ | 1,826 |

|

Distribution fees | | 1,118 |

| | 1,510 |

| | 299 |

| | 474 |

|

Shareholder services fees | | 507 |

| | 721 |

| | 143 |

| | 229 |

|

Administrative services fees | | 516 |

| | 566 |

| | 141 |

| | 213 |

|

| | 7,500 |

| | 8,534 |

| | 1,831 |

| | 2,742 |

|

Operating Expenses | | | | | | | | |

Employee compensation and benefits | | 4,512 |

| | 5,277 |

| | 1,389 |

| | 1,524 |

|

General and administrative | | 3,248 |

| | 4,140 |

| | 1,048 |

| | 996 |

|

Platform fees | | 1,634 |

| | 1,381 |

| | 435 |

| | 420 |

|

Advertising | | 286 |

| | 505 |

| | 96 |

| | 155 |

|

Depreciation and amortization | | 246 |

| | 187 |

| | 81 |

| | 62 |

|

| | 9,926 |

| | 11,490 |

| | 3,049 |

| | 3,157 |

|

Operating Loss | | (2,426 | ) | | (2,956 | ) | | (1,218 | ) | | (415 | ) |

Other Income | | | | | | | | |

Investment income | | 522 |

| | 1,482 |

| | 249 |

| | 373 |

|

Equity in earnings of Galileo | | — |

| | 15 |

| | — |

| | 30 |

|

| | 522 |

| | 1,497 |

| | 249 |

| | 403 |

|

Loss from Continuing Operations Before Income Taxes | | (1,904 | ) | | (1,459 | ) | | (969 | ) | | (12 | ) |

Provision for Federal Income Taxes | | | | | | | | |

Tax expense (benefit) | | 21 |

| | (466 | ) | | 25 |

| | 14 |

|

Loss from Continuing Operations | | (1,925 | ) | | (993 | ) | | (994 | ) | | (26 | ) |

Discontinued Operations (Note 13) | | | | | | | | |

Loss from operations of discontinued transfer agent | | — |

| | (361 | ) | | — |

| | (3 | ) |

Tax benefit | | — |

| | (123 | ) | | — |

| | (1 | ) |

Loss from Discontinued Operations | | — |

| | (238 | ) | | — |

| | (2 | ) |

Net Loss | | (1,925 | ) | | (1,231 | ) | | (994 | ) | | (28 | ) |

Less: Net Income Attributable to Non-Controlling Interest | | 53 |

| | — |

| | 13 |

| | — |

|

Net Loss Attributable to U.S. Global Investors, Inc. | | $ | (1,978 | ) | | $ | (1,231 | ) | | $ | (1,007 | ) | | $ | (28 | ) |

Basic Net Loss per Share | | | | | | | | |

Loss from continuing operations | | $ | (0.13 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) | | $ | — |

|

Loss from discontinued operations | | $ | — |

| | $ | (0.02 | ) | | $ | — |

| | $ | — |

|

Net loss | | $ | (0.13 | ) | | $ | (0.08 | ) | | $ | (0.07 | ) | | $ | — |

|

Diluted Net Loss per Share | | | | | | | | |

Loss from continuing operations | | $ | (0.13 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) | | $ | — |

|

Loss from discontinued operations | | $ | — |

| | $ | (0.02 | ) | | $ | — |

| | $ | — |

|

Net loss | | $ | (0.13 | ) | | $ | (0.08 | ) | | $ | (0.07 | ) | | $ | — |

|

| | | | | | | | |

Basic weighted average number of common shares outstanding | | 15,406,189 |

| | 15,466,280 |

| | 15,379,365 |

| | 15,454,932 |

|

Diluted weighted average number of common shares outstanding | | 15,406,189 |

| | 15,466,280 |

| | 15,379,365 |

| | 15,454,932 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

|

| | | | | | | | | | | | | | | |

(dollars in thousands) | Nine Months Ended March 31, | | Three Months Ended March 31, |

2015 | | 2014 | | 2015 | | 2014 |

Net Loss Attributable to U.S. Global Investors, Inc. | $ | (1,978 | ) | | $ | (1,231 | ) | | $ | (1,007 | ) | | $ | (28 | ) |

Other Comprehensive Income (Loss), Net of Tax: | | | | | | | |

Unrealized gains (losses) on available-for-sale securities arising during period | (862 | ) | | 750 |

| | (13 | ) | | 380 |

|

Less: reclassification adjustment for gains/losses included in net income | (321 | ) | | (657 | ) | | (69 | ) | | (201 | ) |

Net change from available-for-sale investments, net of tax | (1,183 | ) | | 93 |

| | (82 | ) |

| 179 |

|

Foreign currency translation adjustment | (285 | ) | | — |

| | (136 | ) | | — |

|

Other Comprehensive Income (Loss) | (1,468 | ) | | 93 |

| | (218 | ) | | 179 |

|

Comprehensive Income (Loss) | (3,446 | ) | | (1,138 | ) | | (1,225 | ) | | 151 |

|

Less: Comprehensive Loss Attributable to Non-Controlling Interest | (100 | ) | | — |

| | (48 | ) | | — |

|

Comprehensive Income (Loss) Attributable to U.S. Global Investors, Inc. | $ | (3,346 | ) | | $ | (1,138 | ) | | $ | (1,177 | ) | | $ | 151 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

| | | | | | | | |

(dollars in thousands) | | Nine Months Ended March 31, |

2015 | | 2014 |

Cash Flows from Operating Activities: | | | | |

Net loss | | $ | (1,925 | ) | | $ | (1,231 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

Depreciation and amortization | | 246 |

| | 191 |

|

Net loss on disposal of property and equipment | | 26 |

| | 25 |

|

Net recognized gain on securities | | (483 | ) | | (828 | ) |

Net income from equity method investment | | — |

| | (15 | ) |

Provision for deferred taxes | | 37 |

| | 430 |

|

Stock bonuses | | 9 |

| | 8 |

|

Stock-based compensation expense | | — |

| | 1 |

|

Changes in operating assets and liabilities: | | | | |

Accounts receivable | | 570 |

| | (973 | ) |

Prepaid expenses | | 21 |

| | 4 |

|

Trading securities | | 1,371 |

| | (14,056 | ) |

Accounts payable and accrued expenses | | (510 | ) | | (269 | ) |

Total adjustments | | 1,287 |

| | (15,482 | ) |

Net cash used in operating activities | | (638 | ) | | (16,713 | ) |

Cash Flows from Investing Activities: | | | | |

Purchase of property and equipment | | (40 | ) | | — |

|

Purchase of available-for-sale securities | | (186 | ) | | (1,055 | ) |

Purchase of other investments | | (1,000 | ) | | (160 | ) |

Proceeds on sale of available-for-sale securities | | 754 |

| | 4,736 |

|

Proceeds from return of capital and principal payments on investments | | 19 |

| | 43 |

|

Net cash provided by (used in) investing activities | | (453 | ) | | 3,564 |

|

Cash Flows from Financing Activities: | | | | |

Issuance of common stock | | 91 |

| | 122 |

|

Repurchases of common stock | | (266 | ) | | (230 | ) |

Distributions to non-controlling interest in subsidiary | | (27 | ) | | — |

|

Dividends paid | | (693 | ) | | (696 | ) |

Net cash used in financing activities | | (895 | ) | | (804 | ) |

Effect of exchange rate changes on cash and cash equivalents | | (253 | ) | | — |

|

Net decrease in cash and cash equivalents | | (2,239 | ) | | (13,953 | ) |

Beginning cash and cash equivalents | | 5,910 |

| | 18,085 |

|

Ending cash and cash equivalents | | $ | 3,671 |

| | $ | 4,132 |

|

| | | | |

Supplemental Disclosures of Cash Flow Information: | | | | |

Cash paid for income taxes | | $ | — |

| | $ | — |

|

The accompanying notes are an integral part of these consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. BASIS OF PRESENTATION

U.S. Global Investors, Inc. (the “Company” or “U.S. Global”) has prepared the consolidated financial statements pursuant to accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the rules and regulations of the United States Securities and Exchange Commission (“SEC”) that permit reduced disclosure for interim periods. The financial information included herein reflects all adjustments (consisting solely of normal recurring adjustments), which are, in management’s opinion, necessary for a fair presentation of results for the interim periods presented. The Company has consistently followed the accounting policies set forth in the notes to the consolidated financial statements in the Company’s Form 10-K for the fiscal year ended June 30, 2014.

