UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 14, 2015

Wabash National Corporation

(Exact name of registrant

as specified in its charter)

| Delaware |

1-10883 |

52-1375208 |

| (State or other jurisdiction of incorporation) |

(Commission

File No.) |

(IRS Employer Identification No.) |

| 1000 Sagamore Parkway South, Lafayette, Indiana 47905 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including

area code:

(765) 771-5310

__________________

Not applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

Item 7.01. Regulation FD Disclosure.

Wabash National

Corporation is making the presentation attached hereto as Exhibit 99.1 and incorporated herein by reference in connection with

the Company’s 2015 Annual Shareholder Meeting on May 14, 2015.

Item 9.01. Financial Statements and Exhibits.

| 99.1 | Wabash National Corporation presentation on May 14, 2015. |

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

| |

WABASH NATIONAL CORPORATION |

| |

|

|

| Date: May 14, 2015 |

By: |

/s/ Jeffery L. Taylor |

| |

|

Jeffery L. Taylor |

| |

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Wabash National Corporation presentation on May 14, 2015 |

Exhibit 99.1

ANNUAL SHAREHOLDER MEETING May 14, 2015 Dick Giromini, President & CEO Wabash National Corporation

2 This presentation contains certain forward - looking statements, as defined by the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward - looking statements, including without limit, those regarding shipment outlook, Operating EBITDA, backlog, demand level expectations, profitability and earnings capacity, margin opportunities, and potential benefits of any recent acquisitions. Any forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward - looking statements. Without limit, these risks and uncertainties include economic conditions, increased competition, dependence on new management, reliance on certain customers and corporate partnerships, shortages and costs of raw materials, manufacturing capacity and cost containment risks, dependence on industry trends, access to capital, acceptance of products, and government regulation. You should review and consider the various disclosures made by the Company in this presentation and in its reports to its stockholders and periodic reports on Forms 10 - K and 10 - Q. We cannot give assurance that the expectations reflected in our forward - looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward - looking statements. All written and oral forward - looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. S AFE H ARBOR S TATEMENT © 2015 Wabash National, L.P. All rights reserved. Wabash®, Wabash National®, DuraPlate®, DuraPlate AeroSkirt®, Walker, Brenner® and Beall® are marks owned by Wabash National, L. P. Transcraft® and Benson® are marks owned by Transcraft Corporation.

3 Acquired assets of leading liquid tank and dry bulk trailer producer Acquired assets of leading aluminum flatbed producer Founded as a start - up IPO ( NYSE : WNC ) Achieved leading industry position Introduced the DuraPlate ® composite dry van trailer Record trailer production of 70,000 units Acquired leading liquid transport equipment producer Acquired leading steel flatbed producer Acquired assets of Acquired Cloud Oak Flooring Co. Launched DuraPlate Products Group business (Wabash Composites) 1985 1991 1994 1996 1997 1999 2006 2008 2009 2011 2012 2013 W ABASH N ATIONAL C ORPORATION Celebrating 30 Years of Innovation Leadership • 2014 Revenue: $1.86B • 6,000 Associates (full time & contract) • 12 Manufacturing Locations in 3 Countries • 15 Company - Owned Retail Locations

4 S TRATEGIC S EGMENTS Wabash National Corporation Commercial Trailer Products 2014 Sales: $ 1.3B • Dry & Refrigerated Vans • Platform Trailers • Fleet Used Trailers Diversified Products 2014 Sales: $466M • Tank Trailers • Truck - Mounted Tanks • Aircraft Refueling Equipment • Composite Panels & Products • Aseptic Containment Systems • Dairy, Food and Beverage Equipment New Markets. New Innovation. New Growth. Retail 2014 Sales: $ 190M • 15 Retail Locations in U.S. • New & Used Trailer Sales • Parts & Service Segment Revenue is prior to the elimination of intersegment sales.

