As filed with the Securities and Exchange Commission on April 24, 2015

Registration No. 333-203312

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment

No. 1 to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

| England and Wales |

|

Not Required |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Amarin Corporation plc

2 Pembroke House

Upper

Pembroke Street 28-32

Dublin 2, Ireland

+353 1 6699 020

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

John F. Thero

President

and Chief Executive Officer

Amarin Corporation plc

c/o Amarin Pharma, Inc.

1430 Route 206

Bedminster, New Jersey 07921, USA

Telephone: (908) 719-1315

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Michael

H. Bison, Esq.

Goodwin Procter LLP

Exchange Place

53 State

Street

Boston, MA 02109

Telephone: (617) 570-1000

Facsimile: (617) 523-1231

Approximate

date of commencement of proposed sale to the public: From time to time or at one time after the effective date of the Registration Statement as the registrant shall determine.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

þ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Amount to be

Registered |

|

Proposed

Maximum Offering

Price Per Share |

|

Proposed

Maximum

Aggregate

Offering Price |

|

Amount of

Registration Fee (1) |

| Series A Convertible Preference Shares, par value £0.05 per share (2) |

|

352,150,790 (3) |

|

$0.15 |

|

$52,822,618.50 |

|

$6,137.99 |

| Ordinary Shares, par value £0.50 per share (4) |

|

35,215,079 (5) |

|

— |

|

— |

|

(6) |

| Total |

|

387,365,869 |

|

$0.15 |

|

$52,822,618.50 |

|

$6,137.99 (7) |

| |

| |

| (1) |

Calculated pursuant to Rule 457(o) under the Securities Act. |

| (2) |

The Series A Convertible Preference Shares, par value £0.05 per share, (the “Series A Preference Shares”) are represented by American Depositary Shares (“Preference

ADSs”), each of which represents one Series A Preference Share. A separate Registration Statement on Form F-6 will be filed for the registration of Preference ADSs. |

| (3) |

Represents the number of Series A Preference Shares represented by the Preference ADSs issued to certain investors in a private placement on March 30, 2015. |

| (4) |

The ordinary shares, par value par value £0.50 per share, may be represented by American Depositary Shares (“Ordinary ADSs”), each of which currently represents one ordinary share. A

separate Registration Statement on Form F-6 has been filed for the registration of Ordinary ADSs and was declared effective on November 4, 2011 (Reg. File No. 333-176898). |

| (5) |

Consists of (a) 35,215,079 ordinary shares to be created by the consolidation and redesignation of the Series A Preference Shares at a rate of one ordinary share for ten Series A Preference Shares and (b) an

indeterminate number of additional ordinary shares as may from time to time be issued with respect to the foregoing securities as a result of equity splits, dividends, reclassifications, recapitalizations, combinations or similar events, which

shares shall be deemed registered hereunder pursuant to Rule 416 under the Securities Act. |

| (6) |

No separate consideration will be received for the ordinary shares created by the consolidation and redesignation of the Series A Preference Shares, and, therefore, no registration fee for those shares is required

pursuant to Rule 457(i) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Amarin Corporation plc has prepared this Amendment No. 1 to the Registration Statement on Form S-3 (File No. 333-203312) for the

sole purpose of filing an amended Exhibit 5.1 to the Registration Statement with the Securities and Exchange Commission. This Amendment No. 1 does not modify any provision of the Prospectus that forms a part of the Registration Statement and

accordingly such Prospectus has not been included herein.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The expenses payable by us in connection with this offering are as follows:

|

|

|

|

|

| |

|

Amount |

|

| Securities and Exchange Commission Registration Fee |

|

$ |

6,137.99 |

|

| Accountants’ Fees and Expenses |

|

$ |

100,000.00 |

|

| Legal Fees and Expenses |

|

$ |

360,000.00 |

|

| Miscellaneous |

|

$ |

103,862.01 |

|

|

|

|

|

|

| Total Expenses |

|

$ |

570,000.00 |

|

Item 15. Indemnification of Officers and Directors.

Except as set forth below, there is no provision of the Company’s Articles of Association or any contract, arrangement or statute under

which any director or officer of the Company is insured or indemnified in any manner against liability which he may incur in his capacity as such.

