UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 5, 2015

MYRIAD GENETICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-26642 |

|

87-0494517 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

320 Wakara Way

Salt Lake City, Utah 84108

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (801) 584-3600

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 2.02 |

Results of Operations and Financial Condition. |

On May 5, 2015, Myriad announced

its financial results for the three months ended March 31, 2015. The earnings release is attached hereto as an exhibit to this Current Report on Form 8-K and incorporated herein by reference, and is being furnished pursuant to this

Item 2.02 as Exhibit 99.1 to this Current Report on Form 8-K.

| ITEM 9.01 |

Financial Statements and Exhibits. |

(d)

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Earnings release dated May 5, 2015 for the three months ended March 31, 2015. |

The press releases contain hypertext links to information on our website or other parties’ websites. The information on

our website and other parties’ websites is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of this Form 8-K.

In accordance with General Instruction B-2 of Form 8-K, the information set forth in Item 2.02 and in Exhibit 99.1 shall not be deemed to be

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any

registration statement or other document filed under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Page 2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MYRIAD GENETICS, INC. |

|

|

|

|

| Date: May 5, 2015 |

|

|

|

By: |

|

/s/ R. Bryan Riggsbee |

|

|

|

|

|

|

R. Bryan Riggsbee |

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer |

Page 3

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Earnings release dated May 5, 2015 for the three months ended March 31, 2015. |

Page 4

Exhibit 99.1

News Release

|

|

|

|

|

|

|

|

|

| Media Contact: |

|

Ron Rogers |

|

|

|

Investor Contact: |

|

Scott Gleason |

|

|

(801) 584-3065 |

|

|

|

|

|

(801) 584-1143 |

|

|

rrogers@myriad.com |

|

|

|

|

|

sgleason@myriad.com |

Myriad Genetics Reports Fiscal Third-Quarter 2015 Financial Results

| • |

|

Total Revenue of $180.0 Million |

| • |

|

Adjusted Diluted EPS of $0.40 and Diluted EPS of $0.29 |

| • |

|

myRisk™ Hereditary Cancer Panel Ended Third Quarter at 58 Percent Conversion |

| • |

|

Myriad Acquires MVZ Clinic to Facilitate Reimbursement in Germany |

| • |

|

Company Provides Fiscal Fourth-Quarter 2015 Financial Guidance |

SALT LAKE CITY, UTAH, May 5,

2015 – Myriad Genetics, Inc. (NASDAQ: MYGN) today announced financial results for its fiscal third-quarter and nine months ended March 31, 2015, provided an update on recent business highlights and provided fiscal fourth-quarter and

revised fiscal year 2015 financial guidance.

“I am pleased with our financial results for the third quarter particularly in light of

the severe weather conditions across the northeast during January and February,” said Peter D. Meldrum, president and chief executive officer of Myriad. “More importantly, we believe we are positioned to see sequential growth in both

revenues and earnings in the fourth quarter and are making excellent progress toward diversifying our portfolio and growing revenues.”

Fiscal Third-Quarter 2015 Financial Highlights

| |

• |

|

Total revenue for the fiscal third quarter was $180.0 million compared to $182.9 million in the same period of the prior year, a decrease of 1.6 percent. Fiscal third-quarter 2015 revenue was detrimentally impacted by

approximately $4 million due to severe weather conditions in the northeast throughout the months of January and February. The following tables display Myriad’s product revenue by market segment and product: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Third Quarter |

|

|

|

|

| ($ in millions) |

|

2015 |

|

|

2014 |

|

|

Percentage

Change |

|

| Molecular diagnostic testing revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hereditary cancer testing revenue |

|

$ |

159.0 |

|

|

$ |

169.6 |

|

|

|

(6.2 |

%) |

|

|

|

|

| Vectra® DA revenue |

|

|

10.5 |

|

|

|

3.1 |

|

|

|

238.7 |

% |

|

|

|

|

| Other testing revenue |

|

|

3.5 |

|

|

|

3.5 |

|

|

|

0.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total molecular diagnostic testing revenue |

