UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2015 (May 6, 2015)

Corrections Corporation of America

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

001-16109 |

|

62-1763875 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

10 Burton Hills Boulevard,

Nashville, Tennessee 37215

(Address of principal executive offices) (Zip Code)

(615) 263-3000

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On May 6, 2015, Corrections Corporation of America,

a Maryland corporation (the “Company”), issued a press release announcing its 2015 first quarter financial results. A copy of the release is furnished as a part of this Current Report as Exhibit 99.1 and is incorporated herein

in its entirety by this reference. The release contains certain financial information calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles, or GAAP, which the Company believes

is useful to investors and other interested parties. The Company has included information concerning this non-GAAP information in the release, including a reconciliation of such information to the most comparable GAAP measures, the reasons why the

Company believes such information is useful, and the Company’s use of such information for additional purposes.

The information furnished pursuant

to this Item 2.02 of Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and Section 11 of the Securities Act of 1933, as amended, or otherwise

subject to the liabilities of those sections. This Current Report will not be deemed an admission by the Company as to the materiality of any information in this report that is required to be disclosed solely by Item 2.02. The Company does not

undertake a duty to update the information in this Current Report and cautions that the information included in this Current Report is current only as of May 6, 2015 and may change thereafter.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) The following exhibit is furnished as part of this Current

Report:

Exhibit 99.1 – Press Release dated May 6, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

|

|

|

|

|

|

|

| Date: May 7, 2015 |

|

|

|

CORRECTIONS CORPORATION OF AMERICA |

|

|

|

|

|

|

|

|

By: |

|

/s/ David M. Garfinkle |

|

|

|

|

|

|

David M. Garfinkle

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release dated May 6, 2015 |

Exhibit 99.1

News Release

|

|

|

| Contact: |

|

Investors and Analysts: Cameron Hopewell, CCA at (615) 263-3024

Financial Media: Dave Gutierrez, Dresner Corporate Services at (312) 780-7204 |

CCA REPORTS FIRST QUARTER 2015 FINANCIAL

RESULTS

NASHVILLE, Tenn. – May 6, 2015 – CCA (Corrections Corporation of America) (NYSE: CXW),

America’s largest owner of partnership correctional and detention facilities, announced today its financial results for the first quarter of 2015.

First Quarter 2015 Highlights

| |

• |

|

EPS and Adjusted Diluted EPS up 11.4% to $0.49 from $0.44 |

| |

• |

|

Normalized FFO per diluted share up 9.7% to $0.68 from $0.62 |

| |

• |

|

AFFO per diluted share up 17.2% to $0.68 from $0.58 |

Net income generated in the first quarter of 2015 totaled

$57.3 million, or $0.49 per diluted share, compared to $51.7 million, or $0.44 per diluted share, generated in the first quarter of 2014. Net income after adjusting for special items increased to $58.2 million, or $0.49 per diluted share, during the

first quarter of 2015, compared to $51.7 million, or $0.44 per diluted share, during the first quarter of 2014. Normalized FFO was $79.5 million, or $0.68 per diluted share, during the first quarter of 2015, compared with $72.8 million, or $0.62 per

diluted share, during the first quarter of 2014.

“We are pleased with our exceptional performance in the first quarter of 2015, which exceeded the

high-end of our guidance for nearly all financial metrics,” said Damon Hininger, CCA’s chief executive officer. “CCA’s ability to differentiate our capabilities by delivering innovative solutions to government partners continues

to drive our growth in the marketplace, as evidenced by the ongoing development of our South Texas Family Residential Center and the expansion of our contract with the state of Arizona at the Red Rock Correctional Center. We are actively pursuing a

multitude of opportunities which, when coupled with our two additional facilities under development, should allow for the delivery of continued shareholder value.”

