UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2015

VERTEX PHARMACEUTICALS INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | |

MASSACHUSETTS (State or other jurisdiction of incorporation) | 000-19319 (Commission File Number) | 04-3039129 (IRS Employer Identification No.) |

50 Northern Avenue

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip Code)

(617) 341-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On April 29, 2015, we issued a press release in which we reported our consolidated financial results for the three months ended March 31, 2015. A copy of that press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description of Document

99.1 Press Release, dated April 29, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| VERTEX PHARMACEUTICALS INCORPORATED |

| (Registrant) |

| |

Date: April 29, 2015 | /s/ Ian F. Smith |

| Ian F. Smith Executive Vice President and Chief Financial Officer |

| |

Vertex Reports First Quarter 2015 Financial Results

-First quarter 2015 total revenues of $139 million, including net product revenues of $130 million for KALYDECO® (ivacaftor) in cystic fibrosis-

-Cash, cash equivalents and marketable securities of approximately $1.2 billion on March 31, 2015-

BOSTON -- Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today reported consolidated financial results for the quarter ended March 31, 2015. Vertex also reiterated its financial guidance for total 2015 KALYDECO revenues and non-GAAP operating expenses. Key financial results include:

|

| | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Increase/(Decrease) |

| 2015 | | 2014 | | $ | | % |

| (in millions, except per share data) | | |

KALYDECO product revenues, net | $ | 130.2 |

| | $ | 99.5 |

| | $ | 30.7 |

| | 31 | % |

GAAP net loss | $ | (198.6 | ) | | $ | (232.5 | ) | | $ | (33.9 | ) | | (15 | )% |

GAAP net loss per share | $ | (0.83 | ) | | $ | (1.00 | ) | | $ | (0.17 | ) | | (17 | )% |

Non-GAAP net loss | $ | (148.4 | ) | | $ | (151.4 | ) | | $ | (3.0 | ) | | (2 | )% |

Non-GAAP net loss per share | $ | (0.62 | ) | | $ | (0.65 | ) | | $ | (0.03 | ) | | (5 | )% |

"We continue to make significant progress toward our goals of bringing new medicines to more people with CF and positioning the company for long-term growth," said Jeffrey Leiden, M.D., Ph.D., Chairman, President and Chief Executive Officer of Vertex. "The number of people eligible for Kalydeco continues to increase with both geographic and label expansion, and we are also preparing for the potential launch of Orkambi, which we announced today as the proposed tradename for the combination of lumacaftor and ivacaftor. Our New Drug Application for Orkambi is currently under review by the FDA, and if approved, Orkambi would be the first medicine to treat the underlying cause of CF for eligible patients ages 12 and older with two copies of the F508del mutation - some 8,500 people in the U.S."

First Quarter 2015 Non-GAAP Financial Results

The non-GAAP financial results for the first quarter 2015 and first quarter 2014 exclude stock-based compensation expense, costs related to the relocation of the company's corporate headquarters, hepatitis C-related revenues and costs and other adjustments.

Total Non-GAAP Revenues: Total non-GAAP revenues for the first quarter of 2015 were $135.4 million, including $130.2 million in net product revenues from KALYDECO and $5.3 million from royalty revenues.

| |

• | Net Product Revenues from KALYDECO: Vertex's first quarter 2015 net product revenues from KALYDECO were $130.2 million compared to $99.5 million for the first quarter of 2014. The increased KALYDECO net product revenues, compared to the first quarter of 2014, resulted primarily from additional people being treated with KALYDECO in both U.S. and ex-U.S. markets. |

Non-GAAP Cost of Product Revenues and Royalty Expenses (COR): Total combined non-GAAP COR expenses for the first quarter of 2015 were $10.7 million, compared to $9.6 million for the first quarter of 2014.

