UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31,

2014

| |

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from _____ to _____ |

Commission File Number: 333-149158

LIVEWIRE ERGOGENICS INC.

(Exact name of small business issuer

as specified in its charter)

|

Nevada

(State or other jurisdiction

of incorporation or organization) |

26-1212244

(I.R.S. Employer Identification

No.) |

24845 Corbit Place

Yorba Linda, CA 92887

(Current Address of Principal Executive

Offices)

714-940-0155

(Issuer Telephone Number)

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant

to Section 12(g) of the Act: Common Stock, Par Value $0.0001 |

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange

Act. Yes o

No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x

No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Rule 405 of Regulation S-K is not contained herein, and will

not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.:

| Large Accelerated Filer o |

|

Accelerated Filer o |

|

Smaller Reporting Company x |

|

Non-Accelerated Filer o |

|

| (Do not check of a smaller reporting company) |

|

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

The issuer’s revenues for its

most recent fiscal year ended December 31, 2014, were $238,957

As of June 30, 2014, the aggregate market

value of shares of the issuer’s common stock held by non-affiliates was approximately $5,544,000 based upon the closing bid

price of $0.0489 per share. Shares of the issuer’s common stock held by each executive officer and director have

been excluded in that such persons may be deemed to be affiliates of the issuer. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

At April 29, 2015, there were 204,727,594 shares of $0.0001

par value common stock issued and outstanding.

TABLE OF CONTENTS

Item 1 – BUSINESS

History

The Company was formed in Nevada on

October 9, 2007 under the name Semper Flowers, Inc. On May 15, 2009, the Company changed its name to SF Blu Vu, Inc. On

September 20, 2011, the Company changed its name to LIVEWIRE ERGOGENICS INC.

Under the Purchase Agreement dated June

30, 2011 (the “Purchase Agreement”) with LIVEWIRE MC2, LLC, a California limited liability company, (“LiveWire

MC2”) and the selling members of LiveWire MC2 (“Selling Members”), the Company issued 36,000,000 shares of common

stock to the Selling Members in exchange for 100% of LiveWire MC2. As such, LiveWire MC2 became a wholly owned subsidiary

of the Company.

The Purchase Agreement has been accounted

for as a reverse acquisition under the purchase method for business combinations, and accordingly the transaction has been treated

as a recapitalization of LiveWire MC2, with LiveWire MC2 as the accounting acquirer and the Company as the accounting acquiree.

For legal purposes LiveWire MC2 is the legal acquiree and the Company is the legal acquirer and surviving corporation. The

shares issued are treated as being issued for cash and are shown as outstanding for the period presented in the same manner as

for a stock split. The Company was a shell prior to the merger, having no significant assets or liabilities, and seeking

a viable business to acquire.

Item 1A - RISK FACTORS

Management of the Company intends for

the Company and its wholly owned subsidiary LIVEWIRE MC2, LLC, a California limited liability company, (“LiveWire MC2”)

to become a profitable entity with its focus on providing Chewable Energy Supplements and other functional foods as determined

by needs. The risks and uncertainties described below may affect the business, financial condition or operating results:

THE COMPANY IS SUBJECT TO THE RISKS INHERENT IN THE CREATION

OF A NEW BUSINESS.

The Company is subject to substantially

all the risks inherent in the creation of a new business. As a result of its small size and capitalization and limited operating

history, the Company is particularly susceptible to adverse effects of changing economic conditions and consumer tastes, competition,

and other contingencies or events beyond the control of the Company. It may be more difficult for the Company to prepare for and

respond to these types of risks and the risks described elsewhere than for a company with an established business and operating

cash flow.

OUR REVENUE GROWTH RATE DEPENDS PRIMARILY ON OUR ABILITY

TO EXECUTE OUR BUSINESS PLAN.

We may not be able to adequately generate

and adhere to the goals, objectives, strategies and tasks as defined in our business plan.

ANY FAILURE TO MAINTAIN ADEQUATE

GENERAL LIABILITY, COMMERCIAL, AND SERVICE LIABILITY INSURANCE COULD SUBJECT US TO SIGNIFICANT LOSSES OF INCOME.

Any general, commercial and/or service liability claims will

have a material adverse effect on our financial condition.

COMPETITORS WITH MORE RESOURCES MAY FORCE US OUT OF BUSINESS.

We will compete with many well-established

companies such as FRS Healthy Energy, ToGo Brands, Clif Bar, GU Energy Labs, and EN-R-G Foods Inc. Indirect competitors include

Red Bull, Monster, and 5-Hour Energy. Aggressive pricing by our competitors or the entrance of new competitors into our markets

could reduce our revenue and profit margins.

LIMITED OPERATING HISTORY, INITIAL OPERATING LOSSES.

The Company is presently a development

stage Company with limited operating history and only nominal capital. Additionally, though the Management Team has varied and

extensive business backgrounds and technical expertise, they have little substantive prior working running energy chew operations. Because

of the limited operating history, it is very difficult to evaluate the business and the future prospects. The Company will encounter

risks and difficulties. If objectives are not achieved, the Company may not realize sufficient revenues or net income

to succeed.

THE COMPANY MAY USE MORE CASH THAN GENERATED.

The company

anticipates using standard financing models and credit facilities. The Company may experience negative operating cash

flows for the foreseeable future. The Company may need to raise additional capital in the future to meet the operating and investing

cash requirements. The Company may not be able to find additional financing, if required, on favorable terms or at all. If additional

funds are raised through the issuance of equity, equity-related or debt securities, these securities may have rights, preferences

or privileges senior to those of the rights of the common stock holders who may experience additional dilution to their equity

ownership.

NO ASSURANCE OF PROFITABILITY.

The Company has generated revenues from operations. There

can be no assurance that the Company will be profitable.

DEPENDENCE ON MANAGEMENT.

The Company will rapidly and significantly

expand its operations and anticipates that significant expansion of its operations, including administrative facilities, will continue

to be required in order to address potential market opportunities. The rapid growth will place, and is expected to continue to

place, a significant strain on the Company’s management, operational, and financial resources. The Company's success is principally

dependent on its current management personnel for the operation of its business.

