Filed Pursuant to Rule 424(b)(5)

Registration No. 333-203284

The information in this preliminary prospectus supplement

is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to

sell these securities, nor are they soliciting offers to buy these securities in any jurisdiction where the offer or sale is not

permitted.

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 23, 2015)

4,750,000

Shares

Common

Stock

The selling stockholders named in this prospectus

supplement under the caption “Selling Stockholders” are offering 4,750,000 shares of our common stock in this

offering. The selling stockholders will pay all underwriting discounts and selling commissions applicable to the sale of the

shares pursuant to this offering, and will reimburse us for certain legal and accounting fees and expenses incurred by us in

connection with this offering. We will not receive any of the proceeds from sales of any of the shares subject to this

offering

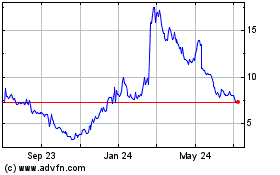

Our common stock is listed on The Nasdaq Global Market under

the symbol “LBIO.” On April 30, 2015, the last reported sale price of our common stock on The Nasdaq Global Market

was $11.93 per share.

Investing in our common stock involves a high degree of

risk. Please read “Risk Factors” beginning on page S-5 of this prospectus supplement, on page 4 of the accompanying

prospectus, and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total | |

| Public Offering Price | |

$ | | | |

$ | | |

| Underwriting Discounts and Commissions | |

$ | | | |

$ | | |

| Proceeds to Selling Stockholders Before Expenses | |

$ | | | |

$ | | |

Delivery of the shares of common stock is expected to

be made on or about May , 2015. The total underwriting discount payable by the selling stockholders

will be $ and the total proceeds to the selling stockholders, before

expenses, will be $ .

Sole Book-Running

Manager

Prospectus Supplement

dated May , 2015

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

SUPPLEMENT

This prospectus supplement and the accompanying prospectus form

part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. Under this shelf registration process, the selling stockholders named in this prospectus supplement under

the caption “Selling Stockholders” are offering to sell shares of our common stock using this prospectus supplement

and the accompanying prospectus. Both this prospectus supplement and the accompanying prospectus include important information

about us, our securities being offered and other information you should know before investing. This prospectus supplement also

adds, updates, and changes information contained in the accompanying prospectus. You should read both this prospectus supplement

and the accompanying prospectus as well as additional information described in the section entitled “Incorporation of Certain

Documents by Reference” in this prospectus supplement before investing in our securities.

You should rely only on the information contained in or incorporated

by reference into this prospectus supplement and the accompanying prospectus. To the extent the information contained in this prospectus

supplement differs or varies from the information contained in the accompanying prospectus or any document filed prior to the date

of this prospectus supplement and incorporated by reference, the information in this prospectus supplement will control. We have

not, the selling stockholders have not, and the underwriters have not, authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, the selling

stockholders are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. The information in this prospectus supplement and the accompanying prospectus is accurate only as of

the date it is presented. Our business, financial condition, results of operations and prospects may have changed since these dates.

You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus in their entirety before making an investment decision.

Unless otherwise indicated, information contained in this prospectus

supplement, the accompanying prospectus or the documents incorporated by reference, concerning our industry and the markets in

which we operate, including our general expectations and market position, market opportunity and market share, is based on information

from our own management estimates and research, as well as from industry and general publications and research, surveys and studies

conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry

and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates

of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in “Risk Factors” beginning on page S-5 of this prospectus supplement, on page

4 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement. These and other

important factors could cause our future performance to differ materially from our assumptions and estimates. See “Special

Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires, in this prospectus supplement

the “Company,” “Lion,” “we,” “us,” “our” and similar names refer to

Lion Biotechnologies, Inc.

This prospectus supplement, the accompanying prospectus and

the documents incorporated by reference also include trademarks, tradenames and service marks that are the property of other organizations.

Solely for convenience, trademarks and tradenames referred to in this prospectus supplement, the accompanying prospectus and the

documents incorporated by reference appear without the ® and ™ symbols, but those references are not intended to indicate,

in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not

assert its rights, to these trademarks and tradenames.

PROSPECTUS SUPPLEMENT

SUMMARY

This summary highlights selected information about us, this

offering and the information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents

we incorporate by reference. This summary is not complete and does not contain all the information you should consider before investing

in our common stock. Before making an investment decision you should carefully read this entire prospectus supplement and the accompanying

prospectus, including “Risk Factors” beginning on page S-5 of this prospectus supplement and page 4 of the accompanying

prospectus, the financial statements and related notes, and the other information that we incorporate by reference into this prospectus

supplement.

Our Company

We are a clinical-stage biopharmaceutical company focused on

the development and commercialization of novel cancer immunotherapy products designed to harness the power of a patient’s

own immune system to eradicate cancer cells. Our lead program is an adoptive cell therapy utilizing tumor-infiltrating lymphocytes

(TIL), which are T cells derived from patients’ tumors, for the treatment of metastatic melanoma. TIL therapy is being developed

in collaboration with Steven Rosenberg, M.D., Ph.D., Chief of Surgery Branch at the National Cancer Institute (NCI). Dr. Rosenberg

is a recognized pioneer in immuno-oncology and adoptive cell therapy. A patient's immune system, particularly their TIL, plays

an important role in identifying and killing cancer cells. TIL consist of a heterogeneous population of T cells that can recognize

a wide variety of cancer-specific mutations and can overcome tumor escape mechanisms. TIL therapy involves growing a patient’s

TIL in special culture conditions outside the patient’s body, or ex vivo, and then infusing the T cells back into the patient

in combination with interleukin-2 (IL-2). By taking TIL away from the immune-suppressive tumor microenvironment in the patient,

the T cells can rapidly proliferate. Billions of TIL, when infused back into the patient, are more able to search out and eradicate

the tumor. In most cases, only a single treatment of TIL is administered.

In 2011, we acquired from the National Institutes of Health

(NIH) a non-exclusive, worldwide right and license to certain NIH patents and patent applications to develop and manufacture autologous

TIL for the treatment of metastatic melanoma, ovarian, breast, and colorectal cancers. Under a Cooperative Research and Development

Agreement (CRADA) with the U.S. Department of Health and Human Services, as represented by the NCI and in collaboration with Dr.

Rosenberg, we support the in vitro development of improved methods for the generation and selection of TIL, the development of

large-scale production of TIL, and clinical trials using these improved methods of generating TIL. On February 9, 2015, the NIH

granted us an exclusive, worldwide license to treat metastatic melanoma with TIL therapy. In addition to our CRADA, we also conduct

research and development on TIL technology at our research facility in Tampa, Florida.