5 2007 Higher Growth and Margin Profile, Less Cyclicality 2014 D IVERSIFICATION E FFORTS D RIVING R ESULTS Revenue Manufacturing Retail 14% 86% 24% Commercial Trailer Products Diversified Products Retail 66% 10% Operating Income Manufacturing Retail Diversified Products Commercial Trailer Products 39% 3 % 58% Gross Margin 0% 5% 10% 15% 20% 25% 8.1% 22.2% 10.9% 12.5% CTP Retail Consol. DPG 0% 5% 10% 15% 20% 25% 8.7% 6.3% 8.3% Mfg Retail Consol. $1.1B $1.9B $92M $233M 100% $26M $122M Growth > 69% > 153% > 362%

6 2014 S EGMENT R EVENUE AND P RODUCT M IX New Markets. New Innovation. New Growth. 2014 Consolidated Revenue: $1.86B

7 ▪ Expanded West Coast sales and service with dealer TEC Equipment, Inc. ▪ Introduced Wabash National, Transcraft and Benson brand van and platform trailers to Australian market ▪ Cadiz operations earned ISO 9001:2008 registration for Quality Management ▪ Lafayette operations received fourth consecutive ISO 14001:2004 registration for Environmental Management Best - in - Class , Technologically Innovative Products Financial Performance Segment Revenue and OI are prior to the elimination of intersegment sales. -25 0 25 50 75 100 125 - 250 500 750 1,000 1,250 1,500 2010 2011 2012 2013 2014 Operating Income ($M) Revenue ($M) Revenue ($M) Op Income ($M) K EY 2014 A CCOMPLISHMENTS : C OMMERCIAL T RAILER P RODUCTS

8 0 15 30 45 60 75 90 - 100 200 300 400 500 600 2010 2011 2012 2013 2014 Operating Income ($M) Revenue ($M) Revenue ($M) Op Income ($M) Extensive End Markets and Geographies ▪ Expanded West Coast sales and service with dealer Opperman & Son, Inc. ▪ Bulk Tank received TTMA Plant Safety Award ▪ Production of Beall 406 petroleum and dry bulk tank trailer models expanded to Midwest ▪ Expanded manufacturing operations for diverse Wabash Composites products in Frankfort, Indiana ▪ Expanded operations in Mexico for food , dairy and beverage processing equipment ▪ Delivered first mobile clean rooms K EY 2014 A CCOMPLISHMENTS : D IVERSIFIED P RODUCTS Financial Performance Segment Revenue and OI are prior to the elimination of intersegment sales.

9 Strategic Footprint Providing National Support ▪ Completed third - party service expansion, yielding a 200% increase in locations served . ▪ Expanded mobile service capability, adding units in key U.S. markets ▪ Synergistic expansion in higher - margin tank parts and service K EY 2014 A CCOMPLISHMENTS : R ETAIL Financial Performance Segment Revenue and OI are prior to the elimination of intersegment sales. -2 0 2 4 6 - 50 100 150 200 2010 2011 2012 2013 2014 Operating Income ($M) Revenue ($M) Revenue ($M) Op Income ($M) Tank Services

10 $338 $640 $1,187 $1,462 $1,636 $1,863 $1,943 $0 $300 $600 $900 $1,200 $1,500 $1,800 $2,100 12/09 12/10 12/11 12/12 12/13 12/14 3/15 ($ millions) F INANCIAL P ERFORMANCE Trailing Twelve Month (TTM) Revenue FY 2014 Revenue and Operating Income Set New Records ($ millions) Significantly improved financial results : ▪ TTM revenue up more than $ 1.6B since year end 2009 ▪ TTM Operating Income increases $196M since year end 2009 ▪ Gross Margin levels exceed 12% for second consecutive year ▪ 2014 Financial Results – Record performance in Revenue, Gross Profit and Operating Income TTM Operating Income and Gross Margin $(66) $(15) $20 $70 $103 $122 $130 - 6.8% 4.4% 5.6% 11.2% 13.2% 12.5% 12.5% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% $(90) $(40) $10 $60 $110 $160 12/09 12/10 12/11 12/12 12/13 12/14 3/15 Operating Income Gross Margin