|

|

173.0 |

|

|

|

176.2 |

|

|

|

(1.8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pharmaceutical and clinical service revenue |

|

|

7.0 |

|

|

|

6.7 |

|

|

|

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

|

$ |

180.0 |

|

|

$ |

182.9 |

|

|

|

(1.6 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Third Quarter |

|

|

|

|

| ($ in millions) |

|

2015 |

|

|

2014 |

|

|

Percentage

Change |

|

| Molecular diagnostic segment revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

| Oncology |

|

$ |

86.1 |

|

|

$ |

92.4 |

|

|

|

(6.8 |

%) |

| Preventive Care |

|

|

76.4 |

|

|

|

80.7 |

|

|

|

(5.3 |

%) |

| Rheumatology |

|

|

10.5 |

|

|

|

3.1 |

|

|

|

238.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total molecular diagnostic testing revenue |

|

$ |

173.0 |

|

|

$ |

176.2 |

|

|

|

(1.8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

• |

|

myRisk Hereditary Cancer revenue increased to $81.6 million in the third quarter of fiscal 2015 from $14.5 million in the third quarter of the prior year, and the Company exited the quarter with 58 percent of incoming

hereditary cancer samples ordered as myRisk testing. |

| |

• |

|

Adjusted operating income was $46.2 million in the third quarter which excludes certain non-cash amortization charges, one-time executive transition costs and one-time expenses tied to discontinued operations. Adjusted

operating income declined 33 percent year-over-year primarily due to dilution associated with the Crescendo acquisition, lower gross margins associated with the transition costs of myRisk testing and product launch expenses for Prolaris®, myPath® Melanoma and myPlan® Lung Cancer tests. GAAP operating income was $35.7

million, compared to $55.3 million in the same period of the previous year. |

2

| |

• |

|

Third-quarter adjusted net income was $29.3 million compared to $46.2 million in the same period of the previous year and adjusted diluted earnings per share were $0.40 compared to $0.60 in the same period of the prior

year. GAAP net income was $21.5 million compared to $36.8 million in the same period of the previous year, and GAAP diluted earnings per share were $0.29, compared to $0.48 in the same period of the prior year. |

| |

• |

|

During the quarter, the Company repurchased approximately 1.8 million shares, or $62 million, of common stock under its share repurchase program. In February 2015 the Company’s board authorized the company to

repurchase an additional $200 million of its common stock, almost all of which was remaining as of the end of the third quarter. Fiscal third-quarter diluted weighted average shares outstanding were 73.9 million compared to 76.4 million in

the same period last year. |

Business Highlights

| |

• |

|

Myriad acquired a licensed German MVZ (Medizinisches Versorgungszentrum) clinic near Munich, Germany during the fiscal third quarter which the Company believes will facilitate penetration into the German molecular

diagnostic market. The MVZ will allow Myriad to directly negotiate reimbursement with government and private insurance providers in the German market and collaborate with hospitals and physician groups. Myriad believes the acquisition will be

slightly accretive to earnings per share for the foreseeable future. |

| |

• |

|

Myriad received a final local coverage determination (LCD) from Palmetto and a draft local coverage determination from Noridian covering its Prolaris test for low and very low risk patients with prostate cancer. The

formal comment period on the draft LCD expired on April 30, 2015, and Myriad is awaiting a final Medicare reimbursement decision on Prolaris. |

| |

• |

|

During the third quarter, Myriad signed an expanded agreement with BioMarin Pharmaceutical. Under the expanded collaboration, BioMarin has agreed to use Myriad’s myChoice™ HRD companion diagnostic test to

prospectively identify patients with metastatic breast, ovarian and potentially other tumor types that may be sensitive to BioMarin’s PARP inhibitor, talazoparib. |

| |

• |

|

The Company announced the expansion of its companion diagnostic collaboration with AstraZeneca. Under the terms of the expanded agreement, Myriad’s BRACAnalysis CDx™ test will be used to prospectively identify

patients with metastatic pancreatic cancer that may respond to treatment with AstraZeneca’s PARP inhibitor, Lynparza™ (olaparib). |