Recent Developments

On March 3, 2015 we closed an underwritten public offering of

9,200,000 shares of our common stock, including shares sold pursuant to the exercise in full of the underwriters' option to purchase

additional shares, at a price of $8.00 per share. The net proceeds to us from that public offering were approximately $68.2 million.

We are currently finalizing our financial results for the fiscal

quarter ended March 31, 2015. While complete financial information is not available, based on information currently available,

we estimate that as of March 31, 2015, we had approximately $111.3 million of cash and cash equivalents. These preliminary estimates

have been prepared by, and are the responsibility of, our management. Our actual cash and cash equivalents as of March 31, 2015

may differ from these estimates due to the completion of our closing procedures with respect to the fiscal quarter ended March

31, 2015, final adjustments and other developments that may arise between now and the time the financial results are finalized.

We expect to complete these closing procedures after this offering is consummated. Accordingly, our unaudited financial statements

as of and for the fiscal quarter ended March 31, 2015 will not be available until after this offering is completed.

In March 2015, we announced that researchers from Moffitt

Cancer Center reported positive results from a pilot trial of TIL and ipilimumab in patients with metastatic melanoma. The

Phase 1 trial was conducted at the Moffitt Cancer Center in patients with metastatic melanoma, with the objective of

determining the safety and feasibility of combining TIL therapy with the CTLA-4 checkpoint inhibitor, ipilimumab. The pilot

trial was partially sponsored by us. Twelve patients were treated with ipilimumab one week prior to tumor harvest for TIL

expansion, a second time while their TIL were being expanded, and two more times following TIL transfer. Of the 12 patients

enrolled in the trial, 11 went on to receive their autologous TIL, with five out of the 11 TIL-treated patients (46%)

responding to treatment (one complete response and four partial responses), consistent with response rates from previous TIL

studies in metastatic melanoma. Of the 12 enrolled patients, only one (8%) was ineligible for TIL transfer, indicating

relatively high patient adherence to trial protocol.

Corporate Information

Our principal executive offices are located at 21900 Burbank

Blvd, Third Floor, Woodland Hills, California 91367, and our telephone number is (818) 992-3126. Our website address is www.lbio.com.

The information contained in, or accessible through, our website should not be considered a part of this prospectus supplement.

THE OFFERING

| Common stock offered by the selling stockholders |

4,750,000 shares |

| |

|

| Common stock outstanding before and after this offering |

44,909,888 shares |

| |

|

| Use of proceeds |

We will not receive any of the proceeds from this offering. |

| |

|

| Risk factors |

See “Risk Factors” beginning on page S-5 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement for a discussion of factors that you should consider before investing in our common stock. |

| |

|

| Nasdaq Global Market symbol |

LBIO |

The number of shares of our common stock to be outstanding before

and after this offering is based on 44,909,888 shares of our common stock outstanding as of April 24, 2015 and excludes as of that

date:

| · | 1,907,877 shares of common stock issuable upon exercise of stock options, at a weighted average exercise price of $6.62 per

share; |

| · | 1,847,000 shares of common stock issuable upon the conversion of shares of Series A Convertible Preferred Stock; |

| · | 2,163,873 shares of common stock reserved for issuance under our 2014 Equity Incentive Plan; and |

| · | 10,124,726 shares of common stock issuable upon exercise of warrants outstanding at a weighted average exercise price of $2.50

per share. |

Unless otherwise indicated, this prospectus supplement reflects

and assumes no exercise of the outstanding options and warrants described above.

RISK FACTORS

Investing in our common stock involves a high degree of risk.

Before investing in our common stock, you should consider carefully the risks described below, together with the other information

contained in this prospectus supplement, the accompanying prospectus or incorporated by reference herein or therein, including

the risks and uncertainties discussed under “Risk Factors” beginning on page 4 of the accompanying prospectus and in

the documents incorporated by reference into this prospectus supplement. If any of the risks set forth below, in the accompanying

prospectus or in the documents incorporated by reference herein occur, our business, financial condition, results of operations

and future growth prospects could be materially and adversely affected. In these circumstances, the market price of our common

stock could decline, and you may lose all or part of your investment.

Risks Related to our Securities and this Offering

A substantial number of shares of common stock may

be sold in the market following this offering, which may depress the market price for our common stock.

Pursuant to a registration statement that was

declared effective by the SEC in September 2014, we registered the resale of 7,010,403 shares of then outstanding shares of

common stock, 1,847,000 shares of our common stock issuable upon the conversion of currently outstanding shares of our Series

A Convertible Preferred Stock, and all of the 10,124,726 shares of our common stock issuable upon the exercise of currently

outstanding warrants. In addition, 4,836,878 shares of our common stock held by the selling stockholders after this offering

have been registered with the SEC on Form S-3 and may be publicly sold after the expiration of the 90-day lock-up period

following this offering. In addition, certain shares of our common stock that are currently outstanding but have not been

registered for resale may currently be sold under Rule 144 under the Securities Act of 1933, as amended. Sales of a

substantial number of these shares in the public market following this offering, or the perception that those sales may

occur, could cause the market price of our common stock to decline.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and

the SEC filings that are incorporated by reference into this prospectus supplement and the accompanying prospectus contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of

historical facts, including statements regarding our future results of operations and financial position, including estimated cash

and cash equivalents as of March 31, 2015, business strategy, prospective products, regulatory filings and initiation of clinical

trials and other research and development activities, intellectual property rights and license agreements, and other future events,

are forward-looking statements. You can generally identify these forward-looking statements by forward-looking words such as “anticipates,”

“believes,” “expects,” “intends,” “future,” “could,” “estimates,”

