UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) May 5, 2015

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-35625 | 20-8023465 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On May 5, 2015, Bloomin’ Brands, Inc. issued a press release reporting its financial results for the thirteen weeks ended March 29, 2015. A copy of the release is attached as Exhibit 99.1.

The information contained in this report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any document whether or not filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such document.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

| | | |

| Exhibit Number | | Description |

| | | |

| 99.1 | | Press Release of Bloomin’ Brands, Inc. dated May 5, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | BLOOMIN’ BRANDS, INC. |

| | | (Registrant) |

| | | |

Date: | May 5, 2015 | By: | /s/ David J. Deno |

| | | David J. Deno |

| | | Executive Vice President and Chief Financial and Administrative Officer (Principal Financial Officer) |

|

| | | | |

| | NEWS | | Exhibit 99.1 |

| | | |

| Chris Meyer | | |

| Group Vice President, IR & Finance | | |

| (813) 830-5311 | | |

Bloomin’ Brands Announces 2015 First Quarter Adjusted Diluted EPS of $0.54 and Diluted EPS of $0.47;

Posts U.S. Comparable Sales Increase of 3.6%;

Reaffirms 2015 Guidance for Adjusted Diluted EPS and U.S. Comparable Sales;

Declares Dividend of $0.06 Per Share

TAMPA, Fla., May 5, 2015 - Bloomin’ Brands, Inc. (Nasdaq:BLMN) today reported financial results for the first quarter (“Q1 2015”) ended March 29, 2015 compared to the the first quarter (“Q1 2014”) ended March 30, 2014.

Key highlights for Q1 2015 include the following:

| |

• | Comparable sales for Company-owned U.S. concepts increased 3.6% with a traffic increase of 0.7% |

| |

• | Comparable sales for our Brazilian Outback Steakhouse restaurants increased 6.2% |

| |

• | System-wide development was 14 new restaurants. In March 2015, we opened our first International Carrabba’s Italian Grill in Brazil, known as Abbraccio |

| |

• | Adjusted operating income margin was 9.1% versus 8.4% in Q1 2014 and U.S. GAAP operating income margin was 8.1% versus 7.8% in the Q1 2014 |

| |

• | Adjusted net income was $69.7 million versus $58.5 million in Q1 2014 and U.S. GAAP Net income attributable to Bloomin’ Brands was $60.6 million versus $53.7 million in Q1 2014 |

Adjusted Diluted EPS and Diluted EPS

The following table reconciles Adjusted diluted earnings per share to Diluted earnings per share for the periods as indicated below. Due to our conversion to a 52-53 week fiscal year in 2014, there were two more days in the first quarter in fiscal 2015, which had an impact of $0.04 to adjusted diluted EPS.

|

| | | | | | | | | | | |

| Q1 2015 | | Q1 2014 | | CHANGE |

Adjusted diluted earnings per share | $ | 0.54 |

| | $ | 0.46 |

| | $ | 0.08 |

|

Adjustments | (0.07 | ) | | (0.04 | ) | | (0.03 | ) |

Diluted earnings per share | $ | 0.47 |

| | $ | 0.42 |

| | $ | 0.05 |

|

| | | | | |

____________________

See Non-GAAP Measures later in this release.

CEO Comments

“The first quarter was a strong start to the year. We were pleased with our sales performance and margin delivery. These results set us up to deliver our 2015 goals,” said Elizabeth Smith, CEO. “In addition, we continue to make great progress in our International business as it becomes a larger part of our portfolio and growth plans.”

First Quarter Financial Results

The following summarizes our results for Q1 2015 and Q1 2014:

|

| | | | | | | | | | |

(dollars in millions) | Q1 2015 | | Q1 2014 | | % Change |

Total revenues | $ | 1,202.1 |

| | $ | 1,157.9 |

| | 3.8 | % |

| | | | | |

Adjusted restaurant level operating margin | 18.3 | % | | 18.0 | % | | 0.3 | % |

U.S. GAAP restaurant level operating margin | 18.4 | % | | 18.2 | % | | 0.2 | % |

| | | | | |

Adjusted operating income margin | 9.1 | % | | 8.4 | % | | 0.7 | % |

U.S. GAAP operating income margin | 8.1 | % | | 7.8 | % | | 0.3 | % |

| |

• | The increase in Total revenues was primarily due to additional revenues from new restaurant openings, an increase in U.S. comparable restaurant sales and the gain of two operating days due to the 2014 change to a 52-53 week fiscal year. The increase in Total revenues was partially offset by the closing of 73 restaurants since December 31, 2013, the sale of 20 Roy’s restaurants and the effect of foreign currency translation. |

| |

• | The increases in Adjusted and U.S. GAAP restaurant-level operating margin were primarily due to productivity savings and higher U.S. average unit volumes. These increases were partially offset by commodity and wage rate inflation as well as lunch expansion rollout costs. |

| |

• | The increase in Adjusted operating income margin was driven primarily by higher Adjusted restaurant-level operating margin as described above and lower compensation expenses due to our organizational realignment in the second half of fiscal 2014. |

| |

• | U.S. GAAP operating income margin is lower than Adjusted operating income margin primarily due to restaurant closing costs related to our International Restaurant Closure Initiative. This decrease was partially offset by the lapping of our Domestic Restaurant Closure Initiative. |

First Quarter Comparable Restaurant Sales

|

| | | |

THIRTEEN WEEKS ENDED MARCH 29, 2015 | | COMPANY- OWNED |

Comparable restaurant sales (stores open 18 months or more) (1) (2) (3): | | |

U.S. | | |

Outback Steakhouse | | 5.0 | % |

Carrabba’s Italian Grill | | 1.9 | % |

Bonefish Grill | | 0.9 | % |

Fleming’s Prime Steakhouse & Wine Bar | | 3.0 | % |

Combined U.S. | | 3.6 | % |

| | |

International | | |

Outback Steakhouse - South Korea | | (3.0 | )% |

Outback Steakhouse - Brazil | | 6.2 | % |

_________________

| |

(1) | Due to our conversion to a 52-53 week fiscal year in 2014, there were two more days in Q1 2015 as compared to Q1 2014. These additional days increased total revenues by $24.3 million and have been excluded from our comparable restaurant sales calculation. |

| |

(2) | Comparable restaurant sales exclude the effect of fluctuations in foreign currency rates. |

| |

(3) | Relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are excluded from comparable restaurant sales until at least 18 months after reopening. |