THE COMPANY MUST HIRE EXPERIENCED

PERSONNEL, ACQUIRE EQUIPMENT AND EXPAND FACILITIES IN ANTICIPATION OF INCREASED BUSINESS.

The Company may not be able to hire

or retain qualified staff. If qualified and skilled staff are not attracted and retained, growth of the business may be limited.

The ability to provide high quality service will depend on attracting and retaining educated staff, as well as professional experiences

that is relevant to our market, including for marketing, technology and general experience in (manufacturing energy supplements).

There will be competition for personnel with these skill sets. Some technical job categories may experience severe shortages in

the United States.

FAILURE TO MANAGE THE GROWTH COULD REDUCE REVENUES OR

NET INCOME.

Rapid expansion strains

infrastructure, management, internal controls and financial systems. The Company may not be able to effectively manage the

growth or expansion. To support growth, the Company plans to hire new employees. This growth may also strain the

Company’s ability to integrate and properly train these new employees. Inadequate integration and training of employees

may result in under utilization of the workforce and may reduce revenues or net income.

THE COMPANY MAY ACQUIRE OTHER BUSINESSES

OR PRODUCTS SUITABLE FOR THE COMPANY’S PLANNED EXPANSION; IF THIS HAPPENS, THE COMPANY MAY BE UNABLE TO INTEGRATE THEM INTO

THE EXISTING BUSINESS, AND/OR MAY IMPAIR OUR FINANCIAL PERFORMANCE.

If appropriate opportunities present

themselves, the Company may acquire businesses, technologies, services or products that are believed to be strategically viable.

There are currently no understandings, commitments or agreements with respect to any acquisition, aside from acquiring the necessary

equipment to begin operations.

FUTURE GOVERNMENT REGULATION MAY ADD TO OPERATING COSTS.

The Company operates in an environment

of uncertainty as to potential government regulation via (energy supplement manufacturing). We believe that we are not

subject to direct regulation, other than regulations applicable to businesses generally. Laws and regulations may be introduced

and court decisions may affect our business. Any future regulation may have a negative impact on the business by restricting

the method of operation or imposing additional costs.

OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM’S REPORT CONTAINS AN EXPLANATORY PARAGRAPH WHICH HAS EXPRESSED SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE

AS A GOING CONCERN, WHICH MAY HINDER OUR ABILITY TO OBTAIN FUTURE FINANCING

In their report, our independent registered

public accounting firm stated that our consolidated financial statements for the year ended December 31, 2014 were prepared assuming

that we would continue as a going concern, and that they have substantial doubt about our ability to continue as a going concern.

Our auditors' doubts are based on our recurring net losses, deficits in cash flows from operations and stockholders’ deficiency.

We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to generate

a profit and/or obtain necessary funding from outside sources, including by the sale of our securities, or obtaining loans from

financial institutions, where possible. Our continued net operating losses and our auditors' doubts increase the difficulty of

our meeting such goals and our efforts to continue as a going concern may not prove successful.

NOTE: In addition to the above risks, businesses are

often subject to risks not foreseen or fully appreciated by management.

Item 1B – UNRESOLVED STAFF COMMENTS

Smaller reporting companies are not required to provide the

information required by this item.

Item 2 – PROPERTIES

The Company leases space at the following location:

LiveWire Energy

24845 Corbit Place

Yorba Linda, CA 92887

Chief Executive Officer, Bill Hodson,

works full-time at this location. This 60,000 square foot space serves as our manufacturing base, order processing and fulfillment

facility. It has extensive office space and large warehouse areas. This location also acts as the base of operations for event

and promotion efforts. The Company’s LiveWire vehicle is stored at this location and the space is shared with another organization.

Part-time employees are used from time-to-time to satisfy order processing requirements and promotion events.

This facility allows us to expand operations

and add personnel as necessary in the future. Further, on an as needed basis, additional sales and business development

efforts are performed by independent consultants located throughout the country.

Item 3 – Legal Proceedings

In the normal course of our business,

we may periodically become subject to various lawsuits. However, there are currently no legal actions pending against us or, to

our knowledge, are any such proceedings contemplated.

Item 4 – Mine Safety Disclosures

Not applicable

PART II

Item 5 – Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

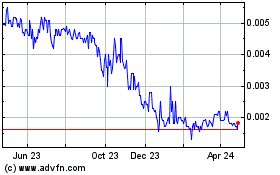

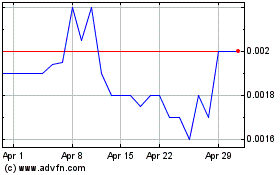

Our common stock has the trading symbol

LVVV.

| | |

High | | |

Low | |

| FISCAL YEAR ENDED December 31, 2014 | |

| | | |

| | |

| Fourth Quarter | |

$ | 0.02 | | |

$ | 0.01 | |

| Third Quarter | |

$ | 0.06 | | |

$ | 0.01 | |

| Second Quarter | |

$ | 0.12 | | |

$ | 0.04 | |

| First Quarter | |

$ | 0.15 | | |

$ | 0.03 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| FISCAL YEAR ENDED December 31, 2013 | |

| | | |

| | |

| | |

| | | |

| | |

| Fourth Quarter | |

$ | 0.05 | | |

$ | 0.02 | |

| Third Quarter | |

$ | 0.04 | | |

$ | 0.01 | |

| Second Quarter | |

$ | 0.07 | | |

$ | 0.02 | |

| First Quarter | |

$ | 0.20 | | |

$ | 0.06 | |

| | |

| | | |

| | |

Holders

We had more than 300 stockholders of record of our common

stock as of April 29, 2015, including shares held in street name.

Dividends

We have not paid any cash dividends

to stockholders. The declaration of any future cash dividend will be at the discretion of

our Board of Directors and will depend upon our earnings, if any, our capital requirements and

financial position, general economic conditions and other pertinent factors. It is

our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, into our

business.

Securities Authorized For Issuance under Equity Compensation

Plans

On May 1, 2013, the Board of Directors

of the Company adopted and approved the 2013 Stock Incentive Plan (“2013 Plan”) whereby it reserved for issuance up

to 7,500,000 shares of its common stock. The purpose of the Plan is to provide directors, officers and employees of, and consultants,

to the Company with additional incentives by increasing their ownership in the Company. Directors, officers, employees and consultants

of the Company are eligible to participate in the 2013 Plan. Incentive stock options may be granted only to employees of the Company.