“plans,” “would,” “should,” “potential,” “continues” and similar words

or expressions (as well as other words or expressions referencing future events, conditions or circumstances). These forward-looking

statements involve risks, uncertainties and other important factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements,

including, but not limited to:

| · | our current unprofitability and the risk that we may never become profitable; |

| · | our limited operating history; |

| · | our lack of revenue and our need for additional funding, which may not be available, and the risks associated with raising

additional capital; |

| · | risks related to our clinical trials, including the uncertainty that results will support our product candidate claims; |

| · | our plans and timing with respect to seeking regulatory approvals and uncertainties regarding the regulatory process; |

| · | risks associated with litigation or SEC and other regulatory investigations, including expending substantial resources and

distracting personnel from their normal responsibilities; |

| · | delays in enrollment of patients in our clinical trials, which could delay or prevent regulatory approvals; |

| · | the dependence of our development program upon third-parties who are outside our control; |

| · | failure to compete successfully against other actual and potential future competitors; |

| · | developments by competitors that may render our products or technologies obsolete or non-competitive; |

| · | failure to comply with obligations of our intellectual property licenses; |

| · | our or our licensors’ inability to obtain and maintain patent protection for technology and products; |

| · | the risk that other companies may license the same intellectual properties that we have licensed, including as a result of

our inability to obtain exclusive rights from the NIH or NCI, or that other companies may otherwise duplicating our business model

and operations; |

| · | risks related to our dependence on third party vendors to design, build, maintain and support our manufacturing and cell processing

facilities and our information technology infrastructure and systems; |

| · | risks related to our compliance with patent application requirements; |

| · | risks related to our infringement of third parties’ rights; |

| · | risks associated with intellectual property litigation; |

| · | risks associated with healthcare reform; |

| · | our reliance on key executive officers and advisors; |

| · | our inability to hire additional qualified personnel; |

| · | volatility in the price of our common stock; and |

| · | capital appreciation being the only source of gain for our common stock. |

All forward-looking statements contained herein are expressly

qualified in their entirety by this cautionary statement, the risk factors set forth under the heading “Risk Factors”

in this prospectus supplement, and in the accompanying prospectus and the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus. These forward-looking statements speak only as of the date of this prospectus supplement.

Except to the extent required by applicable laws and regulations, we undertake no obligation to update these forward-looking statements

to reflect new information, events or circumstances after the date of this prospectus supplement or to reflect the occurrence of

unanticipated events. In light of these risks and uncertainties, the forward-looking events and circumstances described in this

prospectus supplement may not occur and actual results could differ materially from those anticipated or implied in the forward-looking

statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares

of our common stock by the selling stockholders pursuant to this offering. All proceeds from this offering will be solely for the

account of the selling stockholders. The selling stockholders have, however, agreed to reimburse us for certain legal and accounting

fees and expenses incurred by us in connection with this offering.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital

stock. We intend to retain future earnings, if any, to finance the operation and expansion of our business and do not anticipate

paying any cash dividends in the foreseeable future. Any future determination related to dividend policy will be made at the discretion

of our board of directors after considering our financial condition, results of operations, capital requirements, business prospects

and other factors the board of directors deems relevant, and subject to any restrictions contained in financing agreements we may

enter into.

SELLING STOCKHOLDERS

We have registered 9,586,879 shares of our common stock for

sale by the selling stockholders. The following table sets forth:

| · | The number and percent of shares of our common stock that the selling stockholders beneficially owned prior to the offering

of the shares under this prospectus supplement; |

| · | The number of shares of our common stock that may be offered hereby; and |

| · | The number and percent of shares of our common stock to be beneficially owned by the selling stockholders after the offering

of the shares. |

The information in the table is based in part upon information

that we were provided by the selling stockholders, and the percentages in the table were calculated based upon 44,909,888 shares

of our common stock being outstanding as of April 24, 2015. Beneficial ownership of shares is determined in accordance with SEC

rules and includes voting or investment power with respect to the shares. Shares of common stock subject to options, warrants and

convertible securities, if any, currently exercisable or convertible, or exercisable or convertible within 60 days after April

24, 2015, are deemed to be outstanding for purposes of computing the percentage ownership of the selling stockholder who holds

the option, warrant or convertible security, but not for purposes of computing the percentage ownership of any other selling stockholder.

| |

|

Shares of Common Stock Beneficially Owned Prior to this Offering |

|

|

|

Shares of Common Stock Beneficially Owned After Completion of this Offering |

| Selling Stockholder |

|

Number of Shares |

|

Percent |

|

Number of Shares Being Offered |

|

Number of Shares |

|

Percent |

| Bristol Investment Fund, Ltd.(1) |

|

3,868,074 |

|

8.61% |

|

1,919,318 |

|

1,948,756 |

|

4.34% |

| Ayer Capital Partners Master Fund, LP (2) |

|

5,160,000 |

|

11.49% |

|

2,403,614 |

|

2,756,386 |

|

6.14% |

| Ayer Capital Partners Kestrel Fund, LP (2) |

|

125,326 |

|

* |

|

58,379 |

|

66,947 |

|

* |

| Epworth-Ayer Capital (2) |

|

318,689 |

|

* |

|

318,689 |

|

- |

|

- |

| The Hillsberg Trust (3) |

|

269,000(5) |

|

* |

|

50,000 |

|

219,000 |

|

* |

____________

* Represents less than 1% of the outstanding shares of our common stock.

(1) Bristol Capital Advisors, LLC is the investment advisor

of Bristol Investment Fund, Ltd. Paul Kessler is manager of Bristol Capital Advisor, LLC and as such has voting and dispositive

power over the securities held by Bristol Investment Fund, Ltd.

(2) The investment advisor of this selling stockholder is

Ayer Capital Management, LP (the “Advisor”). ACM Capital Partners, LLC (“ACM”) is the general partner of

the Advisor, and Ayer Capital Partners, LLC is the general partner of the selling stockholder. Jay Venkatesan is the managing member

of ACM and Ayer Capital Partners LLC and also is one of our directors.

(3) The Hillsberg Trust is a revocable family trust of which

Sanford J. Hillsberg is a trustee. Mr. Hillsberg is one of our directors.

(4) Excludes options to purchase 65,000 shares of common

stock that are held by Sanford J. Hillsberg, which options are exercisable currently or within 60 days of April 24, 2015.

UNDERWRITING

Subject to the terms and conditions set forth in the underwriting

agreement, dated May 2015, among us, the selling stockholders and Jefferies LLC, as underwriter, the selling stockholders have

agreed to sell to the underwriter, and the underwriter has agreed to purchase from the selling stockholders, the entire number

of shares of common stock offered by this prospectus supplement.

The underwriting agreement provides that the obligations of

the underwriter are subject to certain conditions precedent such as the receipt by the underwriter of officers’ certificates

and legal opinions and approval of certain legal matters by its counsel. The underwriting agreement provides that the underwriter

will purchase all of the shares of common stock if any of them are purchased. We and the selling stockholders have agreed to indemnify

the underwriter and certain of its controlling persons against certain liabilities, including liabilities under the Securities

Act of 1933, as amended, or the Securities Act, and to contribute to payments that the underwriter may be required to make in respect

of those liabilities.

The underwriter has advised us that, following the completion

of this offering, it currently intends to make a market in the common stock as permitted by applicable laws and regulations. However,

the underwriter is not obligated to do so, and the underwriter may discontinue any market-making activities at any time without

notice in its sole discretion. Accordingly, no assurance can be given as to the liquidity of the trading market for the common

stock, that you will be able to sell any of the common stock held by you at a particular time or that the prices that you receive

when you sell will be favorable.