U.S. Segment Operating Results

|

| | | | | | | | | | |

(dollars in millions) | Q1 2015 | | Q1 2014 | | % Change |

U.S. | | | | | |

Total revenues | $ | 1,062.0 |

| | $ | 1,010.6 |

| | 5.1 | % |

| | | | | |

Adjusted restaurant-level operating margin | 17.9 | % | | 17.2 | % | | 0.7 | % |

U.S. GAAP restaurant-level operating margin | 17.9 | % | | 17.4 | % | | 0.5 | % |

| | | | | |

Adjusted operating income margin | 12.2 | % | | 11.1 | % | | 1.1 | % |

U.S. GAAP operating income margin | 12.0 | % | | 10.6 | % | | 1.4 | % |

| |

• | The increase in U.S. GAAP operating income margin was primarily due to higher average unit volumes, productivity savings, the lapping of the Domestic Restaurant Closure Initiative and lower compensation and benefits driven by our organizational realignment in the second half of fiscal 2014. |

International Segment Operating Results

|

| | | | | | | | | | |

(dollars in millions) | Q1 2015 | | Q1 2014 | | % Change |

International | | | | | |

Total revenues | $ | 140.0 |

| | $ | 147.2 |

| | (4.9 | )% |

| | | | | |

Adjusted restaurant-level operating margin | 21.7 | % | | 20.1 | % | | 1.6 | % |

U.S. GAAP restaurant-level operating margin | 21.7 | % | | 20.0 | % | | 1.7 | % |

| | | | | |

Adjusted operating income margin | 12.6 | % | | 12.0 | % | | 0.6 | % |

U.S. GAAP operating income margin | 6.3 | % | | 11.0 | % | | (4.7 | )% |

| |

• | The decrease in Total revenues is primarily due to the impact of the International Restaurant Closure Initiative and foreign currency translation. |

| |

• | The increase in Adjusted operating income margin was primarily due to higher restaurant-level operating margin, partially offset by general and administrative expenses due to investment spending. |

| |

• | U.S. GAAP operating income margin is lower than Adjusted operating income margin primarily due to restaurant closing costs related to our International Restaurant Closure Initiative. |

| |

• | Foreign currency translation negatively impacted income from operations by $2.0 million |

Unallocated Corporate Operating Expense

Certain expenses are managed centrally and are not allocated to the U.S. or International segment. In total, Q1 2015 unallocated expenses were $38.6 million, which was $5.5 million higher than Q1 2014. $4.9 million of this variance is primarily due to an increase in insurance expenses, which are included in consolidated restaurant-level operating margin.

System-wide Development

The following summarizes our system-wide development for the thirteen weeks ended March 29, 2015:

|

| | | | | | | | | | | |

| DECEMBER 28, 2014 | | OPENINGS | | CLOSURES (1) | | MARCH 29, 2015 |

U.S.: | | | | | | | |

Outback Steakhouse—Company-owned | 648 |

| | 1 |

| | — |

| | 649 |

|

Carrabba’s Italian Grill | | | | | | | |

Company-owned | 242 |

| | 2 |

| | — |

| | 244 |

|

Franchised | 1 |

| | 1 |

| | — |

| | 2 |

|

Bonefish Grill—Company-owned | 201 |

| | 4 |

| | (1 | ) | | 204 |

|

| | | | | | | |

International: | | | | | | | |

Outback Steakhouse | | | | | | | |

Company-owned—South Korea (2) | 91 |

| | 2 |

| | (18 | ) | | 75 |

|

Company-owned—Brazil | 63 |

| | 1 |

| | — |

| | 64 |

|

Company-owned—Other | 11 |

| | 1 |

| | (2 | ) | | 10 |

|

Franchised | 55 |

| | 2 |

| | — |

| | 57 |

|

System-wide development | | | 14 |

| | (21 | ) | | |

____________________

| |

(1) | Excludes 20 Roy’s restaurants sold in January 2015. |

| |

(2) | In Q1 2015, we adopted a policy that relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are considered a closure. Prior periods have been revised to conform to the current year presentation. |

Dividend Declaration and Share Repurchases

On April 29, 2015, our Board of Directors declared a quarterly cash dividend of $0.06 per share to be paid on May 27, 2015 to all stockholders of record as of the close of business on May 15, 2015.

In December 2014, our Board of Directors approved a share repurchase program under which we are authorized to repurchase up to $100.0 million of our outstanding common stock. The authorization will expire on June 12, 2016. During the thirteen weeks ended March 29, 2015, $70.0 million of outstanding stock was repurchased under the program. As of March 29, 2015, $30.0 million remains authorized under the share repurchase program.

Other Events

Q1 2015 adjusted results reflect the following items:

| |

• | In our November 4, 2014 earnings release, we announced our intention to close 36 underperforming international locations as part of the International Restaurant Closure Initiative. In Q1 2015, we incurred $7.5 million of restaurant closing costs associated with this initiative. |

| |

• | In January 2015, we sold our Roy’s business and recognized a loss on sale of $1.1 million. |

Fiscal 2015 Financial Outlook

We are reaffirming our full-year guidance for blended domestic comparable restaurant sales growth of at least 1.5% and Adjusted diluted earnings per share to be at least $1.27 as previously communicated in our February 19, 2015 earnings release.