Article 192 of the Company’s Articles of Association provides:

| 192 |

Subject to the provisions of, and so far as may be permitted by and consistent with, the Statutes but without prejudice to any indemnity to which he may otherwise be entitled, every Director, Secretary and officer of

the Company and every director, secretary and officer of each Associated Company shall be indemnified out of the assets of the Company against: |

| |

(a) |

any liability incurred by or attaching to him in connection with any negligence, default, breach of duty or breach of trust by him in relation to the Company or any Associated Company other than: |

| |

(i) |

any liability to the Company or any Associated Company; and |

| |

(ii) |

any liability incurred by him to pay a fine imposed in criminal proceedings or a sum payable to a regulatory authority by way of a penalty in respect of non-compliance with any requirement of a regulatory nature

(however arising); and |

| |

(iii) |

any liability incurred by him: |

| |

(A) |

in defending criminal proceedings in which he is convicted; |

| |

(B) |

in defending any civil proceedings brought by the Company, or an Associated Company in which judgment is given against him; |

| |

(C) |

in connection with the application made under sections 661(3) or (4) or section 1157 of the 2006 Act in which the court refuses to grant him relief; |

where, in any case, the conviction, judgment or refusal of relief (as the case may be) has become final, and

| |

(b) |

any other liability incurred by or attaching to him in the actual or purported performance and/or discharge of his duties and/or the exercise or purported exercise of his powers and/or otherwise in relation to or in

connection with his duties, powers or office. |

II-1

| 192.1 Subject |

to the provisions of, and so far as may be permitted by and consistent with, the Statutes, the Company may: |

| |

(a) |

provide a Director of the Company or a director of an Associated Company with funds to meet expenditure incurred or to be incurred by him: |

| |

(i) |

in defending any criminal or civil proceedings in connection with any alleged negligence, default, breach of duty or breach of trust by him in relation to the Company or an Associated Company; or |

| |

(ii) |

in connection with an application for relief under the provisions referred to in sections 661(3) or (4) or section 1157 of the 2006 Act (or until such time as such provisions come into effect sections 144(3) or

(4) or section 727 of the 1985 Act); and |

| |

(b) |

do anything to enable him to avoid incurring such expenditure: |

| |

(i) |

when the conviction becomes final; or |

| |

(ii) |

the date when the judgment becomes final; or |

| |

(iii) |

the date when the refusal of relief becomes final, |

provided always that any loan made or

liability incurred under any transaction connected with anything done pursuant to this Article 192.1 shall be repaid or (as the case may be) discharged in the event of such director being convicted or judgment being given against him in the

proceedings or the court refusing to grant him relief on the application and by not later than the date.

| 192.2 Subject |

to the provisions of, and far as may be permitted by and consistent with, the Statutes, the Company may: |

| |

(a) |

provide a Director of the Company or a director of an Associated Company with funds to meet expenditure incurred or to be incurred by him in defending himself in an investigation by a regulatory authority or against

action proposed to be taken by a regulatory authority in connection with any alleged negligence, default, breach of duty or breach of trust by him in relation to the Company or any Associated Company; and |

| |

(b) |

do anything to enable him to avoid incurring such expenditure. |

| 192.3 |

Subject to the provisions of, and so far as may be permitted by and consistent with, the Statutes but without prejudice to any indemnity to which he may otherwise be entitled, every director of any Trustee Company shall

be indemnified out of the assets of the Company against any liability incurred in connection with the activities of the Trustee Company as a trustee of any occupational pension scheme of which it is a trustee other than any liability of the kind

referred to in section 235(3) of the 2006 Act. For the purposes of this Article 192.3: |

| |

(a) |

“Trustee Company” means a company (being the Company or an Associated Company) that is a trustee of an occupational pension scheme; and |

| |

(b) |

“occupational pension scheme” means an occupational pension scheme as defined in section 150(5) of the Finance Act 2004 that is established under a trust. |

| 192.4 For |

the purposes of Article 192: |

| |

(a) |

“Associated Company” means a company which is associated with the Company within the meaning of section 256 of the 2006 Act; |

II-2

| |

(b) |

where a director is indemnified against any liability, such indemnity shall extend to all costs, charges, losses, expenses and liabilities incurred by him in relation thereto; |

| |

(c) |

a conviction, judgment, or refusal of relief becomes final if: |

| |

(i) |

not appealed against, at the end of the period for bringing an appeal; or |

| |

(ii) |

if appealed against, at the time when the appeal (or any further appeal) is disposed of; and |

| |

(d) |

an appeal is disposed of if: |

| |

(i) |

it is determined and the period for brining any further appeal has ended; or |

| |

(ii) |

if it is abandoned or otherwise ceases to have effect. |

In addition, U.K. companies can obtain

liability insurance for directors and can also pay directors’ legal costs if they are successful in defending legal proceedings.