Non-GAAP Research and Development (R&D) Expenses and Sales, General and Administrative (SG&A) Expenses: Total combined non-GAAP R&D and SG&A expenses for the first quarter of 2015 were $246.3 million, compared to $233.9 million for the first quarter of 2014. The components include:

| |

• | R&D Expenses: Non-GAAP R&D expenses were $177.2 million for the first quarter of 2015, compared to $181.5 million in non-GAAP R&D expenses for the first quarter of 2014. The R&D expenses for the first quarter of 2015 were similar to the first quarter of 2014 as a result of the completion of the Phase 3 program for the combination of lumacaftor and ivacaftor in the first half of 2014, offset by increased costs related to the initiation of the pivotal Phase 3 program for VX-661 in combination with ivacaftor in the first quarter of 2015. |

| |

• | SG&A Expenses: Non-GAAP SG&A expenses were $69.1 million for the first quarter of 2015, compared to $52.4 million in non-GAAP SG&A expenses for the first quarter of 2014. This increase was primarily the result of increased investment in global commercial support for the planned launch of ORKAMBITM (lumacaftor/ivacaftor). |

Non-GAAP Net Loss Attributable to Vertex: Vertex's first quarter 2015 non-GAAP net loss was $148.4 million, or $0.62 per diluted share, compared to a non-GAAP net loss of $151.4 million, or $0.65 per diluted share, for the first quarter of 2014. The non-GAAP net loss for the first quarter of 2015 was similar to the

first quarter of 2014 as a result of increased KALYDECO product revenues, offset by increased operating expenses and interest expense.

Cash Position at March 31, 2015

As of March 31, 2015, Vertex had $1.2 billion in cash, cash equivalents and marketable securities compared to $1.4 billion in cash, cash equivalents and marketable securities as of December 31, 2014. As of March 31, 2015, Vertex had $300 million outstanding from a credit agreement that provides for a secured loan of up to $500 million.

2015 Financial Guidance

This section contains forward-looking guidance about the financial outlook for Vertex.

Vertex today reiterated its financial guidance for total 2015 KALYDECO revenues and non-GAAP operating expenses:

| |

• | KALYDECO Net Revenues: Vertex expects KALYDECO net revenues of $560 to $580 million for 2015. |

| |

• | Non-GAAP R&D and SG&A Expenses: Vertex expects that its combined non-GAAP R&D and SG&A expenses in 2015 will be in the range of $1.05 to $1.10 billion. |

Vertex's expected combined non-GAAP R&D and SG&A expenses exclude stock-based compensation expense and certain other expenses recorded in 2015.

Non-GAAP Financial Measures

In this press release, Vertex's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. In particular, non-GAAP financial results exclude stock-based compensation expense, costs related to the relocation of the company's corporate headquarters, hepatitis C-related revenues and costs and other adjustments. These results are provided as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help indicate underlying trends in the company's business, are important in comparing current results with prior period results and provide additional information regarding the company's financial position. Management also uses these non-GAAP financial measures to establish budgets and operational goals that are communicated internally and externally and to

manage the company's business and to evaluate its performance. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached financial information.

First Quarter 2015 GAAP Financial Results

Total Revenues: Total revenues for the first quarter of 2015 were $138.5 million compared with $118.5 million in total revenues for the first quarter of 2014. First quarter 2015 revenues were comprised primarily of $130.2 million in KALYDECO net product revenues and an aggregate of $8.3 million in net product revenues from INCIVEK, royalty revenues and collaborative revenues. For the first quarter of 2014, Vertex reported $99.5 million in net product revenues from KALYDECO and an aggregate of $18.9 million in net product revenues from INCIVEK, royalty revenues and collaborative revenues.

Operating Costs and Expenses: Total operating costs and expenses for the first quarter of 2015 were $310.5 million, including certain charges of $53.5 million, compared to $334.5 million for the first quarter of 2014, including certain charges of $91.0 million. GAAP operating costs and expenses include:

| |

• | COR Expenses: COR expenses were $12.3 million for the first quarter of 2015, including $1.6 million of certain charges, compared to $15.5 million for the first quarter of 2014, including $5.9 million of certain charges. |

| |

• | R&D Expenses: R&D expenses were $215.6 million for the first quarter of 2015, including $38.4 million of certain charges, compared to $238.6 million for the first quarter of 2014, including $57.1 million of certain charges. |

| |

• | SG&A Expenses: SG&A expenses were $85.9 million for the first quarter of 2015, including $16.7 million of certain charges, compared to $74.2 million for the first quarter of 2014, including $21.8 million of certain charges. |

Net Loss Attributable to Vertex: Vertex's first quarter 2015 net loss was $198.6 million, or $0.83 per diluted share, including net charges of $50.2 million. Vertex's first quarter 2014 net loss was $232.5 million, or $1.00 per diluted share, including net charges of $81.1 million.