Operating Results

Total revenue for the first quarter of

2015 was $426.0 million compared to $404.2 million in the first quarter of 2014. The increase in revenue was primarily attributable to the

10 Burton Hills

Boulevard, Nashville, Tennessee 37215, Phone: 615-263-3000

First Quarter 2015 Financial Results

Page

2

operational ramp of our South Texas Family Residential Center, which contributed approximately $36.0 million in first quarter revenue, and the acceptance of an additional 500 inmates from the

state of Arizona at the Red Rock Correctional Center. Partially offsetting the aforementioned revenue contributors was the termination last year of three managed-only contracts with the state of Florida and one managed only contract with the state

of Idaho, which in the aggregate contributed $12.5 million to revenue in the first quarter of 2014. These four facilities incurred net operating losses totaling $1.0 million in the first quarter of 2014. Additional headwinds to revenue resulted from

modest declines in first quarter 2015 occupancy at CCA facilities housing detainees for the U.S. Marshals Service (USMS) and Immigration and Customs Enforcement (ICE) versus the comparable prior year period. However, we began to experience increases

from these federal partners late in the first quarter of 2015. Total net operating income (NOI) for the first quarter of 2015 of $125.3 million increased 7.3% from $116.8 million generated in the first quarter of 2014.

Net income generated in the first quarter of 2015 totaled $57.3 million, or $0.49 per diluted share, compared to net income of $51.7 million, or $0.44 per

diluted share in the prior year quarter. Special items in the first quarter of 2015 included a non-cash asset impairment charge related to the write-off of goodwill resulting from our election to terminate our contract at the Winn Correctional

Center in Louisiana. Excluding this special item, adjusted net income during the first quarter of 2015 was $58.2 million, or $0.49 per diluted share, compared with $51.7 million, or $0.44 per diluted share, in the prior year quarter, an increase of

11.4% in adjusted diluted earnings per share.

Adjusted net income, NOI, FFO, Normalized FFO and AFFO, and their corresponding per share amounts, are

measures calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles (GAAP). Please refer to the Supplemental Financial Information and related note following the financial statements

herein for further discussion and reconciliations of these measures to GAAP measures.

Partnership Development Update

South Texas Family Residential Center Update. In the first quarter of 2015, ICE continued housing female adults with children arriving illegally

on the Southwest border at the South Texas Family Residential Center, a facility we lease in Dilley, Texas. As of the end of the first quarter of 2015, the facility had capacity to house up to 480 individuals while ongoing construction will provide

housing in 480-bed increments for up to 2,400 individuals scheduled to be completed in the second quarter of 2015. The new facility and services are being provided under an amended Intergovernmental Service Agreement (IGSA), which has a term of up

to four years, and can be extended by bi-lateral modification. During the first quarter of 2015, the Company recognized $36.0 million in revenue associated with the amended IGSA.

Trousdale Turner Correctional Center Update. Construction of the new 2,552-bed Trousdale Turner Correctional Center remains on schedule

for completion near the end of 2015. The total cost of construction is estimated at $140.0 million to $145.0 million,

First Quarter 2015 Financial Results

Page

3

including $87.4 million invested through March 31, 2015. We expect to begin receiving inmates from the state of Tennessee in early 2016 pursuant to a new IGSA with Trousdale County.

Otay Mesa Detention Center Update. Construction of the new 1,492-bed Otay Mesa Detention Center is on schedule for completion during the third

quarter of 2015. The total cost of construction is estimated at $153.0 million to $157.0 million, including $136.1 million invested through March 31, 2015. We plan to begin transferring federal inmate populations to this new facility from the

1,154-bed San Diego Correctional Facility during the third quarter of 2015.

Red Rock Correctional Center Update. During the first quarter

of 2014, we received 500 inmates from the state of Arizona at our 1,596-bed Red Rock Correctional Center pursuant to a new management contract that became effective January 1, 2014. During the first quarter of 2015, we received an additional

500 inmates under this contract, bringing the total population to approximately 1,000 inmates.