The

Company has entered into deeds of indemnification with directors or formers directors including William Hall, Srinivas Akkaraju, Dr. John Climax, James Healy, Dr. Bill Mason, Dr. Simon Kukes, Dr. Michael Walsh, Manus Rogan, Rick

Stewart, Eric Aguiar, Carl Gordon, Lars Ekman, Thomas Lynch, Anthony Russell-Roberts, Dr. Joseph Anderson, Joseph Zakrzewski, Kristine Peterson, David Feigel, Jan van Heek, Patrick O’Sullivan, David Stack and John Thero. The Company

has entered into deeds of indemnification with officers, former officers or members of senior management including Conor Dalton, Dr. Declan Doogan, Paul Duffy, John Thero, Alan Cooke, Tom Maher, Paresh Soni, Frederick W. Ahlholm, Paul Huff,

Stuart Sedlack, Joseph Kennedy, Steven Ketchum, Michael Farrell, Aaron Berg and Rami Daoud.

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the charter provision, by-law, contract, arrangements, statute or otherwise, the Company acknowledges that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

Item 16. Exhibits.

See the Exhibit Index set forth on page II-8 of this registration statement.

Item 17. Undertakings.

The undersigned Registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration

Statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective Registration Statement; or

(iii) to include any material information with respect to the plan of distribution

not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

II-3

provided, however, that if the information required to be included in a post-effective amendment

by paragraphs (1)(i) and (ii) above is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated

by reference in this Registration Statement, paragraphs (1)(i) and (ii) shall not apply.

2. That, for the

purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for the

purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the

registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in this Registration Statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to

be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As

provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is

part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of

sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of this Registration Statement or made in any such document immediately prior to such effective date.

5. That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the

initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the

securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such

securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to

the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the

offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the

undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other

communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6. That, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each

II-4

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling Person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The undersigned registrant hereby further undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed

as part of this registration statement in reliance under Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the Securities Act shall be deemed to be part of this

registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the

Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof.

The undersigned registrant hereby undertakes to file an application for the purpose of

determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act (the “Act”) in accordance with the rules and regulations prescribed by the Commission under

Section 305(b)(2) of the Act.

II-5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-3 and has caused this Amendment No. 1 to the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in Bedminster, New Jersey, on April 24,

2015.

|

|

|

|

|

Amarin Corporation plc |

|

|

| By: |

|

/s/ John F. Thero |

|

|

John F. Thero President and Chief Executive

Officer |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Amendment No. 1 to the

Registration Statement on Form S-3 has been signed by the following persons in the capacities indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ John F. Thero

John F. Thero |

|

Director, President and Chief

Executive Officer

(Principal Executive Officer) |

|

April 24, 2015 |

|

|

|

| *

Michael J. Farrell |

|

Vice President, Finance

(Principal Financial and Accounting Officer) |

|

April 24, 2015 |

|

|

|

| *

David Stack |

|

Director |

|

April 24, 2015 |

|

|

|

| *

James I. Healy, M.D., Ph.D. |

|

Director |

|

April 24, 2015 |

|

|

|

| *

Joseph S. Zakrzewski |

|

Director |

|

April 24, 2015 |

|

|

|

| *

Patrick O’Sullivan |

|

Director |

|

April 24, 2015 |

|

|

|

| *

Lars G. Ekman, M.D., Ph.D. |

|

Director |

|

April 24, 2015 |

|

|

|

| *

Jan van Heek |

|

Director |

|

April 24, 2015 |

|

|

|

| *

Kristine Peterson |

|

Director |

|

April 24, 2015 |

II-6

|

|

|

|

|

|

|

|

| /s/ John F. Thero

John F. Thero |

|

Authorized Representative in the U.S. |

|

April 24, 2015 |

The undersigned by signing his name hereto, signs and executes this Amendment No. 1 to the Registration Statement

pursuant to the Powers of Attorney executed by the above named signatories and filed previously with the Securities and Exchange Commission on April 9, 2015.