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, United Shareholder Services, Inc. (“USSI”), U.S. Global Investors (Guernsey) Limited (“USGG”) (on August 3, 2013, USGG was dissolved), U.S. Global Brokerage, Inc., U.S. Global Investors (Bermuda) Limited, U.S. Global Investors (Canada) Limited (“USCAN”), and U.S. Global Indices, LLC, and its 65% interest in Galileo Global Equity Advisor Inc. (“Galileo”).

The Company's evaluation for consolidation includes whether entities in which it has an interest are variable interest entities (“VIEs”) and whether the Company is the primary beneficiary of any VIEs identified in its analysis. A VIE is an entity in which either (a) the equity investment at risk is not sufficient to permit the entity to finance its own activities without additional financial support or (b) the group of holders of the equity investment at risk lack certain characteristics of a controlling financial interest. The primary beneficiary is the entity that has the power to direct the activities that most significantly impact the VIE’s economic performance and the obligation to absorb losses of or right to receive benefits from the VIE that could potentially be significant to the VIE. If the VIE qualifies for the investment company deferral, the primary beneficiary is the entity that has the obligation to absorb a majority of the expected losses or the right to receive the majority of the residual returns.

The Company holds variable interests in, but is not deemed to be the primary beneficiary of, the mutual funds it advises. The Company has determined that these entities qualify for the investment company deferral in ASC 810-10-65-2 (aa) and thus determines whether it is the primary beneficiary of these entities by virtue of its exposure to the expected losses and expected residual returns of the entity. The Company’s interests in these entities consist of the Company’s direct ownership therein, which in each case is insignificant to the total ownership of the fund, and any fees earned but uncollected. In the ordinary course of business, the Company may choose to waive certain fees or assume operating expenses of the funds it advises for competitive, regulatory or contractual reasons (see Note 5 for information regarding fee waivers). The Company has not provided financial support to any of these entities outside the ordinary course of business. The Company’s risk of loss with respect to these managed entities is limited to the carrying value of its investments in, and fees receivable from, the entities. The Company does not consolidate these VIEs because it is not the primary beneficiary of these VIEs.

All significant intercompany balances and transactions have been eliminated in consolidation. Certain amounts have been reclassified for comparative purposes. The results of operations for the nine months ended March 31, 2015, are not necessarily indicative of the results to be expected for the entire year.

The unaudited interim financial information in these condensed financial statements should be read in conjunction with the consolidated financial statements contained in the Company’s annual report.

Recent Accounting Pronouncements

In July 2013, the FASB issued ASU 2013-11, Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (“ASU 2013-11”). ASU 2013-11 became effective for the Company on July 1, 2014. The adoption of ASU 2013-11 was not material to the consolidated financial statements.

In April 2014, the FASB issued ASU No. 2014-08, Presentation of Financial Statements and Property, Plant, and Equipment - Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity (“ASU 2014-08”). ASU 2014-08 will become effective for the Company on July 1, 2015. Management is evaluating the ASU and its potential impact on the financial statements.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”), which supersedes nearly all existing revenue recognition guidance under U.S. GAAP. The standard is effective for annual periods beginning after December 15, 2016, and interim periods therein, using either of the following transition methods: (i) a full retrospective approach

reflecting the application of the standard in each prior reporting period with the option to elect certain practical expedients, or (ii) a retrospective approach with the cumulative effect of initially adopting ASU 2014-09 recognized at the date of adoption (which includes additional footnote disclosures). Management is currently evaluating the impact of the pending adoption of ASU 2014-09 on the consolidated financial statements and has not yet determined the method by which the Company will adopt the standard in 2017.

In August 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern (“ASU 2014-15”). This update requires an entity's management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity's ability to continue as a going concern within one year after the date that the financial statements are issued (or within one year after the date that the financial statements are available to be issued when applicable). When conditions or events raise substantial doubts about an entity’s ability to continue as a going concern, management shall disclose: i) the principal conditions or events that raise substantial doubt about the entity's ability to continue as a going concern; ii) management's evaluation of the significance of those conditions or events in relation to the entity's ability to meet its obligations; and iii) management's plans that are intended to mitigate the conditions or events - and whether or not those plans alleviate the substantial doubt about the entity's ability to continue as a going concern. ASU 2014-15 is effective for the annual period ending after December 15, 2016, and early application is permitted. Management does not currently anticipate that this update will have any impact on the Company’s financial statement disclosures.

In November 2014, the FASB issued ASU 2014-17, Business Combinations: Pushdown Accounting (“ASU 2014-17”). ASU 2014-17 provides companies with the option to apply pushdown accounting in its separate financial statements upon occurrence of an event in which an acquirer obtains control of the acquired entity. The election to apply pushdown accounting can be made either in the period in which the change of control occurred, or in a subsequent period. If the election is made in a subsequent period, it would be considered a change in accounting principle and treated in accordance with Topic 250, Accounting Changes and Error Corrections. ASU 2014-17 became effective for the Company on November 18, 2014. The adoption of ASU 2014-17 was not material to the consolidated financial statements.

In February 2015, the FASB issued ASU 2015-02, Amendments to the Consolidation Analysis (“ASU 2015-02”), which amends the consolidation requirements in Accounting Standards Codification (“ASC”) 810, Consolidation. This standard modifies existing consolidation guidance for reporting organizations that are required to evaluate whether they should consolidate certain legal entities. ASU 2015-02 is effective for fiscal years and interim periods within those years beginning after December 15, 2015, and requires either a retrospective or a modified retrospective approach to adoption. Early adoption is permitted. The Company is currently evaluating the potential impact of this standard on its consolidated financial statements, as well as the available transition methods.

NOTE 2. INVESTMENTS

As of March 31, 2015, the Company held investments with a fair value of approximately $20.7 million and a cost basis of approximately $22.0 million. In addition, the Company held other investments of $2.4 million. Total investments are approximately 70.1 percent of the Company’s total assets. On March 31, 2015, the Company had $17.5 million and $465,000 at fair value invested in USGIF and an offshore fund the Company advises, respectively. These amounts were included in the Consolidated Balance Sheet as “trading securities” and “available-for-sale securities.”

Investments in securities classified as trading are reflected as current assets on the Consolidated Balance Sheets at their fair value. Unrealized holding gains and losses on trading securities are included in earnings in the Consolidated Statements of Operations.

Investments in securities classified as available-for-sale, which may not be readily marketable, are reflected as non-current assets on the Consolidated Balance Sheets at their fair value. Unrealized holding gains and losses on available-for-sale securities are excluded from earnings and reported in other comprehensive income as a separate component of shareholders’ equity until realized.

Other investments consist of equity investments in entities over which the Company is unable to exercise significant influence and which do not have readily determinable fair values. These investments are accounted for under the cost method of accounting and evaluated for impairment.

The Company considers many factors in determining impairment, including the severity and duration of the decline in value below cost, the Company’s interest and ability to hold the security for a period of time sufficient for an anticipated recovery in value, and the financial condition and specific events related to the issuer. When an impairment of a security is determined to be other-than-temporary, the impairment is recognized in earnings.