Options in the form of Non-Statutory Stock Options (“NSO”) may be granted under the 2013 Plan. Restricted Stock may

also be granted under the 2013 Plan. On May 3, 2013, the Company filed Form S-8 with the SEC to register those 7,500,000 shares

of common stock. On May 24, 2014, the Company filed Form S-8 with the SEC to register an additional 10,000,000 shares of common

stock under the 2013 Plan. On May 24, 2014, the Company filed Form S-8 with the SEC to register an additional 10,000,000 shares

of common stock under the 2013 Plan. On April 10, 2015, the Company filed Form S-8 with the SEC to register an additional 135,000,000

shares of common stock under the 2013 Plan.

Item 6 – Selected Financial Data

The Company is a smaller reporting company

as defined by Rule 12b-2 of the Exchange Act and is not required to provide the information required under this item.

Item 7 – Management’s Discussion and Analysis

of Financial Condition and Results of Operation

The following discussion and analysis

should be read in conjunction with our consolidated financial statements. This discussion should not be construed to imply that

the results discussed herein will necessarily continue into the future, or that any conclusion reached herein will necessarily

be indicative of actual operating results in the future.

We are engaged in the sale and marketing

of energy chew products. Our product delivers a blend of ingredients that provides an energy boost similar to an energy

drink, such as Red Bull or 5-Hour Energy, but is about the size of a Starburst candy. The product is not a gum; it dissolves

quickly and is an alternative to drinks or shots.

The accounting rules we are required

to follow permit us to recognize revenue only when certain criteria are met.

CRITICAL ACCOUNTING POLICIES

The preparation of our consolidated

financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates

and judgments that affect our reported assets, liabilities, revenues, and expenses and the disclosure of contingent assets and

liabilities. We base our estimates and judgments on historical experience and on various others assumptions we believe to be reasonable

under the circumstances. Future events, however, may differ markedly from our current expectations and assumptions. While

there are a number of significant accounting policies affecting our consolidated financial statements; we believe the following

critical accounting policies involve the most complex, difficult and subjective estimates and judgments:

Accounts Receivable – We

evaluate the collectability of our trade accounts receivable based on a number of factors. In circumstances where we become aware

of a specific customer’s inability to meet its financial obligations to us, a specific reserve for bad debts is estimated

and recorded, which reduces the recognized receivable to the estimated amount we believe will ultimately be collected. In addition

to specific customer identification of potential bad debts, bad debt charges are recorded based on our recent loss history and

an overall assessment of past due trade accounts receivable outstanding.

Inventories – Inventories

are stated at the lower of cost to purchase and/or manufacture the inventory or the current estimated market value of the inventory.

We regularly review our inventory quantities on hand and record a provision for excess and obsolete inventory based primarily on

our estimated forecast of product demand, production availability and/or our ability to sell the product(s) concerned. Demand for

our products can fluctuate significantly. Factors that could affect demand for our products include unanticipated changes in consumer

preferences, general market and economic conditions or other factors that may result in cancellations of advance orders or reductions

in the rate of reorders placed by customers and/or continued weakening of economic conditions. Additionally, management’s

estimates of future product demand may be inaccurate, which could result in an understated or overstated provision required for

excess and obsolete inventory.

Long-Lived Assets –

Management regularly reviews property and equipment and other long-lived assets, including certain definite-lived identifiable

intangible assets, for possible impairment. This review occurs annually or more frequently if events or changes in circumstances

indicate the carrying amount of the asset may not be recoverable. If there is indication of impairment of property and equipment

or amortizable intangible assets, then management prepares an estimate of future cash flows (undiscounted and without interest

charges) expected to result from the use of the asset and its eventual disposition. If these cash flows are less than the carrying

amount of the asset, an impairment loss is recognized to write down the asset to its estimated fair value. The fair value is estimated

at the present value of the future cash flows discounted at a rate commensurate with management’s estimates of the business

risks.

Revenue Recognition – We

recognize revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable

and collectability is reasonably assured. Generally, ownership of and title to our products pass to customers upon

delivery of the products to customers. Certain of our distributors may also perform a separate function as a co-packer on our behalf.

In such cases, ownership of and title to our products that are co-packed on our behalf by those co-packers who are also distributors,

passes to such distributors when we are notified by them that they have taken transfer or possession of the relevant portion of

our finished goods. Net sales have been determined after deduction of promotional and other allowances in accordance with ASC 605-50.

Amounts received pursuant to new and/or amended distribution agreements entered into with certain distributors, relating to the

costs associated with terminating our prior distributors, are accounted for as revenue ratably over the anticipated life of the

respective distribution agreement, generally 20 years. Management believes that adequate provision has been made for cash discounts,

returns and spoilage based on our historical experience.

Cost of Sales – Cost of

sales consists of the costs of raw materials utilized in the manufacture of products, co-packing fees, repacking fees, in-bound

freight charges, as well as certain internal transfer costs, warehouse expenses incurred prior to the manufacture of our finished

products and certain quality control costs. Raw materials account for the largest portion of the cost of sales.

Operating

Expenses – Operating expenses include selling expenses such as distribution expenses to transport products to customers

and warehousing expenses after manufacture, as well as expenses for advertising, commissions, sampling and in-store demonstration

costs, costs for merchandise displays, point-of-sale materials and premium items, sponsorship expenses, other marketing expenses

and design expenses. Operating expenses also include payroll costs, travel costs, professional service fees including legal fees,

entertainment, insurance, postage, depreciation and other general and administrative costs.

Income Taxes – We utilize

the liability method of accounting for income taxes as set forth in ASC 740. Under the liability method, deferred taxes are determined

based on the temporary differences between the financial statement and tax basis of assets and liabilities using tax rates expected

to be in effect during the years in which the basis differences reverse. A valuation allowance is recorded when it is more likely

than not that some of the deferred tax assets will not be realized. In determining the need for valuation allowances we consider

projected future taxable income and the availability of tax planning strategies. If in the future we determine that we would not

be able to realize our recorded deferred tax assets, an increase in the valuation allowance would be recorded, decreasing earnings

in the period in which such determination is made.