|

|

|

|

|

| By: |

|

/s/ John F. Thero |

| Name: John F. Thero |

II-7

AMARIN CORPORATION PLC

EXHIBIT INDEX

|

|

|

Exhibit

Number |

|

Description of Exhibit |

| 3.1 |

|

Articles of Association of Amarin Corporation plc (1) |

| 4.1 |

|

Form of Ordinary Share Certificate (2) |

| 4.2 |

|

Form of American Depositary Receipt evidencing ADSs (3) |

| 4.3 |

|

Form of Amended and Restated Deposit Agreement, dated as of November 4, 2011, among the Company, Citibank, N.A., as Depositary, and all holders and beneficial owners of American Depositary Receipts issued thereunder (4) |

| 4.4 |

|

Preference Share Deposit Agreement, dated as of March 30, 2015, among the Company, Citibank, N.A., as Depositary, and all holders and beneficial owners of American Depositary Receipts issued thereunder (5) |

| 4.5 |

|

Form of Series A Preference Share Certificate* |

| 4.6 |

|

Form of Series A Preference Share Terms (6) |

| 5.1 |

|

Opinion of K&L Gates LLP |

| 10.1 |

|

Securities Subscription Agreement dated March 5, 2015 (7) |

| 12.1 |

|

Statement Regarding Computation of Ratio of Earnings to Fixed Charges † |

| 23.1 |

|

Consent of Ernst & Young LLP, independent registered public accounting firm † |

| 23.2 |

|

Consent of Deloitte & Touche LLP, independent registered public accounting firm † |

| 23.3 |

|

Consent of K&L Gates LLP (filed as part of Exhibit 5.1) |

| 24.1 |

|

Power of Attorney † |

|

|

| * |

|

To be filed, if necessary, by amendment or as an exhibit to a report filed under the Exchange Act and incorporated herein by reference. |

|

|

| † |

|

Previously filed; incorporated by reference to the registration statement on Form S-3 filed by the Company with the Securities and Exchange Commission on April 9, 2015. |

|

|

| (1) |

|

Incorporated herein by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2013, File No. 0-21392, filed with the Securities and Exchange Commission on August 8, 2013. |

| (2) |

|

Incorporated herein by reference to Exhibit 2.4 to the Company’s Annual Report on Form 20-F for the year ended December 31, 2002, filed with the Securities and Exchange Commission on April 24, 2003. |

| (3) |

|

Incorporated by reference to Exhibit 4.2 to the Company’s Form 8-K, File No. 0-21392, filed with the Securities and Exchange Commission on March 30, 2015. |

| (4) |

|

Incorporated by reference to Exhibit 4.4 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, File No. 0-21392, filed with the Securities and Exchange Commission on February 29, 2012. |

| (5) |

|

Incorporated by reference to Exhibit 4.1 to the Company’s Form 8-K, File No. 0-21392, filed with the Securities and Exchange Commission on March 30, 2015. |

| (6) |

|

Incorporated by reference to Exhibit 4.1 to the Company’s Form 8-K, File No. 0-21392, filed with the Securities and Exchange Commission on March 11, 2015. |

| (7) |

|

Incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K, File No. 0-21392, filed with the Securities and Exchange Commission on March 11, 2015. |

II-8

EXHIBIT 5.1

|

|

|

|

|

|

|

|

|

K&L GATES LLP ONE NEW CHANGE

LONDON EC4M 9AF

T +44 (0)20 7648 9000 F +44 (0)20 7648

9001 klgates.com |

|

|

|

| Amarin Corporation Plc One New

Change London EC4M 9AF

STRICTLY PRIVATE & CONFIDENTIAL |

|

|

|

Tom Sibert tom.sibert@klgates.com

T +44 (0)20 7360 8197

Our ref TJS/6002745.00081

LDE No 58 London/Chancery Lane |

24 April

2015

Dear Sirs

AMARIN CORPORATION PLC (THE “COMPANY”)

This

opinion is being delivered to you in connection with a registration statement on Form S-3 (the “Registration Statement”), filed with the United States Securities and Exchange Commission (the “SEC”) on 9 April

2015 and as amended on 24 April 2015, under the United States Securities Act of 1933 as amended (the “US Securities Act”), and the allotment and issue of certain securities by the Company pursuant to the securities subscription

agreement dated 5 March 2015 between the Company and the Purchasers (as such term is defined therein) (the “Securities Subscription Agreement”).

The Registration Statement is filed in connection with the issue by the Company on

30 March 2015, pursuant to the Securities Subscription Agreement, of 352,150,790 preference shares of £0.05 each in the capital of the Company and designated Series A Preference Shares (the “Series A Preference Shares”).