The underwriter is offering the shares of common stock subject

to its acceptance of the shares of common stock from the selling stockholders and subject to prior sale. The underwriter reserves

the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Commission and Expenses

The underwriter has advised us that it proposes to offer the

shares of common stock to the public at the public offering price set forth on the cover page of this prospectus supplement and

to certain dealers, at that price less a concession not in excess of $ per share of common stock. The underwriter may allow, and

certain dealers may reallow, a discount from the concession not in excess of $ per share of common stock to certain brokers and

dealers. After the offering, the public offering price, concession and reallowance to dealers may be reduced by the underwriter.

The following table shows the public offering price, the underwriting

discounts and commissions that the selling stockholders are to pay the underwriter and the proceeds, before expenses, to the selling

stockholders in connection with this offering.

| | |

Per Share | | |

Total |

|

| | |

| | |

|

|

| Public offering price | |

$ | | | |

$ | |

|

| | |

| | | |

| |

|

| Underwriting discounts and commissions paid by the selling stockholders | |

$ | | | |

$ | |

|

| | |

| | | |

| |

|

| Proceeds to the selling stockholders, before expenses | |

$ | | | |

$ | |

|

We estimate expenses payable by us in connection with

this offering, other than the underwriting discounts and commissions referred to above, will be approximately $

. Certain of these expenses will be reimbursed to us by the selling stockholders as

set forth in the underwriting agreement, which include an amount up to $30,000 to reimburse certain of the

underwriter’s expenses. We estimate expenses payable by the selling stockholders in connection with this offering, other than

the underwriting discounts and commissions referred to above, will be approximately

$ , excluding any expenses reimbursed to us or the underwriter by the selling

stockholders.

Listing

Our common stock is listed on The Nasdaq Global Market under

the symbol “LBIO.”

No Sales of Similar Securities

We, our officers and directors and the selling stockholders

have agreed, subject to specified exceptions, not to directly or indirectly:

| · | sell, offer, contract or grant any option to sell (including any short sale), pledge, transfer, establish an open “put

equivalent position” within the meaning of Rule 16a-l(h) under the Securities Exchange Act of 1934, as amended, or |

| · | otherwise dispose of any shares of common stock, options or warrants to acquire shares of common stock, or securities exchangeable

or exercisable for or convertible into shares of common stock currently or hereafter owned either of record or beneficially, or |

| · | publicly announce an intention to do any of the foregoing for a period of 90 days after the date of this prospectus without

the prior written consent of Jefferies LLC. |

This restriction terminates after the close of trading of the

common stock on and including the 90th day after the date of this prospectus. However, subject to certain exceptions, in the event

that either:

| · | during the last 17 days of the restricted period, we issue an earnings release or material news or a material event relating

to us occurs, or |

| · | prior to the expiration of the restricted period, we announce that we will release earnings results during the 16-day period

beginning on the last day of the restricted period, |

then in either case the expiration of the restricted period

will be extended until the expiration of the 18-day period beginning on the date of the issuance of an earnings release or the

occurrence of the material news or event, as applicable, unless Jefferies LLC waives, in writing, such an extension.

Jefferies LLC may, in its sole discretion and at any time or

from time to time before the termination of the 90-day period release all or any portion of the securities subject to lock-up agreements.

There are no existing agreements between the underwriters and any of our stockholders who will execute a lock-up agreement, providing

consent to the sale of shares prior to the expiration of the lock-up period.

Stabilization

The underwriter has advised us that it, pursuant to Regulation

M under the Securities Exchange Act of 1934, as amended, and certain persons participating in the offering may engage in short

sale transactions, stabilizing transactions, syndicate covering transactions or the imposition of penalty bids in connection with

this offering. These activities may have the effect of stabilizing or maintaining the market price of the common stock at a level

above that which might otherwise prevail in the open market. Establishing short sales positions may involve either “covered”

short sales or “naked” short sales.

Short sales involve the sales by the underwriter of a greater number of shares than they are required to purchase in the offering.

The underwriter must close out any naked short position by purchasing shares in the open market. A naked short position is

more likely to be created if the underwriter is concerned that there may be downward pressure on the price of the shares of

common stock in the open market after pricing that could adversely affect investors who purchase in this offering.

A stabilizing bid is a bid for the purchase of shares of common

stock on behalf of the underwriter for the purpose of fixing or maintaining the price of the common stock. A syndicate covering

transaction is the bid for or the purchase of shares of common stock on behalf of the underwriter to reduce a short position incurred

by the underwriter in connection with the offering. Similar to other purchase transactions, the underwriter’s purchases to

cover the syndicate short sales may have the effect of raising or maintaining the market price of our common stock or preventing

or retarding a decline in the market price of our common stock. As a result, the price of our common stock may be higher than the

price that might otherwise exist in the open market. A penalty bid is an arrangement permitting the underwriter to reclaim the

selling concession otherwise accruing to a syndicate member in connection with the offering if the common stock originally sold

by such syndicate member are purchased in a syndicate covering transaction and therefore have not been effectively placed by such

syndicate member.

Neither we nor the underwriter makes any representation or prediction

as to the direction or magnitude of any effect that the transactions described above may have on the price of our common stock.

The underwriter is not obligated to engage in these activities and, if commenced, any of the activities may be discontinued at

any time.

Electronic Distribution

A prospectus in electronic format may be made available by e-mail

or on the websites or through online services maintained by one or more of the underwriters or their affiliates. In those cases,

prospective investors may view offering terms online and may be allowed to place orders online. The underwriter may agree with

us to allocate a specific number of shares of common stock for sale to online brokerage account holders. Any such allocation for

online distributions will be made by the underwriters on the same basis as other allocations. Other than the prospectus in electronic

format, the information on the underwriter’s websites and any information contained in any other website maintained by any

of the underwriter is not part of this prospectus supplement or the accompanying prospectus, has not been approved and/or endorsed

by us or the underwriter and should not be relied upon by investors.

Other Activities and Relationships

The underwriter and certain of its affiliates are full service

financial institutions engaged in various activities, which may include securities trading, commercial and investment banking,

financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities.

The underwriter and certain of its affiliates have, from time to time, performed, and may in the future perform, various commercial

and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary

fees and expenses.

