Company Launches First ETF Product

U.S. Global Investors, Inc. (NASDAQ: GROW), a boutique

registered investment advisory firm with longstanding experience in

global markets and specialized sectors, recorded a net loss of

$1.01 million or ($0.07) per share, on operating revenues of $1.83

million for the quarter ended March 31, 2015.

Net loss for the same quarter of the previous year was $28,000,

or ($0.00) per share, on operating revenues of $2.74 million.

Average assets under management, including SEC-registered funds,

Galileo funds and offshore clients, were $818 million for the

quarter ended March 31, 2015, compared to an average of $978

million for the same quarter a year ago. Total assets under

management were $785 million as of March 31, 2015, versus $959

million at March 31, 2014.

Challenges of a Strong Dollar

Emerging markets have suffered bigger net capital outflows over

the latest three quarters than during the 2008-2009 financial

crisis. “The strongest dollar in forty years is hurting foreign

countries and emerging markets have been hit the hardest, stifling

worldwide economic growth and demand for commodities. This slump

continues to hurt our resource-based and emerging market funds,

which impacted our revenues. We are not alone in experiencing the

squeeze of the strong dollar. The dollar’s surge has also reduced

reported earnings at many blue-chip American companies from

Caterpillar to Tiffany,” says Frank Holmes, U. S. Global Investors

CEO.

An Antidote to Volatile Markets

“While the equity markets have been volatile, our Near-Term Tax

Free Fund (NEARX) has demonstrated positive returns every year for

the past two decades, providing investors and financial advisors

steady past performance with tax-free income. Out of 25,000 equity

and bond mutual funds, only 30 of them have had positive returns

for 20 years in a row. We are proud that NEARX is one of the few,”

says Holmes. The fund has experienced modest growth in assets this

quarter.

Launch of Company’s First Smart Beta ETF—The Only Airline

ETF

U.S. Global Investors rang in a new era for the company with the

launch of its first exchange-traded fund, U.S. Global Jets ETF, on

April 30, 2015. The smart-beta index fund focuses on the airline

industry and trades on the New York Stock Exchange under the ticker

JETS. U.S. Global Investors recognized the airline industry’s

significant restructuring in recent years had contributed to the

industry’s financial success and had stoked demand from investors.

The airline industry has experienced a rise of 287% over the past

three years ended April 1, 2015, making it the best performing

industry within the industrials sector. As the only airline-focused

ETF presently available to investors, the product positions the

company to grow assets under management.

“ETFs are vital to U.S. Global’s future growth. Ten years ago

ETF assets in the U.S. were at $228 million. Today they top $2

trillion and show no signs of slowing. Investors are increasingly

demonstrating a preference for ETFs over mutual funds. That’s why

we have invested considerable time, effort and resources to launch

this new product line. The landscape for ETF marketing,

distribution and operations is quite different than mutual funds,”

says Holmes. The company plans to expand its ETF product offerings

in 2015.

Share Repurchase Program, Strong Balance Sheet, and Monthly

Dividends

The company continued repurchasing outstanding stock in the

third fiscal quarter totaling 19,245 class A shares using cash of

$60,000. The company is using an algorithm to purchase shares on

down days, following the rules and regulations that restrict the

amounts and times when shares can be purchased on any given day,

such as at the opening of the day and in the last half-hour of

trading. The share repurchase plan is set to expire at the end of

calendar year 2015 but may be suspended or discontinued at any

time.

As of March 31, 2015, the company had net working capital of

approximately $21.1 million. Cash and cash equivalents totaled $3.7

million and marketable securities totaled $20.7 million as of the

end of the quarter.

In addition, the company has had no long-term debt since 2004

and owns its headquarters building. The company has also continued

to pay monthly dividends for more than seven years. A monthly

dividend of $0.005 per share is authorized through June 2015 and

will be reviewed by the board quarterly.

Earnings Webcast Information

The company has scheduled a webcast for 7:30 a.m. Central time

on Friday, May 15, 2015, to discuss the company’s key financial

results for the quarter. Frank Holmes will be accompanied on the

webcast by Susan McGee, president and general counsel, and Lisa

Callicotte, chief financial officer. Click here to register for the

earnings webcast or visit www.usfunds.com for more information.