For the purposes of this opinion, we have examined only the following:

| 2.1 |

a copy of the Registration Statement in the form filed on 9 April 2015, as amended on 24 April 2015, under the US Securities Act (excluding its exhibits); |

| 2.2 |

a Certificate of Good Standing issued by the Registrar of Companies in England and Wales in respect of the Company dated 24 April 2015; |

| 2.3 |

a certificate (the “Secretary’s Certificate”) from the Company Secretary of the Company (the “Secretary”) of the same date as this opinion confirming, inter alia (i) that the

copy of the Articles (referred to in paragraph 2.4 below) attached to the Secretary’s Certificate is correct and up-to-date; (ii) that the board meeting and the committee meeting referred to in paragraphs 2.6 and 2.7 respectively below

were duly convened and held and that the resolutions set out in the extract of the minutes of each meeting (the “Board Resolutions”) were duly passed; (iii) that the shareholders’ meeting referred to in paragraph 2.8 below

was duly convened and held and that the resolutions set out in the print of resolutions filed at Companies House (the “Shareholder Resolutions”) were duly |

K&L Gates LLP is a limited liability

partnership registered in England and Wales under number OC309508 and is authorised and regulated by the Solicitors Regulation Authority. Any reference to a partner in relation to K&L Gates LLP is a reference to a member of that LLP. A list of

the names of the members and their professional qualifications may be inspected at our registered office: One New Change, London, EC4M 9AF, England. A reference to any office other than our London and Paris offices is a reference to an office of an

associated firm.

Page

2

24 April 2015

| |

passed; (iv) that the Company no longer has an authorised but unissued share capital, and that there are no other limits under the constitution of the Company on the powers of the directors to allot shares or to

grant rights to subscribe for shares; (v) the nominal amount of shares which the directors are authorised to allot or grant rights to subscribe for under section 551 of the UK Companies Act 2006 (the “2006 Act”); and

(vi) the extent of the powers to allot equity securities conferred on the directors under section 570 of the 2006 Act; |

| 2.4 |

copies of the certificate of incorporation, certificates of incorporation on change of name and articles of association of the Company (the “Articles”), copies of which are attached to the

Secretary’s Certificate; |

| 2.5 |

information on the file held at Companies House in respect of the Company disclosed by an online search of such file carried out by us at Companies House at 11:45 a.m. on 24 April 2015 (the “Companies

Registry Search”) and information disclosed by an enquiry by telephone at the Central Index of Winding Up Petitions, London on 24 April 2015 at 11:47 a.m. with respect to the Company (the “Central Index Search”);

|

| 2.6 |

a copy of the minutes of a meeting of the board of directors of the Company dated 8 December 2014, a copy of which is attached to the Secretary’s Certificate; |

| 2.7 |

a copy of the minutes of a meeting of a committee of the board of directors of the Company dated 5 March 2015, inter alia, establishing the Series A Preference Shares, a copy of which is attached to the

Secretary’s Certificate; |

| 2.8 |

a print of the resolutions of the Company passed at a meeting of the Company on 6 July 2010, authorising the board of directors of the Company to allot shares and to grant rights to subscribe for shares and

empowering the directors to allot equity securities, a copy of which is attached to the Secretary’s Certificate; |

| 2.9 |

a copy of the executed Securities Subscription Agreement, a copy of which is attached to the Secretary’s Certificate, but excluding any exhibits thereto; and |

| 2.10 |

copies of the subscription letters in respect of the Series A Preference Shares from the Purchasers to the Company, copies of which are attached to the Secretary’s Certificate (the “Subscription

Letters”). |

For the purposes of this opinion we have assumed without investigation:

| 3.1 |

the authenticity, accuracy and completeness of all documents submitted to us as originals or copies, the genuineness of all signatures and the conformity to original documents of all copies; |

| 3.2 |

the capacity, power and authority of each of the parties (other than the Company) to any documents reviewed by us; |

Page

3

24 April 2015

| 3.3 |

the due execution and delivery of any documents reviewed by us in compliance with all requisite corporate authorisations; |

| 3.4 |

that all agreements and documents examined by us that are governed by the laws of any jurisdiction other than England and Wales were as at the date of allotment and issue of the Series A Preference Shares and are on the

date of this opinion legal, valid and binding under the laws by which they are (or are expressed to be) governed; |

| 3.5 |

that the contents of the Secretary’s Certificate were true and not misleading when given and remain true and not misleading as at the date of this opinion and that there is no matter not referred to in the