In the ordinary course of their various business activities,

the underwriter and certain of its affiliates may make or hold a broad array of investments and actively trade debt and equity

securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the

accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by

us and our affiliates. If the underwriter or its affiliates have a lending relationship with us, they routinely hedge their credit

exposure to us consistent with their customary risk management policies. The underwriter and its affiliates may hedge such exposure

by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in

our securities or the securities of our affiliates, including potentially the common stock offered hereby. Any such short positions

could adversely affect future trading prices of the common stock offered hereby. The underwriter and certain of its affiliates

may also communicate independent investment recommendations, market color or trading ideas, or publish or express independent research

views in respect of such securities or instruments, and may at any time hold, or recommend to clients that they acquire, long and/or

short positions in such securities and instruments.

Disclaimers About Non-U.S. Jurisdictions

Australia

This prospectus is not a disclosure document for the purposes

of Australia’s Corporations Act 2001 (Cth) of Australia, or Corporations Act, has not been lodged with the Australian Securities

& Investments Commission and is only directed to the categories of exempt persons set out below. Accordingly, if you receive

this prospectus in Australia:

You confirm and warrant that you are either:

| · | a “sophisticated investor” under section 708(8)(a) or (b) of the Corporations Act; |

| · | a “sophisticated investor” under section 708(8)(c) or (d) of the Corporations Act and that you have provided an

accountant’s certificate to the company which complies with the requirements of section 708(8)(c)(i) or (ii) of the Corporations

Act and related regulations before the offer has been made; or |

| · | a “professional investor” within the meaning of section 708(11)(a) or (b) of the Corporations Act. |

To the extent that you are unable to confirm or warrant that

you are an exempt sophisticated investor or professional investor under the Corporations Act any offer made to you under this prospectus

is void and incapable of acceptance.

You warrant and agree that you will not offer any of the shares

issued to you pursuant to this prospectus for resale in Australia within 12 months of those shares being issued unless any such

resale offer is exempt from the requirement to issue a disclosure document under section 708 of the Corporations Act.

European Economic Area

In relation to each member state of the European Economic Area

which has implemented the Prospectus Directive, each referred to herein as a Relevant Member State, with effect from and including

the date on which the Prospectus Directive is implemented in that Relevant Member State, referred to herein as the Relevant Implementation

Date, no offer of any securities which are the subject of the offering contemplated by this prospectus has been or will be made

to the public in that Relevant Member State other than any offer where a prospectus has been or will be published in relation to

such securities that has been approved by the competent authority in that Relevant Member State or, where appropriate, approved

in another Relevant Member State and notified to the relevant competent authority in that Relevant Member State in accordance with

the Prospectus Directive, except that with effect from and including the Relevant Implementation Date, an offer of such securities

may be made to the public in that Relevant Member State:

| · | to any legal entity which is a “qualified investor” as defined in the Prospectus Directive; |

| · | to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive,

150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus

Directive, subject to obtaining the prior consent of the representatives of the underwriters for any such offer; or |

| · | in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided that no such offer of securities shall require the

Company or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus

pursuant to Article 16 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer

to the public” in relation to any securities in any Relevant Member State means the communication in any form and by any

means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide

to purchase or subscribe the securities, as the same may be varied in that Relevant Member State by any measure implementing the

Prospectus Directive in that Relevant Member State and the expression “Prospectus Directive” means Directive 2003/71/EC

(and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and

includes any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive”

means Directive 2010/73/EU.

Hong Kong

No securities have been offered or sold, and no securities may

be offered or sold, in Hong Kong, by means of any document, other than to persons whose ordinary business is to buy or sell shares

or debentures, whether as principal or agent; or to “professional investors” as defined in the Securities and Futures

Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or in other circumstances which do not result in the

document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute

an offer to the public within the meaning of the Companies Ordinance (Cap.32) of Hong Kong. No document, invitation or advertisement

relating to the securities has been issued or may be issued or may be in the possession of any person for the purpose of issue

(in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read

by, the public of Hong Kong (except if permitted under the securities laws of Hong Kong) other than with respect to securities

which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as

defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance.

This prospectus has not been registered with the Registrar of

Companies in Hong Kong. Accordingly, this prospectus may not be issued, circulated or distributed in Hong Kong, and the securities

may not be offered for subscription to members of the public in Hong Kong. Each person acquiring the securities will be required,

and is deemed by the acquisition of the securities, to confirm that he is aware of the restriction on offers of the securities

described in this prospectus and the relevant offering documents and that he is not acquiring, and has not been offered any securities

in circumstances that contravene any such restrictions.

Israel

In the State of Israel this prospectus shall not be regarded

as an offer to the public to purchase shares of common stock under the Israeli Securities Law, 5728 – 1968, which requires

a prospectus to be published and authorized by the Israel Securities Authority, if it complies with certain provisions of Section

15 of the Israeli Securities Law, 5728–1968, including, inter alia, if: (i) the offer is made, distributed or directed to

not more than 35 investors, subject to certain conditions (the “Addressed Investors”); or (ii) the offer is made, distributed

or directed to certain qualified investors defined in the First Addendum of the Israeli Securities Law, 5728 – 1968, subject

to certain conditions (the “Qualified Investors”). The Qualified Investors shall not be taken into account in the count

of the Addressed Investors and may be offered to purchase securities in addition to the 35 Addressed Investors. The Company has

not and will not take any action that would require it to publish a prospectus in accordance with and subject to the Israeli Securities

Law, 5728 – 1968. The Company and the underwriters have not and will not distribute this prospectus or make, distribute or

direct an offer to subscribe for our common stock to any person within the State of Israel, other than to Qualified Investors and

up to 35 Addressed Investors.

Qualified Investors may have to submit written evidence that

they meet the definitions set out in of the First Addendum to the Israeli Securities Law, 5728 – 1968. In particular, we

may request, as a condition to be offered common stock, that Qualified Investors will each represent, warrant and certify to us

and/or to anyone acting on our behalf: (i) that it is an investor falling within one of the categories listed in the First Addendum

to the Israeli Securities Law, 5728 – 1968; (ii) which of the categories listed in the First Addendum to the Israeli Securities

Law, 5728 – 1968 regarding Qualified Investors is applicable to it; (iii) that it will abide by all provisions set forth

in the Israeli Securities Law, 5728 – 1968 and the regulations promulgated thereunder in connection with the offer to be

issued common stock; (iv) that the shares of common stock that it will be issued are, subject to exemptions available under the

Israeli Securities Law, 5728 – 1968: (a) for its own account; (b) for investment purposes only; and (c) not issued with a

view to resale within the State of Israel, other than in accordance with the provisions of the Israeli Securities Law, 5728 –

1968; and (v) that it is willing to provide further evidence of its Qualified Investor status. Addressed Investors may have to

submit written evidence in respect of their identity and may have to sign and submit a declaration containing, inter alia, the

Addressed Investor’s name, address and passport number or Israeli identification number.