Selected financial data (unaudited) (dollars in thousands,

except per share data):

Three months ended 3/31/2015

3/31/2014 Operating Revenues $ 1,831 $ 2,742

Operating Expenses 3,049 3,157

Operating Loss (1,218 ) (415 ) Total Other Income 249

403 Loss from Continuing

Operations Before Income Taxes (969 ) (12 ) Tax Expense 25

14 Loss from Continuing

Operations (994 ) (26 ) Loss from Discontinued Operations (net of

tax) -- (2 ) Net Loss $ (994 ) $

(28 ) Less: Net Income Attributable to Non-Controlling Interest

13 -- Net Loss

Attributable to U.S. Global Investors $ (1,007 ) $

(28 ) Loss per share (basic and diluted) $ (0.07 ) $

0.00 Avg. common shares outstanding (basic)

15,379,365 15,454,932 Avg. common shares outstanding (diluted)

15,379,365 15,454,932 Avg. assets under management

(billions) $ 0.818 $ 0.978

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 40 years

when it began as an investment club. Today, U.S. Global Investors,

Inc. (www.usfunds.com) is a registered investment advisor that

focuses on niche markets around the world. Headquartered in San

Antonio, Texas, the company provides money management and other

services to U.S. Global Investors Funds and other international

clients.

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other information, obtain a fund

prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS

(1-800-873-8637). Read it carefully before investing. U.S. Global

Investors Funds are distributed by U.S. Global Brokerage, Inc.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors

may include certain “forward-looking statements” including

statements relating to revenues, expenses and expectations

regarding market conditions. You can identify these forward-looking

statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “opportunity,” “seeks,” “anticipates” or

other comparable words. Such statements involve certain risks and

uncertainties and should be read with corporate filings and other

important information on the company’s website, www.usfunds.com, or

the Securities and Exchange Commission’s website at

www.sec.gov.

These filings, such as the company’s annual report and Form

10-Q, should be read in conjunction with the other cautionary

statements that are included in this release. Future events could

differ materially from those anticipated in such statements and

there can be no assurance that such statements will prove accurate

and actual results may vary. The company undertakes no obligation

to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Total Annualized Returns as of 3/31/15

One-Year Five-Year Ten-Year

GrossExpenseRatio

Expense Cap Near-Term Tax Free Fund 2.38 % 2.59 %

3.10 % 1.08 % 0.45 %

Expense ratio as stated in the most recent prospectus. The

expense cap is a contractual limit through April 30, 2016, for the

Near-Term Tax Free Fund, on total fund operating expenses

(exclusive of acquired fund fees and expenses, extraordinary

expenses, taxes, brokerage commissions and interest). Performance

data quoted above is historical. Past performance is no guarantee

of future results. Results reflect the reinvestment of dividends

and other earnings. For a portion of periods, the fund had expense

limitations, without which returns would have been lower. Current

performance may be higher or lower than the performance data

quoted. The principal value and investment return of an investment

will fluctuate so that your shares, when redeemed, may be worth

more or less than their original cost. Performance does not include

the effect of any direct fees described in the fund’s prospectus

which, if applicable, would lower your total returns. Performance

quoted for periods of one year or less is cumulative and not

annualized. Obtain performance data current to the most recent

month-end at www.usfunds.com or 1-800-US-FUNDS.

Bond funds are subject to interest-rate risk; their value

declines as interest rates rise. Though the Near-Term Tax Free Fund

seeks minimal fluctuations in share price, it is subject to the

risk that the credit quality of a portfolio holding could decline,

as well as risk related to changes in the economic conditions of a

state, region or issuer. These risks could cause the fund’s share

price to decline. Tax-exempt income is federal income tax free. A

portion of this income may be subject to state and local taxes and

at times the alternative minimum tax. The Near-Term Tax Free Fund

may invest up to 20% of its assets in securities that pay taxable

interest. Income or fund distributions attributable to capital

gains are usually subject to both state and federal income

taxes.

The Galileo Mutual Funds are not offered for sale in the United

States. They are represented across Canada by independent financial

advisors.

U.S. Global Investors, Inc.Susan Filyk, 210-308-1286Public

Relationssfilyk@usfunds.com

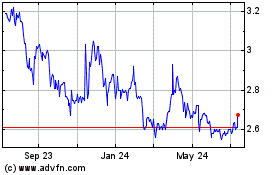

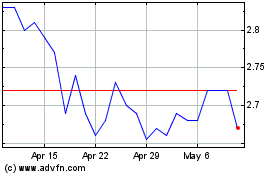

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Apr 2023 to Apr 2024