| |

• |

|

Data from Myriad’s first pivotal clinical validation on myPath Melanoma testing was published in the Journal of Cutaneous Pathology, which demonstrated that the myPath™ Melanoma test is highly effective

at differentiating benign skin moles from malignant melanoma with greater than 90 percent accuracy. |

| |

• |

|

Myriad presented its third clinical utility study on myPath Melanoma testing at the American Academy of Dermatology annual meeting. The study followed patients for 6 to12 months after their diagnosis and in 214 patients

who received a benign myPath Melanoma score there was no evidence of recurrent disease. |

3

Fiscal Fourth Quarter and Fiscal Year 2015 Financial Guidance

The Company is projecting total revenues for the fiscal fourth quarter ending June 30, 2015 of $187 to $189 million and adjusted

diluted earnings per share of $0.40 to $0.42 (GAAP diluted EPS of $0.28 to $0.30). Based on this financial guidance and third quarter financial results, the Company is revising its fiscal year 2015 financial guidance and now expects total revenues

of $720 to $722 million and adjusted diluted earnings per share of $1.44 to $1.46 (GAAP diluted EPS of $1.09 to $1.11). The primary reasons for this guidance revision are related to the impact of severe weather on our fiscal third-quarter revenue, a delay in Medicare reimbursement for Prolaris until the first quarter of fiscal year 2016, and a delay in international reimbursement. These projections are

forward-looking statements and are subject to the risks summarized in the safe harbor statement at the end of this press release. The Company will provide further details on its business outlook during the

conference call it is holding today to discuss its fiscal third quarter 2015 financial results.

Conference Call and Webcast

A conference call will be held today, Tuesday, May 5, 2015, at 4:30 p.m. Eastern Time to discuss Myriad’s financial results for the

fiscal third quarter of 2015, business developments and financial guidance. The dial-in number for domestic callers is (800) 732-8470. International callers may dial (212) 231-2910. All callers will

be asked to reference reservation number 21766620. An archived replay of the call will be available for seven days by dialing (800) 633-8284 and entering the reservation number above. The conference

call also will be available through a live Webcast at www.myriad.com.

About Myriad Genetics

Myriad Genetics is a leading molecular diagnostic company dedicated to making a difference in patients’ lives through the discovery and

commercialization of transformative tests to assess a person’s risk of developing disease, guide treatment decisions and assess risk of disease progression and recurrence. Myriad is focused on strategic directives to grow existing markets,

diversify through the

4

introduction of new products, including companion diagnostics, as well as to expand internationally. For more information on how Myriad is making a difference, please visit the Company’s

website: www.myriad.com.

Myriad, the Myriad logo, BART, BRACAnalysis, Colaris, Colaris AP, myPath, myRisk, myRisk

Hereditary Cancer, myChoice, myPlan, BRACAnalysis CDx, Tumor BRACAnalysis CDx, myChoice HRD, Vectra and Prolaris are trademarks or registered trademarks of Myriad Genetics, Inc. or its wholly owned subsidiaries in the United States and foreign

countries. MYGN-F, MYGN-G Lynparza is a trademark of AstraZeneca PLC.

Safe Harbor Statement

This press release contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s belief that it is positioned to see sequential growth in both revenues and

earnings in the fourth quarter and the Company making excellent progress toward diversifying the Company’s portfolio and growing revenues; the Company’s belief that the acquisition of the MVZ will facilitate penetration into the German

molecular diagnostic market and allow the Company to directly negotiate reimbursement with government and private insurance providers in the German market and collaborate with hospitals and physician groups; the Company’s belief that the clinic

acquisition will be slightly accretive to earnings per share for the foreseeable future; the timing and extent of a final Medicare reimbursement decision on Prolaris testing; the success and outcome of the Company’s expanded collaborations with