Japan

The offering has not been and will not be registered under the

Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948 of Japan, as amended), or FIEL, and the underwriter will not

offer or sell any securities, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (which term

as used herein means, unless otherwise provided herein, any person resident in Japan, including any corporation or other entity

organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to a resident of

Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the FIEL and any

other applicable laws, regulations and ministerial guidelines of Japan.

Singapore

This prospectus has not been and will not be lodged or registered

with the Monetary Authority of Singapore.

Accordingly, this prospectus and any other document or material

in connection with the offer or sale, or the invitation for subscription or purchase of the securities may not be issued, circulated

or distributed, nor may the securities be offered or sold, or be made the subject of an invitation for subscription or purchase,

whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to an institutional investor

under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore, or the SFA, (ii) to a relevant person as defined

under Section 275(2), or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions, specified in

Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of any other applicable provision

of the SFA.

Where the securities are subscribed or purchased under Section

275 of the SFA by a relevant person which is:

| · | a corporation (which is not an accredited investor as defined under Section 4A of the SFA) the sole business of which is to

hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor;

or |

| · | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary is

an accredited investor, |

shares, debentures and units of shares and debentures of that

corporation or the beneficiaries’ rights and interest in that trust shall not be transferable for six months after that corporation

or that trust has acquired the Offer Shares under Section 275 of the SFA except:

| · | to an institutional investor under Section 274 of the SFA or to a relevant person defined in Section 275(2) of the SFA, or

to any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that

corporation or such rights and interest in that trust are acquired at a consideration of not less than $200,000 (or its equivalent

in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other

assets, and further for corporations, in accordance with the conditions, specified in Section 275 of the SFA; |

| · | where no consideration is given for the transfer; or |

| · | where the transfer is by operation of law. |

Switzerland

The securities may not be publicly offered in Switzerland and

will not be listed on the SIX Swiss Exchange, or SIX, or on any other stock exchange or regulated trading facility in Switzerland.

This prospectus has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art.

1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing

Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this prospectus nor

any other offering or marketing material relating to the securities or the offering may be publicly distributed or otherwise made

publicly available in Switzerland.

Neither this prospectus nor any other offering or marketing

material relating to the offering, the Company or the securities have been or will be filed with or approved by any Swiss regulatory

authority. In particular, this prospectus will not be filed with, and the offer of securities will not be supervised by, the Swiss

Financial Market Supervisory Authority and the offer of securities has not been and will not be authorized under the Swiss Federal

Act on Collective Investment Schemes, or CISA. The investor protection afforded to acquirers of interests in collective investment

schemes under the CISA does not extend to acquirers of securities.

United Kingdom

This prospectus is only being distributed to, and is only directed

at, persons in the United Kingdom that are qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive

that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended, referred to herein as the Order, and/or (ii) high net worth entities falling within Article

49(2)(a) to (d) of the Order and other persons to whom it may lawfully be communicated. Each such person is referred to herein

as a Relevant Person.

This prospectus and its contents are confidential and should

not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the United

Kingdom. Any person in the United Kingdom that is not a Relevant Person should not act or rely on this document or any of its contents.

LEGAL MATTERS

The validity of the shares of common stock offered hereby will

be passed upon for us by TroyGould PC. Certain legal matters with respect to the common stock offered pursuant to this prospectus

supplement and the accompanying prospectus will be passed upon for the selling stockholders by DLA Piper LLP. Certain legal matters

relating to this offering will be passed upon for the underwriters by Latham & Watkins LLP, San Diego, California.

EXPERTS

The financial statements and management’s assessment of

the effectiveness of internal control over the financial reporting of Lion Biotechnologies, Inc. included in this prospectus and

registration statement by reference to the Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities

and Exchange Commission, have been so incorporated in reliance on the reports of Weinberg & Company, P. A. an independent

registered public accounting firm, given on the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

We file reports, proxy statements and other information with

the SEC. Information filed with the SEC by us can be inspected and copied at the Public Reference Room maintained by the SEC at

100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information by mail from the Public Reference Section

of the SEC at prescribed rates. Further information on the operation of the SEC’s Public Reference Room in Washington, D.C.

can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is

http://www.sec.gov.

Our web site address is www.lbio.com. The information on our

web site, however, is not, and should not be deemed to be, a part of this prospectus supplement or the accompanying prospectus.

This prospectus supplement and the accompanying prospectus are

part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement.

The full registration statement may be obtained from the SEC or us, as provided below. Other documents establishing the terms of

the offered securities are filed as exhibits to the registration statement. Statements in this prospectus supplement and the accompanying

prospectus about these documents are summaries and each statement is qualified in all respects by reference to the document to

which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect

a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or through the SEC’s website,

as provided above.

INCORPORATION OF

CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference”

information into this prospectus supplement and the accompanying prospectus, which means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed

to be part of this prospectus supplement and the accompanying prospectus, and subsequent information that we file with the SEC

will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by

reference will be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying prospectus

to the extent that a statement contained in this prospectus supplement or the accompanying prospectus modifies or replaces that

statement.

We incorporate by reference the following information or documents

that we have filed with the SEC:

| · | our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 16, 2015, as amended by Amendment

No. 1 on Form 10-K/A filed with the SEC on April 20, 2015; |

| · | our Current Reports on Form 8-K filed with the SEC on January 27, 2015, February 12, 2015, February 18, 2015, February 25,

2015, March 3, 2015, April 17, 2015 and May 1, 2015; and |

| · | the description of our stock contained in our registration statement on Form 8-A filed on February 25, 2015 pursuant to Section

12 of the Exchange Act, as such statement may be amended from time to time. |

We are not, however, incorporating by reference any documents

or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the

SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item

9.01 of Form 8-K. The reports and documents specifically listed above or filed in the future (excluding any information furnished

to, rather than filed with, the SEC) are deemed to be part of this prospectus supplement and accompanying prospectus from the date

of the filing of such reports and documents.

You may request a copy of any of these filings from us at no

cost by writing or calling our Chief Financial Officer at the following address or telephone number: Lion Biotechnologies, Inc.,

21900 Burbank Boulevard, Third Floor, Woodland Hills, California 91367; (818) 992-3126. Exhibits to the filings will not be sent,

however, unless those exhibits have specifically been incorporated by reference in this prospectus supplement and the accompanying

prospectus supplement.

PROSPECTUS

LION BIOTECHNOLOGIES, INC.