Winn Correctional Center Update. In early

April 2015, we provided notice to the state of Louisiana that we will cease management of the Winn Correctional Center within 180 days, in accordance with the notice provisions of the contract. In anticipation of terminating the contract at the

facility, we recorded an asset impairment of $1.0 million during the first quarter of 2015 for the write-off of goodwill associated with the facility. Our contractual per diem at the Winn facility is approximately $10 lower than our average

managed-only per diem rate, and contributed to operating losses in the first quarter of 2015.

Guidance

We currently expect Adjusted Diluted EPS for the second quarter of 2015 to be in the range of $0.49 to $0.51, while Normalized FFO and AFFO per share are

expected to be in the range of $0.67 to $0.69 and $0.65 to $0.67, respectively. For the full year 2015, we now expect Adjusted Diluted EPS to be in the range of $1.89 to $1.97, while Normalized FFO and AFFO per share are now expected to be in the

range of $2.62 to $2.70 and $2.57 to $2.64, respectively.

We have updated full-year 2015 guidance to reflect year-to-date financial results and current

market developments, the most significant development being an expected decline in California inmates housed in certain of our facilities located outside the state of California as a result of decreases in inmate populations within the state’s

correctional system. During the first quarter of 2015 the adult inmate population held in state of California institutions met the Federal court order to reduce inmate populations below 137.5% of its capacity. Inmate populations in the state have

continued to decline below the court ordered capacity limit, which has resulted in inmate populations in the out-of-state program declining to approximately 8,100 as of April 30, 2015 from approximately 8,600 as of March 31, 2015. While we

expect a reduction in the program, we believe our contract with the state of California will continue beyond the next state fiscal year as we have been an important solution in the state’s efforts to address overcrowding and comply with court

mandates.

First Quarter 2015 Financial Results

Page

4

During 2015, we expect to invest approximately $193.0 million to $208.0 million in capital expenditures,

consisting of approximately $135.0 million to $145.0 million in on-going prison construction and expenditures related to potential land acquisitions, and certain leasehold improvements and equipment at the South Texas Family Residential Center;

approximately $25.0 million to $26.0 million in maintenance capital expenditures on real estate assets; and approximately $33.0 million to $37.0 million for capital expenditures on other assets and information technology.

Supplemental Financial Information and Investor Presentations

We have made available on our website supplemental financial information and other data for the first quarter of 2015. We do not undertake any obligation, and

disclaim any duty to update any of the information disclosed in this report. Interested parties may access this information through our website at www.cca.com under “Financial Information” of the Investors section.

Management may meet with investors from time to time during the second quarter of 2015. Written materials used in the investor presentations will also be

available on our website beginning on or about May 18, 2015. Interested parties may access this information through our website at www.cca.com under “Webcasts” of the Investors section.

Webcast and Replay Information

We will host a webcast

conference call at 10:00 a.m. central time (11:00 a.m. eastern time) on Thursday, May 7, 2015, to discuss our first quarter 2015 financial results and future outlook. To listen to this discussion, please access “Webcasts” on the

Investors page at www.cca.com. The conference call will be archived on our website following the completion of the call. In addition, a telephonic replay will be available at 1:00 p.m. central time (2:00 p.m. eastern time) on May 7,

2015, through 1:00 p.m. central time (2:00 p.m. eastern time) on May 15, 2015. To access the telephonic replay, dial 888-203-1112 in the U.S. and Canada, International callers dial +719-457-0820 and enter passcode 5399162.

About CCA

CCA, a publicly traded real estate investment

trust (REIT), is the nation’s largest owner of partnership correction and detention facilities and one of the largest prison operators in the United States. Following the completion of our previously announced development projects, we will own

or control 51 correctional and detention facilities, with a design capacity of approximately 71,000 beds, and manage 11 additional facilities owned by our government partners with a total design capacity of approximately 14,000 beds, in 18 states

and the District of Columbia. CCA specializes in owning, operating and managing prisons and other correctional facilities and providing residential, community re-entry and prisoner transportation services for governmental agencies. In addition to

providing

First Quarter 2015 Financial Results

Page

5

fundamental residential services, our facilities offer a variety of rehabilitation and educational programs, including basic education, faith-based services, life skills and employment training

and substance abuse treatment. These services are intended to reduce recidivism and to prepare offenders for their successful re-entry into society upon their release.