BioMarin and Astrazeneca; the continued transition of the Company’s testing to its myRisk cancer panel; the Company’s fiscal fourth quarter 2015 guidance and revised fiscal year 2015 financial guidance, including the primary reasons stated

for the guidance and guidance revision, under the caption “Fiscal Fourth Quarter and Fiscal Year 2015 Financial Guidance”; and the Company’s strategic directives under the caption “About Myriad Genetics.” These “forward-looking statements” are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially

and adversely from those set forth in or implied by forward-looking statements. These risks and uncertainties include, but are not limited to: the risk that sales and profit margins of our molecular diagnostic

tests and pharmaceutical and clinical services may decline or will not continue to increase at historical rates; risks related to our ability to transition from our existing to new testing services, including unexpected costs and delays; risks

related to decisions or changes in the governmental or private insurers’ reimbursement levels for our tests or our ability to obtain reimbursement for our new tests at comparable levels to our existing tests; risks related to increased

5

competition and the development of new competing tests and services; the risk that we may be unable to develop or achieve commercial success for additional molecular diagnostic tests and

pharmaceutical and clinical services in a timely manner, or at all; the risk that we may not successfully develop new markets for our molecular diagnostic tests and pharmaceutical and clinical services, including our ability to successfully generate

revenue outside the United States; the risk that licenses to the technology underlying our molecular diagnostic tests and pharmaceutical and clinical services and any future tests and services are terminated or cannot be maintained on satisfactory

terms; risks related to delays or other problems with operating our laboratory testing facilities; risks related to public concern over genetic testing in general or our tests in particular; risks related to regulatory requirements or enforcement in

the United States and foreign countries and changes in the structure of the healthcare system or healthcare payment systems; risks related to our ability to obtain new corporate collaborations or licenses and acquire new technologies or businesses

on satisfactory terms, if at all; risks related to our ability to successfully integrate and derive benefits from any technologies or businesses that we license or acquire; risks related to our projections about our business, results of operations

and financial condition; risks related to the potential market opportunity for our products and services; the risk that we or our licensors may be unable to protect or that third parties will infringe the proprietary technologies underlying our

tests; the risk of patent-infringement claims or challenges to the validity of our patents or other intellectual property; risks related to changes in intellectual property laws covering our molecular

diagnostic tests and pharmaceutical and clinical services and patents or enforcement in the United States and foreign countries; risks of new, changing and competitive technologies and regulations in the United States and internationally; and other

factors discussed under the heading “Risk Factors” contained in Item 1A in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, as well as any

updates to those risk factors filed from time to time in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. All information in this press

release is as of the date of the release, and Myriad undertakes no duty to update this information unless required by law.

6

MYRIAD GENETICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED INCOME STATEMENTS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands, except per share amounts) |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

|

|

|

|

| Molecular diagnostic testing |

|

$ |

172,978 |

|

|

$ |

176,191 |

|

|

$ |

516,634 |

|

|

$ |

565,335 |

|

| Pharmaceutical and clinical services |

|

|

7,007 |

|

|

|

6,733 |

|

|

|

16,582 |

|

|

|

24,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

179,985 |

|

|

|

182,924 |

|

|

|

533,216 |

|

|

|

589,450 |

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of molecular diagnostic testing |