11 F INANCIAL P ERFORMANCE TTM Operating EBITDA at $178M and Net Leverage of 1.3x Net Leverage Ratio Improved top - line and margins lead to: ▪ Record level FY Operating EBITDA in 2014 ▪ Cash generation leading to lower net debt leverage and significantly improved liquidity ($43) $5 $39 $119 $150 $169 $178 ($100) ($50) $0 $50 $100 $150 $200 12/09 12/10 12/11 12/12 12/13 12/14 3/15 ($millions) (1) See Appendix for reconciliation of non - GAAP financial information TTM Operating EBITDA (1) Target Liquidity ( 2) (2) Defined as cash on hand plus available borrowing capacity on our revolving credit facility $21 $60 $126 $224 $254 $290 $269 $- $50 $100 $150 $200 $250 $300 $350 12/09 12/10 12/11 12/12 12/13 12/14 3/15 ($ millions) 3.1 2.7 2.3 1.9 2.1 1.9 1.7 1.2 1.3 0 0.5 1 1.5 2 2.5 3 3.5 4 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Leverage

12 F INANCIAL P ERFORMANCE – A DJUSTED EPS G ROWTH 2011 – 2015 Adjusted EPS CAGR is 71% a) 2011 Reported Non - GAAP EPS was $0.23. Adjusted EPS as shown of $ 0.14 has been tax effected @40% as the tax rate for 2011 was impacted by full valuation allowances on our NOLS. Adjustment made to enable comparisons to 2013 - 2015. b) 2012 Reported Non - GAAP EPS $0.95. Adjusted EPS as shown of $0.57 has been tax effected @ 40% as WNC did not accrue for income ta x expense in 2012. Adjustment made to enable comparisons to 2013 - 2015. c) 2015 represents the mid - point of WNC EPS guidance as of 4/28/2015 ($1.15 - 1.25). ▪ 2015 is projected to be the fifth straight year of EPS growth ▪ 2011 - 2015 Adjusted EPS CAGR is 71% $0.14 $0.57 $0.70 $0.89 $1.20 22.8% 27.1% 34.8% 0% 5% 10% 15% 20% 25% 30% 35% 40% $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2011ᵃ 2012ᵇ 2013 2014 2015F ᶜ Tax Impact Adjusted EPS (Left) YoY EPS Growth (Right) $0.95 $0.23

13 L ONG - T ERM G ROWTH D RIVERS ▪ Pricing discipline ▪ Operational efficiency / lean manufacturing ▪ Supply chain optimization Margin Expansion ▪ New end markets and geographies ▪ Product innovations / portfolio expansion ▪ Aftermarket p arts and s ervice capabilities Organic Growth ▪ Proven ability to acquire and integrate ▪ Enhance business stability and reduce cyclicality ▪ Operational synergies ▪ Strategic but selective Mergers & Acquisitions New Markets. New Innovation. New Growth.

WABASH NATIONAL CORPORATION Appendix

15 R ECONCILIATION OF N ON - GAAP M EASURES New Markets. New Innovation. New Growth. ($ in millions) Note: This table reconciles annual net income (loss) for the periods presented to the non - GAAP measure of Operating EBITDA. Di fferences may exist in the calculation of Operating EBITDA due to rounding. 2009 2010 2011 2012 2013 2014 Q1 2015 Net (loss) income (101.8)$ (141.8)$ 15.0$ 105.6$ 46.5$ 60.9$ 10.5$ Income tax (benefit) expense (3.0) (0.1) 0.2 (57.1) 31.1 37.5 6.2 Increase in fair value of warrant 33.4 121.6 - - - - - Interest expense 4.4 4.1 4.1 21.7 26.3 22.2 5.2 Depreciation and amortization 19.6 16.9 15.6 25.6 38.3 38.8 9.5 Stock-based compensation 3.4 3.5 3.4 5.2 7.5 7.8 2.4 Acquisition expenses - - - 17.3 0.9 - - Other non-operating expense (income) 0.9 0.7 0.5 0.2 (0.7) 1.8 5.3 Operating EBITDA (43.1)$ 4.9$ 38.8$ 118.5$ 149.9$ 169.0$ 39.1$ % of sales -12.8% 0.8% 3.3% 8.1% 9.2% 9.1% 8.9%

16 R ECONCILIATION OF N ON - GAAP M EASURES ($ in millions) Note: This table reconciles the trailing twelve month net income (loss) for the periods presented above to the non - GAAP measure of Operating EBITDA. Differences may exist in the calculation of Operating EBITDA due to rounding. New Markets. New Innovation. New Growth. Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Net (loss) income (101.8)$ (212.5)$ (200.2)$ (135.7)$ (141.8)$ 0.6$ 9.5$ 12.5$ 15.0$ 17.0$ 15.6$ 32.9$ 105.6$ 106.2$ 118.4$ 116.2$ 46.5$ 48.1$ 50.2$ 52.3$ 60.9$ 64.1$ Income tax (benefit) expense (3.0) (3.0) (3.0) (2.9) (0.1) (0.2) (0.2) (0.1) 0.2 (0.3) 0.8 1.9 (57.1) (52.9) (44.6) (35.1) 31.1 33.7 35.2 35.0 37.5 37.3 Increase (Decrease) in fair value of warrant 33.4 160.3 158.4 101.1 121.6 (5.2) (3.3) - - - - - - - - - - - - - - - Interest expense 4.4 4.3 4.0 3.9 4.1 4.0 4.1 4.2 4.1 3.9 8.2 14.9 21.7 28.5 29.7 28.2 26.3 24.5 23.6 22.7 22.2 21.6 Depreciation and amortization 19.6 19.2 18.7 18.0 16.9 16.3 15.9 15.7 15.6 15.4 18.6 21.7 25.6 31.6 34.0 36.4 38.3 38.1 38.4 38.8 38.8 38.8 Stock-based compensation 3.4 3.3 3.0 2.9 3.5 3.4 3.2 2.9 3.4 4.0 4.1 5.2 5.2 5.7 6.9 7.0 7.5 7.2 7.2 7.5 7.8 8.6 Acquisition expenses - - - - - - - - - 1.7 15.0 17.0 17.3 16.2 3.1 1.1 0.9 0.3 - - - - Other non-operating expense (income) 0.9 0.8 1.7 0.5 0.7 0.8 0.7 0.7 0.5 0.6 - (0.2) 0.2 (2.0) (1.7) (0.9) (0.7) 1.5 2.2 2.2 1.8 7.1 Operating EBITDA (43.1)$ (27.6)$ (17.4)$ (12.2)$ 4.9$ 19.7$ 29.9$ 35.9$ 38.8$ 42.3$ 62.3$ 93.4$ 118.5$ 133.3$ 145.8$ 152.9$ 149.9$ 153.4$ 156.8$ 158.5$ 169.0$ 177.5$ % of sales -12.8% -8.2% -4.3% -2.5% 0.8% 2.5% 3.2% 3.3% 3.3% 3.4% 4.7% 6.7% 8.1% 8.8% 9.4% 9.6% 9.2% 9.2% 9.0% 8.8% 9.1% 9.1% Trailing Twelve Months Operating EBITDA For Quarter Ending 201520142009 2010 2011 2012 2013

17 R ECONCILIATION OF N ON - GAAP M EASURES Note: This table reconciles annual net income for the periods presented to the non - GAAP measure of adjusted earnings and adjusted earnings per share. Differences may exist in the calculation of adjusted earnings per share due to rounding. $ Per Share $ Per Share $ Per Share $ Per Share Net income 15,042$ 0.22$ 105,631$ 1.54$ 46,529$ 0.67$ 60,930$ 0.86$ Income tax benefit, net - - (58,991) (0.86) - - - - Loss on debt extinguishment, net of taxes 668 0.01 - - 1,132 0.02 645 0.01 Impact of acquired profit in inventories and short term intangible amortization - - 3,800 0.06 - - - - Revaluation of net deferred income tax assets due to changes in statutory tax rates - - - - - - 1,041 0.01 Acquisition expenses, net of taxes - - 14,409 0.21 529 0.01 - - Loss on transitioning Retail branch locations, net of tax - - - - - - 376 0.01 Adjusted Earnings and Adjusted Earnings Per Share 15,710$ 0.23$ 64,849$ 0.95$ 48,190$ 0.70$ 62,992$ 0.89$ WA shares outstanding 68,418 68,564 69,081 71,063 2011 2012 2013 2014 Twelve Months Ended December 31,

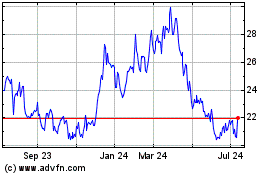

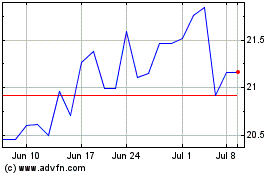

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024