We assess our income tax positions and

record tax benefits for all years subject to examination based upon our evaluation of the facts, circumstances and information

available at the reporting date. For those tax positions where there is a greater than 50% likelihood that a tax benefit will be

sustained, we have recorded the largest amount of tax benefit that may potentially be realized upon ultimate settlement with a

taxing authority that has full knowledge of all relevant information. For those income tax positions where there is less than 50%

likelihood that a tax benefit will be sustained, no tax benefit has been recognized in the financial statements.

Derivative Liabilities

The Company assessed the classification

of its derivative financial instruments as of December 31, 2014, which consist of convertible instruments and rights to shares

of the Company’s common stock, and determined that such derivatives meet the criteria for liability classification under

ASC 815.

ASC 815 generally provides three criteria

that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free standing

derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks

of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host

contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured

at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings

as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative

instrument subject to the requirements of ASC 815. ASC 815 also provides an exception to this rule when the host instrument is

deemed to be conventional, as described.

Fair Value of Financial Instruments

Effective January 1, 2008, the Company

adopted FASB ASC 820-Fair Value Measurements and Disclosures, or ASC 820, for assets and liabilities measured at fair value on

a recurring basis. ASC 820 establishes a common definition for fair value to be applied to existing generally accepted accounting

principles that require the use of fair value measurements establishes a framework for measuring fair value and expands disclosure

about such fair value measurements. The adoption of ASC 820 did not have an impact on the Company’s financial position or

operating results, but did expand certain disclosures.

ASC 820 defines fair value as the price

that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at

the measurement date. Additionally, ASC 820 requires the use of valuation techniques that maximize the use of observable inputs

and minimize the use of unobservable inputs. These inputs are prioritized below:

| Level 1: |

Observable inputs such as quoted market prices in active markets for identical assets or liabilities |

| Level 2: |

Observable market-based inputs or unobservable inputs that are corroborated by market data |

| Level 3: |

Unobservable inputs for which there is little no market data, which require the use of the reporting entity’s own assumptions. |

The Company did not have any

Level 2 or Level 3 assets or liabilities as of December 31, 2014, with the exception of its convertible notes payable and

derivative liability. The carrying amounts of these liabilities at December 31, 2014 approximate their respective fair value based on

the Company’s incremental borrowing rate.

Cash is considered to be highly liquid

and easily tradable as of December 31, 2014 and therefore classified as Level 1 within our fair value hierarchy.

In addition, FASB ASC 825-10-25 Fair

Value Option, or ASC 825-10-25, was effective for January 1, 2008. ASC 825-10-25 expands opportunities to use fair value measurements

in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value.

The Company did not elect the fair value options for any of its qualifying financial instruments.

Convertible Instruments

The Company evaluates and accounts for

conversion options embedded in its convertible instruments in accordance with professional standards for “Accounting for

Derivative Instruments and Hedging Activities”.

Professional standards generally

provides three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account

for them as free standing derivative financial instruments. These three criteria include circumstances in which (a) the economic

characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics

and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host

contract is not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair

value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument

would be considered a derivative instrument. Professional standards also provide an exception to this rule when the

host instrument is deemed to be conventional as defined under professional standards as “The Meaning of “Conventional

Convertible Debt Instrument”.

The Company accounts for convertible

instruments (when it has determined that the embedded conversion options should not be bifurcated from their host instruments)

in accordance with professional standards when “Accounting for Convertible Securities with Beneficial Conversion Features,”

as those professional standards pertain to “Certain Convertible Instruments.” Accordingly, the Company records, when

necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in debt instruments based upon

the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective

conversion price embedded in the note. Debt discounts under these arrangements are amortized over the term of the related debt

to their earliest date of redemption. The Company also records when necessary deemed dividends for the intrinsic value of conversion

options embedded in preferred shares based upon the differences between the fair value of the underlying common stock at the commitment

date of the note transaction and the effective conversion price embedded in the note.

ASC 815-40 provides that, among other

things, generally, if an event is not within the entity’s control could or require net cash settlement, then the contract

shall be classified as an asset or a liability.

Results of Operations

Company Overview for the year ended December 31, 2014

and 2013

During the year ended December 31, 2014 and 2013, we incurred

net losses of $4,183,518 and $1,265,936, respectively.

Comparison of the results of operations for the year ended

December 31, 2014 and 2013

Sales. During the years

ended December 31, 2014 and 2013, sales of our products amounted to $238,957 and $146,169, respectively. Our sales increased by

$92,788 or 63% due to larger initial orders from first time customers.

Cost of goods sold. For the fiscal

year ended December 31, 2014, cost of goods sold was $240,618 compared to $93,592 for the fiscal year ended December 31, 2013.

Our increase of $147,026 or 157% in cost of goods is a result of increase in orders and a larger supply of raw materials and inventory

write-down of $78,541 during 2014.

Gross (loss) profit. For the fiscal

year ended December 31, 2014, our gross loss was $1,661 (.7% of revenue) compared to gross profit of $52,577 (36% of revenue)

for the fiscal year ended December 31, 2013. The decrease in gross profit dollar amount and in gross profit percentage in 2014

from 2013, is a result of increased cost of goods sold in 2014 due to inventory write-down of $78,541.

Costs and Expenses

General

and Administrative. During the year ended December 31, 2014, general and administrative expenses amounted to $2,827,508,

as compared to $869,131 in the year ended December 31, 2013, an increase of $1,958,377 or 225%. The increase in general and administrative

expenses was almost entirely due to $1,751,184 of stock based compensation in 2014 compared to $0 in the corresponding period in

2013.

Selling

Costs. During the years ended December 31, 2014 and 2013, selling costs amounted to $55,764 or 23% of sales and $64,678

or 44% of sales, respectively. The dollar decrease in selling costs is attributable to efficiencies gained through higher sales

volume.

Depreciation. During

the years ended December 31, 2014 and 2013, depreciation expense amounted to $4,658 and $7,079, respectively.

Other expense.

During the years ended December 31, 2014 and 2013, other expense totaled $298,786 and $0 respectively. The increase is primarily

due to the write off of subscription receivable totaling $45,000, loss of settlement of debt totaling $24,000, the issuance of

common stock at a discount totaling $80,600 and the issuance of common stock for the purchase of Apple Rush trademarks totaling

$84,000.