Total Revenues are now expected to be at least $4.43 billion. The reduction from $4.49 billion is due to expected additional impact from foreign currency translation. All other elements of the fiscal 2015 guidance included in the February 19, 2015 release remain intact.

Non-GAAP Measures

In addition to the results provided in accordance with U.S. GAAP, this press release and related tables include certain non-GAAP measures which present operating results on an adjusted basis. These are supplemental measures of performance that are not required by or presented in accordance with U.S. GAAP and include the following: (i) Adjusted restaurant-level operating margins, (ii) Adjusted income from operations and the corresponding margins, (iii) Adjusted net income, (iv) Adjusted diluted earnings per share, (v) Adjusted segment restaurant-level operating margins and (vi) Adjusted segment income from operations and the corresponding margins.

Although we believe these non-GAAP measures enhance investors’ understanding of our business and performance,

these non-GAAP financial measures are not intended to replace accompanying U.S. GAAP financial measures. These metrics are not necessarily comparable to similarly titled measures used by other companies. The use of other non-GAAP financial measures permits investors to assess the operating performance of our business relative to our performance based on U.S. GAAP results and relative to other companies within the restaurant industry by isolating the effects of certain items that vary from period to period without correlation to core operating performance or that vary widely among similar companies. However, our inclusion of these adjusted measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items or that the items for which we have made adjustments are unusual or infrequent. We believe that the disclosure of these non-GAAP measures is useful to investors as they form the basis for how our management team and Board of Directors evaluate our operating performance, allocate resources and establish employee incentive plans.

For reconciliations of the non-GAAP measures used in this release, refer to tables four, five, six, seven, ten and eleven included later in this release.

Conference Call

The Company will host a conference call today, May 5, 2015 at 9:00 AM ET. The conference call can be accessed live over the telephone by dialing (888) 438-5448, or (719) 325-2491 for international participants. A replay will be available beginning two hours after the call and can be accessed by dialing (877) 870-5176 or (858) 384-5517 for international callers; the conference ID is 9881887. The replay will be available through Tuesday, May 12, 2015. The call will also be webcast live from the Company’s website at http://www.bloominbrands.com under the Investors section. A replay of this webcast will be available on the Company’s website after the call.

About Bloomin’ Brands, Inc.

Bloomin’ Brands, Inc. is one of the largest casual dining restaurant companies in the world with a portfolio of leading, differentiated restaurant concepts. The Company has four founder-inspired brands: Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill and Fleming's Prime Steakhouse & Wine Bar. The Company operates approximately 1,500 restaurants in 48 states, Puerto Rico, Guam and 22 countries, some of which are franchise locations. For more information, please visit bloominbrands.com.

Forward-Looking Statements

Certain statements contained herein, including statements under the heading “Fiscal 2015 Financial Outlook,” are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Generally, these statements can be identified by the use of words such as “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward-looking statements. These risks and uncertainties include, but are not limited to: local, regional, national and international economic conditions; consumer confidence and spending patterns; challenges associated with new restaurant development; our ability to preserve the value of our brands; price and availability of commodities; weather, acts of God and other disasters; the seasonality of the Company’s business; increases in unemployment rates and taxes; increases in labor costs; competition; changes in patterns of consumer traffic, consumer tastes and dietary habits; consumer reaction to public health and food safety issues; government actions and policies; foreign currency exchange rates; interruption or breach of our systems or loss of consumer or employee information; interest rate changes, compliance with debt covenants and the Company’s ability to make debt payments; the cost and availability of credit; and our ability to continue to pay dividends. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its most recent Form 10-K filed with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this release. All forward-looking statements are qualified in their entirety by this cautionary statement.

Note: Numerical figures included in this release have been subject to rounding adjustments.

|

| | | | | | | |

TABLE ONE |

BLOOMIN’ BRANDS, INC. |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED |

(dollars in thousands, except per share data) | MARCH 29, 2015 | | MARCH 30, 2014 |

