UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2015

|

BIO-key International, Inc.

(Exact name of registrant as specified in its charter) |

| |

|

|

|

Delaware

(State or other jurisdiction of incorporation) |

1-13463

(Commission File Number) |

41-1741861

(I.R.S. Employer Identification No.) |

| |

|

3349 Highway 138, Building A, Suite E

Wall, NJ 07719

(Address of principal executive offices) |

| |

|

(732) 359-1100

(Registrant’s telephone number, including area code) |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2015, BIO-key International, Inc. (the “Company”) issued a press release announcing its financial results for its first quarter of 2015. A copy of the press release issued by the Company on May 13, 2015 is attached as Exhibit 99.

The information, including the exhibit attached hereto, in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements, Pro Forma Financial Information and Exhibit.

(d) Exhibits

99.1 Press Release, dated May 13, 2015, issued by the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BIO-KEY INTERNATIONAL, INC. |

|

|

Date: May 13, 2015 |

|

|

|

| |

By: |

/s/ Cecilia C. Welch |

|

|

|

|

Cecilia C. Welch |

|

|

|

|

Chief Financial Officer |

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

|

99.1 |

Press Release, dated May 13, 2015, issued by the Company. |

4

Exhibit 99.1

|

NEWS RELEASE |

BIO-key™ Reports Q1 Revenue of $649,000;

Affirms 2015 Revenue Guidance of $5M - $7M

Wall, NJ, May 13, 2015 – BIO-key International, Inc. (OTCQB: BKYI), a leader in high-accuracy fingerprint biometric software technologies for mobile, enterprise and cloud-based identification and verification, today reported results for its first quarter ended March 31, 2015 (Q1’15) and provided an update on its full year 2015 revenue guidance range which remains $5M to $7M. BIO-key will host a conference call today at 10:00 a.m. EDT, details below.

Michael DePasquale, BIO-key, Chairman and CEO, commented, “We made good progress across the business during the first quarter, helping to solidify our outlook for the balance of 2015 and beyond. Our go to market strategy builds upon our growing base of OEM and distribution relationships that substantially expand our reach as well as focused direct sales efforts. We added important new partnerships with Avnet and Aventura and with the introduction of our new high performance, low cost, finger scanner (EcoID), we are seeing new interest and demand from prospects around the globe who can now more cost effectively integrate finger biometrics for a wide range of applications”.

“Though our Q1 sales performance fell below last year’s level, this reflects the deal-driven nature of our software licensing efforts and was in-line with our anticipated range. Looking out over the balance of 2015, we are on target to achieve our full year revenue guidance of five to seven million dollars and expect to demonstrate the strength of our sales effort in our Q2 performance.”

Recent Business Highlights Include:

|

● |

BIO-key partnered with HealthCast Inc. to deliver innovative Single Sign-On solutions and secure two-factor authentication for the Electronic Prescription of Controlled Substances (EPCS) to leading hospitals and hospital systems |

|

● |

BIO-key selected to provide international financial services firm with customer and employee authentication solution |

|

● |

BIO-key partnered with Aventura to provide a biometric authentication solution for the Electronic Prescribing of Controlled Substances (EPCS) |

|

● |

Global Application Specific Licensing Agreement with Avnet to develop identification solutions integrating IBM middleware with BIO-key software for customers in the Americas, EMEA and Asia Pacific. Avnet is a major distributor of electronic components, IT solutions and embedded technology |

|

● |

BIO-key Introduced EcoID, a compact USB touch fingerprint reader pairing the Active Thermal™ sensor from NEXT Biometrics with the superior accuracy of BIO-key’s biometric algorithms and software, to deliver top quality at an unprecedented price point. |

Q1 Results

Q1’15 revenue declined to $649,000 from $1,368,000 in Q1’14. The decrease was principally the result of the variability in timing of software license activity in the comparable periods. Service revenues were essentially unchanged in the Q1’15 and Q1’14 periods.

During Q1’15, BIO-key continued to ship biometric software solutions to support the roll-out of the AccuDose® product line of Aesynt (formerly McKesson) as well as the continued expansion of biometric ID deployments via commercial partners ChoicePoint / LexisNexis, Educational Biometric Technology, and Identimetrics.

Q1’15 gross margin declined to 79% from 91% in Q1’14, principally due to the decrease in software license revenue as well as an increase in costs related to non-recurring custom services revenue. Operating expenses for Q1’15 increased 8%, to $1,447,000 from $1,344,000 in Q1’14, principally due to an increase in non-cash share based compensation expenses as well as higher costs related to sales and marketing activities and legal expense. BIO-key reported a Q1’15 net loss of ($924,000), or ($0.01) per basic share, compared to a net loss of ($299,000), or ($0.00) per basic share, in Q1’14.

Liquidity and Capital Resources

BIO-key had cash and cash equivalents of $303,000 and total current assets of $1,207,000 at March 31, 2015, compared to $1,794,000 of total current assets at December 31, 2014. Net cash used for operations during Q1 ’15 was $519,000 compared to $1,277,000 in Q1’14.