FORWARD-LOOKING STATEMENTS

This press release contains statements as to our beliefs and expectations of the outcome of future events that are forward-looking statements as defined within

the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. These include, but are not

limited to, the risks and uncertainties associated with: (i) general economic and market conditions, including the impact governmental budgets can have on our per diem rates, occupancy, and overall utilization; (ii) fluctuations in our

operating results because of, among other things, changes in occupancy levels, competition, increases in cost of operations, fluctuations in interest rates and risks of operations; (iii) our ability to obtain and maintain correctional facility

management contracts, including, but not limited to, sufficient governmental appropriations, contract compliance and as a result of inmate disturbances; (iv) changes in the privatization of the corrections and detention industry, the public

acceptance of our services, the timing of the opening of and demand for new prison facilities and the commencement of new management contracts; (v) changes in government policy and in legislation and regulation of the corrections and detention

industry that affect our business, including but not limited to, California’s continued utilization of out of state private correctional capacity; (vi) our ability to meet and maintain REIT qualification status; and (vii) increases in

costs to construct or expand correctional and other facilities that exceed original estimates, or the inability to complete such projects on schedule as a result of various factors, many of which are beyond our control, such as weather, labor

conditions and material shortages, resulting in increased construction costs. Other factors that could cause operating and financial results to differ are described in the filings we make from time to time with the Securities and Exchange

Commission.

CCA takes no responsibility for updating the information contained in this press release following the date hereof to reflect events or

circumstances occurring after the date hereof or the occurrence of unanticipated events or for any changes or modifications made to this press release or the information contained herein by any third-parties, including, but not limited to, any wire

or internet services.

###

First Quarter 2015 Financial Results

Page

6

CORRECTIONS CORPORATION OF AMERICA AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

74,022 |

|

|

$ |

74,393 |

|

| Restricted cash |

|

|

2,254 |

|

|

|

— |

|

| Accounts receivable, net of allowance of $2,269 and $748, respectively |

|

|

226,275 |

|

|

|

248,588 |

|

| Current deferred tax assets |

|

|

11,414 |

|

|

|

13,229 |

|

| Prepaid expenses and other current assets |

|

|

29,213 |

|

|

|

29,775 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

343,178 |

|

|

|

365,985 |

|

|

|

|

| Property and equipment, net |

|

|

2,720,082 |

|

|

|

2,658,628 |

|

|

|

|

| Restricted cash |

|

|

105 |

|

|

|

2,858 |

|

| Investment in direct financing lease |

|

|

2,617 |

|

|

|

3,223 |

|

| Goodwill |

|

|

15,155 |

|

|

|

16,110 |

|

| Non-current deferred tax assets |

|

|

3,479 |

|

|

|

2,301 |

|

| Other assets |

|

|

75,155 |

|

|

|

78,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

3,159,771 |

|

|

$ |

3,127,191 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

$ |

316,149 |

|

|

$ |

317,566 |

|

| Income taxes payable |

|

|

659 |

|

|

|

1,368 |

|

| Current liabilities of discontinued operations |

|

|

— |

|

|

|

54 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

316,808 |

|

|

|

318,988 |

|

|

|

|

| Long-term debt |

|

|

1,240,000 |

|

|

|

1,200,000 |

|

| Deferred revenue |

|

|

91,607 |

|

|

|

87,227 |

|

| Other liabilities |

|

|

37,740 |

|

|

|

39,476 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,686,155 |

|

|

|

1,645,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock — $0.01 par value; 50,000 shares authorized; none issued and outstanding at March 31, 2015 and