In December 2013, the shareholders of the U.S. Government Securities Savings Fund approved a proposal resulting in the conversion of the fund from a money market fund to a U.S. Government ultra-short bond fund that is not a money market fund. The fund was renamed U.S. Government Securities Ultra-Short Bond Fund (“Government Fund”). Prior to the conversion, while the fund was a money market fund, the amount held in the fund was classified as a cash equivalent. After the conversion, the amount held in the fund is classified as a trading mutual fund investment. The amount held in the fund by the Company as of the conversion date was $14.1 million.

The Company records security transactions on trade date. Realized gains (losses) from security transactions are calculated on the first-in/first-out cost basis, unless otherwise identifiable, and are recorded in earnings on the date of sale.

The following details the components of the Company’s investments recorded as fair value as of March 31, 2015, and June 30, 2014.

|

| | | | | | | | | | | | | | | | |

| | March 31, 2015 |

| | | | Gross Unrealized | | |

(dollars in thousands) | | Cost | | Gains | | (Losses) | | Fair Value |

Trading securities 1 | | | | | | | | |

Offshore fund | | $ | 1,184 |

| | $ | — |

| | $ | (719 | ) | | $ | 465 |

|

Mutual funds - Fixed income | | 15,441 |

| | 140 |

| | (1 | ) | | 15,580 |

|

Mutual funds - Domestic equity | | 535 |

| | — |

| | (137 | ) | | 398 |

|

Other | | 81 |

| | — |

| | (81 | ) | | — |

|

Total trading securities | | $ | 17,241 |

| | $ | 140 |

| | $ | (938 | ) | | $ | 16,443 |

|

| | | | | | | | |

Available-for-sale securities 2 | | | | | | | | |

Common stock - Domestic | | $ | 575 |

| | $ | 367 |

| | $ | (13 | ) | | $ | 929 |

|

Common stock - International | | 652 |

| | 219 |

| | (32 | ) | | 839 |

|

Corporate debt | | 1,582 |

| | — |

| | (912 | ) | | 670 |

|

Mutual funds - Fixed income | | 1,228 |

| | 14 |

| | (13 | ) | | 1,229 |

|

Mutual funds - Domestic equity | | 543 |

| | — |

| | (75 | ) | | 468 |

|

Other | | 170 |

| | 3 |

| | (5 | ) | | 168 |

|

Total available-for-sale securities 3 | | $ | 4,750 |

| | $ | 603 |

| | $ | (1,050 | ) | | $ | 4,303 |

|

|

| | | | | | | | | | | | | | | | |

| | June 30, 2014 |

| | | | Gross Unrealized | | |

(dollars in thousands) | | Cost | | Gains | | (Losses) | | Fair Value |

Trading securities 1 | | | | | | | | |

Offshore fund | | $ | 1,184 |

| | $ | — |

| | $ | (186 | ) | | $ | 998 |

|

Mutual funds - Fixed income | | 16,241 |

| | 92 |

| | — |

| | 16,333 |

|

Mutual funds - Domestic equity | | 535 |

| | — |

| | (76 | ) | | 459 |

|

Other | | 107 |

| | — |

| | (80 | ) | | 27 |

|

Total trading securities | | $ | 18,067 |

| | $ | 92 |

| | $ | (342 | ) | | $ | 17,817 |

|

| | | | | | | | |

Available-for-sale securities 2 | | | | | | | | |

Common stock - Domestic | | $ | 535 |

| | $ | 586 |

| | $ | (3 | ) | | $ | 1,118 |

|

Common stock - International | | 607 |

| | 802 |

| | — |

| | 1,409 |

|

Corporate debt | | 1,706 |

| | — |

| | (74 | ) | | 1,632 |

|

Mutual funds - Fixed income | | 1,228 |

| | 21 |

| | (2 | ) | | 1,247 |

|

Mutual funds - Domestic equity | | 543 |

| | 7 |

| | — |

| | 550 |

|

Other | | 232 |

| | 9 |

| | (1 | ) | | 240 |

|

Total available-for-sale securities 3 | | $ | 4,851 |

| | $ | 1,425 |

| | $ | (80 | ) | | $ | 6,196 |

|

| |

1 | Unrealized and realized gains and losses on trading securities are included in earnings in the statement of operations. |

| |

2 | Unrealized gains and losses on available-for-sale securities are excluded from earnings and recorded in other comprehensive income as a separate component of shareholders’ equity until realized. |

| |

3 | Net unrealized gains (losses) on available-for-sale securities gross and net of tax as of March 31, 2015, are $(447) and $(295), respectively, and as of June 30, 2014, are $1,345 and $888, respectively. |

The following tables show the gross unrealized losses and fair values of available-for-sale investment securities with unrealized losses aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2015 |

| | Less Than 12 Months | | 12 Months or Greater | | Total |

(dollars in thousands) | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses |

Available-for-sale securities | | | | | | | | | | | | |

Common stock - Domestic | | $ | 45 |

| | $ | (3 | ) | | $ | 98 |

| | $ | (10 | ) | | $ | 143 |

| | $ | (13 | ) |

Common stock - International | | 75 |

| | (18 | ) | | 42 |

| | (14 | ) | | 117 |

| | (32 | ) |

Corporate debt | | 425 |

| | (912 | ) | | — |

| | — |

| | 425 |

| | (912 | ) |

Mutual funds - Fixed income | | 166 |

| | (10 | ) | | 50 |

| | (3 | ) | | 216 |

| | (13 | ) |

Mutual funds - Domestic equity | | 467 |

| | (75 | ) | | — |

| | — |

| | 467 |

| | (75 | ) |

Other | | 9 |

| | (5 | ) | | — |

| | — |

| | 9 |

| | (5 | ) |

Total available-for-sale securities | | $ | 1,187 |

|

| $ | (1,023 | ) | | $ | 190 |

| | $ | (27 | ) |

| $ | 1,377 |

|

| $ | (1,050 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2014 |

| | Less Than 12 Months | | 12 Months or Greater | | Total |

(dollars in thousands) | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses |

Available-for-sale securities | | | | | | | | | | | | |

Common stock - Domestic | | $ | 125 |

| | $ | (3 | ) | | $ | — |

| | $ | — |

| | $ | 125 |

| | $ | (3 | ) |

Corporate debt | | 1,382 |

| | (74 | ) | | — |

| | — |

| | 1,382 |

| | (74 | ) |

Mutual funds - Fixed income | | 151 |

| | (2 | ) | | — |

| | — |

| | 151 |

| | (2 | ) |

Other | | 118 |

| | (1 | ) | | — |

| | — |

| | 118 |

| | (1 | ) |

Total available-for-sale securities | | $ | 1,776 |

| | $ | (80 | ) | | $ | — |

| | $ | — |

| | $ | 1,776 |

| | $ | (80 | ) |

Investment income can be volatile and varies depending on market fluctuations, the Company’s ability to participate in investment opportunities, and timing of transactions. The Company expects that gains and losses will continue to fluctuate in the future.

Investment income (loss) from the Company’s investments includes:

| |

• | realized gains and losses on sales of securities; |

| |

• | unrealized gains and losses on trading securities; |

| |

• | realized foreign currency gains and losses; |

| |

• | other-than-temporary impairments on available-for-sale securities; and |

| |

• | dividend and interest income. |

The following summarizes investment income reflected in earnings for the periods discussed:

|

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | Nine Months Ended March 31, | | Three Months Ended March 31, |

Investment Income (Loss) | | 2015 | | 2014 | | 2015 | | 2014 |

Realized gains on sales of available-for-sale securities | | $ | 591 |

| | $ | 999 |

| | $ | 209 |

| | $ | 307 |

|

Realized gains (losses) on sales of trading securities | | (3 | ) | | (168 | ) | | 3 |

| | — |

|

Unrealized gains (losses) on trading securities | | (548 | ) | | 284 |

| | (21 | ) | | 5 |

|

Realized foreign currency gains | | 82 |

| | 6 |

| | 58 |

| | 2 |

|

Other-than-temporary declines in available-for sale securities | | (105 | ) | | (3 | ) | | (105 | ) | | (3 | ) |

Dividend and interest income | | 505 |

| | 364 |

| | 105 |

| | 62 |

|

Total Investment Income | | $ | 522 |

| | $ | 1,482 |

| | $ | 249 |

| | $ | 373 |

|

Included in investment income were other-than temporary declines in value on available-for-sale corporate debt securities of approximately $105,000 for the three and nine months ended March 31, 2015. The impairment loss resulted from the issuers defaulting on scheduled payments. One security with a cost basis of $44,000 was written down to its fair value of $15,000. Another security, which has resumed interest payments, was written down to the net present value of estimated cash flows. This security had a cost basis of $310,000 and was written down to $234,000. In making these determinations, the Company considered the length of time and extent to which the fair value has been less than cost basis, financial condition and prospects of the issuers and the Company's ability to hold the investment until recovery.