Interest

expense. During the year ended December 31, 2014 interest expense increased to $653,916 from $59,196 during the year ended

December 31, 2013, an increase of $594,720. The primary reason for the increase is due to the issuance of shares recorded as interest

totaling $614,200 in the first quarter of 2014.

Loss on

settlement of debt. During the year ended December 31, 2014 loss on settlement of debt totaled $54,376 compared to $13,746

gain on settlement of debt for the year ended December 31, 2013. The increase relates to the Company settling debts by issuing

shares of common and preferred stock as well as the forgiveness of approximately $45,000 in convertible debt.

Gain on

change in fair value of derivative liability. As described in our accompanying consolidated financial statements, we issued

convertible notes with certain conversion features that have certain reset provisions. All of which, we are required to bifurcate

from the host financial instrument and mark to market each reporting period. We recorded the initial fair value of the reset provision

as a liability with an offset to equity or debt discount and subsequently mark to market the reset provision liability at each

reporting cycle.

For the year

ended December 31, 2014, we recorded a loss of $61,030 in change in fair value of the derivative liability including initial non-cash

interest as compared to a gain $65,544 for the year ended December 31, 2013. Also, the Company amortized beneficial conversion

feature expense on convertible notes of $225,819 during the year ended December 31, 2014 as compared to $397,719 in 2013.

Going Concern

The Company’s consolidated financial

statements are prepared using U.S. GAAP applicable to a going concern, which contemplates the realization of assets and liquidation

of liabilities in the normal course of business. We have an accumulated deficit of $8,134,449 and our current liabilities

exceeded our current assets by $715,162 as of December 31, 2014. We may require additional funding to sustain our operations and

satisfy our contractual obligations for our planned operations. Our ability to establish the Company as a going concern is may

be dependent upon our ability to obtain additional funding in order to finance our planned operations.

In order to continue as a going concern,

develop a reliable source of revenues, and achieve a profitable level of operations the Company will need, among other things,

additional capital resources. Management’s plans to continue as a going concern include raising additional capital

through increased sales of product and by sale of common shares. However, management cannot provide any assurances that

the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as a going concern is

dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other

sources of financing and attain profitable operations. The accompanying consolidated financial statements do not include

any adjustments that might be necessary if the Company is unable to continue as a going concern.

Liquidity and Capital Resources

During the year ended December 31, 2014,

our cash flows from operations were not sufficient for us to meet our operating commitments. Our cash flows from operations

continue to be, and are expected to continue to be, insufficient to meet our operating commitments.

Working Capital. As of December 31, 2014,

we had a working capital deficit of $715,162 and cash of $1,448, while at December 31, 2013 we had a working capital deficit of

$772,935 and cash of $8,342. The decrease in our working capital deficit is primarily attributable to an increase in current assets,

with a minimal increase in current liabilities in the current year versus the prior year. We do not expect our working capital

deficit to decrease in the near future.

Cash Flow. Net cash used

in or provided by operating, investing and financing activities for the years ended December 31, 2014 and 2013 were as follows:

| |

|

Year Ended

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

|

|

|

|

|

| Net cash used in operating activities |

|

$ |

(757,463 |

) |

|

$ |

(500,167 |

) |

| Net cash used in investing activities |

|

$ |

(28,431 |

) |

|

$ |

- |

|

| Net cash provided by financing activities |

|

$ |

779,000 |

|

|

$ |

506,399 |

|

Net Cash Used in Operating Activities.

The changes in net cash used in operating activities are attributable to our net loss adjusted for non-cash charges as presented

in the consolidated statements of cash flows and changes in working capital as discussed above.

Net Cash Used in Investing Activities.

Net cash used in investing activities for the year ended December 31, 2014 was related to purchases of equipment and payments for

security deposits. There were no capital expenditures for the year ended December 31, 2013.

Net Cash Provided by Financing Activities. Net

cash provided by financing activities relates primarily to cash received from sales of our common stock and issuance of our notes

payable as well as capital contributions and advances from shareholders.

Off-Balance Sheet Arrangements

We do not have off-balance sheet arrangements.

Inflation

The effect of inflation on the Company's revenue and operating

results was not significant.

Contractual Obligations

None.

Recently Issued Accounting Pronouncements

In

May 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers (Topic 606)," which is the new comprehensive

revenue recognition standard that will supersede all existing revenue recognition guidance under GAAP. The standard's core principle

is that a company will recognize revenue when it transfers promised goods or services to a customer in an amount that reflects

the consideration to which the company expects to be entitled in exchange for those goods or services. This ASU is effective for

annual and interim periods beginning on or after December 15, 2016, and early adoption is not permitted. Entities will have the

option of using either a full retrospective approach or a modified approach to adopt the guidance in the ASU. The Company is currently

evaluating the impact of adopting this guidance.

In

June 2014, the FASB issued ASU 2014-12, "Compensation - Stock Compensation (Topic 718): Accounting for Share-Based Payments

When the Terms of an Award Provide That a Performance Target Could be Achieved after the Requisite Service Period." This ASU

provides more explicit guidance for treating share-based payment awards that require a specific performance target that affects

vesting and that could be achieved after the requisite service period as a performance condition. The new guidance is effective

for annual and interim reporting periods beginning after December 15, 2015. The Company does not expect the adoption of

this guidance to have a material impact on the consolidated financial statements.

In August 2014, the FASB issued a new

accounting standard which requires management to evaluate whether there is substantial doubt about an entity’s ability to

continue as a going concern for each annual and interim reporting period. If substantial doubt exists, additional disclosure is

required. This new standard will be effective for the Company for annual and interim periods beginning after December 15, 2016.

Early adoption is permitted. The Company expects to adopt this new standard for the fiscal year ending December 31, 2015 and the

Company will continue to assess the impact on its consolidated financial statements.

There are various other updates recently

issued, most of which represented technical corrections to the accounting literature or application to specific industries and

are not expected to a have a material impact on the Company's financial position, results of operations or cash flows.

Item 7A – Quantitative and Qualitative Disclosures

About Market Risk

The Company is a smaller reporting

company as defined by Rule 12b-2 under the Exchange Act and is not required to provide the information required under this item.