Revenues | | | |

Restaurant sales | $ | 1,194,810 |

| | $ | 1,150,525 |

|

Other revenues | 7,249 |

| | 7,334 |

|

Total revenues | 1,202,059 |

| | 1,157,859 |

|

Costs and expenses | |

| | |

Cost of sales | 387,468 |

| | 373,614 |

|

Labor and other related | 323,986 |

| | 311,418 |

|

Other restaurant operating | 264,038 |

| | 256,518 |

|

Depreciation and amortization | 46,486 |

| | 46,165 |

|

General and administrative | 73,247 |

| | 74,054 |

|

Provision for impaired assets and restaurant closings | 9,133 |

| | 6,064 |

|

Total costs and expenses | 1,104,358 |

| | 1,067,833 |

|

Income from operations | 97,701 |

| | 90,026 |

|

Other expense, net | (1,147 | ) | | (164 | ) |

Interest expense, net | (13,198 | ) | | (16,598 | ) |

Income before provision for income taxes | 83,356 |

| | 73,264 |

|

Provision for income taxes | 21,274 |

| | 18,164 |

|

Net income | 62,082 |

| | 55,100 |

|

Less: net income attributable to noncontrolling interests | 1,494 |

| | 1,367 |

|

Net income attributable to Bloomin’ Brands | $ | 60,588 |

| | $ | 53,733 |

|

| | | |

Net income | $ | 62,082 |

| | $ | 55,100 |

|

Other comprehensive income: | | | |

Foreign currency translation adjustment | (25,462 | ) | | (5,365 | ) |

Unrealized losses on derivatives, net of tax | (4,012 | ) | | — |

|

Comprehensive income | 32,608 |

| | 49,735 |

|

Less: comprehensive income attributable to noncontrolling interests | 1,494 |

| | 1,367 |

|

Comprehensive income attributable to Bloomin’ Brands | $ | 31,114 |

| | $ | 48,368 |

|

| | | |

Earnings per share: | | | |

Basic | $ | 0.48 |

| | $ | 0.43 |

|

Diluted | $ | 0.47 |

| | $ | 0.42 |

|

Weighted average common shares outstanding: | | | |

Basic | 125,302 |

| | 124,542 |

|

Diluted | 128,759 |

| | 127,851 |

|

| | | |

Cash dividends declared per common share | $ | 0.06 |

| | $ | — |

|

|

| | | | | | | |

TABLE TWO |

BLOOMIN’ BRANDS, INC. |

SEGMENT RESULTS |

(UNAUDITED) |

(dollars in thousands) | THIRTEEN WEEKS ENDED |

U.S. Segment | MARCH 29, 2015 | | MARCH 30, 2014 |

Revenues | | | |

Restaurant Sales | $ | 1,056,104 |

| | $ | 1,004,875 |

|

Other Revenues | 5,910 |

| | 5,751 |

|

Total revenues | $ | 1,062,014 |

| | $ | 1,010,626 |

|

Restaurant-level operating margin | 17.9 | % | | 17.4 | % |

Income from operations | $ | 127,408 |

| | $ | 106,901 |

|

Operating income margin | 12.0 | % | | 10.6 | % |

International Segment | |

Revenues | | | |

Restaurant sales | $ | 138,706 |

| | $ | 145,650 |

|

Other revenues | 1,339 |

| | 1,583 |

|

Total revenues | $ | 140,045 |

| | $ | 147,233 |

|

Restaurant-level operating margin | 21.7 | % | | 20.0 | % |

Income from operations | $ | 8,879 |

| | $ | 16,225 |

|

Operating income margin | 6.3 | % | | 11.0 | % |

Reconciliation of Segment Income from Operations to Consolidated Income from Operations | | | |

Segment income from operations | | | |

U.S. | $ | 127,408 |

| | $ | 106,901 |

|

International | 8,879 |

| | 16,225 |

|

Total segment income from operations | 136,287 |

| | 123,126 |

|

Unallocated corporate operating expense - Cost of sales, Labor and other related and Other restaurant operating | (288 | ) | | 4,594 |

|

Unallocated corporate operating expense - Depreciation and amortization and General and administrative | (38,298 | ) | | (37,694 | ) |

Unallocated corporate operating expense | (38,586 | ) | | (33,100 | ) |

Total income from operations | $ | 97,701 |

| | $ | 90,026 |

|

|

| | | | | | | |

TABLE THREE |

BLOOMIN’ BRANDS, INC. |

SUPPLEMENTAL BALANCE SHEET INFORMATION |

(UNAUDITED) |

(dollars in thousands) | MARCH 29, 2015 | | DECEMBER 28, 2014 |

Cash and cash equivalents (1) | $ | 135,648 |

| | $ | 165,744 |

|

Net working capital (deficit) (2) | $ | (251,128 | ) | | $ | (239,559 | ) |

Total assets | $ | 3,198,644 |

| | $ | 3,344,286 |

|

Total debt, net | $ | 1,311,310 |

| | $ | 1,315,843 |

|

Total stockholders’ equity | $ | 518,847 |

| | $ | 556,449 |

|

_________________

| |

(1) | Excludes restricted cash. |

| |

(2) | The Company has, and in the future may continue to have, negative working capital balances (as is common for many restaurant companies). The Company operates successfully with negative working capital because cash collected on Restaurant sales is typically received before payment is due on its current liabilities and its inventory turnover rates require relatively low investment in inventories. Additionally, ongoing cash flows from restaurant operations and gift card sales are used to service debt obligations and to make capital expenditures. |

|

| | | | | | | | | | | | | | |

TABLE FOUR |

BLOOMIN’ BRANDS, INC. |

RESTAURANT-LEVEL OPERATING MARGIN NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| MARCH 29, 2015 | | MARCH 30, 2014 | |

| U.S. GAAP | | ADJUSTED (1) | | U.S. GAAP | | ADJUSTED (2) | | QUARTER TO DATE |

Restaurant sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | |

| | | | | | | | | |

Cost of sales | 32.4 | % | | 32.4 | % | | 32.5 | % | | 32.5 | % | | 0.1 | % |

Labor and other related | 27.1 | % | | 27.1 | % | | 27.1 | % | | 27.1 | % | | — | % |

Other restaurant operating | 22.1 | % | | 22.1 | % | | 22.3 | % | | 22.5 | % | | 0.4 | % |

| | | | | | | | | |

Restaurant-level operating margin | 18.4 | % | | 18.3 | % | | 18.2 | % | | 18.0 | % | | 0.3 | % |

_________________

| |

(1) | Includes adjustments of $0.2 million of expenses from the International Restaurant Closure Initiative, partially offset by $0.1 million of non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. All adjustments were recorded in Other restaurant operating. |

| |

(2) | Includes adjustments related to the write-off of deferred rent liabilities of $2.1 million associated with the Domestic Restaurant Closure Initiative, partially offset by $0.1 million of non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. All adjustments were recorded in Other restaurant operating. |

|

| | | | | | | | | | | | | | |

TABLE FIVE |

BLOOMIN’ BRANDS, INC. |

SEGMENT RESTAURANT-LEVEL OPERATING MARGIN NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | (UNFAVORABLE) FAVORABLE CHANGE IN ADJUSTED |

| MARCH 29, 2015 | | MARCH 30, 2014 | |

Restaurant-level operating margin: | U.S. GAAP | | ADJUSTED | | U.S. GAAP | | ADJUSTED | | QUARTER TO DATE |

U.S. (1) | 17.9 | % | | 17.9 | % | | 17.4 | % | | 17.2 | % | | 0.7 | % |

International (2) | 21.7 | % | | 21.7 | % | | 20.0 | % | | 20.1 | % | | 1.6 | % |