Secretary’s Certificate which would make any of the information in the Secretary’s Certificate incorrect or misleading; |

| 3.6 |

that the Board Resolutions have not been and will not be amended or rescinded and were at 30 March 2015, are at the date of this opinion and will remain in full force and effect, and that the minutes of the meeting

at which such resolutions were passed have been signed by the chairman of the meeting and filed in the Company’s minute book; |

| 3.7 |

that the Shareholder Resolutions have not been and will not be amended or rescinded and were at 30 March 2015, are at the date of this opinion and will remain in full force and effect, and that the minutes of the

meeting at which such resolutions were passed have been signed by the chairman of the meeting and filed in the Company’s minute book; |

| 3.8 |

that the directors present at each of the meetings referred to in paragraph 3.6 above duly declared any personal interest in the business transacted at the meeting and were entitled to count in the quorum and to vote in

respect of the resolutions passed at the meeting and that in approving the allotment and issue of Series A Preference Shares in accordance with the terms of the Securities Subscription Agreement and the Subscription Letters, the directors were and

will be acting in good faith and without any conflict of interest which was not fully disclosed and properly approved; |

| 3.9 |

that no event has occurred since the issue of the Certificate of Good Standing referred to at paragraph 2.2 above such that the Registrar of Companies would decline to issue a similar certificate as at the date of this

opinion; |

| 3.10 |

having undertaken the Companies Registry Search and the Central Index Search and having made enquiries of the Secretary and examined the Certificate of Good Standing referred to in paragraph 2.2 above (together, the

“Searches and Enquiries”) (but having made no other searches or enquiries) and the Searches and Enquiries not revealing any of the same, that on the date of allotment and issue of the Series A Preference Shares and on the date of

this opinion no resolution has been passed and no petition has been presented and no order has been made for the administration, winding up or dissolution of the Company and no receiver, administrative receiver, administrator, liquidator,

provisional liquidator, trustee or similar officer has been appointed in relation to the Company or any of its assets; |

| 3.11 |

that no change has occurred to the information on the file at Companies House in respect of the Company since the time of the Companies Registry Search; |

Page

4

24 April 2015

| 3.12 |

that the Companies Registry Search revealed all matters required by law to be notified to the Registrar of Companies and that the information revealed is complete and accurate as of the date of the Companies Registry

Search and that further searches would not have revealed additional or different matters that could have affected the opinions contained in this opinion; |

| 3.13 |

that the information revealed by the Central Index Search is complete and accurate as of the date of such search and that further searches would not have revealed additional or different matters that could have affected

the opinions contained in this opinion; |

| 3.14 |

that the centre of main interests, as such term is defined in Article 3(1) of the European Regulation on Insolvency Proceedings (EC No. 1346/2000), of the Company is and remains in England; |

| |

(a) |

no Series A Preference Shares were allotted or issued at a discount to their nominal value (whether in pounds sterling or equivalent in any other currency); |

| |

(b) |

no alteration had been made to the Articles or the rights attaching to the Series A Preference Shares as at the date of allotment and issue of the Series A Preference Shares; |

| |

(c) |

as at the date of allotment and issue of the Series A Preference Shares, the directors of the Company had sufficient authority and powers conferred on them to allot and issue such Series A Preference Shares under

section 551 of the 2006 Act and under section 570 of the 2006 Act as if section 561 of the 2006 Act did not apply to such allotment and the directors of the Company did not allot or issue (or purport to allot or issue) Series A Preference Shares and

did not grant rights (or purport to grant rights) to subscribe for Series A Preference Shares in excess of such powers or in breach of any other limitation on their powers to allot and issue Series A Preference Shares or grant rights to subscribe

for Series A Preference Shares; |

| |

(d) |

at the time of allotment and issue of the Series A Preference Shares, the Company had received in full a ‘cash consideration’ (as such term is defined in section 583(3) of the 2006 Act) equal to the

subscription price payable for the Series A Preference Shares (such subscription price being no less than the nominal value of such Series A Preference Shares, whether in pounds sterling or equivalent in any other currency) and had entered the

holder or holders thereof in the register of members of the Company showing that all the Series A Preference Shares had been fully paid up as to their nominal value and any premium thereon as at the date of their allotment; and |

| |

(e) |

the Series A Preference Shares were allotted and issued in accordance with the terms set out in the Securities Subscription Agreement and the Subscription Letters and in accordance with the Articles; |

Page

5

24 April 2015

| |

(a) |

the conversion of Series A Preference Shares into ordinary shares of £0.50 each in the capital of the Company (“Ordinary Shares”) in accordance with the Articles and the rights attaching to the

Series A Preference Shares will be effected by the consolidation and redesignation of the Series A Preference Shares into Ordinary Shares on the basis of 10 Series A Preference Shares being consolidated into one consolidated Series A preference

share of £0.50 and the redesignation of each consolidated Series A preference share as an Ordinary Share; |

| |

(b) |

the conversion of Series A Preference Shares into Ordinary Shares in accordance with the Articles and the rights attaching to the Series A Preference Shares will not result in any fractional entitlement to Ordinary