Item 8 – Financial Statements

and Supplementary Data

See pages F-1 through F-20 following:

LIVEWIRE ERGOGENICS, INC.

DECEMBER 31, 2014

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Table of

Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors and Shareholders of

LiveWire Ergogenics, Inc.

We have audited the accompanying consolidated

balance sheets of LiveWire Ergogenics, Inc. (the “Company”) as of December 31, 2014 and 2013, and the related consolidated

statements of operations, stockholders’ deficit and cash flows for each of the two years in the period ended December 31,

2014. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to

express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance

with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not

engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration

of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.

Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management,

and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial

statements referred to above present fairly, in all material respects, the financial position of LiveWire Ergogenics, Inc. at December

31, 2014 and 2013, and the results of its operations and its cash flows for each of the two years in the period ended December

31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial

statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the consolidated

financial statements, the Company has sustained net losses and stockholder’s deficit. These conditions raise substantial

doubt about the Company’s ability to continue as a going concern. Management’s plans in regards to these matters are

also described in Note 3. The consolidated financial statements do not include any adjustments that might result from the outcome

of this uncertainty.

/s/ RBSM LLP

May 8, 2015

New York, New York

| LiveWire

Ergogenics, Inc. |

| Consolidated

Balance Sheets |

| | |

December 31, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 1,448 | | |

$ | 8,342 | |

| Accounts receivable, net | |

| 9,447 | | |

| - | |

| Inventory, net | |

| 47,128 | | |

| 46,234 | |

| Prepaid and other current assets | |

| 220,391 | | |

| 930 | |

| Total current assets | |

| 278,414 | | |

| 55,506 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 7,799 | | |

| 7,456 | |

| Security deposits | |

| 23,430 | | |

| - | |

| | |

| | | |

| | |

| Total assets | |

$ | 309,643 | | |

$ | 62,962 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 153,370 | | |

$ | 104,145 | |

| Accounts payable - related party | |

| - | | |

| 236,341 | |

| Deferred revenue | |

| 79,342 | | |

| - | |

| Due to others | |

| 23,015 | | |

| - | |

| Notes payable | |

| 235,700 | | |

| 165,096 | |

| Notes payable - related party | |

| 196,341 | | |

| - | |

| Convertible debentures, net | |

| 244,778 | | |

| 322,859 | |

| Derivative liability | |

| 61,030 | | |

| - | |

| Total liabilities | |

| 993,576 | | |

| 828,441 | |

| | |

| | | |

| | |

| COMMITMENT AND CONTINGENCIES (SEE NOTE 8) | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 10,000,000 shares authorized | |

| | | |

| | |

| Series B convertible preferred stock, $0.0001 par value,

150,000 shares designated, 32,820 and 134,724 shares issued and outstanding at December 31, 2014 and 2013 respectively,

liquidation preference is $1 per share | |

| 3 | | |

| 13 | |

| Series C convertible preferred stock, $0.0001 par value,

75 shares designated, 75 and 0 shares issued and outstanding at December 31, 2014 and 2013, respectively, liquidation preference is $200 per share | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 200,000,000 and

100,000,000 shares authorized, respectively, 156,508,559 and 86,807,868 shares issued and outstanding at December 31,

2014 and 2013, respectively | |

| 15,651 | | |

| 8,681 | |

| Class A convertible common stock, $0.0001 par value,

1,000,000 shares authorized, 0 shares issued and outstanding at December 31, 2014 and 2013 | |

| - | | |

| - | |

| Subscription receivable | |

| - | | |

| (45,000 | ) |

| Additional paid-in-capital | |

| 7,434,862 | | |

| 3,221,758 | |

| Accumulated deficit | |

| (8,134,449 | ) | |

| (3,950,931 | ) |

| Total stockholders' deficit | |

| (683,933 | ) | |

| (765,479 | ) |

| | |

| | | |

| | |

| Total liabilities and stockholders' deficit | |

$ | 309,643 | | |

$ | 62,962 | |

The

accompanying notes to the consolidated financial statements are an integral part of these statements.

| LiveWire

Ergogenics, Inc. |

| Consolidated

Statements of Operations |

| | |

For the years ended

December 31, | |

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| Income: | |

| | |

| |

| Sales | |

$ | 238,957 | | |

$ | 146,169 | |

| Cost of goods sold | |

| 240,618 | | |

| 93,592 | |

| Gross (Loss) Profit | |

| (1,661 | ) | |

| 52,577 | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Selling costs | |

| 55,764 | | |

| 64,678 | |

| General and administrative costs | |

| 2,827,508 | | |

| 869,131 | |

| Depreciation | |

| 4,658 | | |

| 7,079 | |

| Total Operating Expenses | |

| 2,887,930 | | |

| 940,888 | |

| | |

| | | |

| | |

| Loss from operations | |

| (2,889,591 | ) | |

| (888,311 | ) |

| | |

| | | |

| | |

| Other Expenses (Income): | |

| | | |

| | |

| Other expense | |

| 298,786 | | |

| - | |

| Loss (gain) on change in fair value of derivative liability | |

| 61,030 | | |

| (65,544 | ) |

| (Gain) loss on settlement of debt | |

| 54,376 | | |

| (13,746 | ) |

| Amortization of beneficial conversion feature | |

| 225,819 | | |

| 397,719 | |

| Interest expense | |

| 653,916 | | |

| 59,196 | |

| Total other expenses | |

| 1,293,927 | | |

| 377,625 | |

| | |

| | | |

| | |

| Net Loss Before Provision for Income Taxes | |

$ | (4,183,518 | ) | |

$ | (1,265,936 | ) |

| | |

| | | |

| | |

| Income Tax | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net Loss | |

$ | (4,183,518 | ) | |

$ | (1,265,936 | ) |

| | |

| | | |

| | |

| Basic and diluted loss per share | |

$ | (0.03 | ) | |

$ | (0.02 | ) |

| | |

| | | |

| | |

| Weighted average shares | |

| | | |

| | |

| outstanding - basic and diluted | |

| 133,042,823 | | |

| 75,068,775 | |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

| LiveWire Ergogenics,

Inc. |

| CONSOLIDATED

STATEMENTS OF STOCKHOLDERS' DEFICIT |

| | |

Preferred Stock

Series B | | |

Preferred Stock

Series C | | |

Common Stock

Series A | | |

Common Stock | | |

Common Stock

to be

Issued | | |

Stock

Subscription | | |

Additional

Paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Receivable | | |

Capital | | |

Deficit | | |

Total | |

| Balances, December 31, 2012 | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 68,460,139 | | |