_________________

| |

(1) | The thirteen weeks ended March 30, 2014 includes adjustments for the write-off of $2.1 million of deferred rent liabilities associated with the Domestic Restaurant Closure Initiative. |

| |

(2) | The thirteen weeks ended March 30, 2014 includes an adjustment of $0.1 million of non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

|

| | | | | | | |

TABLE SIX |

BLOOMIN’ BRANDS, INC. |

INCOME FROM OPERATIONS, NET INCOME AND DILUTED EARNINGS PER SHARE NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED |

(in thousands, except per share data) | MARCH 29, 2015 | | MARCH 30, 2014 |

Income from operations | $ | 97,701 |

| | $ | 90,026 |

|

Operating income margin | 8.1 | % | | 7.8 | % |

Adjustments: | | | |

Restaurant impairments and closing costs (1) | 8,870 |

| | 4,929 |

|

Purchased intangibles amortization (2) | 1,283 |

| | 1,458 |

|

Restaurant relocations and related costs (3) | 1,169 |

| | — |

|

Transaction-related expenses (4) | 275 |

| | 1,118 |

|

Total income from operations adjustments | 11,597 |

| | 7,505 |

|

Adjusted income from operations | $ | 109,298 |

| | $ | 97,531 |

|

Adjusted operating income margin | 9.1 | % | | 8.4 | % |

| | | |

Net income attributable to Bloomin’ Brands | $ | 60,588 |

| | $ | 53,733 |

|

Adjustments: | | | |

Income from operations adjustments | 11,597 |

| | 7,505 |

|

Loss on disposal of business (5) | 1,151 |

| | — |

|

Total adjustments, before income taxes | 12,748 |

| | 7,505 |

|

Adjustment to provision for income taxes (6) | (3,627 | ) | | (2,695 | ) |

Net adjustments | 9,121 |

| | 4,810 |

|

Adjusted net income | $ | 69,709 |

| | $ | 58,543 |

|

| | | |

Diluted earnings per share | $ | 0.47 |

| | $ | 0.42 |

|

Adjusted diluted earnings per share | $ | 0.54 |

| | $ | 0.46 |

|

| | | |

Diluted weighted average common shares outstanding | 128,759 |

| | 127,851 |

|

_________________

| |

(1) | Represents expenses incurred in the thirteen weeks ended March 29, 2015 for the International and Domestic Restaurant Closure Initiatives and expenses incurred for the Domestic Restaurant Closure Initiative during the thirteen weeks ended March 30, 2014. |

| |

(2) | Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

| |

(3) | Represents asset impairment charges and accelerated depreciation incurred in connection with the Company’s relocation program. |

| |

(4) | Relates primarily to costs incurred with the secondary offering of our common stock in March 2015 and March 2014, respectively, and other transaction costs. |

| |

(5) | Represents loss on sale of the Roy’s business. |

| |

(6) | Income tax effect of adjustments for the thirteen weeks ended March 29, 2015 and March 30, 2014, respectively, are calculated based on the statutory rate applicable to jurisdictions in which the above non-GAAP adjustments relate. |

Following is a summary of the financial statement line item classification of the net income adjustments in the Consolidated Statements of Operations and Comprehensive Income:

|

| | | | | | | |

| THIRTEEN WEEKS ENDED |

(dollars in thousands) | MARCH 29, 2015 | | MARCH 30, 2014 |

Other restaurant operating expense | $ | (136 | ) | | $ | (1,983 | ) |

Depreciation and amortization | 1,266 |

| | 1,363 |

|

General and administrative | 1,602 |

| | 2,153 |

|

Provision for impaired assets and restaurant closings | 8,865 |

| | 5,972 |

|

Other expense, net | 1,151 |

| | — |

|

Provision for income taxes | (3,627 | ) | | (2,695 | ) |

Net adjustments | $ | 9,121 |

| | $ | 4,810 |

|

|

| | | | | | | |

TABLE SEVEN |

BLOOMIN’ BRANDS, INC. |

SEGMENT INCOME FROM OPERATIONS NON-GAAP RECONCILIATION |

(UNAUDITED) |

U.S. Segment | THIRTEEN WEEKS ENDED |

(dollars in thousands) | MARCH 29, 2015 | | MARCH 30, 2014 |

Income from operations | $ | 127,408 |

| | $ | 106,901 |

|

Operating income margin | 12.0 | % | | 10.6 | % |

Adjustments: | | | |

Restaurant impairments and closing costs (1) | 1,336 |

| | 4,929 |

|

Restaurant relocations and related costs (2) | 1,169 |

| | — |

|

Adjusted income from operations | $ | 129,913 |

| | $ | 111,830 |

|

Adjusted operating income margin | 12.2 | % | | 11.1 | % |

| | | |

International Segment | | | |

(dollars in thousands) | | | |

Income from operations | $ | 8,879 |

| | $ | 16,225 |

|

Operating income margin | 6.3 | % | | 11.0 | % |

Adjustments: | | | |

Restaurant impairments and closing costs (3) | 7,534 |

| | — |

|

Purchased intangibles amortization (4) | 1,283 |

| | 1,458 |

|

Adjusted income from operations | $ | 17,696 |

| | $ | 17,683 |

|

Adjusted operating income margin | 12.6 | % | | 12.0 | % |

_________________

| |

(1) | Represents expenses incurred for the Domestic Restaurant Closure Initiative. |

| |

(2) | Represents asset impairment charges and accelerated depreciation incurred in connection with the Company’s relocation program. |

| |

(3) | Represents expenses incurred for the International Restaurant Closure Initiative. |

