Highlights

• 1st Detect announced initial orders

from new industrial customers in the petrochemical and food

processing verticals.

• 1st Detect received GSA status,

expanding the accessibility and ease of procurement of its products

to government customers.

• 1st Detect granted three U.S. patents

for core technology enhancements, validating the company's ability

to provide breakthrough technological solutions.

• Astrotech Corporation launched Astral Images

following the acquisition of key assets and intellectual property

from Image Trends, Inc. via bankruptcy auction.

Astrotech Corporation (NASDAQ: ASTC), a leader in the

commercialization of government sponsored advanced space

technologies, today announced financial results for its third

quarter ended March 31, 2015.

“The third quarter was an exciting period for Astrotech as we

have now successfully completed the divesting of our legacy

government services assets while we transition to a space

technology commercialization company. We are very pleased to

announce that 1st Detect is now booking orders as we execute our

strategy of being the first full functioning mass spectrometer to

serve the industrial processing markets. Additionally, we are also

applying space satellite imaging correction technology to our newly

formed film scanning company Astral Images which is ideally

positioned to convert film to the new Ultra-High Definition 4K

standards,” said Thomas B. Pickens III, Chairman and CEO of

Astrotech Corporation.

Third Quarter Results

The Company posted third quarter fiscal year 2015 net income of

$(2.1) million, or $(0.11) per diluted share, compared with a third

quarter fiscal year 2014 net income of $(2.8) million or $(0.14)

per diluted share. It also posted year to date fiscal year 2015 net

income of $18.8 million, or $0.93 per diluted share, which was

primarily the result of a $25.6 million gain ($23.7 million

after-tax) related to the sale of our former ASO business to

Lockheed Martin, compared with a third quarter year to date fiscal

year 2014 net income of $(4.1) million or $(0.22) per diluted

share.

Financial Position and Liquidity

Working capital was $34.7 million as of March 31, 2015,

which primarily consisted of $30.6 million in cash and cash

equivalents and short-term investments. Additionally, the Company

continues to record a receivable of $6.1 million for an amount held

in escrow related to the sale, which is not included in working

capital. The Company believes it will fully realize the remaining

$6.1 million held in escrow in February 2016.

About Astrotech Corporation

Astrotech Corporation is an Austin, TX based technology company

that has evolved from over 30 years in the human spaceflight, Space

Shuttle, and Department of Defense satellite programs. The company

has become a leader in the commercialization of government

sponsored advanced space technologies. In 2014, the company

completed the sale of one of its businesses, Astrotech Space

Operations, to Lockheed Martin for $61 million.

1st Detect Corporation was create to develop a mass spectrometer

that was designed for use on the International Space Station. 1st

Detect is a game-changing technology in the chemical detection and

analysis market because it delivers laboratory performance of

traditional mass spectrometry, but in a small, affordable and

portable package. 1st Detect's technology is useful in the

semiconductor, food and beverage processing, petrochemical,

laboratory, process control, explosive detection, and chemical

warfare markets.

Astrogenetix Corporation was formed as a result of over $4

billion spent by NASA over a 25 year period on experiments

conducted in sustained microgravity, where results were only

achieved while orbiting in space. Astrotech designed and flew 1,113

of these experiments in its Spacehab modules, and after an

extensive review, discovered that microgravity greatly enhanced the

discovery of valuable vaccines and therapeutics. The company has

completed 12 successful biomarker discovery missions to the

International Space Station and has identified a salmonella vaccine

candidate, while ten additional discoveries are in the pipeline.

NASA has awarded Astrogenetix 26 free flights to the $130 billion

ISS National Laboratory, along with full crew support.

Astral Images, Inc. was launched to commercialize identified

government funded satellite image correction technologies. Along

with the acquisition of certain established defect correction

technologies, first funded by IBM and Kodak, Astral is positioned

to be the world leader in the technology required to convert and

repair feature films and film based television series to the new

digital Ultra-High Definition 4K standards.

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, our ability to successfully develop our remaining

Spacetech business unit, our ability to develop and integrate our

miniaturized mass spectrometer, the MMS-1000™, product performance,

market acceptance of products and services, and our ability to

identify, execute and integrate potential acquisitions, as well as

other risk factors and business considerations. Any forward-looking

statements in this document should be evaluated in light of these

important risk factors. Astrotech assumes no obligation to update

these forward-looking statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (In

thousands, except per share data) (unaudited)

Three Months Ended March 31, Nine Months Ended

March 31, 2015

2014 2015

2014 Revenue $ 12 $ 48 $ 336 $ 130 Cost of revenue

— — 281 —

Gross profit 12 48

55 130 Operating

expenses: Selling, general and administrative 1,681 1,432 5,653

5,007 Research and development 659 645

2,335 1,800 Total operating expenses

2,340 2,077 7,988

6,807

Loss from operations (2,328 )

(2,029 ) (7,933 ) (6,677

) Interest and other income (expense), net 76

— 112 9

Loss from

continuing operations before income taxes (2,252

) (2,029 ) (7,821 )

(6,668 ) Income tax benefit (expense) 894

(360 ) 2,953 1,371

Loss from continuing operations (1,358

) (2,389 ) (4,868

) (5,297 ) Discontinued operations

(Note 3) Income (loss) from operations of ASO business

(including gain from sale of $25.6 million) — (1,022 ) 26,933 1,855

Income tax expense (753 ) 358 (3,315 )