|

|

33,011 |

|

|

|

23,648 |

|

|

|

100,859 |

|

|

|

67,842 |

|

| Cost of pharmaceutical and clinical services |

|

|

3,282 |

|

|

|

2,961 |

|

|

|

8,152 |

|

|

|

10,379 |

|

| Research and development expense |

|

|

16,673 |

|

|

|

13,397 |

|

|

|

56,788 |

|

|

|

47,289 |

|

| Selling, general, and administrative expense |

|

|

91,279 |

|

|

|

87,631 |

|

|

|

269,415 |

|

|

|

242,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

144,245 |

|

|

|

127,637 |

|

|

|

435,214 |

|

|

|

368,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

35,740 |

|

|

|

55,287 |

|

|

|

98,002 |

|

|

|

221,188 |

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

| Interest income |

|

|

124 |

|

|

|

2,498 |

|

|

|

265 |

|

|

|

5,190 |

|

| Other |

|

|

(298 |

) |

|

|

(442 |

) |

|

|

1,117 |

|

|

|

(1,066 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income |

|

|

(174 |

) |

|

|

2,056 |

|

|

|

1,382 |

|

|

|

4,124 |

|

|

|

|

|

|

| Income before income taxes |

|

|

35,566 |

|

|

|

57,343 |

|

|

|

99,384 |

|

|

|

225,312 |

|

|

|

|

|

|

| Income tax provision |

|

|

14,091 |

|

|

|

20,573 |

|

|

|

37,896 |

|

|

|

82,719 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

21,475 |

|

|

$ |

36,770 |

|

|

|

61,488 |

|

|

|

142,593 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.30 |

|

|

$ |

0.50 |

|

|

$ |

0.85 |

|

|

$ |

1.87 |

|

| Diluted |

|

$ |

0.29 |

|

|

$ |

0.48 |

|

|

$ |

0.82 |

|

|

$ |

1.82 |

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

|

70,696 |

|

|

|

73,821 |

|

|

|

71,985 |

|

|

|

76,173 |

|

| Diluted |

|

|

73,870 |

|

|

|

76,374 |

|

|

|

75,122 |

|

|

|

78,332 |

|

Condensed Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Mar. 31, 2015 |

|

|

Jun. 30, 2014 |

|

| (In thousands) |

|

|

|

|

|

|

| Cash, cash equivalents, and marketable investment securities |

|

$ |

175,633 |

|

|

$ |

270,586 |

|

| Trade receivables, net |

|

|

92,195 |

|

|

|

81,869 |

|

| Other receivables |

|

|

2,992 |

|

|

|

3,198 |

|

| Prepaid expenses |

|

|

9,985 |

|

|

|

6,921 |

|

| Inventory |

|

|

29,359 |

|

|

|

23,919 |

|

| Prepaid taxes |

|

|

— |

|

|

|

13,609 |

|

| Property, plant and equipment, net |

|

|

69,099 |

|

|

|

34,594 |

|

| Other assets |

|

|

5,000 |

|

|

|

5,000 |

|

| Intangibles, net |

|

|

195,691 |

|

|

|

205,312 |

|

| Goodwill |

|

|

185,228 |

|

|

|

169,181 |

|

| Deferred tax assets |

|

|

13,867 |

|

|

|

9,625 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

779,049 |

|

|

$ |

823,814 |

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

65,834 |

|

|

$ |

79,488 |

|

| Deferred revenue |

|

|

1,339 |

|

|

|

1,090 |

|

| Long term liabilities |

|

|

16,867 |

|

|

|

— |

|

| Uncertain tax benefits |

|

|

26,111 |

|

|

|

24,238 |

|

| Stockholders’ equity |

|

|

668,898 |

|

|

|

718,998 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

779,049 |

|

|

$ |

823,814 |

|

7

Statement regarding use of non-GAAP financial measures

In this press release, the Company’s financial results and financial guidance are provided in accordance with accounting principles generally accepted in

the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures

provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses

non-GAAP financial measures to establish budgets and to manage the Company’s business. A reconciliation of the GAAP financial results to non-GAAP financial results

is included in the attached financial statements.

Following is a description of the adjustments made to GAAP measures:

| |

• |

|

Acquisition — amortization of intangible assets: Represents recurring amortization charges resulting from the acquisition of intangible assets including developed technology and database rights. |

| |

• |

|

Executive transition cost: Represents one-time expenses tied to the transition of key executive officers at the Company. |

| |

• |

|

Discontinued operations: One-time charges associated with the closing of business units. |

The

Company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its

business. Non-GAAP results are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