9,586,879 Shares of Common Stock

Offered By Selling Stockholders

This prospectus relates to shares of

our common stock to offered for resale by the selling stockholders listed under “Selling Stockholders” on page 4 of

this prospectus.

We are not selling any shares of common

stock under this prospectus, and will not receive any proceeds from the sale of the shares offered by the selling stockholders.

We will pay all fees and expenses incurred in connection with the registration of the shares of common stock offered by this prospectus,

and the selling stockholders will pay any brokerage or underwriting commissions or discounts or other expenses relating to the

sale of these shares.

The selling stockholders or their donees,

pledgees or other transferees may sell or otherwise transfer the shares of common stock offered by this prospectus from time to

time in the public market or in privately negotiated transactions, either directly or through broker-dealers or underwriters, at

fixed prices, at prevailing market prices at the time of sale, at prices relating to the prevailing market prices, at varying prices

determined at the time of sale or at negotiated prices. See “Plan of Distribution” beginning on page 6 of this prospectus

for more information about how the selling stockholders may sell or otherwise transfer their shares of common stock.

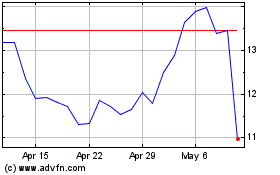

Our common stock is traded on The NASDAQ

Global Market under the symbol “LBIO.” On April 21, 2015, the last reported sale price of our common stock on The

NASDAQ Global Market was $12.00 per share.

Investing in our securities involves risks. See the “Risk

Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is

April 23, 2015.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed on behalf of the selling stockholders with the Securities and Exchange Commission, or the SEC, to permit

the selling stockholders to sell the shares described in this prospectus in one or more transactions. The selling stockholders

and the plan of distribution of the shares being offered by them are described in this prospectus under the headings “Selling

Stockholders” and “Plan of Distribution.”

As permitted by the rules and regulations

of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read

the registration statement and the other reports we file with the SEC at the SEC’s web site or its offices described below

under the heading “Where You Can Find More Information.”

You should rely only on the information

that is contained in this prospectus or that is incorporated by reference into this prospectus. We and the selling stockholders

have not authorized anyone to provide you with information that is in addition to or different from that contained in, or incorporated

by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

The shares of common stock offered by this

prospectus are not being offered in any jurisdiction where the offer or sale of such common stock is not permitted. You should

not assume that the information contained in, or incorporated by reference into, this prospectus is accurate as of any date other

than the date of this prospectus or, in the case of the documents incorporated by reference, the date of such documents, regardless

of the date of delivery of this prospectus or any sale of the common stock offered by this prospectus. Our business, financial

condition, liquidity, results of operations and prospects may have changed since those dates.

Unless the context otherwise requires, references

in this prospectus to “the company,” “we,” “us” and “our” refer to Lion Biotechnologies,

Inc.

PROSPECTUS SUMMARY

This summary highlights selected information

appearing elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information

that may be important to you or that you should consider before investing in our common stock. This prospectus includes or incorporates

by reference information about the common stock being offered by the selling stockholders, as well as information regarding our

business and industry and detailed financial data. Before making an investment decision, you should read this prospectus and the

information incorporated by reference herein in their entirety, including “Risk Factors” beginning on page 4 of this

prospectus.

All references to the number of shares

issued or outstanding in this prospectus, and all per share and other similar data, reflect a 1-for-100 reverse stock split that

we effected on September 26, 2013.

About Lion Biotechnologies

Lion Biotechnologies, Inc. (“we,”

“us,” “our,” “Lion Biotechnologies” or the “company”) is a clinical-stage biopharmaceutical

company focused on the development and commercialization of novel cancer immunotherapy products designed to harness the power of

a patient's own immune system to eradicate cancer cells. Our lead program is an adoptive cell therapy utilizing tumor-infiltrating

lymphocytes (TIL), which are T cells derived from patients’ tumors, for the treatment of metastatic melanoma. TIL therapy

is being developed in collaboration with Steven Rosenberg, M.D., Ph.D., Chief of Surgery Branch at the National Cancer Institute

(NCI). Dr. Rosenberg is a recognized pioneer in immuno-oncology and adoptive cell therapy.

A patient's immune system, particularly

their TIL, plays an important role in identifying and killing cancer cells. TIL consist of a heterogeneous population of T cells

that can recognize a wide variety of cancer-specific mutations and can overcome tumor escape mechanisms. TIL therapy involves growing

a patient's TIL in special culture conditions outside the patient's body, or ex vivo, and then infusing the T cells back into the

patient in combination with interleukin-2 (IL-2). By taking TIL away from the immune-suppressive tumor microenvironment in the

patient, the T cells can rapidly proliferate. Billions of TIL, when infused back into the patient, are more able to search out

and eradicate the tumor.

We have a Cooperative Research and Development

Agreement (CRADA) with the U.S. Department of Health and Human Services, as represented by the NCI, through which we are funding

the research and development of TIL-based product candidates for the treatment of advanced solid tumors. Pursuant to the CRADA,

we fund NCI clinical trials with TIL therapy that are being conducted in collaboration with Dr. Rosenberg. In a 101-patient, Phase

2 clinical trial conducted at the NCI, about half of the patients with relapsed/refractory metastatic melanoma treated with TIL

therapy achieved an objective response. An objective response occurs when there is a complete remission or a partial remission

of the tumor. A complete remission requires a complete disappearance of all detectable evidence of disease, and a partial remission

typically requires at least approximately 50% regression of measurable disease without new sites of disease. As of November 2014,

14 out of the 101 patients had experienced a complete remission and continue to remain in remission. Severe and life threatening

toxicities occurred mostly in the first week after cell infusion and generally resolved within a few weeks. We are also funding

an NCI-sponsored, Phase 2 clinical trial of a TIL therapy utilizing enriched tumor-reactive T cells to treat patients with metastatic

melanoma. In addition to melanoma, we expect to fund multiple NCI-sponsored clinical trials involving TIL therapy to treat a variety

of solid tumors, including, cervical, head and neck, bladder, breast, and lung cancers. Dr. Rosenberg has filed or intends to file

investigational new drug applications (INDs) with the FDA in order to conduct these trials. Depending on the availability of funding,

our evaluation of commercial viability of some of these product candidates and other factors, our goal is to submit separate INDs

to conduct our own clinical trials relating to some or all of these product candidates. The CRADA provides us with an option to

negotiate commercialization licenses from the NIH for additional intellectual property relating to certain TIL-based product candidates

developed by the NCI under the CRADA.