December 31, 2014, respectively |

|

|

— |

|

|

|

— |

|

| Common stock — $0.01 par value; 300,000 shares authorized; 117,000 and 116,764 shares issued and outstanding at March 31,

2015 and December 31, 2014, respectively |

|

|

1,170 |

|

|

|

1,168 |

|

| Additional paid-in capital |

|

|

1,746,727 |

|

|

|

1,748,303 |

|

| Accumulated deficit |

|

|

(274,281 |

) |

|

|

(267,971 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

$ |

1,473,616 |

|

|

$ |

1,481,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

3,159,771 |

|

|

$ |

3,127,191 |

|

|

|

|

|

|

|

|

|

|

First Quarter 2015 Financial Results

Page

7

CORRECTIONS CORPORATION OF AMERICA AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| REVENUE: |

|

|

|

|

|

|

|

|

| Owned and controlled properties |

|

$ |

372,122 |

|

|

$ |

339,169 |

|

| Managed only and other |

|

|

53,878 |

|

|

|

65,053 |

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

426,000 |

|

|

|

404,222 |

|

|

|

|

|

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

|

|

| Operating: |

|

|

|

|

|

|

|

|

| Owned and controlled properties |

|

|

248,706 |

|

|

|

225,219 |

|

| Managed only and other |

|

|

51,956 |

|

|

|

62,161 |

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

300,662 |

|

|

|

287,380 |

|

| General and administrative |

|

|

26,872 |

|

|

|

25,392 |

|

| Depreciation and amortization |

|

|

28,685 |

|

|

|

28,384 |

|

| Asset impairments |

|

|

955 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

357,174 |

|

|

|

341,156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

68,826 |

|

|

|

63,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER (INCOME) EXPENSE: |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

10,190 |

|

|

|

10,348 |

|

| Other income |

|

|

(26 |

) |

|

|

(387 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

10,164 |

|

|

|

9,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

58,662 |

|

|

|

53,105 |

|

|

|

|

| Income tax expense |

|

|

(1,385 |

) |

|

|

(1,367 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

57,277 |

|

|

$ |

51,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS PER SHARE: |

|

$ |

0.49 |

|

|

$ |

0.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| DILUTED EARNINGS PER SHARE: |

|

$ |

0.49 |

|

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| REGULAR DIVIDENDS DECLARED PER SHARE |

|

$ |

0.54 |

|

|

$ |

0.51 |

|

|

|

|

|

|

|

|

|

|

First Quarter 2015 Financial Results

Page

8

CORRECTIONS CORPORATION OF AMERICA AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL INFORMATION

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

CALCULATION OF ADJUSTED NET INCOME AND ADJUSTED DILUTED EPS

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended March 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

|

|

| Net income |

|

$ |

57,277 |

|

|

$ |

51,738 |

|

| Special items: |

|

|

|

|

|

|

|

|

| Asset impairments, net |

|

|

955 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Diluted adjusted net income |

|

$ |

58,232 |

|

|

$ |

51,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic |

|

|

116,634 |

|

|

|

115,773 |

|

| Effect of dilutive securities: |

|

|

|

|

|

|

|

|

| Stock options |

|

|

869 |

|

|

|

963 |

|

| Restricted stock-based compensation |

|

|

265 |

|

|

|

224 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares and assumed conversions - diluted |

|

|

117,768 |

|

|

|

116,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Diluted Earnings Per Share |

|

$ |

0.49 |

|

|

$ |

0.44 |

|

|

|

|

|

|

|

|

|

|

CALCULATION OF NORMALIZED FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended March 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

|

|

| Net income |

|

$ |

57,277 |

|

|

$ |

51,738 |

|

| Depreciation of real estate assets |

|

|

21,272 |

|

|

|

21,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funds From Operations |

|

$ |

78,549 |

|

|

$ |

72,815 |

|

|

|

|

| Goodwill and other impairments, net |

|

|

955 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Normalized Funds From Operations |