| |

(4) | Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

|

| | | | | |

TABLE EIGHT |

BLOOMIN’ BRANDS, INC. |

COMPARATIVE STORE INFORMATION |

| MARCH 29, | | MARCH 30, |

| 2015 | | 2014 |

Number of restaurants (at end of the period): | | | |

U.S. | | | |

Outback Steakhouse | | | |

Company-owned | 649 |

| | 650 |

|

Franchised | 105 |

| | 104 |

|

Total | 754 |

| | 754 |

|

Carrabba’s Italian Grill | | | |

Company-owned | 244 |

| | 240 |

|

Franchised | 2 |

| | 1 |

|

Total | 246 |

| | 241 |

|

Bonefish Grill | | | |

Company-owned | 204 |

| | 192 |

|

Franchised | 5 |

| | 5 |

|

Total | 209 |

| | 197 |

|

Fleming’s Prime Steakhouse & Wine Bar | | | |

Company-owned | 66 |

| | 66 |

|

Roy’s (1) | | | |

Company-owned | — |

| | 20 |

|

International | | | |

Outback Steakhouse | | | |

Company-owned - South Korea | 75 |

| | 108 |

|

Company-owned - Brazil (2) | 64 |

| | 51 |

|

Company-owned - Other | 10 |

| | 12 |

|

Franchised | 57 |

| | 51 |

|

Total | 206 |

| | 222 |

|

System-wide total | 1,481 |

| | 1,500 |

|

____________________

| |

(1) | On January 26, 2015, we sold our Roy’s concept. |

| |

(2) | The restaurant counts for Brazil are reported as of February 2015 and 2014, respectively, to correspond with the balance sheet dates of this subsidiary. |

|

| | | | | | | | | | | | | | | | | | | |

TABLE NINE |

BLOOMIN’ BRANDS, INC. |

SELECTED SEGMENT INFORMATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | FISCAL YEAR |

| MARCH 30, | | JUNE 29, | | SEPTEMBER 28, | | DECEMBER 28, | |

| 2014 | | 2014 | | 2014 | | 2014 | | 2014 |

Selected Operating Data: | | | | | | | | | |

Comparable restaurant sales (restaurants open 18 months or more) (1): | | | | | | | | | |

Outback Steakhouse - South Korea | (18.8 | )% | | (14.3 | )% | | (21.4 | )% | | (15.8 | )% | | (17.7 | )% |

Outback Steakhouse - Brazil (2) | 6.8 | % | | 12.2 | % | | 8.9 | % | | 4.2 | % | | 7.6 | % |

| | | | | | | | | |

Menu price (decreases) increases (3): | | | | | | | | | |

Outback Steakhouse - South Korea | (0.1 | )% | | 0.9 | % | | 1.9 | % | | 1.9 | % | | 1.1 | % |

Outback Steakhouse - Brazil | 6.6 | % | | 7.8 | % | | 7.3 | % | | 6.8 | % | | 7.1 | % |

| | | | | | | | | |

Average restaurant unit volumes (weekly): | | | | | | | | | |

Outback Steakhouse - South Korea (4) | $ | 48,102 |

| | $ | 40,523 |

| | $ | 42,330 |

| | $ | 43,528 |

| | $ | 43,621 |

|

Outback Steakhouse - Brazil (5) | $ | 111,261 |

| | $ | 112,479 |

| | $ | 110,982 |

| | $ | 100,645 |

| | $ | 108,527 |

|

| | | | | | | | | |

Operating weeks: | | | | | | | | | |

Outback Steakhouse - South Korea | 1,386 |

| | 1,387 |

| | 1,385 |

| | 1,316 |

| | 5,474 |

|

Outback Steakhouse - Brazil | 638 |

| | 692 |

| | 732 |

| | 797 |

| | 2,859 |

|

| | | | | | | | | |

Selected Financial Data (dollars in thousands): | | | | | | | | | |

U.S. | | | | | | | | | |

Restaurant sales | $ | 1,004,875 |

| | $ | 961,608 |

| | $ | 910,482 |

| | $ | 955,408 |

| | $ | 3,832,373 |

|

Other revenues | 5,751 |

| | 5,435 |

| | 4,953 |

| | 5,767 |

| | 21,906 |

|

Total revenues | $ | 1,010,626 |

| | $ | 967,043 |

| | $ | 915,435 |

| | $ | 961,175 |

| | $ | 3,854,279 |

|

Restaurant-level operating margin | 17.4 | % | | 15.2 | % | | 13.5 | % | | 15.4 | % | | 15.4 | % |

Income from operations | $ | 106,901 |

| | $ | 81,268 |

| | $ | 54,734 |

| | 77,658 |

| | $ | 320,561 |

|

Operating income margin | 10.6 | % | | 8.4 | % | | 6.0 | % | | 8.1 | % | | 8.3 | % |

| | | | | | | | | |

International | | | | | | | | | |

Restaurant sales | $ | 145,650 |

| | $ | 142,829 |

| | $ | 148,735 |

| | $ | 146,196 |

| | $ | 583,410 |

|

Other revenues | 1,583 |

| | 1,040 |

| | 1,284 |

| | 1,115 |

| | 5,022 |

|

Total revenues | $ | 147,233 |

| | $ | 143,869 |

| | $ | 150,019 |

| | $ | 147,311 |

| | $ | 588,432 |

|

Restaurant-level operating margin | 20.0 | % | | 17.2 | % | | 16.6 | % | | 20.0 | % | | 18.4 | % |

Income (loss) from operations | $ | 16,225 |

| | $ | 8,282 |

| | $ | (2,968 | ) | | $ | 3,481 |

| | $ | 25,020 |

|

Operating income (loss) margin | 11.0 | % | | 5.8 | % | | (2.0 | )% | | 2.4 | % | | 4.3 | % |

| | | | | | | | | |

| | | | | | | (CONTINUED...) | |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