2015 Financial Guidance

BIO-key continues to expect full year 2015 revenue to range between $5.0 million and $7.0 million with a gross margin ranging between 75% and 80%. BIO-key’s sales and marketing will focus on large enterprise and government opportunities that have been sourced directly or through partners. Such opportunities range in size from under $100,000 to several million dollars in certain cases. The Company’s current pipeline of sales opportunities is valued at $30 million, as compared to $25 million at December 31, 2014 and $12.7 million at December 31, 2013.

Given the variability in the timing and size of potential contracts within the Company’s pipeline of sales opportunities, quarterly financial performance is likely to vary significantly from quarter to quarter. BIO-key currently expects Q2 revenue to range between $1.5 million and $3.0 million. Of this amount, three quarters is expected to be derived from OEM, reseller and integration partner channels with the bulk of expected revenue coming from highly regulated industries, including healthcare and financial services. Gross margin is expected to be in the range of 75%-80%. BIO-key’s quarterly break-even revenue run rate remain in the range of $1.5M-$1.75M.

Conference Call and Webcast Replay

|

|

Date/Time: |

Today – Wednesday, May 13, 2015 at 10am EDT |

| |

|

|

|

|

Dial-In number: |

1-877-418-5460 (U.S.), 412-717-9594 (Intl.), ask for the BIO-key call |

| |

|

|

|

|

Webcast Replay: |

available shortly after the call at www.bio-key.com |

About BIO-key

BIO-key International, Inc. develops and delivers advanced fingerprint biometric identification solutions to commercial and government enterprises, integrators, and application developers. BIO-key’s award winning, high performance, scalable, cost-effective and easy-to-deploy biometric finger identification technology accurately identifies and authenticates users of wireless and enterprise applications. Our solutions are used in local embedded OEM products as well as some of the world’s largest identification deployments to improve security, guarantee identity, and reduce identity theft. BIO-key’s technology is offered directly or by market leading partners around the world. (http://www.bio-key.com)

BIO-key Safe Harbor Statement

Certain statements contained in this press release and in other public statements by the Company and Company officers include or may contain certain forward-looking statements. All statements other than statements of historical facts contained in this press release, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “will,” “may,” “future,” “plan,” “intend” and “expect” and similar expressions generally identify forward-looking statements. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Although we believe that our plans, intentions and expectations reflected in the forward-looking statements are reasonable, we cannot be sure that they will be achieved. Particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include: our history of losses and limited revenue; our ability to raise additional capital; our ability to protect our intellectual property; changes in business conditions; changes in our sales strategy and product development plans; changes in the marketplace; continued services of our executive management team; security breaches; competition between us and other companies in the biometric technology industry; market acceptance of biometric products generally and our products under development; delays in the development of products and statements of assumption underlying any of the foregoing, as well as other factors set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Except as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Investor & Media Contacts:

|

Jay Meier, VP Corporate Development |

David Collins, Tanya Kamatu |

|

BIO-key Intl, Inc. |

Catalyst Global |

|

651-789-6116 |

212-924-9800 |

|

Jay.meier@bio-key.com |

bkyi@catalyst-ir.com |

BIO-key International, Inc. and Subsidiary

CONSOLIDATED BALANCE SHEETS

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

303,499 |

|

|

$ |

843,632 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $20,526 at March 31, 2015 and December 31, 2014 |

|

|

589,307 |

|

|

|

625,341 |

|

|

Due from factor |

|

|

- |

|

|

|

76,657 |

|

|

Inventory |

|

|

205,410 |

|

|

|

11,825 |

|

|

Prepaid expenses and other |

|

|

108,590 |

|

|

|

236,429 |

|

|

Total current assets |

|

|

1,206,806 |

|

|

|

1,793,884 |

|

|

Equipment and leasehold improvements, net |

|

|

92,903 |

|

|

|

103,509 |

|

|

Deposits and other assets |

|

|

8,712 |

|

|

|

8,712 |

|

|

Intangible assets—less accumulated amortization |

|

|

157,943 |

|

|

|

161,344 |

|

|

Total non-current assets |

|

|

259,558 |

|

|

|

273,565 |

|

|

TOTAL ASSETS |

|

$ |

1,466,364 |

|

|

$ |

2,067,449 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

415,829 |

|

|

$ |

347,311 |

|

|

Accrued liabilities |

|

|

471,416 |

|

|

|

488,617 |

|

|

Due to factor |

|

|

116,048 |

|

|

|

- |

|

|

Deferred revenue |

|

|

458,234 |

|

|

|

429,233 |

|

|

Warrant liabilities |

|

|

28,568 |

|

|

|

43,227 |

|

|

Total current liabilities |

|

|

1,490,095 |

|

|

|

1,308,388 |

|

|

TOTAL LIABILITIES |

|

|

1,490,095 |

|

|

|

1,308,388 |

|

|

Commitments and Contingency |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

|

Common stock — authorized, 170,000,000 shares; issued and outstanding; 66,001,260 of $.0001 par value at March 31, 2015 and December 31, 2014 |

|

|

6,600 |

|

|

|

6,600 |

|

|

Additional paid-in capital |

|

|

57,647,916 |

|

|

|

57,506,605 |

|

|

Accumulated deficit |

|

|

(57,678,247 |

) |

|

|

(56,754,144 |

) |

|

TOTAL STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

(23,731 |

) |

|

|

759,061 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY |

|

$ |

1,466,364 |

|

|

$ |

2,067,449 |

|

BIO-key shares outstanding for all periods reflect a 2-for-1 reverse stock split effective February 3, 2015.