|

$ |

79,504 |

|

|

$ |

72,815 |

|

|

|

|

| Maintenance capital expenditures on real estate assets |

|

|

(4,238 |

) |

|

|

(8,728 |

) |

| Stock-based compensation |

|

|

3,798 |

|

|

|

3,293 |

|

| Amortization of debt costs and other non-cash interest |

|

|

776 |

|

|

|

771 |

|

| Other non-cash revenue and expenses |

|

|

(16 |

) |

|

|

(16 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations |

|

$ |

79,824 |

|

|

$ |

68,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Normalized Funds From Operations Per Diluted Share |

|

$ |

0.68 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations Per Diluted Share |

|

$ |

0.68 |

|

|

$ |

0.58 |

|

|

|

|

|

|

|

|

|

|

First Quarter 2015 Financial Results

Page

9

CORRECTIONS CORPORATION OF AMERICA AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL INFORMATION

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

CALCULATION OF ADJUSTED FUNDS FROM OPERATIONS PER SHARE & ADJUSTED EBITDA GUIDANCE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Quarter Ending

June 30, 2015 |

|

|

For the Year Ending

December 31, 2015 |

|

| |

|

Low End of

Guidance |

|

|

High End of

Guidance |

|

|

Low End of

Guidance |

|

|

High End of

Guidance |

|

| Net income |

|

$ |

58,000 |

|

|

$ |

60,000 |

|

|

$ |

222,045 |

|

|

$ |

231,045 |

|

| Asset impairment, net |

|

|

— |

|

|

|

— |

|

|

|

955 |

|

|

|

955 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

58,000 |

|

|

$ |

60,000 |

|

|

$ |

223,000 |

|

|

$ |

232,000 |

|

| Depreciation on real estate assets |

|

|

21,000 |

|

|

|

21,000 |

|

|

|

86,000 |

|

|

|

87,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funds From Operations |

|

$ |

79,000 |

|

|

$ |

81,000 |

|

|

$ |

309,000 |

|

|

$ |

319,000 |

|

| Other non-cash revenue and expenses |

|

|

5,000 |

|

|

|

5,000 |

|

|

|

19,000 |

|

|

|

19,000 |

|

| Maintenance capital expenditures on real estate assets |

|

|

(7,000 |

) |

|

|

(7,000 |

) |

|

|

(25,000 |

) |

|

|

(26,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations |

|

$ |

77,000 |

|

|

$ |

79,000 |

|

|

$ |

303,000 |

|

|

$ |

312,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EPS per diluted share |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

1.89 |

|

|

$ |

1.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO per diluted share |

|

$ |

0.67 |

|

|

$ |

0.69 |

|

|

$ |

2.62 |

|

|

$ |

2.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AFFO per diluted share |

|

$ |

0.65 |

|

|

$ |

0.67 |

|

|

$ |

2.57 |

|

|

$ |

2.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net Income |

|

$ |

58,000 |

|

|

$ |

60,000 |

|

|

$ |

223,000 |

|

|

$ |

232,000 |

|

| Interest expense, net |

|

|

12,000 |

|

|

|

12,000 |

|

|

|

49,000 |

|

|

|

51,000 |

|

| Depreciation and amortization |

|

|

38,000 |

|

|

|

39,000 |

|

|

|

154,000 |

|

|

|

156,000 |

|

| Income tax expense |

|

|

4,000 |

|

|

|

4,000 |

|

|

|

12,000 |

|

|

|

14,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

112,000 |

|

|

$ |

115,000 |

|

|

$ |

438,000 |

|

|

$ |

453,000 |

|

| Depreciation associated with STFRC rent payment |

|

|

(9,000 |

) |

|

|

(9,000 |

) |

|

|

(30,000 |

) |

|

|

(30,000 |

) |

| Interest expense associated with STFRC rent payment |

|

|

(2,000 |

) |

|

|

(2,000 |

) |

|

|

(8,000 |

) |

|

|

(8,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

101,000 |

|

|

$ |

104,000 |

|

|

$ |

400,000 |

|

|

$ |

415,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO SUPPLEMENTAL FINANCIAL INFORMATION