8

Reconciliation of GAAP to Non-GAAP Financial Measures

for the Three and Nine Months ended March 31, 2015 and 2014

(Unaudited data in thousands, except per share amount)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

|

|

|

|

| Revenue |

|

$ |

179,985 |

|

|

$ |

182,924 |

|

|

$ |

533,216 |

|

|

$ |

589,450 |

|

|

|

|

|

|

| GAAP Cost of molecular diagnostic testing |

|

$ |

33,011 |

|

|

$ |

23,648 |

|

|

$ |

100,859 |

|

|

$ |

67,842 |

|

| GAAP Cost of pharmaceutical and clinical services |

|

|

3,282 |

|

|

|

2,961 |

|

|

|

8,152 |

|

|

|

10,379 |

|

| Acquisition - change of control payments |

|

|

— |

|

|

|

(238 |

) |

|

|

— |

|

|

|

(238 |

) |

| Acquisition - accelerated share-based compensation |

|

|

— |

|

|

|

(185 |

) |

|

|

— |

|

|

|

(185 |

) |

| Acquisition - amortization of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP COGS |

|

$ |

36,293 |

|

|

$ |

26,186 |

|

|

$ |

109,011 |

|

|

$ |

77,798 |

|

|

|

|

|

|

| Non-GAAP Gross Margin |

|

|

80 |

% |

|

|

86 |

% |

|

|

80 |

% |

|

|

87 |

% |

|

|

|

|

|

| GAAP Research and Development |

|

$ |

16,673 |

|

|

$ |

13,397 |

|

|

$ |

56,788 |

|

|

$ |

47,289 |

|

| Acquisition - change of control payments |

|

|

— |

|

|

|

(1,710 |

) |

|

|

— |

|

|

|

(1,710 |

) |

| Acquisition - accelerated share-based compensation |

|

|

— |

|

|

|

(2,075 |

) |

|

|

— |

|

|

|

(2,075 |

) |

| Acquisition - amortization of intangible assets |

|

|

(78 |

) |

|

|

(78 |

) |

|

|

(234 |

) |

|

|

(234 |

) |

| Executive transition costs |

|

|

(398 |

) |

|

|

— |

|

|

|

(398 |

) |

|

|

— |

|

| Discontinued operations |

|

|

(178 |

) |

|

|

— |

|

|

|

(178 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP R&D |

|

$ |

16,019 |

|

|

$ |

9,534 |

|

|

$ |

55,978 |

|

|

$ |

43,270 |

|

|

|

|

|

|

| GAAP Selling, General and Administrative |

|

$ |

91,279 |

|

|

$ |

87,631 |

|

|

$ |

269,415 |

|

|

$ |

242,752 |

|

| Acquisition - change of control payments |

|

|

— |

|

|

|

(3,747 |

) |

|

|

— |

|

|

|

(3,747 |

) |

| Acquisition - accelerated share-based compensation |

|

|

— |

|

|

|

(4,669 |

) |

|

|

— |

|

|

|

(4,669 |

) |

| Acquisition - amortization of intangible assets |

|

|

(3,057 |

) |

|

|

(1,067 |

) |

|

|

(9,172 |

) |

|

|

(1,400 |

) |

| Executive transition costs |

|

|

(6,788 |

) |

|

|

— |

|

|

|

(11,100 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP SG&A |

|

$ |

81,434 |

|

|

$ |

78,148 |

|

|

$ |

249,143 |

|

|

$ |

232,936 |

|

|

|

|

|

|

| GAAP Operating Income |

|

$ |

35,740 |

|

|

$ |

55,287 |

|

|

$ |

98,002 |

|

|

$ |

221,188 |

|

| Acquisition - change of control payments |

|

|

— |

|

|

|

5,695 |

|

|

|

— |

|

|

|

5,695 |

|

| Acquisition - accelerated share-based compensation |

|

|

— |

|

|

|

6,929 |

|

|

|

— |

|

|

|

6,929 |

|

| Acquisition - amortization of intangible assets |

|

|

3,135 |

|

|

|

1,145 |

|

|

|

9,406 |

|

|

|

1,634 |

|

| Executive transition costs |

|

|

7,186 |

|

|

|

— |

|

|

|

11,498 |

|

|

|

— |

|

| Discontinued operations |

|

|

178 |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Operating Income |

|

$ |

46,239 |

|

|

$ |

69,056 |

|

|

$ |

119,084 |

|

|

$ |