(1,379 )

Income (loss) on discontinued operations

(753 )

(664 ) 23,618

476 Net (loss) income

(2,111 ) (3,053 ) 18,750

(4,821 ) Less: Net loss attributable to

noncontrolling interest (11 ) (216 ) (11 )

(681 )

Net (loss) income attributable to Astrotech

Corporation $ (2,100 ) $

(2,837 ) $ 18,761 $

(4,140 ) Amounts attributable to Astrotech

Corporation: Loss from continuing operations, net of tax $

(1,347 ) $ (2,173 ) $ (4,857 ) $ (4,616 ) Income (loss) from

discontinued operations, net of tax (753 ) (664 )

23,618 476

Net (loss) income

attributable to Astrotech Corporation $ (2,100

) $ (2,837 ) $ 18,761

$ (4,140 ) Weighted average

common shares outstanding: Basic and diluted 19,497 19,486 19,561

19,479 Basic and diluted net income (loss) per common share: Net

loss attributable to Astrotech Corporation from continuing

operations $ (0.07 ) $ (0.11 ) $ (0.28 ) $ (0.24 ) Net (loss)

income from discontinued operations (0.04 ) (0.03 )

1.21 0.02 Net (loss) income

attributable to Astrotech Corporation $ (0.11 ) $ (0.14 ) $ 0.93

$ (0.22 )

*

Noncontrolling interest resulted from

grants of restricted stock in 1st Detect and Astrogenetix to

certain employees, officers and directors. Please refer to the

September 30, 2014 10-Q filed with the Securities and Exchange

Commission for further detail.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets (In thousands, except share data)

(unaudited) March 31, 2015 June

30, 2014 Assets Current assets Cash and cash

equivalents $ 6,666 $ 3,831 Short-term investments 23,946 —

Accounts receivable, net of allowance 95 59 Income tax receivable —

— Indemnity receivable 6,100 — Prepaid expenses and other current

assets 725 389 Discontinued operations – current assets —

1,405

Total current assets

37,532 5,684 Property and equipment, net 2,699 1,211

Long-term investments 9,255 — Discontinued operations – net of

current assets — 33,887

Total

assets $ 49,486 $ 40,782

Liabilities and stockholders’ equity Current

liabilities Accounts payable $ 462 $ 996 Accrued liabilities and

other 2,082 1,753 Income tax payable 300 — Discontinued operations

– current liabilities — 7,344

Total

current liabilities 2,844 10,093 Other

liabilities 114 152 Discontinued operations – net of current

liabilities — 237

Total

liabilities 2,958 10,482

Commitments and Contingencies Stockholders’

equity Preferred stock, no par value, convertible, 2,500,000

authorized shares; no issued and outstanding shares, at March 31,

2015 and June 30, 2014 — — Common stock, no par value, 75,000,000

authorized shares; 20,013,787 and 19,856,454 shares issued at March

31, 2015 and June 30, 2014 184,088 183,866 Treasury stock, 524,285

and 311,660 at March 31, 2015 and at June 30, 2014, at cost (775 )

(237 ) Additional paid-in capital 1,087 1,671 Accumulated deficit

(138,039 ) (156,800 ) Accumulated other comprehensive income 13 —

Noncontrolling interest 154 1,800

Total stockholders’ equity 46,528

30,300 Total liabilities and stockholders’

equity $ 49,486 $ 40,782

ASTROTECH CORPORATION AND SUBSIDIARIES

Unaudited Reconciliation of Non-GAAP

Measures

Earnings Before Interest, Taxes,

Depreciation and Amortization

(In thousands) Three Months Ended March

31, Nine Months Ended March 31,

2015 2014

2015 2014 EBITDA $

(2,160 ) $ (2,414 ) $ 19,724 $ (2,881 ) Depreciation &

amortization 92 574 549 1,739 Interest expense — 63 63 193 Income

tax (benefit) expense (141 ) 2 362

8

Net (loss) income (2,111 ) (3,053 )

18,750 (4,821 ) Less: Net loss attributable to NCI (11 )

(216 ) (11 ) (681 )

Net (loss) income

attributable to ASTC $ (2,100 ) $ (2,837 ) $ 18,761 $

(4,140 )

EBITDA (earnings before interest, taxes, depreciation and

amortization) is a non-U.S. GAAP financial measure. We included

information concerning EBITDA because we use such information when

evaluating operating earnings (loss) to better evaluate the

underlying performance of the Company. EBITDA does not represent,

and should not be considered an alternative to, net income (loss),

operating earnings (loss), or cash flow from operations as those

terms are defined by U.S. GAAP and does not necessarily indicate

whether cash flows will be sufficient to fund cash needs. While

EBITDA is frequently used as measures of operations and the ability

to meet debt service requirements by other companies, our use of

this financial measure is not necessarily comparable to such other

similarly titled captions of other companies.

Astrotech CorporationEric Stober, 512-485-9530Chief Financial

Officer

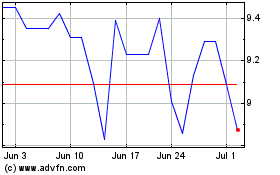

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024