TABLE NINE |

BLOOMIN’ BRANDS, INC. |

SELECTED SEGMENT INFORMATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | FISCAL YEAR |

| MARCH 30, | | JUNE 29, | | SEPTEMBER 28, | | DECEMBER 28, | |

| 2014 | | 2014 | | 2014 | | 2014 | | 2014 |

Segment income (loss) from operations | | | | | | | | | |

U.S. | $ | 106,901 |

| | $ | 81,268 |

| | $ | 54,734 |

| | $ | 77,658 |

| | $ | 320,561 |

|

International | 16,225 |

| | 8,282 |

| | (2,968 | ) | | 3,481 |

| | 25,020 |

|

Total segment income from operations | $ | 123,126 |

| | $ | 89,550 |

| | $ | 51,766 |

| | $ | 81,139 |

| | $ | 345,581 |

|

Unallocated corporate operating expense - Cost of sales, Labor and other related and Other restaurant operating | 4,594 |

| | 6,728 |

| | (1,641 | ) | | 4,770 |

| | 14,451 |

|

Unallocated corporate operating expense - Depreciation and amortization, General and administrative and Provision for impaired assets and restaurant closings | (37,694 | ) | | (33,887 | ) | | (51,246 | ) | | (45,241 | ) | | (168,068 | ) |

Total unallocated corporate operating expense | (33,100 | ) | | (27,159 | ) | | (52,887 | ) | | (40,471 | ) | | (153,617 | ) |

Total income (loss) from operations | $ | 90,026 |

| | $ | 62,391 |

| | $ | (1,121 | ) | | $ | 40,668 |

| | $ | 191,964 |

|

____________________

| |

(1) | Comparable restaurant sales exclude the effect of fluctuations in foreign currency rates. Relocated international restaurants closed more than 30 days and relocated U.S. restaurants closed more than 60 days are excluded from comparable restaurant sales until at least 18 months after reopening. |

| |

(2) | Prior to November 1, 2013, sales from the acquired restaurants in Brazil were reported as income from unconsolidated joint ventures. Subsequent to November 1, 2013, the sales of these restaurants are reported as Company-owned. Calculation of comparable restaurant sales and general menu price increases for company-owned operations in Brazil include all restaurants that were open at least 18 months at the beginning of each respective period. Brazil results are reported on a one-month calendar lag. |

| |

(3) | The stated menu price changes exclude the impact of product mix shifts to new menu offerings. |

| |

(4) | Translated at an average exchange rate of 1,069.41, 1,028.98, 1,025.85 and 1,088.53 for the thirteen weeks ended March 30, 2014, June 29, 2014, September 28, 2014 and December 28, 2014, respectively. Translated at an average exchange rate of 1,053.78 for the fiscal year ended December 28, 2014. |

| |

(5) | Translated at an average exchange rate of 2.37, 2.26, 2.24 and 2.45 for the thirteen weeks ended March 30, 2014, June 29, 2014, September 28, 2014 and December 28, 2014, respectively. Translated at an average exchange rate of 2.33 for the fiscal year ended December 28, 2014. |

|

| | | | | | | | | | | | | | | | | | | |

TABLE TEN |

BLOOMIN’ BRANDS, INC. |

SELECTED SEGMENT INFORMATION - NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | |

| MARCH 30, | | JUNE 29, | | SEPTEMBER 28, | | DECEMBER 28, | | FISCAL YEAR |

(dollars in thousands) | 2014 | | 2014 | | 2014 | | 2014 | | 2014 |

Reconciliation of adjusted income from operations: | | | | | | | | | |

U.S. | | | | | | | | | |

Income from operations | $ | 106,901 |

| | $ | 81,268 |

| | $ | 54,734 |

| | $ | 77,658 |

| | $ | 320,561 |

|

Operating income margin | 10.6 | % | | 8.4 | % | | 6.0 | % | | 8.1 | % | | 8.3 | % |

Adjustments: | | | | | | | | | |

Restaurant impairments and closing costs (1) | 4,929 |

| | — |

| | — |

| | — |

| | 4,929 |

|

Asset impairments and related costs (2) | — |

| | — |

| | 6,112 |

| | 7,396 |

| | 13,508 |

|

Restaurant relocations and related costs (3) | — |

| | — |

| | — |

| | 249 |

| | 249 |

|

Adjusted income from operations | $ | 111,830 |

| | $ | 81,268 |

| | $ | 60,846 |

| | $ | 85,303 |

| | $ | 339,247 |

|

Adjusted operating income margin | 11.1 | % | | 8.4 | % | | 6.6 | % | | 8.9 | % | | 8.8 | % |

| | | | | | | | | |

International | | | | | | | | | |

Income (loss) from operations | $ | 16,225 |

| | $ | 8,282 |

| | $ | (2,968 | ) | | $ | 3,481 |

| | $ | 25,020 |

|

Operating income margin | 11.0 | % | | 5.8 | % | | (2.0 | )% | | 2.4 | % | | 4.3 | % |

Adjustments: | | | | | | | | | |

Purchased intangibles amortization (4) | 1,458 |

| | 1,532 |

| | 1,545 |

| | 1,417 |

| | 5,952 |

|

Restaurant impairments and closing costs (5) | — |

| | — |

| | 11,573 |

| | 10,339 |

| | 21,912 |

|

Adjusted income from operations | $ | 17,683 |

| | $ | 9,814 |

| | $ | 10,150 |

| | $ | 15,237 |

| | $ | 52,884 |

|

Adjusted operating income margin | 12.0 | % | | 6.8 | % | | 6.8 | % | | 10.3 | % | | 9.0 | % |

| | | | | | | | | |

Unallocated corporate operating expense | $ | (33,100 | ) | | $ | (27,159 | ) | | $ | (52,887 | ) | | $ | (40,471 | ) | | $ | (153,617 | ) |