$ | 6,846 | | |

| 50,400 | | |

$ | 5 | | |

$ | (45,000 | ) | |

$ | 1,832,115 | | |

$ | (2,684,995 | ) | |

$ | (891,029 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,800,000 | | |

| 480 | | |

| - | | |

| - | | |

| - | | |

| 183,840 | | |

| - | | |

| 184,320 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for payment of notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,672,330 | | |

| 167 | | |

| - | | |

| - | | |

| - | | |

| 34,813 | | |

| - | | |

| 34,980 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for payment of convertible notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 11,591,523 | | |

| 1,160 | | |

| - | | |

| - | | |

| - | | |

| 140,340 | | |

| - | | |

| 141,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for interest of convertible notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 233,476 | | |

| 23 | | |

| - | | |

| - | | |

| - | | |

| 3,797 | | |

| - | | |

| 3,820 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for common stock to be issued | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 50,400 | | |

| 5 | | |

| (50,400 | ) | |

| (5 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred shares issued for conversion of notes payables and accrued expenses | |

| 134,724 | | |

| 13 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 134,711 | | |

| - | | |

| 134,724 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capital contribution | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 460,667 | | |

| - | | |

| 460,667 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Extinguishment of derivative liability | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 216,911 | | |

| - | | |

| 216,911 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beneficial conversion feature in connection with convertible notes | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 214,564 | | |

| - | | |

| 214,564 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the year ended December 31, 2013 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,265,936 | ) | |

| (1,265,936 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances, December 31, 2013 | |

| 134,724 | | |

$ | 13 | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 86,807,868 | | |

$ | 8,681 | | |

| - | | |

$ | - | | |

$ | (45,000 | ) | |

| 3,221,758 | | |

$ | (3,950,931 | ) | |

$ | (765,479 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of Series B Preferred shares to shares of common stock | |

| (101,904 | ) | |

| (10 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,112,955 | | |

| 311 | | |

| - | | |

| - | | |

| - | | |

| (301 | ) | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Series C Preferred shares isued for stock based compensation | |

| - | | |

| - | | |

| 75 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 24,000 | | |

| - | | |

| 24,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Write down of subscription receivable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 45,000 | | |

| - | | |

| - | | |

| 45,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Class A common shares issued for conversion of debt | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,000,000 | | |

| 100 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 62,496 | | |

| - | | |

| 62,596 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of Class A Common Stock to shares of Common Stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,000,000 | ) | |

| (100 | ) | |

| 1,000,000 | | |

| 100 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for stock based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 16,035,000 | | |

| 1,604 | | |

| - | | |

| - | | |

| - | | |

| 1,734,580 | | |

| - | | |

| 1,736,184 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for services and prepaid services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 15,350,000 | | |

| 1,535 | | |

| - | | |

| - | | |

| - | | |

| 654,475 | | |

| - | | |

| 656,010 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for payment of notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,000,000 | | |

| 200 | | |

| - | | |

| - | | |

| - | | |

| 73,800 | | |

| - | | |

| 74,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for payment of convertible notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| 11,297,365 | | |

| 1,130 | | |

| - | | |

| - | | |

| - | | |

| 249,170 | | |

| - | | |

| 250,300 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for interest of convertible notes payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 485,349 | | |

| 48 | | |

| - | | |

| - | | |

| - | | |

| 8,832 | | |

| - | | |

| 8,880 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for conversion of accrued expenses | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 431,428 | | |

| 43 | | |

| - | | |

| - | | |

| - | | |

| 46,551 | | |

| - | | |

| 46,594 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,346,000 | | |

| 835 | | |

| - | | |

| - | | |

| - | | |

| 423,465 | | |

| - | | |

| 424,300 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for purchase of trademarks | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,000,000 | | |

| 400 | | |

| - | | |

| - | | |

| - | | |

| 83,600 | | |

| - | | |

| 84,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for interest expense | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,642,593 | | |

| 764 | | |

| - | | |

| - | | |

| - | | |

| 613,436 | | |

| - | | |

| 614,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss on settlement of debt | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 24,000 | | |

| - | | |

| 24,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beneficial conversion feature in connection with convertible notes | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 215,000 | | |

| - | | |

| 215,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| Net loss for the year ended December 31, 2014 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,183,518 | ) | |

| (4,183,518 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances, December 31, 2014 | |

| 32,820 | | |

$ | 3 | | |

| 75 | | |

$ | - | | |

| - | | |

$ | - | | |

| 156,508,558 | | |

$ | 15,651 | | |

| - | | |

$ | - | | |

$ | - | | |

$ | 7,434,862 | | |

$ | (8,134,449 | ) | |

$ | (683,933 | ) |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

| LiveWire Ergogenics,

Inc. |

| Consolidated

Statements of Cash Flows |

| | |

For the years ended | |

| | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| Cash Flows From Operating Activities: | |

| | |

| |

| Net loss | |

$ | (4,183,518 | ) | |

$ | (1,265,936 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation expense | |

| 4,658 | | |

| 7,079 | |

| Net loss (gain) on settlement of debt | |

| 79,401 | | |

| (13,746 | ) |

| Change in fair value of derivative liability | |

| 61,030 | | |

| (65,544 | ) |

| Amortization of beneficial conversion feature | |

| 225,819 | | |

| 397,719 | |

| Amortization of prepaid consulting fees | |

| 297,336 | | |

| - | |

| Common stock issued for services | |

| 210,850 | | |

| 184,320 | |

| Common stock issued for interest expense | |

| 614,200 | | |

| 3,820 | |

| Common stock issued for purchase of trademarks | |

| 84,000 | | |

| - | |

| Stock based compensation | |

| 1,751,184 | | |

| - | |

| Write off of subscription receivable | |

| 45,000 | | |

| - | |

| Bad debt provision | |

| 91,222 | | |

| 1,780 | |

| Discount on issuance of common stock | |

| 80,600 | | |

| - | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| (100,669 | ) | |

| 2,695 | |

| Due to others | |

| 23,015 | | |

| - | |

| Inventory, net | |

| (894 | ) | |

| 662 | |

| Prepaid and other current assets | |

| (152,237 | ) | |

| - | |

| Accounts payable and accrued expenses | |

| 62,198 | | |

| (4,016 | ) |

| Accounts payable - related party | |

| (30,000 | ) | |

| 251,000 | |

| Deferred revenue | |

| 79,342 | | |

| - | |

| Net cash used in operating activities | |

| (757,463 | ) | |

| (500,167 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Purchase of equipment | |