NOTE 3. FAIR VALUE DISCLOSURES

Accounting Standards Codification (ASC) 820, Fair Value Measurement and Disclosures, defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value and requires companies to disclose the fair value of their financial instruments according to a fair value hierarchy (i.e., Levels 1, 2, and 3 inputs, as defined below). The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities and the lowest priority to unobservable inputs.

Financial instruments measured and reported at fair value are classified and disclosed in one of the following categories:

Level 1 – Valuations based on quoted prices in active markets for identical assets or liabilities at the reporting date. Since valuations are based on quoted prices that are readily and regularly available in an active market, value of these products does not entail a significant degree of judgment.

Level 2 – Valuations based on quoted prices in markets for which not all significant inputs are observable, directly or indirectly. Corporate debt securities valued in accordance with the evaluated price supplied by an independent service are categorized as Level 2 in the hierarchy. Other securities categorized as Level 2 include securities valued at the mean between the last reported bid and ask quotation.

Level 3 – Valuations based on inputs that are unobservable and significant to the fair value measurement.

The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with the investing in those securities. Because of the inherent uncertainties of valuation, the values reflected may materially differ from the values received upon actual sale of those investments.

For actively traded securities, the Company values investments using the closing price of the securities on the exchange or market on which the securities principally trade. If the security is not traded on the last business day of the quarter, it is generally valued at the mean between the last bid and ask quotation. Mutual funds, which include open- and closed-end funds, exchange-traded funds, and offshore funds, are valued at net asset value or closing price, as applicable. Certain corporate debt securities are valued by an independent pricing service using an evaluated quote based on such factors as institutional-size trading in similar groups of securities, yield, quality maturity, coupon rate, type of issuance and individual trading characteristics and other market data. As part of its independent price verification process, the Company reviews the fair value provided by the pricing service using information such as transactions in these investments, broker quotes, market transactions in comparable investments, general market conditions and the issuer's financial condition. Debt securities that are not valued by an independent pricing service are valued based on review of similarly structured issuances in similar jurisdictions, when possible, or based on other traded debt securities issued by the issuer. The Company also takes into consideration numerous other factors that could affect valuation such as overall market conditions, liquidity of the security and bond structure. Securities for which market quotations are not readily available are valued at their fair value as determined by the portfolio management team. The portfolio management team includes representatives from the investment, accounting and legal/compliance departments. The portfolio management team meets periodically to consider a number of factors in determining a security’s fair value, including the security’s trading volume, market values of similar class issuances, investment personnel’s judgment regarding the market experience of the issuer, financial status of the issuer, the issuer’s management, and back testing, as appropriate. The fair values may differ from what may have been used had a broader market for these securities existed. The portfolio management team reviews inputs and assumptions and reports material items to the board of directors.

Prior to March 31, 2014, the Company classified investments that were valued using the mean between the last reported bid ask quotation as Level 1 investments. The Company has determined that it is reasonable to classify these securities as Level 2 investments. This reclassification does not affect balance sheet presentation, net income or earnings per share.

The following presents fair value measurements, as of March 31, 2015, and June 30, 2014, for the major categories of U.S. Global’s investments measured at fair value on a recurring basis:

|

| | | | | | | | | | | | | | | | |

| | Fair Value Measurement using |

| | March 31, 2015 |

(dollars in thousands) | | Quoted Prices (Level 1) | | Significant Other Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total |

Trading securities | | | | | | | | |

Offshore fund | | $ | — |

| | $ | 465 |

| | $ | — |

| | $ | 465 |

|

Mutual funds - Fixed income | | 15,580 |

| | — |

| | — |

| | 15,580 |

|

Mutual funds - Domestic equity | | 398 |

| | — |

| | — |

| | 398 |

|

Other | | — |

| | — |

| | — |

| | — |

|

Total trading securities | | 15,978 |

| | 465 |

| | — |

| | 16,443 |

|

| | | | | | | | |

Available-for-sale securities | | | | | | | | |

Common stock - Domestic | | 929 |

| | — |

| | — |

| | 929 |

|

Common stock - International | | 839 |

| | 1 |

| | — |

| | 840 |

|

Corporate debt | | — |

| | 97 |

| | 574 |

| | 671 |

|

Mutual funds - Fixed income | | 1,229 |

| | — |

| | — |

| | 1,229 |

|

Mutual funds - Domestic equity | | 467 |

| | — |

| | — |

| | 467 |

|

Other | | 167 |

| | — |

| | — |

| | 167 |

|

Total available-for-sale securities | | 3,631 |

| | 98 |

| | 574 |

| | 4,303 |

|

Total Investments Measured at Fair Value on a Recurring Basis | | $ | 19,609 |

| | $ | 563 |

| | $ | 574 |

| | $ | 20,746 |

|

|

| | | | | | | | | | | | | | | | |

| | Fair Value Measurement using |

| | June 30, 2014 |

(dollars in thousands) | | Quoted Prices (Level 1) | | Significant Other Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Total |

Trading securities | | | | | | | | |

Offshore fund | | $ | — |

| | $ | 998 |

| | $ | — |

| | $ | 998 |

|

Mutual funds - Fixed income | | 16,333 |

| | — |

| | — |

| | 16,333 |

|

Mutual funds - Domestic equity | | 459 |

| | — |

| | — |

| | 459 |

|

Other | | 27 |

| | — |

| | — |

| | 27 |

|

Total trading securities | | 16,819 |

| | 998 |

| | — |

| | 17,817 |

|

| | | | | | | | |

Available-for-sale securities | | | | | | | | |

Common stock - Domestic | | 1,118 |

| | — |

| | — |

| | 1,118 |

|

Common stock - International | | 1,406 |

| | 3 |

| | — |

| | 1,409 |

|

Corporate debt | | 292 |

| | 1,090 |

| | 250 |

| | 1,632 |

|

Mutual funds - Fixed income | | 1,247 |

| | — |

| | — |

| | 1,247 |

|

Mutual funds - Domestic equity | | 550 |

| | — |

| | — |

| | 550 |

|

Other | | 240 |

| | — |

| | — |

| | 240 |

|

Total available-for-sale securities | | 4,853 |

| | 1,093 |

| | 250 |

| | 6,196 |

|

Total Investments Measured at Fair Value on a Recurring Basis | | $ | 21,672 |

| | $ | 2,091 |

| | $ | 250 |

| | $ | 24,013 |

|

As of March 31, 2015, approximately 94 percent of the Company’s financial assets measured at fair value are derived from Level 1 inputs, three percent of the Company’s financial assets measured at fair value are derived from Level 2 inputs, and the remaining three percent are Level 3 inputs. As of June 30, 2014, approximately 90 percent of the Company’s financial assets measured at fair value are derived from Level 1 inputs, nine percent of the Company’s financial assets measured at fair value are derived from Level 2 inputs, and the remaining one percent are Level 3 inputs. The Company had transfers from Level 1 to Level 2 in the amount of $82,000 due to securities valued at the mean between bid and ask quotations at March 31, 2015, and which were valued at a quoted price at the prior period end. The Company had transfers from Level 2 to Level 3 in the amount of $343,000 due to securities being valued based on similarly structured issuances at March 31, 2015, and which were valued at a price supplied by an independent pricing service at the prior period end. The Company recognizes transfers between levels at the end of each quarter.