Adjustments: | | | | | | | | | |

Transaction-related expenses (6) | 1,118 |

| | — |

| | — |

| | 229 |

| | 1,347 |

|

Severance (7) | — |

| | — |

| | 5,362 |

| | 3,683 |

| | 9,045 |

|

Asset impairments and related costs (8) | — |

| | — |

| | 10,840 |

| | 142 |

| | 10,982 |

|

Legal settlement | — |

| | — |

| | — |

| | (6,070 | ) | | (6,070 | ) |

Adjusted unallocated corporate operating expense | $ | (31,982 | ) | | $ | (27,159 | ) | | $ | (36,685 | ) | | $ | (42,487 | ) | | $ | (138,313 | ) |

| | | | | | | | | |

Adjustment line item classifications: | | | | | | | | | |

U.S. | | | | | | | | | |

Other restaurant operating expense | $ | (2,078 | ) | | $ | — |

| | $ | — |

| | $ | — |

| | $ | (2,078 | ) |

Depreciation and amortization | — |

| | — |

| | — |

| | 249 |

| | 249 |

|

General and administrative | 1,035 |

| | — |

| | — |

| | — |

| | 1,035 |

|

Provision for impaired assets and restaurant closings | 5,972 |

| | — |

| | 6,112 |

| | 7,396 |

| | 19,480 |

|

| $ | 4,929 |

| | $ | — |

| | $ | 6,112 |

| | $ | 7,645 |

| | $ | 18,686 |

|

| | | | | | | | | |

| | | | | | | (CONTINUED...) | |

|

| | | | | | | | | | | | | | | | | | | |

TABLE TEN |

BLOOMIN’ BRANDS, INC. |

SELECTED SEGMENT INFORMATION - NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | |

| MARCH 30, | | JUNE 29, | | SEPTEMBER 28, | | DECEMBER 28, | | FISCAL YEAR |

(dollars in thousands) | 2014 | | 2014 | | 2014 | | 2014 | | 2014 |

International | | | | | | | | | |

Other restaurant operating expense | $ | 95 |

| | $ | 100 |

| | $ | 101 |

| | $ | (741 | ) | | $ | (445 | ) |

Depreciation and amortization | 1,363 |

| | 1,432 |

| | 1,444 |

| | 1,324 |

| | 5,563 |

|

General and administrative | — |

| | — |

| | — |

| | 2,855 |

| | 2,855 |

|

Provision for impaired assets and restaurant closings | — |

| | — |

| | 11,573 |

| | 8,318 |

| | 19,891 |

|

| $ | 1,458 |

| | $ | 1,532 |

| | $ | 13,118 |

| | $ | 11,756 |

| | $ | 27,864 |

|

| | | | | | | | | |

Unallocated corporate operating expense | | | | | | | | | |

Other restaurant operating expense | $ | — |

| | $ | — |

| | $ | — |

| | $ | (6,070 | ) | | $ | (6,070 | ) |

General and administrative | 1,118 |

| | — |

| | 5,726 |

| | 4,216 |

| | 11,060 |

|

Provision for impaired assets and restaurant closings | — |

| | — |

| | 10,476 |

| | (162 | ) | | 10,314 |

|

| $ | 1,118 |

| | $ | — |

| | $ | 16,202 |

| | $ | (2,016 | ) | | $ | 15,304 |

|

_________________

| |

(1) | Represents impairments and expenses incurred for the Domestic Restaurant Closure Initiative. |

| |

(2) | Represents asset impairment charges and related costs associated with our decision to sell the Roy’s business. |

| |

(3) | Represents accelerated depreciation incurred in connection with the Company’s relocation program. |

| |

(4) | Represents non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations. |

| |

(5) | Represents impairments and expenses incurred for the International Restaurant Closure Initiative. |

| |

(6) | Transaction-related expenses primarily relate to secondary offerings of our common stock completed in November 2014 and March 2014, the refinancing of the Senior Secured Credit Facility in May 2014, and other transaction costs. |

| |

(7) | Relates to severance incurred as a result of our organizational realignment. |

| |

(8) | Represents asset impairment charges and related costs associated with our decision to sell corporate aircraft. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TABLE ELEVEN |

BLOOMIN’ BRANDS, INC. |

SELECTED SEGMENT INFORMATION - NON-GAAP RECONCILIATION |

(UNAUDITED) |

| THIRTEEN WEEKS ENDED | | FISCAL YEAR ENDED |

| MARCH 30, 2014 | | JUNE 29, 2014 | | SEPTEMBER 28, 2014 | | DECEMBER 28, 2014 | | DECEMBER 28, 2014 |

Restaurant-level operating margin: | U.S GAAP | | ADJUSTED | | U.S GAAP | | ADJUSTED | | U.S GAAP | | ADJUSTED | | U.S GAAP | | ADJUSTED | | U.S GAAP | | ADJUSTED |

U.S. (1) | 17.4 | % | | 17.2 | % | | 15.2 | % | | 15.2 | % | | 13.5 | % | | 13.5 | % | | 15.4 | % | | 15.4 | % | | 15.4 | % | | 15.4 | % |

International (2) | 20.0 | % | | 20.1 | % | | 17.2 | % | | 17.3 | % | | 16.6 | % | | 16.6 | % | | 20.0 | % | | 19.5 | % | | 18.4 | % | | 18.4 | % |

_________________

| |

(1) | Includes adjustments for the write-off of $2.1 million of deferred rent liabilities associated with the Domestic Restaurant Closure Initiative for the thirteen weeks ended March 30, 2014 and fiscal year ended December 28, 2014. |

| |

(2) | Includes: (i) an adjustment of $0.1 million for each thirteen week period presented for non-cash intangible amortization recorded as a result of the acquisition of our Brazil operations and (ii) the write-off of $0.8 million of deferred rent liabilities associated with the International Restaurant Closure Initiative for the thirteen weeks and fiscal year ended December 28, 2014. |

SOURCE: Bloomin’ Brands, Inc.

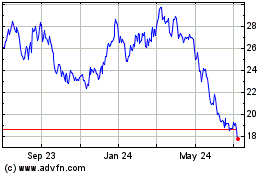

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

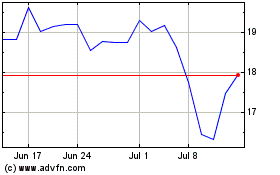

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024