Vertex Pharmaceuticals Incorporated

First Quarter Results

Condensed Consolidated Statements of Operations Data

(in thousands, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Revenues: | | | |

Product revenues, net | $ | 130,875 |

| | $ | 103,461 |

|

Royalty revenues | 6,792 |

| | 10,733 |

|

Collaborative revenues | 842 |

| | 4,257 |

|

Total revenues | 138,509 |

| | 118,451 |

|

Costs and expenses: | | | |

Cost of product revenues | 9,381 |

| | 8,572 |

|

Royalty expenses | 2,926 |

| | 6,904 |

|

Research and development expenses | 215,599 |

| | 238,617 |

|

Sales, general and administrative expenses | 85,860 |

| | 74,212 |

|

Restructuring (income) expenses | (3,272 | ) | | 6,188 |

|

Total costs and expenses | 310,494 |

| | 334,493 |

|

Loss from operations | (171,985 | ) | | (216,042 | ) |

Interest expense, net | (21,307 | ) | | (15,717 | ) |

Other (expense) income, net | (5,113 | ) | | 451 |

|

Loss from continuing operations before provision for income taxes | (198,405 | ) | | (231,308 | ) |

Provision for income taxes | 299 |

| | 803 |

|

Loss from continuing operations | (198,704 | ) | | (232,111 | ) |

Loss from discontinued operations, net of tax (Note 1) | — |

| | (346 | ) |

Net loss | (198,704 | ) | | (232,457 | ) |

Loss attributable to noncontrolling interest | 98 |

| | — |

|

Net loss attributable to Vertex | $ | (198,606 | ) | | $ | (232,457 | ) |

| | | |

Amounts attributable to Vertex: | | | |

Loss from continuing operations | $ | (198,606 | ) | | $ | (232,111 | ) |

Loss from discontinued operations (Note 1) | — |

| | (346 | ) |

Net loss attributable to Vertex | $ | (198,606 | ) | | $ | (232,457 | ) |

| | | |

Amounts per share attributable to Vertex common shareholders: | | | |

Net loss from continuing operations: | | | |

Basic and diluted | $ | (0.83 | ) | | $ | (1.00 | ) |

Net loss: | | | |

Basic and diluted | $ | (0.83 | ) | | $ | (1.00 | ) |

Shares used in per share calculations: | | | |

Basic and diluted | 239,493 |

| | 232,887 |

|

Reconciliation of GAAP to Non-GAAP Net Loss

First Quarter Results

(in thousands, except per share amounts)

(unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

GAAP loss attributable to Vertex | $ | (198,606 | ) | | $ | (232,457 | ) |

Stock-based compensation expense | 57,384 |

| | 46,580 |

|

Real estate restructuring costs (Note 2) | (3,567 | ) | | 19,942 |

|

HCV related revenues and costs (Note 3) | (4,469 | ) | | 11,216 |

|

Other adjustments (Note 4) | 882 |

| | 3,325 |

|

Non-GAAP net loss attributable to Vertex | $ | (148,376 | ) | | $ | (151,394 | ) |

|

| | |

Amounts per diluted share attributable to Vertex common shareholders: | | | |

GAAP | $ | (0.83 | ) | | $ | (1.00 | ) |

Non-GAAP | $ | (0.62 | ) | | $ | (0.65 | ) |

Shares used in diluted per share calculations: | | | |

GAAP and Non-GAAP | 239,493 |

| | 232,887 |

|

Reconciliation of GAAP to Non-GAAP Revenues and Expenses

First Quarter Results

(in thousands)

(unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

GAAP total revenues | $ | 138,509 |

| | $ | 118,451 |

|

HCV related revenues (Note 3) | (2,869 | ) | | (10,241 | ) |

Other adjustments (Note 4) | (200 | ) | | — |

|

Non-GAAP total revenues | $ | 135,440 |

| | $ | 108,210 |

|

| | | |

| | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

GAAP cost of product revenues and royalty expenses | $ | 12,307 |

| | $ | 15,476 |

|

HCV related costs (Note 3) | (1,596 | ) | | (5,887 | ) |

Non-GAAP cost of product revenues and royalty expenses | $ | 10,711 |

| | $ | 9,589 |

|

| | | |

GAAP research and development expenses | $ | 215,599 |

| | $ | 238,617 |

|

Stock-based compensation expense | (38,217 | ) | | (32,900 | ) |

Real estate restructuring costs (Note 2) | — |

| | (12,201 | ) |

HCV related costs (Note 3) | 488 |

| | (8,656 | ) |

Other adjustments (Note 4) | (696 | ) | | (3,325 | ) |

Non-GAAP research and development expenses | $ | 177,174 |

| | $ | 181,535 |

|

| | | |

GAAP sales, general and administrative expenses | $ | 85,860 |

| | $ | 74,212 |

|

Stock-based compensation expense | (19,167 | ) | | (13,680 | ) |

Real estate restructuring costs (Note 2) | — |

| | (2,200 | ) |

HCV related costs (Note 3) | 2,904 |

| | (5,921 | ) |

Other adjustments (Note 4) | (448 | ) | | — |

|

Non-GAAP sales, general and administrative expenses | $ | 69,149 |

| | $ | 52,411 |

|

| | | |

Combined Non-GAAP R&D and SG&A expenses | $ | 246,323 |

| | $ | 233,946 |

|

| | | |

| | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

GAAP provision for income taxes | $ | 299 |

| | $ | 803 |

|

Other adjustments (Note 4) | 63 |

| | — |

|

Non-GAAP provision for income taxes | $ | 362 |

| | $ | 803 |

|

Condensed Consolidated Balance Sheets Data

(in thousands)

(unaudited)

|

| | | | | | | |

| March 31, 2015 | | December 31, 2014 |

Assets | | | |

Cash, cash equivalents and marketable securities | $ | 1,181,134 |

| | $ | 1,387,106 |

|

Accounts receivable, net | 80,332 |

| | 75,964 |

|

Inventories | 34,089 |

| | 30,848 |

|

Other current assets | 62,648 |

| | 52,593 |

|

Property and equipment, net | 708,616 |

| | 715,812 |

|

Intangible assets | 29,000 |

| | 29,000 |

|

Goodwill | 39,915 |

| | 39,915 |

|

Other non-current assets | 30,093 |

| | 3,441 |

|

Total assets | $ | 2,165,827 |

| | $ | 2,334,679 |

|

| | | |

Liabilities and Shareholders' Equity | | | |

Other liabilities | $ | 272,977 |

| | $ | 322,418 |

|

Accrued restructuring expense | 21,488 |

| | 45,855 |

|

Deferred revenues | 39,918 |

| | 45,276 |

|

Capital leases | 66,143 |

| | 57,099 |

|

Fan Pier lease obligation | 472,971 |

| | 473,073 |

|

Senior secured term loan | 294,793 |

| | 294,775 |

|

Shareholders' equity | 997,537 |

| | 1,096,183 |

|

Total liabilities and shareholders' equity | $ | 2,165,827 |

| | $ | 2,334,679 |

|

| | | |

Common shares outstanding | 243,580 |

| | 241,764 |

|

Note 1: For the three months ended March 31, 2014, the company presents the effect of its relationship with Alios, which it consolidated as a variable interest entity from June 2011 to December 2013, as discontinued operations attributable to Vertex in its condensed consolidated statements of operations.