235,446 |

|

|

|

|

|

|

| Non-GAAP Operating Margin |

|

|

26 |

% |

|

|

38 |

% |

|

|

22 |

% |

|

|

40 |

% |

|

|

|

|

|

| GAAP Net Income |

|

$ |

21,475 |

|

|

$ |

36,770 |

|

|

$ |

61,488 |

|

|

$ |

142,593 |

|

| Acquisition - change of control payments |

|

|

— |

|

|

|

5,695 |

|

|

|

— |

|

|

|

5,695 |

|

| Acquisition - accelerated share-based compensation |

|

|

— |

|

|

|

6,929 |

|

|

|

— |

|

|

|

6,929 |

|

| Acquisition - amortization of intangible assets |

|

|

3,135 |

|

|

|

1,145 |

|

|

|

9,406 |

|

|

|

1,634 |

|

| Executive transition costs |

|

|

7,186 |

|

|

|

— |

|

|

|

11,498 |

|

|

|

— |

|

| Discontinued operations |

|

|

178 |

|

|

|

— |

|

|

|

178 |

|

|

|

— |

|

| Tax expense associated with non-GAAP adjustments |

|

|

(2,713 |

) |

|

|

(4,337 |

) |

|

|

(4,415 |

) |

|

|

(4,337 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net Income |

|

$ |

29,261 |

|

|

$ |

46,202 |

|

|

$ |

78,155 |

|

|

$ |

152,514 |

|

|

|

|

|

|

| GAAP Diluted EPS |

|

$ |

0.29 |

|

|

$ |

0.48 |

|

|

$ |

0.82 |

|

|

$ |

1.82 |

|

| Non-GAAP Diluted EPS |

|

$ |

0.40 |

|

|

$ |

0.60 |

|

|

$ |

1.04 |

|

|

$ |

1.95 |

|

|

|

|

|

|

| Diluted shares outstanding |

|

|

73,870 |

|

|

|

76,374 |

|

|

|

75,122 |

|

|

|

78,332 |

|

9

Free Cash Flow Reconciliation

(Unaudited data in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

Mar. 31, 2015 |

|

|

Mar. 31, 2014 |

|

|

|

|

|

|

| GAAP cash flow from operations |

|

$ |

29,878 |

|

|

$ |

11,249 |

|

|

$ |

89,456 |

|

|

$ |

149,280 |

|

|

|

|

|

|

| Capital expenditures |

|

|

(4,457 |

) |

|

|

(1,555 |

) |

|

|

(21,905 |

) |

|

|

(9,653 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

25,421 |

|

|

$ |

9,694 |

|

|

$ |

67,551 |

|

|

$ |

139,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP for Fiscal Year 2015 and Fourth Quarter Fiscal Year 2015 Financial Guidance

The Company’s future performance and financial results are subject to risks and uncertainties, and actual results could differ materially from guidance

set forth below. Some of the factors that could affect the Company’s financial results are stated in the safe harbor statement of this press release. More information on potential factors that could affect the Company’s financial results

are included under the heading “Risk Factors” contained in Item 1A in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, as well as

any updates to those risk factors filed from time to time in the Company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

|

|

|

| |

|

Fiscal Year 2015 |

| Diluted net income per share |

|

|

| GAAP diluted net income per share |

|

$1.09 - $1.11 |

| Acquisition - amortization of intangible assets |

|

0.16 |

| Executive transition costs |

|

0.19 |

|

|

|

| Non-GAAP diluted net income per share |

|

$1.44 - $1.46 |

|

|

|

|

|

|

| |

|

Fiscal Fourth Quarter 2015 |

| Diluted net income per share |

|

|

| GAAP diluted net income per share |

|

$0.28 - $0.30 |

| Acquisition - amortization of intangible assets |

|

0.04 |

| Executive transition costs |

|

0.08 |

|

|

|

| Non-GAAP diluted net income per share |

|

$0.40 - $0.42 |

|

|

|

10

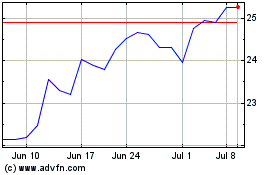

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024