We have a worldwide, exclusive patent license

from the National Institutes of Health (NIH) for intellectual property to develop, manufacture and commercialize TIL therapy for

the treatment of melanoma, and a worldwide, non-exclusive license to this intellectual property for the treatment of ovarian cancer,

breast cancer, and colorectal cancer. We also have an exclusive license from the NIH for intellectual property relating to a TIL-based

therapy utilizing enriched tumor reactive T cells patients with metastatic melanoma.

In January 2015 our IND for a company-sponsored,

Phase 2 clinical trial designed to establish the feasibility of our lead product candidate, LN-144, and assess its overall safety

in patients with metastatic melanoma was allowed by the U.S. Food and Drug Administration (FDA). We expect to initiate this trial

later this year. The trial's primary objective is to determine the safety and feasibility of the administration of TIL therapy.

Our company-sponsored, Phase 2 trial will use a protocol that is nearly identical to one which is currently being used at the NCI

to treat patients. However, we believe we have streamlined and improved the NCI's manufacturing process of TIL production for our

LN-144 product candidate. Assuming that the trial results meet our expectations, we plan to initiate a pivotal trial for regulatory

approval for LN-144 in 2016. If the data from this pivotal trial are compelling, we intend to discuss with the FDA the filing of

a Biologics License Application (BLA) for accelerated approval of LN-144 as a therapy for refractory metastatic melanoma.

We also intend to apply for an orphan drug

designation for LN-144 in the United States and Europe to treat metastatic melanoma. This designation may provide seven years of

market exclusivity in the United States, subject to certain limited exceptions. However, the orphan drug designation does not convey

any advantage in or shorten the duration of the regulatory review or approval process.

We are pursuing relapsed/refractory metastatic

melanoma as our first target indication because of the promising initial NCI results and the commercial opportunity inherent in

the significant unmet need of this patient population. Melanoma is a common type of skin cancer, accounting for approximately 76,000

patients diagnosed and 9,700 deaths each year in the United States according to the NCI. About 4% of patients with melanoma have

metastatic disease. Patients with relapsed/refractory metastatic melanoma following treatment under the current standards of care

have a particularly dire prognosis with very few curative treatment options.

In addition to the research and development

being conducted under the CRADA, in 2014 we established our own significant internal research and development capabilities in Tampa,

Florida, near the H. Lee Moffitt Cancer & Research Institute (Moffitt) on the campus of the University of South Florida, to

explore the next-generation of TIL technology and new product candidates, as well as generate new intellectual property.

Company History

We filed our original Articles of Incorporation

with the Secretary of State of Nevada on September 17, 2007. Until March 2010, we were an inactive company known as Freight Management

Corp. On March 15, 2010, we changed our name to Genesis Biopharma, Inc., and in 2011 we commenced our current business. In May

2013 we completed a restructuring of our outstanding debt and equity securities (the “Restructuring”) and raised $1.25

million through the sale of our common stock. As part of the Restructuring, we converted $7.2 million of senior secured promissory

notes, $1.7 million of bridge promissory notes, and $0.3 million in other outstanding debt into shares of common stock at a conversion

price of $1.00 per share. In connection with, and shortly after the Restructuring, we replaced our Chief Executive Officer and

most of our directors. On July 24, 2013, we acquired Lion Biotechnologies, Inc., a Delaware corporation. On September 26, 2013,

we amended and restated our Articles of Incorporation to, among other things, change our name to Lion Biotechnologies, Inc., effect

a 1-for-100 reverse stock split (pro-rata reduction of outstanding shares) of our common stock, increase (after the reverse stock

split) the number of our authorized number of shares of common stock to 150,000,000 shares, and authorize the issuance of 50,000,000

shares of “blank check” preferred stock, $0.001 par value per share.

Our principal executive offices are located

at 21900 Burbank Boulevard, 3rd Floor, Woodland Hills, California 91367, and our telephone number at that address is (818) 992-3126.

Our website is located at www.lionbio.com. Information on our website is not, and should not be considered, part of this prospectus.

| |

The Offering |

| |

|

| Issuer |

Lion Biotechnologies, Inc. |

| |

|

| Selling stockholders |

The selling stockholders who are offering shares of common stock for sale under this prospectus are named under “Selling

Stockholders” beginning on page 4 of this prospectus. See, “Selling Stockholders.” |

| Common stock offered by the selling security holders |

Up to an aggregate of 9,586,879 currently issued and outstanding shares

of our common stock.

|

| |

|

| Common stock outstanding |

44,762,388 shares, without giving effect to any other issuances of common stock subsequent

to the date of this prospectus.

|

| |

|

| Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholders. |

| |

|

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 4 of this prospectus. |

| |

|

| NASDAQ Global Market listing |

Our common stock is listed on The NASDAQ Global Market under the symbol “LBIO.” |

| |

|

The number of outstanding shares of common

stock shown above is based on 44,762,388 shares outstanding as of April 20, 2015 and excludes as of that date the following:

| · | 1,907,877

shares of common stock issuable upon exercise of stock options outstanding as of April

20, 2015, at a weighted average exercise price of $6.62 per share; |

| · | 1,847,000

shares of common stock issuable upon the conversion of shares of Series A Convertible

Preferred Stock outstanding as of April 20, 2015; |

| · | 2,163,873

shares of common stock reserved for issuance under our 2014 Equity Incentive Plan as

of April 20, 2015; and |

| · | 10,272,226

shares of common stock issuable upon exercise of warrants outstanding as of April 20,

2015 at a weighted average exercise price of $2.50 per share. |

RISK FACTORS

Investing in our common stock involves certain

risks. Before you decide whether to purchase any shares of our common stock, in addition to the other information in this prospectus,

you should carefully consider the risks described under the heading “Risk Factors” in our most recent Annual Report

on Form 10-K and Quarterly Report on Form 10-Q, which are incorporated by reference into this prospectus, as such risk factors

may be updated from time to time by our future filings with the SEC. If one or more of these risks materializes, our business,

financial condition and results of operations may be adversely affected. In that event, the value of our common stock could decline.

The risks that are described in this prospectus or in any document that is incorporated by reference into this prospectus are not

the only risks that we face. Additional risks not presently known to us or that we currently believe to be immaterial may also

adversely affect our business, financial condition and results of operations.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus, any related prospectus

supplement and the documents incorporated by reference into this prospectus contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts that are contained

in this prospectus, any related prospectus supplement and the documents incorporated by reference into this prospectus, including

statements regarding our future results of operations, financial condition, business strategy and business prospects, should be

considered forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “believe,”

“anticipate,” “intend,” “plan,” “estimate,” “may,” “could,”

“anticipate,” “predict,” or “expect” and similar expressions.

These forward-looking statements involve