BIO-key International, Inc. and Subsidiary

CONSOLIDATED STATEMENTS OF OPERATIONS

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Services |

|

$ |

250,353 |

|

|

$ |

249,232 |

|

|

License fees and other |

|

|

398,473 |

|

|

|

1,118,290 |

|

| |

|

|

648,826 |

|

|

|

1,367,522 |

|

|

Costs and other expenses |

|

|

|

|

|

|

|

|

|

Cost of services |

|

|

67,063 |

|

|

|

39,175 |

|

|

Cost of license fees and other |

|

|

72,293 |

|

|

|

78,049 |

|

| |

|

|

139,356 |

|

|

|

117,224 |

|

|

Gross Profit |

|

|

509,470 |

|

|

|

1,250,298 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

1,040,681 |

|

|

|

856,997 |

|

|

Research, development and engineering |

|

|

406,641 |

|

|

|

486,657 |

|

|

Total Operating Expenses |

|

|

1,447,322 |

|

|

|

1,343,654 |

|

|

Operating loss |

|

|

(937,852 |

) |

|

|

(93,356 |

) |

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

2 |

|

|

|

2 |

|

|

Gain (loss) on derivative liabilities |

|

|

14,659 |

|

|

|

(204,948 |

) |

|

Income taxes |

|

|

(912 |

) |

|

|

(912 |

) |

|

Total Other Income (Expenses) |

|

|

13,749 |

|

|

|

(205,858 |

) |

|

Net loss |

|

$ |

(924,103 |

) |

|

$ |

(299,214 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic & Diluted Loss per Common Share |

|

$ |

(0.01 |

) |

|

$ |

* |

|

|

* Represents less than ($0.01) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

Basic & Diluted |

|

|

66,001,260 |

|

|

|

57,938,231 |

|

BIO-key shares outstanding and per share amounts reflect a 2-for-1 reverse stock split effective February 3, 2015.

BIO-key International, Inc. and Subsidiary

CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

Three Months Ended March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOW FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(924,103 |

) |

|

$ |

(299,214 |

) |

|

Adjustments to reconcile net loss to cash used for operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

10,606 |

|

|

|

10,258 |

|

|

Amortization |

|

|

|

|

|

|

|

|

|

Intangible assets |

|

|

3,401 |

|

|

|

3,401 |

|

|

Share-based compensation |

|

|

162,219 |

|

|

|

85,773 |

|

|

Loss (gain) on derivative liabilities |

|

|

(14,659 |

) |

|

|

204,948 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable trade |

|

|

36,034 |

|

|

|

(1,061,936 |

) |

|

Due to factor |

|

|

192,705 |

|

|

|

(8,111 |

) |

|

Inventory |

|

|

(193,585 |

) |

|

|

429 |

|

|

Prepaid expenses and other |

|

|

127,839 |

|

|

|

(12,951 |

) |

|

Accounts payable |

|

|

68,518 |

|

|

|

(217,070 |

) |

|

Accrued liabilities |

|

|

(17,201 |

) |

|

|

(1,874 |

) |

|

Deferred revenue |

|

|

29,001 |

|

|

|

19,718 |

|

|

Net cash used for operating activities |

|

|

(519,225 |

) |

|

|

(1,276,629 |

) |

|

CASH FLOW FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

- |

|

|

|

(3,799 |

) |

|

Net cash used for investing activities |

|

|

- |

|

|

|

(3,799 |

) |

|

CASH FLOW FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Repurchase of outstanding warrants |

|

|

- |

|

|

|

(150,000 |

) |

|

Costs to issue common stock |

|

|

(20,908 |

) |

|

|

- |

|

|

Net cash used for financing activities |

|

|

(20,908 |

) |

|

|

(150,000 |

) |

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

|

(540,133 |

) |

|

|

(1,430,428 |

) |

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

|

|

843,632 |

|

|

|

2,023,349 |

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD |

|

$ |

303,499 |

|

|

$ |

592,921 |

|

# # #

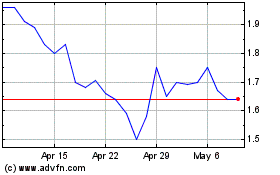

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

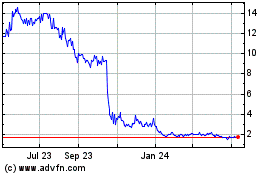

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Apr 2023 to Apr 2024