In Level 2, the Company has an investment in an affiliated offshore fund, classified as trading, with a fair value of $465,000 as of March 31, 2015, based on the net asset value per share, which invests in companies in the energy and natural resources sectors. The Company may redeem this investment on the first business day of each month after providing a redemption notice at least forty-five days prior to the proposed redemption date.

In addition, the Company has investments in corporate debt securities of $97,000 as of March 31, 2015, categorized as Level 2, which the Company valued in accordance with the evaluated price supplied by an independent pricing service or valued using the mean between the last reported bid ask quotation.

The corporate debt in Level 3 is valued based on review of similarly structured issuances in similar jurisdictions. At March 31, 2015, the Level 3 corporate debt is valued at cost, which approximates fair value as a result of the Company’s review of similar structured issuances in similar jurisdictions or valued based on traded issuances from the issuer.

The following table is a reconciliation of investments for which unobservable inputs (Level 3) were used in determining fair value during the nine months ended March 31, 2015, and March 31, 2014:

|

| | | | | | | | | | | | | | | | |

| | Changes in Level 3 Assets Measured at Fair Value on a Recurring Basis |

| | March 31, 2015 | | March 31, 2014 |

(dollars in thousands) | | Corporate Debt | | Common Stock - International | | Corporate Debt | | Other |

Beginning Balance | | $ | 250 |

| | $ | 95 |

| | $ | — |

| | $ | 163 |

|

Return of capital/principal payments received | | (19 | ) | | — |

| | — |

| | (43 | ) |

Total gains or losses (realized/unrealized) | | | | | | | | |

Included in earnings (investment income) | | — |

| | — |

| | — |

| | — |

|

Included in other comprehensive income | | — |

| | 5 |

| | — |

| | 5 |

|

Purchases | | — |

| | — |

| | 250 |

| | 160 |

|

Sales | | — |

| | — |

| | — |

| | — |

|

Transfers into Level 3 | | 343 |

| | — |

| | — |

| | — |

|

Transfers out of Level 3 | | — |

| | (100 | ) | | — |

| | (285 | ) |

Ending Balance | | $ | 574 |

| | $ | — |

| | $ | 250 |

| | $ | — |

|

NOTE 4. BUSINESS COMBINATION

Effective March 31, 2013, the Company, through USCAN, purchased 50 percent of the issued and outstanding shares of Galileo Global Equity Advisors, Inc., a privately held Toronto-based asset management firm, for $600,000 cash.

Effective June 1, 2014, the Company, through USCAN, completed its purchase of an additional 15 percent interest in Galileo from the company's founder, Michael Waring, for $180,000 cash. This strategic investment brings USCAN's ownership to 65 percent of the outstanding shares of Galileo, which represents a controlling interest in Galileo. Prior to June 1, 2014, the Company accounted for the investment in Galileo under the equity method of accounting. After June 1, 2014, Galileo was consolidated with the operations of the Company. Frank Holmes, CEO, and Susan McGee, President and General Counsel, serve as directors of Galileo.

Included in other income for the three and nine months ending March 31, 2014, is $30,000 and $15,000, respectively, from the Company's interest in Galileo, accounted for under the equity method of accounting.

NOTE 5. INVESTMENT MANAGEMENT, TRANSFER AGENT AND OTHER FEES

The Company serves as investment adviser to U.S. Global Investors Funds (“USGIF” or the “Funds”) and receives a fee based on a specified percentage of net assets under management.

The advisory agreement for the equity funds provides for a base advisory fee that is adjusted upwards or downwards by 0.25 percent when there is a performance difference of 5 percent or more between a fund’s performance and that of its designated benchmark index over the prior rolling 12 months. For the three and nine months ended March 31, 2015, the Company realized a decrease in its base advisory fee of $281,000 and $710,000, respectively. For the corresponding periods in fiscal year 2014, base advisory fees were adjusted downward by $214,000 and $632,000, respectively.

The following changes were made during the prior fiscal year to the mutual funds the Company manages: (1) the Global Emerging Markets Fund liquidated on October 31, 2013, (2) the MegaTrends Fund was reorganized into the Holmes Growth Fund (renamed Holmes Macro Trends Fund), (3) the Tax Free Fund was reorganized into the Near-Term Tax Free Fund, (4) the Government Fund changed from a money market fund to a U.S. Government ultra-short bond fund, and (5) the U.S. Treasury Securities Cash Fund was liquidated on December 27, 2013.

The Company has agreed to contractually limit the expenses of the Near-Term Tax Free Fund through April 2016. The Company has voluntarily waived or reduced its fees and/or agreed to pay expenses on the remaining funds. These caps will continue on a voluntary basis at the Company’s discretion. The aggregate fees waived and expenses borne by the Company for the three and nine months ended March 31, 2015, were $391,000 and $1,005,000, respectively, compared with $354,000 and $2,102,000, respectively, for the corresponding periods in the prior fiscal year.

Prior to the U.S. Treasury Securities Cash Fund liquidation and the U.S. Government Securities Savings Fund conversion, the Company voluntarily agreed to waive fees and/or reimburse the U.S. Treasury Securities Cash Fund and the Government Fund to the extent necessary to maintain the respective fund’s yield at a certain level as determined by the Company (Minimum Yield). The above waived fees for the three and nine months ended March 31, 2014, include total fees waived and/or expenses reimbursed as a result of this agreement of $0 and $584,000, respectively.

The Company may recapture any fees waived and/or expenses reimbursed to maintain the Minimum Yield within three years after the end of the fund’s fiscal year of such waiver and/or reimbursement. Thus, $510,000 of the waiver for the Government Fund is recoverable by the Company through December 31, 2015; and $498,000 through December 31, 2016.

The Company receives shareholder servicing fees based on the value of assets held through broker-dealer platforms.

Effective in December 2013, administrative service fees paid to the Company changed from an annual rate of 0.08 percent to 0.10 percent per investor class and from 0.06 percent to 0.08 percent per institutional class of each fund, based on average daily net assets, plus $10,000 per fund per year. Effective November 1, 2014, the per fund fee changed to $7,000 per year.

As of March 31, 2015, the Company had $502,000 of receivables from USGIF included in the Consolidated Balance Sheets with “receivables”.

The Company’s Board of Directors formally agreed on August 23, 2013, to exit the transfer agency business so that the Company could focus more on its core strength of investment management. USSI served as the transfer agent to the USGIF until conversion to a new transfer agent on December 9, 2013. Before the conversion, USSI received fees based on the number of shareholder accounts, transaction and activity-based fees and certain miscellaneous fees directly from USGIF shareholders. The transfer agency fees are included in discontinued operations in the statement of operations.

The Company provides advisory services for two offshore clients and received advisory fees based on the net asset values of the clients and performance fees, if any, based on the overall increase in net asset values. Another offshore fund had liquidated in November 2013. The Company recorded advisory and performance fees from these clients totaling $25,000 and $103,000, respectively, for the three and nine months ended March 31, 2015, and $42,000 and $147,000, respectively, for the corresponding periods in the prior fiscal year. Frank Holmes, CEO, serves as a director of the offshore clients.

Galileo provides advisory services for clients and receives advisory fees based on the net asset values of the clients. Galileo recorded advisory fees from these clients totaling $413,000 and $1.59 million, respectively, for the three and nine months ended March 31, 2015.

NOTE 6. BORROWINGS

As of March 31, 2015, the Company has no long-term liabilities.