Note A: Adjusted Net Income, EBITDA, Funds From Operations (FFO), Normalized FFO and Adjusted Funds From Operations (AFFO), and their corresponding per

share metrics are non-GAAP financial measures. CCA believes that these measures are important operating measures that supplement discussion and analysis of the Company’s results of operations and are used to review and assess operating

performance of the Company and its correctional facilities and their management teams. CCA believes that it is useful to provide investors, lenders and security analysts’ disclosures of its results of operations on the same basis that is used

by management. FFO and AFFO, in particular, are widely accepted non-GAAP supplemental measures of REIT performance, each grounded in the standards for FFO established by the National Association of Real Estate Investment Trusts (NAREIT).

NAREIT defines FFO as net income computed in accordance with generally accepted accounting principles, excluding gains (or losses) from sales of property and

extraordinary items, plus depreciation and

First Quarter 2015 Financial Results

Page

10

amortization of real estate and impairment of depreciable real estate. EBITDA, FFO and AFFO are useful as supplemental measures of performance of the Company’s corrections facilities because

they don’t take into account depreciation and amortization, or with respect to EBITDA, the impact of the Company’s tax provisions and financing strategies. Because the historical cost accounting convention used for real estate assets

requires depreciation (except on land), this accounting presentation assumes that the value of real estate assets diminishes at a level rate over time. Because of the unique structure, design and use of the Company’s properties, management

believes that assessing performance of the Company’s properties without the impact of depreciation or amortization is useful. CCA may make adjustments to FFO from time to time for certain other income and expenses that it considers

non-recurring, infrequent or unusual, even though such items may require cash settlement, because such items do not reflect a necessary component of the ongoing operations of the Company. Normalized FFO excludes the effects of such items. CCA

calculates AFFO by adding to Normalized FFO non-cash expenses such as the amortization of deferred financing costs and stock-based compensation, and by subtracting from Normalized FFO recurring real estate expenditures that are capitalized and then

amortized, but which are necessary to maintain a REIT’s properties and its revenue stream. Some of these capital expenditures contain a discretionary element with respect to when they are incurred, while others may be more urgent. Therefore,

these capital expenditures may fluctuate from quarter to quarter, depending on the nature of the expenditures required, seasonal factors such as weather, and budgetary conditions. CCA calculates Adjusted Net Income by adding or deducting from GAAP

Net Income amounts associated with the Company’s debt refinancing, REIT conversion, mergers and acquisitions activity and certain impairments that the Company believes are unusual or nonrecurring to provide an alternative measure of comparing

operating performance for the periods presented.

Other companies may calculate Adjusted Net Income, EBITDA, FFO, Normalized FFO, and AFFO differently

than the Company does, or adjust for other items, and therefore comparability may be limited. Adjusted Net Income, EBITDA, FFO, Normalized FFO, and AFFO and their corresponding per share measures are not measures of performance under GAAP, and

should not be considered as an alternative to cash flows from operating activities, a measure of liquidity or an alternative to net income as indicators of the Company’s operating performance or any other measure of performance derived in

accordance with GAAP. This data should be read in conjunction with the Company’s consolidated financial statements and related notes included in its filings with the Securities and Exchange Commission.

###

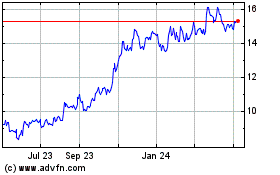

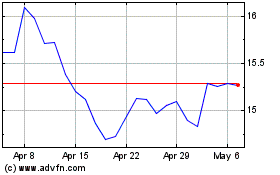

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Mar 2024 to Apr 2024

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Apr 2023 to Apr 2024