Shares; and |

| |

(c) |

the conversion of the Series A Preference Shares into Ordinary Shares will be in accordance with the terms set out in the Securities Subscription Agreement and in accordance with the Articles and the rights attaching to

the Series A Preference Shares; |

| 3.17 |

that no Series A Preference Shares or Ordinary Shares or rights to subscribe for Series A Preference Shares or Ordinary Shares have been or shall be offered to the public in the United Kingdom in breach of the Financial

Services and Markets Act 2000 (“FSMA”) or of any other UK laws or regulations concerning the offer of securities to the public, and no communication has been or shall be made in relation to the Series A Preference Shares or Ordinary

Shares in breach of section 21 of FSMA or any other UK laws or regulations relating to offers or invitations to subscribe for, or to acquire rights to subscribe for or otherwise acquire, shares or other securities; |

| 3.18 |

that no shares or securities of the Company were at the date of allotment and issue of the Series A Preference Shares or are listed on any recognised investment exchange in the United Kingdom (as defined in section 285

of FSMA) or traded on any prescribed market (as defined in the Financial Services and Markets Act 2000 (Prescribed Markets and Qualifying Investments) Order 2001); |

| 3.19 |

that in issuing and allotting the Series A Preference Shares the Company was not carrying on a regulated activity for the purposes of section 19 of FSMA, including (but without limitation) pursuant to Article 5 of the

Financial Services and Markets Act 2000 (Regulated Activities) Order 2001; |

| 3.20 |

that the Company’s place of central management and control was not at the date of allotment and issue of the Series A Preference Shares and is not in the UK, the Channel Islands or the Isle of Man for the purposes

of the City Code on Takeovers and Mergers; |

| 3.21 |

that the Registration Statement shall have been declared effective and such effectiveness shall not have been terminated or rescinded; |

Page

6

24 April 2015

| 3.22 |

that the Company has complied (and will continue to comply) with all applicable anti-terrorism, anti-corruption, anti-money laundering, sanctions and human rights laws and regulations; and |

| 3.23 |

that there has been since the date of allotment and issue of the Series A Preference Shares and will be after the date of this opinion no change to the Articles, the Registration Statement, the Securities Subscription

Agreement or the rights attaching to the Series A Preference Shares or the Ordinary Shares which would affect any of the opinions given in this opinion. |

| 4.1 |

Based upon and subject to the foregoing, and subject to the reservations mentioned below and to any matters not disclosed to us, we are of the opinion that: |

| |

(a) |

the Company is a public limited company duly incorporated and validly existing and in good standing under English law; |

| |

(b) |

upon allotment and issue thereof and payment therefor pursuant to the Securities Subscription Agreement and the Subscription Letters, the Series A Preference Shares were validly issued, fully paid and non-assessable;

and |

| |

(c) |

upon the conversion of the Series A Preference Shares into Ordinary Shares in accordance with the assumptions above, the Securities Subscription Agreement, the Articles and the rights attaching to the Series A

Preference Shares, the Ordinary Shares created by the consolidation and redesignation of the Series A Preference Shares will be validly issued, fully paid and non-assessable. |

| 4.2 |

For the purposes of this opinion we have assumed that the term “non-assessable” in relation to the Series A Preference Shares and the Ordinary Shares means under English law that holders of such Series A

Preference Shares or Ordinary Shares, in respect of which all amounts due on such Series A Preference Shares or Ordinary Shares as to the nominal amount and any premium thereon have been fully paid, will be under no obligation to contribute to the

liabilities of the Company solely in their capacity as holders of such Series A Preference Shares or Ordinary Shares. |

Our reservations are as follows:

| 5.1 |

we express no opinion as to matters of United Kingdom taxation or any liability to tax (including, without limitation, stamp duty and stamp duty reserve tax) which may arise or be incurred as a result of or in

connection with the allotment and issue of the Series A Preference Shares or their conversion into Ordinary Shares, or as to tax matters generally; |

| 5.2 |

we express no opinion on European Community law as it affects any jurisdiction other than England; |

Page

7

24 April 2015

| 5.3 |

the obligations of the Company are subject to all laws from time to time in effect relating to bankruptcy, insolvency, liquidation, administration, reorganisation or any other laws (or other legal or equitable remedies)

or legal procedures affecting the rights of creditors or their enforcement; |

| 5.4 |

we have relied entirely on the facts, statements and confirmations contained in the Secretary’s Certificate and we have not undertaken any independent investigation or verification of the matters referred to in the

