Report of Foreign Issuer (6-k)

May 14 2015 - 9:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of May 2015

CAMTEK LTD.

(Translation of Registrant’s Name into English)

Ramat Gavriel Industrial Zone

P.O. Box 544

Migdal Haemek 23150

ISRAEL

(Address of Principal Corporate Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities and Exchange Act of 1934.

Yes o No x

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

CAMTEK LTD.

(Registrant)

By: /s/ Moshe Eisenberg

——————————————

Moshe Eisenberg,

Chief Financial Officer

|

Dated: May 14, 2015

|

Exhibit Description

Exhibit A –Camtek Ltd. Prices Underwritten Public Offering of Ordinary Shares

|

Exhibit A

|

Camtek Ltd.

P.O.Box 544, Ramat Gabriel Industrial Park

Migdal Ha’Emek 23150, ISRAEL

Tel: +972 (4) 604-8100 Fax: +972 (4) 644-0523

E-Mail: Info@camtek.co.il Web site: http://www.camtek.co.il

|

|

CAMTEK LTD.

Moshe Eisenberg, CFO

Tel: +972 4 604 8308

Mobile: +972 54 900 7100

moshee@camtek.co.il

|

INTERNATIONAL INVESTOR RELATIONS

GK Investor Relations

Ehud Helft

Tel: (US) 1 646 201 9246

camtek@gkir.com

|

FOR IMMEDIATE RELEASE

CAMTEK PRICES UNDERWRITTEN PUBLIC OFFERING OF ORDINARY SHARES

MIGDAL HAEMEK, Israel - May 14, 2015 - Camtek Ltd. (NASDAQ: CAMT and TASE: CAMT), today announced the pricing of an underwritten public offering of 4.3 million of its ordinary shares at a price of $2.85 per share. The company has also granted to the underwriters a 30-day option to acquire an additional 450,000 shares to cover overallotments in connection with the offering. After the underwriting discount, but before estimated offering expenses payable by the company, the company expects to receive net proceeds of approximately $11.4 million, assuming no exercise of the overallotment option. Camtek intends to use the net proceeds from the offering for general corporate purposes. The offering is expected to close on May 19, 2015, subject to customary closing conditions.

Needham & Company is acting as sole book-running manager of the offering. B. Riley & Co. and Chardan Capital Markets are acting as co-managers of the offering.

The shares described above are being offered by Camtek pursuant to a registration statement on Form F-3, including a base prospectus, previously filed (on April 1, 2014) with and subsequently declared effective (on April 14, 2014) by the Securities and Exchange Commission. The securities may be offered only by means of a prospectus. A preliminary prospectus supplement relating to the offering was filed with the SEC on May 13, 2015 and a final prospectus supplement relating to the offering will be filed with the SEC and will be available on the SEC’s website at http://www.sec.gov. Copies of the final prospectus supplement and accompanying base prospectus relating to this offering may also be obtained, when available, from Needham & Company, LLC, 445 Park Avenue, New York, NY 10022, via telephone at (800) 903-3268 or by email to prospectus@needhamco.com.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Camtek Ltd.

Camtek Ltd. provides automated and technologically advanced solutions dedicated to enhancing production processes, increasing products yield and reliability, enabling and supporting customer's latest technologies in the Semiconductors, Printed Circuit Boards (PCB) and IC Substrates industries. Camtek addresses the specific needs of these interconnected industries with dedicated solutions based on a wide and advanced platform of technologies including intelligent imaging, image processing and functional 3D inkjet printing.

Safe Harbor

This press release may contain projections or other forward-looking statements regarding future events or the future performance of the Company. These statements are only predictions and may change as time passes. We do not assume any obligation to update that information. Actual events or results may differ materially from those projected, including as a result of changing industry and market trends, reduced demand for our products, the timely development of our new products and their adoption by the market, increased competition in the industry, intellectual property litigation, price reductions as well as due to risks identified in the documents filed by the Company with the SEC.

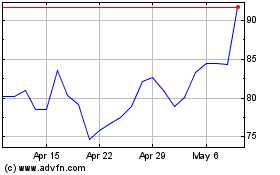

Camtek (NASDAQ:CAMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

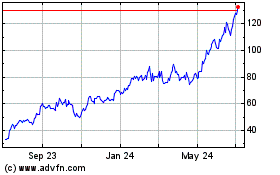

Camtek (NASDAQ:CAMT)

Historical Stock Chart

From Apr 2023 to Apr 2024