Note 2: In the three months ended March 31, 2015, "Real estate restructuring costs" consisted of restructuring credits of $3.6 million primarily related to the company's relocation from Cambridge to Boston, Massachusetts. In the three months ended March 31, 2014, "Real estate restructuring costs" consisted of (i) transition costs related to the company's relocation that were recorded as R&D and SG&A, and (ii) restructuring charges related to this relocation.

Note 3: In the three months ended March 31, 2015, "HCV related revenues and costs" consisted of (i) $0.7 million net product revenues from INCIVEK, (ii) $1.5 million royalty revenues from INCIVO, (iii) $0.6 million HCV collaborative revenues, (iv) $1.6 million COR expenses, (v) R&D and SG&A credits (including the pharma fee) and (vi) $0.2 million restructuring expenses. In the three months ended March 31, 2014, "HCV related revenues and costs" included in the company's loss from continuing operations consisted of (1) $3.9 million net product revenues from INCIVEK, (2) $4.9 million royalty revenues from INCIVO, (3) $1.4 million HCV collaborative revenues, (4) $0.7 million and $5.2 million costs of product revenues and royalty revenues related to INCIVEK and INCIVO, respectively, (5) R&D and SG&A expenses (including the pharma fee) and (6) $0.6 million restructuring expenses.

Note 4: In each of the three months ended March 31, 2014 and 2015, "Other adjustments" consisted of development cost associated with VX-509. In addition, in the three months ended March 31, 2015, "Other adjustments" included amounts related to a variable interest entity.

Note 5: In each of the three months ended March 31, 2014 and 2015, the company excludes from its non-GAAP loss attributable to Vertex restructuring (income) expenses. In addition, in the three months ended March 31, 2014 discontinued operations are excluded from its non-GAAP loss attributable to Vertex.

INDICATION AND IMPORTANT SAFETY INFORMATION FOR KALYDECO® (ivacaftor)

Ivacaftor is a cystic fibrosis transmembrane conductance regulatory (CFTR) potentiator indicated for the treatment of cystic fibrosis (CF). In the U.S. (in patients age 2 years and older) and Europe (in patients age 6 years and older), ivacaftor is indicated for patients who have one of the following mutations in the CFTR gene: G551D, G1244E, G1349D, G178R, G551S, S1251N, S1255P, S549N, or S549R. In Canada (in patients 6 years and older), ivacaftor is indicated for patients with these same mutations and also for patients with the G970R mutation. Additionally, in the U.S. (in patients age 2 years and older) and Canada (in patients age 18 years and older) ivacaftor is indicated for the treatment of CF in patients who have an R117H mutation in the CFTR gene.

Ivacaftor is available as 150 mg tablets in countries where it is approved for patients age 6 years and older, and additionally in the U.S. as 50 mg and 75 mg oral granules for patients age 2 to less than 6 years.

Ivacaftor is not effective in patients with CF with 2 copies of the F508del mutation (F508del/F508del) in the CFTR gene. The safety and efficacy of ivacaftor in children with CF younger than 2 years of age have not been studied. The use of ivacaftor in children under the age of 2 years is not recommended.

High liver enzymes (transaminases; ALT and AST) have been reported in patients with CF receiving ivacaftor. Transaminase elevations were more common in patients with a history of transaminase elevations or in patients who had abnormal transaminases at baseline. It is recommended that ALT and AST be assessed prior to initiating ivacaftor, every 3 months during the first year of treatment, and annually thereafter. For patients with a history of transaminase elevations, more frequent monitoring of liver function tests should be considered. Patients who develop increased transaminase levels should be closely monitored until the abnormalities resolve. Dosing should be interrupted in patients with ALT or AST of greater than 5 times the upper limit of normal. Following resolution of transaminase elevations, consider the benefits and risks of resuming ivacaftor dosing.

Use of ivacaftor with medicines that are strong CYP3A inducers, such as the antibiotics rifampin and rifabutin; seizure medications (phenobarbital, carbamazepine, or phenytoin); and the herbal supplement St. John's wort, substantially decreases exposure of ivacaftor and may diminish effectiveness. Therefore, co-administration is not recommended. The dose of ivacaftor must be adjusted when used concomitantly with strong and moderate CYP3A inhibitors or when used in patients with moderate or severe hepatic disease.

Cases of non-congenital lens opacities/cataracts have been reported in pediatric patients treated with ivacaftor. Baseline and follow-up ophthalmological examinations are recommended in pediatric patients initiating ivacaftor treatment.

Serious adverse reactions that occurred more frequently with ivacaftor included abdominal pain, increased liver enzymes, and low blood sugar (hypoglycemia). The most common side effects associated with ivacaftor include headache; upper respiratory tract infection (common cold), including sore throat, nasal or sinus congestion, and runny nose; stomach (abdominal) pain; diarrhea; rash; nausea; and dizziness. These are not all the possible side effects of ivacaftor. A list of the adverse reactions can be found in the product labeling for each country where ivacaftor is approved. Patients should tell their healthcare providers about any side effect that bothers them or does not go away.

Please see KALYDECO (ivacaftor) U.S. Prescribing Information, EU Summary of Product Characteristics, Canadian Product Monograph, Australian Consumer Medicine Information and Product Information, Swiss Prescribing Information and Patient Information, and the New Zealand Datasheet and Consumer Medicine Information.

About Vertex

Vertex is a global biotechnology company that aims to discover, develop and commercialize innovative medicines so people with serious diseases can lead better lives. In addition to our clinical development programs focused on cystic fibrosis, Vertex has more than a dozen ongoing research programs aimed at other serious and life-threatening diseases.

Founded in 1989 in Cambridge, Mass., Vertex today has research and development sites and commercial offices in the United States, Europe, Canada and Australia. For five years in a row, Science magazine has named Vertex one of its Top Employers in the life sciences. For additional information and the latest updates from the company, please visit www.vrtx.com.

Special Note Regarding Forward-looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including, without limitation, Dr. Leiden's statements in the second paragraph of the press release, the information provided in the section captioned "2015 Financial Guidance," and the information provided regarding the development and potential regulatory approval of ORKAMBI. While Vertex believes the forward-looking statements contained in this press release are accurate, these forward-looking statements represent the company's beliefs only as of the date of this press release and there are a number of factors that could cause actual events or results to differ materially from those indicated by such forward-looking statements. Those risks and uncertainties include, among other things, that the company's expectations regarding its 2015 revenues and financial results and its 2015 non-GAAP operating expenses may be incorrect (including because one or more of the company's assumptions underlying its revenue or expense expectations may not be realized), that regulatory authorities may not approve, or approve on a timely basis, ORKAMBI, that data from the company's development programs may not support registration or further development of its compounds due to safety, efficacy or other reasons, and other risks listed under Risk Factors in Vertex's annual report and quarterly reports filed with the Securities and Exchange Commission and available through the company's website at www.vrtx.com. Vertex disclaims any obligation to update the information contained in this press release as new information becomes available.

Conference Call and Webcast

The company will host a conference call and webcast today at 5:00 p.m. ET. To access the call, please dial (866) 501-1537 (U.S.) or +1 (720) 545-0001 (International). The conference call will be webcast live and a link to the webcast can be accessed through Vertex's website at www.vrtx.com in the "Investors" section under "Events and Presentations." To ensure a timely connection, it is recommended that users register at least 15 minutes prior to the scheduled webcast. An archived webcast will be available on the company's website.

(VRTX-GEN)

Vertex Contacts:

Investors:

Michael Partridge, 617-341-6108

or

Kelly Lewis, 617-961-7530

or

Eric Rojas, 617-961-7205

Media:

Zach Barber 617-341-6992

mediainfo@vrtx.com

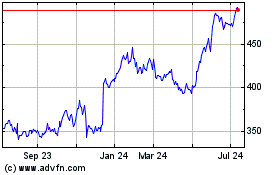

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

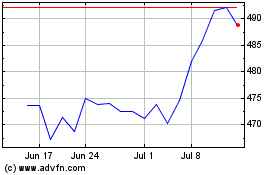

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024