The Company has access to a $1 million credit facility with a 1-year maturity for working capital purposes. The credit agreement requires the Company to maintain certain quarterly financial covenants to access the line of credit. The Company has been in compliance with all financial covenants during the fiscal year. As of March 31, 2015, this credit facility remained unutilized by the Company.

NOTE 7. STOCKHOLDERS’ EQUITY

Payment of cash dividends is within the discretion of the Company’s board of directors and is dependent on earnings, operations, capital requirements, general financial condition of the Company, and general business conditions. A monthly dividend of $0.005 per share is authorized through June 30, 2015, and will be reviewed by the board quarterly.

The Board of Directors approved a share repurchase program on December 7, 2012, authorizing the Company to purchase up to $2.75 million of its outstanding common shares as market and business conditions warrant on the open market in compliance with Rule 10b-18 of the Securities Exchange Act of 1934. This share repurchase authorization ended on December 31, 2013. On December 12, 2013, and December 10, 2014, the Board of Directors renewed the repurchase program for calendar year 2014 and 2015, respectively. The total amount of shares that may be repurchased in 2015 under the renewed program is $2.75 million. The acquired shares may be used for corporate purposes, including shares issued to employees in the Company’s stock-based compensation programs. For the three and nine months ended March 31, 2015, the Company repurchased 19,245 and 86,250 class A shares using cash of $60,000 and $266,000, respectively. For the three and nine months ended March 31, 2014, the Company repurchased 35,065 and 76,511 class A shares using cash of $121,000 and $230,000, respectively.

Stock compensation plans

The Company’s stock option plans provide for the granting of class A shares as either incentive or nonqualified stock options to employees and non-employee directors. Options are subject to terms and conditions determined by the Compensation Committee of the Board of Directors. Options outstanding and exercisable at March 31, 2015, were 22,000 at a weighted average exercise price of $18.72. There were no options granted, exercised or forfeited for the nine months ended March 31, 2015.

The Company accounts for stock-based compensation in accordance with ASC 718 Compensation – Stock Compensation. Stock-based compensation expense is recorded for the cost of stock options. There was no stock-based compensation expense for the three and nine months ended March 31, 2015. Due to option forfeitures that occurred in the three months ended March 31, 2014, the Company reversed $1,000 of compensation expense recognized during the first six months of the fiscal year. Stock-based compensation expense for the nine months ended March 31, 2014, was $1,000. As of March 31, 2015, and March 31, 2014, there was no unrecognized share-based compensation cost related to share-based compensation granted under the plans to be recognized over the remainder of their respective vesting periods.

NOTE 8. EARNINGS PER SHARE

The basic earnings per share (“EPS”) calculation excludes dilution and is computed by dividing net income by the weighted average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution of EPS that could occur if options to issue common stock were exercised.

The following table sets forth the computation for basic and diluted EPS:

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended March 31, | | Three Months Ended March 31, |

(dollars in thousands, except per share data) | | 2015 | | 2014 | | 2015 | | 2014 |

Net loss | | | | | | | | |

Loss from continuing operations | | $ | (1,925 | ) | | $ | (993 | ) | | $ | (994 | ) | | $ | (26 | ) |

Less: Income attributable to non-controlling interest in subsidiary | | 53 |

| | — |

| | 13 |

| | — |

|

Loss from continuing operations attributable to U.S. Global Investors, Inc. | | (1,978 | ) | | (993 | ) | | (1,007 | ) | | (26 | ) |

Loss from discontinued operations attributable to U.S. Global Investors, Inc. | | — |

| | (238 | ) | | — |

| | (2 | ) |

Net loss attributable to U.S. Global Investors, Inc. | | $ | (1,978 | ) | | $ | (1,231 | ) | | $ | (1,007 | ) | | $ | (28 | ) |

| | | | | | | | |

Weighted average number of outstanding shares | | | | | | |

Basic | | 15,406,189 |

| | 15,466,280 |

| | 15,379,365 |

| | 15,454,932 |

|

Effect of dilutive securities | | | | | | | | |

Employee stock options | | — |

| | — |

| | — |

| | — |

|

Diluted | | 15,406,189 |

| | 15,466,280 |

| | 15,379,365 |

| | 15,454,932 |

|

| | | | | | | | |

Loss per share attributable to U.S. Global Investors, Inc. | | | | | | | | |

Basic | | | | | | | | |

Loss from continuing operations | | $ | (0.13 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) | | $ | — |

|

Loss from discontinued operations | | $ | — |

| | $ | (0.02 | ) | | $ | — |

| | — |

|

Net loss attributable to U.S. Global Investors, Inc. | | $ | (0.13 | ) | | $ | (0.08 | ) | | $ | (0.07 | ) | | $ | — |

|

Diluted | | | | | | | | |

Loss from continuing operations | | $ | (0.13 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) | | $ | — |

|

Loss from discontinued operations | | $ | — |

| | $ | (0.02 | ) | | $ | — |

| | $ | — |

|

Net loss attributable to U.S. Global Investors, Inc. | | $ | (0.13 | ) | | $ | (0.08 | ) | | $ | (0.07 | ) | | $ | — |

|

The diluted EPS calculation excludes the effect of stock options when their exercise prices exceed the average market price for the period. For the three and nine months ended March 31, 2015, and the three and nine months ended March 31, 2014, 22,000 options were excluded from diluted EPS.

During the three and nine months ended March 31, 2015, and the three and nine months ended March 31, 2014, the Company repurchased class A shares on the open market. Upon repurchase, these shares are classified as treasury shares and are deducted from outstanding shares in the earnings per share calculation.

NOTE 9. INCOME TAXES

The Company and its subsidiaries, except as noted, file a consolidated U.S. federal income tax return. USCAN and Galileo file separate tax returns in Canada. Provisions for income taxes include deferred taxes for temporary differences in the bases of assets and liabilities for financial and tax purposes, resulting from the use of the liability method of accounting for income taxes. The

current deferred tax asset primarily consists of unrealized losses on trading securities. The long-term deferred tax asset is composed primarily of unrealized losses and other-than-temporary impairments on available-for-sale securities, differences in tax and book accumulated depreciation and the difference in tax treatment of stock options.

For federal income tax purposes at March 31, 2015, the Company has charitable contribution carryovers of approximately $121,000, expiring in fiscal years 2018 - 2020. The Company has net operating loss carryovers of $1,946,000, expiring in fiscal year 2035. If certain changes in the Company's ownership should occur, there could be an annual limitation on the amount of net operating loss carryovers that could be utilized.

A valuation allowance is provided when it is more likely than not that some portion of the deferred tax amount will not be realized. At March 31, 2015, and June 30, 2014, a valuation allowance of $703,000 and $35,000, respectively, was included related to the charitable contribution carryover and the fiscal 2014 net operating loss carryover.

NOTE 10. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The following table presents change in accumulated other comprehensive income (loss) ("AOCI") by component:

|

| | | | | | | | | | | |

(dollars in thousands) | Unrealized gains (losses) on available-for-sale investments 1 | | Foreign currency adjustment | | Total |

Nine Months Ended March 31, 2015 | | | | | |

Balance at June 30, 2014 | $ | 888 |

| | $ | 18 |

| | $ | 906 |

|

Other comprehensive loss before reclassifications | (1,306 | ) | | (185 | ) | | (1,491 | ) |

Tax effect | 444 |

| | — |

| | 444 |

|

Amount reclassified from AOCI | (486 | ) | | — |

| | (486 | ) |

Tax effect | 165 |

| | — |

| | 165 |

|

Net other comprehensive loss for the nine months ended March 31, 2015 | (1,183 | ) | | (185 | ) | | (1,368 | ) |

Balance at March 31, 2015 | $ | (295 | ) | | $ | (167 | ) | | $ | (462 | ) |

|

| | | | | | | | | | | |

(dollars in thousands) | Unrealized gains (losses) on available-for-sale investments 1 | | Foreign currency adjustment | | Total |

Three Months Ended March 31, 2015 | | | | | |

Balance at December 31, 2014 | $ | (213 | ) | | $ | (78 | ) | | $ | (291 | ) |

Other comprehensive loss before reclassifications | (20 | ) | | (89 | ) | | (109 | ) |

Tax effect | 7 |

| | — |

| | 7 |

|

Amount reclassified from AOCI | (105 | ) | | — |

| | (105 | ) |

Tax effect | 36 |

| | — |

| | 36 |

|

Net other comprehensive loss for the three months ended March 31, 2015 | (82 | ) | | (89 | ) | | (171 | ) |

Balance at March 31, 2015 | $ | (295 | ) | | $ | (167 | ) | | $ | (462 | ) |

|

| | | | | | | | | | | |

(dollars in thousands) | Unrealized gains (losses) on available-for-sale investments 1 | | Foreign currency adjustment | | Total |

Nine Months Ended March 31, 2014 | | | | | |

Balance at June 30, 2013 | $ | 652 |

| | $ | — |

| | $ | 652 |

|

Other comprehensive loss before reclassifications | 1,137 |

| | — |

| | 1,137 |

|

Tax effect | (387 | ) | | — |

| | (387 | ) |

Amount reclassified from AOCI | (996 | ) | | — |

| | (996 | ) |

Tax effect | 339 |

| | — |

| | 339 |

|

Net other comprehensive loss for the nine months ended March 31, 2014 | 93 |

| | — |

| | 93 |

|

Balance at March 31, 2014 | $ | 745 |

| | $ | — |

| | $ | 745 |

|

|

| | | | | | | | | | | |

(dollars in thousands) | Unrealized gains (losses) on available-for-sale investments 1 | | Foreign currency adjustment | | Total |

Three Months Ended March 31, 2014 | | | | | |

Balance at December 31, 2013 | $ | 566 |

| | $ | — |

| | $ | 566 |

|

Other comprehensive loss before reclassifications | 575 |

| | — |

| | 575 |

|

Tax effect | (195 | ) | | — |

| | (195 | ) |

Amount reclassified from AOCI | (304 | ) | | — |

| | (304 | ) |

Tax effect | 103 |

| | — |

| | 103 |

|

Net other comprehensive income for the three months ended March 31, 2014 | 179 |

| | — |

| | 179 |

|

Balance at March 31, 2014 | $ | 745 |

| | $ | — |

| | $ | 745 |

|

| |

1 | Amounts reclassified from unrealized gains (losses) on available-for-sale investments, net of tax, were recorded in investment income (loss) on the Consolidated Statements of Operations. |

NOTE 11. FINANCIAL INFORMATION BY BUSINESS SEGMENT

The Company operates principally in three business segments: providing investment management services to USGIF and offshore funds it manages, investment management services in Canada, and investing for its own account in an effort to add growth and value to its cash position. The following schedule details total revenues and income by business segment:

|

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | Investment Management Services | | Investment Management Services - Canada | | Corporate Investments | | Consolidated |

Nine months ended March 31, 2015 | | | | | | | | |

Net operating revenues | | $ | 5,906 |

| | $ | 1,594 |

| | $ | — |

| | $ | 7,500 |

|

Net other income | | $ | — |

| | $ | — |

| | $ | 522 |

| | $ | 522 |

|

Income (loss) from continuing operations before income taxes | | $ | (2,422 | ) | | $ | 3 |

| | $ | 515 |

| | $ | (1,904 | ) |

Depreciation and amortization | | $ | 190 |

| | $ | 56 |

| | $ | — |

| | $ | 246 |

|

Capital expenditures | | $ | 40 |

| | $ | — |

| | $ | — |

| | $ | 40 |

|

Gross identifiable assets at March 31, 2015 | | $ | 6,979 |

| | $ | 1,790 |

| | $ | 23,327 |

| | $ | 32,096 |

|

Deferred tax asset | | | | | | | | $ | 922 |

|

Consolidated total assets at March 31, 2015 | | | | | | | | $ | 33,018 |

|

Nine months ended March 31, 2014 | | | | | | | | |

Net operating revenues | | $ | 8,534 |

| | $ | — |

| | $ | — |

| | $ | 8,534 |

|

Net other income | | $ | — |

| | $ | — |

| | $ | 1,497 |

| | $ | 1,497 |

|

Income (loss) from continuing operations before income taxes | | $ | (2,950 | ) | | $ | — |

| | $ | 1,491 |

| | $ | (1,459 | ) |

Loss from discontinued operations | | $ | (238 | ) | | $ | — |

| | $ | — |

| | $ | (238 | ) |

Depreciation and amortization | | $ | 191 |

| | $ | — |

| | $ | — |

| | $ | 191 |

|

Capital expenditures | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Three months ended March 31, 2015 | | | | | | | | |

Net operating revenues | | $ | 1,418 |

| | $ | 413 |

| | $ | — |

| | $ | 1,831 |

|

Net other income | | $ | — |

| | $ | — |

| | $ | 249 |

| | $ | 249 |

|

Income (loss) from continuing operations before income taxes | | $ | (1,175 | ) | | $ | (39 | ) | | $ | 245 |

| | $ | (969 | ) |

Depreciation and amortization | | $ | 63 |

| | $ | 18 |

| | $ | — |

| | $ | 81 |

|

Capital expenditures | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Three months ended March 31, 2014 | | | | | | | | |

Net operating revenues | | $ | 2,742 |

| | $ | — |

| | $ | — |

| | $ | 2,742 |

|

Net other income | | $ | — |

| | $ | — |

| | $ | 403 |

| | $ | 403 |

|

Income (loss) from continuing operations before income taxes | | $ | (409 | ) | | $ | — |

| | $ | 397 |

| | $ | (12 | ) |

Loss from discontinued operations | | $ | (2 | ) | | $ | — |

| | $ | — |

| | $ | (2 | ) |

Depreciation and amortization | | $ | 62 |

| | $ | — |

| | $ | — |

| | $ | 62 |

|

Capital expenditures | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

NOTE 12. CONTINGENCIES AND COMMITMENTS

The Company continuously reviews all investor, employee and vendor complaints, and pending or threatened litigation. The likelihood that a loss contingency exists is evaluated through consultation with legal counsel, and a loss contingency is recorded if probable and reasonably estimable.

During the normal course of business, the Company may be subject to claims, legal proceedings, and other contingencies. These matters are subject to various uncertainties, and it is possible that some of these matters may be resolved unfavorably. The Company establishes accruals for matters for which the outcome is probable and can be reasonably estimated. Management believes that any liability in excess of these accruals upon the ultimate resolution of these matters will not have a material adverse effect on the consolidated financial statements of the Company.

The Board has authorized a monthly dividend of $0.005 per share through June 30, 2015, at which time it will be considered for continuation by the Board. Payment of cash dividends is within the discretion of the Company’s Board of Directors and is dependent on earnings, operations, capital requirements, general financial condition of the Company, and general business conditions. The total amount of cash dividends expected to be paid to class A and class C shareholders from April to June 2015 is approximately $231,000.

NOTE 13. DISCONTINUED OPERATIONS

The Company’s Board of Directors formally agreed on August 23, 2013, to exit the transfer agency business so that the Company could focus more on its core strength of investment management. USSI served as transfer agent until conversion to the new transfer agent in December 2013.

The transfer agency results, together with expenses associated with discontinuing transfer agency operations, are reflected as discontinued operations in the statement of operations and are therefore excluded from continuing operations results.

There were no assets and liabilities related to the transfer agency business at March 31, 2015.

The components of loss from discontinued operations were as follows for the three and nine months ended March 31, 2015, and 2014:

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended March 31, | | Three Months Ended March 31, |

(dollars in thousands) | | 2015 | | 2014 | | 2015 | | 2014 |

Operating revenue | | $ | — |

| | $ | 528 |

| | $ | — |

| | $ | (12 | ) |

Operating expenses | | — |

| | 889 |

| | — |

| | (9 | ) |

Loss from discontinued operations before income taxes | | — |

| | (361 | ) | | — |

| | (3 | ) |

Income tax benefit | | — |

| | (123 | ) | | — |

| | (1 | ) |

Loss from discontinued operations, net of tax | | $ | — |

| | $ | (238 | ) | | $ | — |

| | $ | (2 | ) |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

U.S. Global has made forward-looking statements concerning the Company’s performance, financial condition, and operations in this report. The Company from time to time may also make forward-looking statements in its public filings and press releases. Such forward-looking statements are subject to various known and unknown risks and uncertainties and do not guarantee future performance. Actual results could differ materially from those anticipated in such forward-looking statements due to a number of factors, some of which are beyond the Company’s control, including: (i) the volatile and competitive nature of the investment management industry, (ii) changes in domestic and foreign economic conditions, (iii) the effect of government regulation on the Company’s business, and (iv) market, credit, and liquidity risks associated with the Company’s investment management activities. Due to such risks, uncertainties, and other factors, the Company cautions each person receiving such forward-looking information not to place undue reliance on such statements. All such forward-looking statements are current only as of the date on which such statements were made.

BUSINESS SEGMENTS

The Company, with principal operations located in San Antonio, Texas, manages three business segments: (1) the Company offers a broad range of investment management products and services to meet the needs of individual and institutional investors; (2) the Company, through its Canadian subsidiary, owns a 65% controlling interest in Galileo Global Equity Advisors Inc. ("Galileo"), which offers investment management products and services in Canada; and (3) the Company invests for its own account in an effort to add growth and value to its cash position. Although the Company generates the majority of its revenues from its investment advisory segments, the Company holds a significant amount of its total assets in investments. The following is a brief discussion of the Company’s three business segments.

Investment Management Services

The Company generates operating revenues from managing and servicing U.S. Global Investors Funds (“USGIF”) and other advisory clients. These revenues are largely dependent on the total value and composition of assets under its management. Fluctuations in the markets and investor sentiment directly impact the funds’ asset levels, thereby affecting income and results of operations. Detailed information regarding the SEC-registered funds managed by the Company can be found on the Company’s website, www.usfunds.com, including performance information for each USGIF fund for various time periods, assets under management as of the most recent quarter end and inception date of each fund.

SEC-registered mutual fund shareholders are not required to give advance notice prior to redemption of shares in the funds; however, the equity funds charge a redemption fee if the fund shares have been held for less than the applicable periods of time set forth in the funds’ prospectuses. The fixed income funds do not charge a redemption fee. Detailed information about redemption fees can be found in the funds’ prospectuses, which are available on the Company’s website, www.usfunds.com.

The Company provided advisory services for two offshore clients and received advisory fees based on the net asset values of the clients and performance fees, if any, based on the overall increase in net asset values. Another offshore fund had liquidated in November 2013. The Company recorded advisory and performance fees from these clients totaling $25,000 and $103,000, respectively, for the three and nine months ended March 31, 2015, and $42,000 and $147,000, respectively, for the corresponding periods in fiscal 2014. Frank Holmes, CEO, serves as a director of the offshore clients.

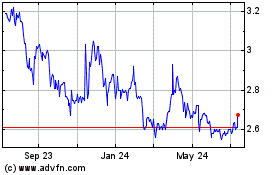

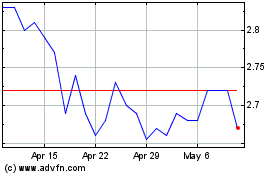

At March 31, 2015, total assets under management as of period-end, including SEC-registered funds and offshore clients, were $632.0 million versus $959.0 million at March 31, 2014, a decrease of 34.1 percent. During the nine months ended March 31, 2015, average assets under management were $773.5 million versus $1.1 billion during the nine months ended March 31, 2014. Total assets under management as of period-end at March 31, 2015, were $632.0 million versus $965.9 million at June 30, 2014, the Company’s prior fiscal year end.

The following tables summarize the changes in assets under management for the SEC-registered funds for the three and nine months ended March 31, 2015, and 2014:

|

| | | | | | | | | | | | |

| | Three Months Ended March 31, 2015 |

(dollars in thousands) | | Equity | | Fixed Income | | Total |

Beginning Balance | | $ | 506,008 |

| | $ | 153,651 |

| | $ | 659,659 |

|

Market appreciation (depreciation) | | (28,435 | ) | | 409 |

| | (28,026 | ) |

Dividends and distributions | | — |

| | (412 | ) | | (412 | ) |

Net shareholder (redemptions) purchases | | (14,951 | ) | | 4,197 |

| | (10,754 | ) |

Ending Balance | | $ | 462,622 |

| | $ | 157,845 |

| | $ | 620,467 |

|

| | | | | | |

Average investment management fee | | 0.89 | % | | 0.00 | % | | 0.68 | % |

Average net assets | | $ | 496,904 |

| | $ | 154,163 |

| | $ | 651,067 |

|

| | | | | | |

| | Three Months Ended March 31, 2014 |

(dollars in thousands) | | Equity | | Money Market and Fixed Income | | Total |

Beginning Balance | | $ | 818,029 |

| | $ | 137,111 |

| | $ | 955,140 |

|

Market appreciation | | 20,767 |

| | 831 |

| | 21,598 |

|

Dividends and distributions | | — |

| | (466 | ) | | (466 | ) |

Net shareholder redemptions | | (31,307 | ) | | (3,028 | ) | | (34,335 | ) |

Ending Balance | | $ | 807,489 |

| | $ | 134,448 |

| | $ | 941,937 |

|

| | | | | | |

Average investment management fee | | 0.98 | % | | 0.00 | % | | 0.84 | % |

Average net assets | | $ | 826,463 |

| | $ | 135,022 |

| | $ | 961,485 |

|

|

| | | | | | | | | | | | |

| | | | | | |

| | Nine Months Ended March 31, 2015 |

(dollars in thousands) | | Equity | | Fixed Income | | Total |

Beginning Balance | | $ | 815,368 |

| | $ | 130,560 |

| | $ | 945,928 |

|

Market appreciation (depreciation) | | (254,472 | ) | | 902 |

| | (253,570 | ) |

Dividends and distributions | | (10,590 | ) | | (1,245 | ) | | (11,835 | ) |

Net shareholder (redemptions) purchases | | (87,684 | ) | | 27,628 |

| | (60,056 | ) |

Ending Balance | | $ | 462,622 |

| | $ | 157,845 |

| | $ | 620,467 |

|

| | | | | | |

Average investment management fee | | 0.95 | % | | 0.00 | % | | 0.77 | % |

Average net assets | | $ | 615,690 |

| | $ | 143,474 |

| | $ | 759,164 |

|

| | | | | | |

| | Nine Months Ended March 31, 2014 |

(dollars in thousands) | | Equity | | Money Market and Fixed Income | | Total |

Beginning Balance | | $ | 857,302 |

| | $ | 283,144 |

| | $ | 1,140,446 |

|

Market appreciation | | 64,147 |

| | 1,694 |

| | 65,841 |

|

Dividends and distributions | | (20,287 | ) | | (1,312 | ) | | (21,599 | ) |

Net shareholder redemptions | | (93,673 | ) | | (149,078 | ) | | (242,751 | ) |

Ending Balance | | $ | 807,489 |

| | $ | 134,448 |

| | $ | 941,937 |

|

| | | | | | |

Average investment management fee | | 0.96 | % | | 0.00 | % | | 0.77 | % |

Average net assets | | $ | 860,563 |

| | $ | 215,893 |

| | $ | 1,076,456 |

|