Secretary’s Certificate; |

| 5.5 |

we express no opinion as to any law other than English law in force, and as interpreted, at the date of this opinion. We are not qualified to, and we do not, express an opinion on the laws of any other jurisdiction. In

particular and without prejudice to the generality of the foregoing, we have not independently investigated the laws of the United States of America or the State of New York or the rules of any non-UK regulatory body (including, without limitation,

the SEC) or any investment exchange outside the United Kingdom (including, without limitation, the NASDAQ Stock Market LLC) for the purpose of this opinion; |

| 5.6 |

this opinion deals exclusively with the statutory authorities and powers required by the directors of the Company to allot the Series A Preference Shares and not with any contractual restrictions which may be binding on

the Company or its directors or any investing institutions’ guidelines; |

| 5.7 |

the expression “in good standing” in paragraph 4.1(a) above means that according to the documents on the file of the Company in the custody of the Registrar of Companies, the Company has been in continuous and

unbroken existence since the date of its incorporation and that no notification has been received by the Registrar of Companies that it is in liquidation or administration; |

| 5.8 |

the Companies Registry Search may not completely and accurately reflect the situation of the Company at the time it was made due to (i) failure of the Company to file documents that ought to be filed,

(ii) statutory prescribed time-periods within which documents evidencing actions may be filed, (iii) the possibility of additional delays (beyond the statutory time-limits) between the taking of the action and the necessary filing with the

Registrar of Companies, (iv) the possibility of delays by the Registrar of Companies or his staff in the registration of documents and their subsequent copying onto public records and (v) errors and mis-filing that may occur;

|

| 5.9 |

the Central Index Search may not completely and accurately reveal whether or not petitions for winding-up orders or administration orders have been lodged, since (i) whilst in relation to winding-up petitions it

should show all such petitions issued in England and Wales, it is limited to petitions for administration issued in London only, (ii) there may be delays in entering details of petitions on the index, (iii) County Courts may not notify the

Central Index immediately (if at all) of petitions which they have issued, (iv) enquiries of the Central Index, in any event, only show petitions presented since June 1994 and (v) errors and mis-filing may occur; |

| 5.10 |

the list of members maintained by the Company’s registrars does not disclose details of the payment up of any Ordinary Shares, such details being

recorded by or on behalf of |

Page

8

24 April 2015

| |

the Company in a separate register of allotments which contains certain of the information required under the 2006 Act and we assume that the same procedure will be adopted in relation to the Series A Preference Shares

to be allotted and issued as described in paragraph 1 above; |

| 5.11 |

in relation to the assumption at paragraph 3.14 above, we understand that the Company moved its tax residence to the Republic of Ireland in 2008 and we have not considered the effect this change in tax residence may

have on any of the matters covered by this opinion; and |

| 5.12 |

a member of a company incorporated under the laws of England and Wales may apply to the English courts under Part 30 of the 2006 Act on the grounds that the affairs of the company are being or have been conducted in a

manner unfairly prejudicial to members’ interests, and in such circumstances, the court may (inter alia) require the company to refrain from doing or continuing an act complained of by the petitioner and such an order may extend to the

allotment of the Series A Preference Shares. |

This opinion speaks only as at the date hereof. Notwithstanding any reference herein to future

matters or circumstances, we have no obligation to advise the addressee (or any third party) of any changes in the law or facts that may occur or become known to us after the date of this opinion.

This opinion is given on condition that it is governed by and shall be construed in accordance with English law as in force and as interpreted at the date of

this opinion and that the English courts shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with this opinion.

This opinion is given solely in connection with the filing of the Registration Statement and allotment and issue of the Series A Preference Shares. We hereby

consent to the filing of this opinion in its full form and the use of our name under the caption “Legal Matters” contained in the Registration Statement or in such other form as we may approve in writing.

In giving such consent, if and to the extent that this might otherwise apply in relation to the giving of an opinion governed by English law, we do not admit

that we are in the category of persons whose consent is required under Section 7 of the US Securities Act or the Rules and Regulations thereunder.

Yours faithfully

/s/ K&L Gates LLP

K&L Gates LLP

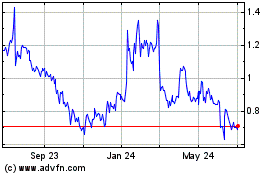

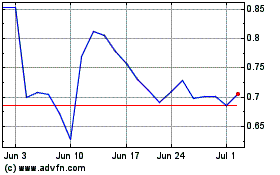

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024