| (5,001 | ) | |

| - | |

| Payments towards security deposits | |

| (23,430 | ) | |

| - | |

| Net cash used in investing activities | |

| (28,431 | ) | |

| - | |

| | |

| | | |

| | |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Proceeds from notes payable | |

| 177,700 | | |

| 180,000 | |

| Repayment of note payable | |

| (28,000 | ) | |

| (53,500 | ) |

| Proceeds from convertible notes payable | |

| 215,000 | | |

| 540,000 | |

| Repayment of convertible note payable | |

| - | | |

| (151,000 | ) |

| Advance from stockholders | |

| - | | |

| 57,446 | |

| Repayment of advances from stockholders | |

| - | | |

| (10,297 | ) |

| Repayment of shareholder loans | |

| - | | |

| (56,250 | ) |

| Repayment of notes payable - related party | |

| (10,000 | ) | |

| - | |

| Proceeds from issuance of common stock | |

| 424,300 | | |

| - | |

| Net cash provided by financing activities | |

| 779,000 | | |

| 506,399 | |

| | |

| | | |

| | |

| Net (Decrease) Increase in Cash | |

| (6,894 | ) | |

| 6,232 | |

| | |

| | | |

| | |

| Cash at Beginning of Year | |

| 8,342 | | |

| 2,110 | |

| | |

| | | |

| | |

| Cash at End of Year | |

$ | 1,448 | | |

$ | 8,342 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information | |

| | | |

| | |

| Cash paid for interest | |

$ | - | | |

$ | 15,023 | |

| Cash paid for income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non Cash Investing and Financing Activities | |

| | | |

| | |

| Beneficial conversion feature on convertible notes | |

$ | 215,000 | | |

$ | 425,500 | |

| Preferred shares issued for conversion/payment of notes payable | |

$ | - | | |

$ | 134,724 | |

| Conversion of accounts payable - related party to convertible notes payable | |

$ | - | | |

$ | 90,045 | |

| Common stock issued for payment of notes payable | |

$ | 50,000 | | |

$ | 34,980 | |

| Common stock issued for payment of convertible notes payable | |

$ | 250,300 | | |

$ | 141,500 | |

| Conversion of interest to note payable | |

$ | - | | |

$ | 7,500 | |

| Conversion of note payable to Class A common stock | |

$ | 20,596 | | |

$ | - | |

| Conversion of Class A common stock to common stock | |

$ | 100 | | |

$ | - | |

| Accounts payable and accrued expenses settled by issuance of common stock | |

$ | 12,973 | | |

$ | - | |

| Conversion of accounts payable - related party to notes payable - related party | |

$ | 206,341 | | |

$ | - | |

| Common stock issued for prepaid consulting services | |

$ | 364,560 | | |

$ | - | |

| Conversion of Series B preferred stock to common stock | |

$ | 10 | | |

$ | - | |

| Capital contribution related to accrued expenses | |

$ | - | | |

$ | 460,667 | |

| Reclassification of derivative liabilities to additional paid-in capital on conversion of debt | |

$ | - | | |

$ | 216,911 | |

| Common stock issued for conversion of interest | |

$ | 8,880 | | |

$ | - | |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

LIVEWIRE ERGOGENICS INC.

NOTES TO THE CONSOLIDATED FINANCIAL

STATEMENTS

DECEMBER 31, 2014

NOTE 1 – BASIS OF PRESENTATION AND NATURE OF OPERATIONS

The Company

LiveWire MC2, LLC (“LVWR”)

was organized under the laws of the State of California on January 7, 2008 as a limited liability company. LVWR was formed for

the purpose of developing and marketing consumable energy supplements. LVWR adopted December 31 as the fiscal year end.

On June 30, 2011, LVWR,

together with its members, entered into a purchase agreement (the “Purchase Agreement”), for a share exchange with

SF Blu Vu, Inc., (“SF Blu”), a public Nevada shell corporation. SF Blu Vu Inc. was formed in Nevada on October 9, 2007

under the name Semper Flowers, Inc. On May 15, 2009, Semper Flowers, Inc. changed its name to SF Blu Vu, Inc. The Purchase Agreement

was ultimately completed on August 31, 2011. Under the terms of the Purchase Agreement, SF Blu issued 36,000,000 (30,000,000 shares

pre stock split of 1 additional share for every five shares held) of their common shares for 100% of the members’ interest

in LVWR. Subsequent to the Purchase Agreement, the members of LVWR owned 60% of common shares of SF Blu, effectively obtaining

operational and management control of SF Blu. For accounting purposes, the transaction has been accounted for as a reverse acquisition

under the purchase method of business combinations, and accordingly the transaction has been treated as a recapitalization of LVWR,

the accounting acquirer in this transaction, with SF Blu (the shell) as the legal acquirer.

Subsequent to the Purchase Agreement

being completed, SF Blu as the legal acquirer and surviving company, together with their controlling stockholders from LVWR changed

the name of SF Blu to LiveWire Ergogenics, Inc. (“LiveWire”) on September 20, 2011. Hereafter, SF Blu, LVWR, or LiveWire

are referred to as the “Company”, unless specific reference is made to an individual entity.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Advertising

Advertising is expensed as incurred

and is included in selling costs on the accompanying consolidated statements of operations. Advertising and marketing expense for

the years ended December 31, 2014 and 2013 was approximately $55,700 and $64,700, respectively.

Accounts Receivable

Accounts receivable are presented net

of an allowance for doubtful accounts. The Company maintains allowances for doubtful accounts for estimated losses. The Company

reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability